Investigation into Patents for Metasurface Antenna Developments

SEP 25, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Metasurface Antenna Technology Background and Objectives

Metasurface antennas represent a revolutionary advancement in electromagnetic wave manipulation technology, emerging from the broader field of metamaterials research that gained significant momentum in the early 2000s. These ultra-thin, planar structures consist of subwavelength elements arranged in specific patterns to control electromagnetic wavefronts with unprecedented precision. The evolution of this technology has been driven by the increasing demands for miniaturization, bandwidth enhancement, and multi-functionality in modern communication systems.

The historical trajectory of metasurface antenna development can be traced through several key phases. Initially, researchers focused on basic electromagnetic principles and theoretical frameworks, establishing the foundational physics of metasurfaces. This was followed by experimental validations using simple structures, primarily in microwave frequencies. The field has since expanded to encompass applications across the electromagnetic spectrum, from radio frequencies to optical domains.

Current technological trends indicate a shift toward intelligent, reconfigurable metasurface antennas capable of dynamic beam steering, polarization control, and frequency tuning. This evolution aligns with the growing requirements of 5G/6G communications, satellite networks, radar systems, and emerging Internet of Things (IoT) applications, where conventional antenna technologies face significant limitations.

The primary technical objectives in metasurface antenna development include achieving wider bandwidth operation, enhancing gain and efficiency, reducing profile thickness, enabling multi-band functionality, and incorporating active tuning capabilities. Researchers are particularly focused on overcoming the inherent narrow-band nature of resonant metasurface elements while maintaining their advantageous properties.

Patent activities in this domain have accelerated dramatically over the past decade, with significant contributions from both academic institutions and industry leaders. These patents encompass novel metasurface designs, fabrication techniques, and system-level implementations that address specific application challenges. The intellectual property landscape reveals concentrated efforts in developing metasurfaces for beam-forming arrays, reflectarrays, transmitarrays, and absorbers.

Looking forward, the metasurface antenna field aims to bridge the gap between laboratory demonstrations and commercial viability. This requires addressing challenges related to manufacturing scalability, integration with existing systems, and cost-effectiveness. The convergence of metasurface technology with advanced materials science, semiconductor fabrication techniques, and artificial intelligence promises to unlock new capabilities that transcend the limitations of conventional antenna designs.

The historical trajectory of metasurface antenna development can be traced through several key phases. Initially, researchers focused on basic electromagnetic principles and theoretical frameworks, establishing the foundational physics of metasurfaces. This was followed by experimental validations using simple structures, primarily in microwave frequencies. The field has since expanded to encompass applications across the electromagnetic spectrum, from radio frequencies to optical domains.

Current technological trends indicate a shift toward intelligent, reconfigurable metasurface antennas capable of dynamic beam steering, polarization control, and frequency tuning. This evolution aligns with the growing requirements of 5G/6G communications, satellite networks, radar systems, and emerging Internet of Things (IoT) applications, where conventional antenna technologies face significant limitations.

The primary technical objectives in metasurface antenna development include achieving wider bandwidth operation, enhancing gain and efficiency, reducing profile thickness, enabling multi-band functionality, and incorporating active tuning capabilities. Researchers are particularly focused on overcoming the inherent narrow-band nature of resonant metasurface elements while maintaining their advantageous properties.

Patent activities in this domain have accelerated dramatically over the past decade, with significant contributions from both academic institutions and industry leaders. These patents encompass novel metasurface designs, fabrication techniques, and system-level implementations that address specific application challenges. The intellectual property landscape reveals concentrated efforts in developing metasurfaces for beam-forming arrays, reflectarrays, transmitarrays, and absorbers.

Looking forward, the metasurface antenna field aims to bridge the gap between laboratory demonstrations and commercial viability. This requires addressing challenges related to manufacturing scalability, integration with existing systems, and cost-effectiveness. The convergence of metasurface technology with advanced materials science, semiconductor fabrication techniques, and artificial intelligence promises to unlock new capabilities that transcend the limitations of conventional antenna designs.

Market Demand Analysis for Metasurface Antennas

The global market for metasurface antennas is experiencing robust growth driven by increasing demand for high-performance communication systems across multiple sectors. Current market analysis indicates that the metasurface antenna market is expanding at a compound annual growth rate of approximately 7.8% and is projected to reach significant market value by 2030, primarily fueled by applications in 5G/6G telecommunications, satellite communications, and defense systems.

