Standards and regulations for thermal barrier coatings ceramics in gas turbines

OCT 10, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Thermal Barrier Coatings Evolution and Objectives

Thermal Barrier Coatings (TBCs) have evolved significantly since their inception in the 1960s, initially developed for military aircraft engines before expanding to commercial aviation and power generation. The primary objective of TBCs has consistently been to provide thermal insulation for metallic components operating in high-temperature environments, particularly in gas turbines where temperatures can exceed 1600°C.

Early TBC systems utilized plasma-sprayed zirconia stabilized with magnesia (MgO), which was later replaced by yttria-stabilized zirconia (YSZ) in the 1970s due to its superior phase stability and lower thermal conductivity. The 1980s marked a significant advancement with the introduction of electron beam physical vapor deposition (EB-PVD) techniques, enabling the creation of columnar microstructures that enhanced strain tolerance and durability.

The 1990s witnessed the standardization of TBC compositions and processes, with the establishment of initial regulatory frameworks by organizations such as ASTM International and the International Organization for Standardization (ISO). These early standards primarily focused on material composition and basic performance requirements rather than comprehensive regulatory guidelines.

The early 2000s brought increased attention to environmental and safety regulations affecting TBC production and application, particularly regarding hazardous materials used in processing. Simultaneously, research efforts intensified on developing advanced ceramic compositions beyond traditional YSZ, including gadolinium zirconate and lanthanum zirconate, which offer lower thermal conductivity and improved phase stability at extreme temperatures.

Current technological objectives for TBCs in gas turbines focus on extending coating lifespans beyond 30,000 hours of operation while maintaining thermal protection at increasingly higher operating temperatures. This push aims to improve overall turbine efficiency, which directly translates to reduced fuel consumption and lower emissions in both aerospace and power generation applications.

Regulatory objectives have evolved to emphasize standardized testing methodologies for thermal cycling resistance, erosion resistance, and long-term stability. Organizations including the European Aviation Safety Agency (EASA), the Federal Aviation Administration (FAA), and various international standards bodies continue to refine requirements for certification and qualification of TBC systems in critical applications.

Future development trajectories aim to establish unified global standards for TBC ceramics that address not only performance and safety but also environmental sustainability throughout the coating lifecycle. This includes considerations for raw material sourcing, manufacturing processes, and end-of-life recycling or disposal options that align with increasingly stringent environmental regulations worldwide.

Early TBC systems utilized plasma-sprayed zirconia stabilized with magnesia (MgO), which was later replaced by yttria-stabilized zirconia (YSZ) in the 1970s due to its superior phase stability and lower thermal conductivity. The 1980s marked a significant advancement with the introduction of electron beam physical vapor deposition (EB-PVD) techniques, enabling the creation of columnar microstructures that enhanced strain tolerance and durability.

The 1990s witnessed the standardization of TBC compositions and processes, with the establishment of initial regulatory frameworks by organizations such as ASTM International and the International Organization for Standardization (ISO). These early standards primarily focused on material composition and basic performance requirements rather than comprehensive regulatory guidelines.

The early 2000s brought increased attention to environmental and safety regulations affecting TBC production and application, particularly regarding hazardous materials used in processing. Simultaneously, research efforts intensified on developing advanced ceramic compositions beyond traditional YSZ, including gadolinium zirconate and lanthanum zirconate, which offer lower thermal conductivity and improved phase stability at extreme temperatures.

Current technological objectives for TBCs in gas turbines focus on extending coating lifespans beyond 30,000 hours of operation while maintaining thermal protection at increasingly higher operating temperatures. This push aims to improve overall turbine efficiency, which directly translates to reduced fuel consumption and lower emissions in both aerospace and power generation applications.

Regulatory objectives have evolved to emphasize standardized testing methodologies for thermal cycling resistance, erosion resistance, and long-term stability. Organizations including the European Aviation Safety Agency (EASA), the Federal Aviation Administration (FAA), and various international standards bodies continue to refine requirements for certification and qualification of TBC systems in critical applications.

