Surface Treatment Effects on Corrosion Resistance Enhancement

OCT 13, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Surface Treatment Technology Background and Objectives

Surface treatment technologies have evolved significantly over the past century, transforming from simple protective coatings to sophisticated engineered surfaces with multifunctional properties. The field has witnessed accelerated development since the 1950s with the emergence of advanced manufacturing techniques and materials science breakthroughs. Initially focused on basic protection against environmental degradation, surface treatments have progressively incorporated enhanced functionalities including corrosion resistance, wear resistance, and aesthetic improvements.

The evolution of surface treatment for corrosion resistance has been driven by increasing demands from industries such as aerospace, automotive, marine, and infrastructure, where material failure due to corrosion represents significant economic and safety concerns. Global corrosion costs are estimated to exceed $2.5 trillion annually, representing approximately 3.4% of global GDP, highlighting the critical importance of effective surface treatment technologies.

Current technological trends in surface treatment include the development of environmentally friendly alternatives to traditional chromate conversion coatings, which despite their excellent corrosion protection properties contain hexavalent chromium, a known carcinogen subject to increasing regulatory restrictions worldwide. This regulatory landscape has accelerated research into sustainable alternatives including sol-gel coatings, plasma electrolytic oxidation, and self-healing smart coatings incorporating active corrosion inhibitors.

Nanotechnology has emerged as a transformative force in surface treatments, enabling unprecedented control over surface properties at the molecular level. Nanostructured coatings can provide superior barrier properties, enhanced adhesion, and improved mechanical characteristics compared to conventional treatments. The integration of nanomaterials such as graphene, carbon nanotubes, and various metal oxide nanoparticles has opened new avenues for corrosion protection with minimal environmental impact.

The primary objectives of modern surface treatment technologies for corrosion resistance enhancement include developing treatments that provide long-term protection under extreme environmental conditions, minimizing environmental impact through elimination of toxic substances, reducing application and maintenance costs, and ensuring compatibility with diverse substrate materials including advanced alloys and composites. Additionally, there is growing interest in multifunctional treatments that simultaneously address corrosion resistance alongside other properties such as wear resistance, electrical conductivity, or antimicrobial activity.

Looking forward, the field aims to develop predictive models for corrosion behavior of treated surfaces, standardize testing protocols for emerging technologies, and establish comprehensive lifecycle assessments for various treatment options. These objectives align with broader industrial trends toward sustainability, cost-effectiveness, and enhanced performance in increasingly demanding applications.

The evolution of surface treatment for corrosion resistance has been driven by increasing demands from industries such as aerospace, automotive, marine, and infrastructure, where material failure due to corrosion represents significant economic and safety concerns. Global corrosion costs are estimated to exceed $2.5 trillion annually, representing approximately 3.4% of global GDP, highlighting the critical importance of effective surface treatment technologies.

Current technological trends in surface treatment include the development of environmentally friendly alternatives to traditional chromate conversion coatings, which despite their excellent corrosion protection properties contain hexavalent chromium, a known carcinogen subject to increasing regulatory restrictions worldwide. This regulatory landscape has accelerated research into sustainable alternatives including sol-gel coatings, plasma electrolytic oxidation, and self-healing smart coatings incorporating active corrosion inhibitors.

Nanotechnology has emerged as a transformative force in surface treatments, enabling unprecedented control over surface properties at the molecular level. Nanostructured coatings can provide superior barrier properties, enhanced adhesion, and improved mechanical characteristics compared to conventional treatments. The integration of nanomaterials such as graphene, carbon nanotubes, and various metal oxide nanoparticles has opened new avenues for corrosion protection with minimal environmental impact.

The primary objectives of modern surface treatment technologies for corrosion resistance enhancement include developing treatments that provide long-term protection under extreme environmental conditions, minimizing environmental impact through elimination of toxic substances, reducing application and maintenance costs, and ensuring compatibility with diverse substrate materials including advanced alloys and composites. Additionally, there is growing interest in multifunctional treatments that simultaneously address corrosion resistance alongside other properties such as wear resistance, electrical conductivity, or antimicrobial activity.

Looking forward, the field aims to develop predictive models for corrosion behavior of treated surfaces, standardize testing protocols for emerging technologies, and establish comprehensive lifecycle assessments for various treatment options. These objectives align with broader industrial trends toward sustainability, cost-effectiveness, and enhanced performance in increasingly demanding applications.