Telecommunications represents the largest market segment, with network operators actively seeking metasurface antenna solutions to address the challenges of millimeter-wave 5G deployment. These antennas offer superior beam-forming capabilities and reduced interference, critical for dense urban environments where traditional antenna systems struggle to provide consistent coverage.

The aerospace and defense sectors demonstrate particularly strong demand growth, with military applications requiring advanced radar systems and secure communications that benefit from the low profile and electronic beam-steering capabilities of metasurface antennas. Government defense contracts worldwide are increasingly specifying metasurface technology requirements, creating a stable demand pipeline.

Consumer electronics manufacturers are exploring metasurface antennas for integration into next-generation devices, driven by the need for compact form factors that don't compromise performance. The ability to embed these antennas directly into device surfaces without protruding elements represents a significant advantage for smartphone, tablet, and wearable device designs.

Automotive applications represent an emerging high-growth segment, particularly for advanced driver assistance systems (ADAS) and autonomous vehicles. The demand for high-resolution, weather-resistant radar systems that can be seamlessly integrated into vehicle exteriors makes metasurface antennas particularly attractive to automotive manufacturers.

Market research indicates that end-users are primarily concerned with cost-effectiveness, miniaturization capabilities, and performance metrics such as gain, bandwidth, and beam-steering range. Current premium pricing of metasurface antennas remains a barrier to mass adoption, though economies of scale are gradually improving the value proposition.

Regional analysis shows North America leading in market share due to substantial defense investments and telecommunications infrastructure upgrades. However, Asia-Pacific demonstrates the fastest growth rate, driven by China's aggressive 5G/6G deployment strategies and Japan's focus on advanced electronics manufacturing.

Industry surveys reveal that potential customers are increasingly prioritizing energy efficiency and environmental sustainability in their antenna solutions, creating new market opportunities for metasurface designs that can operate with lower power requirements than conventional alternatives.

Telecommunications represents the largest market segment, with network operators actively seeking metasurface antenna solutions to address the challenges of millimeter-wave 5G deployment. These antennas offer superior beam-forming capabilities and reduced interference, critical for dense urban environments where traditional antenna systems struggle to provide consistent coverage.

The aerospace and defense sectors demonstrate particularly strong demand growth, with military applications requiring advanced radar systems and secure communications that benefit from the low profile and electronic beam-steering capabilities of metasurface antennas. Government defense contracts worldwide are increasingly specifying metasurface technology requirements, creating a stable demand pipeline.

Consumer electronics manufacturers are exploring metasurface antennas for integration into next-generation devices, driven by the need for compact form factors that don't compromise performance. The ability to embed these antennas directly into device surfaces without protruding elements represents a significant advantage for smartphone, tablet, and wearable device designs.

Automotive applications represent an emerging high-growth segment, particularly for advanced driver assistance systems (ADAS) and autonomous vehicles. The demand for high-resolution, weather-resistant radar systems that can be seamlessly integrated into vehicle exteriors makes metasurface antennas particularly attractive to automotive manufacturers.

Market research indicates that end-users are primarily concerned with cost-effectiveness, miniaturization capabilities, and performance metrics such as gain, bandwidth, and beam-steering range. Current premium pricing of metasurface antennas remains a barrier to mass adoption, though economies of scale are gradually improving the value proposition.

Regional analysis shows North America leading in market share due to substantial defense investments and telecommunications infrastructure upgrades. However, Asia-Pacific demonstrates the fastest growth rate, driven by China's aggressive 5G/6G deployment strategies and Japan's focus on advanced electronics manufacturing.

Industry surveys reveal that potential customers are increasingly prioritizing energy efficiency and environmental sustainability in their antenna solutions, creating new market opportunities for metasurface designs that can operate with lower power requirements than conventional alternatives.

Current State and Technical Challenges in Metasurface Development

Metasurface technology has witnessed significant advancements globally, with research institutions and companies across North America, Europe, and Asia making substantial contributions. The current state of metasurface antenna development represents a convergence of electromagnetic theory, materials science, and nanofabrication techniques. Leading research centers including MIT, Stanford University, and Tsinghua University have established robust metasurface research programs, while companies like Samsung, Huawei, and Kymeta are actively commercializing these technologies.

