Strategic Forecasts in Dimethyl Ether Market Expansion

JUL 1, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

DME Market Evolution

The dimethyl ether (DME) market has undergone significant evolution over the past few decades, driven by increasing demand for clean-burning alternative fuels and the growing emphasis on reducing greenhouse gas emissions. Initially developed as a propellant for aerosol products, DME has since found applications in various sectors, particularly as a substitute for liquefied petroleum gas (LPG) and diesel fuel.

In the early stages of its market development, DME was primarily produced as a byproduct of methanol synthesis. However, as demand grew, dedicated DME production facilities began to emerge, utilizing diverse feedstocks such as natural gas, coal, and biomass. This diversification in production methods has played a crucial role in expanding the market and improving the economic viability of DME as an alternative fuel.

The Asia-Pacific region, particularly China, has been at the forefront of DME market growth. China's government-backed initiatives to promote DME as a cleaner alternative to coal and traditional fuels have significantly boosted market expansion in the region. Other countries, including Japan, South Korea, and India, have also shown increasing interest in DME, further driving market growth in Asia.

Europe and North America have seen a slower adoption of DME, primarily due to the established infrastructure for conventional fuels and the competition from other alternative energy sources. However, recent years have witnessed a growing interest in DME in these regions, particularly for its potential in reducing carbon emissions in the transportation sector.

The DME market has also been influenced by technological advancements in production processes and end-use applications. Improvements in catalytic conversion technologies have enhanced the efficiency of DME production, while innovations in engine design have expanded its potential use in automotive and power generation sectors.

Environmental regulations and policies have played a significant role in shaping the DME market landscape. Stringent emission standards and incentives for clean energy adoption have created favorable conditions for DME market growth in many countries. The Paris Agreement and subsequent national commitments to reduce carbon emissions have further bolstered the prospects for DME as a low-carbon alternative fuel.

Looking ahead, the DME market is poised for continued expansion, driven by increasing environmental concerns, energy security considerations, and technological advancements. The potential for DME in the hydrogen economy, as a hydrogen carrier, presents new opportunities for market growth. Additionally, the integration of DME production with renewable energy sources and carbon capture technologies could further enhance its environmental credentials and market appeal.

In the early stages of its market development, DME was primarily produced as a byproduct of methanol synthesis. However, as demand grew, dedicated DME production facilities began to emerge, utilizing diverse feedstocks such as natural gas, coal, and biomass. This diversification in production methods has played a crucial role in expanding the market and improving the economic viability of DME as an alternative fuel.

The Asia-Pacific region, particularly China, has been at the forefront of DME market growth. China's government-backed initiatives to promote DME as a cleaner alternative to coal and traditional fuels have significantly boosted market expansion in the region. Other countries, including Japan, South Korea, and India, have also shown increasing interest in DME, further driving market growth in Asia.

Europe and North America have seen a slower adoption of DME, primarily due to the established infrastructure for conventional fuels and the competition from other alternative energy sources. However, recent years have witnessed a growing interest in DME in these regions, particularly for its potential in reducing carbon emissions in the transportation sector.

The DME market has also been influenced by technological advancements in production processes and end-use applications. Improvements in catalytic conversion technologies have enhanced the efficiency of DME production, while innovations in engine design have expanded its potential use in automotive and power generation sectors.

Environmental regulations and policies have played a significant role in shaping the DME market landscape. Stringent emission standards and incentives for clean energy adoption have created favorable conditions for DME market growth in many countries. The Paris Agreement and subsequent national commitments to reduce carbon emissions have further bolstered the prospects for DME as a low-carbon alternative fuel.

Looking ahead, the DME market is poised for continued expansion, driven by increasing environmental concerns, energy security considerations, and technological advancements. The potential for DME in the hydrogen economy, as a hydrogen carrier, presents new opportunities for market growth. Additionally, the integration of DME production with renewable energy sources and carbon capture technologies could further enhance its environmental credentials and market appeal.

Global DME Demand Analysis

The global demand for dimethyl ether (DME) has been steadily increasing, driven by its versatile applications across various industries. As a clean-burning, non-toxic fuel alternative, DME has gained significant attention in recent years, particularly in the energy and transportation sectors. The market demand analysis reveals a complex interplay of factors influencing the growth trajectory of DME consumption worldwide.

In the energy sector, DME has emerged as a promising substitute for liquefied petroleum gas (LPG) and diesel fuel. Its low emissions profile and high cetane number make it an attractive option for countries seeking to reduce their carbon footprint and improve air quality. This has led to a surge in demand from developing economies, especially in Asia, where rapid industrialization and urbanization have intensified the need for cleaner energy sources.

