Impact of Sodium Supply Chains on Battery Production Scalability

AUG 7, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Sodium Battery Evolution

The evolution of sodium batteries represents a significant shift in energy storage technology, driven by the need for more sustainable and cost-effective alternatives to lithium-ion batteries. This progression can be traced through several key stages, each marked by notable advancements and breakthroughs.

In the early 1980s, initial research into sodium-based batteries began, focusing primarily on high-temperature sodium-sulfur (NaS) batteries. These early designs operated at temperatures around 300-350°C, limiting their practical applications. However, they laid the groundwork for future sodium battery technologies.

The 1990s saw the development of room-temperature sodium-ion batteries, addressing the temperature limitations of their predecessors. This period was characterized by intensive research into suitable electrode materials and electrolytes that could facilitate sodium ion intercalation at ambient temperatures.

The early 2000s marked a turning point with the discovery of new cathode materials, such as layered oxides and polyanionic compounds. These materials demonstrated improved sodium storage capabilities and cycling stability, sparking renewed interest in sodium-ion technology.

From 2010 onwards, significant progress was made in anode material development. Hard carbons emerged as promising candidates due to their ability to accommodate sodium ions effectively. This period also saw advancements in electrolyte formulations, enhancing the overall performance and safety of sodium-ion batteries.

Recent years have witnessed a surge in research focused on optimizing cell design and scaling up production. Efforts have been directed towards improving energy density, cycle life, and charge-discharge rates to make sodium-ion batteries competitive with their lithium-ion counterparts.

The current phase of sodium battery evolution is characterized by a shift towards commercialization. Several companies and research institutions are now working on pilot-scale production and real-world applications, particularly in grid storage and electric vehicles.

Looking ahead, the sodium battery landscape is poised for further innovation. Research is ongoing into novel electrode materials, including organic compounds and advanced nanostructures. Additionally, there is a growing focus on developing solid-state sodium batteries, which promise enhanced safety and energy density.

This evolutionary trajectory of sodium batteries highlights the persistent efforts to overcome technical challenges and harness the potential of this abundant element for energy storage. As the technology continues to mature, it is expected to play an increasingly significant role in addressing the scalability and sustainability concerns associated with battery production.

In the early 1980s, initial research into sodium-based batteries began, focusing primarily on high-temperature sodium-sulfur (NaS) batteries. These early designs operated at temperatures around 300-350°C, limiting their practical applications. However, they laid the groundwork for future sodium battery technologies.

The 1990s saw the development of room-temperature sodium-ion batteries, addressing the temperature limitations of their predecessors. This period was characterized by intensive research into suitable electrode materials and electrolytes that could facilitate sodium ion intercalation at ambient temperatures.

The early 2000s marked a turning point with the discovery of new cathode materials, such as layered oxides and polyanionic compounds. These materials demonstrated improved sodium storage capabilities and cycling stability, sparking renewed interest in sodium-ion technology.

From 2010 onwards, significant progress was made in anode material development. Hard carbons emerged as promising candidates due to their ability to accommodate sodium ions effectively. This period also saw advancements in electrolyte formulations, enhancing the overall performance and safety of sodium-ion batteries.

Recent years have witnessed a surge in research focused on optimizing cell design and scaling up production. Efforts have been directed towards improving energy density, cycle life, and charge-discharge rates to make sodium-ion batteries competitive with their lithium-ion counterparts.

The current phase of sodium battery evolution is characterized by a shift towards commercialization. Several companies and research institutions are now working on pilot-scale production and real-world applications, particularly in grid storage and electric vehicles.

Looking ahead, the sodium battery landscape is poised for further innovation. Research is ongoing into novel electrode materials, including organic compounds and advanced nanostructures. Additionally, there is a growing focus on developing solid-state sodium batteries, which promise enhanced safety and energy density.

This evolutionary trajectory of sodium batteries highlights the persistent efforts to overcome technical challenges and harness the potential of this abundant element for energy storage. As the technology continues to mature, it is expected to play an increasingly significant role in addressing the scalability and sustainability concerns associated with battery production.

Market Demand Analysis

The market demand for sodium-ion batteries has been steadily increasing, driven by the growing need for sustainable and cost-effective energy storage solutions. As the world transitions towards renewable energy sources and electric vehicles, the demand for large-scale energy storage systems has surged. Sodium-ion batteries are emerging as a promising alternative to lithium-ion batteries, particularly in grid-scale applications and electric vehicles.