Despite impressive progress, metasurface antenna development faces several critical technical challenges. Bandwidth limitation remains a significant obstacle, as most current metasurface antennas operate efficiently only within narrow frequency ranges, restricting their application in broadband communication systems. This limitation stems from the resonant nature of metasurface elements, which typically exhibit optimal performance at specific frequencies.

Fabrication complexity presents another major hurdle. The production of metasurfaces requires precise nanoscale manufacturing capabilities to create subwavelength structures with consistent properties across large areas. Current fabrication methods such as electron-beam lithography offer high precision but are costly and time-consuming, making mass production challenging. Alternative techniques like nanoimprint lithography show promise but still face issues with scalability and defect control.

Power handling capacity represents a third significant challenge. Many metasurface designs incorporate delicate structures or materials with limited thermal stability, restricting their use in high-power applications. This limitation is particularly problematic for transmitting antennas in communication systems and radar applications where substantial power levels are required.

Tunable and reconfigurable metasurfaces represent the cutting edge of current research but face substantial implementation difficulties. While static metasurfaces are well-established, dynamic control of electromagnetic properties remains challenging. Current approaches using mechanical actuation, liquid crystals, or phase-change materials each present trade-offs between response time, power consumption, and reliability.

The integration of metasurfaces with existing RF systems and components presents compatibility challenges. Impedance matching, feeding mechanisms, and system-level integration require careful design considerations that often necessitate compromises in performance. Additionally, standardization efforts remain in early stages, with limited consensus on design methodologies and performance metrics.

Patent analysis reveals geographical disparities in metasurface development, with China leading in patent quantity while the United States maintains an edge in citation impact. European entities demonstrate strength in specialized applications, particularly in automotive radar and medical imaging domains.

Despite impressive progress, metasurface antenna development faces several critical technical challenges. Bandwidth limitation remains a significant obstacle, as most current metasurface antennas operate efficiently only within narrow frequency ranges, restricting their application in broadband communication systems. This limitation stems from the resonant nature of metasurface elements, which typically exhibit optimal performance at specific frequencies.

Fabrication complexity presents another major hurdle. The production of metasurfaces requires precise nanoscale manufacturing capabilities to create subwavelength structures with consistent properties across large areas. Current fabrication methods such as electron-beam lithography offer high precision but are costly and time-consuming, making mass production challenging. Alternative techniques like nanoimprint lithography show promise but still face issues with scalability and defect control.

Power handling capacity represents a third significant challenge. Many metasurface designs incorporate delicate structures or materials with limited thermal stability, restricting their use in high-power applications. This limitation is particularly problematic for transmitting antennas in communication systems and radar applications where substantial power levels are required.

Tunable and reconfigurable metasurfaces represent the cutting edge of current research but face substantial implementation difficulties. While static metasurfaces are well-established, dynamic control of electromagnetic properties remains challenging. Current approaches using mechanical actuation, liquid crystals, or phase-change materials each present trade-offs between response time, power consumption, and reliability.

The integration of metasurfaces with existing RF systems and components presents compatibility challenges. Impedance matching, feeding mechanisms, and system-level integration require careful design considerations that often necessitate compromises in performance. Additionally, standardization efforts remain in early stages, with limited consensus on design methodologies and performance metrics.

Patent analysis reveals geographical disparities in metasurface development, with China leading in patent quantity while the United States maintains an edge in citation impact. European entities demonstrate strength in specialized applications, particularly in automotive radar and medical imaging domains.

