Protective Coatings for Alloy Corrosion Mitigation

OCT 13, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Alloy Corrosion Protection Background and Objectives

Alloy corrosion represents one of the most significant challenges in materials engineering, with global economic impacts exceeding $2.5 trillion annually, approximately 3.4% of the world's GDP. The history of protective coatings dates back to ancient civilizations, but modern scientific approaches emerged in the early 20th century with the development of chromate conversion coatings. The evolution accelerated post-World War II with the introduction of various polymer-based and metallic coating systems designed specifically for industrial applications.

Recent technological advancements have shifted focus toward environmentally friendly alternatives to traditional hexavalent chromium and other toxic coating systems. This transition has been driven by stringent regulations such as REACH in Europe and similar frameworks in North America and Asia, compelling industries to seek sustainable yet equally effective protection methods for critical infrastructure and components.

The current technological landscape features a diverse array of coating solutions including organic coatings (epoxies, polyurethanes), inorganic systems (silicates, phosphates), metallic coatings (zinc, aluminum), and emerging hybrid technologies. Each system presents unique advantages in specific operational environments, yet universal protection across varied corrosive conditions remains elusive.

Market trends indicate growing demand for multi-functional coatings that not only prevent corrosion but also offer additional properties such as wear resistance, thermal insulation, or self-healing capabilities. The aerospace, automotive, marine, and energy sectors have been particularly vocal about these requirements, driving research priorities in the field.

The primary objective of this research is to comprehensively evaluate existing protective coating technologies for alloy corrosion mitigation, with particular emphasis on their performance in extreme environments including high-temperature applications, marine exposures, and chemical processing facilities. The investigation aims to identify technological gaps in current solutions and establish potential development pathways for next-generation protective systems.

Secondary objectives include quantifying the long-term performance metrics of various coating systems, analyzing their environmental impact throughout their lifecycle, and exploring novel application methodologies that could enhance coating efficiency and durability. Special attention will be given to emerging nanomaterial-based solutions and their potential to revolutionize the field.

The ultimate goal is to establish a technological roadmap for protective coating development that addresses both immediate industrial needs and anticipates future challenges in alloy protection, particularly as new alloy compositions enter the market and operational environments become increasingly demanding.

Recent technological advancements have shifted focus toward environmentally friendly alternatives to traditional hexavalent chromium and other toxic coating systems. This transition has been driven by stringent regulations such as REACH in Europe and similar frameworks in North America and Asia, compelling industries to seek sustainable yet equally effective protection methods for critical infrastructure and components.

The current technological landscape features a diverse array of coating solutions including organic coatings (epoxies, polyurethanes), inorganic systems (silicates, phosphates), metallic coatings (zinc, aluminum), and emerging hybrid technologies. Each system presents unique advantages in specific operational environments, yet universal protection across varied corrosive conditions remains elusive.

Market trends indicate growing demand for multi-functional coatings that not only prevent corrosion but also offer additional properties such as wear resistance, thermal insulation, or self-healing capabilities. The aerospace, automotive, marine, and energy sectors have been particularly vocal about these requirements, driving research priorities in the field.

The primary objective of this research is to comprehensively evaluate existing protective coating technologies for alloy corrosion mitigation, with particular emphasis on their performance in extreme environments including high-temperature applications, marine exposures, and chemical processing facilities. The investigation aims to identify technological gaps in current solutions and establish potential development pathways for next-generation protective systems.

Secondary objectives include quantifying the long-term performance metrics of various coating systems, analyzing their environmental impact throughout their lifecycle, and exploring novel application methodologies that could enhance coating efficiency and durability. Special attention will be given to emerging nanomaterial-based solutions and their potential to revolutionize the field.

The ultimate goal is to establish a technological roadmap for protective coating development that addresses both immediate industrial needs and anticipates future challenges in alloy protection, particularly as new alloy compositions enter the market and operational environments become increasingly demanding.

Market Analysis for Protective Coating Solutions

The global protective coatings market for alloy corrosion mitigation is experiencing robust growth, driven by increasing industrialization and infrastructure development across various sectors. Currently valued at approximately 15.6 billion USD, the market is projected to reach 21.3 billion USD by 2027, representing a compound annual growth rate of 5.8%. This growth trajectory is particularly evident in regions with high industrial activity and severe environmental conditions, such as Asia-Pacific, North America, and parts of Europe.

