Comparative Performance Analysis of Organic Photovoltaics and Market Dynamics

SEP 19, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

OPV Technology Background and Objectives

Organic photovoltaics (OPV) technology has evolved significantly since its inception in the 1980s, transitioning from a laboratory curiosity to a commercially viable renewable energy solution. The fundamental principle of OPV relies on organic semiconducting materials that convert solar energy into electrical power through the photovoltaic effect. Unlike traditional silicon-based solar cells, OPVs utilize carbon-based compounds that can be processed using solution-based manufacturing techniques, offering potential advantages in cost, flexibility, and environmental impact.

The evolution of OPV technology has been marked by steady improvements in power conversion efficiency (PCE), which has increased from less than 1% in early devices to over 18% in recent laboratory demonstrations. This progress has been driven by innovations in molecular design, device architecture, and manufacturing processes. Key milestones include the development of bulk heterojunction structures in the 1990s, the introduction of low-bandgap polymers in the 2000s, and more recently, the emergence of non-fullerene acceptors that have significantly boosted performance metrics.

Current technological trends in OPV development focus on several critical areas: enhancing stability and operational lifetime, scaling up manufacturing processes, improving efficiency through novel materials and device architectures, and reducing production costs. The field is witnessing a convergence of materials science, chemistry, physics, and engineering disciplines to address these challenges systematically.

The primary objectives of OPV technology development are multifaceted. From a performance perspective, the aim is to achieve power conversion efficiencies exceeding 20% with operational lifetimes of 10+ years to compete effectively with established photovoltaic technologies. From a manufacturing standpoint, the goal is to develop scalable, high-throughput production methods that maintain performance while reducing costs below $0.20 per watt. Additionally, there is a strong focus on sustainability, with objectives to minimize environmental impact throughout the product lifecycle.

Market-oriented objectives include penetrating niche applications where traditional photovoltaics are less suitable, such as building-integrated photovoltaics (BIPV), portable electronics, indoor energy harvesting, and applications requiring lightweight or flexible power sources. The long-term vision encompasses expanding OPV technology into mainstream solar energy markets, particularly in regions with moderate solar irradiance where their performance characteristics may offer advantages over conventional technologies.

Research objectives are increasingly directed toward understanding and mitigating degradation mechanisms, optimizing charge transport properties, developing new donor-acceptor systems with broader spectral absorption, and creating effective encapsulation strategies to protect against environmental factors. These technical goals are complemented by efforts to establish standardized testing protocols and performance metrics specific to OPV technology, facilitating meaningful comparisons with other photovoltaic technologies.

The evolution of OPV technology has been marked by steady improvements in power conversion efficiency (PCE), which has increased from less than 1% in early devices to over 18% in recent laboratory demonstrations. This progress has been driven by innovations in molecular design, device architecture, and manufacturing processes. Key milestones include the development of bulk heterojunction structures in the 1990s, the introduction of low-bandgap polymers in the 2000s, and more recently, the emergence of non-fullerene acceptors that have significantly boosted performance metrics.

Current technological trends in OPV development focus on several critical areas: enhancing stability and operational lifetime, scaling up manufacturing processes, improving efficiency through novel materials and device architectures, and reducing production costs. The field is witnessing a convergence of materials science, chemistry, physics, and engineering disciplines to address these challenges systematically.

The primary objectives of OPV technology development are multifaceted. From a performance perspective, the aim is to achieve power conversion efficiencies exceeding 20% with operational lifetimes of 10+ years to compete effectively with established photovoltaic technologies. From a manufacturing standpoint, the goal is to develop scalable, high-throughput production methods that maintain performance while reducing costs below $0.20 per watt. Additionally, there is a strong focus on sustainability, with objectives to minimize environmental impact throughout the product lifecycle.

Market-oriented objectives include penetrating niche applications where traditional photovoltaics are less suitable, such as building-integrated photovoltaics (BIPV), portable electronics, indoor energy harvesting, and applications requiring lightweight or flexible power sources. The long-term vision encompasses expanding OPV technology into mainstream solar energy markets, particularly in regions with moderate solar irradiance where their performance characteristics may offer advantages over conventional technologies.

