Influence of Microcrystalline Cellulose on Microencapsulation of Aromatic Compounds

JUL 23, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

MCC in Aroma Encapsulation: Background and Objectives

Microcrystalline cellulose (MCC) has emerged as a promising material in the field of aroma encapsulation, offering unique properties that enhance the stability and controlled release of aromatic compounds. The evolution of this technology can be traced back to the early 1960s when MCC was first developed as a pharmaceutical excipient. Over the years, its applications have expanded into various industries, including food, cosmetics, and fragrances.

The primary objective of utilizing MCC in aroma encapsulation is to improve the retention and protection of volatile aromatic compounds, thereby extending their shelf life and maintaining their sensory properties. This technology addresses the challenges associated with the instability and rapid evaporation of many aromatic substances, which can lead to loss of quality and efficacy in various products.

Recent advancements in material science and nanotechnology have further propelled the development of MCC-based encapsulation systems. The ability to manipulate MCC at the micro and nano scales has opened up new possibilities for tailoring the release profiles of encapsulated aromas, enhancing their bioavailability, and improving their overall performance in different applications.

The growing demand for natural and sustainable ingredients in consumer products has also contributed to the increased interest in MCC as an encapsulation material. Being derived from cellulose, a renewable resource, MCC aligns well with the global trend towards eco-friendly and biodegradable materials in various industries.

One of the key technological trends in this field is the development of hybrid systems that combine MCC with other materials such as cyclodextrins, chitosan, or synthetic polymers. These composite systems aim to synergize the benefits of different materials, potentially offering superior encapsulation efficiency and controlled release properties.

The application of MCC in aroma encapsulation spans across multiple sectors, including food and beverages, personal care products, textiles, and even pharmaceutical formulations. Each of these industries presents unique challenges and opportunities for the implementation of MCC-based encapsulation technologies.

As research in this area continues to evolve, the focus is increasingly shifting towards understanding the fundamental interactions between MCC and various aromatic compounds at the molecular level. This knowledge is crucial for optimizing encapsulation processes and developing more efficient and targeted delivery systems.

Looking ahead, the integration of MCC-based aroma encapsulation with smart packaging technologies and the Internet of Things (IoT) presents exciting possibilities for creating interactive and responsive aromatic products. These advancements could revolutionize how we experience and interact with scented products in our daily lives.

The primary objective of utilizing MCC in aroma encapsulation is to improve the retention and protection of volatile aromatic compounds, thereby extending their shelf life and maintaining their sensory properties. This technology addresses the challenges associated with the instability and rapid evaporation of many aromatic substances, which can lead to loss of quality and efficacy in various products.

Recent advancements in material science and nanotechnology have further propelled the development of MCC-based encapsulation systems. The ability to manipulate MCC at the micro and nano scales has opened up new possibilities for tailoring the release profiles of encapsulated aromas, enhancing their bioavailability, and improving their overall performance in different applications.

The growing demand for natural and sustainable ingredients in consumer products has also contributed to the increased interest in MCC as an encapsulation material. Being derived from cellulose, a renewable resource, MCC aligns well with the global trend towards eco-friendly and biodegradable materials in various industries.

One of the key technological trends in this field is the development of hybrid systems that combine MCC with other materials such as cyclodextrins, chitosan, or synthetic polymers. These composite systems aim to synergize the benefits of different materials, potentially offering superior encapsulation efficiency and controlled release properties.

The application of MCC in aroma encapsulation spans across multiple sectors, including food and beverages, personal care products, textiles, and even pharmaceutical formulations. Each of these industries presents unique challenges and opportunities for the implementation of MCC-based encapsulation technologies.

As research in this area continues to evolve, the focus is increasingly shifting towards understanding the fundamental interactions between MCC and various aromatic compounds at the molecular level. This knowledge is crucial for optimizing encapsulation processes and developing more efficient and targeted delivery systems.