The oil and gas industry remains the largest consumer of protective coatings, accounting for nearly 28% of the total market share. This sector's demand is primarily fueled by the need to protect offshore platforms, pipelines, and refinery equipment from aggressive marine environments and chemical exposure. Following closely is the marine industry, where protective coatings are essential for preventing biofouling and corrosion on ship hulls and offshore structures.

Infrastructure development represents another significant market segment, with growing investments in bridges, highways, and public utilities driving demand for durable protective coating solutions. The power generation sector, particularly nuclear and thermal power plants, also constitutes a substantial market due to the critical need for corrosion protection in extreme operating conditions.

Recent market trends indicate a shift toward environmentally friendly coating solutions with reduced volatile organic compound (VOC) content. This transition is largely influenced by stringent environmental regulations in developed regions and increasing awareness of sustainability issues. Water-based coatings and powder coatings are gaining traction as alternatives to traditional solvent-based systems, despite challenges related to performance characteristics and application methods.

Customer preferences are evolving toward multi-functional coating systems that offer additional benefits beyond corrosion protection, such as thermal insulation, fire resistance, and anti-microbial properties. This trend is creating new market opportunities for innovative coating technologies that can address multiple performance requirements simultaneously.

Regional analysis reveals that Asia-Pacific dominates the market with a 38% share, driven by rapid industrialization in China, India, and Southeast Asian countries. North America follows with 27% market share, where the focus is primarily on high-performance coatings for critical infrastructure and industrial applications. Europe accounts for 22% of the market, with stringent environmental regulations shaping product development and adoption patterns.

The competitive landscape is characterized by a mix of global players and regional specialists. Major companies are investing heavily in research and development to create advanced coating formulations that offer superior protection while meeting regulatory requirements. Strategic partnerships between coating manufacturers and end-users are becoming increasingly common, facilitating customized solutions for specific application environments.

The oil and gas industry remains the largest consumer of protective coatings, accounting for nearly 28% of the total market share. This sector's demand is primarily fueled by the need to protect offshore platforms, pipelines, and refinery equipment from aggressive marine environments and chemical exposure. Following closely is the marine industry, where protective coatings are essential for preventing biofouling and corrosion on ship hulls and offshore structures.

Infrastructure development represents another significant market segment, with growing investments in bridges, highways, and public utilities driving demand for durable protective coating solutions. The power generation sector, particularly nuclear and thermal power plants, also constitutes a substantial market due to the critical need for corrosion protection in extreme operating conditions.

Recent market trends indicate a shift toward environmentally friendly coating solutions with reduced volatile organic compound (VOC) content. This transition is largely influenced by stringent environmental regulations in developed regions and increasing awareness of sustainability issues. Water-based coatings and powder coatings are gaining traction as alternatives to traditional solvent-based systems, despite challenges related to performance characteristics and application methods.

Customer preferences are evolving toward multi-functional coating systems that offer additional benefits beyond corrosion protection, such as thermal insulation, fire resistance, and anti-microbial properties. This trend is creating new market opportunities for innovative coating technologies that can address multiple performance requirements simultaneously.

Regional analysis reveals that Asia-Pacific dominates the market with a 38% share, driven by rapid industrialization in China, India, and Southeast Asian countries. North America follows with 27% market share, where the focus is primarily on high-performance coatings for critical infrastructure and industrial applications. Europe accounts for 22% of the market, with stringent environmental regulations shaping product development and adoption patterns.

The competitive landscape is characterized by a mix of global players and regional specialists. Major companies are investing heavily in research and development to create advanced coating formulations that offer superior protection while meeting regulatory requirements. Strategic partnerships between coating manufacturers and end-users are becoming increasingly common, facilitating customized solutions for specific application environments.

Current Challenges in Alloy Corrosion Protection

Despite significant advancements in protective coating technologies, alloy corrosion protection continues to face substantial challenges that limit the effectiveness and longevity of current solutions. One of the primary obstacles is the development of universally effective coatings that can withstand diverse environmental conditions. Industrial applications often expose alloys to varying temperatures, pH levels, chemical exposures, and mechanical stresses simultaneously, creating complex corrosion mechanisms that single-function coatings cannot adequately address.