The transportation industry has also shown increasing interest in DME as a potential replacement for conventional diesel fuel in heavy-duty vehicles. Several major automotive manufacturers have conducted trials and pilot projects to assess the feasibility of DME-powered trucks and buses. This growing interest has contributed to a steady rise in demand, particularly in regions with stringent emissions regulations.

In the chemical industry, DME serves as a crucial intermediate in the production of various compounds, including methyl acetate, dimethyl sulfate, and acetic acid. The expanding chemical manufacturing sector, especially in emerging economies, has further bolstered the global demand for DME. Additionally, its use as an aerosol propellant in personal care and household products has created a niche market segment with consistent growth potential.

Regional variations in DME demand are notable, with Asia-Pacific leading the global market. China, in particular, has been at the forefront of DME adoption, driven by government initiatives to promote cleaner fuels and reduce dependence on imported energy sources. Other significant markets include Japan, South Korea, and India, where DME is increasingly viewed as a strategic component in their energy diversification plans.

Europe and North America have also shown growing interest in DME, primarily due to its potential in reducing greenhouse gas emissions from the transportation sector. However, the pace of adoption in these regions has been relatively slower compared to Asia, largely due to the established infrastructure for conventional fuels and the need for significant investments in DME production and distribution networks.

The agricultural sector presents another avenue for DME demand growth, particularly in developing countries. DME's potential as a cooking fuel alternative to traditional biomass and kerosene has garnered attention from policymakers and international development organizations. This application could drive substantial demand in rural areas of Africa and South Asia, where access to clean cooking fuels remains a challenge.

Looking ahead, the global DME demand is expected to continue its upward trajectory, supported by ongoing research and development efforts to expand its applications and improve production efficiencies. The push towards cleaner energy sources and the increasing focus on circular economy principles are likely to further catalyze DME adoption across various industries, potentially reshaping the global energy landscape in the coming decades.

In the energy sector, DME has emerged as a promising substitute for liquefied petroleum gas (LPG) and diesel fuel. Its low emissions profile and high cetane number make it an attractive option for countries seeking to reduce their carbon footprint and improve air quality. This has led to a surge in demand from developing economies, especially in Asia, where rapid industrialization and urbanization have intensified the need for cleaner energy sources.

The transportation industry has also shown increasing interest in DME as a potential replacement for conventional diesel fuel in heavy-duty vehicles. Several major automotive manufacturers have conducted trials and pilot projects to assess the feasibility of DME-powered trucks and buses. This growing interest has contributed to a steady rise in demand, particularly in regions with stringent emissions regulations.

In the chemical industry, DME serves as a crucial intermediate in the production of various compounds, including methyl acetate, dimethyl sulfate, and acetic acid. The expanding chemical manufacturing sector, especially in emerging economies, has further bolstered the global demand for DME. Additionally, its use as an aerosol propellant in personal care and household products has created a niche market segment with consistent growth potential.

Regional variations in DME demand are notable, with Asia-Pacific leading the global market. China, in particular, has been at the forefront of DME adoption, driven by government initiatives to promote cleaner fuels and reduce dependence on imported energy sources. Other significant markets include Japan, South Korea, and India, where DME is increasingly viewed as a strategic component in their energy diversification plans.

Europe and North America have also shown growing interest in DME, primarily due to its potential in reducing greenhouse gas emissions from the transportation sector. However, the pace of adoption in these regions has been relatively slower compared to Asia, largely due to the established infrastructure for conventional fuels and the need for significant investments in DME production and distribution networks.

The agricultural sector presents another avenue for DME demand growth, particularly in developing countries. DME's potential as a cooking fuel alternative to traditional biomass and kerosene has garnered attention from policymakers and international development organizations. This application could drive substantial demand in rural areas of Africa and South Asia, where access to clean cooking fuels remains a challenge.

Looking ahead, the global DME demand is expected to continue its upward trajectory, supported by ongoing research and development efforts to expand its applications and improve production efficiencies. The push towards cleaner energy sources and the increasing focus on circular economy principles are likely to further catalyze DME adoption across various industries, potentially reshaping the global energy landscape in the coming decades.

DME Production Challenges

The production of dimethyl ether (DME) faces several significant challenges that impact its market expansion and widespread adoption as an alternative fuel. One of the primary obstacles is the high capital cost associated with DME production facilities. The infrastructure required for large-scale DME production involves substantial investment, which can deter potential producers and slow market growth.

