Manufacturing Methods For Metal Hydride Alloys At Scale

AUG 22, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Metal Hydride Alloy Technology Background and Objectives

Metal hydride alloys have emerged as critical materials in the clean energy transition, particularly for hydrogen storage applications. The development of these alloys dates back to the 1970s when researchers first discovered certain metal compounds could absorb hydrogen reversibly under moderate conditions. Over subsequent decades, various compositions including AB5 (LaNi5), AB2 (TiMn2), and AB (TiFe) type alloys have been developed with progressively improved hydrogen storage capacities and kinetics.

The evolution of metal hydride technology has been driven by increasing demands for efficient energy storage solutions and the global push toward decarbonization. Early applications focused primarily on niche markets such as nickel-metal hydride batteries, but recent technological advancements have expanded potential applications to include large-scale hydrogen storage, heat pumps, hydrogen compression, and integration with renewable energy systems.

Current technological trajectories indicate a shift toward developing metal hydride alloys with higher gravimetric and volumetric storage capacities, improved cycling stability, faster kinetics, and reduced material costs. Research is increasingly focused on multi-component alloys and nanostructured materials that can overcome traditional limitations of conventional metal hydrides.

The primary technical objectives for manufacturing metal hydride alloys at scale include developing cost-effective production methods that maintain precise compositional control, achieving consistent microstructural properties across large production volumes, and establishing efficient activation processes. Additionally, there are goals to reduce the energy intensity of manufacturing processes and minimize the use of critical raw materials without compromising performance characteristics.

Industry stakeholders aim to bridge the gap between laboratory-scale production techniques and industrial-scale manufacturing capabilities. This includes addressing challenges related to heat management during alloying, preventing oxidation during processing, and developing specialized equipment capable of handling hydrogen-reactive materials safely and efficiently.

Long-term objectives include establishing circular economy approaches for metal hydride manufacturing, including recycling pathways for spent materials, and developing standardized quality control protocols specific to hydrogen storage applications. The ultimate goal is to achieve production costs below $50 per kilogram for high-performance alloys while maintaining performance metrics that meet or exceed Department of Energy targets for hydrogen storage systems.

The technological landscape is further complicated by competing hydrogen storage technologies, including high-pressure gas storage and liquid hydrogen systems, which necessitates continuous innovation in metal hydride manufacturing to maintain competitive advantages in specific application niches where their energy density and safety characteristics are most valued.

The evolution of metal hydride technology has been driven by increasing demands for efficient energy storage solutions and the global push toward decarbonization. Early applications focused primarily on niche markets such as nickel-metal hydride batteries, but recent technological advancements have expanded potential applications to include large-scale hydrogen storage, heat pumps, hydrogen compression, and integration with renewable energy systems.

Current technological trajectories indicate a shift toward developing metal hydride alloys with higher gravimetric and volumetric storage capacities, improved cycling stability, faster kinetics, and reduced material costs. Research is increasingly focused on multi-component alloys and nanostructured materials that can overcome traditional limitations of conventional metal hydrides.

The primary technical objectives for manufacturing metal hydride alloys at scale include developing cost-effective production methods that maintain precise compositional control, achieving consistent microstructural properties across large production volumes, and establishing efficient activation processes. Additionally, there are goals to reduce the energy intensity of manufacturing processes and minimize the use of critical raw materials without compromising performance characteristics.

Industry stakeholders aim to bridge the gap between laboratory-scale production techniques and industrial-scale manufacturing capabilities. This includes addressing challenges related to heat management during alloying, preventing oxidation during processing, and developing specialized equipment capable of handling hydrogen-reactive materials safely and efficiently.

Long-term objectives include establishing circular economy approaches for metal hydride manufacturing, including recycling pathways for spent materials, and developing standardized quality control protocols specific to hydrogen storage applications. The ultimate goal is to achieve production costs below $50 per kilogram for high-performance alloys while maintaining performance metrics that meet or exceed Department of Energy targets for hydrogen storage systems.

The technological landscape is further complicated by competing hydrogen storage technologies, including high-pressure gas storage and liquid hydrogen systems, which necessitates continuous innovation in metal hydride manufacturing to maintain competitive advantages in specific application niches where their energy density and safety characteristics are most valued.

