Comparative study of electropolishing versus mechanical polishing for precision parts

OCT 11, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Surface Finishing Technology Background and Objectives

Surface finishing technologies have evolved significantly over the past century, transitioning from primarily manual processes to sophisticated automated systems that deliver unprecedented precision and consistency. The development trajectory has been driven by increasing demands across various high-precision industries including aerospace, medical devices, semiconductor manufacturing, and automotive components. These industries require surface finishes that not only meet aesthetic standards but also fulfill critical functional requirements such as reduced friction, improved corrosion resistance, enhanced fatigue life, and optimal biocompatibility.

Electropolishing emerged in the early 20th century as an electrochemical process that selectively removes material from metal surfaces, while mechanical polishing techniques have continuously evolved from basic abrasive methods to highly controlled processes utilizing advanced materials and equipment. The interplay between these two distinct approaches represents a fundamental dichotomy in precision surface finishing technology.

The global precision components market, valued at approximately $256 billion in 2022, is projected to grow at a CAGR of 7.8% through 2030, with surface finishing technologies playing an increasingly critical role in this expansion. This growth is particularly evident in sectors requiring ultra-precision components with surface roughness measurements in the nanometer range.

Recent technological advancements have significantly narrowed the performance gap between electropolishing and mechanical polishing. Modern mechanical polishing systems now incorporate computer-controlled pressure application, advanced abrasive materials, and precise motion control that can achieve surface finishes approaching those of electropolishing in certain applications. Simultaneously, electropolishing has become more sophisticated with the development of pulse current techniques, specialized electrolyte formulations, and precise temperature control systems.

The primary objective of this technical research is to conduct a comprehensive comparative analysis of electropolishing versus mechanical polishing technologies for precision components. This analysis aims to establish quantitative benchmarks for surface quality, dimensional accuracy, process efficiency, environmental impact, and cost-effectiveness across various material types and component geometries.

Additionally, this research seeks to identify optimal application scenarios for each technology, recognizing that material characteristics, component geometry, production volume, and specific performance requirements all influence the selection of the most appropriate finishing method. The findings will provide a decision framework to guide engineers and manufacturers in selecting the most suitable surface finishing approach for specific precision applications.

Electropolishing emerged in the early 20th century as an electrochemical process that selectively removes material from metal surfaces, while mechanical polishing techniques have continuously evolved from basic abrasive methods to highly controlled processes utilizing advanced materials and equipment. The interplay between these two distinct approaches represents a fundamental dichotomy in precision surface finishing technology.

The global precision components market, valued at approximately $256 billion in 2022, is projected to grow at a CAGR of 7.8% through 2030, with surface finishing technologies playing an increasingly critical role in this expansion. This growth is particularly evident in sectors requiring ultra-precision components with surface roughness measurements in the nanometer range.

Recent technological advancements have significantly narrowed the performance gap between electropolishing and mechanical polishing. Modern mechanical polishing systems now incorporate computer-controlled pressure application, advanced abrasive materials, and precise motion control that can achieve surface finishes approaching those of electropolishing in certain applications. Simultaneously, electropolishing has become more sophisticated with the development of pulse current techniques, specialized electrolyte formulations, and precise temperature control systems.

The primary objective of this technical research is to conduct a comprehensive comparative analysis of electropolishing versus mechanical polishing technologies for precision components. This analysis aims to establish quantitative benchmarks for surface quality, dimensional accuracy, process efficiency, environmental impact, and cost-effectiveness across various material types and component geometries.

Additionally, this research seeks to identify optimal application scenarios for each technology, recognizing that material characteristics, component geometry, production volume, and specific performance requirements all influence the selection of the most appropriate finishing method. The findings will provide a decision framework to guide engineers and manufacturers in selecting the most suitable surface finishing approach for specific precision applications.

Market Analysis for Precision Surface Treatment Solutions

The global market for precision surface treatment solutions has experienced significant growth in recent years, driven by increasing demand for high-precision components across various industries. The market size for precision surface finishing technologies reached approximately $5.7 billion in 2022 and is projected to grow at a CAGR of 6.8% through 2028, reaching an estimated value of $8.5 billion.

Electropolishing and mechanical polishing represent two dominant segments within this market, collectively accounting for over 45% of the total market share. Electropolishing solutions specifically have seen accelerated adoption with a growth rate exceeding 8% annually, outpacing traditional mechanical polishing methods which grow at around 5% per year.

