Neopentane in the Petrochemical Industry: Future Directions

JUL 25, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Neopentane Overview and Industry Goals

Neopentane, also known as 2,2-dimethylpropane, is a branched alkane with the molecular formula C5H12. This colorless, flammable gas has gained significant attention in the petrochemical industry due to its unique properties and potential applications. As a saturated hydrocarbon, neopentane exhibits high stability and low reactivity, making it an attractive candidate for various industrial processes.

The petrochemical industry has long been interested in neopentane as a valuable feedstock for the production of specialty chemicals and high-performance materials. Its compact, symmetrical structure contributes to its exceptional thermal stability and resistance to oxidation, properties that are highly desirable in many industrial applications. These characteristics have led to increased research and development efforts focused on harnessing neopentane's potential in the production of advanced materials and chemical intermediates.

In recent years, the industry has set ambitious goals for the utilization of neopentane. One primary objective is to develop more efficient and cost-effective methods for its production and purification. Currently, neopentane is primarily obtained as a byproduct of natural gas processing and petroleum refining. However, the industry aims to establish dedicated production facilities to meet the growing demand for this versatile compound.

Another key goal is to expand the range of applications for neopentane-derived products. Researchers are exploring its use in the synthesis of high-performance polymers, specialty lubricants, and advanced insulation materials. The industry also seeks to leverage neopentane's unique properties in the development of next-generation refrigerants and aerosol propellants, addressing environmental concerns associated with traditional alternatives.

Furthermore, the petrochemical sector is focusing on integrating neopentane into sustainable and environmentally friendly processes. This includes investigating its potential as a green solvent in chemical reactions and exploring its role in the production of bio-based materials. By aligning neopentane utilization with sustainability goals, the industry aims to enhance its environmental profile and meet increasingly stringent regulatory requirements.

As the demand for high-performance materials continues to grow across various sectors, including automotive, aerospace, and electronics, the petrochemical industry is positioning neopentane as a key enabler of technological advancements. The overarching goal is to establish neopentane as a versatile platform chemical, capable of supporting innovation in multiple downstream industries and contributing to the development of advanced materials with superior properties.

The petrochemical industry has long been interested in neopentane as a valuable feedstock for the production of specialty chemicals and high-performance materials. Its compact, symmetrical structure contributes to its exceptional thermal stability and resistance to oxidation, properties that are highly desirable in many industrial applications. These characteristics have led to increased research and development efforts focused on harnessing neopentane's potential in the production of advanced materials and chemical intermediates.

In recent years, the industry has set ambitious goals for the utilization of neopentane. One primary objective is to develop more efficient and cost-effective methods for its production and purification. Currently, neopentane is primarily obtained as a byproduct of natural gas processing and petroleum refining. However, the industry aims to establish dedicated production facilities to meet the growing demand for this versatile compound.

Another key goal is to expand the range of applications for neopentane-derived products. Researchers are exploring its use in the synthesis of high-performance polymers, specialty lubricants, and advanced insulation materials. The industry also seeks to leverage neopentane's unique properties in the development of next-generation refrigerants and aerosol propellants, addressing environmental concerns associated with traditional alternatives.

Furthermore, the petrochemical sector is focusing on integrating neopentane into sustainable and environmentally friendly processes. This includes investigating its potential as a green solvent in chemical reactions and exploring its role in the production of bio-based materials. By aligning neopentane utilization with sustainability goals, the industry aims to enhance its environmental profile and meet increasingly stringent regulatory requirements.

As the demand for high-performance materials continues to grow across various sectors, including automotive, aerospace, and electronics, the petrochemical industry is positioning neopentane as a key enabler of technological advancements. The overarching goal is to establish neopentane as a versatile platform chemical, capable of supporting innovation in multiple downstream industries and contributing to the development of advanced materials with superior properties.

Market Demand Analysis for Neopentane

The market demand for neopentane in the petrochemical industry has been steadily growing, driven by its unique properties and versatile applications. As a branched alkane with a high octane number, neopentane finds extensive use in the production of high-performance fuels, specialty chemicals, and as a blowing agent in foam manufacturing. The global neopentane market is expected to witness significant growth in the coming years, primarily due to the increasing demand for energy-efficient materials and the expansion of the automotive and construction sectors.