Another critical challenge lies in the feedstock availability and price volatility. DME can be produced from various sources, including natural gas, coal, and biomass. However, the fluctuating prices of these raw materials can significantly affect the economic viability of DME production. This uncertainty in feedstock costs makes it difficult for producers to maintain consistent pricing and profitability.

The energy efficiency of the DME production process also presents a challenge. While improvements have been made, there is still room for optimization in the conversion of feedstock to DME. The energy-intensive nature of the process can impact the overall environmental benefits of DME as a clean fuel alternative, particularly when fossil fuels are used as feedstock.

Technical issues in the production process pose additional challenges. The synthesis of DME typically involves a two-step process: first, the production of syngas, and then its conversion to DME. Each step has its own set of technical complexities, including catalyst performance, reaction conditions, and process control. Improving catalyst efficiency and longevity remains an ongoing area of research to enhance DME yield and reduce production costs.

Scale-up challenges also exist when moving from pilot plants to commercial-scale production. Ensuring consistent product quality and maintaining process efficiency at larger scales can be problematic. This scaling issue can lead to delays in commercialization and increased costs during the early stages of market expansion.

Furthermore, the handling and storage of DME require specialized equipment due to its properties as a compressed gas at room temperature. This necessitates investment in appropriate storage and transportation infrastructure, which can be a barrier to entry for some markets or regions.

Regulatory challenges and the lack of standardized specifications for DME as a fuel in many regions also hinder its production and market growth. The absence of clear regulatory frameworks can create uncertainty for producers and potential investors, slowing down the development of the DME market.

Addressing these production challenges is crucial for the strategic expansion of the DME market. Overcoming these hurdles will require continued technological innovation, supportive policy frameworks, and collaborative efforts across the industry to improve production efficiency and reduce costs.

Another critical challenge lies in the feedstock availability and price volatility. DME can be produced from various sources, including natural gas, coal, and biomass. However, the fluctuating prices of these raw materials can significantly affect the economic viability of DME production. This uncertainty in feedstock costs makes it difficult for producers to maintain consistent pricing and profitability.

The energy efficiency of the DME production process also presents a challenge. While improvements have been made, there is still room for optimization in the conversion of feedstock to DME. The energy-intensive nature of the process can impact the overall environmental benefits of DME as a clean fuel alternative, particularly when fossil fuels are used as feedstock.

Technical issues in the production process pose additional challenges. The synthesis of DME typically involves a two-step process: first, the production of syngas, and then its conversion to DME. Each step has its own set of technical complexities, including catalyst performance, reaction conditions, and process control. Improving catalyst efficiency and longevity remains an ongoing area of research to enhance DME yield and reduce production costs.

Scale-up challenges also exist when moving from pilot plants to commercial-scale production. Ensuring consistent product quality and maintaining process efficiency at larger scales can be problematic. This scaling issue can lead to delays in commercialization and increased costs during the early stages of market expansion.

Furthermore, the handling and storage of DME require specialized equipment due to its properties as a compressed gas at room temperature. This necessitates investment in appropriate storage and transportation infrastructure, which can be a barrier to entry for some markets or regions.

Regulatory challenges and the lack of standardized specifications for DME as a fuel in many regions also hinder its production and market growth. The absence of clear regulatory frameworks can create uncertainty for producers and potential investors, slowing down the development of the DME market.

Addressing these production challenges is crucial for the strategic expansion of the DME market. Overcoming these hurdles will require continued technological innovation, supportive policy frameworks, and collaborative efforts across the industry to improve production efficiency and reduce costs.

Current DME Production Methods

01 Production methods for dimethyl ether

Various methods for producing dimethyl ether are explored, including catalytic dehydration of methanol, direct synthesis from syngas, and conversion of biomass. These processes aim to improve efficiency and yield, contributing to the expansion of the dimethyl ether market.- Production methods for dimethyl ether: Various methods for producing dimethyl ether are explored, including catalytic dehydration of methanol, direct synthesis from syngas, and conversion of biomass. These processes aim to improve efficiency and reduce production costs, contributing to market expansion.

- Catalysts for dimethyl ether synthesis: Development of novel catalysts to enhance the production of dimethyl ether. These catalysts are designed to improve selectivity, increase yield, and operate under milder conditions, making the production process more economical and environmentally friendly.

- Applications in fuel and energy sectors: Expansion of dimethyl ether use in fuel and energy applications, including as a clean-burning diesel substitute, LPG alternative, and in power generation. These applications drive market growth by offering environmentally friendly alternatives to traditional fuels.