Market Analysis for Large-Scale Metal Hydride Applications

The global market for metal hydride applications has witnessed significant growth in recent years, driven primarily by the increasing demand for clean energy solutions and sustainable technologies. Metal hydrides, with their exceptional hydrogen storage capabilities, have emerged as critical materials across various industrial sectors, particularly in energy storage, transportation, and industrial processes.

The hydrogen storage market, where metal hydrides play a crucial role, is projected to reach substantial market value by 2030, with a compound annual growth rate exceeding 5% during the forecast period. This growth is largely attributed to the rising adoption of hydrogen fuel cells in automotive applications and stationary power generation systems, where efficient hydrogen storage is paramount.

Battery technologies represent another significant market segment for metal hydride applications. The nickel-metal hydride (NiMH) battery market continues to maintain relevance despite competition from lithium-ion technologies, particularly in hybrid electric vehicles and specific industrial applications where safety and reliability outweigh energy density considerations.

Regionally, Asia-Pacific dominates the metal hydride market, with Japan, South Korea, and China leading in both production and consumption. These countries have established robust manufacturing ecosystems and supportive government policies promoting hydrogen technologies. North America and Europe follow closely, with substantial investments in hydrogen infrastructure and renewable energy integration.

The industrial gas sector represents another substantial market for metal hydrides, particularly in purification processes and specialized gas handling applications. Metal hydrides offer selective hydrogen separation capabilities that conventional technologies cannot match, creating premium market opportunities in high-purity gas applications.

Market challenges include high manufacturing costs associated with scaling production of high-quality metal hydride alloys, competition from alternative hydrogen storage technologies such as compressed gas and liquid hydrogen, and supply chain vulnerabilities for critical raw materials. The price volatility of constituent metals like lanthanum, nickel, and titanium directly impacts market dynamics and adoption rates.

Consumer awareness and acceptance of hydrogen technologies remain developing factors in market growth. While industrial applications have established clear value propositions, consumer-facing applications require further market education and infrastructure development to achieve mainstream adoption.

The market outlook remains highly positive, with technological advancements in manufacturing methods potentially unlocking new application areas and reducing production costs. As economies of scale improve and manufacturing innovations address current limitations, metal hydride technologies are positioned to capture increasing market share in the global transition toward hydrogen-based energy systems.

The hydrogen storage market, where metal hydrides play a crucial role, is projected to reach substantial market value by 2030, with a compound annual growth rate exceeding 5% during the forecast period. This growth is largely attributed to the rising adoption of hydrogen fuel cells in automotive applications and stationary power generation systems, where efficient hydrogen storage is paramount.

Battery technologies represent another significant market segment for metal hydride applications. The nickel-metal hydride (NiMH) battery market continues to maintain relevance despite competition from lithium-ion technologies, particularly in hybrid electric vehicles and specific industrial applications where safety and reliability outweigh energy density considerations.

Regionally, Asia-Pacific dominates the metal hydride market, with Japan, South Korea, and China leading in both production and consumption. These countries have established robust manufacturing ecosystems and supportive government policies promoting hydrogen technologies. North America and Europe follow closely, with substantial investments in hydrogen infrastructure and renewable energy integration.

The industrial gas sector represents another substantial market for metal hydrides, particularly in purification processes and specialized gas handling applications. Metal hydrides offer selective hydrogen separation capabilities that conventional technologies cannot match, creating premium market opportunities in high-purity gas applications.

Market challenges include high manufacturing costs associated with scaling production of high-quality metal hydride alloys, competition from alternative hydrogen storage technologies such as compressed gas and liquid hydrogen, and supply chain vulnerabilities for critical raw materials. The price volatility of constituent metals like lanthanum, nickel, and titanium directly impacts market dynamics and adoption rates.

Consumer awareness and acceptance of hydrogen technologies remain developing factors in market growth. While industrial applications have established clear value propositions, consumer-facing applications require further market education and infrastructure development to achieve mainstream adoption.

The market outlook remains highly positive, with technological advancements in manufacturing methods potentially unlocking new application areas and reducing production costs. As economies of scale improve and manufacturing innovations address current limitations, metal hydride technologies are positioned to capture increasing market share in the global transition toward hydrogen-based energy systems.