Industry-specific analysis reveals aerospace and medical device manufacturing as the primary demand drivers, collectively representing 53% of the precision polishing market. The aerospace sector demands ultra-smooth surfaces for critical components to enhance aerodynamic efficiency and structural integrity, while medical device manufacturers require biocompatible, contamination-free surfaces for implantable devices and surgical instruments.

Regional market distribution shows North America leading with 38% market share, followed by Europe (29%) and Asia-Pacific (24%). However, the Asia-Pacific region demonstrates the highest growth trajectory at 9.2% annually, primarily driven by rapid industrialization in China and India, and the expansion of precision manufacturing capabilities in countries like South Korea and Taiwan.

Customer segmentation analysis indicates that large OEMs constitute 62% of the market, while small and medium enterprises represent the remaining 38%. This distribution highlights the capital-intensive nature of advanced surface treatment technologies, particularly for electropolishing systems which require specialized equipment and expertise.

Price sensitivity varies significantly across market segments. High-precision industries like semiconductor manufacturing and medical implants demonstrate low price elasticity, prioritizing quality and consistency over cost considerations. Conversely, automotive and general manufacturing segments exhibit higher price sensitivity, creating opportunities for cost-effective mechanical polishing solutions in less demanding applications.

Market forecasts suggest a gradual shift toward hybrid polishing solutions that combine the advantages of both electropolishing and mechanical methods. This trend is expected to create new market opportunities estimated at $1.2 billion by 2027, particularly in emerging applications such as additive manufacturing post-processing and advanced electronics.

Electropolishing and mechanical polishing represent two dominant segments within this market, collectively accounting for over 45% of the total market share. Electropolishing solutions specifically have seen accelerated adoption with a growth rate exceeding 8% annually, outpacing traditional mechanical polishing methods which grow at around 5% per year.

Industry-specific analysis reveals aerospace and medical device manufacturing as the primary demand drivers, collectively representing 53% of the precision polishing market. The aerospace sector demands ultra-smooth surfaces for critical components to enhance aerodynamic efficiency and structural integrity, while medical device manufacturers require biocompatible, contamination-free surfaces for implantable devices and surgical instruments.

Regional market distribution shows North America leading with 38% market share, followed by Europe (29%) and Asia-Pacific (24%). However, the Asia-Pacific region demonstrates the highest growth trajectory at 9.2% annually, primarily driven by rapid industrialization in China and India, and the expansion of precision manufacturing capabilities in countries like South Korea and Taiwan.

Customer segmentation analysis indicates that large OEMs constitute 62% of the market, while small and medium enterprises represent the remaining 38%. This distribution highlights the capital-intensive nature of advanced surface treatment technologies, particularly for electropolishing systems which require specialized equipment and expertise.

Price sensitivity varies significantly across market segments. High-precision industries like semiconductor manufacturing and medical implants demonstrate low price elasticity, prioritizing quality and consistency over cost considerations. Conversely, automotive and general manufacturing segments exhibit higher price sensitivity, creating opportunities for cost-effective mechanical polishing solutions in less demanding applications.

Market forecasts suggest a gradual shift toward hybrid polishing solutions that combine the advantages of both electropolishing and mechanical methods. This trend is expected to create new market opportunities estimated at $1.2 billion by 2027, particularly in emerging applications such as additive manufacturing post-processing and advanced electronics.

Current State and Challenges in Polishing Technologies

The global precision parts manufacturing industry has witnessed significant advancements in surface finishing technologies over the past decade. Currently, both electropolishing and mechanical polishing represent mature yet evolving technologies with distinct application domains. Electropolishing has gained substantial traction in medical device manufacturing, semiconductor components, and aerospace applications where microscopic surface quality is paramount. Meanwhile, mechanical polishing continues to dominate in automotive, jewelry, and general machining industries where cost-effectiveness and established workflows are prioritized.

Recent market research indicates that approximately 65% of precision manufacturing facilities employ mechanical polishing as their primary finishing method, while electropolishing accounts for roughly 25%, with the remainder using hybrid or alternative approaches. This distribution reflects both technological capabilities and economic considerations that influence adoption rates across different sectors.