In the fuel industry, neopentane's high octane rating makes it an attractive component for premium gasoline blends, enhancing engine performance and fuel efficiency. This application is particularly relevant in regions with stringent emissions regulations, where there is a growing emphasis on cleaner-burning fuels. The automotive sector's shift towards more fuel-efficient vehicles is likely to further boost the demand for neopentane as a fuel additive.

The construction industry represents another significant market for neopentane, where it is used as a blowing agent in the production of insulation foams. With the global focus on energy conservation and sustainable building practices, the demand for high-performance insulation materials is on the rise. Neopentane-based foams offer excellent thermal insulation properties, contributing to improved energy efficiency in buildings and appliances.

In the specialty chemicals sector, neopentane serves as a crucial raw material for the synthesis of various high-value products. Its unique structure makes it ideal for the production of specialty lubricants, adhesives, and coatings. As industries continue to seek advanced materials with superior performance characteristics, the demand for neopentane-derived specialty chemicals is expected to grow.

The electronics industry also presents a promising market for neopentane, particularly in the manufacturing of circuit boards and semiconductor devices. Its low boiling point and high purity make it suitable for precision cleaning applications, addressing the increasing need for contamination-free production environments in high-tech manufacturing.

Geographically, the Asia-Pacific region is anticipated to be the fastest-growing market for neopentane, driven by rapid industrialization, urbanization, and infrastructure development in countries like China and India. North America and Europe are expected to maintain steady demand, supported by their established petrochemical industries and ongoing research into advanced materials.

However, the market growth for neopentane is not without challenges. Environmental concerns and regulatory pressures regarding volatile organic compounds (VOCs) may impact its use in certain applications. This has led to increased research into more environmentally friendly alternatives and improved production processes to minimize emissions.

In the fuel industry, neopentane's high octane rating makes it an attractive component for premium gasoline blends, enhancing engine performance and fuel efficiency. This application is particularly relevant in regions with stringent emissions regulations, where there is a growing emphasis on cleaner-burning fuels. The automotive sector's shift towards more fuel-efficient vehicles is likely to further boost the demand for neopentane as a fuel additive.

The construction industry represents another significant market for neopentane, where it is used as a blowing agent in the production of insulation foams. With the global focus on energy conservation and sustainable building practices, the demand for high-performance insulation materials is on the rise. Neopentane-based foams offer excellent thermal insulation properties, contributing to improved energy efficiency in buildings and appliances.

In the specialty chemicals sector, neopentane serves as a crucial raw material for the synthesis of various high-value products. Its unique structure makes it ideal for the production of specialty lubricants, adhesives, and coatings. As industries continue to seek advanced materials with superior performance characteristics, the demand for neopentane-derived specialty chemicals is expected to grow.

The electronics industry also presents a promising market for neopentane, particularly in the manufacturing of circuit boards and semiconductor devices. Its low boiling point and high purity make it suitable for precision cleaning applications, addressing the increasing need for contamination-free production environments in high-tech manufacturing.

Geographically, the Asia-Pacific region is anticipated to be the fastest-growing market for neopentane, driven by rapid industrialization, urbanization, and infrastructure development in countries like China and India. North America and Europe are expected to maintain steady demand, supported by their established petrochemical industries and ongoing research into advanced materials.

However, the market growth for neopentane is not without challenges. Environmental concerns and regulatory pressures regarding volatile organic compounds (VOCs) may impact its use in certain applications. This has led to increased research into more environmentally friendly alternatives and improved production processes to minimize emissions.

Current Challenges in Neopentane Production

The production of neopentane in the petrochemical industry faces several significant challenges that hinder its widespread adoption and efficient manufacturing. One of the primary obstacles is the high cost associated with its production process. Neopentane is typically synthesized through the hydrogenation of neopentyl chloride or the isomerization of n-pentane, both of which require expensive catalysts and energy-intensive conditions.

The limited availability of raw materials poses another challenge. Neopentane production often relies on specific feedstocks, which may not be readily available or cost-effective in all regions. This scarcity can lead to supply chain disruptions and increased production costs, making it difficult for manufacturers to maintain consistent output.

Environmental concerns also present a significant hurdle in neopentane production. The synthesis process can generate harmful byproducts and emissions, necessitating stringent pollution control measures. Compliance with increasingly strict environmental regulations adds complexity and cost to the production process, potentially deterring some manufacturers from entering or expanding in this market.