Current Manufacturing Challenges and Global Status

The global manufacturing of metal hydride alloys at scale faces significant technical and economic challenges despite growing demand in hydrogen storage, battery, and clean energy applications. Current production methods predominantly rely on conventional metallurgical processes including arc melting, induction melting, and mechanical alloying, which present considerable limitations when scaled to industrial volumes.

Primary manufacturing challenges include achieving homogeneous composition throughout large batches, which directly impacts hydrogen storage capacity and cycling stability. Temperature control during melting processes remains problematic, as many metal hydride compositions contain elements with vastly different melting points, leading to segregation and non-uniform microstructures in the final product.

Oxidation during processing represents another critical obstacle, particularly for reactive elements like lanthanum, cerium, and magnesium commonly used in metal hydride formulations. Even trace oxygen contamination can significantly degrade performance characteristics and reduce service life of the resulting materials.

Cost-effectiveness at scale continues to impede widespread commercialization. Current manufacturing routes require substantial energy inputs, specialized equipment, and often involve multiple processing steps including melting, casting, heat treatment, and mechanical processing. The high-purity raw materials needed further elevate production costs, making metal hydride technologies less competitive against alternative solutions.

Globally, manufacturing capabilities are unevenly distributed, with advanced production concentrated in industrialized regions including Japan, Germany, China, and the United States. China has emerged as the dominant producer, controlling significant portions of both raw material supply chains and manufacturing capacity, particularly for rare earth-based metal hydride alloys used in NiMH batteries.

Recent technological developments have focused on novel processing routes including rapid solidification techniques, powder metallurgy approaches, and additive manufacturing. These methods show promise for better compositional control but remain largely confined to laboratory or small-batch production environments.

Environmental and safety concerns also present challenges, as manufacturing processes generate potentially hazardous waste streams and dust. Hydrogen embrittlement of processing equipment and potential for pyrophoric reactions during powder handling necessitate specialized safety protocols that add complexity to scaling operations.

Regulatory frameworks vary significantly across regions, creating additional barriers to establishing global manufacturing standards and consistent quality control benchmarks for these specialized materials.

Primary manufacturing challenges include achieving homogeneous composition throughout large batches, which directly impacts hydrogen storage capacity and cycling stability. Temperature control during melting processes remains problematic, as many metal hydride compositions contain elements with vastly different melting points, leading to segregation and non-uniform microstructures in the final product.

Oxidation during processing represents another critical obstacle, particularly for reactive elements like lanthanum, cerium, and magnesium commonly used in metal hydride formulations. Even trace oxygen contamination can significantly degrade performance characteristics and reduce service life of the resulting materials.

Cost-effectiveness at scale continues to impede widespread commercialization. Current manufacturing routes require substantial energy inputs, specialized equipment, and often involve multiple processing steps including melting, casting, heat treatment, and mechanical processing. The high-purity raw materials needed further elevate production costs, making metal hydride technologies less competitive against alternative solutions.

Globally, manufacturing capabilities are unevenly distributed, with advanced production concentrated in industrialized regions including Japan, Germany, China, and the United States. China has emerged as the dominant producer, controlling significant portions of both raw material supply chains and manufacturing capacity, particularly for rare earth-based metal hydride alloys used in NiMH batteries.

Recent technological developments have focused on novel processing routes including rapid solidification techniques, powder metallurgy approaches, and additive manufacturing. These methods show promise for better compositional control but remain largely confined to laboratory or small-batch production environments.

Environmental and safety concerns also present challenges, as manufacturing processes generate potentially hazardous waste streams and dust. Hydrogen embrittlement of processing equipment and potential for pyrophoric reactions during powder handling necessitate specialized safety protocols that add complexity to scaling operations.

Regulatory frameworks vary significantly across regions, creating additional barriers to establishing global manufacturing standards and consistent quality control benchmarks for these specialized materials.