Looking ahead, the integration of MCC-based aroma encapsulation with smart packaging technologies and the Internet of Things (IoT) presents exciting possibilities for creating interactive and responsive aromatic products. These advancements could revolutionize how we experience and interact with scented products in our daily lives.

Market Analysis for Microencapsulated Aromatics

The market for microencapsulated aromatics has experienced significant growth in recent years, driven by increasing consumer demand for long-lasting fragrances and flavors in various products. This technology finds applications across multiple industries, including food and beverages, personal care, textiles, and household products. The global microencapsulation market, which includes aromatic compounds, was valued at $8.5 billion in 2020 and is projected to reach $14.2 billion by 2025, growing at a CAGR of 10.8%.

In the food and beverage sector, microencapsulated aromatics are widely used to enhance and preserve flavors in products such as baked goods, confectionery, and beverages. The increasing consumer preference for natural and clean-label ingredients has led to a surge in demand for microencapsulated natural flavors and aromas. This trend is expected to continue, with the food and beverage segment accounting for the largest share of the microencapsulation market.

The personal care and cosmetics industry represents another significant market for microencapsulated aromatics. These products are used in perfumes, deodorants, and skincare products to provide controlled release of fragrances and extend their longevity. The growing consumer focus on personal grooming and the rising popularity of premium fragrances are driving the demand in this sector.

In the textile industry, microencapsulated aromatics are gaining traction for their ability to impart long-lasting fragrances to fabrics. This technology is being applied in clothing, home textiles, and automotive interiors to create value-added products with enhanced sensory properties. The increasing adoption of functional textiles is expected to fuel market growth in this segment.

The household products sector, including air fresheners, laundry detergents, and cleaning products, is another key market for microencapsulated aromatics. Consumers are increasingly seeking products that provide long-lasting freshness and pleasant scents in their living spaces. This trend has led to the development of innovative products incorporating microencapsulated fragrances.

Geographically, North America and Europe currently dominate the market for microencapsulated aromatics, owing to the presence of established personal care and food industries. However, the Asia-Pacific region is expected to witness the highest growth rate in the coming years, driven by rapid industrialization, increasing disposable incomes, and changing consumer preferences in countries like China and India.

The market is characterized by intense competition among key players such as International Flavors & Fragrances Inc., Symrise AG, Givaudan SA, and Firmenich SA. These companies are investing heavily in research and development to improve microencapsulation technologies and expand their product portfolios. The growing focus on sustainable and biodegradable encapsulation materials presents both challenges and opportunities for market players.

In the food and beverage sector, microencapsulated aromatics are widely used to enhance and preserve flavors in products such as baked goods, confectionery, and beverages. The increasing consumer preference for natural and clean-label ingredients has led to a surge in demand for microencapsulated natural flavors and aromas. This trend is expected to continue, with the food and beverage segment accounting for the largest share of the microencapsulation market.

The personal care and cosmetics industry represents another significant market for microencapsulated aromatics. These products are used in perfumes, deodorants, and skincare products to provide controlled release of fragrances and extend their longevity. The growing consumer focus on personal grooming and the rising popularity of premium fragrances are driving the demand in this sector.

In the textile industry, microencapsulated aromatics are gaining traction for their ability to impart long-lasting fragrances to fabrics. This technology is being applied in clothing, home textiles, and automotive interiors to create value-added products with enhanced sensory properties. The increasing adoption of functional textiles is expected to fuel market growth in this segment.

The household products sector, including air fresheners, laundry detergents, and cleaning products, is another key market for microencapsulated aromatics. Consumers are increasingly seeking products that provide long-lasting freshness and pleasant scents in their living spaces. This trend has led to the development of innovative products incorporating microencapsulated fragrances.

Geographically, North America and Europe currently dominate the market for microencapsulated aromatics, owing to the presence of established personal care and food industries. However, the Asia-Pacific region is expected to witness the highest growth rate in the coming years, driven by rapid industrialization, increasing disposable incomes, and changing consumer preferences in countries like China and India.