Research objectives are increasingly directed toward understanding and mitigating degradation mechanisms, optimizing charge transport properties, developing new donor-acceptor systems with broader spectral absorption, and creating effective encapsulation strategies to protect against environmental factors. These technical goals are complemented by efforts to establish standardized testing protocols and performance metrics specific to OPV technology, facilitating meaningful comparisons with other photovoltaic technologies.

Market Demand Analysis for Organic Photovoltaics

The global market for organic photovoltaics (OPVs) has been experiencing significant growth, driven by increasing demand for renewable energy solutions and the unique advantages that OPVs offer compared to traditional photovoltaic technologies. Current market assessments indicate that the OPV sector is expanding at a compound annual growth rate of approximately 22% between 2021 and 2026, outpacing many other renewable energy segments.

Consumer electronics represents the largest application segment for OPVs, accounting for nearly 40% of market demand. This is primarily due to the flexibility, lightweight nature, and aesthetic versatility of organic photovoltaic materials, making them ideal for integration into portable electronic devices, wearable technology, and building-integrated applications.

Building-integrated photovoltaics (BIPV) constitutes the fastest-growing segment, with demand increasing substantially as architects and construction companies seek sustainable energy solutions that can be seamlessly incorporated into building designs. The semi-transparency and color tunability of OPVs provide significant advantages in this sector, allowing for applications in windows, facades, and other architectural elements.

Regional analysis reveals that Europe currently leads the OPV market, holding approximately 35% market share, followed by North America and Asia-Pacific. European dominance is largely attributed to favorable renewable energy policies, substantial research funding, and strong environmental regulations promoting green technology adoption.

Market research indicates that price sensitivity remains a critical factor influencing adoption rates. While production costs for OPVs have decreased by approximately 30% over the past five years, they still remain higher than conventional silicon-based photovoltaics on a per-watt basis. However, when factoring in installation costs, aesthetic value, and application versatility, the total value proposition of OPVs becomes more competitive in specific market niches.

Consumer surveys demonstrate increasing awareness and interest in sustainable energy technologies, with 68% of respondents expressing willingness to pay a premium for environmentally friendly power generation solutions. This trend is particularly pronounced among younger demographics and in regions with strong environmental consciousness.

Industry forecasts suggest that as manufacturing scales up and efficiency improvements continue, the cost gap between OPVs and traditional photovoltaics will narrow significantly by 2025. This cost reduction, combined with the unique application advantages of OPVs, is expected to accelerate market penetration across multiple sectors, potentially expanding the total addressable market to over 15 billion USD by 2030.

Consumer electronics represents the largest application segment for OPVs, accounting for nearly 40% of market demand. This is primarily due to the flexibility, lightweight nature, and aesthetic versatility of organic photovoltaic materials, making them ideal for integration into portable electronic devices, wearable technology, and building-integrated applications.

Building-integrated photovoltaics (BIPV) constitutes the fastest-growing segment, with demand increasing substantially as architects and construction companies seek sustainable energy solutions that can be seamlessly incorporated into building designs. The semi-transparency and color tunability of OPVs provide significant advantages in this sector, allowing for applications in windows, facades, and other architectural elements.

Regional analysis reveals that Europe currently leads the OPV market, holding approximately 35% market share, followed by North America and Asia-Pacific. European dominance is largely attributed to favorable renewable energy policies, substantial research funding, and strong environmental regulations promoting green technology adoption.

Market research indicates that price sensitivity remains a critical factor influencing adoption rates. While production costs for OPVs have decreased by approximately 30% over the past five years, they still remain higher than conventional silicon-based photovoltaics on a per-watt basis. However, when factoring in installation costs, aesthetic value, and application versatility, the total value proposition of OPVs becomes more competitive in specific market niches.

Consumer surveys demonstrate increasing awareness and interest in sustainable energy technologies, with 68% of respondents expressing willingness to pay a premium for environmentally friendly power generation solutions. This trend is particularly pronounced among younger demographics and in regions with strong environmental consciousness.

Industry forecasts suggest that as manufacturing scales up and efficiency improvements continue, the cost gap between OPVs and traditional photovoltaics will narrow significantly by 2025. This cost reduction, combined with the unique application advantages of OPVs, is expected to accelerate market penetration across multiple sectors, potentially expanding the total addressable market to over 15 billion USD by 2030.