Market Analysis for Corrosion-Resistant Solutions

The global market for corrosion-resistant solutions has experienced substantial growth in recent years, driven primarily by increasing industrial activities and infrastructure development across various sectors. The market was valued at approximately 7.5 billion USD in 2022 and is projected to reach 10.2 billion USD by 2028, representing a compound annual growth rate (CAGR) of 5.3% during the forecast period.

Surface treatment technologies for corrosion resistance enhancement are witnessing particularly strong demand in key industries including oil and gas, marine, aerospace, automotive, and construction. The oil and gas sector remains the largest consumer, accounting for nearly 24% of the total market share, due to the harsh operating environments and critical safety requirements in offshore and onshore operations.

Regional analysis indicates that Asia-Pacific currently dominates the market with a 35% share, followed by North America (28%) and Europe (22%). This dominance is attributed to rapid industrialization in countries like China and India, coupled with significant infrastructure development projects. The Middle East region is emerging as a high-growth market due to extensive oil and gas operations and increasing investments in infrastructure development.

Customer demand patterns reveal a growing preference for environmentally friendly and sustainable corrosion protection solutions. This shift is driven by stringent environmental regulations limiting the use of hazardous materials like hexavalent chromium and certain volatile organic compounds (VOCs). Consequently, water-based and powder coating technologies have gained significant market traction, with annual growth rates exceeding the industry average by 2-3 percentage points.

Cost-benefit analysis indicates that while advanced surface treatments may require higher initial investments, they offer substantial long-term savings through extended asset lifespans and reduced maintenance requirements. Industries are increasingly adopting a total cost of ownership approach when evaluating corrosion protection solutions, with particular emphasis on performance longevity and maintenance intervals.

Market segmentation by technology shows that thermal spray coatings hold the largest market share (27%), followed by conversion coatings (22%), anodizing (18%), and electroplating (15%). Emerging technologies such as sol-gel coatings and self-healing materials are experiencing the fastest growth rates, albeit from smaller base values.

The competitive landscape features both established multinational corporations and specialized regional players. Major companies like PPG Industries, AkzoNobel, Henkel, and Sherwin-Williams collectively control approximately 45% of the global market, while numerous small and medium enterprises cater to specialized applications and regional markets.

Surface treatment technologies for corrosion resistance enhancement are witnessing particularly strong demand in key industries including oil and gas, marine, aerospace, automotive, and construction. The oil and gas sector remains the largest consumer, accounting for nearly 24% of the total market share, due to the harsh operating environments and critical safety requirements in offshore and onshore operations.

Regional analysis indicates that Asia-Pacific currently dominates the market with a 35% share, followed by North America (28%) and Europe (22%). This dominance is attributed to rapid industrialization in countries like China and India, coupled with significant infrastructure development projects. The Middle East region is emerging as a high-growth market due to extensive oil and gas operations and increasing investments in infrastructure development.

Customer demand patterns reveal a growing preference for environmentally friendly and sustainable corrosion protection solutions. This shift is driven by stringent environmental regulations limiting the use of hazardous materials like hexavalent chromium and certain volatile organic compounds (VOCs). Consequently, water-based and powder coating technologies have gained significant market traction, with annual growth rates exceeding the industry average by 2-3 percentage points.

Cost-benefit analysis indicates that while advanced surface treatments may require higher initial investments, they offer substantial long-term savings through extended asset lifespans and reduced maintenance requirements. Industries are increasingly adopting a total cost of ownership approach when evaluating corrosion protection solutions, with particular emphasis on performance longevity and maintenance intervals.

Market segmentation by technology shows that thermal spray coatings hold the largest market share (27%), followed by conversion coatings (22%), anodizing (18%), and electroplating (15%). Emerging technologies such as sol-gel coatings and self-healing materials are experiencing the fastest growth rates, albeit from smaller base values.

The competitive landscape features both established multinational corporations and specialized regional players. Major companies like PPG Industries, AkzoNobel, Henkel, and Sherwin-Williams collectively control approximately 45% of the global market, while numerous small and medium enterprises cater to specialized applications and regional markets.

Current Challenges in Surface Treatment Technologies

Despite significant advancements in surface treatment technologies for corrosion resistance enhancement, several critical challenges persist that limit their widespread industrial application and long-term effectiveness. These challenges span technical, economic, and environmental dimensions that require innovative solutions to overcome.

