Regulation and Standardization Trends in Organic Photovoltaics Mass Transfer

SEP 19, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

OPV Mass Transfer Regulation Background and Objectives

Organic photovoltaics (OPV) technology has evolved significantly over the past three decades, transitioning from laboratory curiosities to commercially viable renewable energy solutions. The mass transfer processes within OPV systems—including charge carrier transport, exciton diffusion, and interfacial dynamics—represent critical factors determining device efficiency and stability. Historically, regulation in this domain has been fragmented, with different regions adopting varied approaches to standardization, certification, and performance evaluation.

The evolution of OPV technology has been marked by several key milestones: the discovery of conductive polymers in the 1970s, the development of bulk heterojunction architectures in the 1990s, and recent breakthroughs in non-fullerene acceptors that have pushed power conversion efficiencies beyond 18%. Throughout this progression, regulatory frameworks have struggled to keep pace with technological innovation, creating inconsistencies in market access requirements and performance reporting methodologies.

Current regulatory landscapes for OPV mass transfer processes vary significantly across major markets. The European Union has implemented the most comprehensive framework through its Renewable Energy Directive and associated technical standards, while the United States relies on a combination of voluntary industry standards and state-level renewable portfolio requirements. Asian markets, particularly China and Japan, have developed robust certification systems focused on durability and performance under specific environmental conditions.

International standardization efforts, primarily through the International Electrotechnical Commission (IEC) and the International Organization for Standardization (ISO), have attempted to harmonize testing protocols for OPV technologies. However, these standards often fail to adequately address the unique mass transfer characteristics of organic semiconductors, which differ fundamentally from traditional silicon-based photovoltaics in terms of charge generation, transport mechanisms, and degradation pathways.

The primary objective of this technical research report is to comprehensively analyze the current regulatory and standardization landscape governing OPV mass transfer processes, identify critical gaps in existing frameworks, and forecast emerging regulatory trends that will shape the industry's development. Additionally, we aim to evaluate how these regulatory frameworks influence innovation trajectories, market adoption rates, and manufacturing practices within the OPV sector.

Secondary objectives include mapping the geographical distribution of regulatory approaches, assessing the technical validity of current testing protocols for mass transfer characterization, and developing recommendations for harmonized international standards that accurately reflect the unique properties of organic semiconductor materials and devices. This analysis will provide strategic insights for stakeholders navigating the complex regulatory environment while advancing OPV technology toward broader commercial deployment.

The evolution of OPV technology has been marked by several key milestones: the discovery of conductive polymers in the 1970s, the development of bulk heterojunction architectures in the 1990s, and recent breakthroughs in non-fullerene acceptors that have pushed power conversion efficiencies beyond 18%. Throughout this progression, regulatory frameworks have struggled to keep pace with technological innovation, creating inconsistencies in market access requirements and performance reporting methodologies.

Current regulatory landscapes for OPV mass transfer processes vary significantly across major markets. The European Union has implemented the most comprehensive framework through its Renewable Energy Directive and associated technical standards, while the United States relies on a combination of voluntary industry standards and state-level renewable portfolio requirements. Asian markets, particularly China and Japan, have developed robust certification systems focused on durability and performance under specific environmental conditions.

International standardization efforts, primarily through the International Electrotechnical Commission (IEC) and the International Organization for Standardization (ISO), have attempted to harmonize testing protocols for OPV technologies. However, these standards often fail to adequately address the unique mass transfer characteristics of organic semiconductors, which differ fundamentally from traditional silicon-based photovoltaics in terms of charge generation, transport mechanisms, and degradation pathways.

The primary objective of this technical research report is to comprehensively analyze the current regulatory and standardization landscape governing OPV mass transfer processes, identify critical gaps in existing frameworks, and forecast emerging regulatory trends that will shape the industry's development. Additionally, we aim to evaluate how these regulatory frameworks influence innovation trajectories, market adoption rates, and manufacturing practices within the OPV sector.

Secondary objectives include mapping the geographical distribution of regulatory approaches, assessing the technical validity of current testing protocols for mass transfer characterization, and developing recommendations for harmonized international standards that accurately reflect the unique properties of organic semiconductor materials and devices. This analysis will provide strategic insights for stakeholders navigating the complex regulatory environment while advancing OPV technology toward broader commercial deployment.

