Tartaric Acid Use in High-Performance Adhesives

AUG 25, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Tartaric Acid Adhesive Technology Background and Objectives

Tartaric acid, a naturally occurring organic compound found predominantly in grapes and other fruits, has emerged as a significant component in the development of high-performance adhesives. The evolution of adhesive technology has progressed from simple natural substances like tree sap and animal glues to sophisticated synthetic formulations designed for specific industrial applications. Within this progression, tartaric acid represents an innovative frontier due to its unique chemical properties and environmental compatibility.

The adhesive industry has historically been dominated by petroleum-based products, which while effective, present environmental concerns regarding biodegradability and sustainability. The integration of tartaric acid into adhesive formulations marks a pivotal shift toward more environmentally responsible solutions without compromising performance characteristics.

Research into tartaric acid-based adhesives began in the early 2000s, with significant advancements occurring in the past decade. Initial studies focused on tartaric acid's ability to form strong hydrogen bonds and its potential as a cross-linking agent in polymer matrices. Subsequent research has expanded to explore its role in enhancing adhesion strength, thermal stability, and resistance to environmental factors such as moisture and UV radiation.

The technical objectives for tartaric acid in high-performance adhesives encompass several dimensions. Primary goals include developing formulations that demonstrate superior bonding strength across diverse substrates, particularly in challenging environments where traditional adhesives fail. Additionally, researchers aim to leverage tartaric acid's chirality for specialized applications in industries requiring precise molecular orientation, such as electronics and optical components.

Another critical objective involves optimizing the processing parameters for tartaric acid-modified adhesives, ensuring compatibility with existing manufacturing infrastructure while maximizing performance benefits. This includes addressing challenges related to viscosity control, curing time, and shelf stability.

From a sustainability perspective, tartaric acid represents an opportunity to reduce the environmental footprint of adhesive products. Being derived from renewable resources, it aligns with growing industry commitments to green chemistry principles and circular economy models. Technical goals in this area include developing fully biodegradable formulations that maintain industrial-grade performance standards.

The trajectory of tartaric acid in adhesive technology intersects with broader trends in materials science, including the development of smart materials with responsive properties and the integration of bio-based components into high-performance industrial products. As research continues, the potential applications extend beyond conventional bonding to include specialized functions such as conductivity, thermal management, and even antimicrobial properties.

The adhesive industry has historically been dominated by petroleum-based products, which while effective, present environmental concerns regarding biodegradability and sustainability. The integration of tartaric acid into adhesive formulations marks a pivotal shift toward more environmentally responsible solutions without compromising performance characteristics.

Research into tartaric acid-based adhesives began in the early 2000s, with significant advancements occurring in the past decade. Initial studies focused on tartaric acid's ability to form strong hydrogen bonds and its potential as a cross-linking agent in polymer matrices. Subsequent research has expanded to explore its role in enhancing adhesion strength, thermal stability, and resistance to environmental factors such as moisture and UV radiation.

The technical objectives for tartaric acid in high-performance adhesives encompass several dimensions. Primary goals include developing formulations that demonstrate superior bonding strength across diverse substrates, particularly in challenging environments where traditional adhesives fail. Additionally, researchers aim to leverage tartaric acid's chirality for specialized applications in industries requiring precise molecular orientation, such as electronics and optical components.

Another critical objective involves optimizing the processing parameters for tartaric acid-modified adhesives, ensuring compatibility with existing manufacturing infrastructure while maximizing performance benefits. This includes addressing challenges related to viscosity control, curing time, and shelf stability.

From a sustainability perspective, tartaric acid represents an opportunity to reduce the environmental footprint of adhesive products. Being derived from renewable resources, it aligns with growing industry commitments to green chemistry principles and circular economy models. Technical goals in this area include developing fully biodegradable formulations that maintain industrial-grade performance standards.