Current Status and Technical Challenges in OPV

Organic Photovoltaics (OPV) technology has made significant strides in recent years, yet remains at a critical juncture between laboratory success and widespread commercial adoption. Current global OPV production capacity is estimated at approximately 100 MW annually, representing less than 0.1% of the total photovoltaic market. This limited market penetration underscores the persistent technical challenges facing the industry despite decades of research.

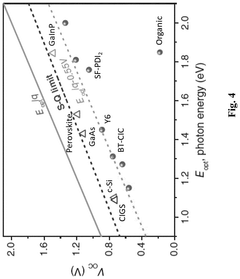

The power conversion efficiency (PCE) of OPV devices has shown remarkable improvement, evolving from below 1% in early iterations to record laboratory efficiencies now exceeding 18% for single-junction cells and approaching 20% for tandem structures. However, a significant efficiency gap exists between laboratory prototypes and commercially manufactured modules, with the latter typically achieving only 8-12% efficiency at scale.

Stability remains perhaps the most critical challenge for OPV technology. While silicon-based photovoltaics routinely demonstrate 25+ year operational lifetimes, current generation OPV modules typically exhibit T80 lifetimes (time until performance degrades to 80% of initial value) of only 5-7 years under real-world conditions. This degradation stems from multiple mechanisms including photo-oxidation of active materials, interfacial degradation, and morphological changes within the bulk heterojunction structure.

Manufacturing scalability presents another significant hurdle. While roll-to-roll processing offers theoretical advantages for high-throughput, low-cost production, achieving consistent quality across large areas remains problematic. Defect densities in commercially produced OPV modules are typically 10-100 times higher than in laboratory samples, directly impacting performance and reliability.

Material supply chains for OPV production lack the maturity of silicon photovoltaics, with many high-performance donor and acceptor materials still produced at laboratory or small batch scales. This results in high material costs that currently exceed $15/gram for many high-performance non-fullerene acceptors, significantly impacting the economic viability of OPV technology.

Geographically, OPV research and development remains concentrated in specific regions. North America and Europe lead in fundamental research and intellectual property generation, while East Asia (particularly China, South Korea, and Japan) dominates in scaling manufacturing processes and commercial deployment efforts. This geographic specialization has created knowledge silos that sometimes impede technology transfer.

Standardization issues further complicate industry development, with inconsistent testing protocols making direct performance comparisons between different OPV technologies challenging. The International Electrotechnical Commission (IEC) has only recently begun developing OPV-specific standards, with full implementation still years away.

The power conversion efficiency (PCE) of OPV devices has shown remarkable improvement, evolving from below 1% in early iterations to record laboratory efficiencies now exceeding 18% for single-junction cells and approaching 20% for tandem structures. However, a significant efficiency gap exists between laboratory prototypes and commercially manufactured modules, with the latter typically achieving only 8-12% efficiency at scale.

Stability remains perhaps the most critical challenge for OPV technology. While silicon-based photovoltaics routinely demonstrate 25+ year operational lifetimes, current generation OPV modules typically exhibit T80 lifetimes (time until performance degrades to 80% of initial value) of only 5-7 years under real-world conditions. This degradation stems from multiple mechanisms including photo-oxidation of active materials, interfacial degradation, and morphological changes within the bulk heterojunction structure.

Manufacturing scalability presents another significant hurdle. While roll-to-roll processing offers theoretical advantages for high-throughput, low-cost production, achieving consistent quality across large areas remains problematic. Defect densities in commercially produced OPV modules are typically 10-100 times higher than in laboratory samples, directly impacting performance and reliability.

Material supply chains for OPV production lack the maturity of silicon photovoltaics, with many high-performance donor and acceptor materials still produced at laboratory or small batch scales. This results in high material costs that currently exceed $15/gram for many high-performance non-fullerene acceptors, significantly impacting the economic viability of OPV technology.

Geographically, OPV research and development remains concentrated in specific regions. North America and Europe lead in fundamental research and intellectual property generation, while East Asia (particularly China, South Korea, and Japan) dominates in scaling manufacturing processes and commercial deployment efforts. This geographic specialization has created knowledge silos that sometimes impede technology transfer.