Current Scale-Up Manufacturing Solutions

01 Composition and structure of metal hydride alloys

Metal hydride alloys are composed of specific combinations of metals that can absorb, store, and release hydrogen. These alloys typically include rare earth metals, transition metals, and other elements to form intermetallic compounds with optimized hydrogen storage capacity. The microstructure and crystalline arrangement of these alloys significantly impact their hydrogen absorption and desorption properties. Various manufacturing techniques are employed to create alloys with desired structural characteristics for specific applications.- Composition and structure of metal hydride alloys: Metal hydride alloys can be composed of various elements including rare earth metals, transition metals, and other elements to form specific crystal structures. These alloys are designed with specific compositions to optimize hydrogen storage capacity, absorption/desorption kinetics, and cycle stability. The microstructure and phase composition of these alloys significantly influence their hydrogen storage properties and performance in various applications.

- Metal hydride alloys for battery applications: Metal hydride alloys are widely used as negative electrode materials in rechargeable batteries, particularly in nickel-metal hydride (Ni-MH) batteries. These alloys can store hydrogen reversibly during charge-discharge cycles, providing high energy density and long cycle life. Various compositions and structures have been developed to enhance battery performance, including improved capacity, cycle stability, and rate capability at different operating temperatures.

- Hydrogen storage systems using metal hydride alloys: Metal hydride alloys are utilized in hydrogen storage systems for various applications including fuel cells, heat pumps, and energy storage. These systems leverage the ability of metal hydrides to absorb and release hydrogen under specific temperature and pressure conditions. The design of such systems includes considerations for heat management, pressure control, and efficient hydrogen flow to optimize storage capacity and kinetics of hydrogen absorption and desorption.

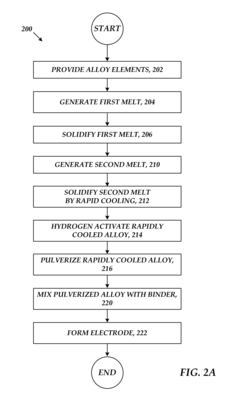

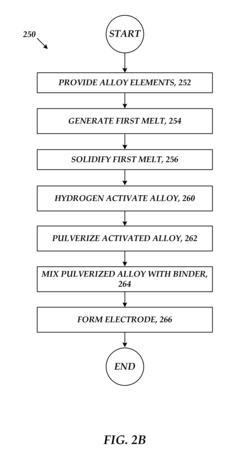

- Manufacturing processes for metal hydride alloys: Various manufacturing techniques are employed to produce metal hydride alloys with desired properties, including arc melting, induction melting, mechanical alloying, and rapid solidification. Post-processing treatments such as annealing, pulverization, and surface modification can further enhance the performance characteristics of these alloys. The manufacturing process significantly influences the microstructure, homogeneity, and ultimately the hydrogen storage properties of the final product.

- Novel applications and improvements in metal hydride technology: Recent advancements in metal hydride alloys include their application in thermal management systems, hydrogen purification, isotope separation, and catalysis. Innovations focus on developing multi-component alloys with enhanced properties, surface-modified hydrides, and composite materials combining metal hydrides with other functional materials. These developments aim to overcome limitations such as activation requirements, sensitivity to impurities, and thermal management challenges while expanding the range of practical applications.

02 Metal hydride alloys for battery applications

Metal hydride alloys are extensively used as negative electrode materials in rechargeable batteries, particularly in nickel-metal hydride (Ni-MH) batteries. These alloys enable high energy density storage through hydrogen absorption and desorption during charge-discharge cycles. Specific alloy compositions are designed to improve battery performance characteristics such as cycle life, capacity, and charge retention. Advanced manufacturing processes help create electrode materials with enhanced electrochemical properties and stability during repeated charging cycles.Expand Specific Solutions03 Hydrogen storage applications of metal hydride alloys

Metal hydride alloys serve as efficient hydrogen storage media for various applications including fuel cells, hydrogen compression, and energy storage systems. These alloys can absorb large volumes of hydrogen at moderate pressures and temperatures, releasing it when needed through controlled heating. The hydrogen storage capacity, absorption/desorption kinetics, and cycling stability are optimized through specific alloy compositions and processing techniques. These materials offer advantages in terms of safety, volumetric efficiency, and operational flexibility compared to conventional hydrogen storage methods.Expand Specific Solutions04 Manufacturing and processing techniques for metal hydride alloys