Current Metasurface Antenna Design Solutions

01 Design and structure of metasurface antennas

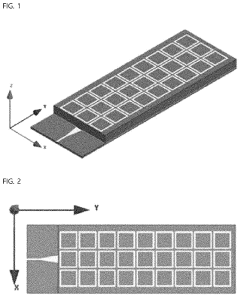

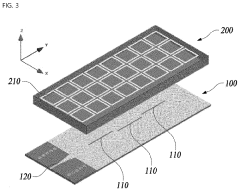

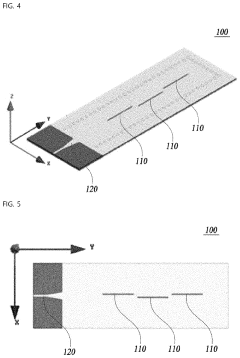

Metasurface antennas utilize engineered surfaces with sub-wavelength elements to manipulate electromagnetic waves. These structures can be designed with various patterns and geometries to achieve desired radiation characteristics, including beam steering, focusing, and polarization control. The design typically involves periodic arrangements of resonant elements that collectively modify the phase, amplitude, and polarization of incident waves, enabling compact form factors with enhanced performance compared to conventional antennas.- Design and structure of metasurface antennas: Metasurface antennas utilize engineered surfaces with sub-wavelength structures to manipulate electromagnetic waves. These designs typically incorporate periodic arrays of resonant elements that can control phase, amplitude, and polarization of incident waves. The structural configuration enables enhanced directivity, bandwidth, and radiation efficiency compared to conventional antennas, while maintaining a low profile and reduced physical footprint.

- Beam steering and pattern control in metasurface antennas: Metasurface antennas can dynamically control beam direction and radiation patterns through reconfigurable elements. By incorporating tunable components such as varactors, PIN diodes, or MEMS switches, these antennas can achieve electronic beam steering without mechanical movement. This capability enables adaptive coverage, interference mitigation, and multi-beam formation for applications in radar systems, satellite communications, and 5G/6G networks.

- Frequency-selective metasurface antennas: Frequency-selective metasurface antennas incorporate resonant structures designed to operate at specific frequency bands. These antennas can achieve multi-band operation, frequency filtering, and bandwidth enhancement through careful design of the metasurface elements. The frequency-selective properties enable applications in cognitive radio, spectrum sharing, and multi-standard communication systems where frequency agility and selectivity are critical requirements.

- Fabrication and manufacturing techniques for metasurface antennas: Advanced fabrication methods for metasurface antennas include printed circuit board technology, photolithography, 3D printing, and nanofabrication techniques. These manufacturing approaches enable precise creation of sub-wavelength structures with controlled electromagnetic properties. The fabrication processes must balance precision requirements with cost-effectiveness for commercial viability, while addressing challenges related to material selection, structural integrity, and production scalability.

- Integration of metasurface antennas in communication systems: Metasurface antennas can be integrated into various communication platforms including mobile devices, base stations, satellites, and IoT nodes. The integration process addresses challenges of miniaturization, power consumption, and compatibility with existing RF components. These antennas offer advantages in terms of space utilization, energy efficiency, and system performance, making them suitable for next-generation wireless networks, MIMO systems, and millimeter-wave applications.

02 Beam steering and focusing capabilities

Metasurface antennas can dynamically control beam direction and focus without mechanical movement. By incorporating tunable elements or reconfigurable structures, these antennas can electronically steer beams in desired directions, enabling applications in radar systems, satellite communications, and wireless networks. Advanced metasurface designs can achieve wide-angle scanning with high gain and efficiency, while maintaining a low profile form factor.Expand Specific Solutions03 Frequency-selective and wideband operation

Metasurface antennas can be engineered to operate across specific frequency bands or with wideband characteristics. By carefully designing the resonant elements and their arrangements, these antennas can achieve selective frequency responses or broad bandwidth operation. Multi-layer metasurfaces can support multiple frequency bands simultaneously, making them suitable for multi-functional communication systems and spectrum-efficient applications.Expand Specific Solutions04 Integration with communication systems

Metasurface antennas can be integrated into modern communication systems to enhance performance and enable new capabilities. These antennas are particularly valuable in 5G/6G networks, satellite communications, and IoT applications where compact size, high efficiency, and directional control are critical. The integration often involves combining metasurfaces with active components, signal processing systems, and network infrastructure to create advanced communication platforms with improved coverage and capacity.Expand Specific Solutions05 Fabrication techniques and materials

Various fabrication methods and materials are employed to create metasurface antennas with desired electromagnetic properties. These include printed circuit board technology, lithography, 3D printing, and nanofabrication techniques. Advanced materials such as liquid crystals, phase-change materials, graphene, and other 2D materials can be incorporated to create tunable or reconfigurable metasurfaces. The choice of fabrication method and materials significantly impacts the performance, cost, and scalability of metasurface antenna production.Expand Specific Solutions