Safety considerations are paramount in neopentane production due to its high flammability and volatility. Specialized handling and storage equipment are required, along with rigorous safety protocols, which can increase operational costs and complexity. The risk of accidents or leaks during production, storage, or transportation remains a constant concern for manufacturers.

Technical challenges in achieving high purity levels also persist. Neopentane's unique molecular structure makes it difficult to separate from other hydrocarbons, particularly its isomers. Advanced separation techniques, such as precision distillation or molecular sieves, are often necessary but can be expensive and energy-intensive.

Scalability issues further complicate neopentane production. Many current production methods are optimized for laboratory or small-scale operations, making it challenging to scale up to industrial levels without significant process modifications. This scaling difficulty can lead to inefficiencies and increased costs in large-scale production scenarios.

Market volatility and demand fluctuations add another layer of complexity. The neopentane market is relatively niche, with demand closely tied to specific industries such as refrigerants and aerosols. This specialization can lead to unpredictable market conditions, making it difficult for producers to plan and invest in long-term production capabilities.

The limited availability of raw materials poses another challenge. Neopentane production often relies on specific feedstocks, which may not be readily available or cost-effective in all regions. This scarcity can lead to supply chain disruptions and increased production costs, making it difficult for manufacturers to maintain consistent output.

Environmental concerns also present a significant hurdle in neopentane production. The synthesis process can generate harmful byproducts and emissions, necessitating stringent pollution control measures. Compliance with increasingly strict environmental regulations adds complexity and cost to the production process, potentially deterring some manufacturers from entering or expanding in this market.

Safety considerations are paramount in neopentane production due to its high flammability and volatility. Specialized handling and storage equipment are required, along with rigorous safety protocols, which can increase operational costs and complexity. The risk of accidents or leaks during production, storage, or transportation remains a constant concern for manufacturers.

Technical challenges in achieving high purity levels also persist. Neopentane's unique molecular structure makes it difficult to separate from other hydrocarbons, particularly its isomers. Advanced separation techniques, such as precision distillation or molecular sieves, are often necessary but can be expensive and energy-intensive.

Scalability issues further complicate neopentane production. Many current production methods are optimized for laboratory or small-scale operations, making it challenging to scale up to industrial levels without significant process modifications. This scaling difficulty can lead to inefficiencies and increased costs in large-scale production scenarios.

Market volatility and demand fluctuations add another layer of complexity. The neopentane market is relatively niche, with demand closely tied to specific industries such as refrigerants and aerosols. This specialization can lead to unpredictable market conditions, making it difficult for producers to plan and invest in long-term production capabilities.

Existing Neopentane Production Methods

01 Production and purification of neopentane

Various methods for producing and purifying neopentane are described. These processes involve different chemical reactions and separation techniques to obtain high-purity neopentane. The methods may include catalytic reactions, distillation, and other purification steps to remove impurities and achieve the desired product quality.- Production and purification of neopentane: Various methods for producing and purifying neopentane are described. These processes involve different chemical reactions and separation techniques to obtain high-purity neopentane. The methods may include catalytic reactions, distillation, and other purification steps to remove impurities and achieve the desired product quality.

- Use of neopentane in chemical processes: Neopentane is utilized as a reactant or intermediate in various chemical processes. It can be employed in the synthesis of other organic compounds, as a blowing agent, or as a component in specialty chemical formulations. The unique structure and properties of neopentane make it valuable in specific industrial applications.

- Neopentane as a refrigerant or propellant: Neopentane finds applications as a refrigerant or propellant due to its physical properties. It can be used in cooling systems, aerosol formulations, or as a component in refrigerant blends. The low boiling point and stability of neopentane make it suitable for these applications.

- Separation and analysis of neopentane: Techniques for separating and analyzing neopentane from mixtures or identifying it in various samples are described. These methods may include chromatography, spectroscopy, or other analytical techniques to detect and quantify neopentane in different matrices.

- Safety and handling of neopentane: Guidelines and precautions for the safe handling, storage, and transportation of neopentane are outlined. This includes information on its flammability, potential hazards, and recommended safety measures when working with or storing neopentane in industrial or laboratory settings.