The primary technical challenges facing both polishing methodologies center around process consistency, material-specific optimization, and automation integration. For electropolishing, achieving uniform current distribution on complex geometries remains problematic, often resulting in preferential dissolution at edges and corners. Additionally, the environmental impact of electrolytic solutions presents regulatory hurdles in many regions, with increasingly stringent waste management requirements driving up operational costs.

Mechanical polishing faces different but equally significant challenges. The inherent variability in manual processes creates quality control issues, while tool wear affects repeatability in automated systems. Surface deformation and residual stress introduction remain persistent concerns, particularly for thin-walled or delicate components where dimensional stability is critical.

Geographically, advanced electropolishing technologies are concentrated in North America, Western Europe, and Japan, where stringent medical and aerospace regulations have driven innovation. Emerging economies, particularly in Southeast Asia, are rapidly adopting these technologies but often struggle with process control and quality consistency. China has made substantial investments in automated mechanical polishing systems but faces challenges in high-precision electropolishing applications requiring sophisticated process control.

The integration of real-time monitoring systems represents a significant development in both polishing technologies. Optical surface analysis, machine learning algorithms for process optimization, and closed-loop feedback systems are beginning to address consistency challenges, though implementation costs remain prohibitive for smaller manufacturers. Material science advancements have also introduced new challenges, as novel alloys and composites often require specialized polishing protocols that deviate from established practices.

Recent market research indicates that approximately 65% of precision manufacturing facilities employ mechanical polishing as their primary finishing method, while electropolishing accounts for roughly 25%, with the remainder using hybrid or alternative approaches. This distribution reflects both technological capabilities and economic considerations that influence adoption rates across different sectors.

The primary technical challenges facing both polishing methodologies center around process consistency, material-specific optimization, and automation integration. For electropolishing, achieving uniform current distribution on complex geometries remains problematic, often resulting in preferential dissolution at edges and corners. Additionally, the environmental impact of electrolytic solutions presents regulatory hurdles in many regions, with increasingly stringent waste management requirements driving up operational costs.

Mechanical polishing faces different but equally significant challenges. The inherent variability in manual processes creates quality control issues, while tool wear affects repeatability in automated systems. Surface deformation and residual stress introduction remain persistent concerns, particularly for thin-walled or delicate components where dimensional stability is critical.

Geographically, advanced electropolishing technologies are concentrated in North America, Western Europe, and Japan, where stringent medical and aerospace regulations have driven innovation. Emerging economies, particularly in Southeast Asia, are rapidly adopting these technologies but often struggle with process control and quality consistency. China has made substantial investments in automated mechanical polishing systems but faces challenges in high-precision electropolishing applications requiring sophisticated process control.

The integration of real-time monitoring systems represents a significant development in both polishing technologies. Optical surface analysis, machine learning algorithms for process optimization, and closed-loop feedback systems are beginning to address consistency challenges, though implementation costs remain prohibitive for smaller manufacturers. Material science advancements have also introduced new challenges, as novel alloys and composites often require specialized polishing protocols that deviate from established practices.

Current Electropolishing and Mechanical Polishing Methods

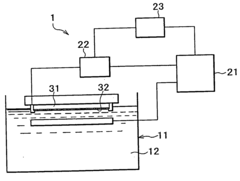

01 Electropolishing techniques for surface finish improvement

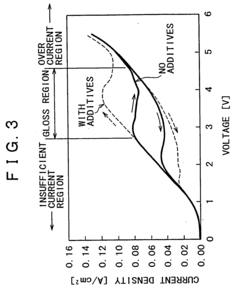

Electropolishing is an electrochemical process that removes material from a metal workpiece to improve surface finish quality. This technique involves the workpiece acting as an anode in an electrolytic cell, where controlled dissolution of the surface occurs, preferentially removing microscopic peaks and leaving a smoother surface. The process parameters such as current density, electrolyte composition, and processing time significantly affect the final surface quality, with optimal conditions resulting in mirror-like finishes with reduced roughness and improved corrosion resistance.- Electropolishing techniques for surface finish improvement: Electropolishing is an electrochemical process that removes material from a metal workpiece to improve surface finish quality. This technique involves the workpiece acting as an anode in an electrolytic cell, where controlled dissolution of the surface occurs, preferentially removing microscopic peaks and leaving a smoother surface. The process parameters such as current density, electrolyte composition, and processing time significantly affect the final surface quality, with optimal conditions resulting in mirror-like finishes with reduced roughness.