Market Analysis for Organic Photovoltaics Technologies

The global organic photovoltaics (OPV) market is experiencing significant growth, driven by increasing demand for renewable energy solutions and advancements in OPV technology. Current market valuations place the OPV sector at approximately $55 million in 2023, with projections indicating a compound annual growth rate (CAGR) of 22.4% through 2030, potentially reaching $250 million by the end of the decade.

The market segmentation reveals distinct application sectors, with building-integrated photovoltaics (BIPV) emerging as the dominant segment, accounting for nearly 40% of current market share. Portable electronics applications follow at 25%, while automotive applications and consumer goods represent 20% and 15% respectively.

Geographically, Europe leads the OPV market with approximately 45% market share, driven by stringent renewable energy policies and substantial research investments. North America follows at 30%, while the Asia-Pacific region, particularly China and Japan, is experiencing the fastest growth rate at 25% annually, fueled by expanding manufacturing capabilities and government incentives.

Consumer demand patterns indicate increasing preference for sustainable energy solutions, with 68% of surveyed consumers expressing willingness to pay premium prices for products incorporating green technologies like OPV. This trend is particularly pronounced in developed economies where environmental consciousness is higher.

Market penetration faces challenges related to efficiency limitations, with current commercial OPV solutions achieving 10-12% efficiency compared to 20-22% for traditional silicon-based photovoltaics. However, recent laboratory breakthroughs demonstrating 18% efficiency in OPV cells suggest significant market expansion potential as these advances move toward commercialization.

Cost structures are evolving favorably, with production costs decreasing by approximately 15% annually over the past five years. Current manufacturing costs average $0.20 per watt, approaching the $0.15 per watt threshold considered necessary for mass market adoption without subsidies.

Supply chain analysis reveals vulnerabilities in rare materials procurement, with 75% of specialized organic compounds sourced from a limited number of suppliers. Market forecasts suggest this bottleneck will ease as production scales, with supplier diversity expected to increase by 40% within three years.

Regulatory environments vary significantly by region, with the European Union's Renewable Energy Directive providing the most comprehensive framework supporting OPV adoption. Emerging standardization efforts through the International Electrotechnical Commission (IEC) are expected to harmonize testing protocols by 2025, potentially accelerating market acceptance and cross-border trade.

The market segmentation reveals distinct application sectors, with building-integrated photovoltaics (BIPV) emerging as the dominant segment, accounting for nearly 40% of current market share. Portable electronics applications follow at 25%, while automotive applications and consumer goods represent 20% and 15% respectively.

Geographically, Europe leads the OPV market with approximately 45% market share, driven by stringent renewable energy policies and substantial research investments. North America follows at 30%, while the Asia-Pacific region, particularly China and Japan, is experiencing the fastest growth rate at 25% annually, fueled by expanding manufacturing capabilities and government incentives.

Consumer demand patterns indicate increasing preference for sustainable energy solutions, with 68% of surveyed consumers expressing willingness to pay premium prices for products incorporating green technologies like OPV. This trend is particularly pronounced in developed economies where environmental consciousness is higher.

Market penetration faces challenges related to efficiency limitations, with current commercial OPV solutions achieving 10-12% efficiency compared to 20-22% for traditional silicon-based photovoltaics. However, recent laboratory breakthroughs demonstrating 18% efficiency in OPV cells suggest significant market expansion potential as these advances move toward commercialization.

Cost structures are evolving favorably, with production costs decreasing by approximately 15% annually over the past five years. Current manufacturing costs average $0.20 per watt, approaching the $0.15 per watt threshold considered necessary for mass market adoption without subsidies.

Supply chain analysis reveals vulnerabilities in rare materials procurement, with 75% of specialized organic compounds sourced from a limited number of suppliers. Market forecasts suggest this bottleneck will ease as production scales, with supplier diversity expected to increase by 40% within three years.

Regulatory environments vary significantly by region, with the European Union's Renewable Energy Directive providing the most comprehensive framework supporting OPV adoption. Emerging standardization efforts through the International Electrotechnical Commission (IEC) are expected to harmonize testing protocols by 2025, potentially accelerating market acceptance and cross-border trade.