The complexity of corrosion mechanisms across different environments presents a fundamental challenge. Surface treatments that perform excellently in one environment may fail prematurely in another due to varying pH levels, temperature fluctuations, or the presence of specific aggressive ions. This environmental sensitivity necessitates customized approaches rather than universal solutions, complicating implementation across diverse industrial settings.

Durability and longevity of surface treatments remain problematic, particularly in harsh operating conditions. Many current treatments exhibit degradation over time, with protective layers experiencing cracking, delamination, or chemical breakdown. This deterioration often occurs unpredictably, making maintenance scheduling difficult and increasing lifetime costs of protected components.

The trade-off between corrosion protection and other material properties presents another significant challenge. Enhanced corrosion resistance frequently comes at the expense of other desirable characteristics such as wear resistance, electrical conductivity, or aesthetic appearance. Balancing these competing requirements without compromising core functionality continues to challenge materials scientists and engineers.

Scale-up and manufacturing consistency pose substantial hurdles when transitioning from laboratory success to industrial implementation. Many promising surface treatment technologies demonstrate excellent performance in controlled laboratory settings but encounter reproducibility issues during large-scale production. Variations in substrate materials, processing conditions, and quality control further complicate consistent application.

Environmental and health concerns associated with traditional surface treatments have intensified regulatory pressures. Chromate conversion coatings, while highly effective against corrosion, face severe restrictions due to hexavalent chromium toxicity. Similarly, many organic coatings release volatile organic compounds (VOCs) during application and curing. Finding equally effective yet environmentally benign alternatives remains an ongoing challenge.

Cost-effectiveness represents a persistent barrier to adoption, particularly for advanced surface treatments. Novel technologies often require specialized equipment, precise process control, and highly skilled operators, driving up implementation costs. Industries must carefully weigh these expenses against the economic benefits of extended component lifespans and reduced maintenance requirements.

The lack of standardized testing protocols and performance metrics further complicates technology evaluation and comparison. Different industries employ varying corrosion testing methodologies, making it difficult to objectively assess the relative merits of competing surface treatment approaches or predict real-world performance from accelerated laboratory tests.

The complexity of corrosion mechanisms across different environments presents a fundamental challenge. Surface treatments that perform excellently in one environment may fail prematurely in another due to varying pH levels, temperature fluctuations, or the presence of specific aggressive ions. This environmental sensitivity necessitates customized approaches rather than universal solutions, complicating implementation across diverse industrial settings.

Durability and longevity of surface treatments remain problematic, particularly in harsh operating conditions. Many current treatments exhibit degradation over time, with protective layers experiencing cracking, delamination, or chemical breakdown. This deterioration often occurs unpredictably, making maintenance scheduling difficult and increasing lifetime costs of protected components.

The trade-off between corrosion protection and other material properties presents another significant challenge. Enhanced corrosion resistance frequently comes at the expense of other desirable characteristics such as wear resistance, electrical conductivity, or aesthetic appearance. Balancing these competing requirements without compromising core functionality continues to challenge materials scientists and engineers.

Scale-up and manufacturing consistency pose substantial hurdles when transitioning from laboratory success to industrial implementation. Many promising surface treatment technologies demonstrate excellent performance in controlled laboratory settings but encounter reproducibility issues during large-scale production. Variations in substrate materials, processing conditions, and quality control further complicate consistent application.

Environmental and health concerns associated with traditional surface treatments have intensified regulatory pressures. Chromate conversion coatings, while highly effective against corrosion, face severe restrictions due to hexavalent chromium toxicity. Similarly, many organic coatings release volatile organic compounds (VOCs) during application and curing. Finding equally effective yet environmentally benign alternatives remains an ongoing challenge.

Cost-effectiveness represents a persistent barrier to adoption, particularly for advanced surface treatments. Novel technologies often require specialized equipment, precise process control, and highly skilled operators, driving up implementation costs. Industries must carefully weigh these expenses against the economic benefits of extended component lifespans and reduced maintenance requirements.

The lack of standardized testing protocols and performance metrics further complicates technology evaluation and comparison. Different industries employ varying corrosion testing methodologies, making it difficult to objectively assess the relative merits of competing surface treatment approaches or predict real-world performance from accelerated laboratory tests.