Future development trajectories aim to establish unified global standards for TBC ceramics that address not only performance and safety but also environmental sustainability throughout the coating lifecycle. This includes considerations for raw material sourcing, manufacturing processes, and end-of-life recycling or disposal options that align with increasingly stringent environmental regulations worldwide.

Market Demand Analysis for Advanced TBC Systems

The global market for advanced Thermal Barrier Coating (TBC) systems is experiencing robust growth, driven primarily by the expanding gas turbine industry across power generation and aerospace sectors. Current market valuations indicate that the TBC market reached approximately 1.2 billion USD in 2022, with projections suggesting a compound annual growth rate of 6.8% through 2030, potentially reaching 2.1 billion USD by the end of the forecast period.

The aerospace segment represents the largest demand driver, accounting for nearly 45% of the total market share. This is attributed to the increasing production of commercial aircraft and the growing emphasis on fuel efficiency and emission reduction in aviation. The power generation sector follows closely, contributing about 38% to the overall market demand, with particular growth observed in regions developing new energy infrastructure.

Geographically, North America and Europe currently dominate the market with a combined share of 58%, owing to their established aerospace industries and stringent emission regulations. However, the Asia-Pacific region is emerging as the fastest-growing market, with China and India leading the expansion due to rapid industrialization and increasing energy demands.

Market analysis reveals several key demand factors for advanced TBC systems. First, there is a growing requirement for coatings that can withstand higher operating temperatures, as modern gas turbines are designed to operate at increasingly elevated temperatures to improve efficiency. Industry data indicates that each 50°C increase in operating temperature can potentially improve turbine efficiency by 1-2%.

Second, durability and lifecycle cost considerations are becoming paramount. End-users are seeking TBC systems that offer extended service life and reduced maintenance requirements, with the potential to decrease overall operational costs by 15-20% over the lifecycle of the equipment.

Third, environmental regulations are significantly influencing market demand. Stringent emission standards in developed economies are pushing manufacturers to develop more efficient combustion systems, which inherently operate at higher temperatures, thus requiring more advanced thermal protection solutions.

Furthermore, the market is witnessing increased demand for customized TBC solutions tailored to specific operational environments and performance requirements. This trend is particularly evident in the aerospace sector, where different flight profiles and engine designs necessitate specialized coating formulations.

The aftermarket segment for TBC systems is also expanding, driven by the need for regular maintenance and replacement of coatings in existing turbine fleets. This segment is expected to grow at a rate of 7.5% annually, slightly outpacing the overall market growth.

The aerospace segment represents the largest demand driver, accounting for nearly 45% of the total market share. This is attributed to the increasing production of commercial aircraft and the growing emphasis on fuel efficiency and emission reduction in aviation. The power generation sector follows closely, contributing about 38% to the overall market demand, with particular growth observed in regions developing new energy infrastructure.

Geographically, North America and Europe currently dominate the market with a combined share of 58%, owing to their established aerospace industries and stringent emission regulations. However, the Asia-Pacific region is emerging as the fastest-growing market, with China and India leading the expansion due to rapid industrialization and increasing energy demands.

Market analysis reveals several key demand factors for advanced TBC systems. First, there is a growing requirement for coatings that can withstand higher operating temperatures, as modern gas turbines are designed to operate at increasingly elevated temperatures to improve efficiency. Industry data indicates that each 50°C increase in operating temperature can potentially improve turbine efficiency by 1-2%.

Second, durability and lifecycle cost considerations are becoming paramount. End-users are seeking TBC systems that offer extended service life and reduced maintenance requirements, with the potential to decrease overall operational costs by 15-20% over the lifecycle of the equipment.

Third, environmental regulations are significantly influencing market demand. Stringent emission standards in developed economies are pushing manufacturers to develop more efficient combustion systems, which inherently operate at higher temperatures, thus requiring more advanced thermal protection solutions.