Current Regulatory Landscape and Technical Barriers

The organic photovoltaics (OPV) industry currently faces a complex and evolving regulatory landscape that varies significantly across global markets. In the European Union, the Renewable Energy Directive (RED II) and the European Green Deal have established ambitious targets for renewable energy adoption, creating a favorable policy environment for OPV technologies. However, these regulations also impose stringent requirements regarding material sustainability, recyclability, and end-of-life management that present significant technical challenges for OPV manufacturers.

In the United States, regulatory frameworks are more fragmented, with policies varying at federal, state, and local levels. The recent Inflation Reduction Act has allocated substantial funding for renewable energy development, but specific standards for emerging technologies like OPV remain underdeveloped. This regulatory uncertainty creates barriers for market entry and scaling of OPV technologies.

Asian markets, particularly China, Japan, and South Korea, have implemented aggressive renewable energy targets and supportive policies, but also maintain protective measures for domestic manufacturers that can limit international collaboration on standardization efforts for mass transfer technologies in OPV production.

A critical technical barrier in the OPV sector relates to the lack of standardized testing protocols for evaluating mass transfer efficiency and stability under various environmental conditions. Current IEC standards (IEC 61215 and IEC 61646) were primarily developed for traditional silicon-based photovoltaics and do not adequately address the unique characteristics of organic materials and their degradation mechanisms during mass transfer processes.

Material compatibility issues present another significant challenge, as regulations concerning hazardous substances (such as REACH in Europe and similar frameworks globally) increasingly restrict certain solvents and additives commonly used in OPV mass transfer processes. This necessitates the development of alternative, environmentally benign processing methods that maintain performance standards.

Manufacturing scalability faces regulatory hurdles related to quality control and consistency. The absence of universally accepted metrics for evaluating mass transfer uniformity across large-area substrates hampers the industry's ability to establish credible quality assurance protocols that satisfy regulatory requirements in different markets.

Certification processes for OPV technologies remain cumbersome and expensive, with limited mutual recognition between different regulatory jurisdictions. This creates redundant testing requirements and extends time-to-market, particularly affecting smaller innovators with limited resources.

Energy performance claims verification represents another regulatory challenge, as current standards do not adequately account for the unique performance characteristics of OPV technologies, including their superior performance under low-light and indoor conditions compared to conventional photovoltaics.

In the United States, regulatory frameworks are more fragmented, with policies varying at federal, state, and local levels. The recent Inflation Reduction Act has allocated substantial funding for renewable energy development, but specific standards for emerging technologies like OPV remain underdeveloped. This regulatory uncertainty creates barriers for market entry and scaling of OPV technologies.

Asian markets, particularly China, Japan, and South Korea, have implemented aggressive renewable energy targets and supportive policies, but also maintain protective measures for domestic manufacturers that can limit international collaboration on standardization efforts for mass transfer technologies in OPV production.

A critical technical barrier in the OPV sector relates to the lack of standardized testing protocols for evaluating mass transfer efficiency and stability under various environmental conditions. Current IEC standards (IEC 61215 and IEC 61646) were primarily developed for traditional silicon-based photovoltaics and do not adequately address the unique characteristics of organic materials and their degradation mechanisms during mass transfer processes.

Material compatibility issues present another significant challenge, as regulations concerning hazardous substances (such as REACH in Europe and similar frameworks globally) increasingly restrict certain solvents and additives commonly used in OPV mass transfer processes. This necessitates the development of alternative, environmentally benign processing methods that maintain performance standards.

Manufacturing scalability faces regulatory hurdles related to quality control and consistency. The absence of universally accepted metrics for evaluating mass transfer uniformity across large-area substrates hampers the industry's ability to establish credible quality assurance protocols that satisfy regulatory requirements in different markets.

Certification processes for OPV technologies remain cumbersome and expensive, with limited mutual recognition between different regulatory jurisdictions. This creates redundant testing requirements and extends time-to-market, particularly affecting smaller innovators with limited resources.

Energy performance claims verification represents another regulatory challenge, as current standards do not adequately account for the unique performance characteristics of OPV technologies, including their superior performance under low-light and indoor conditions compared to conventional photovoltaics.

