Strategies for Market Penetration of Self-Powered Sensor Technologies

OCT 21, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Self-Powered Sensor Technology Background and Objectives

Self-powered sensor technologies have evolved significantly over the past two decades, transitioning from laboratory curiosities to commercially viable solutions. These technologies harness ambient energy sources such as vibration, thermal gradients, light, and RF signals to power sensing devices without the need for batteries or wired connections. The evolution began with basic piezoelectric and thermoelectric generators in the early 2000s, progressing to more sophisticated triboelectric nanogenerators and hybrid energy harvesting systems in recent years.

The technological trajectory has been characterized by continuous improvements in energy conversion efficiency, miniaturization, and integration capabilities. Early self-powered sensors could generate only microwatts of power, limiting their application scope. Modern systems can now produce milliwatts, enabling more complex sensing and communication functions while maintaining compact form factors.

A significant trend in this field is the convergence with other emerging technologies, particularly IoT architectures, edge computing, and advanced materials science. This convergence has expanded the potential application landscape from simple environmental monitoring to complex industrial automation, healthcare diagnostics, and smart infrastructure systems.

The primary technical objective for self-powered sensor technologies is to achieve true perpetual operation without maintenance intervention. This requires not only efficient energy harvesting but also ultra-low-power sensing circuits, intelligent power management systems, and robust energy storage solutions that can withstand environmental variations and aging effects.

Secondary objectives include enhancing interoperability with existing sensor networks, developing standardized interfaces for seamless integration, and creating scalable manufacturing processes to reduce production costs. The cost factor remains particularly critical for market penetration, as self-powered solutions must compete with conventional battery-powered alternatives on both performance and economic grounds.

From a sustainability perspective, self-powered sensors aim to eliminate the environmental impact associated with battery disposal and replacement logistics. This aligns with global initiatives for reducing electronic waste and carbon footprints in technological deployments.

The research community is increasingly focused on developing application-specific optimizations rather than general-purpose solutions. This targeted approach recognizes that energy availability varies dramatically across deployment environments, necessitating customized harvesting and storage strategies for different use cases such as industrial monitoring, wearable health devices, or environmental sensing networks.

The technological trajectory has been characterized by continuous improvements in energy conversion efficiency, miniaturization, and integration capabilities. Early self-powered sensors could generate only microwatts of power, limiting their application scope. Modern systems can now produce milliwatts, enabling more complex sensing and communication functions while maintaining compact form factors.

A significant trend in this field is the convergence with other emerging technologies, particularly IoT architectures, edge computing, and advanced materials science. This convergence has expanded the potential application landscape from simple environmental monitoring to complex industrial automation, healthcare diagnostics, and smart infrastructure systems.

The primary technical objective for self-powered sensor technologies is to achieve true perpetual operation without maintenance intervention. This requires not only efficient energy harvesting but also ultra-low-power sensing circuits, intelligent power management systems, and robust energy storage solutions that can withstand environmental variations and aging effects.

Secondary objectives include enhancing interoperability with existing sensor networks, developing standardized interfaces for seamless integration, and creating scalable manufacturing processes to reduce production costs. The cost factor remains particularly critical for market penetration, as self-powered solutions must compete with conventional battery-powered alternatives on both performance and economic grounds.

From a sustainability perspective, self-powered sensors aim to eliminate the environmental impact associated with battery disposal and replacement logistics. This aligns with global initiatives for reducing electronic waste and carbon footprints in technological deployments.

The research community is increasingly focused on developing application-specific optimizations rather than general-purpose solutions. This targeted approach recognizes that energy availability varies dramatically across deployment environments, necessitating customized harvesting and storage strategies for different use cases such as industrial monitoring, wearable health devices, or environmental sensing networks.

Market Demand Analysis for Self-Powered Sensors

The global market for self-powered sensors is experiencing robust growth, driven by increasing demand for autonomous and maintenance-free sensing solutions across multiple industries. Current market valuations indicate that the self-powered sensor market reached approximately 2.5 billion USD in 2022, with projections suggesting a compound annual growth rate (CAGR) of 13-15% through 2030, potentially reaching 8.7 billion USD by the end of the decade.

Industrial IoT applications represent the largest market segment, accounting for roughly 35% of current demand. This is primarily due to the significant advantages self-powered sensors offer in remote monitoring of industrial equipment, predictive maintenance, and process optimization without requiring battery replacements or wired power infrastructure. The elimination of maintenance costs and downtime presents compelling economic benefits for industrial adopters.