Key Industry Players and Patent Holders

The metasurface antenna patent landscape is currently in a growth phase, with market size expanding rapidly due to increasing demand for advanced connectivity solutions across multiple sectors. The technology is approaching early maturity, with key players demonstrating varying levels of technical advancement. Kymeta Corp. leads with commercial satellite-cellular hybrid solutions, while major telecommunications companies like Huawei, OPPO, and vivo are actively developing metasurface technologies for next-generation mobile communications. Research institutions including California Institute of Technology and University of Electronic Science & Technology of China contribute fundamental innovations. Traditional electronics manufacturers such as Sharp, Kyocera, and Murata are leveraging their manufacturing expertise to develop practical applications. The competitive landscape is diverse, spanning specialized antenna developers, telecommunications giants, academic institutions, and electronics manufacturers, indicating broad recognition of metasurface antennas as a critical future technology.

Kymeta Corp.

Technical Solution: Kymeta has pioneered electronically steerable metasurface antennas based on liquid crystal technology. Their patented approach uses tunable liquid crystal elements integrated with a metasurface structure to dynamically control the phase of electromagnetic waves. The company's mTenna technology employs thousands of microscopic elements on a flat panel that can be electronically tuned to form and steer a beam without any moving parts. This holographic beamforming technology allows their antennas to track satellites in geostationary orbit while maintaining connectivity even on moving platforms. Kymeta's u8 terminal incorporates these metasurface principles to deliver Ku-band satellite communications with software-defined beam steering capabilities, achieving gains comparable to traditional parabolic dishes but in a much lower profile form factor.

Strengths: Flat panel design eliminates mechanical components, reducing failure points and maintenance requirements; software-defined operation enables dynamic beam steering without physical movement; low profile form factor suitable for mobile applications. Weaknesses: Higher power consumption compared to passive antennas; complex manufacturing process increases production costs; performance can be affected by extreme temperature variations.

Huawei Technologies Co., Ltd.

Technical Solution: Huawei has developed extensive metasurface antenna technology for 5G and beyond communications systems. Their patented approach focuses on reconfigurable intelligent surfaces (RIS) that can manipulate electromagnetic waves with unprecedented control. Huawei's metasurface designs incorporate sub-wavelength unit cells with tunable properties that can be electronically controlled to shape wavefronts, redirect signals, and enhance coverage. Their patents describe metasurface structures that integrate with massive MIMO systems to improve signal quality and reduce interference in complex environments. Huawei has pioneered the use of coding metasurfaces where each unit element can be programmed with specific phase responses to create desired radiation patterns. These technologies enable smart radio environments where the propagation channel itself becomes programmable, allowing for optimized signal paths in challenging deployment scenarios and significantly improving spectral efficiency.

Strengths: Strong integration capabilities with existing network infrastructure; advanced manufacturing techniques for mass production; comprehensive intellectual property portfolio covering various metasurface implementations. Weaknesses: Regulatory challenges in some markets may limit deployment; higher implementation costs compared to conventional antenna technologies; requires sophisticated control systems to fully leverage capabilities.

Critical Patent Analysis and Technical Innovations

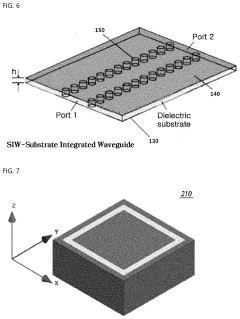

Substrate-integrated waveguide slot antenna with metasurface

PatentActiveUS20200373678A1

Innovation

- Incorporating a metasurface with a plurality of unit cells arranged at predetermined intervals on an upper substrate stacked over a lower substrate with a substrate-integrated waveguide structure, which guides and reemits electromagnetic waves through slots, enhancing both gain and bandwidth.