Furthermore, the market is witnessing increased demand for customized TBC solutions tailored to specific operational environments and performance requirements. This trend is particularly evident in the aerospace sector, where different flight profiles and engine designs necessitate specialized coating formulations.

The aftermarket segment for TBC systems is also expanding, driven by the need for regular maintenance and replacement of coatings in existing turbine fleets. This segment is expected to grow at a rate of 7.5% annually, slightly outpacing the overall market growth.

Current TBC Technology Challenges in Gas Turbines

Despite significant advancements in thermal barrier coating (TBC) technology for gas turbines, several critical challenges persist that impede optimal performance and reliability. The most pressing issue remains the limited temperature capability of current ceramic materials. While yttria-stabilized zirconia (YSZ) has been the industry standard for decades, its maximum operating temperature ceiling of approximately 1200-1300°C restricts further efficiency improvements in advanced gas turbine systems that aim to operate at even higher temperatures.

Durability under thermal cycling conditions presents another major challenge. The thermal expansion mismatch between ceramic top coats and metallic bond coats creates significant stress during operational cycling, leading to premature spallation and coating failure. This issue becomes particularly acute in applications requiring frequent start-up and shutdown sequences, such as in power generation turbines responding to fluctuating grid demands.

CMAS (calcium-magnesium-alumino-silicate) infiltration represents an increasingly problematic degradation mechanism. These environmental contaminants melt at high temperatures and penetrate the porous TBC structure, causing severe chemical and mechanical degradation upon cooling. As turbines operate in diverse environments worldwide, CMAS resistance has become a critical performance parameter that current coating systems struggle to address adequately.

Manufacturing consistency and quality control continue to challenge the industry. Plasma spray and electron beam physical vapor deposition (EB-PVD) processes, while well-established, still exhibit variability that can significantly impact coating performance. The complex microstructural requirements of advanced TBCs demand precise control over porosity, columnar structure, and phase composition that remains difficult to achieve consistently at industrial scales.

Lifetime prediction models for TBCs remain insufficiently accurate for critical applications. The complex failure mechanisms involving oxidation, sintering, phase transformations, and mechanical damage accumulation are not fully captured in current predictive tools. This gap between predicted and actual service life creates significant uncertainty in maintenance scheduling and component design.

Emerging requirements for sensor integration and self-diagnostic capabilities in smart turbine systems present new challenges for TBC design. Traditional ceramic coatings are not conducive to embedding sensors or functional materials that could provide real-time monitoring of coating health and temperature distribution.

Cost considerations also remain significant, particularly for advanced ceramic compositions and deposition techniques. The economic viability of next-generation TBCs must balance performance improvements against increased manufacturing complexity and material costs, especially for large-scale industrial applications where cost sensitivity is high.

Durability under thermal cycling conditions presents another major challenge. The thermal expansion mismatch between ceramic top coats and metallic bond coats creates significant stress during operational cycling, leading to premature spallation and coating failure. This issue becomes particularly acute in applications requiring frequent start-up and shutdown sequences, such as in power generation turbines responding to fluctuating grid demands.

CMAS (calcium-magnesium-alumino-silicate) infiltration represents an increasingly problematic degradation mechanism. These environmental contaminants melt at high temperatures and penetrate the porous TBC structure, causing severe chemical and mechanical degradation upon cooling. As turbines operate in diverse environments worldwide, CMAS resistance has become a critical performance parameter that current coating systems struggle to address adequately.

Manufacturing consistency and quality control continue to challenge the industry. Plasma spray and electron beam physical vapor deposition (EB-PVD) processes, while well-established, still exhibit variability that can significantly impact coating performance. The complex microstructural requirements of advanced TBCs demand precise control over porosity, columnar structure, and phase composition that remains difficult to achieve consistently at industrial scales.

