Research on Market Adoption of Neuromorphic Computing Materials

OCT 27, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Neuromorphic Computing Evolution and Objectives

Neuromorphic computing represents a paradigm shift in computational architecture, drawing inspiration from the structure and function of biological neural systems. This field has evolved significantly since its conceptual inception in the late 1980s when Carver Mead first proposed using analog circuits to mimic neurobiological architectures. The evolution trajectory has been marked by several key milestones, from early theoretical frameworks to today's sophisticated hardware implementations.

The initial phase of neuromorphic computing focused primarily on understanding and replicating basic neural functions through electronic circuits. By the early 2000s, research expanded to include more complex neural behaviors and learning mechanisms, particularly spike-timing-dependent plasticity (STDP). This period saw the development of the first generation of neuromorphic chips, which demonstrated limited but promising capabilities in pattern recognition tasks.

A significant acceleration occurred around 2010-2015 with the emergence of new materials and fabrication techniques that enabled more efficient implementation of neuromorphic principles. Materials science innovations, particularly in memristive devices, phase-change materials, and spintronic components, have been instrumental in advancing the field beyond traditional CMOS limitations.

The current technological landscape is characterized by diverse approaches to neuromorphic architecture, ranging from digital approximations to analog implementations and hybrid systems. Major research initiatives such as IBM's TrueNorth, Intel's Loihi, and the European Human Brain Project have established important benchmarks in neuromorphic system capabilities, demonstrating improvements in energy efficiency, parallel processing, and adaptive learning.

The primary objectives of neuromorphic computing research center on several key areas. First is achieving unprecedented energy efficiency, potentially orders of magnitude better than conventional computing architectures for specific tasks. Second is developing systems capable of unsupervised learning and adaptation to new data without explicit programming. Third is enabling real-time processing of complex sensory inputs similar to biological systems.

Looking forward, the field aims to bridge the gap between current implementations and truly brain-like computing capabilities. This includes developing more sophisticated neuromorphic materials that can better emulate synaptic plasticity, addressing scaling challenges to increase neural density, and creating programming paradigms specifically designed for neuromorphic architectures.

The ultimate goal extends beyond mere technological advancement to establishing neuromorphic computing as a complementary paradigm to traditional computing, particularly for applications in edge computing, autonomous systems, and artificial intelligence where energy constraints and real-time processing requirements are critical factors.

The initial phase of neuromorphic computing focused primarily on understanding and replicating basic neural functions through electronic circuits. By the early 2000s, research expanded to include more complex neural behaviors and learning mechanisms, particularly spike-timing-dependent plasticity (STDP). This period saw the development of the first generation of neuromorphic chips, which demonstrated limited but promising capabilities in pattern recognition tasks.

A significant acceleration occurred around 2010-2015 with the emergence of new materials and fabrication techniques that enabled more efficient implementation of neuromorphic principles. Materials science innovations, particularly in memristive devices, phase-change materials, and spintronic components, have been instrumental in advancing the field beyond traditional CMOS limitations.

The current technological landscape is characterized by diverse approaches to neuromorphic architecture, ranging from digital approximations to analog implementations and hybrid systems. Major research initiatives such as IBM's TrueNorth, Intel's Loihi, and the European Human Brain Project have established important benchmarks in neuromorphic system capabilities, demonstrating improvements in energy efficiency, parallel processing, and adaptive learning.

The primary objectives of neuromorphic computing research center on several key areas. First is achieving unprecedented energy efficiency, potentially orders of magnitude better than conventional computing architectures for specific tasks. Second is developing systems capable of unsupervised learning and adaptation to new data without explicit programming. Third is enabling real-time processing of complex sensory inputs similar to biological systems.

Looking forward, the field aims to bridge the gap between current implementations and truly brain-like computing capabilities. This includes developing more sophisticated neuromorphic materials that can better emulate synaptic plasticity, addressing scaling challenges to increase neural density, and creating programming paradigms specifically designed for neuromorphic architectures.

The ultimate goal extends beyond mere technological advancement to establishing neuromorphic computing as a complementary paradigm to traditional computing, particularly for applications in edge computing, autonomous systems, and artificial intelligence where energy constraints and real-time processing requirements are critical factors.