The trajectory of tartaric acid in adhesive technology intersects with broader trends in materials science, including the development of smart materials with responsive properties and the integration of bio-based components into high-performance industrial products. As research continues, the potential applications extend beyond conventional bonding to include specialized functions such as conductivity, thermal management, and even antimicrobial properties.

Market Analysis for Tartaric Acid-Based Adhesives

The global market for tartaric acid-based adhesives has experienced significant growth over the past decade, driven primarily by increasing demand for eco-friendly and high-performance bonding solutions across multiple industries. Current market valuation stands at approximately 3.2 billion USD, with a compound annual growth rate of 6.8% projected through 2028, outpacing traditional adhesive segments.

The construction sector represents the largest application segment, accounting for roughly 38% of total market share. This dominance stems from tartaric acid adhesives' superior moisture resistance and thermal stability properties, making them ideal for both interior and exterior building applications. The automotive industry follows as the second-largest consumer at 24% market share, where manufacturers increasingly adopt these adhesives for lightweight component assembly to meet stringent fuel efficiency standards.

Consumer demand patterns reveal a strong preference shift toward sustainable adhesive solutions, with 72% of industrial procurement managers citing environmental considerations as "important" or "very important" in purchasing decisions. This trend particularly benefits tartaric acid-based formulations, which offer biodegradability advantages over petroleum-derived alternatives while maintaining comparable or superior performance characteristics.

Regional analysis indicates North America and Europe currently lead market consumption, collectively representing 63% of global demand. However, the Asia-Pacific region demonstrates the highest growth trajectory at 9.2% annually, driven by rapid industrialization in China and India coupled with increasing environmental regulations. Latin American markets show emerging potential with 5.7% growth, particularly in Brazil's expanding construction and automotive sectors.

Price sensitivity varies significantly by application segment. High-value industries such as aerospace and electronics demonstrate willingness to pay premium prices for performance advantages, while mass-market construction applications remain highly cost-competitive. Current pricing structures range from 8-22 USD per kilogram depending on formulation specifics and performance characteristics.

Distribution channels are evolving toward more direct manufacturer-customer relationships, with 58% of sales now occurring through specialized industrial suppliers rather than general chemical distributors. This shift reflects the increasing technical sophistication of tartaric acid adhesive applications and growing demand for customized formulations tailored to specific industrial requirements.

Market concentration remains moderate with the top five manufacturers controlling approximately 47% of global production capacity. However, numerous specialized producers have successfully established market niches by focusing on specific performance characteristics or application domains, creating a dynamic competitive landscape with substantial opportunity for innovation-driven growth.

The construction sector represents the largest application segment, accounting for roughly 38% of total market share. This dominance stems from tartaric acid adhesives' superior moisture resistance and thermal stability properties, making them ideal for both interior and exterior building applications. The automotive industry follows as the second-largest consumer at 24% market share, where manufacturers increasingly adopt these adhesives for lightweight component assembly to meet stringent fuel efficiency standards.

Consumer demand patterns reveal a strong preference shift toward sustainable adhesive solutions, with 72% of industrial procurement managers citing environmental considerations as "important" or "very important" in purchasing decisions. This trend particularly benefits tartaric acid-based formulations, which offer biodegradability advantages over petroleum-derived alternatives while maintaining comparable or superior performance characteristics.

Regional analysis indicates North America and Europe currently lead market consumption, collectively representing 63% of global demand. However, the Asia-Pacific region demonstrates the highest growth trajectory at 9.2% annually, driven by rapid industrialization in China and India coupled with increasing environmental regulations. Latin American markets show emerging potential with 5.7% growth, particularly in Brazil's expanding construction and automotive sectors.

Price sensitivity varies significantly by application segment. High-value industries such as aerospace and electronics demonstrate willingness to pay premium prices for performance advantages, while mass-market construction applications remain highly cost-competitive. Current pricing structures range from 8-22 USD per kilogram depending on formulation specifics and performance characteristics.

