Comparing Patent Activity in Metasurface Antenna Technologies

SEP 25, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Metasurface Antenna Technology Background and Objectives

Metasurface antennas represent a revolutionary advancement in electromagnetic wave manipulation technology, emerging from the broader field of metamaterials research that gained significant momentum in the early 2000s. These ultra-thin, planar structures consist of subwavelength elements arranged in specific patterns to control electromagnetic wavefronts with unprecedented precision. Unlike conventional antennas that rely on three-dimensional structures, metasurface antennas achieve similar or superior functionality through two-dimensional engineered surfaces.

The evolution of metasurface antenna technology has followed a clear trajectory from theoretical concepts to practical implementations. Initial research focused on fundamental electromagnetic principles, gradually transitioning to proof-of-concept prototypes, and now moving toward commercial applications. This progression has been accelerated by advances in nanofabrication techniques, computational electromagnetic modeling, and material science innovations.

Current technological trends indicate a shift toward active and reconfigurable metasurface antennas, which can dynamically alter their electromagnetic properties in response to external stimuli. This represents a significant departure from early static designs and opens new possibilities for adaptive and intelligent antenna systems. Additionally, the integration of metasurface antennas with other emerging technologies, such as 5G/6G communications, autonomous vehicles, and IoT devices, is driving specialized development paths.

The primary objectives of metasurface antenna technology development include achieving wider bandwidth operation, enhancing gain and efficiency, reducing manufacturing costs, and enabling multi-functional capabilities. Researchers are particularly focused on overcoming the inherent narrowband limitations of many metasurface designs while maintaining their compact form factor advantages.

Patent activity in this field serves as a critical indicator of technological maturity and commercial interest. Analysis of patent trends reveals accelerating innovation rates, with particular concentration in telecommunications, aerospace, defense, and medical imaging applications. Geographic distribution of patent filings shows strong activity centers in the United States, China, South Korea, and Europe, reflecting the global strategic importance of this technology.

The ultimate goal of metasurface antenna development is to create highly efficient, compact, and versatile electromagnetic interfaces that can outperform conventional antenna technologies across multiple metrics simultaneously. This includes achieving higher data transmission rates, more precise beam steering, reduced interference, lower power consumption, and seamless integration into existing and emerging systems.

The evolution of metasurface antenna technology has followed a clear trajectory from theoretical concepts to practical implementations. Initial research focused on fundamental electromagnetic principles, gradually transitioning to proof-of-concept prototypes, and now moving toward commercial applications. This progression has been accelerated by advances in nanofabrication techniques, computational electromagnetic modeling, and material science innovations.

Current technological trends indicate a shift toward active and reconfigurable metasurface antennas, which can dynamically alter their electromagnetic properties in response to external stimuli. This represents a significant departure from early static designs and opens new possibilities for adaptive and intelligent antenna systems. Additionally, the integration of metasurface antennas with other emerging technologies, such as 5G/6G communications, autonomous vehicles, and IoT devices, is driving specialized development paths.

The primary objectives of metasurface antenna technology development include achieving wider bandwidth operation, enhancing gain and efficiency, reducing manufacturing costs, and enabling multi-functional capabilities. Researchers are particularly focused on overcoming the inherent narrowband limitations of many metasurface designs while maintaining their compact form factor advantages.

Patent activity in this field serves as a critical indicator of technological maturity and commercial interest. Analysis of patent trends reveals accelerating innovation rates, with particular concentration in telecommunications, aerospace, defense, and medical imaging applications. Geographic distribution of patent filings shows strong activity centers in the United States, China, South Korea, and Europe, reflecting the global strategic importance of this technology.

The ultimate goal of metasurface antenna development is to create highly efficient, compact, and versatile electromagnetic interfaces that can outperform conventional antenna technologies across multiple metrics simultaneously. This includes achieving higher data transmission rates, more precise beam steering, reduced interference, lower power consumption, and seamless integration into existing and emerging systems.

Market Demand Analysis for Metasurface Antennas

The global market for metasurface antennas is experiencing robust growth, driven by increasing demand for high-performance communication systems across multiple sectors. Current market valuations indicate significant expansion potential, with the metasurface antenna market projected to grow at a compound annual growth rate of over 20% through 2030, outpacing traditional antenna technologies.