Various manufacturing and processing techniques are employed to produce metal hydride alloys with optimized properties. These include melt spinning, mechanical alloying, arc melting, and powder metallurgy approaches. Surface modification treatments and heat treatment processes are used to enhance hydrogen absorption/desorption kinetics and cycling stability. Advanced processing methods help control grain size, phase distribution, and surface characteristics, which significantly impact the functional properties of the alloys for specific applications.Expand Specific Solutions05 Novel compositions and improvements in metal hydride alloys

Research on novel metal hydride alloy compositions focuses on improving hydrogen storage capacity, reaction kinetics, and thermal management. Innovations include multi-component alloys, nanostructured materials, and composite systems that combine different types of hydride-forming elements. Catalytic additives are incorporated to enhance hydrogen absorption and desorption rates. These advanced alloy systems address challenges such as heat management during hydrogen cycling, resistance to impurities, and cost reduction while maintaining or improving functional properties.Expand Specific Solutions

Key Industrial Players in Metal Hydride Manufacturing

The metal hydride alloys manufacturing landscape is currently in a growth phase, with increasing market demand driven by hydrogen storage applications. The market is characterized by a mix of established automotive giants like Toyota Motor Corp. and Toyota Industries Corp., specialized materials companies such as Daido Steel and Grirem Advanced Materials, and research institutions including Tohoku University and Northwestern University. Technical maturity varies significantly across players, with Toyota leading commercial implementation through its fuel cell vehicles, while companies like Toshiba Materials and Panasonic focus on advancing manufacturing processes for higher efficiency and lower costs. Academic-industrial partnerships are accelerating innovation, particularly in scalable production methods that maintain material performance while reducing manufacturing complexity.

Toyota Motor Corp.

Technical Solution: Toyota has developed advanced manufacturing methods for metal hydride alloys at scale, particularly for their hydrogen storage applications in fuel cell vehicles. Their process involves high-precision melt spinning techniques that create thin ribbons of metal hydride alloys with optimized microstructure for hydrogen absorption and desorption[1]. Toyota employs a proprietary vacuum induction melting process followed by rapid solidification to produce homogeneous alloy compositions with controlled grain boundaries. Their manufacturing approach includes mechanical alloying and ball milling processes to reduce particle size and increase surface area, enhancing hydrogen storage capacity[3]. Toyota has also implemented continuous production lines that integrate casting, heat treatment, and surface modification processes to maintain consistent quality while achieving industrial-scale output volumes. Their facilities utilize automated quality control systems that monitor alloy composition, crystal structure, and hydrogen storage performance throughout the production process[5].

Strengths: Toyota's manufacturing methods enable high-volume production while maintaining precise control over alloy microstructure, resulting in superior hydrogen storage performance and cycling stability. Their integrated production approach reduces contamination risks and ensures consistent quality. Weaknesses: Their processes require significant capital investment and energy consumption, potentially limiting cost-effectiveness compared to simpler manufacturing methods. The complex multi-stage production also creates challenges for rapid process modifications when developing new alloy compositions.

Daido Steel Co., Ltd.

Technical Solution: Daido Steel has pioneered strip casting technology for metal hydride alloy production, enabling direct conversion from molten metal to thin strips, significantly reducing processing steps compared to conventional methods[2]. Their manufacturing process incorporates precise control of cooling rates during solidification, which is critical for achieving optimal microstructure in AB5-type and AB2-type hydrogen storage alloys. Daido employs a specialized heat treatment process that enhances hydrogen absorption kinetics while maintaining mechanical integrity during cycling. Their production facilities utilize induction melting under controlled atmosphere conditions to prevent oxidation and maintain alloy purity throughout the manufacturing process[4]. Daido has also developed pulverization techniques specifically optimized for brittle intermetallic compounds, producing powder with ideal particle size distribution for hydrogen storage applications. Their quality control system incorporates in-line compositional analysis using X-ray fluorescence and automated pressure-composition-temperature (PCT) testing to verify hydrogen storage performance of finished products[7].

Strengths: Daido's strip casting approach significantly reduces energy consumption and processing time compared to conventional ingot metallurgy routes. Their specialized heat treatment processes result in superior hydrogen absorption/desorption kinetics and cycling stability. Weaknesses: The process requires tight control of multiple parameters simultaneously, making it challenging to maintain consistency across large production volumes. Their manufacturing method may have limitations when scaling to certain complex multi-component alloy systems that require more precise solidification control.