Lifetime prediction models for TBCs remain insufficiently accurate for critical applications. The complex failure mechanisms involving oxidation, sintering, phase transformations, and mechanical damage accumulation are not fully captured in current predictive tools. This gap between predicted and actual service life creates significant uncertainty in maintenance scheduling and component design.

Emerging requirements for sensor integration and self-diagnostic capabilities in smart turbine systems present new challenges for TBC design. Traditional ceramic coatings are not conducive to embedding sensors or functional materials that could provide real-time monitoring of coating health and temperature distribution.

Cost considerations also remain significant, particularly for advanced ceramic compositions and deposition techniques. The economic viability of next-generation TBCs must balance performance improvements against increased manufacturing complexity and material costs, especially for large-scale industrial applications where cost sensitivity is high.

Current Standardization Frameworks for TBCs

01 Yttria-stabilized zirconia (YSZ) thermal barrier coatings

Yttria-stabilized zirconia (YSZ) is widely used as a thermal barrier coating material due to its excellent thermal insulation properties and high temperature stability. These coatings typically consist of a ceramic top coat of YSZ applied over a metallic bond coat. The YSZ provides thermal protection to the underlying metal components in high-temperature environments such as gas turbine engines. Various deposition techniques including plasma spraying and electron beam physical vapor deposition (EB-PVD) are used to apply these coatings.- Yttria-stabilized zirconia (YSZ) thermal barrier coatings: Yttria-stabilized zirconia (YSZ) is widely used as a thermal barrier coating material due to its excellent thermal insulation properties and high temperature stability. These coatings typically contain 6-8 wt% yttria to stabilize the zirconia in its tetragonal phase, preventing phase transformations that could lead to coating failure. YSZ coatings provide effective thermal protection for metal components in high-temperature environments such as gas turbine engines.

- Multi-layer ceramic thermal barrier coating systems: Multi-layer ceramic coating systems consist of different ceramic layers with complementary properties to enhance overall performance. These systems typically include a bond coat, a thermally grown oxide layer, and one or more ceramic top coats. The layered structure helps to accommodate thermal expansion mismatch between the substrate and coating, improve adhesion, and provide better thermal insulation and erosion resistance than single-layer coatings.

- Advanced ceramic compositions for enhanced thermal barrier performance: Novel ceramic compositions have been developed to overcome the limitations of traditional thermal barrier materials. These include rare-earth zirconates, hafnates, pyrochlores, and perovskites that offer lower thermal conductivity and better phase stability at elevated temperatures. Some compositions incorporate multiple oxides or dopants to create complex crystal structures that scatter phonons more effectively, resulting in superior thermal insulation properties compared to conventional materials.

- Deposition methods for ceramic thermal barrier coatings: Various deposition techniques are used to apply ceramic thermal barrier coatings, including atmospheric plasma spraying (APS), electron beam physical vapor deposition (EB-PVD), suspension plasma spraying, and solution precursor plasma spraying. Each method produces coatings with different microstructures and properties. EB-PVD typically creates columnar structures with superior strain tolerance, while plasma spraying methods can produce lamellar structures with lower thermal conductivity. The choice of deposition method significantly affects coating performance and durability.

- Nanostructured ceramic thermal barrier coatings: Nanostructured ceramic coatings incorporate nanoscale features such as nanopores, nanoparticles, or nanolayers to enhance thermal barrier performance. These coatings exhibit significantly reduced thermal conductivity due to increased phonon scattering at interfaces. Nanostructured ceramics also demonstrate improved mechanical properties, including better erosion resistance and strain tolerance. Manufacturing techniques for these advanced coatings include solution-based methods, controlled crystallization processes, and specialized thermal spray parameters to preserve the nanoscale features during deposition.