Current Surface Treatment Techniques and Applications

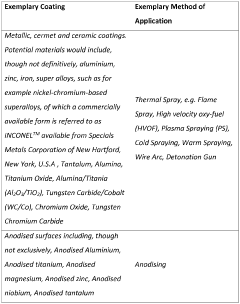

01 Chemical conversion coatings for corrosion resistance

Chemical conversion coatings involve treating metal surfaces with chemical solutions that react with the base metal to form a protective layer. These treatments, such as chromate conversion, phosphate conversion, and oxide coatings, create a barrier that prevents corrosive elements from reaching the metal substrate. The conversion layer also provides an excellent base for subsequent paint or coating applications, enhancing overall corrosion protection and extending the service life of metal components.- Chemical conversion coatings for corrosion resistance: Chemical conversion coatings involve treating metal surfaces with chemical solutions that react with the base metal to form a protective layer. These treatments include phosphating, chromating, and other conversion processes that create a barrier against corrosive elements. The resulting coating provides enhanced corrosion resistance by forming a passive layer that prevents direct contact between the metal substrate and corrosive environments.

- Polymer-based protective coatings: Polymer-based coatings provide corrosion resistance by forming an impermeable barrier on metal surfaces. These coatings include epoxy resins, polyurethanes, and other organic polymers that physically isolate the metal from corrosive environments. The polymeric materials can be modified with additives to enhance adhesion, flexibility, and durability, resulting in long-lasting protection against various corrosive agents.

- Metal plating and galvanization techniques: Metal plating involves depositing a thin layer of corrosion-resistant metal onto a substrate to provide protection. Techniques include hot-dip galvanization, electroplating, and thermal spraying. These methods create a sacrificial layer that corrodes preferentially to protect the underlying metal. Common plating metals include zinc, nickel, chromium, and aluminum, each offering different levels of protection depending on the environmental conditions.

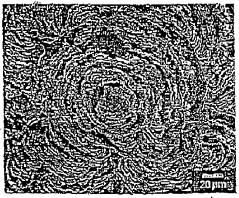

- Surface modification through physical treatments: Physical surface treatments modify the surface properties of metals to enhance corrosion resistance. These methods include shot peening, laser surface treatment, and plasma treatment, which can alter the surface morphology, create compressive stresses, or modify the microstructure. Such treatments can increase hardness, reduce surface defects, and create a more uniform surface that is less susceptible to localized corrosion.

- Hybrid and composite coating systems: Hybrid coating systems combine multiple protection mechanisms to provide enhanced corrosion resistance. These may include combinations of inorganic and organic components, multi-layer systems, or nanocomposite coatings. By integrating different materials and protection mechanisms, these systems can provide synergistic effects that offer superior protection compared to single-component systems, addressing multiple corrosion pathways simultaneously.

02 Polymer and organic coatings for corrosion protection

Polymer and organic coatings provide effective barriers against corrosive environments. These coatings include epoxy resins, polyurethanes, acrylics, and specialized polymer formulations that create a physical barrier between the metal substrate and corrosive elements. The coatings can be enhanced with corrosion inhibitors, which actively prevent electrochemical reactions that lead to corrosion. These treatments offer excellent durability, chemical resistance, and can be tailored for specific environmental conditions.Expand Specific Solutions03 Metal plating and electrochemical surface treatments

Metal plating and electrochemical treatments involve depositing a layer of corrosion-resistant metal onto a substrate through electroplating, electroless plating, or hot-dip processes. Common plating metals include zinc, nickel, chromium, and copper. These treatments not only provide a physical barrier against corrosion but can also offer sacrificial protection where the coating corrodes preferentially to protect the base metal. Advanced electrochemical treatments can create multi-layered protection systems with enhanced durability and performance.Expand Specific Solutions04 Surface modification techniques for improved corrosion resistance

Surface modification techniques alter the physical or chemical properties of metal surfaces to enhance corrosion resistance. These include laser surface treatment, ion implantation, plasma treatment, and mechanical surface treatments like shot peening or burnishing. These processes can create compressive stresses in the surface layer, modify the microstructure, or create nanoscale features that improve corrosion resistance. Surface hardening treatments can simultaneously improve wear resistance while enhancing corrosion protection properties.Expand Specific Solutions05 Environmentally friendly corrosion protection treatments