Existing Compliance Frameworks and Technical Standards

01 Organic photovoltaic device fabrication techniques

Various fabrication techniques are employed to enhance the performance of organic photovoltaic devices. These include specialized deposition methods, interface engineering, and material processing techniques that control the mass transfer during manufacturing. Optimized fabrication processes can significantly improve charge carrier mobility, film morphology, and overall device efficiency while ensuring reproducibility for standardization purposes.- Manufacturing processes for organic photovoltaic devices: Various manufacturing processes are employed for the production of organic photovoltaic devices, including mass transfer techniques that ensure uniform deposition of organic materials. These processes involve controlled deposition methods such as vapor deposition, solution processing, and roll-to-roll manufacturing that enable precise layer formation. Standardized manufacturing protocols help maintain consistency in device performance and efficiency across production batches.

- Material composition and formulation standards: Standardization of organic materials used in photovoltaics focuses on composition, purity, and formulation requirements. Regulations govern the selection and quality control of donor and acceptor materials, conductive polymers, and interfacial layers. These standards ensure consistent material properties across different manufacturing facilities, enabling reproducible device performance and facilitating industry-wide quality benchmarks for organic semiconductor materials.

- Testing and certification protocols for organic photovoltaics: Standardized testing protocols are essential for evaluating organic photovoltaic performance and ensuring compliance with industry regulations. These include procedures for measuring power conversion efficiency, stability under various environmental conditions, and operational lifetime. Certification systems verify that devices meet minimum performance requirements and safety standards, providing a framework for quality assurance and enabling fair comparison between different technologies and manufacturers.

- Environmental and safety regulations for organic photovoltaic production: Regulations governing the environmental impact and safety aspects of organic photovoltaic manufacturing address concerns related to solvent use, waste management, and toxicity of materials. Standards specify acceptable limits for hazardous substances, proper handling procedures, and end-of-life recycling requirements. These regulations aim to minimize environmental footprint while ensuring worker safety throughout the production, installation, and disposal phases of organic photovoltaic systems.

- Quality control systems for mass production: Quality control systems for mass production of organic photovoltaics incorporate in-line monitoring techniques, statistical process control, and automated inspection methods. These systems regulate mass transfer parameters such as coating thickness, morphology, and interface quality during high-volume manufacturing. Standardized quality metrics and tolerance limits ensure consistency across production runs, while feedback mechanisms allow for real-time process adjustments to maintain optimal device performance.

02 Mass transfer control in organic semiconductor layers

Controlling mass transfer during the formation of organic semiconductor layers is critical for photovoltaic performance. This involves regulating the movement of molecules, polymers, and nanoparticles during deposition and annealing processes. Techniques such as controlled solvent evaporation, temperature gradient manipulation, and phase separation management help achieve optimal morphology and interface formation, which directly impacts charge generation and transport efficiency.Expand Specific Solutions03 Standardization protocols for organic photovoltaic testing

Standardization protocols are essential for consistent evaluation and comparison of organic photovoltaic devices. These protocols define specific testing conditions, measurement procedures, and performance metrics to ensure reproducibility across different laboratories and manufacturing facilities. Standard testing includes power conversion efficiency measurements, stability assessments, and accelerated aging tests under controlled environmental conditions, enabling reliable benchmarking and quality control.Expand Specific Solutions04 Regulatory frameworks for organic photovoltaic materials

Regulatory frameworks govern the use, production, and disposal of organic photovoltaic materials. These regulations address environmental concerns, safety standards, and sustainability requirements throughout the product lifecycle. Compliance with these frameworks ensures that organic photovoltaic technologies meet international standards for hazardous substance limitations, recyclability, and carbon footprint reduction, facilitating global market acceptance and integration into renewable energy policies.Expand Specific Solutions05 Mass transfer optimization systems for manufacturing scale-up

Mass transfer optimization systems are crucial for scaling up organic photovoltaic production from laboratory to industrial levels. These systems incorporate automated process control, real-time monitoring, and feedback mechanisms to maintain consistent material distribution and film formation across large areas. Advanced manufacturing equipment with precise control over coating parameters, drying conditions, and material flow enables high-throughput production while maintaining the quality and performance characteristics established in research prototypes.Expand Specific Solutions

Key Regulatory Bodies and Industry Stakeholders

The organic photovoltaics mass transfer regulation landscape is evolving rapidly, with the market currently in a growth phase characterized by increasing standardization efforts. The global market is projected to expand significantly as technology matures, driven by sustainability demands. Leading academic institutions (MIT, University of California, University of Michigan) are collaborating with industry players to establish technical standards, while major corporations (Merck, Canon, Toyota, Sharp) are investing in commercial applications. Chinese research entities (Chinese Academy of Science, Nankai University) are emerging as significant contributors, particularly in manufacturing standards. The technology is approaching commercial viability, with companies like Sumitomo Chemical and Murata Manufacturing working to scale production while navigating an increasingly complex regulatory environment focused on performance metrics, safety protocols, and environmental compliance.