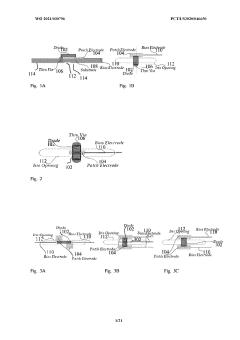

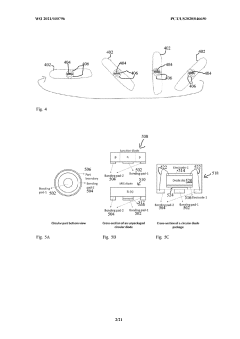

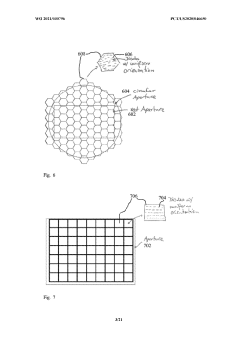

Metasurface antennas manufactured with mass transfer technologies

PatentWO2021030796A1

Innovation

- The use of tunable capacitance devices within unit cells of metasurface antennas, combined with mass transfer technologies, allows for the precise tuning of resonant frequencies and independent control of each element, enabling efficient and scalable manufacturing through self-assembly processes.

Patent Landscape and IP Strategy

The metasurface antenna patent landscape reveals a rapidly evolving intellectual property environment with significant strategic implications for market participants. Analysis of patent filings shows concentrated activity among major technology corporations and research institutions, with notable geographic distribution across the United States, China, and Europe. Companies like Samsung, Huawei, and Qualcomm have established substantial patent portfolios, while academic institutions including MIT, Stanford, and Tsinghua University contribute significant intellectual property in this domain.

Patent filing trends indicate accelerated growth beginning around 2015, coinciding with the emergence of 5G technology development and increasing interest in millimeter-wave applications. The most heavily protected technical areas include reconfigurable metasurfaces, beam-steering capabilities, and manufacturing techniques for mass production. These patents frequently incorporate complementary technologies such as MEMS, liquid crystals, and semiconductor integration methods.

Strategic patent analysis reveals several distinct approaches among market leaders. Some entities pursue broad foundational patents covering basic metasurface principles, while others focus on application-specific implementations for targeted market segments. Cross-licensing agreements between major players have begun to emerge, indicating the formation of technology ecosystems and potential industry standards.

For new market entrants, the patent landscape presents both challenges and opportunities. While core technology areas show significant patent density, specialized applications and novel manufacturing techniques remain relatively underexplored. Freedom-to-operate analyses suggest viable pathways exist for innovation, particularly in areas combining metasurfaces with emerging technologies like artificial intelligence for adaptive control systems.

IP strategy recommendations for organizations in this space include: developing patent portfolios focused on specific vertical applications rather than competing directly with established fundamental patents; pursuing strategic partnerships with patent holders to access core technologies; and maintaining vigilant monitoring of patent filing trends to identify emerging white spaces. Additionally, organizations should consider defensive publication strategies for innovations that may not warrant patent protection but could prevent competitors from restricting market access.

The evolving regulatory environment surrounding 6G development and international technology transfer restrictions adds further complexity to IP strategy formulation. Companies must navigate these considerations while building patent portfolios that balance protection of proprietary innovations with participation in standards-essential patent pools that may become necessary for market access.

Patent filing trends indicate accelerated growth beginning around 2015, coinciding with the emergence of 5G technology development and increasing interest in millimeter-wave applications. The most heavily protected technical areas include reconfigurable metasurfaces, beam-steering capabilities, and manufacturing techniques for mass production. These patents frequently incorporate complementary technologies such as MEMS, liquid crystals, and semiconductor integration methods.

Strategic patent analysis reveals several distinct approaches among market leaders. Some entities pursue broad foundational patents covering basic metasurface principles, while others focus on application-specific implementations for targeted market segments. Cross-licensing agreements between major players have begun to emerge, indicating the formation of technology ecosystems and potential industry standards.

For new market entrants, the patent landscape presents both challenges and opportunities. While core technology areas show significant patent density, specialized applications and novel manufacturing techniques remain relatively underexplored. Freedom-to-operate analyses suggest viable pathways exist for innovation, particularly in areas combining metasurfaces with emerging technologies like artificial intelligence for adaptive control systems.

IP strategy recommendations for organizations in this space include: developing patent portfolios focused on specific vertical applications rather than competing directly with established fundamental patents; pursuing strategic partnerships with patent holders to access core technologies; and maintaining vigilant monitoring of patent filing trends to identify emerging white spaces. Additionally, organizations should consider defensive publication strategies for innovations that may not warrant patent protection but could prevent competitors from restricting market access.