Telecommunications represents the primary demand driver, particularly with the ongoing global 5G network deployment and early planning for 6G technologies. Network operators seek metasurface antennas to overcome bandwidth limitations, reduce interference, and support higher data transmission rates. The ability of metasurface antennas to enable beamforming and beam steering capabilities makes them particularly valuable for dense urban environments where signal optimization is critical.

Aerospace and defense sectors constitute another substantial market segment. Military applications require increasingly sophisticated communication systems with enhanced security features, reduced detectability, and improved reliability under adverse conditions. Metasurface antennas offer significant advantages in these contexts, particularly in radar systems, secure communications, and electronic warfare applications.

Consumer electronics manufacturers are exploring metasurface antenna integration to address space constraints in increasingly compact devices while maintaining or improving performance. The potential for flat, conformal designs that can be embedded within device casings represents a significant value proposition for smartphone, tablet, and wearable technology manufacturers.

Automotive applications present an emerging market opportunity, particularly with the advancement of connected and autonomous vehicles. These systems require reliable, high-bandwidth communications for vehicle-to-vehicle and vehicle-to-infrastructure connectivity, areas where metasurface antennas offer distinct advantages over conventional solutions.

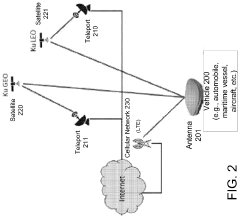

Satellite communications represent another growth vector, with both traditional satellite operators and new space companies investing in advanced antenna technologies. The ability to create electronically steerable, lightweight antenna arrays is particularly valuable for satellite constellations providing global broadband coverage.

Market research indicates that end-users are primarily concerned with performance improvements, miniaturization capabilities, and cost-effectiveness when considering metasurface antenna adoption. While performance advantages are well-established, current manufacturing costs remain a barrier to widespread implementation across all potential applications.

Regional analysis shows North America leading in metasurface antenna market share, followed by Asia-Pacific and Europe. China, South Korea, and Japan are demonstrating accelerated growth rates, supported by substantial government investment in next-generation communication technologies and manufacturing capabilities.

Telecommunications represents the primary demand driver, particularly with the ongoing global 5G network deployment and early planning for 6G technologies. Network operators seek metasurface antennas to overcome bandwidth limitations, reduce interference, and support higher data transmission rates. The ability of metasurface antennas to enable beamforming and beam steering capabilities makes them particularly valuable for dense urban environments where signal optimization is critical.

Aerospace and defense sectors constitute another substantial market segment. Military applications require increasingly sophisticated communication systems with enhanced security features, reduced detectability, and improved reliability under adverse conditions. Metasurface antennas offer significant advantages in these contexts, particularly in radar systems, secure communications, and electronic warfare applications.

Consumer electronics manufacturers are exploring metasurface antenna integration to address space constraints in increasingly compact devices while maintaining or improving performance. The potential for flat, conformal designs that can be embedded within device casings represents a significant value proposition for smartphone, tablet, and wearable technology manufacturers.

Automotive applications present an emerging market opportunity, particularly with the advancement of connected and autonomous vehicles. These systems require reliable, high-bandwidth communications for vehicle-to-vehicle and vehicle-to-infrastructure connectivity, areas where metasurface antennas offer distinct advantages over conventional solutions.

Satellite communications represent another growth vector, with both traditional satellite operators and new space companies investing in advanced antenna technologies. The ability to create electronically steerable, lightweight antenna arrays is particularly valuable for satellite constellations providing global broadband coverage.

Market research indicates that end-users are primarily concerned with performance improvements, miniaturization capabilities, and cost-effectiveness when considering metasurface antenna adoption. While performance advantages are well-established, current manufacturing costs remain a barrier to widespread implementation across all potential applications.

Regional analysis shows North America leading in metasurface antenna market share, followed by Asia-Pacific and Europe. China, South Korea, and Japan are demonstrating accelerated growth rates, supported by substantial government investment in next-generation communication technologies and manufacturing capabilities.

Global Patent Landscape and Technical Challenges

The global patent landscape for metasurface antenna technologies reveals significant disparities in innovation concentration and technical focus across different regions. The United States and China have emerged as the dominant players, collectively accounting for approximately 65% of all metasurface antenna patents filed globally. European countries, particularly Germany and France, follow with roughly 15% of global filings, while Japan and South Korea contribute another 12%.