Smart building applications follow as the second-largest market segment at approximately 22% of current demand. Energy harvesting sensors for occupancy detection, environmental monitoring, and building automation systems are gaining traction as they align perfectly with green building initiatives and energy efficiency regulations being implemented globally.

Consumer electronics applications, while currently representing only about 15% of the market, show the highest growth potential at nearly 18% CAGR. This is driven by increasing integration of self-powered sensors in wearable technology, smart home devices, and portable electronics where battery life limitations have traditionally been a significant constraint.

Regional analysis reveals North America currently leads market adoption with approximately 38% market share, followed by Europe (29%) and Asia-Pacific (26%). However, the Asia-Pacific region is expected to demonstrate the fastest growth rate over the next five years due to rapid industrial modernization, smart city initiatives, and increasing IoT adoption across China, Japan, South Korea, and India.

Key market drivers include the growing need for maintenance-free operation in hard-to-reach deployments, increasing focus on sustainability and green technologies, rising energy costs, and the exponential growth of IoT deployments requiring distributed sensing capabilities. The convergence of these factors creates a particularly favorable environment for self-powered sensing technologies.

Customer pain points that self-powered sensors address include battery replacement logistics and costs, environmental concerns regarding battery disposal, installation constraints in locations without power access, and the operational limitations of traditional sensors in harsh or remote environments. These factors collectively contribute to a strong value proposition for end-users across multiple sectors.

Industrial IoT applications represent the largest market segment, accounting for roughly 35% of current demand. This is primarily due to the significant advantages self-powered sensors offer in remote monitoring of industrial equipment, predictive maintenance, and process optimization without requiring battery replacements or wired power infrastructure. The elimination of maintenance costs and downtime presents compelling economic benefits for industrial adopters.

Smart building applications follow as the second-largest market segment at approximately 22% of current demand. Energy harvesting sensors for occupancy detection, environmental monitoring, and building automation systems are gaining traction as they align perfectly with green building initiatives and energy efficiency regulations being implemented globally.

Consumer electronics applications, while currently representing only about 15% of the market, show the highest growth potential at nearly 18% CAGR. This is driven by increasing integration of self-powered sensors in wearable technology, smart home devices, and portable electronics where battery life limitations have traditionally been a significant constraint.

Regional analysis reveals North America currently leads market adoption with approximately 38% market share, followed by Europe (29%) and Asia-Pacific (26%). However, the Asia-Pacific region is expected to demonstrate the fastest growth rate over the next five years due to rapid industrial modernization, smart city initiatives, and increasing IoT adoption across China, Japan, South Korea, and India.

Key market drivers include the growing need for maintenance-free operation in hard-to-reach deployments, increasing focus on sustainability and green technologies, rising energy costs, and the exponential growth of IoT deployments requiring distributed sensing capabilities. The convergence of these factors creates a particularly favorable environment for self-powered sensing technologies.

Customer pain points that self-powered sensors address include battery replacement logistics and costs, environmental concerns regarding battery disposal, installation constraints in locations without power access, and the operational limitations of traditional sensors in harsh or remote environments. These factors collectively contribute to a strong value proposition for end-users across multiple sectors.

Technical Status and Challenges in Energy Harvesting

Energy harvesting technologies for self-powered sensors have made significant strides globally, yet face substantial technical challenges that impede widespread market adoption. Current energy harvesting methods include photovoltaic, piezoelectric, thermoelectric, and electromagnetic technologies, each with varying degrees of maturity and application suitability. Photovoltaic harvesting leads in efficiency and commercial readiness, achieving conversion rates of 15-25% in consumer applications, while emerging perovskite cells demonstrate potential for 30%+ efficiency in laboratory settings.

Piezoelectric energy harvesting, which converts mechanical vibration to electricity, has reached commercial viability in specific applications but struggles with power density limitations, typically generating only 10-100 μW/cm³ under normal conditions. This restricts its utility to low-power sensing applications unless deployed in environments with consistent mechanical energy.

Thermoelectric generators (TEGs) convert temperature differentials into electrical energy but face significant efficiency constraints, with most commercial solutions operating at just 5-8% efficiency. The requirement for substantial temperature gradients (typically >20°C) limits deployment scenarios, particularly in ambient environmental monitoring applications.