The market is characterized by intense competition among key players such as International Flavors & Fragrances Inc., Symrise AG, Givaudan SA, and Firmenich SA. These companies are investing heavily in research and development to improve microencapsulation technologies and expand their product portfolios. The growing focus on sustainable and biodegradable encapsulation materials presents both challenges and opportunities for market players.

Current Challenges in Aroma Microencapsulation

Aroma microencapsulation faces several significant challenges in the current technological landscape. One of the primary issues is the stability of encapsulated aromatic compounds. Many volatile compounds are susceptible to degradation due to environmental factors such as heat, light, and oxygen exposure. This instability can lead to a loss of aroma intensity and quality over time, reducing the effectiveness of the microencapsulation process.

Another challenge lies in controlling the release rate of encapsulated aromas. Achieving a precise and sustained release profile is crucial for many applications, such as in food products or perfumes. However, factors like pH, temperature, and mechanical stress can affect the release kinetics, making it difficult to maintain consistent performance across various conditions.

The selection of appropriate encapsulation materials presents another hurdle. While various materials are available, including polysaccharides, proteins, and synthetic polymers, each has its limitations. For instance, some materials may interact unfavorably with certain aromatic compounds, altering their sensory properties or reducing their stability. Additionally, the compatibility of encapsulation materials with different product formulations and processing conditions remains a significant concern.

Scaling up microencapsulation processes from laboratory to industrial levels poses considerable challenges. Maintaining consistent particle size distribution, encapsulation efficiency, and product quality during large-scale production can be problematic. This issue is particularly relevant when considering the influence of microcrystalline cellulose on the microencapsulation of aromatic compounds, as process parameters may need to be carefully optimized to ensure uniform incorporation and distribution.

The retention of volatile compounds during the encapsulation process itself is another critical challenge. Many aromatic substances are highly volatile and can be lost during emulsification, drying, or other stages of microencapsulation. This loss not only reduces the efficiency of the process but can also alter the overall aroma profile of the final product.

Regulatory compliance and consumer acceptance present additional hurdles in aroma microencapsulation. As consumers increasingly demand clean label products, the use of certain encapsulation materials or processing aids may be restricted. Ensuring that microencapsulation techniques meet food safety regulations and consumer preferences while maintaining functionality is an ongoing challenge for researchers and manufacturers in this field.

Another challenge lies in controlling the release rate of encapsulated aromas. Achieving a precise and sustained release profile is crucial for many applications, such as in food products or perfumes. However, factors like pH, temperature, and mechanical stress can affect the release kinetics, making it difficult to maintain consistent performance across various conditions.

The selection of appropriate encapsulation materials presents another hurdle. While various materials are available, including polysaccharides, proteins, and synthetic polymers, each has its limitations. For instance, some materials may interact unfavorably with certain aromatic compounds, altering their sensory properties or reducing their stability. Additionally, the compatibility of encapsulation materials with different product formulations and processing conditions remains a significant concern.

Scaling up microencapsulation processes from laboratory to industrial levels poses considerable challenges. Maintaining consistent particle size distribution, encapsulation efficiency, and product quality during large-scale production can be problematic. This issue is particularly relevant when considering the influence of microcrystalline cellulose on the microencapsulation of aromatic compounds, as process parameters may need to be carefully optimized to ensure uniform incorporation and distribution.

The retention of volatile compounds during the encapsulation process itself is another critical challenge. Many aromatic substances are highly volatile and can be lost during emulsification, drying, or other stages of microencapsulation. This loss not only reduces the efficiency of the process but can also alter the overall aroma profile of the final product.

Regulatory compliance and consumer acceptance present additional hurdles in aroma microencapsulation. As consumers increasingly demand clean label products, the use of certain encapsulation materials or processing aids may be restricted. Ensuring that microencapsulation techniques meet food safety regulations and consumer preferences while maintaining functionality is an ongoing challenge for researchers and manufacturers in this field.