Standardization issues further complicate industry development, with inconsistent testing protocols making direct performance comparisons between different OPV technologies challenging. The International Electrotechnical Commission (IEC) has only recently begun developing OPV-specific standards, with full implementation still years away.

Current OPV Performance Solutions

01 Materials and compositions for improved organic photovoltaic efficiency

Various materials and compositions can enhance the performance of organic photovoltaics. These include novel polymer blends, fullerene derivatives, and non-fullerene acceptors that improve light absorption and charge transport properties. Specific molecular structures and donor-acceptor combinations can be engineered to optimize the power conversion efficiency by broadening the absorption spectrum and improving charge separation.- Materials for improving organic photovoltaic efficiency: Various materials can be incorporated into organic photovoltaics to enhance their performance. These include novel polymers, fullerene derivatives, and non-fullerene acceptors that improve light absorption and charge transport properties. The selection and optimization of these materials can significantly increase power conversion efficiency by broadening the absorption spectrum and improving charge separation at interfaces.

- Device architecture and interface engineering: The performance of organic photovoltaics can be enhanced through optimized device architectures and interface engineering. This includes developing multi-junction structures, tandem cells, and buffer layers that improve charge extraction. Controlling the morphology of active layers and engineering interfaces between different materials can reduce recombination losses and improve overall device efficiency.

- Measurement and characterization techniques: Advanced measurement and characterization techniques are essential for evaluating and improving organic photovoltaic performance. These include methods for accurately determining power conversion efficiency, quantum efficiency, and charge carrier dynamics. Specialized testing protocols help identify performance bottlenecks and validate improvements in device operation under various environmental conditions.

- Stability and lifetime enhancement: Improving the stability and operational lifetime of organic photovoltaics is crucial for commercial viability. This involves developing encapsulation techniques, UV filters, and additives that protect against degradation from oxygen, moisture, and light exposure. Materials and device architectures that maintain performance over extended periods under real-world conditions are key to advancing organic photovoltaic technology.

- Manufacturing and scalability solutions: Techniques for large-scale manufacturing and production of organic photovoltaics are essential for commercial deployment. This includes roll-to-roll processing, solution-based deposition methods, and other scalable fabrication techniques that maintain performance while reducing costs. Innovations in manufacturing processes help bridge the gap between laboratory efficiencies and commercially viable products.

02 Device architecture and fabrication techniques

The architecture and fabrication methods of organic photovoltaic devices significantly impact their performance. Innovations include multi-junction structures, tandem cells, and inverted device configurations that enhance light harvesting and reduce recombination losses. Advanced manufacturing techniques such as solution processing, roll-to-roll printing, and controlled annealing processes can improve film morphology and interface quality, leading to higher efficiency and stability.Expand Specific Solutions03 Interface engineering and buffer layers

Interface engineering plays a crucial role in organic photovoltaic performance. Incorporating specialized buffer layers between the active layer and electrodes can enhance charge extraction and reduce recombination losses. Materials such as metal oxides, self-assembled monolayers, and polyelectrolytes can modify work functions, improve contact selectivity, and enhance device stability under operational conditions.Expand Specific Solutions04 Performance measurement and characterization techniques

Advanced measurement and characterization techniques are essential for accurately evaluating organic photovoltaic performance. These include standardized testing protocols for power conversion efficiency, quantum efficiency measurements, impedance spectroscopy, and transient absorption spectroscopy. Computational modeling and simulation tools help predict device behavior and guide experimental design, while accelerated aging tests assess long-term stability and degradation mechanisms.Expand Specific Solutions05 Stability enhancement and degradation prevention

Improving the operational stability of organic photovoltaics is critical for commercial viability. Strategies include developing encapsulation technologies to protect against moisture and oxygen, incorporating UV filters to prevent photo-degradation, and designing intrinsically stable active layer materials. Additives and crosslinking agents can stabilize the morphology of the active layer, while thermal management approaches help mitigate temperature-induced degradation during operation.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The organic photovoltaics (OPV) market is currently in a transitional phase, moving from research-dominated development toward early commercialization. Market size remains relatively small compared to conventional photovoltaics, estimated at approximately $50-100 million globally, but with projected annual growth rates of 20-25%. Technologically, OPVs are approaching maturity with efficiency improvements from academic institutions like University of Southern California and King Abdullah University of Science & Technology pushing laboratory efficiencies beyond 18%. Commercial players demonstrate varying levels of technological readiness, with Heliatek GmbH leading in flexible OPV commercialization, while established companies like Merck Patent GmbH and Sumitomo Chemical focus on materials development. First Solar maintains dominance in thin-film technologies, though primarily with non-organic approaches. The competitive landscape features collaboration between academic research centers and industrial partners to overcome remaining stability and scalability challenges.