02 Advanced ceramic compositions for enhanced thermal barrier performance

Novel ceramic compositions have been developed to enhance the performance of thermal barrier coatings beyond traditional YSZ. These include rare-earth zirconates, pyrochlores, hexaaluminates, and other complex oxide systems. These advanced ceramics offer benefits such as lower thermal conductivity, better phase stability at high temperatures, and improved resistance to calcium-magnesium-alumino-silicate (CMAS) infiltration. The compositions are engineered to provide longer service life and higher operating temperature capabilities for components in extreme thermal environments.Expand Specific Solutions03 Multilayer and functionally graded thermal barrier coating systems

Multilayer and functionally graded thermal barrier coating systems incorporate different ceramic materials in layers or with gradual compositional changes to optimize performance. These systems combine the beneficial properties of different ceramics, such as the excellent adhesion of YSZ with the lower thermal conductivity of gadolinium zirconate. The layered or graded structure helps mitigate thermal expansion mismatch stresses and improve durability. These advanced architectures can also incorporate porosity gradients to further enhance thermal insulation properties.Expand Specific Solutions04 Deposition methods for ceramic thermal barrier coatings

Various deposition techniques are employed to apply ceramic thermal barrier coatings, each offering distinct microstructural features and performance characteristics. Methods include atmospheric plasma spraying (APS), suspension plasma spraying (SPS), electron beam physical vapor deposition (EB-PVD), and solution precursor plasma spraying (SPPS). These techniques can create columnar structures, controlled porosity, or dense microstructures depending on application requirements. The deposition parameters significantly influence coating adhesion, strain tolerance, thermal conductivity, and erosion resistance.Expand Specific Solutions05 Environmental barrier aspects of ceramic thermal coatings

Ceramic thermal barrier coatings must also function as environmental barriers in many applications, protecting against hot corrosion, oxidation, and degradation from contaminants. These coatings are designed to resist infiltration by molten silicates (CMAS), sulfates, and other corrosive species present in combustion environments. Specialized ceramic compositions and microstructural features are incorporated to enhance resistance to these environmental attacks. Self-healing capabilities and reaction layers that form protective scales are being developed to extend coating lifetimes in aggressive operating conditions.Expand Specific Solutions

Leading Manufacturers and Research Institutions

The thermal barrier coatings (TBCs) market for gas turbines is in a mature growth phase, with increasing regulatory focus on performance standards and safety requirements. The global market is projected to expand significantly due to rising energy demands and efficiency requirements in power generation and aerospace sectors. Major players like General Electric, Siemens Energy, Rolls-Royce, and Mitsubishi Power dominate with established technological capabilities, while research institutions such as Xi'an Jiaotong University and Tsinghua University contribute to innovation. Chinese companies including CHINA UNITED GAS TURBINE TECHNOLOGY are emerging as significant competitors. Technical maturity varies across regions, with Western companies generally leading in advanced ceramic formulations, while Asian manufacturers are rapidly closing the technology gap through strategic R&D investments and university-industry collaborations.

Mitsubishi Heavy Industries, Ltd.

Technical Solution: Mitsubishi Heavy Industries has developed advanced thermal barrier coating systems for gas turbines featuring yttria-stabilized zirconia (YSZ) with 6-8% yttria content as the primary ceramic material. Their proprietary TBC systems utilize both air plasma spray (APS) and electron beam physical vapor deposition (EB-PVD) techniques, with the latter producing columnar microstructures that enhance strain tolerance during thermal cycling. MHI's TBC systems typically consist of a MCrAlY bond coat (150-250 μm thick) applied via low-pressure plasma spray (LPPS) or high-velocity oxygen fuel (HVOF) methods, followed by a ceramic top coat ranging from 200-500 μm in thickness. Their coatings comply with JIS H8304 standards for thermal spray coatings and ASTM C633 for adhesion strength testing, consistently achieving bond strengths exceeding 25 MPa. MHI has also developed specialized TBC formulations incorporating lanthanum zirconate and gadolinium zirconate for enhanced CMAS resistance, with thermal conductivity values as low as 0.9-1.3 W/m·K at operating temperatures. These advanced TBCs meet Japanese Industrial Safety and Health Law requirements and conform to ISO 13123 specifications for thermal spray process parameters. MHI's coating systems undergo rigorous thermal cycling testing (>1000 cycles at 1100°C) and erosion resistance evaluation per ASTM G76 standards.