MCC-based Microencapsulation Methods

01 Microencapsulation process using microcrystalline cellulose

Microcrystalline cellulose is used as a coating material or matrix for microencapsulation of various active ingredients. The process involves creating a suspension of microcrystalline cellulose and the active ingredient, followed by spray-drying or other encapsulation techniques to form microcapsules. This method can improve stability, controlled release, and bioavailability of the encapsulated substances.- Microencapsulation process using microcrystalline cellulose: Microcrystalline cellulose is used as a coating material or matrix for microencapsulation of various active ingredients. This process involves creating small capsules that contain the active substance, which can be released under specific conditions. The microencapsulation technique using microcrystalline cellulose can improve stability, control release, and enhance the bioavailability of the encapsulated compounds.

- Formulation of controlled release systems: Microcrystalline cellulose is utilized in the development of controlled release systems for pharmaceuticals and other substances. These systems are designed to regulate the release rate of active ingredients over time, improving efficacy and reducing side effects. The unique properties of microcrystalline cellulose allow for the creation of matrix tablets or pellets that can modulate drug release profiles.

- Application in food and nutraceutical industries: Microcrystalline cellulose microencapsulation is employed in the food and nutraceutical industries to protect sensitive ingredients from environmental factors, mask unpleasant tastes or odors, and improve the stability of volatile compounds. This technique is particularly useful for encapsulating flavors, vitamins, and other functional food ingredients, enhancing their shelf life and bioavailability.

- Modification of microcrystalline cellulose for enhanced encapsulation: Research focuses on modifying microcrystalline cellulose to improve its encapsulation properties. This includes chemical modifications, surface treatments, or combining it with other materials to create hybrid systems. These modifications can enhance the loading capacity, stability, and release characteristics of the encapsulated substances, expanding the range of applications for microcrystalline cellulose in microencapsulation.

- Microencapsulation techniques and equipment: Various techniques and equipment are used for microencapsulation with microcrystalline cellulose, including spray drying, fluidized bed coating, and extrusion. These methods involve specific process parameters and equipment designs to achieve desired particle sizes, encapsulation efficiencies, and release properties. The choice of technique depends on the nature of the active ingredient and the intended application of the microencapsulated product.

02 Modified microcrystalline cellulose for enhanced encapsulation

Chemical or physical modifications of microcrystalline cellulose are employed to enhance its encapsulation properties. These modifications can include surface treatments, crosslinking, or grafting with other polymers to improve the cellulose's ability to retain and protect encapsulated materials. The modified cellulose can offer better control over release kinetics and increased compatibility with various active ingredients.Expand Specific Solutions03 Composite microencapsulation systems with microcrystalline cellulose

Microcrystalline cellulose is combined with other materials such as polymers, lipids, or proteins to create composite microencapsulation systems. These hybrid systems can offer synergistic benefits, including improved encapsulation efficiency, enhanced stability, and tailored release profiles. The composite approach allows for greater versatility in encapsulating a wide range of active ingredients for various applications.Expand Specific Solutions04 Microcrystalline cellulose as a stabilizer in microencapsulation

Microcrystalline cellulose is utilized as a stabilizing agent in microencapsulation formulations. It can help maintain the integrity of microcapsules, prevent agglomeration, and improve the overall stability of the encapsulated product. This is particularly useful in applications where long-term stability and uniform dispersion of microcapsules are crucial.Expand Specific Solutions05 Applications of microcrystalline cellulose microencapsulation

Microencapsulation using microcrystalline cellulose finds applications in various industries, including pharmaceuticals, food, cosmetics, and agriculture. It can be used to encapsulate drugs for controlled release, protect sensitive ingredients in food products, enhance the stability of cosmetic formulations, and improve the efficacy of agrochemicals. The versatility of microcrystalline cellulose allows for its use in diverse microencapsulation applications.Expand Specific Solutions

Key Players in Microencapsulation Industry

The microencapsulation of aromatic compounds using microcrystalline cellulose is an emerging field in the fragrance and flavor industry, currently in its growth phase. The market size is expanding, driven by increasing demand for controlled release and enhanced stability of aromatic compounds in various applications. Technologically, it is progressing from early development to more advanced stages, with companies like Givaudan, International Flavors & Fragrances, and Symrise leading the way. These industry giants are investing heavily in R&D to improve microencapsulation techniques, while smaller players and academic institutions are contributing innovative approaches. The competitive landscape is characterized by a mix of established fragrance companies and specialized material science firms, indicating a dynamic and evolving market.