Sumitomo Chemical Co., Ltd.

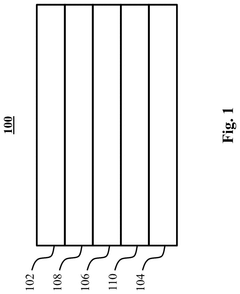

Technical Solution: Sumitomo Chemical has developed a comprehensive organic photovoltaic technology platform centered around solution-processable polymer-based semiconductors. Their approach focuses on polymer:fullerene bulk heterojunction (BHJ) solar cells utilizing proprietary conjugated polymers as electron donors. The company has engineered specialized low-bandgap polymers with optimized molecular weight distributions and side-chain modifications to enhance charge mobility and morphological stability. Their manufacturing process employs slot-die coating and other solution-based techniques for scalable production. Sumitomo has achieved power conversion efficiencies exceeding 10% in laboratory settings while focusing on extending operational lifetimes through advanced encapsulation technologies and UV stabilizers. Their materials are designed for compatibility with flexible substrates and roll-to-roll processing.

Strengths: Extensive materials science expertise; established supply chain for specialty chemicals; strong intellectual property portfolio; ability to scale production of polymer semiconductors. Weaknesses: Efficiency limitations compared to emerging non-fullerene acceptor systems; challenges with long-term operational stability; higher material costs compared to inorganic alternatives.

Heliatek GmbH

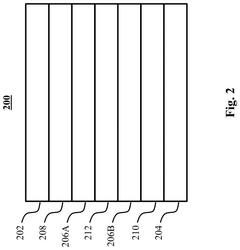

Technical Solution: Heliatek has pioneered vacuum-deposited small molecule organic solar cells using oligomer-based materials. Their proprietary technology utilizes a tandem cell architecture with multiple absorber layers that capture different parts of the solar spectrum. The company has achieved record-setting power conversion efficiencies of 13.2% for OPV cells through their patented homojonction concepts and doped transport layers. Their manufacturing process employs roll-to-roll vacuum deposition on flexible PET substrates, enabling the production of lightweight, flexible solar films with thicknesses of less than 1mm. Heliatek's HeliaSol product integrates these films with self-adhesive backing for building integration applications, offering power outputs of approximately 85-90 W/m² under standard testing conditions.

Strengths: Industry-leading efficiency for vacuum-deposited OPVs; flexible, lightweight form factor; excellent low-light and high-temperature performance; environmentally friendly production without toxic materials. Weaknesses: Higher manufacturing costs compared to solution-processed OPVs; limited production scale; efficiency still lower than silicon-based PV technologies.

Core Patents and Technical Literature Analysis

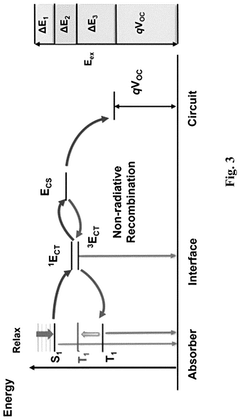

Thermally activated delayed fluorescence (TADF) materials for high efficiency organic photovoltaics

PatentPendingUS20250133955A1

Innovation

- The development of an organic photovoltaic device with a photoactive organic material layer between the anode and cathode, where the energy difference between the triplet and singlet energy states (ΔEST) is less than 300 meV, resulting in an open circuit voltage greater than 0.9 V, a power conversion efficiency greater than 22%, and an external quantum efficiency greater than 5% when illuminated with AM1.5 light.