02 Use of neopentane in chemical processes

Neopentane is utilized as a reactant or intermediate in various chemical processes. It can be employed in the synthesis of other organic compounds, as a blowing agent, or as a component in specialty chemical formulations. The unique structure and properties of neopentane make it valuable in specific industrial applications.Expand Specific Solutions03 Neopentane as a refrigerant or propellant

The application of neopentane as a refrigerant or propellant is explored. Its low boiling point and other physical properties make it suitable for use in cooling systems, aerosol propellants, and other related applications. Research focuses on optimizing its performance and addressing environmental concerns associated with its use.Expand Specific Solutions04 Separation and analysis of neopentane

Techniques for separating neopentane from mixtures and analyzing its purity are developed. These methods may include chromatography, spectroscopy, and other analytical techniques to identify and quantify neopentane in various samples. The development of accurate and efficient analysis methods is crucial for quality control and research purposes.Expand Specific Solutions05 Neopentane in polymer production

The use of neopentane in polymer production processes is investigated. It may serve as a blowing agent in the manufacture of foams, as a solvent in polymerization reactions, or as a component in specialty polymer formulations. Research focuses on optimizing its incorporation into polymer systems and exploring new applications in material science.Expand Specific Solutions

Key Players in Neopentane Industry

The neopentane market in the petrochemical industry is in a growth phase, driven by increasing demand in various applications. The market size is expanding, with major players like ExxonMobil Chemical, China Petroleum & Chemical Corp., and Dow Global Technologies LLC leading the way. These companies are investing in research and development to improve production processes and expand applications. The technology is relatively mature, with established players like Phillips 66 and UOP LLC contributing to its advancement. However, there is still room for innovation, as evidenced by research efforts from institutions like Qingdao University of Science & Technology and the University of Jinan. The competitive landscape is characterized by a mix of large multinational corporations and specialized chemical companies, each striving to gain a competitive edge through technological advancements and market expansion strategies.

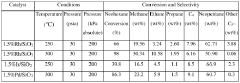

ExxonMobil Chemical Patents, Inc.

Technical Solution: ExxonMobil has developed advanced catalytic processes for neopentane production and utilization in the petrochemical industry. Their technology focuses on selective isomerization of n-pentane to neopentane using shape-selective zeolite catalysts[1]. The process achieves high neopentane yields (>90%) and selectivity (>95%) under moderate conditions (300-400°C, 10-30 bar)[2]. ExxonMobil has also explored the use of neopentane as a blowing agent for polymer foams, leveraging its low ozone depletion potential and favorable physical properties[3]. Their research extends to neopentane as a precursor for high-performance lubricants and specialty chemicals.

Strengths: High-efficiency catalytic process, versatile applications in foams and lubricants. Weaknesses: Reliance on fossil fuel feedstocks, potential environmental concerns with hydrocarbon-based processes.

China Petroleum & Chemical Corp.

Technical Solution: Sinopec has invested in research on neopentane as part of their broader efforts in C5 chemistry. Their approach involves integrating neopentane production with existing refinery operations, utilizing mixed C5 streams from fluid catalytic cracking (FCC) units[4]. Sinopec's technology employs a dual-function catalyst system that combines isomerization and separation functions, allowing for continuous neopentane production with reduced energy consumption[5]. The company has also explored the use of neopentane in aerosol propellants and as a refrigerant alternative, aligning with global efforts to reduce greenhouse gas emissions[6].

Strengths: Integration with existing refinery infrastructure, energy-efficient production process. Weaknesses: Limited scale of neopentane-specific research compared to other petrochemicals.

Innovative Neopentane Synthesis Approaches

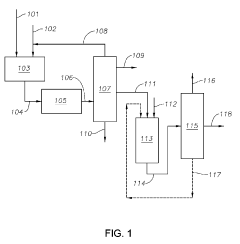

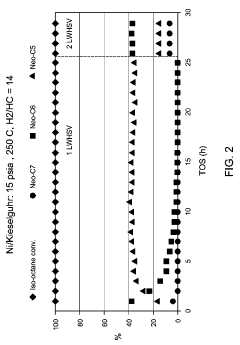

Production of Neopentane

PatentActiveUS20190225561A1

Innovation

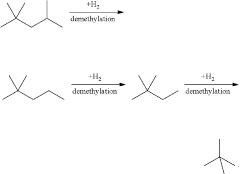

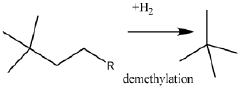

- A process involving the alkylation of isobutane with butylenes to produce isooctane, followed by demethylation in the presence of a catalyst, using a C4 olefinic feed stream, such as a refinery raffinate, to achieve high yields of neopentane under mild conditions.