RF energy harvesting, while promising for IoT applications, suffers from rapid power attenuation over distance, with harvested power dropping below usable thresholds beyond 10-15 meters from RF sources in typical environments. This spatial dependency creates significant deployment constraints for self-powered sensor networks.

A critical technical challenge across all harvesting methods remains energy storage integration. Current microbatteries and supercapacitors face trade-offs between energy density, cycle life, and self-discharge rates that compromise long-term autonomous operation. Advanced thin-film batteries show promise but remain costly for mass deployment.

Miniaturization presents another significant hurdle, particularly for applications requiring sub-centimeter form factors. As device dimensions decrease, power output typically diminishes disproportionately, creating fundamental scaling limitations. Recent advances in MEMS-based harvesters have improved miniaturization prospects but often at the cost of reduced power output.

Geographically, energy harvesting technology development shows distinct patterns, with North American and European research focusing on fundamental materials science and novel harvesting mechanisms, while Asian manufacturers, particularly in Japan, South Korea, and increasingly China, lead in commercialization and manufacturing scale. This geographic distribution creates both challenges and opportunities for technology transfer and market penetration strategies.

The integration of multiple harvesting modalities (hybrid harvesters) represents a promising approach to overcome individual technology limitations, though this introduces additional complexity in power management circuitry and increases production costs.

Piezoelectric energy harvesting, which converts mechanical vibration to electricity, has reached commercial viability in specific applications but struggles with power density limitations, typically generating only 10-100 μW/cm³ under normal conditions. This restricts its utility to low-power sensing applications unless deployed in environments with consistent mechanical energy.

Thermoelectric generators (TEGs) convert temperature differentials into electrical energy but face significant efficiency constraints, with most commercial solutions operating at just 5-8% efficiency. The requirement for substantial temperature gradients (typically >20°C) limits deployment scenarios, particularly in ambient environmental monitoring applications.

RF energy harvesting, while promising for IoT applications, suffers from rapid power attenuation over distance, with harvested power dropping below usable thresholds beyond 10-15 meters from RF sources in typical environments. This spatial dependency creates significant deployment constraints for self-powered sensor networks.

A critical technical challenge across all harvesting methods remains energy storage integration. Current microbatteries and supercapacitors face trade-offs between energy density, cycle life, and self-discharge rates that compromise long-term autonomous operation. Advanced thin-film batteries show promise but remain costly for mass deployment.

Miniaturization presents another significant hurdle, particularly for applications requiring sub-centimeter form factors. As device dimensions decrease, power output typically diminishes disproportionately, creating fundamental scaling limitations. Recent advances in MEMS-based harvesters have improved miniaturization prospects but often at the cost of reduced power output.

Geographically, energy harvesting technology development shows distinct patterns, with North American and European research focusing on fundamental materials science and novel harvesting mechanisms, while Asian manufacturers, particularly in Japan, South Korea, and increasingly China, lead in commercialization and manufacturing scale. This geographic distribution creates both challenges and opportunities for technology transfer and market penetration strategies.

The integration of multiple harvesting modalities (hybrid harvesters) represents a promising approach to overcome individual technology limitations, though this introduces additional complexity in power management circuitry and increases production costs.

Current Self-Powered Sensor Solutions

01 Energy harvesting technologies for self-powered sensors

Various energy harvesting technologies are being developed to power sensors autonomously, eliminating the need for battery replacement and enabling deployment in remote locations. These technologies include piezoelectric, thermoelectric, photovoltaic, and electromagnetic energy harvesting methods that convert ambient energy from the environment into electrical power for sensor operation. This self-powering capability is driving market penetration in applications where traditional power sources are impractical.- Energy harvesting technologies for self-powered sensors: Various energy harvesting technologies are being developed to power sensors autonomously, eliminating the need for battery replacement and enabling deployment in hard-to-reach locations. These technologies include piezoelectric, thermoelectric, photovoltaic, and electromagnetic energy harvesting methods that convert ambient energy from the environment into electrical power for sensor operation. This self-powering capability is driving market penetration in applications where maintenance access is limited or costly.

- IoT integration and wireless connectivity solutions: Self-powered sensors are increasingly being integrated into IoT ecosystems with wireless connectivity capabilities, enabling real-time data transmission and remote monitoring. These solutions incorporate low-power communication protocols specifically designed for energy-constrained devices, facilitating wider market adoption across various industries. The ability to operate without external power sources while maintaining reliable wireless communication is accelerating market penetration in smart infrastructure, agriculture, and industrial monitoring applications.