Environmentally friendly corrosion protection treatments have been developed to replace traditional methods that use hazardous substances like hexavalent chromium. These green alternatives include sol-gel coatings, rare earth element treatments, silane-based treatments, and bio-based inhibitors. These technologies provide effective corrosion protection while reducing environmental impact and meeting increasingly stringent regulations. Many of these treatments also offer additional benefits such as improved adhesion for subsequent coatings and self-healing properties.Expand Specific Solutions

Leading Companies in Surface Treatment Industry

The surface treatment effects on corrosion resistance market is currently in a growth phase, with increasing demand across automotive, aerospace, and industrial sectors. The global market size is estimated to exceed $15 billion, driven by stringent environmental regulations and growing infrastructure development. Leading players include established Japanese corporations like Nihon Parkerizing, Nippon Steel, and Kansai Paint, alongside global giants such as Henkel AG and Atotech. The competitive landscape features specialized coating providers (tesa SE, Shinto Paint) and steel manufacturers (POSCO, JFE Steel) investing heavily in advanced corrosion-resistant technologies. Research institutions like Max Planck Society and Lanzhou Institute of Chemical Physics are accelerating innovation through fundamental research, while companies are focusing on environmentally friendly solutions to meet sustainability requirements.

Nihon Parkerizing Co., Ltd.

Technical Solution: Nihon Parkerizing has developed advanced phosphate coating technologies specifically designed for corrosion resistance enhancement. Their proprietary zinc phosphate conversion coatings create a crystalline layer that serves as both a protective barrier and an excellent base for subsequent paint or coating applications. The company has pioneered multi-stage phosphating processes that incorporate nano-scale additives to fill microscopic surface irregularities, creating a more uniform protective layer. Their latest innovation includes environmentally-friendly low-temperature phosphating solutions that reduce energy consumption while maintaining superior corrosion protection performance. Nihon Parkerizing's treatments typically involve a carefully controlled chemical reaction between the metal substrate and phosphate-containing solutions, resulting in the formation of insoluble phosphate crystals that adhere tightly to the metal surface[1][3]. Their processes often incorporate specialized accelerators and refiners to optimize crystal formation and enhance coating uniformity.

Strengths: Industry-leading expertise in phosphate conversion coatings with exceptional adhesion properties; environmentally compliant formulations with reduced heavy metal content; excellent base for paint adhesion. Weaknesses: Some processes require multiple stages and precise control parameters; higher implementation costs compared to basic treatments; certain formulations may have limited effectiveness on specialized alloys.

NIPPON STEEL CORP.

Technical Solution: NIPPON STEEL has developed proprietary hot-dip galvanizing and galvannealing technologies that provide superior corrosion resistance for steel products. Their SuperDyma® coating system incorporates zinc-aluminum-magnesium alloy layers that offer up to 10 times the corrosion resistance of conventional galvanized steel[7]. The company's surface treatment approach involves precisely controlled thermal processing that optimizes the microstructure of the protective layer, creating a dense barrier against corrosive elements. NIPPON STEEL has also pioneered chromate-free passivation treatments that comply with global environmental regulations while maintaining excellent protection performance. Their latest innovation includes self-healing coating systems that incorporate specially formulated corrosion inhibitors that migrate to damaged areas, providing active protection at vulnerable points. The company's research has demonstrated that their zinc-aluminum-magnesium coatings form more stable and protective corrosion products compared to conventional zinc coatings, particularly in environments containing chloride ions. Their treatments typically involve multi-layer approaches with carefully engineered interfaces between the substrate and protective layers to prevent delamination and enhance long-term durability[8].

Strengths: Exceptional corrosion resistance in severe environments including coastal and industrial settings; reduced coating thickness requirements compared to conventional galvanizing; excellent cut-edge protection properties; compatibility with various forming and joining processes. Weaknesses: Higher production costs compared to standard galvanized products; some formulations may have specific processing temperature requirements; certain applications may require specialized handling procedures.