- Industrial and chemical applications: Utilization of dimethyl ether in various industrial and chemical processes, such as aerosol propellants, refrigerants, and as a raw material for other chemical products. These diverse applications contribute to the expansion of the dimethyl ether market.

- Market expansion strategies and technologies: Development of new technologies and strategies to expand the dimethyl ether market, including improved storage and transportation methods, integration with existing infrastructure, and promotion of dimethyl ether as a versatile and eco-friendly chemical.

02 Catalysts for dimethyl ether synthesis

Development of novel catalysts and catalyst systems to enhance the production of dimethyl ether. These catalysts are designed to improve selectivity, reduce byproducts, and increase overall efficiency in the conversion process, supporting market growth.Expand Specific Solutions03 Applications in fuel and energy sectors

Expansion of dimethyl ether use in fuel and energy applications, including as a clean-burning diesel substitute, refrigerant, and propellant. These applications drive market growth by offering environmentally friendly alternatives to traditional fuels.Expand Specific Solutions04 Process optimization and scale-up

Innovations in process design, optimization, and scale-up techniques for dimethyl ether production. These advancements aim to increase production capacity, reduce costs, and improve overall efficiency, facilitating market expansion.Expand Specific Solutions05 Integration with renewable resources

Exploration of methods to produce dimethyl ether from renewable resources, such as biomass and waste materials. This approach aims to create a more sustainable production process and expand the market by aligning with green energy initiatives.Expand Specific Solutions

Key DME Industry Players

The dimethyl ether (DME) market is in a growth phase, driven by increasing demand for clean-burning alternative fuels. The global market size is projected to expand significantly in the coming years, with Asia-Pacific emerging as a key region. Technologically, DME production is relatively mature, with established processes for synthesis from various feedstocks. Key players like China Petroleum & Chemical Corp., SK Energy, and BP are investing in large-scale production facilities. Research institutions such as Dalian University of Technology and CSIR are advancing DME applications. While major oil and gas companies dominate production, specialized chemical firms like Haldor Topsøe are developing catalysts and process technologies to improve efficiency and reduce costs.

China Petroleum & Chemical Corp.

Technical Solution: China Petroleum & Chemical Corp. (Sinopec) has been at the forefront of dimethyl ether (DME) market expansion. They have developed a proprietary technology for large-scale DME production from syngas, with a capacity of up to 1 million tons per year[1]. Their process involves a single-step synthesis method, which combines methanol synthesis and dehydration in one reactor, improving efficiency and reducing costs[2]. Sinopec has also invested in DME as a clean alternative fuel, establishing fueling stations and promoting its use in vehicles and household cooking[3]. Their research focuses on improving catalyst performance and process optimization to enhance DME yield and purity[4].

Strengths: Vertically integrated operations from production to distribution, large-scale production capacity, and established market presence. Weaknesses: Dependence on coal-based feedstock, which may face environmental scrutiny in the long term.

Linde GmbH

Technical Solution: Linde GmbH has developed a comprehensive portfolio of technologies for DME production and application. Their approach includes both traditional fossil-based and renewable pathways. Linde's Carbo-V® technology enables the production of DME from biomass, offering a more sustainable route[8]. They have also focused on small-to-medium scale DME plants, with capacities ranging from 20 to 200 ktpa, catering to diverse market needs[9]. Linde's process design emphasizes energy efficiency, with reported energy savings of up to 20% compared to conventional methods[10]. Additionally, they have developed cryogenic technologies for DME purification and handling, ensuring high-quality product for various applications.

Strengths: Diverse technology portfolio, expertise in gas processing and handling, global presence. Weaknesses: Less focus on large-scale DME production compared to some competitors.

DME Synthesis Innovations

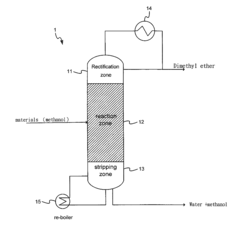

Method for Making Dimethyl Ether by Reactive-Distillation

PatentInactiveUS20120232311A1

Innovation

- A reactive distillation tower with defined zones, operated at specific temperature and pressure conditions, using a catalyst-filled reaction zone and incorporating a condenser and re-boiler to enhance conversion efficiency and reduce energy consumption, allowing for a single, smaller, and less expensive equipment setup.