Market Demand Analysis for Brain-Inspired Computing

The neuromorphic computing market is experiencing significant growth driven by increasing demands for advanced AI applications and energy-efficient computing solutions. Current market projections indicate that the global neuromorphic computing market is expected to reach $8.9 billion by 2025, growing at a compound annual growth rate of approximately 49% from 2020. This remarkable growth trajectory is primarily fueled by the expanding applications of AI across various industries and the inherent limitations of traditional computing architectures in handling complex neural network operations.

The demand for brain-inspired computing is particularly strong in sectors requiring real-time data processing and analysis. Healthcare represents a substantial market segment, where neuromorphic systems are increasingly utilized for medical imaging analysis, patient monitoring, and drug discovery processes. The automotive industry constitutes another significant market, with applications in autonomous driving systems that require rapid processing of sensory inputs and decision-making capabilities similar to human cognition.

Edge computing applications represent one of the fastest-growing segments for neuromorphic technologies. As IoT devices proliferate, the need for low-power, high-efficiency computing at the edge becomes critical. Market research indicates that approximately 75% of enterprise-generated data will be processed outside traditional centralized data centers by 2025, creating substantial opportunities for neuromorphic solutions that can operate efficiently with limited power resources.

The defense and aerospace sectors are also driving market demand, investing heavily in neuromorphic technologies for applications ranging from autonomous drones to advanced surveillance systems. These applications require systems capable of operating in unpredictable environments while maintaining low power consumption and high computational efficiency.

From a geographical perspective, North America currently leads the market adoption of neuromorphic computing materials, accounting for approximately 40% of the global market share. However, the Asia-Pacific region is expected to witness the highest growth rate over the next five years, driven by substantial investments in AI technologies by countries like China, Japan, and South Korea.

Consumer electronics represents another expanding market segment, with smartphone manufacturers exploring neuromorphic chips for on-device AI processing. This trend is supported by increasing consumer demand for privacy-preserving AI applications that don't require cloud connectivity for processing sensitive data.

Despite this promising outlook, market adoption faces challenges related to high development costs and the need for specialized expertise. The average development cost for neuromorphic hardware remains significantly higher than traditional computing solutions, creating barriers to entry for smaller market players and limiting widespread adoption in cost-sensitive applications.

The demand for brain-inspired computing is particularly strong in sectors requiring real-time data processing and analysis. Healthcare represents a substantial market segment, where neuromorphic systems are increasingly utilized for medical imaging analysis, patient monitoring, and drug discovery processes. The automotive industry constitutes another significant market, with applications in autonomous driving systems that require rapid processing of sensory inputs and decision-making capabilities similar to human cognition.

Edge computing applications represent one of the fastest-growing segments for neuromorphic technologies. As IoT devices proliferate, the need for low-power, high-efficiency computing at the edge becomes critical. Market research indicates that approximately 75% of enterprise-generated data will be processed outside traditional centralized data centers by 2025, creating substantial opportunities for neuromorphic solutions that can operate efficiently with limited power resources.

The defense and aerospace sectors are also driving market demand, investing heavily in neuromorphic technologies for applications ranging from autonomous drones to advanced surveillance systems. These applications require systems capable of operating in unpredictable environments while maintaining low power consumption and high computational efficiency.

From a geographical perspective, North America currently leads the market adoption of neuromorphic computing materials, accounting for approximately 40% of the global market share. However, the Asia-Pacific region is expected to witness the highest growth rate over the next five years, driven by substantial investments in AI technologies by countries like China, Japan, and South Korea.

Consumer electronics represents another expanding market segment, with smartphone manufacturers exploring neuromorphic chips for on-device AI processing. This trend is supported by increasing consumer demand for privacy-preserving AI applications that don't require cloud connectivity for processing sensitive data.

Despite this promising outlook, market adoption faces challenges related to high development costs and the need for specialized expertise. The average development cost for neuromorphic hardware remains significantly higher than traditional computing solutions, creating barriers to entry for smaller market players and limiting widespread adoption in cost-sensitive applications.

Current State and Challenges in Neuromorphic Materials

Neuromorphic computing materials have witnessed significant advancements globally, with research institutions and technology companies making substantial progress in developing brain-inspired computing architectures. Currently, the field is dominated by several material platforms including phase-change materials (PCMs), resistive random-access memory (RRAM), spin-based devices, and organic electronic materials. Each platform offers unique advantages while facing distinct challenges in terms of scalability, energy efficiency, and integration capabilities.