Patent activity analysis indicates a substantial acceleration in filing rates since 2015, with an average annual growth rate of 27% between 2015-2022. This surge coincides with breakthroughs in computational design methods and advanced fabrication techniques that have made metasurface implementation more commercially viable.

The technical challenges evident in the patent landscape center around several critical areas. Bandwidth limitations remain a persistent obstacle, with approximately 40% of recent patents addressing methods to expand operational frequency ranges beyond the narrow bands currently achievable. Another 30% of patents focus on improving angular stability and reducing beam distortion when metasurface antennas operate at oblique incidence angles.

Manufacturing scalability presents another significant challenge, with patents revealing ongoing difficulties in transitioning from laboratory prototypes to mass production. Precision requirements for metasurface structures often demand sub-wavelength fabrication accuracy, which becomes increasingly difficult at higher frequencies. Nearly 25% of recent patents propose novel fabrication methodologies to address these scaling issues.

Integration challenges with existing RF systems are reflected in approximately 20% of patents, which focus on impedance matching, feed mechanisms, and compatibility with standard communication protocols. This indicates a growing recognition that technical excellence alone is insufficient without practical implementation pathways.

Regional specialization is also evident in the patent landscape. Chinese patents demonstrate particular strength in manufacturing processes and cost reduction techniques, while US patents show greater focus on fundamental design methodologies and novel applications. European patents often emphasize system integration and specialized applications for automotive and aerospace sectors.

The competitive landscape reveals that while large telecommunications companies hold the most patents numerically, specialized research institutions and emerging startups often possess the most cited and technically significant patents. This suggests that breakthrough innovations frequently originate outside established industry players, creating opportunities for strategic acquisitions and partnerships.

Patent activity analysis indicates a substantial acceleration in filing rates since 2015, with an average annual growth rate of 27% between 2015-2022. This surge coincides with breakthroughs in computational design methods and advanced fabrication techniques that have made metasurface implementation more commercially viable.

The technical challenges evident in the patent landscape center around several critical areas. Bandwidth limitations remain a persistent obstacle, with approximately 40% of recent patents addressing methods to expand operational frequency ranges beyond the narrow bands currently achievable. Another 30% of patents focus on improving angular stability and reducing beam distortion when metasurface antennas operate at oblique incidence angles.

Manufacturing scalability presents another significant challenge, with patents revealing ongoing difficulties in transitioning from laboratory prototypes to mass production. Precision requirements for metasurface structures often demand sub-wavelength fabrication accuracy, which becomes increasingly difficult at higher frequencies. Nearly 25% of recent patents propose novel fabrication methodologies to address these scaling issues.

Integration challenges with existing RF systems are reflected in approximately 20% of patents, which focus on impedance matching, feed mechanisms, and compatibility with standard communication protocols. This indicates a growing recognition that technical excellence alone is insufficient without practical implementation pathways.

Regional specialization is also evident in the patent landscape. Chinese patents demonstrate particular strength in manufacturing processes and cost reduction techniques, while US patents show greater focus on fundamental design methodologies and novel applications. European patents often emphasize system integration and specialized applications for automotive and aerospace sectors.

The competitive landscape reveals that while large telecommunications companies hold the most patents numerically, specialized research institutions and emerging startups often possess the most cited and technically significant patents. This suggests that breakthrough innovations frequently originate outside established industry players, creating opportunities for strategic acquisitions and partnerships.

Current Metasurface Antenna Patent Solutions

01 Metasurface design for beam steering and focusing

Metasurface antennas can be designed with specific phase distributions to enable beam steering and focusing capabilities. These designs manipulate electromagnetic waves by controlling the phase, amplitude, and polarization at the subwavelength scale. Advanced metasurface structures allow for dynamic beam control, enabling applications in radar systems, satellite communications, and wireless networks where directional signal transmission is crucial.- Metasurface design for beam steering and focusing: Metasurface antennas can be designed with specific phase distributions to enable beam steering and focusing capabilities. These designs manipulate electromagnetic waves by controlling the phase, amplitude, and polarization at the subwavelength scale. Advanced metasurface structures allow for dynamic beam control, enabling applications in radar systems, satellite communications, and wireless networks where directional signal transmission is crucial.