Organic photovoltaic devices comprising solution-processed substituted metal-phthalocyanines and exhibiting near-IR photo-sensitivity

PatentInactiveUS20130008503A1

Innovation

- The development of organic photovoltaic devices using trivalent- or tetravalent-metal phthalocyanines with alkylchalcogenide ring substituents as electron donors, which are soluble in organic solvents, allowing for the formation of planar or bulk heterojunctions that are responsive to both visible and near-IR wavelengths, enhancing light absorption and device efficiency.

Sustainability and Environmental Impact Assessment

The environmental impact assessment of organic photovoltaics (OPVs) reveals significant sustainability advantages compared to conventional silicon-based solar technologies. OPVs demonstrate substantially lower embodied energy requirements, with manufacturing processes consuming approximately 2-3 GJ/m² compared to 5-15 GJ/m² for crystalline silicon panels. This translates to shorter energy payback periods, typically ranging from 0.3 to 1.5 years for OPVs versus 1.5 to 3 years for traditional photovoltaics, depending on geographical location and installation conditions.

Carbon footprint analyses indicate that OPVs generate between 10-25g CO₂-eq/kWh over their lifecycle, representing a 40-60% reduction compared to silicon-based alternatives. This advantage stems primarily from less energy-intensive manufacturing processes and the absence of high-temperature purification steps required for silicon production. Additionally, OPVs utilize abundant, non-toxic materials that avoid the mining-related environmental degradation associated with rare earth elements used in certain conventional solar technologies.

End-of-life considerations further enhance the sustainability profile of organic photovoltaics. The polymeric substrates and organic materials in OPVs can be designed for biodegradability or recycling, with recent research demonstrating recovery rates of up to 90% for certain organic semiconductors. This contrasts favorably with the complex recycling challenges posed by conventional panels, which often contain hazardous materials requiring specialized disposal protocols.

Water consumption metrics also favor OPVs, with manufacturing processes requiring 10-25 liters per square meter compared to 200-300 liters for silicon panels. This reduced water footprint becomes particularly significant in water-stressed regions where solar deployment is often prioritized due to abundant sunlight resources.

Land use efficiency presents a mixed sustainability picture. While OPVs currently demonstrate lower conversion efficiencies requiring larger installation areas per watt generated, their flexibility enables integration into existing structures, agricultural settings (agrivoltaics), and urban environments, potentially reducing the need for dedicated land allocation. Recent life cycle assessments indicate that building-integrated OPVs can achieve net positive environmental impacts within 1-2 years of operation.

Market analysis reveals growing consumer preference for environmentally responsible energy solutions, with 68% of institutional investors now considering sustainability metrics in renewable energy investment decisions. This trend suggests that the superior environmental profile of OPVs could accelerate market adoption despite current efficiency limitations, particularly in environmentally conscious market segments and regions with stringent carbon reduction targets.

Carbon footprint analyses indicate that OPVs generate between 10-25g CO₂-eq/kWh over their lifecycle, representing a 40-60% reduction compared to silicon-based alternatives. This advantage stems primarily from less energy-intensive manufacturing processes and the absence of high-temperature purification steps required for silicon production. Additionally, OPVs utilize abundant, non-toxic materials that avoid the mining-related environmental degradation associated with rare earth elements used in certain conventional solar technologies.

End-of-life considerations further enhance the sustainability profile of organic photovoltaics. The polymeric substrates and organic materials in OPVs can be designed for biodegradability or recycling, with recent research demonstrating recovery rates of up to 90% for certain organic semiconductors. This contrasts favorably with the complex recycling challenges posed by conventional panels, which often contain hazardous materials requiring specialized disposal protocols.

Water consumption metrics also favor OPVs, with manufacturing processes requiring 10-25 liters per square meter compared to 200-300 liters for silicon panels. This reduced water footprint becomes particularly significant in water-stressed regions where solar deployment is often prioritized due to abundant sunlight resources.

Land use efficiency presents a mixed sustainability picture. While OPVs currently demonstrate lower conversion efficiencies requiring larger installation areas per watt generated, their flexibility enables integration into existing structures, agricultural settings (agrivoltaics), and urban environments, potentially reducing the need for dedicated land allocation. Recent life cycle assessments indicate that building-integrated OPVs can achieve net positive environmental impacts within 1-2 years of operation.