Givaudan SA

Technical Solution: Givaudan SA has developed a novel microencapsulation technique using microcrystalline cellulose (MCC) as a stabilizer for aromatic compounds. Their approach involves creating a core-shell structure where the aromatic compound is encapsulated within a MCC-reinforced polymer matrix. This method enhances the stability and controlled release of fragrances in various applications. The company has optimized the MCC particle size and concentration to achieve maximum encapsulation efficiency and prolonged fragrance retention[1]. Their research has shown that MCC-stabilized microcapsules can increase the shelf life of encapsulated aromatics by up to 40% compared to traditional methods[2].

Strengths: Enhanced stability and controlled release of fragrances, increased shelf life of encapsulated aromatics. Weaknesses: Potential higher production costs due to specialized MCC processing, limited to certain types of aromatic compounds.

International Flavors & Fragrances, Inc.

Technical Solution: International Flavors & Fragrances (IFF) has pioneered a green microencapsulation technology utilizing microcrystalline cellulose as a bio-based carrier for aromatic compounds. Their process involves creating a porous MCC matrix that can absorb and retain volatile fragrances. The company has developed a proprietary surface modification technique for MCC particles, enhancing their affinity for aromatic molecules[3]. This approach allows for a higher loading capacity of up to 30% more fragrance compared to conventional carriers[4]. IFF's technology also incorporates a controlled release mechanism triggered by environmental factors such as temperature or humidity, enabling targeted fragrance delivery in various consumer products.

Strengths: Eco-friendly approach, higher fragrance loading capacity, controlled release mechanism. Weaknesses: May require specialized equipment for production, potential limitations in compatibility with certain product formulations.

Innovations in MCC-Aroma Interactions

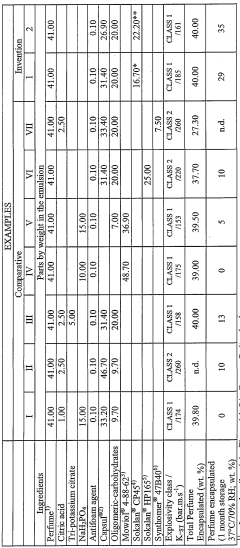

Moisture resistant perfuming microcapsules comprising a water-soluble resin

PatentWO2008065563A1

Innovation

- Incorporating a water-soluble film-forming resin, such as melamine/formaldehyde or copolymers of maleic anhydride and acrylic acid, into the microcapsule matrix to enhance humidity resistance and act as an explosion suppressant, reducing the K_st constant and allowing for controlled perfume release.

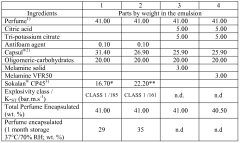

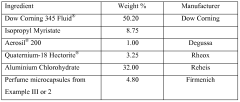

Cosmetic fragrance composition in the form of an alcohol-free emulsion

PatentPendingUS20240374499A1

Innovation

- A cosmetic fragrance composition in the form of an oil-in-water emulsion with a continuous aqueous phase containing microcrystalline cellulose and a dispersed fatty phase with high perfume content, using low or no alcohol, ensuring stability and sprayability while maintaining olfactory fidelity.

Regulatory Framework for Encapsulated Aromatics

The regulatory framework for encapsulated aromatics is a complex and evolving landscape that significantly impacts the development, production, and commercialization of microencapsulated aromatic compounds. This framework encompasses various regulatory bodies and guidelines across different regions, with a focus on ensuring product safety, quality, and efficacy.