- Industrial and manufacturing applications: Self-powered sensor technologies are gaining significant market traction in industrial and manufacturing environments where they enable condition monitoring, predictive maintenance, and process optimization. These sensors can be deployed throughout production facilities to monitor equipment health, environmental conditions, and operational parameters without requiring complex wiring infrastructure. The ability to retrofit existing machinery with self-powered sensors is driving adoption in factories seeking to implement Industry 4.0 concepts while minimizing installation costs.

- Smart infrastructure and environmental monitoring: Self-powered sensor networks are being deployed in smart infrastructure and environmental monitoring applications, enabling long-term data collection without maintenance requirements. These sensors monitor structural health, traffic patterns, air quality, water levels, and other environmental parameters in urban and remote settings. The market penetration in this sector is driven by the need for sustainable monitoring solutions that can operate independently for years, providing valuable data for urban planning, resource management, and environmental protection initiatives.

- Market strategies and commercialization approaches: Various commercialization strategies are being employed to increase market penetration of self-powered sensor technologies. These include developing application-specific sensor packages, creating scalable manufacturing processes, establishing strategic partnerships with industry leaders, and implementing innovative business models such as sensors-as-a-service. Market analysis indicates growing adoption across multiple sectors, with particular emphasis on cost reduction, miniaturization, and performance improvements to address specific industry requirements and overcome adoption barriers.

02 IoT integration and smart infrastructure applications

Self-powered sensor technologies are gaining significant market traction through integration with Internet of Things (IoT) platforms and smart infrastructure applications. These sensors enable continuous monitoring of environmental conditions, structural health, and operational parameters without requiring power infrastructure. The ability to deploy maintenance-free sensor networks is accelerating adoption in smart cities, buildings, transportation systems, and industrial facilities.Expand Specific Solutions03 Wearable and healthcare monitoring applications

Self-powered sensor technologies are penetrating the wearable device and healthcare monitoring markets by enabling continuous health parameter tracking without frequent charging. These sensors can monitor vital signs, physical activity, and environmental exposure while harvesting energy from body heat, motion, or ambient light. The elimination of charging requirements is driving adoption in medical monitoring, fitness tracking, and occupational safety applications.Expand Specific Solutions04 Industrial and environmental monitoring solutions

Self-powered sensor technologies are gaining market share in industrial and environmental monitoring applications where power infrastructure is limited or maintenance access is challenging. These sensors enable continuous monitoring of equipment performance, environmental conditions, and safety parameters in remote or hazardous locations. The ability to operate autonomously for extended periods is driving adoption in manufacturing, resource extraction, agriculture, and environmental conservation sectors.Expand Specific Solutions05 Market strategies and commercialization approaches

Various market strategies are being employed to accelerate the commercial adoption of self-powered sensor technologies. These include strategic partnerships between technology developers and industry-specific solution providers, development of application-specific sensor packages, and innovative business models such as sensing-as-a-service. Demonstration projects in high-visibility applications are helping to build market awareness and confidence in the reliability of self-powered sensing solutions.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The self-powered sensor technology market is currently in its growth phase, with increasing adoption across industrial IoT, smart buildings, and environmental monitoring applications. The global market size is projected to expand significantly, driven by sustainability initiatives and the need for maintenance-free sensing solutions. In terms of technical maturity, established players like EnOcean GmbH, Robert Bosch GmbH, and Honeywell International Technologies lead with commercialized solutions, while academic institutions including Beijing Institute of Nanoenergy & Nanosystems, University of Electronic Science & Technology of China, and Washington University in St. Louis are advancing fundamental research. Emerging companies like Gentle Energy Corp. are introducing innovative AI-enhanced energy harvesting technologies, creating a competitive landscape balanced between established manufacturers and research-driven newcomers focusing on efficiency improvements and application-specific solutions.

Robert Bosch GmbH

Technical Solution: Bosch has implemented a comprehensive market penetration strategy for self-powered sensor technologies across multiple sectors including automotive, industrial equipment, and consumer applications. Their technical approach centers on their Cross Domain Computing Solutions division, which has developed highly efficient MEMS sensors with ultra-low power requirements that can operate from harvested energy. Bosch's self-powered sensors utilize a combination of energy harvesting technologies including vibration harvesting through piezoelectric materials, thermal gradient harvesting, and indoor photovoltaics. Their XDK (Cross-Domain Development Kit) platform has been adapted to support energy-autonomous operation, allowing developers to prototype self-powered IoT applications. For industrial markets, Bosch has focused on demonstrating clear ROI through condition monitoring applications that eliminate battery replacement costs and enable sensor placement in previously inaccessible locations. In automotive applications, their self-powered tire pressure monitoring systems and wireless vehicle sensors reduce wiring complexity and weight. Bosch has leveraged their position as both a sensor manufacturer and systems integrator to create complete solutions that incorporate self-powered sensors into broader automation and monitoring systems.