Strengths: Extensive experience with J-series gas turbines operating at extremely high temperatures; strong integration of materials science with component design; sophisticated quality control systems. Weaknesses: Relatively complex manufacturing processes requiring specialized equipment; higher production costs for advanced ceramic compositions; some newer formulations have limited long-term field validation.

Siemens AG

Technical Solution: Siemens AG has developed comprehensive thermal barrier coating systems for gas turbines that utilize advanced ceramic formulations, primarily based on yttria-stabilized zirconia (YSZ) with 7-8 wt% yttria content. Their TBC systems incorporate both air plasma spray (APS) and electron beam physical vapor deposition (EB-PVD) techniques depending on component requirements. Siemens' proprietary multi-layer approach includes a MCrAlY bond coat (150-300 μm) applied via high-velocity oxygen fuel (HVOF) spraying, followed by a ceramic top coat (250-500 μm) with engineered porosity levels of 10-15%. Their TBCs comply with DIN EN ISO 17836 for thermal spray coating thickness measurement and DIN EN ISO 14923 for coating quality specifications. Siemens has pioneered gadolinium zirconate and ytterbium-doped YSZ compositions for enhanced CMAS resistance in harsh operating environments, achieving thermal conductivity values as low as 0.8 W/m·K at elevated temperatures. Their coating systems undergo rigorous qualification testing including thermal cycling (>1000 cycles at 1100°C), erosion resistance per ASTM G76, and bond strength testing per ASTM C633, consistently achieving adhesion strengths above 25 MPa while meeting European industrial emission standards (2010/75/EU) and German TA-Luft regulations.

Strengths: Extensive field experience across multiple gas turbine generations; sophisticated quality control systems; strong integration with component design and manufacturing processes. Weaknesses: Higher initial implementation costs; complex qualification requirements for new coating variants; specialized equipment needs for advanced deposition techniques.

Key Patents and Technical Literature Review

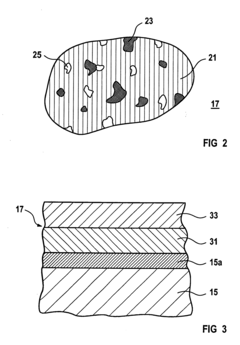

A gas turbine blade comprising a ceramic thermal barrier coating

PatentInactiveEP1445425A2

Innovation

- A porous ceramic thermal barrier coating composed of magnesium oxide grains in a magnesium aluminate matrix, with a specific thermal expansion coefficient matching that of the metallic base body, applied in a layered structure with varying porosity to optimize thermal insulation and corrosion resistance.

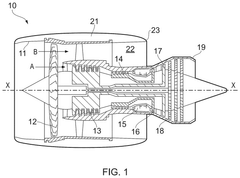

Thermal barrier structure and coating

PatentPendingUS20250256481A1

Innovation

- A thermal barrier structure comprising a first ceramic layer, a second metal foam layer, and a third layer interspersed with ceramic material, allowing for differential expansion and increased thickness without fracturing.

Regulatory Compliance Requirements Across Regions

Regulatory compliance for thermal barrier coatings (TBCs) in gas turbines varies significantly across different regions, with each jurisdiction establishing its own framework of standards and certification requirements. In North America, the Federal Aviation Administration (FAA) enforces stringent regulations through Advisory Circulars and Technical Standard Orders that specifically address ceramic coatings in high-temperature applications. These regulations are complemented by the ASTM C633 standard for adhesion strength testing and ASTM E2109 for thermal cycling resistance, which are mandatory for TBC certification in aerospace gas turbines.