The durability-flexibility paradox presents another significant challenge. Highly durable ceramic or metallic coatings often lack flexibility, leading to cracking and delamination when the substrate expands or contracts due to thermal cycling. Conversely, more flexible polymer-based coatings typically demonstrate lower hardness and wear resistance, resulting in shorter service lifetimes in abrasive environments.

Adhesion failure at the coating-substrate interface remains problematic, particularly for high-performance alloys with complex surface chemistries. Current surface preparation techniques and adhesion promoters do not consistently create strong, long-lasting bonds across all alloy types, leading to premature coating failure through delamination, especially under cyclic loading conditions.

Self-healing capabilities, while promising in laboratory settings, have yet to be successfully implemented in commercial-scale applications. The challenge lies in developing healing mechanisms that can operate autonomously in real-world conditions without compromising the coating's primary protective properties or significantly increasing production costs.

Environmental and regulatory constraints have intensified with the global shift away from chromate-based and other toxic corrosion inhibitors. Finding equally effective yet environmentally benign alternatives has proven difficult, with many "green" solutions demonstrating reduced performance compared to their restricted counterparts.

The scalability of advanced coating technologies presents additional hurdles. Many promising laboratory-developed coatings utilize complex deposition methods or nanomaterials that are difficult to scale to industrial production volumes while maintaining consistent quality and reasonable costs.

Monitoring and predictive maintenance challenges persist as well. Current non-destructive testing methods often cannot detect early-stage coating degradation before significant corrosion damage occurs. The integration of smart sensing capabilities into protective coatings remains in early developmental stages, limiting real-time monitoring options for critical infrastructure.

These multifaceted challenges necessitate interdisciplinary research approaches that combine materials science, electrochemistry, surface engineering, and computational modeling to develop next-generation protective coating systems capable of addressing the complex demands of modern alloy protection.

The durability-flexibility paradox presents another significant challenge. Highly durable ceramic or metallic coatings often lack flexibility, leading to cracking and delamination when the substrate expands or contracts due to thermal cycling. Conversely, more flexible polymer-based coatings typically demonstrate lower hardness and wear resistance, resulting in shorter service lifetimes in abrasive environments.

Adhesion failure at the coating-substrate interface remains problematic, particularly for high-performance alloys with complex surface chemistries. Current surface preparation techniques and adhesion promoters do not consistently create strong, long-lasting bonds across all alloy types, leading to premature coating failure through delamination, especially under cyclic loading conditions.

Self-healing capabilities, while promising in laboratory settings, have yet to be successfully implemented in commercial-scale applications. The challenge lies in developing healing mechanisms that can operate autonomously in real-world conditions without compromising the coating's primary protective properties or significantly increasing production costs.

Environmental and regulatory constraints have intensified with the global shift away from chromate-based and other toxic corrosion inhibitors. Finding equally effective yet environmentally benign alternatives has proven difficult, with many "green" solutions demonstrating reduced performance compared to their restricted counterparts.

The scalability of advanced coating technologies presents additional hurdles. Many promising laboratory-developed coatings utilize complex deposition methods or nanomaterials that are difficult to scale to industrial production volumes while maintaining consistent quality and reasonable costs.

Monitoring and predictive maintenance challenges persist as well. Current non-destructive testing methods often cannot detect early-stage coating degradation before significant corrosion damage occurs. The integration of smart sensing capabilities into protective coatings remains in early developmental stages, limiting real-time monitoring options for critical infrastructure.

These multifaceted challenges necessitate interdisciplinary research approaches that combine materials science, electrochemistry, surface engineering, and computational modeling to develop next-generation protective coating systems capable of addressing the complex demands of modern alloy protection.