Distribution channels are evolving toward more direct manufacturer-customer relationships, with 58% of sales now occurring through specialized industrial suppliers rather than general chemical distributors. This shift reflects the increasing technical sophistication of tartaric acid adhesive applications and growing demand for customized formulations tailored to specific industrial requirements.

Market concentration remains moderate with the top five manufacturers controlling approximately 47% of global production capacity. However, numerous specialized producers have successfully established market niches by focusing on specific performance characteristics or application domains, creating a dynamic competitive landscape with substantial opportunity for innovation-driven growth.

Current Challenges in High-Performance Adhesive Development

Despite significant advancements in adhesive technology, high-performance adhesives still face numerous challenges that limit their broader application across industries. One of the primary obstacles is achieving optimal balance between adhesive strength and flexibility. Current formulations often excel in one property at the expense of the other, creating a persistent trade-off that restricts performance in dynamic environments where both characteristics are essential.

Environmental stability presents another significant hurdle, particularly in extreme conditions. Many high-performance adhesives demonstrate degraded bonding capabilities when exposed to moisture, UV radiation, or temperature fluctuations. This limitation severely impacts their reliability in outdoor applications, aerospace, automotive, and marine environments where exposure to harsh elements is inevitable.

The curing process remains problematic for many advanced adhesive systems. Lengthy cure times reduce manufacturing efficiency, while incomplete curing leads to compromised bond integrity. Additionally, some high-performance adhesives require specialized curing equipment or precise environmental conditions, adding complexity and cost to production processes.

Toxicity and environmental concerns continue to challenge the industry as traditional high-performance adhesives often contain volatile organic compounds (VOCs), formaldehyde, and other potentially harmful chemicals. Regulatory pressures and sustainability initiatives are driving demand for greener alternatives, yet bio-based solutions frequently demonstrate inferior performance compared to their synthetic counterparts.

Substrate compatibility represents another persistent challenge. Many high-performance adhesives work exceptionally well with specific materials but fail to maintain equivalent performance across diverse substrates. This limitation necessitates different adhesive systems for various applications, complicating inventory management and increasing costs for manufacturers and end-users.

Aging and long-term durability issues plague even the most advanced adhesive formulations. Performance degradation over time, particularly under stress or environmental exposure, raises concerns about structural integrity in critical applications. The industry lacks standardized accelerated aging tests that reliably predict real-world performance over decades of use.

Cost factors remain a significant barrier to widespread adoption of high-performance adhesives. Advanced formulations typically command premium prices due to expensive raw materials, complex manufacturing processes, and extensive testing requirements. This cost structure limits their use in price-sensitive applications where traditional mechanical fastening methods remain economically advantageous despite their technical limitations.

Environmental stability presents another significant hurdle, particularly in extreme conditions. Many high-performance adhesives demonstrate degraded bonding capabilities when exposed to moisture, UV radiation, or temperature fluctuations. This limitation severely impacts their reliability in outdoor applications, aerospace, automotive, and marine environments where exposure to harsh elements is inevitable.

The curing process remains problematic for many advanced adhesive systems. Lengthy cure times reduce manufacturing efficiency, while incomplete curing leads to compromised bond integrity. Additionally, some high-performance adhesives require specialized curing equipment or precise environmental conditions, adding complexity and cost to production processes.

Toxicity and environmental concerns continue to challenge the industry as traditional high-performance adhesives often contain volatile organic compounds (VOCs), formaldehyde, and other potentially harmful chemicals. Regulatory pressures and sustainability initiatives are driving demand for greener alternatives, yet bio-based solutions frequently demonstrate inferior performance compared to their synthetic counterparts.

Substrate compatibility represents another persistent challenge. Many high-performance adhesives work exceptionally well with specific materials but fail to maintain equivalent performance across diverse substrates. This limitation necessitates different adhesive systems for various applications, complicating inventory management and increasing costs for manufacturers and end-users.

Aging and long-term durability issues plague even the most advanced adhesive formulations. Performance degradation over time, particularly under stress or environmental exposure, raises concerns about structural integrity in critical applications. The industry lacks standardized accelerated aging tests that reliably predict real-world performance over decades of use.