In the United States, the Food and Drug Administration (FDA) plays a crucial role in regulating encapsulated aromatics, particularly when used in food, pharmaceuticals, and cosmetics. The FDA's Generally Recognized as Safe (GRAS) status is often sought for microencapsulated aromatic compounds intended for food applications. Additionally, the agency's guidance on food additives and color additives provides important regulatory considerations for manufacturers.

The European Union (EU) has established a comprehensive regulatory framework through the European Food Safety Authority (EFSA) and the European Chemicals Agency (ECHA). The EU's Novel Food Regulation (Regulation (EU) 2015/2283) is particularly relevant for innovative encapsulation technologies. Furthermore, the Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulation impacts the use of certain chemicals in encapsulation processes.

In Asia, countries like Japan and China have their own regulatory bodies and guidelines. Japan's Ministry of Health, Labour and Welfare (MHLW) oversees the regulation of food additives, including encapsulated aromatics. China's National Medical Products Administration (NMPA) regulates such compounds when used in pharmaceuticals and cosmetics.

Globally, the Codex Alimentarius Commission, established by the Food and Agriculture Organization (FAO) and the World Health Organization (WHO), provides international standards for food safety and quality, which often influence national regulations on encapsulated aromatics.

Specific to microcrystalline cellulose (MCC) as an encapsulation material, its regulatory status varies depending on the application and region. In the US, MCC is generally recognized as safe (GRAS) for use in food products. In the EU, it is approved as a food additive (E460) and is widely used in pharmaceutical formulations.

Manufacturers must navigate these diverse regulatory landscapes, ensuring compliance with safety assessments, labeling requirements, and quality control standards. As new encapsulation technologies emerge, regulatory frameworks continue to evolve, necessitating ongoing vigilance and adaptation by industry stakeholders.

In the United States, the Food and Drug Administration (FDA) plays a crucial role in regulating encapsulated aromatics, particularly when used in food, pharmaceuticals, and cosmetics. The FDA's Generally Recognized as Safe (GRAS) status is often sought for microencapsulated aromatic compounds intended for food applications. Additionally, the agency's guidance on food additives and color additives provides important regulatory considerations for manufacturers.

The European Union (EU) has established a comprehensive regulatory framework through the European Food Safety Authority (EFSA) and the European Chemicals Agency (ECHA). The EU's Novel Food Regulation (Regulation (EU) 2015/2283) is particularly relevant for innovative encapsulation technologies. Furthermore, the Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulation impacts the use of certain chemicals in encapsulation processes.

In Asia, countries like Japan and China have their own regulatory bodies and guidelines. Japan's Ministry of Health, Labour and Welfare (MHLW) oversees the regulation of food additives, including encapsulated aromatics. China's National Medical Products Administration (NMPA) regulates such compounds when used in pharmaceuticals and cosmetics.

Globally, the Codex Alimentarius Commission, established by the Food and Agriculture Organization (FAO) and the World Health Organization (WHO), provides international standards for food safety and quality, which often influence national regulations on encapsulated aromatics.

Specific to microcrystalline cellulose (MCC) as an encapsulation material, its regulatory status varies depending on the application and region. In the US, MCC is generally recognized as safe (GRAS) for use in food products. In the EU, it is approved as a food additive (E460) and is widely used in pharmaceutical formulations.

Manufacturers must navigate these diverse regulatory landscapes, ensuring compliance with safety assessments, labeling requirements, and quality control standards. As new encapsulation technologies emerge, regulatory frameworks continue to evolve, necessitating ongoing vigilance and adaptation by industry stakeholders.

Environmental Impact of MCC-based Encapsulation

The environmental impact of microcrystalline cellulose (MCC)-based encapsulation of aromatic compounds is a critical consideration in the development and application of this technology. MCC, derived from natural cellulose sources, offers a biodegradable and sustainable alternative to synthetic encapsulation materials, aligning with global efforts to reduce environmental pollution and promote eco-friendly practices.