The global sodium-ion battery market is expected to experience significant growth in the coming years. This growth is primarily attributed to the abundance and low cost of sodium resources compared to lithium. The scalability of sodium-ion battery production is closely tied to the availability and efficiency of sodium supply chains, which are currently less developed than those for lithium.

In the electric vehicle sector, sodium-ion batteries are gaining traction as a potential solution for entry-level and mid-range vehicles. The automotive industry is actively exploring sodium-ion technology to reduce dependency on lithium and cobalt, which face supply constraints and geopolitical challenges. This shift is driven by the need to meet increasing consumer demand for affordable electric vehicles while ensuring a stable supply chain.

Grid energy storage represents another significant market for sodium-ion batteries. As renewable energy sources like wind and solar become more prevalent, the need for large-scale energy storage solutions grows. Sodium-ion batteries offer advantages in this sector due to their potential for lower costs, improved safety, and better performance in extreme temperatures compared to lithium-ion batteries.

The industrial sector is also showing interest in sodium-ion batteries for applications such as backup power systems and off-grid solutions. The ability to operate efficiently in a wide range of temperatures makes sodium-ion batteries attractive for use in diverse environmental conditions.

However, the market demand for sodium-ion batteries is currently constrained by the limited production capacity and the nascent state of sodium supply chains. As the technology matures and production scales up, it is anticipated that the market demand will grow exponentially. The development of robust sodium supply chains will be crucial in meeting this increasing demand and ensuring the scalability of battery production.

The market potential for sodium-ion batteries is further enhanced by the growing emphasis on sustainability and circular economy principles. The recyclability of sodium-ion batteries and the abundance of sodium resources align well with these global trends, potentially driving increased adoption across various industries.

The global sodium-ion battery market is expected to experience significant growth in the coming years. This growth is primarily attributed to the abundance and low cost of sodium resources compared to lithium. The scalability of sodium-ion battery production is closely tied to the availability and efficiency of sodium supply chains, which are currently less developed than those for lithium.

In the electric vehicle sector, sodium-ion batteries are gaining traction as a potential solution for entry-level and mid-range vehicles. The automotive industry is actively exploring sodium-ion technology to reduce dependency on lithium and cobalt, which face supply constraints and geopolitical challenges. This shift is driven by the need to meet increasing consumer demand for affordable electric vehicles while ensuring a stable supply chain.

Grid energy storage represents another significant market for sodium-ion batteries. As renewable energy sources like wind and solar become more prevalent, the need for large-scale energy storage solutions grows. Sodium-ion batteries offer advantages in this sector due to their potential for lower costs, improved safety, and better performance in extreme temperatures compared to lithium-ion batteries.

The industrial sector is also showing interest in sodium-ion batteries for applications such as backup power systems and off-grid solutions. The ability to operate efficiently in a wide range of temperatures makes sodium-ion batteries attractive for use in diverse environmental conditions.

However, the market demand for sodium-ion batteries is currently constrained by the limited production capacity and the nascent state of sodium supply chains. As the technology matures and production scales up, it is anticipated that the market demand will grow exponentially. The development of robust sodium supply chains will be crucial in meeting this increasing demand and ensuring the scalability of battery production.

The market potential for sodium-ion batteries is further enhanced by the growing emphasis on sustainability and circular economy principles. The recyclability of sodium-ion batteries and the abundance of sodium resources align well with these global trends, potentially driving increased adoption across various industries.

Sodium Supply Challenges

The scalability of sodium-ion battery production is significantly impacted by challenges in the sodium supply chain. Unlike lithium, sodium is abundant and widely distributed globally, which initially suggests a more stable and accessible supply. However, the specific requirements for battery-grade sodium compounds present unique obstacles.

One primary challenge is the purification process. While sodium is plentiful, extracting and refining it to the high purity levels required for battery production is complex and energy-intensive. This process often involves electrolysis of molten sodium chloride, which requires substantial energy input and specialized equipment. The cost and environmental impact of this purification step can potentially offset some of the advantages of sodium's abundance.

Another significant issue is the lack of established supply chains for battery-grade sodium compounds. The sodium-ion battery industry is relatively new compared to lithium-ion, and as a result, the infrastructure for large-scale production and distribution of high-purity sodium materials is underdeveloped. This gap in the supply chain can lead to bottlenecks in production and increased costs as manufacturers struggle to secure reliable sources of battery-grade sodium.