Merck Patent GmbH

Technical Solution: Merck has established a comprehensive technical solution for organic photovoltaic mass transfer focusing on material standardization and process optimization. Their approach centers on developing standardized donor-acceptor polymer systems with precisely controlled molecular weights and polydispersity indices to ensure batch-to-batch consistency in industrial production[1]. Merck has pioneered solvent systems that enable uniform film formation during solution processing, with particular emphasis on environmentally friendly green solvents that comply with European REACH regulations. Their technical portfolio includes proprietary additives that control morphology development during thermal annealing, resulting in optimized bulk heterojunction structures with enhanced charge separation efficiency[2]. Merck has also developed specialized barrier materials and encapsulation technologies that extend OPV operational lifetime while meeting IEC 61646 testing standards for flexible photovoltaics. Their quality control system implements in-line optical characterization methods that have been validated against reference standards established by European Metrology Institutes[3].

Strengths: Merck's solutions offer exceptional batch-to-batch consistency critical for industrial scaling, with comprehensive regulatory compliance documentation for global markets. Their materials are optimized for existing manufacturing infrastructure. Weaknesses: Their proprietary material systems can create vendor lock-in for manufacturers. Some of their high-performance formulations still rely on halogenated solvents that face increasing regulatory scrutiny despite compliance with current standards.

Chinese Academy of Science Institute of Chemistry

Technical Solution: The Chinese Academy of Science Institute of Chemistry has developed a comprehensive technical approach to organic photovoltaic mass transfer standardization focusing on morphology control during solution processing. Their methodology incorporates precise solvent engineering techniques that enable reproducible bulk heterojunction formation across different manufacturing scales[1]. The Institute has pioneered standardized protocols for non-fullerene acceptor materials that achieve power conversion efficiencies exceeding 18% while maintaining morphological stability under thermal stress conditions. Their technical solution includes specialized additives that control crystallization kinetics during film formation, resulting in optimized domain sizes for efficient exciton dissociation and charge transport[2]. The Institute has also developed reference materials with certified optoelectronic properties that serve as calibration standards for quality control in industrial production. Their approach incorporates accelerated aging protocols that correlate with real-world performance according to standards developed in collaboration with China National Accreditation Service for Conformity Assessment (CNAS)[3]. The Institute has further established manufacturing guidelines that address critical parameters for solution viscosity, coating speed, and drying conditions to ensure uniform film formation across large-area substrates.

Strengths: Their technical solutions demonstrate exceptional scalability from laboratory to industrial production with minimal efficiency losses. Their standardized protocols have been widely adopted throughout the Chinese photovoltaic manufacturing sector. Weaknesses: Some of their high-performance formulations still face stability challenges in high-humidity environments. Their certification standards, while rigorous, sometimes diverge from international norms, creating potential market barriers for global deployment.

Critical Patents and Research in OPV Mass Transfer

Power transfer system and methods

PatentPendingUS20240128998A1

Innovation

- A bimodal near-field resonant wireless electrical power transfer system that simultaneously enables capacitive and inductive power transfer with an adjustable transfer mode ratio at a resonant power signal oscillation frequency, using a transmitter subsystem with a tuner module to adjust the power signal and a receiver subsystem to receive power efficiently, while allowing for flexible alignment and spacing.

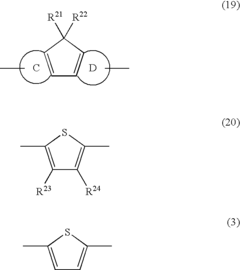

Organic photoelectric conversion device and polymer useful for producing the same

PatentInactiveUS20100084000A1

Innovation

- A polymer comprising specific repeating units with thiophene ring structures and substituents is developed, enhancing conjugation planarity and solubility, characterized by a difference of 0 or 1 in the maximum carbon number of alkyl groups in the repeating units, improving both charge transportability and solubility.