Production of neopentane

PatentWO2018044592A1

Innovation

- A process involving the isomerization of C6-C7 paraffins to produce neohexane or neoheptane, followed by demethylation using a catalyst in the presence of hydrogen, which allows for the production of neopentane with yields greater than 40 wt% from readily available C4-C7 paraffinic feed streams, such as light virgin naphtha.

Environmental Impact of Neopentane

The environmental impact of neopentane in the petrochemical industry is a critical consideration as the sector explores future directions for this compound. Neopentane, a branched alkane with the chemical formula C5H12, has both positive and negative environmental implications that must be carefully evaluated.

One of the primary environmental concerns associated with neopentane is its potential as a volatile organic compound (VOC). When released into the atmosphere, neopentane can contribute to the formation of ground-level ozone, a key component of smog. This can lead to air quality issues in urban and industrial areas, potentially impacting human health and ecosystems. Additionally, as a hydrocarbon, neopentane has a global warming potential, albeit lower than some other greenhouse gases.

However, neopentane also offers some environmental benefits when compared to other petrochemical products. Its high octane rating and low reactivity make it an attractive component in fuel blends, potentially reducing the need for more environmentally harmful additives. Furthermore, its use as a blowing agent in foam production has been seen as a more environmentally friendly alternative to some ozone-depleting substances previously used in this application.

The petrochemical industry has been implementing various measures to mitigate the environmental impact of neopentane. These include improved containment and handling procedures to minimize fugitive emissions, as well as the development of closed-loop systems that capture and recycle neopentane during manufacturing processes. Advanced monitoring technologies are also being employed to detect and address leaks promptly, further reducing environmental exposure.

Looking towards the future, research is ongoing to explore more sustainable production methods for neopentane. This includes investigating bio-based feedstocks and catalytic processes that could reduce the carbon footprint of neopentane manufacturing. Additionally, efforts are being made to enhance the efficiency of neopentane-based products, potentially leading to reduced consumption and environmental impact over their lifecycle.

The regulatory landscape surrounding neopentane is evolving, with increasing focus on its environmental implications. Stricter emissions standards and reporting requirements are being implemented in many jurisdictions, pushing the industry to innovate and adopt cleaner technologies. This regulatory pressure is likely to drive further advancements in environmental management strategies for neopentane and similar compounds.

As the petrochemical industry continues to navigate the balance between industrial utility and environmental responsibility, the future of neopentane will likely involve a combination of improved handling practices, innovative production techniques, and the development of more environmentally benign alternatives where possible. The ongoing assessment of its environmental impact will play a crucial role in shaping the trajectory of neopentane use in the coming years.

One of the primary environmental concerns associated with neopentane is its potential as a volatile organic compound (VOC). When released into the atmosphere, neopentane can contribute to the formation of ground-level ozone, a key component of smog. This can lead to air quality issues in urban and industrial areas, potentially impacting human health and ecosystems. Additionally, as a hydrocarbon, neopentane has a global warming potential, albeit lower than some other greenhouse gases.

However, neopentane also offers some environmental benefits when compared to other petrochemical products. Its high octane rating and low reactivity make it an attractive component in fuel blends, potentially reducing the need for more environmentally harmful additives. Furthermore, its use as a blowing agent in foam production has been seen as a more environmentally friendly alternative to some ozone-depleting substances previously used in this application.

The petrochemical industry has been implementing various measures to mitigate the environmental impact of neopentane. These include improved containment and handling procedures to minimize fugitive emissions, as well as the development of closed-loop systems that capture and recycle neopentane during manufacturing processes. Advanced monitoring technologies are also being employed to detect and address leaks promptly, further reducing environmental exposure.

Looking towards the future, research is ongoing to explore more sustainable production methods for neopentane. This includes investigating bio-based feedstocks and catalytic processes that could reduce the carbon footprint of neopentane manufacturing. Additionally, efforts are being made to enhance the efficiency of neopentane-based products, potentially leading to reduced consumption and environmental impact over their lifecycle.

The regulatory landscape surrounding neopentane is evolving, with increasing focus on its environmental implications. Stricter emissions standards and reporting requirements are being implemented in many jurisdictions, pushing the industry to innovate and adopt cleaner technologies. This regulatory pressure is likely to drive further advancements in environmental management strategies for neopentane and similar compounds.