The geographical distribution of sodium resources also presents challenges. While sodium is more evenly distributed than lithium, the locations with the capability to process it into battery-grade materials are limited. This concentration of processing capabilities in specific regions can lead to geopolitical risks and potential supply disruptions, similar to those seen in the lithium industry.

Transportation and storage of sodium compounds pose additional challenges. Many sodium compounds are hygroscopic, meaning they readily absorb moisture from the air. This property necessitates special handling and storage conditions to maintain purity, adding complexity and cost to the supply chain. The reactive nature of some sodium compounds also requires careful consideration in transportation logistics to ensure safety and compliance with regulations.

The nascent state of the sodium-ion battery industry also means that demand forecasting is challenging. Uncertainties in market adoption rates and competing technologies make it difficult for suppliers to plan and scale their operations effectively. This uncertainty can lead to hesitancy in investing in large-scale production facilities, potentially creating supply shortages as demand grows.

Addressing these sodium supply challenges is crucial for the scalability of sodium-ion battery production. Innovations in extraction and purification technologies, development of robust supply chains, and strategic planning for resource allocation will be key factors in overcoming these obstacles and realizing the full potential of sodium-ion batteries as a scalable energy storage solution.

One primary challenge is the purification process. While sodium is plentiful, extracting and refining it to the high purity levels required for battery production is complex and energy-intensive. This process often involves electrolysis of molten sodium chloride, which requires substantial energy input and specialized equipment. The cost and environmental impact of this purification step can potentially offset some of the advantages of sodium's abundance.

Another significant issue is the lack of established supply chains for battery-grade sodium compounds. The sodium-ion battery industry is relatively new compared to lithium-ion, and as a result, the infrastructure for large-scale production and distribution of high-purity sodium materials is underdeveloped. This gap in the supply chain can lead to bottlenecks in production and increased costs as manufacturers struggle to secure reliable sources of battery-grade sodium.

The geographical distribution of sodium resources also presents challenges. While sodium is more evenly distributed than lithium, the locations with the capability to process it into battery-grade materials are limited. This concentration of processing capabilities in specific regions can lead to geopolitical risks and potential supply disruptions, similar to those seen in the lithium industry.

Transportation and storage of sodium compounds pose additional challenges. Many sodium compounds are hygroscopic, meaning they readily absorb moisture from the air. This property necessitates special handling and storage conditions to maintain purity, adding complexity and cost to the supply chain. The reactive nature of some sodium compounds also requires careful consideration in transportation logistics to ensure safety and compliance with regulations.

The nascent state of the sodium-ion battery industry also means that demand forecasting is challenging. Uncertainties in market adoption rates and competing technologies make it difficult for suppliers to plan and scale their operations effectively. This uncertainty can lead to hesitancy in investing in large-scale production facilities, potentially creating supply shortages as demand grows.

Addressing these sodium supply challenges is crucial for the scalability of sodium-ion battery production. Innovations in extraction and purification technologies, development of robust supply chains, and strategic planning for resource allocation will be key factors in overcoming these obstacles and realizing the full potential of sodium-ion batteries as a scalable energy storage solution.

Current Supply Solutions

01 Supply chain optimization for sodium production

Implementing advanced supply chain management techniques to optimize sodium production and distribution. This includes improving logistics, inventory management, and demand forecasting to enhance the scalability of sodium supply chains.- Supply chain optimization for sodium production: Implementing advanced supply chain management techniques to optimize sodium production and distribution. This includes improving logistics, inventory management, and demand forecasting to enhance the scalability of sodium supply chains.

- Digital transformation in sodium supply chains: Leveraging digital technologies such as IoT, AI, and blockchain to improve visibility, traceability, and efficiency in sodium supply chains. This digital transformation enables better decision-making and scalability.

- Sustainable and scalable sodium extraction methods: Developing and implementing sustainable extraction methods for sodium that can be scaled up to meet growing demand. This includes innovative technologies for extracting sodium from various sources while minimizing environmental impact.

- Collaborative networks for sodium supply chain scalability: Establishing collaborative networks and partnerships among suppliers, manufacturers, and distributors to enhance the scalability of sodium supply chains. This approach facilitates resource sharing, risk mitigation, and improved responsiveness to market demands.