State-of-the-Art Alloy Coating Technologies

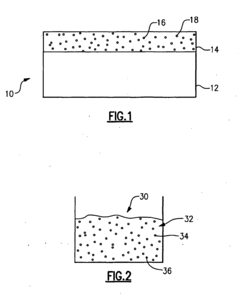

01 Metal-based protective coatings

Metal-based coatings provide effective corrosion protection through various mechanisms. These coatings can include zinc, aluminum, or other metallic elements that offer sacrificial protection to the underlying substrate. The metal coating corrodes preferentially, protecting the base material. These coatings can be applied through various methods such as hot-dipping, electroplating, or thermal spraying, and often provide long-lasting protection even in harsh environments.- Metallic-based protective coatings: Metallic-based coatings provide effective corrosion protection through sacrificial protection mechanisms. These coatings typically contain zinc, aluminum, or other metals that corrode preferentially to the substrate, thereby protecting the underlying material. The coatings can be applied through various methods including hot-dipping, electroplating, or thermal spraying. These metallic coatings form a physical barrier against corrosive environments while also providing cathodic protection when the base metal is exposed.

- Polymer and epoxy-based protective systems: Polymer and epoxy-based coatings create impermeable barriers that prevent corrosive substances from reaching metal surfaces. These systems typically consist of high-performance polymers, epoxy resins, polyurethanes, or fluoropolymers that offer excellent chemical resistance. The coatings can be formulated with various additives to enhance adhesion, flexibility, and durability. Multi-layer systems are often employed where primers provide adhesion and corrosion inhibition while topcoats offer environmental protection and aesthetic properties.

- Corrosion inhibitors and conversion coatings: Corrosion inhibitors and conversion coatings modify the metal surface to create a protective layer that resists corrosion. These treatments include phosphating, chromating, and other chemical conversion processes that transform the metal surface into a more corrosion-resistant form. Inhibitors work by adsorbing onto the metal surface or by forming protective complexes that prevent corrosive species from reaching the substrate. These treatments can be used alone or as pretreatments before applying other protective coatings.

- Smart and self-healing coating technologies: Advanced smart and self-healing coatings incorporate active components that respond to environmental changes or damage. These innovative systems contain microcapsules or other delivery mechanisms that release corrosion inhibitors or healing agents when the coating is damaged or when corrosive conditions are detected. Some systems utilize stimuli-responsive polymers that can adapt to changing environmental conditions. These technologies extend coating lifetimes by automatically repairing minor damage before significant corrosion can occur.

- Nanocomposite and ceramic protective coatings: Nanocomposite and ceramic coatings provide superior corrosion resistance through enhanced barrier properties and surface functionalization. These coatings incorporate nanomaterials such as carbon nanotubes, graphene, or ceramic nanoparticles to improve mechanical properties and reduce permeability to corrosive agents. The nanostructured materials create tortuous pathways that impede the diffusion of corrosive species through the coating. Ceramic coatings offer exceptional resistance to high temperatures and aggressive chemical environments where traditional organic coatings would degrade.

02 Polymer and composite protective coatings

Polymer-based and composite coatings provide corrosion protection by forming an impermeable barrier between the substrate and corrosive environment. These coatings typically incorporate synthetic polymers, epoxy resins, polyurethanes, or other organic compounds that resist chemical attack. Some formulations include reinforcing materials or fillers to enhance mechanical properties and durability. These coatings are valued for their versatility, ease of application, and ability to conform to complex geometries.Expand Specific Solutions03 Corrosion inhibitors and additives

Specialized additives and inhibitors can be incorporated into protective coatings to enhance their corrosion resistance properties. These compounds work through various mechanisms such as forming passive films, neutralizing corrosive species, or interrupting electrochemical reactions. Common inhibitors include chromates, phosphates, molybdates, and various organic compounds. Modern formulations often focus on environmentally friendly alternatives that maintain effectiveness while reducing toxicity concerns.Expand Specific Solutions04 Advanced monitoring and testing methods

Innovative techniques for monitoring and testing the effectiveness of corrosion protection systems enable better performance assessment and maintenance planning. These methods include electrochemical impedance spectroscopy, ultrasonic testing, and various non-destructive evaluation techniques. Some systems incorporate embedded sensors or smart materials that can detect and report corrosion activity before visible damage occurs. These technologies help optimize maintenance schedules and extend the service life of protected structures.Expand Specific Solutions05 Environmental and application-specific coatings

Specialized protective coatings designed for specific environmental conditions or applications provide targeted corrosion protection. These include coatings formulated for marine environments, high-temperature applications, chemical processing facilities, or underground structures. The formulations are tailored to resist specific corrosion mechanisms prevalent in these environments, such as galvanic corrosion, stress corrosion cracking, or microbially influenced corrosion. These specialized coatings often incorporate multiple protection mechanisms to ensure durability under challenging conditions.Expand Specific Solutions