The evolving regulatory environment surrounding 6G development and international technology transfer restrictions adds further complexity to IP strategy formulation. Companies must navigate these considerations while building patent portfolios that balance protection of proprietary innovations with participation in standards-essential patent pools that may become necessary for market access.

Standardization Efforts and Industry Collaboration

The standardization of metasurface antenna technologies has become increasingly critical as these advanced components transition from laboratory research to commercial applications. Industry-wide collaboration efforts have emerged to establish common frameworks, testing methodologies, and performance metrics that enable interoperability and accelerate market adoption. Organizations such as the IEEE, ETSI, and the International Telecommunication Union (ITU) have formed specialized working groups dedicated to metasurface standardization, with particular focus on 5G/6G communications applications.

Patent analysis reveals that major telecommunications companies including Huawei, Samsung, and Nokia have been actively participating in these standardization initiatives while simultaneously protecting their intellectual property. This dual approach demonstrates the strategic importance of balancing proprietary innovation with industry-wide compatibility. The standardization documents reference numerous patented technologies, indicating the significant influence of patent holders in shaping technical standards.

Collaborative research consortia have formed between academic institutions and industry partners to address fundamental challenges in metasurface antenna design and manufacturing. These public-private partnerships, such as the European Metamaterial Alliance and the Metamaterial Devices Consortium in North America, facilitate knowledge transfer between research laboratories and commercial entities. Patent cross-licensing agreements within these consortia have become increasingly common, creating technology pools that benefit all participating members.

Testing and certification protocols represent another crucial area of collaboration. Several international testing laboratories have developed specialized facilities for evaluating metasurface antenna performance against emerging standards. These facilities enable independent verification of patent claims related to efficiency, bandwidth, and beam-steering capabilities. The standardized testing methodologies ensure that patented innovations can be objectively evaluated against competing solutions.

Open innovation initiatives have also emerged alongside traditional standardization efforts. Organizations like the Open Metamaterial Antenna Consortium promote the development of open-source designs and manufacturing techniques that complement proprietary technologies. This approach has created a foundation of non-proprietary knowledge upon which companies can build differentiated, patentable innovations while maintaining compatibility with industry standards.

The convergence of standardization efforts and patent strategies is particularly evident in application-specific domains such as automotive radar, satellite communications, and medical imaging. In these sectors, industry forums have developed specialized implementation guidelines that incorporate patented metasurface technologies while ensuring interoperability across different manufacturers' systems. This balanced approach protects intellectual property rights while fostering the broader ecosystem necessary for widespread technology adoption.

Patent analysis reveals that major telecommunications companies including Huawei, Samsung, and Nokia have been actively participating in these standardization initiatives while simultaneously protecting their intellectual property. This dual approach demonstrates the strategic importance of balancing proprietary innovation with industry-wide compatibility. The standardization documents reference numerous patented technologies, indicating the significant influence of patent holders in shaping technical standards.

Collaborative research consortia have formed between academic institutions and industry partners to address fundamental challenges in metasurface antenna design and manufacturing. These public-private partnerships, such as the European Metamaterial Alliance and the Metamaterial Devices Consortium in North America, facilitate knowledge transfer between research laboratories and commercial entities. Patent cross-licensing agreements within these consortia have become increasingly common, creating technology pools that benefit all participating members.

Testing and certification protocols represent another crucial area of collaboration. Several international testing laboratories have developed specialized facilities for evaluating metasurface antenna performance against emerging standards. These facilities enable independent verification of patent claims related to efficiency, bandwidth, and beam-steering capabilities. The standardized testing methodologies ensure that patented innovations can be objectively evaluated against competing solutions.

Open innovation initiatives have also emerged alongside traditional standardization efforts. Organizations like the Open Metamaterial Antenna Consortium promote the development of open-source designs and manufacturing techniques that complement proprietary technologies. This approach has created a foundation of non-proprietary knowledge upon which companies can build differentiated, patentable innovations while maintaining compatibility with industry standards.

The convergence of standardization efforts and patent strategies is particularly evident in application-specific domains such as automotive radar, satellite communications, and medical imaging. In these sectors, industry forums have developed specialized implementation guidelines that incorporate patented metasurface technologies while ensuring interoperability across different manufacturers' systems. This balanced approach protects intellectual property rights while fostering the broader ecosystem necessary for widespread technology adoption.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!