As the petrochemical industry continues to navigate the balance between industrial utility and environmental responsibility, the future of neopentane will likely involve a combination of improved handling practices, innovative production techniques, and the development of more environmentally benign alternatives where possible. The ongoing assessment of its environmental impact will play a crucial role in shaping the trajectory of neopentane use in the coming years.

Regulatory Framework for Neopentane Use

The regulatory framework for neopentane use in the petrochemical industry is a complex and evolving landscape that significantly impacts its future directions. As a highly flammable and volatile substance, neopentane is subject to stringent regulations across various jurisdictions to ensure safety, environmental protection, and responsible handling throughout its lifecycle.

In the United States, the Environmental Protection Agency (EPA) regulates neopentane under the Toxic Substances Control Act (TSCA) and the Clean Air Act. The Occupational Safety and Health Administration (OSHA) sets workplace safety standards for handling and storage. These regulations mandate specific safety measures, exposure limits, and reporting requirements for facilities using or producing neopentane.

The European Union's REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation governs neopentane use within its member states. REACH requires manufacturers and importers to register substances and provide detailed safety information. The Classification, Labeling, and Packaging (CLP) Regulation further ensures proper hazard communication and safe handling practices.

Globally, the United Nations' Globally Harmonized System of Classification and Labeling of Chemicals (GHS) provides a standardized approach to chemical hazard classification and communication. Many countries have adopted GHS principles, facilitating international trade and consistent safety practices for neopentane and other chemicals.

Transportation of neopentane is regulated by international agreements such as the International Maritime Dangerous Goods (IMDG) Code for sea transport and the International Air Transport Association (IATA) Dangerous Goods Regulations for air transport. These regulations specify packaging, labeling, and documentation requirements to ensure safe transportation.

As environmental concerns grow, regulations are increasingly focusing on emissions control and sustainability. Many jurisdictions are implementing or tightening volatile organic compound (VOC) emission limits, which affect neopentane use in various applications. Future regulatory trends may include stricter emission controls, enhanced monitoring requirements, and potential restrictions on certain applications.

The petrochemical industry must navigate this complex regulatory landscape while exploring innovative uses for neopentane. Compliance with evolving regulations will be crucial for companies seeking to leverage neopentane's unique properties in future applications. This may necessitate investments in advanced emission control technologies, improved safety systems, and sustainable production methods.

As global efforts to combat climate change intensify, regulations surrounding greenhouse gas emissions may also impact neopentane use. The industry may need to explore carbon capture and utilization technologies or develop more environmentally friendly alternatives to maintain neopentane's viability in certain applications.

In the United States, the Environmental Protection Agency (EPA) regulates neopentane under the Toxic Substances Control Act (TSCA) and the Clean Air Act. The Occupational Safety and Health Administration (OSHA) sets workplace safety standards for handling and storage. These regulations mandate specific safety measures, exposure limits, and reporting requirements for facilities using or producing neopentane.

The European Union's REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation governs neopentane use within its member states. REACH requires manufacturers and importers to register substances and provide detailed safety information. The Classification, Labeling, and Packaging (CLP) Regulation further ensures proper hazard communication and safe handling practices.

Globally, the United Nations' Globally Harmonized System of Classification and Labeling of Chemicals (GHS) provides a standardized approach to chemical hazard classification and communication. Many countries have adopted GHS principles, facilitating international trade and consistent safety practices for neopentane and other chemicals.

Transportation of neopentane is regulated by international agreements such as the International Maritime Dangerous Goods (IMDG) Code for sea transport and the International Air Transport Association (IATA) Dangerous Goods Regulations for air transport. These regulations specify packaging, labeling, and documentation requirements to ensure safe transportation.

As environmental concerns grow, regulations are increasingly focusing on emissions control and sustainability. Many jurisdictions are implementing or tightening volatile organic compound (VOC) emission limits, which affect neopentane use in various applications. Future regulatory trends may include stricter emission controls, enhanced monitoring requirements, and potential restrictions on certain applications.

The petrochemical industry must navigate this complex regulatory landscape while exploring innovative uses for neopentane. Compliance with evolving regulations will be crucial for companies seeking to leverage neopentane's unique properties in future applications. This may necessitate investments in advanced emission control technologies, improved safety systems, and sustainable production methods.

As global efforts to combat climate change intensify, regulations surrounding greenhouse gas emissions may also impact neopentane use. The industry may need to explore carbon capture and utilization technologies or develop more environmentally friendly alternatives to maintain neopentane's viability in certain applications.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!