Leading Companies in Corrosion Protection Industry

The protective coatings for alloy corrosion mitigation market is currently in a growth phase, with an increasing demand driven by industrial sectors requiring advanced corrosion protection solutions. The global market size is estimated to be over $15 billion, expanding at approximately 5% CAGR. Technologically, the field shows moderate maturity with established solutions from industry leaders like BASF, Henkel, and Sherwin-Williams, who offer conventional coating systems. However, innovation is accelerating with companies like Applied Graphene Materials and Luna Innovations developing next-generation solutions incorporating nanomaterials. Research institutions including Max Planck Society and Naval Research Laboratory are advancing fundamental understanding, while industrial players such as Saudi Aramco and Siemens are focusing on application-specific developments for harsh environments, creating a competitive landscape balanced between established technologies and emerging solutions.

BASF Corp.

Technical Solution: BASF has developed advanced corrosion protection coatings utilizing their proprietary CathoGuard® electrodeposition technology, specifically designed for alloy protection in harsh environments. Their approach combines zinc-rich primers with specialized polymer matrices that create a barrier against corrosive elements while maintaining excellent adhesion to metal substrates. The company's research has focused on developing self-healing coating systems that incorporate microcapsules containing reactive agents that are released when the coating is damaged, automatically repairing breaches in the protective layer[1]. Additionally, BASF has pioneered environmentally friendly water-based coating formulations that reduce VOC emissions while maintaining superior corrosion resistance through innovative resin chemistry and nano-additive incorporation[3]. Their multi-layer protection systems combine cathodic protection mechanisms with barrier properties to provide comprehensive alloy protection across diverse industrial applications.

Strengths: Industry-leading R&D capabilities with extensive testing facilities allowing rapid development and validation of new formulations. Strong integration of nanotechnology with traditional coating chemistry. Weaknesses: Higher cost compared to conventional coatings, which may limit adoption in price-sensitive markets. Some formulations require specialized application equipment and precise environmental controls during application.

Evonik Operations GmbH

Technical Solution: Evonik has developed sophisticated protective coating systems for alloy corrosion mitigation through their DEGADUR® and VESTAMIN® product lines. Their approach leverages specialized silane chemistry and organosilicon compounds that create strong covalent bonds with metal substrates while providing exceptional barrier properties against corrosive agents. Evonik's research has focused on developing reactive polymer systems that form interpenetrating networks when cured, creating dense, cross-linked structures highly resistant to chemical attack and moisture penetration[5]. Their silica-based sol-gel coatings incorporate functionalized nanoparticles that enhance mechanical properties while maintaining flexibility and adhesion to various alloy substrates. Evonik has pioneered the development of waterborne epoxy systems with corrosion inhibitors encapsulated in specialized delivery systems that provide controlled release over extended periods[6]. Additionally, their research includes the development of hybrid coating systems that combine the benefits of organic polymers with inorganic components, creating synergistic protection mechanisms that address multiple corrosion pathways simultaneously. Evonik's coatings also incorporate specialized additives that scavenge corrosive species before they can reach the metal substrate.

Strengths: Strong expertise in specialty chemicals and polymer science enabling highly customized solutions for specific alloy types and environmental conditions. Advanced testing capabilities for accelerated corrosion testing and performance validation. Weaknesses: Higher cost compared to conventional coating systems, potentially limiting adoption in cost-sensitive applications. Some formulations require specialized application equipment and precise environmental controls.

Key Patents and Research in Corrosion Mitigation

Corrosion inhibiting coating composition for a Zn-containing aluminum alloy

PatentActiveEP2011899B1

Innovation

- A tungstate-free protective coating comprising a non-tungstate anodic corrosion inhibitor, such as zinc molybdate, and a cathodic corrosion inhibitor, like cerium citrate, is used to form a protective layer on aluminum alloys with high zinc content, specifically tailored to avoid reactions with zinc and enhance corrosion resistance.

Corrosion inhibitors method of producing them and protective coatings containing them

PatentInactiveGB2071070B

Innovation

- Incorporating corrosion inhibiting anions such as phosphate, chromate, and benzoate chemically bound to inorganic oxide particles like alumina, which release ions through ion exchange rather than solubility, allowing controlled release based on ion permeability and environmental conditions.