The United States and Europe lead in fundamental research, with institutions like IBM Research, Stanford University, and the University of Zurich pioneering novel neuromorphic materials. Meanwhile, Asian countries, particularly China, South Korea, and Japan, have demonstrated strength in manufacturing processes and integration technologies, establishing a geographical distribution of expertise that shapes the global landscape of neuromorphic computing development.

Despite promising advances, significant technical challenges persist. Power consumption remains a critical concern, as current neuromorphic materials still consume substantially more energy than biological neural systems. The human brain operates at approximately 20 watts, while comparable artificial systems require orders of magnitude more power. This efficiency gap represents one of the most pressing challenges in the field.

Reliability and reproducibility issues also plague current neuromorphic materials. Device-to-device variations and cycle-to-cycle inconsistencies limit the practical implementation of large-scale neuromorphic systems. These variations affect learning accuracy and system stability, presenting major obstacles to commercial deployment. Additionally, the limited endurance of many neuromorphic materials—typically ranging from 10^6 to 10^9 cycles—falls short of the requirements for long-term operation in practical applications.

Fabrication complexity presents another significant barrier. Integration with conventional CMOS technology requires compatible manufacturing processes, which many emerging neuromorphic materials lack. The need for specialized fabrication techniques increases production costs and hinders widespread adoption. Furthermore, the absence of standardized benchmarking methodologies makes it difficult to objectively compare different neuromorphic materials and architectures.

The scalability of neuromorphic systems represents perhaps the most formidable challenge. While biological brains contain approximately 86 billion neurons and 100 trillion synapses, current artificial neuromorphic systems typically incorporate only thousands to millions of artificial neurons. This massive scaling gap limits the complexity of problems that neuromorphic computing can address.

Addressing these technical constraints requires interdisciplinary collaboration among material scientists, electrical engineers, computer architects, and neuroscientists. Recent research has begun exploring hybrid approaches that combine different types of neuromorphic materials to leverage their complementary strengths, potentially offering pathways to overcome current limitations.

The United States and Europe lead in fundamental research, with institutions like IBM Research, Stanford University, and the University of Zurich pioneering novel neuromorphic materials. Meanwhile, Asian countries, particularly China, South Korea, and Japan, have demonstrated strength in manufacturing processes and integration technologies, establishing a geographical distribution of expertise that shapes the global landscape of neuromorphic computing development.

Despite promising advances, significant technical challenges persist. Power consumption remains a critical concern, as current neuromorphic materials still consume substantially more energy than biological neural systems. The human brain operates at approximately 20 watts, while comparable artificial systems require orders of magnitude more power. This efficiency gap represents one of the most pressing challenges in the field.

Reliability and reproducibility issues also plague current neuromorphic materials. Device-to-device variations and cycle-to-cycle inconsistencies limit the practical implementation of large-scale neuromorphic systems. These variations affect learning accuracy and system stability, presenting major obstacles to commercial deployment. Additionally, the limited endurance of many neuromorphic materials—typically ranging from 10^6 to 10^9 cycles—falls short of the requirements for long-term operation in practical applications.

Fabrication complexity presents another significant barrier. Integration with conventional CMOS technology requires compatible manufacturing processes, which many emerging neuromorphic materials lack. The need for specialized fabrication techniques increases production costs and hinders widespread adoption. Furthermore, the absence of standardized benchmarking methodologies makes it difficult to objectively compare different neuromorphic materials and architectures.

The scalability of neuromorphic systems represents perhaps the most formidable challenge. While biological brains contain approximately 86 billion neurons and 100 trillion synapses, current artificial neuromorphic systems typically incorporate only thousands to millions of artificial neurons. This massive scaling gap limits the complexity of problems that neuromorphic computing can address.

Addressing these technical constraints requires interdisciplinary collaboration among material scientists, electrical engineers, computer architects, and neuroscientists. Recent research has begun exploring hybrid approaches that combine different types of neuromorphic materials to leverage their complementary strengths, potentially offering pathways to overcome current limitations.