International Harmonization Efforts and Regional Differences

The global landscape of organic photovoltaics (OPV) regulation and standardization is characterized by significant regional variations, creating challenges for manufacturers, researchers, and market deployment. Despite these differences, substantial international harmonization efforts have emerged in recent years, aiming to create a more unified approach to OPV mass transfer technologies.

The International Electrotechnical Commission (IEC) has established Technical Committee 82, which focuses specifically on solar photovoltaic energy systems. This committee has developed several standards applicable to OPV technologies, including IEC 61215 for design qualification and IEC 61730 for safety qualification. However, these standards were initially designed for traditional silicon-based photovoltaics and require adaptation for the unique properties of organic materials.

The International Organization for Standardization (ISO) has complemented these efforts through its Technical Committee 229, addressing nanomaterials and nanotechnologies relevant to OPV manufacturing processes. Their work has been instrumental in establishing standardized terminology and measurement protocols that facilitate international collaboration and technology transfer.

Regional differences remain pronounced despite these harmonization initiatives. The European Union has implemented the most comprehensive regulatory framework through its Renewable Energy Directive and REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulations, which impose strict requirements on materials used in OPV production. These regulations emphasize environmental sustainability and toxicity concerns specific to organic semiconductors.

In contrast, the United States adopts a more market-driven approach, with the National Renewable Energy Laboratory (NREL) providing technical guidelines rather than mandatory standards. The Department of Energy's SunShot Initiative has established performance benchmarks that influence industry practices without imposing rigid regulatory requirements.

Asian markets present another regulatory paradigm, with Japan's JIS (Japanese Industrial Standards) and China's GB (Guobiao) standards incorporating specific provisions for emerging photovoltaic technologies. China's rapid expansion in renewable energy manufacturing has prompted the development of specialized standards for mass production techniques relevant to OPV scaling.

Bridging these regional differences, the International Renewable Energy Agency (IRENA) has launched initiatives to promote regulatory convergence, particularly focusing on developing nations seeking to adopt OPV technologies. Their "Global Atlas for Renewable Energy" includes standardized assessment methodologies for OPV deployment across diverse geographical and regulatory environments.

Recent multilateral agreements, such as the Clean Energy Ministerial's Standards and Labeling Working Group, have established mutual recognition frameworks that allow certification in one jurisdiction to be accepted in partner regions, significantly reducing barriers to global OPV commercialization and technology transfer.

The International Electrotechnical Commission (IEC) has established Technical Committee 82, which focuses specifically on solar photovoltaic energy systems. This committee has developed several standards applicable to OPV technologies, including IEC 61215 for design qualification and IEC 61730 for safety qualification. However, these standards were initially designed for traditional silicon-based photovoltaics and require adaptation for the unique properties of organic materials.

The International Organization for Standardization (ISO) has complemented these efforts through its Technical Committee 229, addressing nanomaterials and nanotechnologies relevant to OPV manufacturing processes. Their work has been instrumental in establishing standardized terminology and measurement protocols that facilitate international collaboration and technology transfer.

Regional differences remain pronounced despite these harmonization initiatives. The European Union has implemented the most comprehensive regulatory framework through its Renewable Energy Directive and REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulations, which impose strict requirements on materials used in OPV production. These regulations emphasize environmental sustainability and toxicity concerns specific to organic semiconductors.

In contrast, the United States adopts a more market-driven approach, with the National Renewable Energy Laboratory (NREL) providing technical guidelines rather than mandatory standards. The Department of Energy's SunShot Initiative has established performance benchmarks that influence industry practices without imposing rigid regulatory requirements.

Asian markets present another regulatory paradigm, with Japan's JIS (Japanese Industrial Standards) and China's GB (Guobiao) standards incorporating specific provisions for emerging photovoltaic technologies. China's rapid expansion in renewable energy manufacturing has prompted the development of specialized standards for mass production techniques relevant to OPV scaling.

Bridging these regional differences, the International Renewable Energy Agency (IRENA) has launched initiatives to promote regulatory convergence, particularly focusing on developing nations seeking to adopt OPV technologies. Their "Global Atlas for Renewable Energy" includes standardized assessment methodologies for OPV deployment across diverse geographical and regulatory environments.