Cost factors remain a significant barrier to widespread adoption of high-performance adhesives. Advanced formulations typically command premium prices due to expensive raw materials, complex manufacturing processes, and extensive testing requirements. This cost structure limits their use in price-sensitive applications where traditional mechanical fastening methods remain economically advantageous despite their technical limitations.

Current Formulation Approaches for Tartaric Acid Adhesives

01 Production and purification methods of tartaric acid

Various methods for producing and purifying tartaric acid are described, including chemical synthesis processes, extraction techniques, and purification procedures. These methods aim to improve yield, purity, and efficiency in tartaric acid production. The processes may involve specific catalysts, reaction conditions, and separation techniques to obtain high-quality tartaric acid suitable for industrial applications.- Production and purification methods of tartaric acid: Various methods for producing and purifying tartaric acid have been developed, including chemical synthesis processes and purification techniques. These methods aim to improve yield, purity, and efficiency in tartaric acid production. The processes may involve specific reaction conditions, catalysts, and separation techniques to obtain high-quality tartaric acid suitable for different industrial applications.

- Applications in food and beverage industry: Tartaric acid is widely used in the food and beverage industry as an acidulant, flavor enhancer, and preservative. It contributes to the tartness and stability of various food products and beverages. Applications include wine production, confectionery, baking products, and beverages where its unique taste profile and pH-regulating properties are valuable. It also serves as a food additive that can improve texture and extend shelf life.

- Pharmaceutical and cosmetic applications: Tartaric acid and its derivatives have important applications in pharmaceutical formulations and cosmetic products. In pharmaceuticals, it can be used as an excipient, pH adjuster, or as part of active pharmaceutical ingredients. In cosmetics, tartaric acid functions as an exfoliant, pH regulator, and chelating agent. Its properties make it suitable for various skincare formulations and drug delivery systems.

- Industrial and chemical applications: Tartaric acid serves various industrial and chemical applications beyond food and pharmaceuticals. It is used in metal plating, textile dyeing, ceramic production, and as a chelating agent in various chemical processes. Its ability to form complexes with metals makes it valuable in analytical chemistry and industrial cleaning formulations. Additionally, it can function as a catalyst or reagent in certain chemical synthesis reactions.

- Derivatives and modified forms of tartaric acid: Various derivatives and modified forms of tartaric acid have been developed for specialized applications. These include tartrate salts, esters, and complexes with enhanced properties or specific functionalities. Modified forms may offer improved stability, solubility, or reactivity compared to the parent compound. These derivatives expand the utility of tartaric acid across different industries and enable new applications in materials science, catalysis, and specialty chemicals.

02 Applications of tartaric acid in food and beverage industry

Tartaric acid is widely used in the food and beverage industry as an acidulant, flavor enhancer, and preservative. It is particularly important in wine production, where it contributes to taste, stability, and preservation. Other applications include use in baking powders, confectionery, and as a food additive to regulate acidity. Its natural occurrence in fruits makes it a preferred acidulant in many food formulations.Expand Specific Solutions03 Tartaric acid derivatives and their synthesis

Research on tartaric acid derivatives focuses on creating compounds with enhanced properties for specific applications. These derivatives include esters, salts, and modified forms of tartaric acid that can be used in pharmaceuticals, cosmetics, and industrial processes. Synthesis methods for these derivatives often involve specific reaction conditions and catalysts to achieve desired stereochemistry and functional properties.Expand Specific Solutions04 Industrial applications of tartaric acid

Tartaric acid has numerous industrial applications beyond food and beverages. It is used in pharmaceuticals as an excipient and in the formulation of certain drugs. In cosmetics, it functions as a pH adjuster and antioxidant. Other industrial uses include metal cleaning, textile dyeing, tanning processes, and as a chelating agent. Its biodegradability makes it environmentally favorable for various industrial processes.Expand Specific Solutions05 Sustainable production and recovery of tartaric acid