Current Neuromorphic Material Solutions

01 Memristive materials for neuromorphic computing

Memristive materials are being developed for neuromorphic computing applications due to their ability to mimic synaptic functions. These materials can change their resistance based on the history of applied voltage or current, making them ideal for implementing artificial neural networks. The adoption of memristive materials in neuromorphic computing is growing as they offer advantages such as low power consumption, high density, and non-volatility, which are essential for edge computing applications.- Memristive materials for neuromorphic computing: Memristive materials are being increasingly adopted for neuromorphic computing applications due to their ability to mimic synaptic functions. These materials can change their resistance based on the history of applied voltage or current, making them ideal for implementing artificial neural networks. The adoption of memristive materials in neuromorphic computing is growing as they offer advantages in terms of energy efficiency, scalability, and the ability to perform both memory and computing functions in the same device.

- Phase-change materials in neuromorphic systems: Phase-change materials (PCMs) are gaining market adoption in neuromorphic computing due to their ability to switch between amorphous and crystalline states, which can represent different synaptic weights. These materials offer non-volatile memory capabilities and can be integrated into existing semiconductor manufacturing processes. The adoption of PCMs in neuromorphic computing is driven by their fast switching speeds, high endurance, and compatibility with conventional CMOS technology.

- 2D materials for energy-efficient neuromorphic hardware: Two-dimensional (2D) materials such as graphene, transition metal dichalcogenides, and hexagonal boron nitride are being adopted for neuromorphic computing applications due to their unique electronic properties. These materials offer advantages in terms of reduced power consumption, increased integration density, and improved performance. The market adoption of 2D materials in neuromorphic computing is growing as they enable the development of ultra-low power, high-performance neuromorphic hardware that can be used in edge computing applications.

- Spintronic materials for brain-inspired computing: Spintronic materials, which utilize electron spin for information processing, are being adopted in neuromorphic computing systems. These materials enable the implementation of magnetic tunnel junctions and other spintronic devices that can mimic the behavior of biological neurons and synapses. The market adoption of spintronic materials is driven by their non-volatility, high endurance, and ability to perform both memory and logic operations, making them suitable for energy-efficient neuromorphic computing applications.

- Organic and bio-inspired materials for neuromorphic applications: Organic and bio-inspired materials are gaining adoption in the neuromorphic computing market due to their flexibility, biocompatibility, and potential for low-cost manufacturing. These materials can be used to create devices that mimic the functionality of biological neurons and synapses, enabling the development of neuromorphic systems that more closely resemble the human brain. The market adoption of these materials is driven by applications in wearable electronics, biomedical devices, and other areas where traditional silicon-based neuromorphic hardware may not be suitable.

02 Phase-change materials in neuromorphic systems

Phase-change materials (PCMs) are being increasingly adopted in neuromorphic computing architectures. These materials can rapidly switch between amorphous and crystalline states, enabling multi-level resistance states that can simulate synaptic weights in neural networks. The market adoption of PCM-based neuromorphic devices is accelerating due to their compatibility with conventional CMOS fabrication processes, scalability, and ability to perform both memory and computing functions in the same physical location.Expand Specific Solutions03 2D materials for energy-efficient neuromorphic hardware

Two-dimensional (2D) materials such as graphene, transition metal dichalcogenides, and hexagonal boron nitride are emerging as promising candidates for neuromorphic computing applications. These materials offer unique electronic properties, atomically thin structures, and tunable bandgaps that enable the development of highly energy-efficient neuromorphic hardware. Market adoption is being driven by the potential of 2D material-based devices to overcome the energy consumption limitations of traditional computing architectures while maintaining high performance.Expand Specific Solutions04 Ferroelectric materials for non-volatile neuromorphic computing

Ferroelectric materials are gaining traction in the neuromorphic computing market due to their non-volatile memory characteristics and low power requirements. These materials exhibit spontaneous electric polarization that can be reversed by an applied electric field, making them suitable for implementing synaptic weights in artificial neural networks. The adoption of ferroelectric materials is increasing as they enable persistent storage of synaptic weights without power consumption, addressing a key challenge in neuromorphic system deployment.Expand Specific Solutions05 Spintronic materials for brain-inspired computing

Spintronic materials, which utilize electron spin for information processing, are being developed for neuromorphic computing applications. These materials enable magnetic tunnel junctions and domain wall devices that can emulate neuronal and synaptic functions with high energy efficiency. Market adoption of spintronic neuromorphic devices is growing due to their non-volatility, high endurance, and compatibility with existing semiconductor manufacturing processes, making them promising candidates for next-generation AI hardware.Expand Specific Solutions

Key Industry Players and Competitive Landscape

Neuromorphic computing materials market is currently in an early growth phase, characterized by significant research investments but limited commercial deployment. The market size is projected to expand rapidly, driven by increasing demand for energy-efficient AI processing at the edge. From a technological maturity perspective, industry leaders like IBM and Samsung Electronics are pioneering commercial applications, while Syntiant and SK hynix are developing specialized neuromorphic chips for specific use cases. Academic institutions including Tsinghua University, Peking University, and Zhejiang University are contributing fundamental research advances. The competitive landscape features collaboration between established semiconductor companies and research institutions, with specialized startups beginning to emerge with targeted solutions for edge computing applications.