Process for preparing dimethyl ether from crude methanol

PatentInactiveUS6740783B1

Innovation

- A process using a hydrophobic zeolite catalyst with partially replaced hydrogen cations, represented by the formula HxM(1-x)/nZ, which maintains catalytic activity and prevents hydrocarbon generation when using crude methanol containing water, optimizing the SiO2/Al2O3 ratio and adjusting acid site strength to enhance dimethyl ether yield.

DME Environmental Impact

The environmental impact of dimethyl ether (DME) is a critical consideration in its market expansion. DME is increasingly recognized as a cleaner alternative to conventional fossil fuels, particularly in the transportation and energy sectors. Its combustion produces significantly lower emissions of particulate matter, nitrogen oxides, and sulfur oxides compared to diesel fuel, contributing to improved air quality in urban areas.

One of the key environmental advantages of DME is its potential to reduce greenhouse gas emissions. When produced from renewable sources such as biomass or captured carbon dioxide, DME can offer a near-carbon-neutral fuel option. This aligns with global efforts to mitigate climate change and transition towards low-carbon energy systems. The lifecycle carbon footprint of DME varies depending on its production pathway, with bio-based DME showing particularly promising results in terms of carbon reduction.

DME's physical properties also contribute to its environmental benefits. As a gas at ambient conditions, DME vaporizes quickly if spilled, reducing the risk of soil and water contamination compared to liquid fuels. This characteristic makes DME safer to handle and transport, minimizing environmental risks associated with fuel logistics.

In the context of air quality management, DME's clean-burning properties make it an attractive option for reducing urban pollution. Its use in heavy-duty vehicles and industrial applications can lead to significant reductions in smog-forming emissions, potentially improving public health outcomes in densely populated areas.

However, the environmental impact of DME is not without challenges. The production of DME, especially from fossil sources, still involves energy-intensive processes that can offset some of its environmental benefits. Addressing these production-related emissions is crucial for maximizing DME's positive environmental impact.

The expansion of DME infrastructure also raises environmental considerations. While DME can utilize existing LPG infrastructure to some extent, the development of new production facilities and distribution networks may have localized environmental impacts that need to be carefully managed.

As the DME market expands, lifecycle assessments and environmental impact studies will play a crucial role in guiding policy decisions and industry practices. These assessments will need to consider not only the direct emissions from DME use but also the broader implications of its production and distribution on ecosystems and resource consumption.

In conclusion, while DME offers significant environmental advantages, particularly in terms of air quality and greenhouse gas reduction, its overall environmental impact will depend on factors such as production methods, feedstock sources, and infrastructure development. Strategic market expansion of DME will need to prioritize sustainable production practices and efficient distribution systems to fully realize its potential as an environmentally friendly fuel alternative.

One of the key environmental advantages of DME is its potential to reduce greenhouse gas emissions. When produced from renewable sources such as biomass or captured carbon dioxide, DME can offer a near-carbon-neutral fuel option. This aligns with global efforts to mitigate climate change and transition towards low-carbon energy systems. The lifecycle carbon footprint of DME varies depending on its production pathway, with bio-based DME showing particularly promising results in terms of carbon reduction.

DME's physical properties also contribute to its environmental benefits. As a gas at ambient conditions, DME vaporizes quickly if spilled, reducing the risk of soil and water contamination compared to liquid fuels. This characteristic makes DME safer to handle and transport, minimizing environmental risks associated with fuel logistics.

In the context of air quality management, DME's clean-burning properties make it an attractive option for reducing urban pollution. Its use in heavy-duty vehicles and industrial applications can lead to significant reductions in smog-forming emissions, potentially improving public health outcomes in densely populated areas.

However, the environmental impact of DME is not without challenges. The production of DME, especially from fossil sources, still involves energy-intensive processes that can offset some of its environmental benefits. Addressing these production-related emissions is crucial for maximizing DME's positive environmental impact.

The expansion of DME infrastructure also raises environmental considerations. While DME can utilize existing LPG infrastructure to some extent, the development of new production facilities and distribution networks may have localized environmental impacts that need to be carefully managed.

As the DME market expands, lifecycle assessments and environmental impact studies will play a crucial role in guiding policy decisions and industry practices. These assessments will need to consider not only the direct emissions from DME use but also the broader implications of its production and distribution on ecosystems and resource consumption.

In conclusion, while DME offers significant environmental advantages, particularly in terms of air quality and greenhouse gas reduction, its overall environmental impact will depend on factors such as production methods, feedstock sources, and infrastructure development. Strategic market expansion of DME will need to prioritize sustainable production practices and efficient distribution systems to fully realize its potential as an environmentally friendly fuel alternative.