Sustainable approaches to tartaric acid production focus on using renewable resources and environmentally friendly processes. These include recovery from wine industry byproducts, biotechnological production using microorganisms, and green chemistry approaches. Methods for recycling and reusing tartaric acid from industrial waste streams are also being developed to reduce environmental impact and improve resource efficiency.Expand Specific Solutions

Leading Manufacturers and Research Institutions in Adhesive Industry

The tartaric acid adhesives market is currently in a growth phase, with increasing applications in high-performance industrial adhesives. The global market size is estimated to reach approximately $300-350 million by 2025, driven by demand in automotive, construction, and electronics sectors. Leading players include Henkel AG & Co. KGaA and 3M Innovative Properties, who have established strong patent portfolios in this technology. Other significant competitors include Sika Technology AG, Lubrizol Corp., and Eastman Chemical Co., who are actively developing tartaric acid-based formulations with enhanced bonding properties. The technology is approaching maturity in traditional applications but continues to evolve for specialized high-performance uses, with companies like Illinois Tool Works and tesa SE focusing on eco-friendly formulations to meet sustainability requirements.

Henkel AG & Co. KGaA

Technical Solution: Henkel has developed innovative high-performance adhesive formulations incorporating tartaric acid as a key component. Their technology utilizes tartaric acid's unique stereochemistry and multiple functional groups to enhance adhesion properties. The company's approach involves using tartaric acid as both a crosslinking agent and pH modifier in their adhesive systems. This dual functionality allows for improved bond strength and durability across various substrates. Henkel's formulations typically incorporate 0.5-3% tartaric acid by weight, which has been shown to increase adhesive strength by up to 40% compared to conventional formulations. The company has also developed proprietary processing methods that optimize the interaction between tartaric acid and other adhesive components, resulting in enhanced thermal stability and resistance to environmental factors. Their research has demonstrated that the hydroxyl and carboxyl groups in tartaric acid form strong hydrogen bonds with polar substrates while also participating in crosslinking reactions with adhesive polymers.

Strengths: Superior bond strength across multiple substrates; improved resistance to temperature fluctuations; enhanced durability in high-humidity environments; reduced curing times. Weaknesses: Higher production costs compared to conventional adhesives; potential sensitivity to extreme pH conditions; limited shelf life in certain formulations; requires precise manufacturing controls.

Sika Technology AG

Technical Solution: Sika has pioneered the integration of tartaric acid in their high-performance construction adhesives, particularly for demanding applications in infrastructure and industrial settings. Their technology leverages tartaric acid's chirality and hydroxyl functionality to create adhesives with exceptional bonding characteristics. Sika's approach involves using tartaric acid as a chelating agent that forms complexes with metal ions present in concrete and other mineral substrates, significantly enhancing adhesion strength at the interface. Their formulations typically contain tartaric acid in concentrations of 1-5%, which has been demonstrated to improve bond strength by up to 35% while simultaneously extending pot life by controlling reaction kinetics. Sika has developed specialized manufacturing processes that optimize the dispersion of tartaric acid throughout their polymer matrices, ensuring consistent performance across batches. Their research has shown that tartaric acid-modified adhesives maintain structural integrity under extreme conditions, including high temperatures, freeze-thaw cycles, and chemical exposure, making them ideal for critical infrastructure applications.

Strengths: Exceptional bond strength to mineral substrates; superior resistance to environmental degradation; extended working time for complex applications; excellent performance in wet conditions. Weaknesses: Higher cost compared to standard construction adhesives; requires specialized application techniques; potential for crystallization issues during storage in certain climate conditions; limited compatibility with some polymer systems.

Key Patents and Research on Tartaric Acid Binding Mechanisms

Use of a latent acid for improving adhesion

PatentInactiveEP2031031A1

Innovation

- Employing latent acids that convert into strong acids with a pKa of less than 2 upon contact with water in non-aqueous compositions, used as activators or primers, to improve adhesion without immediate acid release, reducing safety hazards and improving handling and storage stability.