- Mechanical polishing methods and their impact on surface quality: Mechanical polishing involves the physical removal of material using abrasive particles to achieve desired surface finish quality. Various techniques such as chemical-mechanical polishing (CMP), abrasive polishing, and buffing are employed depending on the material and required finish. The process typically involves progressively finer abrasives to reduce surface roughness. Factors affecting the final surface quality include abrasive particle size, polishing pad characteristics, applied pressure, and slurry composition. Proper control of these parameters results in uniform material removal and improved surface finish.

- Surface finish measurement and quality control techniques: Accurate measurement and quality control of surface finish are essential for ensuring consistent results in both electropolishing and mechanical polishing processes. Various metrology techniques are employed, including optical profilometry, atomic force microscopy, and interferometry to quantify surface roughness parameters. Real-time monitoring systems can detect surface defects and variations during the polishing process, allowing for immediate adjustments. Statistical process control methods help maintain consistent surface quality across multiple workpieces by analyzing measurement data and identifying process drift.

- Combined polishing approaches for enhanced surface finish: Combining different polishing techniques can yield superior surface finish quality compared to single-method approaches. Sequential processing that incorporates both mechanical and electropolishing steps can address different types of surface imperfections. For example, mechanical polishing may first remove larger defects and establish a uniform surface, followed by electropolishing to achieve final smoothness and luster. Hybrid processes that simultaneously apply multiple polishing mechanisms have also been developed to optimize material removal rates while maintaining high-quality surface finish.

- Material-specific polishing considerations for optimal surface finish: Different materials require tailored polishing approaches to achieve optimal surface finish quality. For metals, electropolishing parameters must be adjusted based on the specific alloy composition and microstructure. Semiconductor materials often require specialized slurries and pad materials during chemical-mechanical polishing to achieve atomic-level smoothness without introducing defects. Ceramic and composite materials present unique challenges due to their heterogeneous nature, requiring carefully selected abrasives and polishing techniques to prevent preferential material removal and maintain surface integrity.

02 Mechanical polishing methods and their impact on surface quality

Mechanical polishing involves the physical removal of material using abrasives to achieve desired surface finish quality. Various techniques including chemical mechanical polishing (CMP), abrasive polishing, and buffing are employed depending on the material and required finish. The process typically involves progressively finer abrasives to reduce surface roughness. Factors affecting the quality of mechanically polished surfaces include abrasive type and size, polishing pad characteristics, applied pressure, and rotational speed. Proper control of these parameters results in uniform material removal and consistent surface finish.Expand Specific Solutions03 Surface finish measurement and quality control techniques

Accurate measurement and quality control of surface finish are essential for ensuring consistent results in both electropolishing and mechanical polishing processes. Various metrology techniques are employed, including optical profilometry, atomic force microscopy, and scanning electron microscopy to quantify surface roughness parameters. Real-time monitoring systems can detect surface defects and variations during the polishing process, allowing for immediate adjustments. Statistical process control methods help maintain consistent surface quality across production batches by establishing acceptable tolerance ranges and identifying process drift.Expand Specific Solutions04 Integration of polishing processes in semiconductor manufacturing

Polishing processes play a critical role in semiconductor manufacturing, particularly in achieving the ultra-smooth surfaces required for advanced microelectronic devices. Chemical mechanical planarization (CMP) is widely used to planarize wafer surfaces between processing steps. The integration of polishing into semiconductor fabrication requires careful consideration of material compatibility, feature preservation, and contamination control. Advanced process control systems help optimize polishing parameters based on incoming wafer characteristics and target specifications, resulting in improved yield and device performance.Expand Specific Solutions05 Novel materials and compositions for enhanced polishing performance

Innovative materials and compositions have been developed to enhance polishing performance and surface finish quality. These include specialized polishing slurries with engineered abrasive particles, chemical additives that promote selective material removal, and novel pad materials with optimized mechanical properties. Nanoparticle-enhanced polishing compounds can achieve higher removal rates while maintaining surface integrity. Additionally, environmentally friendly polishing solutions have been formulated to reduce the use of hazardous chemicals while maintaining or improving surface finish quality. These advancements enable more efficient polishing processes with superior results across various materials.Expand Specific Solutions

Key Industry Players in Precision Polishing

The electropolishing versus mechanical polishing market is currently in a growth phase, with increasing demand for precision components across semiconductor, medical, and automotive industries. The global market size for precision polishing is estimated to exceed $5 billion, driven by requirements for higher surface quality and dimensional accuracy. Technologically, electropolishing is gaining traction due to its superior finish capabilities, though mechanical polishing remains dominant. Leading players include Applied Materials and Novellus Systems in semiconductor applications, Cook Medical and DuPont in medical devices, and Toyota and Rolls-Royce in precision engineering. Academic institutions like Xi'an Jiaotong University and Huazhong University are advancing fundamental research, while specialized firms like Faraday Technology and Steros GPA Innovative are developing novel electropolishing solutions for emerging applications.