Critical Patents and Innovations in Production Methods

Method of fabrication of complex alkali metal hydrides

PatentInactiveEP1025040B1

Innovation

- A mechano-chemical method involving mechanical alloying of particulate hydride materials at room temperature and normal pressure, without solvents or catalysts, to produce complex alkali metal hydrides with enhanced reversible hydrogenation properties.

Metal hydride alloys with improved rate performance

PatentActiveUS20160344022A1

Innovation

- A method of fabricating a metal alloy with a heterogeneous microstructure using a combination of titanium, chromium, vanadium, iron, and nickel, processed through thermal or physical treatments to achieve a body-centered cubic crystal structure, enhancing hydrogen sorption capacity and electrochemical performance.

Supply Chain Considerations for Raw Materials

The secure and reliable sourcing of raw materials represents a critical foundation for scaling metal hydride alloy manufacturing. Primary materials required include rare earth elements (particularly lanthanum, cerium, and neodymium), transition metals (nickel, cobalt, manganese), and other elements such as aluminum and magnesium. These materials often face significant supply chain vulnerabilities due to their geopolitical concentration, with over 80% of rare earth processing occurring in China as of 2023.

Price volatility presents another substantial challenge, with rare earth elements experiencing fluctuations of up to 200% within single calendar years. This volatility necessitates sophisticated hedging strategies and long-term supply agreements to maintain production cost predictability. Companies leading in metal hydride manufacturing have implemented strategic stockpiling programs, typically maintaining 6-18 month reserves of critical materials to mitigate short-term supply disruptions.

Environmental and regulatory considerations further complicate the supply chain landscape. Extraction of rare earth elements generates approximately 2,000 tons of toxic waste per ton of material processed, leading to increasingly stringent international regulations. Forward-thinking manufacturers are developing circular economy approaches, with recycling processes now capable of recovering up to 95% of rare earth content from end-of-life products.

Geographical diversification strategies have emerged as essential risk mitigation measures. Companies are establishing relationships with suppliers across multiple continents, with particular focus on emerging sources in Australia, Vietnam, and Brazil. These diversification efforts typically increase procurement costs by 15-30% but substantially reduce supply disruption risks.

Vertical integration has become increasingly common among major manufacturers, with companies acquiring mining operations or establishing joint ventures to secure priority access to raw materials. This approach requires significant capital investment but provides enhanced supply chain visibility and control. Toyota's partnership with Australian mining companies exemplifies this strategy, securing dedicated lanthanum and neodymium production capacity.

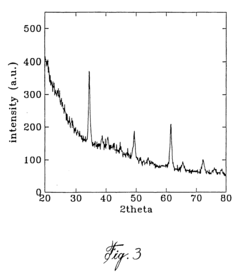

Quality control systems for incoming raw materials represent another critical consideration, as impurities can significantly impact hydrogen storage performance. Leading manufacturers implement comprehensive testing protocols, including ICP-MS analysis and X-ray diffraction techniques, to verify material composition before production integration.

Price volatility presents another substantial challenge, with rare earth elements experiencing fluctuations of up to 200% within single calendar years. This volatility necessitates sophisticated hedging strategies and long-term supply agreements to maintain production cost predictability. Companies leading in metal hydride manufacturing have implemented strategic stockpiling programs, typically maintaining 6-18 month reserves of critical materials to mitigate short-term supply disruptions.

Environmental and regulatory considerations further complicate the supply chain landscape. Extraction of rare earth elements generates approximately 2,000 tons of toxic waste per ton of material processed, leading to increasingly stringent international regulations. Forward-thinking manufacturers are developing circular economy approaches, with recycling processes now capable of recovering up to 95% of rare earth content from end-of-life products.

Geographical diversification strategies have emerged as essential risk mitigation measures. Companies are establishing relationships with suppliers across multiple continents, with particular focus on emerging sources in Australia, Vietnam, and Brazil. These diversification efforts typically increase procurement costs by 15-30% but substantially reduce supply disruption risks.

Vertical integration has become increasingly common among major manufacturers, with companies acquiring mining operations or establishing joint ventures to secure priority access to raw materials. This approach requires significant capital investment but provides enhanced supply chain visibility and control. Toyota's partnership with Australian mining companies exemplifies this strategy, securing dedicated lanthanum and neodymium production capacity.