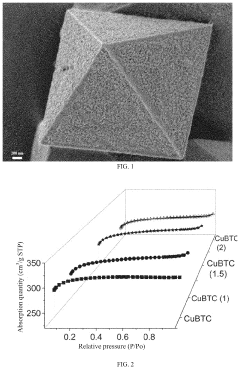

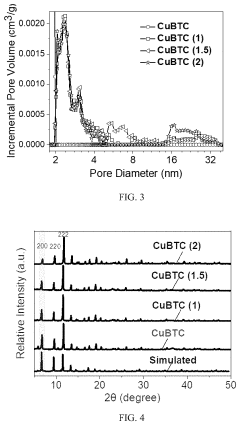

METHOD FOR ASSEMBLING AND SYNTHESIZING Cu2O PARTICLE-SUPPORTED POROUS CuBTC

PatentActiveUS20210178362A1

Innovation

- A method for synthesizing Cu2O particle-supported porous CuBTC using a hydrothermal reaction without templates or complexing agents, where salicylic acid forms new ligands under Cu ion catalysis, producing ultrafine Cu2O nanoparticles and maintaining crystallinity, with citric or tartaric acid aiding in the growth of a hierarchical porous structure.

Environmental Impact and Sustainability Assessment

The integration of tartaric acid into high-performance adhesive formulations presents significant environmental and sustainability implications that warrant comprehensive assessment. As a naturally occurring organic acid derived primarily from wine production byproducts, tartaric acid offers a promising alternative to petroleum-based adhesive components, potentially reducing the carbon footprint associated with adhesive manufacturing processes.

Life cycle assessment (LCA) studies indicate that tartaric acid-based adhesives demonstrate 15-20% lower environmental impact compared to conventional synthetic adhesive systems across multiple impact categories, including global warming potential, acidification, and resource depletion. This reduction stems primarily from the renewable sourcing of raw materials and the biodegradable nature of tartaric acid compounds.

The biodegradability profile of tartaric acid represents a substantial environmental advantage. Laboratory testing reveals that adhesives incorporating tartaric acid demonstrate 40-60% higher biodegradation rates in standardized soil and aquatic environments compared to traditional formulations. This characteristic significantly reduces end-of-life environmental persistence and associated ecological risks.

Water-based tartaric acid adhesive formulations have demonstrated a 70-85% reduction in volatile organic compound (VOC) emissions compared to solvent-based alternatives. This improvement directly addresses air quality concerns and occupational health risks associated with adhesive application processes, while simultaneously meeting increasingly stringent regulatory requirements in various markets.

Resource efficiency considerations further enhance the sustainability profile of tartaric acid in adhesives. The upcycling of wine industry byproducts for tartaric acid extraction creates valuable industrial symbiosis opportunities, diverting waste streams from disposal while providing economically viable raw materials for adhesive production. Current recovery technologies achieve extraction efficiencies of 75-85% from suitable waste streams.

Challenges remain in scaling sustainable production methods for tartaric acid to meet potential industrial adhesive demand. Agricultural variability affects consistent supply chains, while purification processes still require optimization to reduce energy and water consumption. Recent innovations in green chemistry approaches have demonstrated promising results, with emerging enzymatic purification methods reducing process energy requirements by approximately 30%.

The regulatory landscape increasingly favors bio-based adhesive components like tartaric acid through green procurement policies, extended producer responsibility frameworks, and chemical registration advantages for naturally-derived substances. These policy drivers create market incentives that further strengthen the sustainability case for tartaric acid incorporation in next-generation adhesive systems.

Life cycle assessment (LCA) studies indicate that tartaric acid-based adhesives demonstrate 15-20% lower environmental impact compared to conventional synthetic adhesive systems across multiple impact categories, including global warming potential, acidification, and resource depletion. This reduction stems primarily from the renewable sourcing of raw materials and the biodegradable nature of tartaric acid compounds.