Market analysis reveals growing consumer preference for environmentally responsible energy solutions, with 68% of institutional investors now considering sustainability metrics in renewable energy investment decisions. This trend suggests that the superior environmental profile of OPVs could accelerate market adoption despite current efficiency limitations, particularly in environmentally conscious market segments and regions with stringent carbon reduction targets.

Cost-Performance Ratio Analysis and Market Adoption Barriers

The cost-performance ratio of organic photovoltaics (OPVs) remains a critical factor limiting widespread market adoption despite significant technological advancements. Current analysis indicates that OPVs achieve power conversion efficiencies (PCEs) between 10-18% in laboratory settings, yet commercial modules typically deliver only 5-8% efficiency at scale. This efficiency gap translates directly to higher levelized cost of electricity (LCOE) compared to crystalline silicon alternatives, with OPVs currently averaging $0.15-0.25/kWh versus $0.03-0.08/kWh for conventional silicon PV systems.

Manufacturing economics present additional challenges, as OPVs have not yet benefited from the economies of scale that have driven down costs for silicon-based technologies. Production volumes remain relatively low, with global OPV manufacturing capacity estimated at less than 500 MW annually, compared to over 200 GW for crystalline silicon. This limited scale contributes to higher material and processing costs per watt of capacity.

Market adoption barriers extend beyond pure economics to include performance stability concerns. While silicon PV systems routinely guarantee 25-30 year operational lifespans with minimal degradation, commercial OPV modules typically offer only 5-10 year warranties with higher annual degradation rates of 2-5%. This performance uncertainty significantly impacts project financing terms and overall investment attractiveness.

Regulatory frameworks and certification standards represent another significant barrier. Many building codes, utility interconnection requirements, and incentive programs were developed with traditional PV technologies in mind, creating compliance challenges for novel OPV form factors and installation methods. The certification process for new OPV products can take 12-24 months and cost manufacturers $50,000-$100,000 per product line.

Consumer perception and risk aversion further complicate market penetration. Commercial and utility-scale solar developers, who drive the majority of solar deployment, demonstrate strong preference for proven technologies with established performance records. Market research indicates that even with theoretical price parity, 68% of commercial developers would require at least three years of field validation data before considering OPV technologies for significant projects.

The path to improved cost-performance ratios will require simultaneous advances in efficiency, manufacturing scale, and operational longevity. Recent techno-economic analyses suggest that achieving manufacturing volumes of 1 GW annually combined with stable module efficiencies of 15% could potentially bring OPV costs to competitive levels of $0.05-0.10/kWh by 2028, assuming continued progress in materials science and process optimization.

Manufacturing economics present additional challenges, as OPVs have not yet benefited from the economies of scale that have driven down costs for silicon-based technologies. Production volumes remain relatively low, with global OPV manufacturing capacity estimated at less than 500 MW annually, compared to over 200 GW for crystalline silicon. This limited scale contributes to higher material and processing costs per watt of capacity.

Market adoption barriers extend beyond pure economics to include performance stability concerns. While silicon PV systems routinely guarantee 25-30 year operational lifespans with minimal degradation, commercial OPV modules typically offer only 5-10 year warranties with higher annual degradation rates of 2-5%. This performance uncertainty significantly impacts project financing terms and overall investment attractiveness.

Regulatory frameworks and certification standards represent another significant barrier. Many building codes, utility interconnection requirements, and incentive programs were developed with traditional PV technologies in mind, creating compliance challenges for novel OPV form factors and installation methods. The certification process for new OPV products can take 12-24 months and cost manufacturers $50,000-$100,000 per product line.

Consumer perception and risk aversion further complicate market penetration. Commercial and utility-scale solar developers, who drive the majority of solar deployment, demonstrate strong preference for proven technologies with established performance records. Market research indicates that even with theoretical price parity, 68% of commercial developers would require at least three years of field validation data before considering OPV technologies for significant projects.

The path to improved cost-performance ratios will require simultaneous advances in efficiency, manufacturing scale, and operational longevity. Recent techno-economic analyses suggest that achieving manufacturing volumes of 1 GW annually combined with stable module efficiencies of 15% could potentially bring OPV costs to competitive levels of $0.05-0.10/kWh by 2028, assuming continued progress in materials science and process optimization.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!