Strengths: Vertical integration from sensor manufacturing to system integration; cross-industry expertise allowing technology transfer between automotive, industrial and consumer sectors; extensive R&D capabilities and manufacturing scale. Weaknesses: Complex organizational structure may slow decision-making for emerging technologies; conservative approach to new technology adoption in safety-critical applications; competing internal priorities across diverse business units.

Honeywell International Technologies Ltd.

Technical Solution: Honeywell has developed a multi-faceted market penetration strategy for self-powered sensor technologies focused on industrial and building automation applications. Their approach leverages their extensive installed base and distribution channels to introduce self-powered sensors as upgrades to existing systems. Honeywell's technical solution combines thermoelectric energy harvesting from industrial process heat differentials with piezoelectric harvesting from equipment vibrations to power their wireless sensor networks. Their OneWireless Network infrastructure supports these self-powered sensors through ultra-low-power communication protocols optimized for intermittent transmissions. Honeywell has strategically positioned their self-powered sensors as enablers for predictive maintenance and energy efficiency initiatives, demonstrating ROI through reduced maintenance costs and extended equipment life. Their market approach includes tiered offerings from entry-level self-powered temperature and pressure sensors to advanced multi-parameter monitoring solutions, allowing customers to gradually adopt the technology. Honeywell has also established strategic partnerships with energy harvesting component manufacturers to ensure supply chain resilience and continuous technology improvement.

Strengths: Extensive industrial customer base and established distribution channels; integration capabilities with existing building and industrial control systems; strong brand recognition and customer trust in critical applications. Weaknesses: Solutions often tailored to industrial environments with abundant energy harvesting opportunities; higher system complexity requiring specialized integration expertise; competing internal priorities between traditional and self-powered product lines.

Core Patents and Technical Literature Review

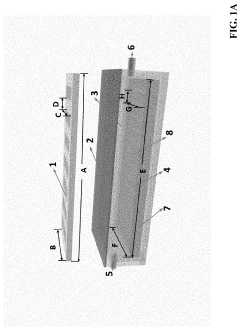

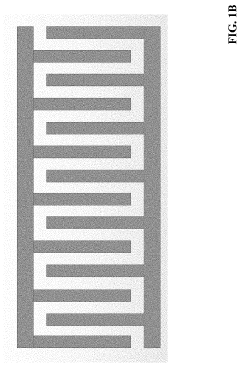

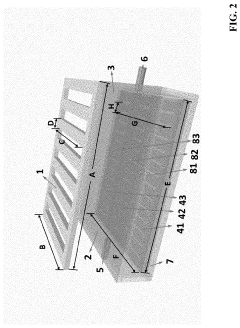

Wireless self-powered gas sensor based on electromagnetic oscillations triggered by external forces and fabrication method thereof

PatentActiveUS20210208121A1

Innovation

- A wireless self-powered gas sensor utilizing polymer materials for energy harvesting through electromagnetic oscillations triggered by external forces, eliminating the need for metal electrodes and wire connections, allowing for energy collection and transmission via friction layers and interdigital electrodes, enabling independent operation without external power.

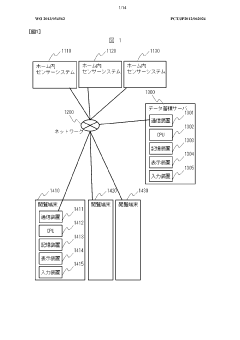

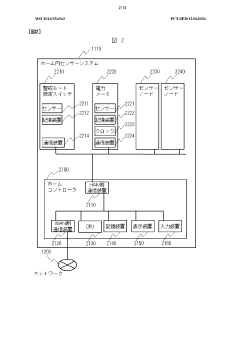

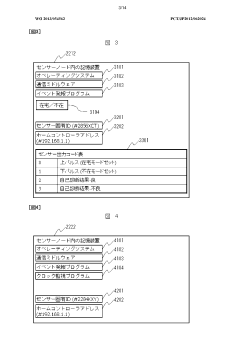

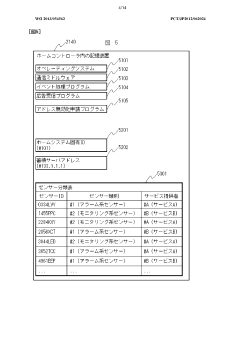

Information viewing system and method

PatentWO2013054562A1

Innovation

- A system comprising sensors, controllers, networks, data storage servers, and viewing terminals that processes and anonymizes sensor data, issuing disposable IDs for data sharing while maintaining data ownership and privacy, allowing third-party access to aggregated statistical information.