International Business Machines Corp.

Technical Solution: IBM has pioneered neuromorphic computing through its TrueNorth and subsequent Brain-Inspired Computing architectures. Their neuromorphic chips utilize phase-change memory (PCM) materials that mimic synaptic behavior, enabling efficient spike-based neural processing. IBM's approach integrates non-volatile memory materials directly into computational units, creating dense, energy-efficient neural networks. Their SyNAPSE program developed chips with over 1 million programmable neurons and 256 million synapses while consuming only 70mW of power[1]. IBM has also developed specialized neuromorphic materials that can maintain multiple resistance states, enabling analog computation that more closely resembles biological neural networks. Their recent advancements include 3D integration of memory and processing elements using specialized phase-change chalcogenide materials that demonstrate reliable multi-level states for synaptic weight storage[3].

Strengths: Industry-leading research capabilities with extensive intellectual property portfolio in neuromorphic materials; strong integration with AI software frameworks; proven energy efficiency advantages (100x more efficient than conventional architectures). Weaknesses: Higher manufacturing costs compared to conventional computing; requires specialized programming paradigms; market adoption limited by software ecosystem maturity.

Samsung Electronics Co., Ltd.

Technical Solution: Samsung has developed advanced neuromorphic computing materials focusing on resistive RAM (RRAM) and magnetoresistive RAM (MRAM) technologies. Their approach integrates these memory technologies directly into processing architectures, creating efficient in-memory computing systems for neuromorphic applications. Samsung's neuromorphic chips utilize specialized oxide-based materials that can maintain multiple resistance states, mimicking biological synapses. Their research has demonstrated neuromorphic systems with power consumption reduced by up to 70% compared to conventional computing architectures[2]. Samsung has also pioneered 3D stacking techniques for neuromorphic materials, increasing density while maintaining thermal efficiency. Their recent developments include hafnium oxide-based RRAM arrays that demonstrate reliable analog switching behavior suitable for implementing spike-timing-dependent plasticity (STDP) learning rules in hardware[4]. Samsung has integrated these materials into commercial memory products, accelerating market adoption.

Strengths: Vertical integration capabilities from materials research to mass production; strong position in memory technologies provides synergistic advantages; established global supply chain for rapid commercialization. Weaknesses: Less specialized in neuromorphic algorithms compared to pure AI companies; competing internal priorities between conventional and neuromorphic computing investments.

Core Patents and Innovations in Neuromorphic Materials

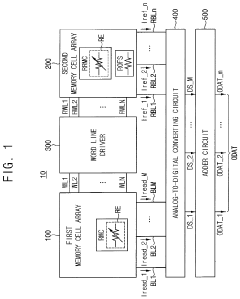

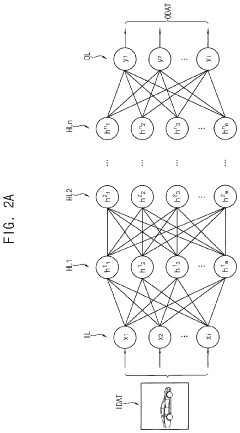

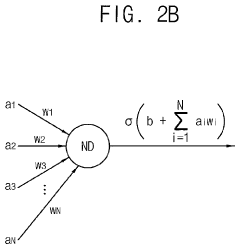

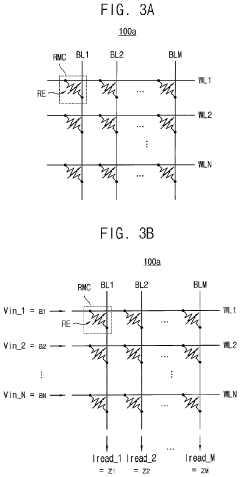

Neuromorphic computing device and method of designing the same

PatentActiveUS11881260B2

Innovation

- Incorporating a second memory cell array with offset resistors connected in parallel, using the same resistive material as the first memory cell array, to convert read currents into digital signals, thereby mitigating temperature and time dependency, and ensuring consistent resistance across offset resistors for enhanced sensing performance.