Environmental Impact of Coating Technologies

The environmental impact of protective coating technologies for alloy corrosion mitigation represents a critical consideration in their development and application. Traditional coating methods have historically relied on materials containing volatile organic compounds (VOCs), heavy metals, and other environmentally hazardous substances. These components, while effective for corrosion protection, pose significant environmental risks through air pollution, water contamination, and soil degradation when improperly managed throughout their lifecycle.

Recent regulatory frameworks, including the European Union's REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) and various national environmental protection standards, have accelerated the transition toward more sustainable coating technologies. These regulations have effectively limited the use of hexavalent chromium, lead compounds, and high-VOC formulations that were once industry standards, compelling manufacturers to develop environmentally responsible alternatives.

The environmental footprint of coating technologies extends beyond their chemical composition to encompass their production processes, application methods, service life, and disposal protocols. Energy-intensive manufacturing processes contribute significantly to greenhouse gas emissions, while inefficient application techniques can result in material wastage and increased environmental burden. The durability of coatings directly influences replacement frequency, with more durable solutions reducing the cumulative environmental impact over time.

Emerging eco-friendly coating technologies demonstrate promising environmental performance metrics. Water-based formulations have substantially reduced VOC emissions compared to solvent-based alternatives. Sol-gel coatings derived from natural precursors offer biodegradable protection options with minimal environmental persistence. Advanced thermal spray techniques have improved material utilization efficiency, reducing waste generation during application processes.

Life cycle assessment (LCA) studies reveal that environmentally optimized coating systems can reduce overall ecological impact by 30-60% compared to conventional technologies. These improvements stem from reduced resource consumption, decreased emissions during production and application, extended service intervals, and enhanced end-of-life recyclability. The environmental benefits become particularly significant in large-scale industrial applications where coating volumes are substantial.

The development of self-healing and smart coating technologies presents additional environmental advantages through extended service life and reduced maintenance requirements. By autonomously responding to environmental stressors and damage, these advanced systems minimize the need for frequent reapplication and the associated environmental costs of production, transportation, and waste management.

Industry-academic collaborations are increasingly focusing on biomimetic and biobased coating solutions that draw inspiration from natural corrosion resistance mechanisms. These approaches offer pathways to protective systems with inherently lower environmental impact while maintaining or exceeding the performance standards required for industrial applications.

Recent regulatory frameworks, including the European Union's REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) and various national environmental protection standards, have accelerated the transition toward more sustainable coating technologies. These regulations have effectively limited the use of hexavalent chromium, lead compounds, and high-VOC formulations that were once industry standards, compelling manufacturers to develop environmentally responsible alternatives.

The environmental footprint of coating technologies extends beyond their chemical composition to encompass their production processes, application methods, service life, and disposal protocols. Energy-intensive manufacturing processes contribute significantly to greenhouse gas emissions, while inefficient application techniques can result in material wastage and increased environmental burden. The durability of coatings directly influences replacement frequency, with more durable solutions reducing the cumulative environmental impact over time.

Emerging eco-friendly coating technologies demonstrate promising environmental performance metrics. Water-based formulations have substantially reduced VOC emissions compared to solvent-based alternatives. Sol-gel coatings derived from natural precursors offer biodegradable protection options with minimal environmental persistence. Advanced thermal spray techniques have improved material utilization efficiency, reducing waste generation during application processes.

Life cycle assessment (LCA) studies reveal that environmentally optimized coating systems can reduce overall ecological impact by 30-60% compared to conventional technologies. These improvements stem from reduced resource consumption, decreased emissions during production and application, extended service intervals, and enhanced end-of-life recyclability. The environmental benefits become particularly significant in large-scale industrial applications where coating volumes are substantial.

The development of self-healing and smart coating technologies presents additional environmental advantages through extended service life and reduced maintenance requirements. By autonomously responding to environmental stressors and damage, these advanced systems minimize the need for frequent reapplication and the associated environmental costs of production, transportation, and waste management.

Industry-academic collaborations are increasingly focusing on biomimetic and biobased coating solutions that draw inspiration from natural corrosion resistance mechanisms. These approaches offer pathways to protective systems with inherently lower environmental impact while maintaining or exceeding the performance standards required for industrial applications.