Applied Materials, Inc.

Technical Solution: Applied Materials has developed advanced Electro-Chemical Mechanical Planarization (ECMP) systems that integrate electropolishing principles with mechanical polishing for semiconductor manufacturing and precision components. Their Reflexion® LK ECMP platform combines electrochemical dissolution with mechanical abrasion in a controlled manner, allowing for precise material removal with minimal surface defects. The system utilizes proprietary pad designs and slurry chemistry that work synergistically with applied electrical potential to achieve nanometer-level surface finishes. Applied Materials' technology incorporates multi-zone control that enables uniform polishing across large wafers despite variations in current density distribution. Their systems feature in-situ metrology for real-time process monitoring and endpoint detection, ensuring consistent results even with varying material compositions[2]. This approach significantly reduces subsurface damage compared to purely mechanical methods while maintaining high throughput necessary for industrial applications.

Strengths: Exceptional planarization capability with nanometer-level precision; reduced mechanical stress on delicate components; excellent for multi-material surfaces with selective removal rates. Weaknesses: Complex integration requirements with supporting infrastructure; higher operational costs than conventional mechanical polishing; requires specialized technical expertise for maintenance and process optimization.

Faraday Technology, Inc.

Technical Solution: Faraday Technology has developed a proprietary Electrochemical Mechanical Polishing (ECMP) technology that combines electropolishing with mechanical abrasion for precision parts. Their FARADAYIC® Process utilizes pulse/pulse-reverse electric fields to enhance mass transport during electropolishing, allowing precise control over material removal rates and surface finish quality. This technology enables selective dissolution of microscopic peaks without affecting valleys, resulting in superior surface smoothness compared to conventional mechanical polishing. Faraday's approach incorporates modulated electric fields that can be tailored to specific metal alloys and geometries, making it particularly effective for complex parts with internal features that are difficult to access with mechanical methods[1]. Their systems also incorporate real-time monitoring and feedback control to maintain consistent results across production batches.

Strengths: Superior ability to polish complex internal geometries inaccessible to mechanical methods; environmentally friendlier than traditional chemical polishing; provides excellent surface uniformity with Ra values below 0.1μm. Weaknesses: Higher initial equipment investment compared to mechanical polishing; requires specialized electrolyte solutions that need periodic replacement; process optimization can be time-consuming for new materials or geometries.

Technical Analysis of Key Surface Treatment Patents

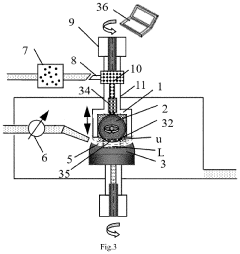

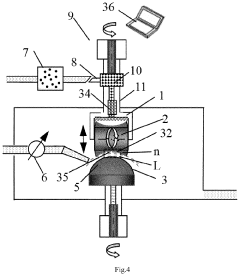

Polishing method and electropolishing apparatus

PatentInactiveUS20040104128A1

Innovation

- A polishing method and apparatus that determine the electropolishing end point by analyzing the change in current waveform through differentiation, allowing for precise control of the electropolishing process and alternating with chemical mechanical polishing or chemical buffing to achieve a smooth and high-quality surface.

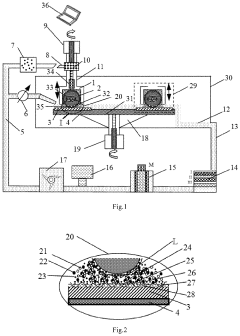

Efficient ultra-precise shear thickening and chemical synergy polishing method

PatentActiveUS20210031328A1

Innovation

- An efficient ultra-precise shear thickening and chemical synergy polishing method using a polishing slurry with 10-20% abrasive particles, 20-30% shear thickening enhanced phase, 39-50% water, and 1-26% green chemistry environmentally-friendly substances, combined with a solution flow boundary constraint mechanism to actively control the polishing process, allowing for precise machining of diverse materials and surface shapes with improved efficiency and precision.