Recent multilateral agreements, such as the Clean Energy Ministerial's Standards and Labeling Working Group, have established mutual recognition frameworks that allow certification in one jurisdiction to be accepted in partner regions, significantly reducing barriers to global OPV commercialization and technology transfer.

Environmental Impact Assessment and Sustainability Metrics

The environmental impact assessment of organic photovoltaics (OPV) mass transfer processes reveals significant advantages over traditional silicon-based solar technologies. OPV manufacturing typically consumes less energy and resources, with studies indicating up to 90% reduction in energy payback time compared to conventional photovoltaics. This translates to substantially lower carbon footprints across the production lifecycle, particularly when solution-processing techniques are employed.

Material sustainability represents a critical metric for evaluating OPV technologies. While organic semiconductors offer biodegradability advantages, concerns persist regarding the environmental persistence of certain additives and processing solvents. Recent regulatory frameworks have increasingly focused on restricting hazardous substances in electronic components, prompting manufacturers to develop greener alternatives to traditional halogenated solvents and toxic metal catalysts.

Life cycle assessment (LCA) methodologies specific to OPV technologies have evolved significantly in recent years. Standardized protocols now incorporate metrics for resource depletion, ecotoxicity, and end-of-life management scenarios. The International Electrotechnical Commission (IEC) has established sustainability reporting guidelines that manufacturers must follow, emphasizing transparency in material sourcing and manufacturing processes.

Water consumption metrics reveal another sustainability advantage of OPV manufacturing. Compared to silicon-based technologies requiring extensive water for purification processes, OPV production typically reduces water usage by 40-60%. However, the potential for water contamination from organic solvents necessitates robust waste management protocols, which are increasingly mandated by regulatory bodies worldwide.

Recycling and end-of-life considerations present both challenges and opportunities. While the organic components of OPVs offer theoretical biodegradability advantages, practical recovery systems for electrode materials and substrates remain underdeveloped. Recent standardization efforts have focused on design-for-disassembly principles to facilitate material recovery, with the European Union's WEEE Directive specifically addressing photovoltaic waste management requirements.

Emerging sustainability metrics now incorporate social impact assessments, including labor conditions in material sourcing and manufacturing. Certification systems such as the Electronic Product Environmental Assessment Tool (EPEAT) have expanded to include photovoltaic technologies, creating market incentives for manufacturers to adopt more sustainable practices throughout their supply chains and production processes.

Material sustainability represents a critical metric for evaluating OPV technologies. While organic semiconductors offer biodegradability advantages, concerns persist regarding the environmental persistence of certain additives and processing solvents. Recent regulatory frameworks have increasingly focused on restricting hazardous substances in electronic components, prompting manufacturers to develop greener alternatives to traditional halogenated solvents and toxic metal catalysts.

Life cycle assessment (LCA) methodologies specific to OPV technologies have evolved significantly in recent years. Standardized protocols now incorporate metrics for resource depletion, ecotoxicity, and end-of-life management scenarios. The International Electrotechnical Commission (IEC) has established sustainability reporting guidelines that manufacturers must follow, emphasizing transparency in material sourcing and manufacturing processes.

Water consumption metrics reveal another sustainability advantage of OPV manufacturing. Compared to silicon-based technologies requiring extensive water for purification processes, OPV production typically reduces water usage by 40-60%. However, the potential for water contamination from organic solvents necessitates robust waste management protocols, which are increasingly mandated by regulatory bodies worldwide.

Recycling and end-of-life considerations present both challenges and opportunities. While the organic components of OPVs offer theoretical biodegradability advantages, practical recovery systems for electrode materials and substrates remain underdeveloped. Recent standardization efforts have focused on design-for-disassembly principles to facilitate material recovery, with the European Union's WEEE Directive specifically addressing photovoltaic waste management requirements.

Emerging sustainability metrics now incorporate social impact assessments, including labor conditions in material sourcing and manufacturing. Certification systems such as the Electronic Product Environmental Assessment Tool (EPEAT) have expanded to include photovoltaic technologies, creating market incentives for manufacturers to adopt more sustainable practices throughout their supply chains and production processes.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!