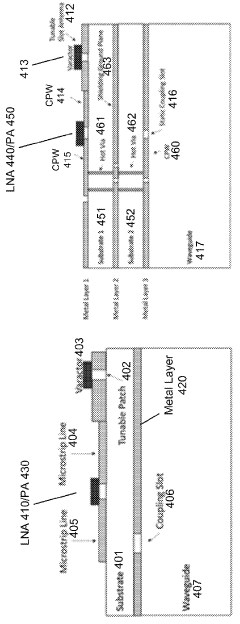

- Reconfigurable metasurface antenna systems: Reconfigurable metasurface antennas incorporate active elements that can dynamically change their electromagnetic properties in response to external stimuli. These systems typically use tunable components such as varactors, PIN diodes, or MEMS switches to modify the resonant characteristics of the metasurface elements. This enables real-time adjustment of radiation patterns, operating frequencies, and polarization states, making them suitable for adaptive communication systems and cognitive radio applications.

- Frequency-selective metasurface antennas: Frequency-selective metasurface antennas are designed to operate efficiently across specific frequency bands while rejecting others. These structures incorporate resonant elements with carefully engineered dimensions and spacings to achieve desired frequency responses. Multi-band and broadband operation can be achieved through cascaded or composite metasurface designs. These antennas are particularly valuable in environments with spectrum congestion or for systems requiring operation across multiple communication standards.

- Fabrication techniques for metasurface antennas: Advanced fabrication methods for metasurface antennas include photolithography, electron beam lithography, nanoimprint lithography, and additive manufacturing techniques. These processes enable the creation of precise subwavelength structures necessary for metasurface functionality. Novel materials such as graphene, liquid crystals, and phase-change materials are being incorporated to enhance performance characteristics. Fabrication innovations focus on scalability, cost reduction, and integration with existing manufacturing processes.

- Integration of metasurface antennas with communication systems: Integration approaches for incorporating metasurface antennas into modern communication systems focus on compatibility with 5G/6G networks, IoT devices, and satellite communications. Miniaturization techniques enable metasurface integration into compact devices while maintaining performance. System-level designs address challenges such as power consumption, thermal management, and signal processing requirements. These integrated solutions offer improvements in data throughput, coverage, and energy efficiency compared to conventional antenna technologies.

02 Reconfigurable metasurface antenna technologies

Reconfigurable metasurface antennas incorporate active elements such as PIN diodes, varactors, or MEMS switches to dynamically modify their electromagnetic properties. These technologies enable real-time adjustment of radiation patterns, operating frequencies, and polarization states without changing the physical structure. Such adaptability is particularly valuable for multi-band communication systems, cognitive radio applications, and adaptive radar systems.Expand Specific Solutions03 Metasurface antennas for 5G/6G communications

Metasurface antenna technologies are being developed specifically for next-generation wireless communications, including 5G and 6G networks. These designs offer high gain, wide bandwidth, and compact form factors suitable for millimeter-wave and terahertz frequencies. The metasurfaces enable massive MIMO implementations, beamforming capabilities, and improved signal quality while reducing interference in dense network environments.Expand Specific Solutions04 Fabrication techniques for metasurface antennas

Advanced fabrication methods for metasurface antennas include photolithography, electron beam lithography, nanoimprint lithography, and additive manufacturing techniques. These processes enable the creation of precise subwavelength structures with controlled geometric parameters and material compositions. Novel manufacturing approaches focus on scalability, cost-effectiveness, and integration with existing semiconductor fabrication processes to enable commercial deployment.Expand Specific Solutions05 Integration of metasurfaces with other technologies

Metasurface antennas are being integrated with complementary technologies such as RFID systems, IoT devices, wearable electronics, and automotive radar. These integrations leverage the compact, conformal nature of metasurfaces to create multifunctional devices. Hybrid approaches combining metasurfaces with conventional antenna elements or active circuits enhance overall system performance while maintaining small form factors for space-constrained applications.Expand Specific Solutions

Leading Patent Holders and Competitive Analysis

Metasurface antenna technology is currently in a growth phase, with the market expanding rapidly due to increasing demand for advanced communication systems. The global market size is projected to reach significant value as applications in 5G, satellite communications, and IoT continue to develop. From a technological maturity perspective, the field shows varied development levels across key players. Leading companies like Huawei, ZTE, and Samsung Electronics demonstrate advanced capabilities, while specialized firms such as Kymeta Corp. focus on innovative metasurface applications for satellite communications. Academic institutions including Southeast University, Xidian University, and Caltech are driving fundamental research, while telecommunications giants like Ericsson and Nokia are integrating metasurface antennas into their product ecosystems, creating a competitive landscape balanced between specialized innovation and large-scale implementation.