- Data-driven decision making for supply chain scalability: Utilizing advanced analytics and data-driven approaches to optimize decision-making processes in sodium supply chains. This includes predictive modeling, scenario analysis, and real-time monitoring to enhance scalability and adaptability.

02 Scalable sodium extraction and processing technologies

Developing and implementing scalable technologies for sodium extraction and processing. This involves innovative methods to increase production capacity, improve efficiency, and reduce costs in sodium manufacturing processes.Expand Specific Solutions03 Digital transformation in sodium supply chains

Leveraging digital technologies such as IoT, AI, and blockchain to enhance the scalability and efficiency of sodium supply chains. This includes implementing smart monitoring systems, predictive maintenance, and real-time tracking of sodium production and distribution.Expand Specific Solutions04 Sustainable and eco-friendly sodium production

Developing sustainable and environmentally friendly methods for sodium production and supply chain management. This includes implementing green technologies, reducing carbon footprint, and optimizing resource utilization to ensure long-term scalability of sodium supply chains.Expand Specific Solutions05 Collaborative sodium supply chain networks

Establishing collaborative networks and partnerships among sodium producers, suppliers, and distributors to enhance supply chain scalability. This involves sharing resources, information, and best practices to improve overall efficiency and responsiveness in the sodium supply chain.Expand Specific Solutions

Key Industry Players

The impact of sodium supply chains on battery production scalability is currently in an early development stage, with a growing market potential as the industry seeks alternatives to lithium-ion batteries. The market size is expanding, driven by the need for sustainable and cost-effective energy storage solutions. Technologically, sodium-ion batteries are progressing rapidly, with companies like CATL, Faradion, and BroadBit Batteries leading research and development efforts. However, the technology's maturity level is still behind lithium-ion batteries, with ongoing challenges in energy density and cycle life. Industry players like NGK Insulators and GEM Co. are also exploring sodium-based technologies, indicating a competitive landscape with diverse approaches to commercialization.

Contemporary Amperex Technology Co., Ltd.

Technical Solution: CATL has developed a sodium-ion battery technology that addresses the scalability challenges in battery production. Their innovative approach includes using Prussian white materials for the cathode and hard carbon materials for the anode[1]. This design allows for high-speed ion transfer and storage structure stability. CATL's sodium-ion batteries can achieve up to 160Wh/kg energy density and can charge to 80% in 15 minutes at room temperature[2]. To tackle supply chain issues, CATL has invested in sodium mining and processing facilities, ensuring a stable supply of raw materials for large-scale production[3].

Strengths: High energy density, fast charging capability, and vertical integration of supply chain. Weaknesses: Still lower energy density compared to lithium-ion batteries, potential challenges in scaling up new technology.

GS Yuasa International Ltd.

Technical Solution: GS Yuasa has been developing sodium-sulfur (NaS) batteries, which are high-temperature batteries operating at about 300°C. Their NaS batteries use molten sodium as the negative electrode and molten sulfur as the positive electrode, separated by a solid beta-alumina ceramic electrolyte[4]. This technology allows for high energy density and long cycle life. To address scalability, GS Yuasa has focused on improving the manufacturing process of beta-alumina tubes, a critical component of NaS batteries. They have also developed modular designs that can be easily scaled up for grid-scale energy storage applications[5].

Strengths: High energy density, long cycle life, and suitability for large-scale stationary storage. Weaknesses: High operating temperature requires additional thermal management systems, potentially limiting applications.

Sodium Extraction Tech

Sodium salts having borate or aluminate anions

PatentWO2024200172A1

Innovation

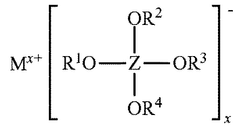

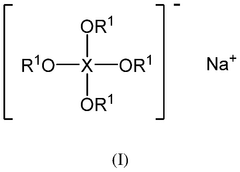

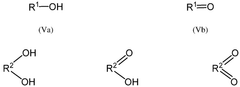

- A compound of formula (I) or (II) is introduced, comprising Al or B with specific organic groups, used in an electrolyte solution with solvents like propylene carbonate, optimizing the sodium cation concentration and solvent ratio to enhance ionic conductivity and battery performance.