Commercialization Strategies and Business Models

The commercialization of self-powered sensor technologies requires strategic approaches that balance technological innovation with market realities. Successful market penetration depends on developing business models that address the unique value propositions these technologies offer while overcoming adoption barriers.

Revenue models for self-powered sensors can take several forms. The traditional product sales approach remains viable but may be enhanced through premium pricing strategies that emphasize long-term cost savings from eliminated battery replacements and reduced maintenance. Subscription-based models are gaining traction, where customers pay for data services rather than hardware, creating recurring revenue streams while lowering initial adoption costs.

As-a-service offerings represent a particularly promising direction, with Sensing-as-a-Service (SaaS) models allowing customers to purchase sensor capabilities without managing the underlying infrastructure. This approach aligns well with IoT ecosystems and can accelerate market penetration by reducing capital expenditure requirements for end users.

Partnership ecosystems play a crucial role in commercialization strategies. Vertical integration with established industry players can provide access to existing distribution channels and customer bases. Strategic alliances between sensor manufacturers, system integrators, and data analytics providers create comprehensive solutions that deliver greater value than standalone products.

Market segmentation and targeting require careful consideration. Early adoption is likely in industries where monitoring is critical but access is challenging, such as industrial equipment monitoring, infrastructure health assessment, and remote environmental sensing. These segments value the maintenance-free operation and deployment flexibility that self-powered sensors uniquely provide.

Pricing strategies must reflect both the technology's value and market realities. Value-based pricing approaches that quantify benefits like extended deployment lifetimes, elimination of battery replacement costs, and reduced maintenance requirements can justify premium positioning. However, penetration pricing may be necessary in highly competitive segments or to establish initial market presence.

Intellectual property management represents another critical dimension of commercialization. Companies must balance patent protection of core technologies with selective open-source approaches that can accelerate ecosystem development and standard adoption. Licensing strategies can generate additional revenue streams while expanding market reach through manufacturing partners.

The path to widespread adoption will likely require hybrid approaches that combine multiple business models tailored to specific market segments and customer needs. Companies that demonstrate flexibility in their commercialization strategies while maintaining focus on their core technological advantages will be best positioned to capture market share in this emerging field.

Revenue models for self-powered sensors can take several forms. The traditional product sales approach remains viable but may be enhanced through premium pricing strategies that emphasize long-term cost savings from eliminated battery replacements and reduced maintenance. Subscription-based models are gaining traction, where customers pay for data services rather than hardware, creating recurring revenue streams while lowering initial adoption costs.

As-a-service offerings represent a particularly promising direction, with Sensing-as-a-Service (SaaS) models allowing customers to purchase sensor capabilities without managing the underlying infrastructure. This approach aligns well with IoT ecosystems and can accelerate market penetration by reducing capital expenditure requirements for end users.

Partnership ecosystems play a crucial role in commercialization strategies. Vertical integration with established industry players can provide access to existing distribution channels and customer bases. Strategic alliances between sensor manufacturers, system integrators, and data analytics providers create comprehensive solutions that deliver greater value than standalone products.

Market segmentation and targeting require careful consideration. Early adoption is likely in industries where monitoring is critical but access is challenging, such as industrial equipment monitoring, infrastructure health assessment, and remote environmental sensing. These segments value the maintenance-free operation and deployment flexibility that self-powered sensors uniquely provide.

Pricing strategies must reflect both the technology's value and market realities. Value-based pricing approaches that quantify benefits like extended deployment lifetimes, elimination of battery replacement costs, and reduced maintenance requirements can justify premium positioning. However, penetration pricing may be necessary in highly competitive segments or to establish initial market presence.

Intellectual property management represents another critical dimension of commercialization. Companies must balance patent protection of core technologies with selective open-source approaches that can accelerate ecosystem development and standard adoption. Licensing strategies can generate additional revenue streams while expanding market reach through manufacturing partners.