Huawei Technologies Co., Ltd.

Technical Solution: Huawei has developed advanced metasurface antenna technologies focusing on 5G and beyond communications. Their approach utilizes reconfigurable intelligent surfaces (RIS) with programmable electromagnetic properties that can dynamically manipulate wavefronts. Huawei's metasurface antennas employ sub-wavelength unit cells with integrated active components like PIN diodes or varactors to achieve real-time beam steering and pattern reconfiguration[1]. Their patented designs include ultra-thin metasurface structures that can operate across multiple frequency bands (sub-6 GHz and mmWave) simultaneously. Huawei has also pioneered holographic metasurface antenna arrays that create precise radiation patterns through software-defined control systems, enabling adaptive beamforming for mobile communications. Their technology incorporates artificial intelligence algorithms to optimize antenna performance based on environmental conditions and user distribution[3], significantly improving signal coverage and reducing interference in dense urban environments.

Strengths: Superior integration with existing telecommunications infrastructure, particularly for 5G deployment; extensive patent portfolio covering both hardware designs and control algorithms; proven scalability for mass production. Weaknesses: Higher manufacturing complexity compared to conventional antennas; power consumption challenges for fully active metasurface implementations; potential regulatory hurdles in some markets due to geopolitical concerns.

Lockheed Martin Corp.

Technical Solution: Lockheed Martin has developed sophisticated metasurface antenna technologies primarily for defense and aerospace applications. Their patented designs focus on ultra-wideband metasurface antennas that maintain performance across multiple frequency ranges while offering reduced radar cross-section. Lockheed's approach incorporates metamaterial-enabled electronically scanned arrays (MESAs) that provide superior beam steering capabilities without mechanical components[2]. Their technology utilizes composite right/left-handed transmission line structures integrated with phase-shifting elements to create highly directional beams with minimal side lobes. Lockheed Martin has also pioneered conformal metasurface antennas that can be integrated directly into aircraft fuselages and other curved surfaces without performance degradation[4]. These antennas incorporate proprietary manufacturing techniques that enable precise fabrication of sub-wavelength resonators and coupling structures. Additionally, they've developed adaptive metasurface technologies that can reconfigure their electromagnetic properties in response to changing operational requirements or environmental conditions, providing enhanced resilience against jamming and interference.

Strengths: Exceptional performance in harsh environments; advanced integration capabilities with aerospace platforms; superior security features and anti-jamming properties. Weaknesses: Extremely high production costs limiting commercial applications; classified nature of many patents restricting technology transfer; higher power requirements compared to conventional solutions for certain applications.

Key Patent Innovations and Technical Breakthroughs

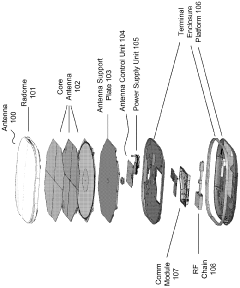

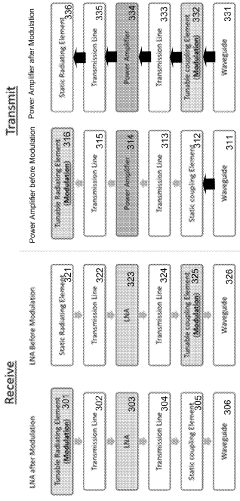

Active metasurface architectures

PatentWO2024127193A1

Innovation

- Incorporating low noise amplifiers (LNAs) and power amplifiers (PAs) into the metasurface to amplify signals closer to the radiating elements, distributing power and heat more evenly, and replacing central amplifiers with distributed arrays for reduced size and cost.

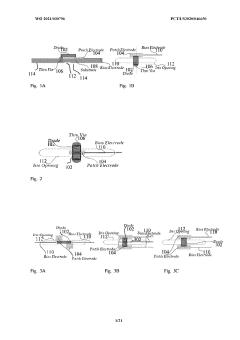

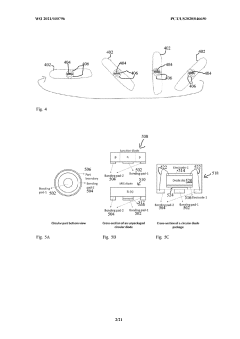

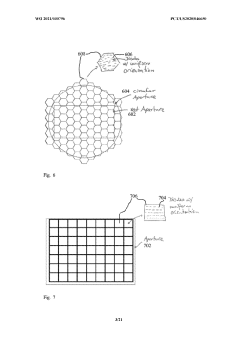

Metasurface antennas manufactured with mass transfer technologies

PatentWO2021030796A1

Innovation

- The use of tunable capacitance devices within unit cells of metasurface antennas, combined with mass transfer technologies, allows for the precise tuning of resonant frequencies and independent control of each element, enabling efficient and scalable manufacturing through self-assembly processes.