Cost-Benefit Analysis of Corrosion Protection Solutions

The economic implications of corrosion protection systems represent a critical factor in industrial decision-making processes. When evaluating protective coatings for alloy corrosion mitigation, organizations must consider both immediate expenditures and long-term financial benefits. Initial implementation costs typically include material procurement, surface preparation requirements, application equipment, specialized labor, and potential production downtime during installation.

Standard protective coating solutions such as epoxy-based systems generally present lower upfront costs, ranging from $5-15 per square foot depending on complexity, while advanced solutions incorporating nanomaterials or specialized polymer blends may cost $20-50 per square foot but offer substantially extended service life.

Maintenance expenses constitute a significant portion of lifetime costs, with traditional coatings often requiring reapplication every 3-5 years in aggressive environments. Advanced protective systems may extend maintenance intervals to 8-12 years, dramatically reducing facility downtime and associated productivity losses. Industry data indicates that facilities implementing premium corrosion protection solutions experience 30-45% lower maintenance costs over a 15-year operational period.

Risk mitigation represents another crucial economic consideration. Catastrophic corrosion failures can result in equipment replacement costs, environmental remediation expenses, regulatory penalties, and potential litigation. Statistical analysis from petrochemical and maritime industries demonstrates that investments in superior corrosion protection typically yield risk-adjusted returns of 300-500% when factoring in avoided failure scenarios.

Environmental compliance costs continue to escalate globally, with increasingly stringent regulations governing VOC emissions and waste disposal. Modern eco-friendly coating technologies may command 15-25% price premiums but eliminate potential environmental penalties and align with corporate sustainability objectives, enhancing brand value and stakeholder relations.

Performance optimization benefits must also factor into economic assessments. High-performance coatings can improve operational efficiency through reduced friction, enhanced heat transfer, or improved flow characteristics in fluid systems. These operational enhancements may generate 5-10% efficiency improvements, translating to substantial energy savings over equipment lifespans.

Comprehensive lifecycle analysis reveals that while premium corrosion protection solutions require higher initial investment, they typically achieve break-even points within 3-4 years of implementation and generate positive returns thereafter. Organizations adopting strategic corrosion management programs report average reductions of 25-35% in total corrosion-related expenditures across asset portfolios when measured on a net present value basis.

Standard protective coating solutions such as epoxy-based systems generally present lower upfront costs, ranging from $5-15 per square foot depending on complexity, while advanced solutions incorporating nanomaterials or specialized polymer blends may cost $20-50 per square foot but offer substantially extended service life.

Maintenance expenses constitute a significant portion of lifetime costs, with traditional coatings often requiring reapplication every 3-5 years in aggressive environments. Advanced protective systems may extend maintenance intervals to 8-12 years, dramatically reducing facility downtime and associated productivity losses. Industry data indicates that facilities implementing premium corrosion protection solutions experience 30-45% lower maintenance costs over a 15-year operational period.

Risk mitigation represents another crucial economic consideration. Catastrophic corrosion failures can result in equipment replacement costs, environmental remediation expenses, regulatory penalties, and potential litigation. Statistical analysis from petrochemical and maritime industries demonstrates that investments in superior corrosion protection typically yield risk-adjusted returns of 300-500% when factoring in avoided failure scenarios.

Environmental compliance costs continue to escalate globally, with increasingly stringent regulations governing VOC emissions and waste disposal. Modern eco-friendly coating technologies may command 15-25% price premiums but eliminate potential environmental penalties and align with corporate sustainability objectives, enhancing brand value and stakeholder relations.

Performance optimization benefits must also factor into economic assessments. High-performance coatings can improve operational efficiency through reduced friction, enhanced heat transfer, or improved flow characteristics in fluid systems. These operational enhancements may generate 5-10% efficiency improvements, translating to substantial energy savings over equipment lifespans.

Comprehensive lifecycle analysis reveals that while premium corrosion protection solutions require higher initial investment, they typically achieve break-even points within 3-4 years of implementation and generate positive returns thereafter. Organizations adopting strategic corrosion management programs report average reductions of 25-35% in total corrosion-related expenditures across asset portfolios when measured on a net present value basis.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!