Non-aqueous electrolyte compositions

PatentWO2025074107A1

Innovation

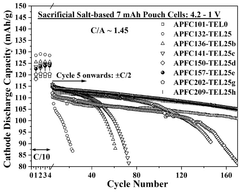

- A novel non-aqueous electrolyte composition is introduced, comprising an organo carbonate-based solvent system and a presodiation reagent with sacrificial sodium salts, which provides additional sodium ions to the anode during charging, thereby compensating for the lost 'recyclable' Na+ ions and enhancing the cell's capacity and cycling stability.

Environmental Impact

The environmental impact of sodium-ion battery production and its associated supply chains is a critical consideration in the scalability of this emerging technology. As the demand for sustainable energy storage solutions grows, understanding and mitigating the ecological footprint of sodium-ion batteries becomes increasingly important.

The extraction and processing of sodium, a key component in these batteries, generally has a lower environmental impact compared to lithium mining. Sodium is abundant in the Earth's crust and can be sourced from seawater, reducing the need for extensive mining operations. This potentially leads to less habitat disruption and lower greenhouse gas emissions associated with extraction processes.

However, the production of other materials used in sodium-ion batteries, such as hard carbon for anodes and transition metal oxides for cathodes, still carries environmental concerns. The manufacturing of these components often involves energy-intensive processes and the use of potentially harmful chemicals, which can contribute to air and water pollution if not properly managed.

Water usage is another significant factor to consider. While sodium extraction from seawater is less water-intensive than lithium brine evaporation, the overall battery production process still requires substantial amounts of water. This could potentially strain local water resources, especially in water-scarce regions where manufacturing facilities might be located.

The scalability of sodium-ion battery production also raises questions about waste management and recycling. As production increases, so does the potential volume of battery waste at the end of their lifecycle. Developing efficient recycling processes for sodium-ion batteries is crucial to minimize environmental impact and recover valuable materials, thereby creating a more circular economy.

Energy consumption during the manufacturing process is a notable environmental concern. As production scales up, the energy demand will increase significantly. The source of this energy – whether from renewable sources or fossil fuels – will greatly influence the overall carbon footprint of sodium-ion battery production.

Transportation and logistics within the supply chain also contribute to the environmental impact. The movement of raw materials, components, and finished batteries across global supply chains involves significant fuel consumption and emissions. Localizing production and sourcing materials closer to manufacturing sites could help reduce these impacts.

In conclusion, while sodium-ion batteries offer potential environmental advantages over lithium-ion batteries, particularly in terms of raw material extraction, their large-scale production still poses significant environmental challenges. Addressing these issues through sustainable practices, clean energy use, efficient resource management, and circular economy principles will be crucial for ensuring that the scalability of sodium-ion battery production aligns with environmental sustainability goals.

The extraction and processing of sodium, a key component in these batteries, generally has a lower environmental impact compared to lithium mining. Sodium is abundant in the Earth's crust and can be sourced from seawater, reducing the need for extensive mining operations. This potentially leads to less habitat disruption and lower greenhouse gas emissions associated with extraction processes.

However, the production of other materials used in sodium-ion batteries, such as hard carbon for anodes and transition metal oxides for cathodes, still carries environmental concerns. The manufacturing of these components often involves energy-intensive processes and the use of potentially harmful chemicals, which can contribute to air and water pollution if not properly managed.

Water usage is another significant factor to consider. While sodium extraction from seawater is less water-intensive than lithium brine evaporation, the overall battery production process still requires substantial amounts of water. This could potentially strain local water resources, especially in water-scarce regions where manufacturing facilities might be located.

The scalability of sodium-ion battery production also raises questions about waste management and recycling. As production increases, so does the potential volume of battery waste at the end of their lifecycle. Developing efficient recycling processes for sodium-ion batteries is crucial to minimize environmental impact and recover valuable materials, thereby creating a more circular economy.

Energy consumption during the manufacturing process is a notable environmental concern. As production scales up, the energy demand will increase significantly. The source of this energy – whether from renewable sources or fossil fuels – will greatly influence the overall carbon footprint of sodium-ion battery production.

Transportation and logistics within the supply chain also contribute to the environmental impact. The movement of raw materials, components, and finished batteries across global supply chains involves significant fuel consumption and emissions. Localizing production and sourcing materials closer to manufacturing sites could help reduce these impacts.