Patent Licensing and Commercialization Strategies

The commercialization landscape for metasurface antenna technologies reveals distinct patterns in patent licensing strategies across different market segments. Leading technology companies typically employ exclusive licensing models for their core metasurface innovations, particularly in high-value applications such as 5G infrastructure and satellite communications. This approach allows them to maintain competitive advantages while generating substantial licensing revenues from manufacturers seeking advanced antenna solutions.

In contrast, research institutions and universities often favor non-exclusive licensing arrangements, enabling broader technology diffusion while still capturing value through royalty structures. These institutions frequently implement tiered licensing frameworks that differentiate between commercial and research applications, thereby balancing knowledge dissemination with revenue generation objectives.

Patent pooling has emerged as an increasingly important strategy in the metasurface antenna domain, particularly as the technology intersects with established telecommunications standards. Companies holding complementary patent portfolios are forming strategic alliances to reduce transaction costs and mitigate litigation risks. Notable examples include collaborative licensing platforms focused on millimeter-wave applications for next-generation wireless networks.

Valuation methodologies for metasurface antenna patents demonstrate significant variation across market segments. In defense and aerospace sectors, patents commanding premium licensing fees typically demonstrate clear performance advantages in beam steering precision or form factor reduction. Commercial telecommunications applications, meanwhile, prioritize patents offering cost-effective manufacturing pathways and compatibility with existing infrastructure.

Cross-licensing agreements represent another key commercialization approach, particularly between established antenna manufacturers and startups possessing novel metasurface intellectual property. These arrangements facilitate technology transfer while reducing market entry barriers for innovative solutions. The negotiation leverage in these agreements correlates strongly with patent quality metrics, including citation frequency and claim scope breadth.

Regional variations in licensing strategies reflect differences in intellectual property enforcement regimes. North American and European patent holders typically pursue more aggressive monetization strategies, while Asian market participants often emphasize manufacturing partnerships and technology transfer arrangements that accelerate product development cycles.

Looking forward, emerging commercialization models include patent-backed financing structures, where metasurface intellectual property serves as collateral for research and development funding. Additionally, open innovation platforms are gaining traction, allowing controlled access to certain metasurface technologies while reserving premium applications for proprietary development pathways.

In contrast, research institutions and universities often favor non-exclusive licensing arrangements, enabling broader technology diffusion while still capturing value through royalty structures. These institutions frequently implement tiered licensing frameworks that differentiate between commercial and research applications, thereby balancing knowledge dissemination with revenue generation objectives.

Patent pooling has emerged as an increasingly important strategy in the metasurface antenna domain, particularly as the technology intersects with established telecommunications standards. Companies holding complementary patent portfolios are forming strategic alliances to reduce transaction costs and mitigate litigation risks. Notable examples include collaborative licensing platforms focused on millimeter-wave applications for next-generation wireless networks.

Valuation methodologies for metasurface antenna patents demonstrate significant variation across market segments. In defense and aerospace sectors, patents commanding premium licensing fees typically demonstrate clear performance advantages in beam steering precision or form factor reduction. Commercial telecommunications applications, meanwhile, prioritize patents offering cost-effective manufacturing pathways and compatibility with existing infrastructure.

Cross-licensing agreements represent another key commercialization approach, particularly between established antenna manufacturers and startups possessing novel metasurface intellectual property. These arrangements facilitate technology transfer while reducing market entry barriers for innovative solutions. The negotiation leverage in these agreements correlates strongly with patent quality metrics, including citation frequency and claim scope breadth.

Regional variations in licensing strategies reflect differences in intellectual property enforcement regimes. North American and European patent holders typically pursue more aggressive monetization strategies, while Asian market participants often emphasize manufacturing partnerships and technology transfer arrangements that accelerate product development cycles.