DME Policy Landscape

The global policy landscape for dimethyl ether (DME) is evolving rapidly as governments and industries recognize its potential as a clean-burning, renewable fuel alternative. In many countries, policies are being implemented to promote DME production and usage, particularly in the transportation and energy sectors.

In the United States, the Environmental Protection Agency (EPA) has approved DME as a renewable fuel under the Renewable Fuel Standard (RFS) program. This classification allows DME producers to generate Renewable Identification Numbers (RINs), providing economic incentives for production and blending. Additionally, several states have introduced legislation to include DME in their low-carbon fuel standards, further encouraging its adoption.

The European Union has set ambitious targets for renewable energy in transportation, with DME playing a potential role in meeting these goals. The Renewable Energy Directive II (RED II) includes DME as an eligible renewable fuel, promoting its use in heavy-duty vehicles and marine applications. Countries like Sweden and Denmark have implemented tax incentives for DME production and consumption, positioning themselves as leaders in the European DME market.

In Asia, China has been at the forefront of DME policy development. The government has included DME in its national energy strategy, offering subsidies for DME production facilities and supporting research and development efforts. Japan has also shown interest in DME, with policies aimed at diversifying its energy mix and reducing dependence on imported fossil fuels.

Developing countries are increasingly recognizing DME's potential to address energy access issues. India, for instance, has included DME in its National Policy on Biofuels, encouraging its production from agricultural residues and other renewable sources. This aligns with the country's goals of reducing oil imports and promoting clean cooking fuels in rural areas.

International organizations are also playing a role in shaping DME policies. The International Energy Agency (IEA) has highlighted DME as a promising alternative fuel in its reports, influencing policy discussions at the global level. The United Nations' Sustainable Development Goals (SDGs) provide a framework for countries to integrate DME into their energy and environmental strategies.

As the DME market expands, policy harmonization efforts are emerging. Industry associations and intergovernmental bodies are working to establish common standards for DME production, quality, and use across different regions. These efforts aim to facilitate international trade and accelerate global adoption of DME technologies.

However, challenges remain in the policy landscape. Some countries still lack specific regulations for DME, creating uncertainty for investors and producers. Balancing DME promotion with existing fossil fuel interests and infrastructure also presents policy dilemmas for many governments. As the market evolves, ongoing policy adjustments will be necessary to address these challenges and capitalize on DME's potential as a sustainable energy solution.

In the United States, the Environmental Protection Agency (EPA) has approved DME as a renewable fuel under the Renewable Fuel Standard (RFS) program. This classification allows DME producers to generate Renewable Identification Numbers (RINs), providing economic incentives for production and blending. Additionally, several states have introduced legislation to include DME in their low-carbon fuel standards, further encouraging its adoption.

The European Union has set ambitious targets for renewable energy in transportation, with DME playing a potential role in meeting these goals. The Renewable Energy Directive II (RED II) includes DME as an eligible renewable fuel, promoting its use in heavy-duty vehicles and marine applications. Countries like Sweden and Denmark have implemented tax incentives for DME production and consumption, positioning themselves as leaders in the European DME market.

In Asia, China has been at the forefront of DME policy development. The government has included DME in its national energy strategy, offering subsidies for DME production facilities and supporting research and development efforts. Japan has also shown interest in DME, with policies aimed at diversifying its energy mix and reducing dependence on imported fossil fuels.

Developing countries are increasingly recognizing DME's potential to address energy access issues. India, for instance, has included DME in its National Policy on Biofuels, encouraging its production from agricultural residues and other renewable sources. This aligns with the country's goals of reducing oil imports and promoting clean cooking fuels in rural areas.

International organizations are also playing a role in shaping DME policies. The International Energy Agency (IEA) has highlighted DME as a promising alternative fuel in its reports, influencing policy discussions at the global level. The United Nations' Sustainable Development Goals (SDGs) provide a framework for countries to integrate DME into their energy and environmental strategies.

As the DME market expands, policy harmonization efforts are emerging. Industry associations and intergovernmental bodies are working to establish common standards for DME production, quality, and use across different regions. These efforts aim to facilitate international trade and accelerate global adoption of DME technologies.

However, challenges remain in the policy landscape. Some countries still lack specific regulations for DME, creating uncertainty for investors and producers. Balancing DME promotion with existing fossil fuel interests and infrastructure also presents policy dilemmas for many governments. As the market evolves, ongoing policy adjustments will be necessary to address these challenges and capitalize on DME's potential as a sustainable energy solution.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!