Material Compatibility and Selection Guidelines

Material selection plays a critical role in determining the effectiveness of both electropolishing and mechanical polishing processes for precision parts. Different materials respond uniquely to these surface finishing techniques, necessitating careful consideration during process planning and implementation.

For electropolishing applications, materials with high electrical conductivity generally yield superior results. Stainless steel alloys, particularly 300 series (304, 316L), demonstrate excellent compatibility with electropolishing processes, achieving mirror-like finishes with minimal material removal. Nickel-based superalloys and titanium alloys also respond favorably, though they require specialized electrolyte formulations and precise current density control to prevent uneven material dissolution.

Conversely, mechanical polishing exhibits broader material compatibility, effectively processing both conductive and non-conductive materials. However, material hardness significantly influences process efficiency and outcome quality. Softer materials like aluminum and copper demand careful pressure control to prevent excessive material removal and surface deformation. Harder materials such as hardened tool steels and tungsten carbide require more aggressive abrasive media and extended processing times.

Material microstructure represents another crucial consideration. Materials with heterogeneous structures, including dual-phase steels and precipitation-hardened alloys, may experience preferential etching during electropolishing, resulting in uneven surface topography. For these materials, mechanical polishing often provides more consistent results, though proper abrasive selection remains essential to prevent selective removal of softer phases.

Surface contamination susceptibility varies significantly between materials. Reactive metals like titanium and magnesium require specialized handling during both polishing methods to prevent oxidation or chemical reaction with processing media. Electropolishing offers advantages for these materials by creating passive oxide layers that enhance corrosion resistance, whereas mechanical polishing may introduce embedded abrasive particles that compromise surface integrity.

For medical and semiconductor applications where biocompatibility or ultra-high purity is required, material-process compatibility becomes particularly critical. Electropolishing is generally preferred for implantable devices made from titanium or cobalt-chrome alloys, as it removes surface contaminants while enhancing passivation. For semiconductor components, material selection must consider both finishing requirements and downstream compatibility with clean room environments.

A systematic material selection approach should incorporate consideration of the component's functional requirements, material properties, surface finish specifications, and post-processing treatments. Developing material-specific process parameters through iterative testing and validation ensures optimal results for precision applications across industries.

For electropolishing applications, materials with high electrical conductivity generally yield superior results. Stainless steel alloys, particularly 300 series (304, 316L), demonstrate excellent compatibility with electropolishing processes, achieving mirror-like finishes with minimal material removal. Nickel-based superalloys and titanium alloys also respond favorably, though they require specialized electrolyte formulations and precise current density control to prevent uneven material dissolution.

Conversely, mechanical polishing exhibits broader material compatibility, effectively processing both conductive and non-conductive materials. However, material hardness significantly influences process efficiency and outcome quality. Softer materials like aluminum and copper demand careful pressure control to prevent excessive material removal and surface deformation. Harder materials such as hardened tool steels and tungsten carbide require more aggressive abrasive media and extended processing times.

Material microstructure represents another crucial consideration. Materials with heterogeneous structures, including dual-phase steels and precipitation-hardened alloys, may experience preferential etching during electropolishing, resulting in uneven surface topography. For these materials, mechanical polishing often provides more consistent results, though proper abrasive selection remains essential to prevent selective removal of softer phases.

Surface contamination susceptibility varies significantly between materials. Reactive metals like titanium and magnesium require specialized handling during both polishing methods to prevent oxidation or chemical reaction with processing media. Electropolishing offers advantages for these materials by creating passive oxide layers that enhance corrosion resistance, whereas mechanical polishing may introduce embedded abrasive particles that compromise surface integrity.

For medical and semiconductor applications where biocompatibility or ultra-high purity is required, material-process compatibility becomes particularly critical. Electropolishing is generally preferred for implantable devices made from titanium or cobalt-chrome alloys, as it removes surface contaminants while enhancing passivation. For semiconductor components, material selection must consider both finishing requirements and downstream compatibility with clean room environments.

A systematic material selection approach should incorporate consideration of the component's functional requirements, material properties, surface finish specifications, and post-processing treatments. Developing material-specific process parameters through iterative testing and validation ensures optimal results for precision applications across industries.