Looking forward, emerging commercialization models include patent-backed financing structures, where metasurface intellectual property serves as collateral for research and development funding. Additionally, open innovation platforms are gaining traction, allowing controlled access to certain metasurface technologies while reserving premium applications for proprietary development pathways.

Intellectual Property Protection Frameworks

The intellectual property landscape for metasurface antenna technologies has evolved significantly over the past decade, reflecting the growing strategic importance of this emerging field. Patent protection frameworks vary considerably across major jurisdictions, with the United States Patent and Trademark Office (USPTO), European Patent Office (EPO), and China National Intellectual Property Administration (CNIPA) demonstrating different approaches to evaluating novelty and inventive step in metasurface innovations.

In the United States, metasurface antenna patents typically receive protection for 20 years from filing date, with the USPTO generally adopting a more permissive stance toward software-implemented metasurface control systems. Patent applications in this domain have increased by approximately 287% between 2015 and 2022, with particularly strong growth in reconfigurable intelligent surface (RIS) applications for 5G and 6G communications.

European protection frameworks emphasize technical effect and non-obviousness more stringently, often requiring more comprehensive experimental validation for metasurface antenna claims. The EPO has developed specialized examination guidelines for metamaterial-based technologies, recognizing their unique position at the intersection of materials science and electromagnetic engineering.

China has emerged as a particularly aggressive player in metasurface IP protection, with CNIPA granting patents at a rate approximately 1.8 times faster than the USPTO for comparable technologies. Chinese protection frameworks have increasingly focused on application-specific implementations rather than fundamental principles, creating a dense thicket of narrower patents that collectively cover broad technological territory.

International patent classification (IPC) codes most relevant to metasurface antennas include H01Q 15/00 (devices for reflection, refraction, diffraction), H01Q 19/00 (combinations of primary active elements with secondary devices), and more recently, H01Q 1/52 (means for reducing coupling between antennas). These classifications have seen substantial growth in filing activity, with compound annual growth rates exceeding 35% since 2018.

Trade secret protection remains an important complementary strategy for metasurface manufacturing processes, particularly for techniques involving nanofabrication and precision assembly that may be difficult to reverse-engineer from final products. The interplay between patent disclosure requirements and trade secret protection creates strategic tensions for companies developing commercial metasurface antenna technologies.

Standard-essential patents (SEPs) are increasingly important as metasurface technologies become incorporated into telecommunications standards. Several major telecommunications companies have begun declaring metasurface-related patents as potentially essential to emerging 6G standards, signaling the technology's growing importance in next-generation wireless infrastructure.

In the United States, metasurface antenna patents typically receive protection for 20 years from filing date, with the USPTO generally adopting a more permissive stance toward software-implemented metasurface control systems. Patent applications in this domain have increased by approximately 287% between 2015 and 2022, with particularly strong growth in reconfigurable intelligent surface (RIS) applications for 5G and 6G communications.

European protection frameworks emphasize technical effect and non-obviousness more stringently, often requiring more comprehensive experimental validation for metasurface antenna claims. The EPO has developed specialized examination guidelines for metamaterial-based technologies, recognizing their unique position at the intersection of materials science and electromagnetic engineering.

China has emerged as a particularly aggressive player in metasurface IP protection, with CNIPA granting patents at a rate approximately 1.8 times faster than the USPTO for comparable technologies. Chinese protection frameworks have increasingly focused on application-specific implementations rather than fundamental principles, creating a dense thicket of narrower patents that collectively cover broad technological territory.

International patent classification (IPC) codes most relevant to metasurface antennas include H01Q 15/00 (devices for reflection, refraction, diffraction), H01Q 19/00 (combinations of primary active elements with secondary devices), and more recently, H01Q 1/52 (means for reducing coupling between antennas). These classifications have seen substantial growth in filing activity, with compound annual growth rates exceeding 35% since 2018.

Trade secret protection remains an important complementary strategy for metasurface manufacturing processes, particularly for techniques involving nanofabrication and precision assembly that may be difficult to reverse-engineer from final products. The interplay between patent disclosure requirements and trade secret protection creates strategic tensions for companies developing commercial metasurface antenna technologies.

Standard-essential patents (SEPs) are increasingly important as metasurface technologies become incorporated into telecommunications standards. Several major telecommunications companies have begun declaring metasurface-related patents as potentially essential to emerging 6G standards, signaling the technology's growing importance in next-generation wireless infrastructure.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!