One of the primary environmental benefits of MCC-based encapsulation is its biodegradability. Unlike many synthetic polymers used in microencapsulation, MCC can be broken down by natural processes, reducing the accumulation of persistent microplastics in ecosystems. This characteristic is particularly important for applications in food, agriculture, and personal care products, where the release of encapsulated compounds into the environment is inevitable.

The production of MCC from renewable plant sources contributes to its positive environmental profile. Compared to petroleum-based alternatives, MCC production has a lower carbon footprint and reduces dependency on non-renewable resources. However, it is essential to consider the environmental impact of cellulose extraction and processing, which may involve chemical treatments and energy-intensive processes.

Water usage and pollution are important factors to evaluate in MCC-based encapsulation. While MCC itself is non-toxic and does not contribute to water pollution, the encapsulation process may involve the use of solvents or other chemicals that require proper handling and disposal to prevent environmental contamination. Implementing closed-loop systems and efficient water recycling in production facilities can mitigate these concerns.

The influence of MCC on the stability and controlled release of aromatic compounds can indirectly affect environmental impact. Enhanced stability may lead to reduced waste and more efficient use of aromatic compounds, potentially decreasing the overall environmental burden associated with their production and application. Additionally, controlled release mechanisms can optimize the delivery of active ingredients, potentially reducing the quantities needed and minimizing environmental exposure.

Considering the end-of-life scenario, MCC-based microcapsules offer advantages in terms of waste management. Their biodegradability facilitates integration into composting systems, reducing the burden on landfills and incineration facilities. However, the presence of encapsulated aromatic compounds may affect the biodegradation process and should be carefully evaluated to ensure complete breakdown without harmful residues.

In conclusion, while MCC-based encapsulation of aromatic compounds presents several environmental advantages, a comprehensive life cycle assessment is necessary to fully understand its environmental impact. This assessment should consider raw material sourcing, production processes, application methods, and end-of-life scenarios to provide a holistic view of the technology's environmental footprint and guide future developments towards more sustainable practices.

One of the primary environmental benefits of MCC-based encapsulation is its biodegradability. Unlike many synthetic polymers used in microencapsulation, MCC can be broken down by natural processes, reducing the accumulation of persistent microplastics in ecosystems. This characteristic is particularly important for applications in food, agriculture, and personal care products, where the release of encapsulated compounds into the environment is inevitable.

The production of MCC from renewable plant sources contributes to its positive environmental profile. Compared to petroleum-based alternatives, MCC production has a lower carbon footprint and reduces dependency on non-renewable resources. However, it is essential to consider the environmental impact of cellulose extraction and processing, which may involve chemical treatments and energy-intensive processes.

Water usage and pollution are important factors to evaluate in MCC-based encapsulation. While MCC itself is non-toxic and does not contribute to water pollution, the encapsulation process may involve the use of solvents or other chemicals that require proper handling and disposal to prevent environmental contamination. Implementing closed-loop systems and efficient water recycling in production facilities can mitigate these concerns.

The influence of MCC on the stability and controlled release of aromatic compounds can indirectly affect environmental impact. Enhanced stability may lead to reduced waste and more efficient use of aromatic compounds, potentially decreasing the overall environmental burden associated with their production and application. Additionally, controlled release mechanisms can optimize the delivery of active ingredients, potentially reducing the quantities needed and minimizing environmental exposure.

Considering the end-of-life scenario, MCC-based microcapsules offer advantages in terms of waste management. Their biodegradability facilitates integration into composting systems, reducing the burden on landfills and incineration facilities. However, the presence of encapsulated aromatic compounds may affect the biodegradation process and should be carefully evaluated to ensure complete breakdown without harmful residues.

In conclusion, while MCC-based encapsulation of aromatic compounds presents several environmental advantages, a comprehensive life cycle assessment is necessary to fully understand its environmental impact. This assessment should consider raw material sourcing, production processes, application methods, and end-of-life scenarios to provide a holistic view of the technology's environmental footprint and guide future developments towards more sustainable practices.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!