Environmental Impact and Sustainability Considerations

The environmental impact of surface finishing processes has become increasingly important as industries strive for sustainable manufacturing practices. Electropolishing and mechanical polishing present distinct environmental profiles that merit careful consideration when selecting finishing methods for precision parts manufacturing.

Electropolishing utilizes chemical baths containing acids and other potentially hazardous substances, creating concerns regarding waste disposal and chemical management. These electrolytic processes generate spent solutions containing dissolved metals and chemical compounds that require specialized treatment before disposal. However, modern electropolishing facilities have implemented closed-loop systems that recover and reuse chemicals, significantly reducing waste generation. Additionally, electropolishing typically consumes less energy per part compared to mechanical methods, particularly for complex geometries requiring uniform surface treatment.

Mechanical polishing, conversely, produces solid waste in the form of abrasive particles, polishing compounds, and metal swarf. While these materials are generally less toxic than electropolishing chemicals, they still require proper disposal protocols. The dust generated during mechanical polishing processes necessitates effective ventilation and filtration systems to protect worker health and prevent environmental contamination. Energy consumption in mechanical polishing can be substantial, especially when multiple processing steps are required to achieve the desired surface finish.

Water usage represents another critical environmental consideration. Electropolishing typically requires significant water volumes for rinsing operations, though advanced systems now incorporate water recycling capabilities. Mechanical polishing generally uses less water but may require coolants and lubricants that introduce additional environmental considerations regarding disposal and potential contamination.

From a lifecycle perspective, the durability of the finished surface affects long-term sustainability. Electropolished surfaces often demonstrate superior corrosion resistance and longevity, potentially extending product lifecycles and reducing replacement frequency. This characteristic may offset initial environmental impacts through reduced material consumption over time.

Carbon footprint assessments reveal that local energy sources significantly influence the environmental impact of both processes. Facilities powered by renewable energy can substantially reduce the carbon footprint of either polishing method. Additionally, transportation considerations become relevant when outsourcing finishing operations, as the environmental cost of shipping parts to specialized facilities may outweigh process-specific impacts.

Recent regulatory trends indicate increasing scrutiny of chemical processes in manufacturing, with stricter controls on effluents and emissions. Companies adopting electropolishing must ensure compliance with evolving regulations, while mechanical polishing operations face growing pressure to control particulate emissions and manage solid waste responsibly.

Electropolishing utilizes chemical baths containing acids and other potentially hazardous substances, creating concerns regarding waste disposal and chemical management. These electrolytic processes generate spent solutions containing dissolved metals and chemical compounds that require specialized treatment before disposal. However, modern electropolishing facilities have implemented closed-loop systems that recover and reuse chemicals, significantly reducing waste generation. Additionally, electropolishing typically consumes less energy per part compared to mechanical methods, particularly for complex geometries requiring uniform surface treatment.

Mechanical polishing, conversely, produces solid waste in the form of abrasive particles, polishing compounds, and metal swarf. While these materials are generally less toxic than electropolishing chemicals, they still require proper disposal protocols. The dust generated during mechanical polishing processes necessitates effective ventilation and filtration systems to protect worker health and prevent environmental contamination. Energy consumption in mechanical polishing can be substantial, especially when multiple processing steps are required to achieve the desired surface finish.

Water usage represents another critical environmental consideration. Electropolishing typically requires significant water volumes for rinsing operations, though advanced systems now incorporate water recycling capabilities. Mechanical polishing generally uses less water but may require coolants and lubricants that introduce additional environmental considerations regarding disposal and potential contamination.

From a lifecycle perspective, the durability of the finished surface affects long-term sustainability. Electropolished surfaces often demonstrate superior corrosion resistance and longevity, potentially extending product lifecycles and reducing replacement frequency. This characteristic may offset initial environmental impacts through reduced material consumption over time.

Carbon footprint assessments reveal that local energy sources significantly influence the environmental impact of both processes. Facilities powered by renewable energy can substantially reduce the carbon footprint of either polishing method. Additionally, transportation considerations become relevant when outsourcing finishing operations, as the environmental cost of shipping parts to specialized facilities may outweigh process-specific impacts.

Recent regulatory trends indicate increasing scrutiny of chemical processes in manufacturing, with stricter controls on effluents and emissions. Companies adopting electropolishing must ensure compliance with evolving regulations, while mechanical polishing operations face growing pressure to control particulate emissions and manage solid waste responsibly.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!