Key Innovations in Corrosion Resistance Technologies

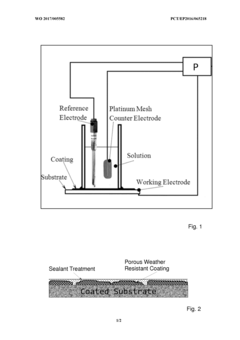

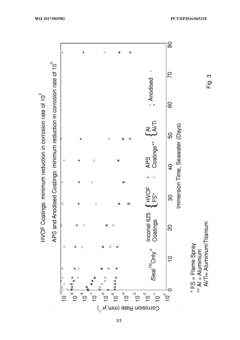

A surface treatment for enhanced resistance to corrosion and synergistic wear and corrosion (tribocorrosion) degradation

PatentWO2017005582A1

Innovation

- A Rare Earth Metal (REM)-based hybrid organic/inorganic coating is applied using a near-neutral pH electrodeposition process, which seals the porosity of underlying coatings, providing a conformal barrier that enhances both wear and corrosion resistance by penetrating and sealing the pores of wear-resistant coatings.

Surface treatments to improve corrosion resistance of austenitic stainless steels.

PatentInactiveMXPA02010475A

Innovation

- A method involving surface treatment such as sandblasting and aggressive chemical cleaning with specific acid solutions at elevated temperatures and extended times to remove corrosion initiation sites without altering the steel's chemical composition, thereby increasing corrosion resistance.

Environmental Impact of Surface Treatment Processes

Surface treatment processes, while essential for enhancing corrosion resistance, carry significant environmental implications that must be carefully considered in industrial applications. Traditional surface treatment methods often involve hazardous chemicals such as chromates, phosphates, and heavy metals that pose substantial risks to ecosystems and human health when improperly managed.

Chromium-based treatments, particularly hexavalent chromium processes, remain among the most environmentally problematic due to their carcinogenic properties and persistence in the environment. Regulatory frameworks worldwide, including the European Union's RoHS and REACH regulations, have increasingly restricted these substances, driving industry transformation toward greener alternatives.

Acid pickling and alkaline cleaning processes generate significant volumes of wastewater containing dissolved metals and chemicals with high biological oxygen demand. Without proper treatment, these effluents can disrupt aquatic ecosystems, alter pH balances in water bodies, and contaminate groundwater resources. Modern facilities typically implement neutralization, precipitation, and filtration systems to mitigate these impacts.

Energy consumption represents another critical environmental consideration. Thermal processes such as hot-dip galvanizing and thermal spraying require substantial energy inputs, contributing to carbon emissions. Advanced plasma and laser surface treatments, while offering superior performance, often demand even greater energy resources, highlighting the need for efficiency improvements and renewable energy integration.

Volatile organic compounds (VOCs) emitted during certain coating applications contribute to photochemical smog formation and air quality degradation. Water-based and powder coating technologies have emerged as environmentally preferable alternatives, reducing VOC emissions by up to 95% compared to traditional solvent-based systems.

Recent advancements in green surface treatment technologies demonstrate promising environmental profiles. Sol-gel coatings, biomimetic surfaces, and self-healing materials offer corrosion protection with minimal environmental impact. Additionally, cold spray technologies and ionic liquid treatments represent emerging approaches that eliminate hazardous waste streams while maintaining or exceeding conventional performance standards.

Life cycle assessment studies indicate that environmentally optimized surface treatments may initially require greater resource investment but typically yield net environmental benefits through extended product lifespans and reduced maintenance requirements. This holistic perspective is increasingly guiding industry decision-making, with manufacturers adopting closed-loop processing systems that recover and reuse chemicals, minimizing waste generation and resource consumption.

Chromium-based treatments, particularly hexavalent chromium processes, remain among the most environmentally problematic due to their carcinogenic properties and persistence in the environment. Regulatory frameworks worldwide, including the European Union's RoHS and REACH regulations, have increasingly restricted these substances, driving industry transformation toward greener alternatives.

Acid pickling and alkaline cleaning processes generate significant volumes of wastewater containing dissolved metals and chemicals with high biological oxygen demand. Without proper treatment, these effluents can disrupt aquatic ecosystems, alter pH balances in water bodies, and contaminate groundwater resources. Modern facilities typically implement neutralization, precipitation, and filtration systems to mitigate these impacts.

Energy consumption represents another critical environmental consideration. Thermal processes such as hot-dip galvanizing and thermal spraying require substantial energy inputs, contributing to carbon emissions. Advanced plasma and laser surface treatments, while offering superior performance, often demand even greater energy resources, highlighting the need for efficiency improvements and renewable energy integration.

Volatile organic compounds (VOCs) emitted during certain coating applications contribute to photochemical smog formation and air quality degradation. Water-based and powder coating technologies have emerged as environmentally preferable alternatives, reducing VOC emissions by up to 95% compared to traditional solvent-based systems.