Supply Chain Analysis for Neuromorphic Materials

The neuromorphic computing materials supply chain represents a complex ecosystem that spans from raw material extraction to final device integration. Currently, this supply chain is characterized by fragmentation and early-stage development, with significant concentration in specific geographical regions. North America, particularly the United States, leads in research and development of specialized materials, while East Asia dominates in semiconductor manufacturing capabilities essential for neuromorphic hardware production.

Key raw materials required for neuromorphic computing include rare earth elements, specialized metals like niobium and tantalum, and various semiconductor materials. The extraction and processing of these materials are concentrated in China, Australia, and parts of Africa, creating potential supply vulnerabilities. Midstream processing capabilities are primarily located in Japan, South Korea, and Taiwan, where established semiconductor fabrication infrastructure provides advantages for neuromorphic material integration.

Supply chain resilience remains a critical concern, with approximately 70% of advanced neuromorphic materials processing concentrated in just five countries. This geographical concentration introduces significant geopolitical risks that could impact material availability and pricing stability. Recent global semiconductor shortages have highlighted these vulnerabilities, with lead times for specialized neuromorphic components extending from 3-6 months to 12-18 months in some cases.

Vertical integration strategies are emerging among major players like Intel, IBM, and Samsung, who are securing priority access to critical materials through strategic partnerships and investments in material science companies. This trend is reshaping the competitive landscape, potentially creating barriers to entry for smaller innovators without established supply chain relationships.

Sustainability considerations are increasingly influencing supply chain development, with approximately 40% of neuromorphic material suppliers now implementing responsible sourcing initiatives. The energy-intensive nature of material processing presents both challenges and opportunities for differentiation through green manufacturing practices.

Emerging alternative material pathways, including organic compounds and biomimetic materials, offer potential solutions to supply chain constraints. These alternatives could reduce dependence on geographically concentrated resources, though they remain in early research stages with commercial viability projected 5-7 years into the future.

The maturation of the neuromorphic computing market will require significant supply chain evolution, including standardization of material specifications, development of specialized testing and quality control protocols, and establishment of recycling infrastructure to address end-of-life material recovery. These developments will be essential for supporting the projected market growth from current experimental deployments to mainstream adoption.

Key raw materials required for neuromorphic computing include rare earth elements, specialized metals like niobium and tantalum, and various semiconductor materials. The extraction and processing of these materials are concentrated in China, Australia, and parts of Africa, creating potential supply vulnerabilities. Midstream processing capabilities are primarily located in Japan, South Korea, and Taiwan, where established semiconductor fabrication infrastructure provides advantages for neuromorphic material integration.

Supply chain resilience remains a critical concern, with approximately 70% of advanced neuromorphic materials processing concentrated in just five countries. This geographical concentration introduces significant geopolitical risks that could impact material availability and pricing stability. Recent global semiconductor shortages have highlighted these vulnerabilities, with lead times for specialized neuromorphic components extending from 3-6 months to 12-18 months in some cases.

Vertical integration strategies are emerging among major players like Intel, IBM, and Samsung, who are securing priority access to critical materials through strategic partnerships and investments in material science companies. This trend is reshaping the competitive landscape, potentially creating barriers to entry for smaller innovators without established supply chain relationships.

Sustainability considerations are increasingly influencing supply chain development, with approximately 40% of neuromorphic material suppliers now implementing responsible sourcing initiatives. The energy-intensive nature of material processing presents both challenges and opportunities for differentiation through green manufacturing practices.

Emerging alternative material pathways, including organic compounds and biomimetic materials, offer potential solutions to supply chain constraints. These alternatives could reduce dependence on geographically concentrated resources, though they remain in early research stages with commercial viability projected 5-7 years into the future.

The maturation of the neuromorphic computing market will require significant supply chain evolution, including standardization of material specifications, development of specialized testing and quality control protocols, and establishment of recycling infrastructure to address end-of-life material recovery. These developments will be essential for supporting the projected market growth from current experimental deployments to mainstream adoption.