The European Union implements a more integrated regulatory approach through the European Aviation Safety Agency (EASA) and the European Committee for Standardization (CEN). The EN 15648 standard specifically addresses ceramic thermal barrier coatings, requiring comprehensive documentation of material properties, manufacturing processes, and performance characteristics. Additionally, the EU's REACH regulation imposes strict controls on hazardous substances that may be used in coating formulations or manufacturing processes.

In Asia, regulatory frameworks show considerable variation. Japan's Ministry of Economy, Trade and Industry (METI) has established the JIS H8451 standard specifically for ceramic coatings in high-temperature applications. China's regulatory landscape is evolving rapidly, with the Civil Aviation Administration of China (CAAC) adopting many international standards while developing indigenous certification requirements through the GB/T framework, particularly GB/T 13912 for ceramic coatings.

International organizations play a crucial role in harmonizing these regional differences. The International Organization for Standardization (ISO) has developed ISO 13123 for thermal barrier coatings testing and ISO 17652 for quality assurance in thermal spray processes. These standards are increasingly being adopted globally, facilitating international trade and technology transfer in the gas turbine industry.

Compliance verification methodologies also differ across regions. The United States emphasizes third-party testing and certification through organizations like the National Aerospace and Defense Contractors Accreditation Program (NADCAP). European authorities typically require manufacturer self-certification supported by quality management systems conforming to EN 9100. Asian markets generally mandate government laboratory testing and certification, particularly for applications in critical infrastructure.

Recent regulatory trends indicate a movement toward performance-based standards rather than prescriptive requirements, allowing greater innovation in TBC technologies while maintaining safety and reliability. Additionally, environmental regulations are increasingly influencing TBC compliance requirements, with growing emphasis on reducing rare earth element usage and minimizing environmental impact throughout the coating lifecycle.

The European Union implements a more integrated regulatory approach through the European Aviation Safety Agency (EASA) and the European Committee for Standardization (CEN). The EN 15648 standard specifically addresses ceramic thermal barrier coatings, requiring comprehensive documentation of material properties, manufacturing processes, and performance characteristics. Additionally, the EU's REACH regulation imposes strict controls on hazardous substances that may be used in coating formulations or manufacturing processes.

In Asia, regulatory frameworks show considerable variation. Japan's Ministry of Economy, Trade and Industry (METI) has established the JIS H8451 standard specifically for ceramic coatings in high-temperature applications. China's regulatory landscape is evolving rapidly, with the Civil Aviation Administration of China (CAAC) adopting many international standards while developing indigenous certification requirements through the GB/T framework, particularly GB/T 13912 for ceramic coatings.

International organizations play a crucial role in harmonizing these regional differences. The International Organization for Standardization (ISO) has developed ISO 13123 for thermal barrier coatings testing and ISO 17652 for quality assurance in thermal spray processes. These standards are increasingly being adopted globally, facilitating international trade and technology transfer in the gas turbine industry.

Compliance verification methodologies also differ across regions. The United States emphasizes third-party testing and certification through organizations like the National Aerospace and Defense Contractors Accreditation Program (NADCAP). European authorities typically require manufacturer self-certification supported by quality management systems conforming to EN 9100. Asian markets generally mandate government laboratory testing and certification, particularly for applications in critical infrastructure.

Recent regulatory trends indicate a movement toward performance-based standards rather than prescriptive requirements, allowing greater innovation in TBC technologies while maintaining safety and reliability. Additionally, environmental regulations are increasingly influencing TBC compliance requirements, with growing emphasis on reducing rare earth element usage and minimizing environmental impact throughout the coating lifecycle.

Environmental Impact and Sustainability Considerations

The environmental impact of thermal barrier coatings (TBCs) in gas turbines extends beyond their primary function of thermal protection. As regulatory frameworks evolve globally, manufacturers must increasingly consider the full lifecycle environmental footprint of these ceramic materials. Current standards, such as ISO 14001 and the EU's Environmental Management System requirements, mandate comprehensive environmental impact assessments for TBC production processes, focusing particularly on resource consumption and emissions.