In conclusion, while sodium-ion batteries offer potential environmental advantages over lithium-ion batteries, particularly in terms of raw material extraction, their large-scale production still poses significant environmental challenges. Addressing these issues through sustainable practices, clean energy use, efficient resource management, and circular economy principles will be crucial for ensuring that the scalability of sodium-ion battery production aligns with environmental sustainability goals.

Geopolitical Factors

The geopolitical landscape plays a crucial role in shaping the sodium supply chains and their impact on battery production scalability. As nations strive to secure their energy future, the control and distribution of sodium resources have become increasingly important in global politics and economics.

Sodium-ion batteries are emerging as a potential alternative to lithium-ion batteries, particularly for large-scale energy storage applications. The abundance and widespread distribution of sodium resources offer a significant advantage over lithium, potentially reducing geopolitical tensions associated with battery production. However, the geopolitical factors influencing sodium supply chains are complex and multifaceted.

One of the primary geopolitical considerations is the geographical distribution of sodium resources. Unlike lithium, which is concentrated in a few countries, sodium is more evenly distributed globally. This distribution could lead to a more diverse and stable supply chain, reducing the risk of supply disruptions due to political conflicts or trade disputes. Countries with significant salt deposits, such as China, the United States, and Germany, may gain strategic advantages in the sodium-ion battery industry.

The development of sodium-ion battery technology has also sparked a new arena for international competition and cooperation. Countries are investing heavily in research and development to gain a technological edge in this emerging field. This competition could lead to accelerated innovation but may also result in protectionist policies and trade barriers as nations seek to protect their domestic industries.

Environmental regulations and sustainability goals are another critical geopolitical factor affecting sodium supply chains. As countries implement stricter environmental policies, the extraction and processing of sodium may face increased scrutiny. Nations with more lenient environmental regulations might gain a short-term advantage in production, but this could lead to long-term environmental and diplomatic challenges.

The geopolitical dynamics of energy transition also play a significant role. As countries shift towards renewable energy sources, the demand for large-scale energy storage solutions is expected to grow. This transition could reshape global power dynamics, with countries that successfully develop and produce sodium-ion batteries gaining influence in the international energy market.

Trade agreements and international partnerships will be crucial in shaping the future of sodium supply chains. Bilateral and multilateral agreements focusing on the exchange of technology, resources, and finished products could significantly impact the scalability of battery production. Countries may form strategic alliances to secure their positions in the sodium-ion battery market, potentially leading to new geopolitical blocs centered around this technology.

Sodium-ion batteries are emerging as a potential alternative to lithium-ion batteries, particularly for large-scale energy storage applications. The abundance and widespread distribution of sodium resources offer a significant advantage over lithium, potentially reducing geopolitical tensions associated with battery production. However, the geopolitical factors influencing sodium supply chains are complex and multifaceted.

One of the primary geopolitical considerations is the geographical distribution of sodium resources. Unlike lithium, which is concentrated in a few countries, sodium is more evenly distributed globally. This distribution could lead to a more diverse and stable supply chain, reducing the risk of supply disruptions due to political conflicts or trade disputes. Countries with significant salt deposits, such as China, the United States, and Germany, may gain strategic advantages in the sodium-ion battery industry.

The development of sodium-ion battery technology has also sparked a new arena for international competition and cooperation. Countries are investing heavily in research and development to gain a technological edge in this emerging field. This competition could lead to accelerated innovation but may also result in protectionist policies and trade barriers as nations seek to protect their domestic industries.

Environmental regulations and sustainability goals are another critical geopolitical factor affecting sodium supply chains. As countries implement stricter environmental policies, the extraction and processing of sodium may face increased scrutiny. Nations with more lenient environmental regulations might gain a short-term advantage in production, but this could lead to long-term environmental and diplomatic challenges.

The geopolitical dynamics of energy transition also play a significant role. As countries shift towards renewable energy sources, the demand for large-scale energy storage solutions is expected to grow. This transition could reshape global power dynamics, with countries that successfully develop and produce sodium-ion batteries gaining influence in the international energy market.

Trade agreements and international partnerships will be crucial in shaping the future of sodium supply chains. Bilateral and multilateral agreements focusing on the exchange of technology, resources, and finished products could significantly impact the scalability of battery production. Countries may form strategic alliances to secure their positions in the sodium-ion battery market, potentially leading to new geopolitical blocs centered around this technology.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!