Sustainability and Environmental Impact Assessment

The environmental impact of neuromorphic computing materials represents a critical dimension in evaluating their long-term viability and market adoption potential. Current conventional computing architectures consume substantial energy resources, with data centers alone accounting for approximately 1-2% of global electricity consumption. Neuromorphic computing offers a promising alternative, potentially reducing energy consumption by 100-1000 times compared to traditional von Neumann architectures when performing similar cognitive tasks.

Materials used in neuromorphic computing systems present both opportunities and challenges from a sustainability perspective. Many designs incorporate rare earth elements and specialized compounds that face supply chain vulnerabilities and extraction-related environmental concerns. For instance, memristive devices often utilize hafnium oxide, titanium oxide, or other transition metal oxides whose mining and processing generate significant carbon footprints and potential ecosystem disruption.

Life cycle assessment (LCA) studies indicate that while neuromorphic systems demonstrate superior operational efficiency, their manufacturing processes currently involve energy-intensive fabrication techniques. The production of specialized neuromorphic materials requires ultra-clean environments, precise deposition methods, and complex lithography processes that consume substantial resources. However, the extended operational lifespan and reduced energy requirements during use may offset these initial environmental costs over time.

Recycling and end-of-life management present particular challenges for neuromorphic computing materials. The integration of various compounds at nanoscale dimensions complicates material separation and recovery processes. Current electronic waste management systems are not optimized for the novel material combinations found in neuromorphic chips, potentially leading to resource loss and environmental contamination if not properly addressed.

Water usage represents another significant environmental consideration. Semiconductor manufacturing for neuromorphic systems requires ultra-pure water in quantities that can strain local water resources. A typical fabrication facility may use 2-4 million gallons of water daily, with neuromorphic materials potentially requiring additional processing steps that increase this demand.

Regulatory frameworks worldwide are increasingly emphasizing environmental compliance for electronic components. The European Union's Restriction of Hazardous Substances (RoHS) directive, the Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulation, and similar policies in other regions may impact material selection and manufacturing processes for neuromorphic computing. Companies developing these technologies must navigate these requirements while maintaining performance characteristics.

Forward-looking sustainability strategies for neuromorphic computing include designing for circularity, exploring bio-inspired and biodegradable materials, and developing specialized recycling technologies. Research into alternative materials that maintain neuromorphic functionality while reducing environmental impact represents a promising frontier that could significantly influence market adoption trajectories.

Materials used in neuromorphic computing systems present both opportunities and challenges from a sustainability perspective. Many designs incorporate rare earth elements and specialized compounds that face supply chain vulnerabilities and extraction-related environmental concerns. For instance, memristive devices often utilize hafnium oxide, titanium oxide, or other transition metal oxides whose mining and processing generate significant carbon footprints and potential ecosystem disruption.

Life cycle assessment (LCA) studies indicate that while neuromorphic systems demonstrate superior operational efficiency, their manufacturing processes currently involve energy-intensive fabrication techniques. The production of specialized neuromorphic materials requires ultra-clean environments, precise deposition methods, and complex lithography processes that consume substantial resources. However, the extended operational lifespan and reduced energy requirements during use may offset these initial environmental costs over time.

Recycling and end-of-life management present particular challenges for neuromorphic computing materials. The integration of various compounds at nanoscale dimensions complicates material separation and recovery processes. Current electronic waste management systems are not optimized for the novel material combinations found in neuromorphic chips, potentially leading to resource loss and environmental contamination if not properly addressed.

Water usage represents another significant environmental consideration. Semiconductor manufacturing for neuromorphic systems requires ultra-pure water in quantities that can strain local water resources. A typical fabrication facility may use 2-4 million gallons of water daily, with neuromorphic materials potentially requiring additional processing steps that increase this demand.

Regulatory frameworks worldwide are increasingly emphasizing environmental compliance for electronic components. The European Union's Restriction of Hazardous Substances (RoHS) directive, the Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulation, and similar policies in other regions may impact material selection and manufacturing processes for neuromorphic computing. Companies developing these technologies must navigate these requirements while maintaining performance characteristics.

Forward-looking sustainability strategies for neuromorphic computing include designing for circularity, exploring bio-inspired and biodegradable materials, and developing specialized recycling technologies. Research into alternative materials that maintain neuromorphic functionality while reducing environmental impact represents a promising frontier that could significantly influence market adoption trajectories.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!