Manufacturing of ceramic TBCs typically involves energy-intensive processes including plasma spraying and electron beam physical vapor deposition. These processes generate significant carbon emissions, with estimates suggesting that the production of advanced ceramic coatings can contribute up to 15-20% of a gas turbine component's total carbon footprint. Regulatory bodies, including the EPA in the United States and the European Environmental Agency, have established increasingly stringent limits on these manufacturing emissions.

The raw material extraction for TBC ceramics presents another environmental concern addressed by emerging regulations. Rare earth elements like yttrium, commonly used in yttria-stabilized zirconia (YSZ) coatings, face scrutiny due to environmentally damaging mining practices. The EU's Raw Materials Initiative and similar frameworks in Japan and South Korea now require sustainability certifications for these supply chains, with penalties for non-compliance becoming increasingly severe.

End-of-life considerations for TBC components have gained regulatory attention, particularly regarding the potential leaching of toxic elements from disposed turbine parts. The EU Waste Electrical and Electronic Equipment (WEEE) Directive and similar regulations in other jurisdictions now classify spent turbine components as specialized waste requiring controlled disposal protocols. This has prompted industry leaders like General Electric and Siemens to develop recycling programs for ceramic-coated components.

Recent sustainability innovations in TBC technology include the development of water-based ceramic slurries that reduce volatile organic compound emissions during application, responding to air quality regulations such as the Clean Air Act amendments. Additionally, research into bio-inspired ceramic structures has shown promise for reducing raw material requirements while maintaining thermal performance, aligning with resource efficiency standards promoted by the International Energy Agency's sustainable manufacturing guidelines.

The regulatory landscape continues to evolve toward lifecycle thinking, with upcoming standards expected to require quantifiable sustainability metrics for TBC systems, including embodied carbon calculations and circular economy considerations. This shift represents both a compliance challenge and an innovation opportunity for gas turbine manufacturers seeking competitive advantage in increasingly environmentally conscious markets.

Manufacturing of ceramic TBCs typically involves energy-intensive processes including plasma spraying and electron beam physical vapor deposition. These processes generate significant carbon emissions, with estimates suggesting that the production of advanced ceramic coatings can contribute up to 15-20% of a gas turbine component's total carbon footprint. Regulatory bodies, including the EPA in the United States and the European Environmental Agency, have established increasingly stringent limits on these manufacturing emissions.

The raw material extraction for TBC ceramics presents another environmental concern addressed by emerging regulations. Rare earth elements like yttrium, commonly used in yttria-stabilized zirconia (YSZ) coatings, face scrutiny due to environmentally damaging mining practices. The EU's Raw Materials Initiative and similar frameworks in Japan and South Korea now require sustainability certifications for these supply chains, with penalties for non-compliance becoming increasingly severe.

End-of-life considerations for TBC components have gained regulatory attention, particularly regarding the potential leaching of toxic elements from disposed turbine parts. The EU Waste Electrical and Electronic Equipment (WEEE) Directive and similar regulations in other jurisdictions now classify spent turbine components as specialized waste requiring controlled disposal protocols. This has prompted industry leaders like General Electric and Siemens to develop recycling programs for ceramic-coated components.

Recent sustainability innovations in TBC technology include the development of water-based ceramic slurries that reduce volatile organic compound emissions during application, responding to air quality regulations such as the Clean Air Act amendments. Additionally, research into bio-inspired ceramic structures has shown promise for reducing raw material requirements while maintaining thermal performance, aligning with resource efficiency standards promoted by the International Energy Agency's sustainable manufacturing guidelines.

The regulatory landscape continues to evolve toward lifecycle thinking, with upcoming standards expected to require quantifiable sustainability metrics for TBC systems, including embodied carbon calculations and circular economy considerations. This shift represents both a compliance challenge and an innovation opportunity for gas turbine manufacturers seeking competitive advantage in increasingly environmentally conscious markets.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!