The path to widespread adoption will likely require hybrid approaches that combine multiple business models tailored to specific market segments and customer needs. Companies that demonstrate flexibility in their commercialization strategies while maintaining focus on their core technological advantages will be best positioned to capture market share in this emerging field.

Sustainability Impact and Environmental Benefits

Self-powered sensor technologies represent a significant advancement in sustainable development, offering substantial environmental benefits across multiple sectors. These autonomous sensing systems eliminate the need for traditional battery replacements, thereby reducing electronic waste generation that typically contributes to environmental pollution. The reduction in battery disposal directly translates to fewer heavy metals and toxic chemicals entering landfills and water systems, addressing a growing environmental concern in our increasingly sensor-dependent world.

The energy harvesting mechanisms employed by self-powered sensors—whether solar, thermal, vibrational, or RF-based—utilize ambient energy that would otherwise be wasted, creating a zero-emission operational profile. This characteristic makes them particularly valuable for environmental monitoring applications, where they can track pollution levels, forest conditions, or water quality with minimal ecological footprint.

From a lifecycle assessment perspective, self-powered sensors demonstrate superior sustainability metrics compared to conventional battery-powered alternatives. The extended operational lifespan without maintenance requirements significantly reduces the carbon footprint associated with manufacturing replacement components, transportation for maintenance crews, and disposal processes. Studies indicate that widespread adoption could reduce electronic waste by thousands of tons annually across industrial applications alone.

In smart building implementations, these technologies contribute to overall energy efficiency by enabling more precise control of HVAC systems, lighting, and other building functions without consuming additional power. The net energy savings often exceed the energy required for sensor operation by orders of magnitude, creating a positive sustainability equation.

For remote environmental monitoring applications, self-powered sensors eliminate the environmental disruption caused by maintenance visits to sensitive ecosystems. This non-invasive quality makes them ideal for wildlife tracking, climate research, and conservation efforts in protected areas where human intervention should be minimized.

The circular economy potential of these technologies is also noteworthy. Many self-powered sensor designs incorporate recyclable materials and modular components that facilitate end-of-life recovery and reuse. As manufacturing scales increase, opportunities for further improving material efficiency and incorporating biodegradable components are emerging as promising research directions.

When quantifying environmental impact, lifecycle analyses suggest that widespread adoption of self-powered sensor networks could contribute meaningfully to carbon reduction targets across industrial, agricultural, and urban sectors, with potential CO2 equivalent savings reaching millions of tons annually if deployed at scale in smart city infrastructure.

The energy harvesting mechanisms employed by self-powered sensors—whether solar, thermal, vibrational, or RF-based—utilize ambient energy that would otherwise be wasted, creating a zero-emission operational profile. This characteristic makes them particularly valuable for environmental monitoring applications, where they can track pollution levels, forest conditions, or water quality with minimal ecological footprint.

From a lifecycle assessment perspective, self-powered sensors demonstrate superior sustainability metrics compared to conventional battery-powered alternatives. The extended operational lifespan without maintenance requirements significantly reduces the carbon footprint associated with manufacturing replacement components, transportation for maintenance crews, and disposal processes. Studies indicate that widespread adoption could reduce electronic waste by thousands of tons annually across industrial applications alone.

In smart building implementations, these technologies contribute to overall energy efficiency by enabling more precise control of HVAC systems, lighting, and other building functions without consuming additional power. The net energy savings often exceed the energy required for sensor operation by orders of magnitude, creating a positive sustainability equation.

For remote environmental monitoring applications, self-powered sensors eliminate the environmental disruption caused by maintenance visits to sensitive ecosystems. This non-invasive quality makes them ideal for wildlife tracking, climate research, and conservation efforts in protected areas where human intervention should be minimized.

The circular economy potential of these technologies is also noteworthy. Many self-powered sensor designs incorporate recyclable materials and modular components that facilitate end-of-life recovery and reuse. As manufacturing scales increase, opportunities for further improving material efficiency and incorporating biodegradable components are emerging as promising research directions.

When quantifying environmental impact, lifecycle analyses suggest that widespread adoption of self-powered sensor networks could contribute meaningfully to carbon reduction targets across industrial, agricultural, and urban sectors, with potential CO2 equivalent savings reaching millions of tons annually if deployed at scale in smart city infrastructure.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!