Quality control systems for incoming raw materials represent another critical consideration, as impurities can significantly impact hydrogen storage performance. Leading manufacturers implement comprehensive testing protocols, including ICP-MS analysis and X-ray diffraction techniques, to verify material composition before production integration.

Environmental Impact and Sustainability Assessment

The manufacturing of metal hydride alloys at scale presents significant environmental considerations that must be addressed to ensure sustainable production practices. Current manufacturing processes often involve energy-intensive methods such as arc melting, induction melting, and mechanical alloying, which contribute substantially to carbon emissions. A comprehensive life cycle assessment reveals that the production of one ton of typical AB5-type metal hydride alloys generates approximately 12-15 tons of CO2 equivalent emissions, primarily from energy consumption during melting and annealing processes.

Water usage represents another critical environmental concern, with conventional manufacturing methods requiring 20-30 cubic meters of water per ton of alloy produced for cooling and processing. This consumption can place significant pressure on local water resources, particularly in water-stressed regions where many rare earth mining and processing facilities are located.

Raw material extraction for metal hydride alloys, especially rare earth elements like lanthanum and cerium, creates substantial environmental disruption through open-pit mining, acid leaching, and separation processes. These activities generate approximately 2,000 tons of mining waste per ton of rare earth elements produced, often containing radioactive elements and toxic chemicals that can contaminate soil and groundwater if improperly managed.

Recent innovations in manufacturing technologies demonstrate promising pathways toward more sustainable production. Rapid solidification techniques reduce energy consumption by up to 40% compared to conventional melting methods. Additionally, solid-state processing routes like reactive milling under hydrogen atmosphere eliminate the need for energy-intensive melting altogether, potentially reducing the carbon footprint by 30-50%.

Circular economy approaches are gaining traction within the industry, with recycling rates for end-of-life metal hydride applications reaching 35-45% in advanced markets. Implementing closed-loop manufacturing systems that recover and reuse process water can reduce freshwater consumption by up to 80%, significantly improving the water footprint of production facilities.

The regulatory landscape is evolving rapidly, with many jurisdictions implementing stricter environmental standards for manufacturing processes. Companies adopting cleaner production technologies not only reduce environmental impact but also gain competitive advantages through regulatory compliance and access to green financing mechanisms. Carbon pricing mechanisms in key manufacturing regions are projected to add $50-120 per ton to production costs for conventional manufacturing methods by 2030, creating strong economic incentives for sustainable innovation.

Water usage represents another critical environmental concern, with conventional manufacturing methods requiring 20-30 cubic meters of water per ton of alloy produced for cooling and processing. This consumption can place significant pressure on local water resources, particularly in water-stressed regions where many rare earth mining and processing facilities are located.

Raw material extraction for metal hydride alloys, especially rare earth elements like lanthanum and cerium, creates substantial environmental disruption through open-pit mining, acid leaching, and separation processes. These activities generate approximately 2,000 tons of mining waste per ton of rare earth elements produced, often containing radioactive elements and toxic chemicals that can contaminate soil and groundwater if improperly managed.

Recent innovations in manufacturing technologies demonstrate promising pathways toward more sustainable production. Rapid solidification techniques reduce energy consumption by up to 40% compared to conventional melting methods. Additionally, solid-state processing routes like reactive milling under hydrogen atmosphere eliminate the need for energy-intensive melting altogether, potentially reducing the carbon footprint by 30-50%.

Circular economy approaches are gaining traction within the industry, with recycling rates for end-of-life metal hydride applications reaching 35-45% in advanced markets. Implementing closed-loop manufacturing systems that recover and reuse process water can reduce freshwater consumption by up to 80%, significantly improving the water footprint of production facilities.

The regulatory landscape is evolving rapidly, with many jurisdictions implementing stricter environmental standards for manufacturing processes. Companies adopting cleaner production technologies not only reduce environmental impact but also gain competitive advantages through regulatory compliance and access to green financing mechanisms. Carbon pricing mechanisms in key manufacturing regions are projected to add $50-120 per ton to production costs for conventional manufacturing methods by 2030, creating strong economic incentives for sustainable innovation.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!