Recent advancements in green surface treatment technologies demonstrate promising environmental profiles. Sol-gel coatings, biomimetic surfaces, and self-healing materials offer corrosion protection with minimal environmental impact. Additionally, cold spray technologies and ionic liquid treatments represent emerging approaches that eliminate hazardous waste streams while maintaining or exceeding conventional performance standards.

Life cycle assessment studies indicate that environmentally optimized surface treatments may initially require greater resource investment but typically yield net environmental benefits through extended product lifespans and reduced maintenance requirements. This holistic perspective is increasingly guiding industry decision-making, with manufacturers adopting closed-loop processing systems that recover and reuse chemicals, minimizing waste generation and resource consumption.

Cost-Benefit Analysis of Advanced Surface Treatments

When evaluating advanced surface treatments for corrosion resistance enhancement, a comprehensive cost-benefit analysis is essential for making informed implementation decisions. The initial investment in advanced surface treatments such as plasma electrolytic oxidation (PEO), physical vapor deposition (PVD), and chemical vapor deposition (CVD) typically ranges from $5,000 to $50,000 for equipment setup, with additional operational costs of $10-100 per square meter of treated surface.

These treatments offer significant long-term economic advantages despite their higher upfront costs. Research indicates that properly treated surfaces can extend component lifespan by 200-300% in corrosive environments, substantially reducing replacement frequency. For industries like offshore oil and gas, where component replacement can cost millions and require operational shutdowns, this translates to considerable savings.

Maintenance cost reduction represents another significant benefit. Advanced treatments like ceramic conversion coatings require maintenance intervals 3-5 times longer than conventional treatments, reducing both direct maintenance expenses and associated downtime costs. A case study from the maritime industry demonstrated annual maintenance savings of approximately $150,000 for vessels with advanced surface treatments compared to conventional methods.

Environmental compliance benefits must also factor into the analysis. As regulatory frameworks become increasingly stringent, particularly regarding hexavalent chromium and other hazardous substances, advanced treatments offer compliant alternatives. The cost avoidance of potential environmental fines (which can exceed $100,000 per violation) and remediation expenses significantly enhances the value proposition of these treatments.

Return on investment (ROI) calculations typically show breakeven periods of 12-36 months for advanced surface treatments, depending on application severity. In highly corrosive environments, ROI can be achieved in as little as 6-8 months. Industries with high safety requirements, such as aerospace and medical devices, see additional value through risk mitigation and liability reduction.

The total cost of ownership analysis reveals that while conventional treatments may cost 30-50% less initially, advanced treatments offer 40-60% lower lifetime costs when considering the entire component lifecycle. This economic advantage increases proportionally with the corrosivity of the operating environment and the criticality of the components being protected.

These treatments offer significant long-term economic advantages despite their higher upfront costs. Research indicates that properly treated surfaces can extend component lifespan by 200-300% in corrosive environments, substantially reducing replacement frequency. For industries like offshore oil and gas, where component replacement can cost millions and require operational shutdowns, this translates to considerable savings.

Maintenance cost reduction represents another significant benefit. Advanced treatments like ceramic conversion coatings require maintenance intervals 3-5 times longer than conventional treatments, reducing both direct maintenance expenses and associated downtime costs. A case study from the maritime industry demonstrated annual maintenance savings of approximately $150,000 for vessels with advanced surface treatments compared to conventional methods.

Environmental compliance benefits must also factor into the analysis. As regulatory frameworks become increasingly stringent, particularly regarding hexavalent chromium and other hazardous substances, advanced treatments offer compliant alternatives. The cost avoidance of potential environmental fines (which can exceed $100,000 per violation) and remediation expenses significantly enhances the value proposition of these treatments.

Return on investment (ROI) calculations typically show breakeven periods of 12-36 months for advanced surface treatments, depending on application severity. In highly corrosive environments, ROI can be achieved in as little as 6-8 months. Industries with high safety requirements, such as aerospace and medical devices, see additional value through risk mitigation and liability reduction.

The total cost of ownership analysis reveals that while conventional treatments may cost 30-50% less initially, advanced treatments offer 40-60% lower lifetime costs when considering the entire component lifecycle. This economic advantage increases proportionally with the corrosivity of the operating environment and the criticality of the components being protected.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!