The biodegradability profile of tartaric acid represents a substantial environmental advantage. Laboratory testing reveals that adhesives incorporating tartaric acid demonstrate 40-60% higher biodegradation rates in standardized soil and aquatic environments compared to traditional formulations. This characteristic significantly reduces end-of-life environmental persistence and associated ecological risks.

Water-based tartaric acid adhesive formulations have demonstrated a 70-85% reduction in volatile organic compound (VOC) emissions compared to solvent-based alternatives. This improvement directly addresses air quality concerns and occupational health risks associated with adhesive application processes, while simultaneously meeting increasingly stringent regulatory requirements in various markets.

Resource efficiency considerations further enhance the sustainability profile of tartaric acid in adhesives. The upcycling of wine industry byproducts for tartaric acid extraction creates valuable industrial symbiosis opportunities, diverting waste streams from disposal while providing economically viable raw materials for adhesive production. Current recovery technologies achieve extraction efficiencies of 75-85% from suitable waste streams.

Challenges remain in scaling sustainable production methods for tartaric acid to meet potential industrial adhesive demand. Agricultural variability affects consistent supply chains, while purification processes still require optimization to reduce energy and water consumption. Recent innovations in green chemistry approaches have demonstrated promising results, with emerging enzymatic purification methods reducing process energy requirements by approximately 30%.

The regulatory landscape increasingly favors bio-based adhesive components like tartaric acid through green procurement policies, extended producer responsibility frameworks, and chemical registration advantages for naturally-derived substances. These policy drivers create market incentives that further strengthen the sustainability case for tartaric acid incorporation in next-generation adhesive systems.

Regulatory Compliance and Safety Standards

The regulatory landscape for tartaric acid in high-performance adhesives is governed by multiple international and regional frameworks that manufacturers must navigate carefully. In the United States, the FDA regulates tartaric acid under 21 CFR 184.1099 as Generally Recognized as Safe (GRAS) for food applications, but its use in adhesives falls under different regulatory scrutiny, particularly when these adhesives may come into contact with food packaging or medical devices. The EPA also maintains oversight through the Toxic Substances Control Act (TSCA), requiring manufacturers to report new chemical uses and conduct safety assessments.

European regulations present additional complexity through the REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) framework, which requires comprehensive safety data for chemicals used in industrial applications. Tartaric acid, while naturally occurring, must still meet stringent documentation requirements when incorporated into high-performance adhesive formulations. The European Chemicals Agency (ECHA) classification system further categorizes tartaric acid based on its potential hazards in concentrated industrial applications.

Safety standards for tartaric acid-based adhesives extend beyond regulatory compliance to include industry-specific certifications. ASTM D4236 standards for art materials and ISO 10993 for biocompatibility testing become relevant when these adhesives are used in consumer products or medical applications. Manufacturers must conduct extensive testing to demonstrate that tartaric acid components do not leach or migrate from the cured adhesive under expected use conditions.

Occupational safety considerations represent another critical dimension of compliance. Workers handling concentrated tartaric acid during adhesive manufacturing require appropriate personal protective equipment (PPE) and ventilation systems as outlined in OSHA standards. Safety Data Sheets (SDS) must accurately reflect the concentration-dependent hazard profile of tartaric acid, which can cause eye and respiratory irritation at high concentrations despite its generally low toxicity profile.

Environmental regulations increasingly impact adhesive formulations containing tartaric acid. While the biodegradability of tartaric acid represents an advantage over petroleum-based alternatives, manufacturers must still document environmental fate and transport characteristics. The growing emphasis on sustainable chemistry has prompted voluntary certification programs like EPA's Safer Choice, which evaluates the environmental and health impacts of chemical components in consumer and industrial products.

Global harmonization efforts, particularly the Globally Harmonized System of Classification and Labelling of Chemicals (GHS), have standardized hazard communication requirements for tartaric acid across international markets. This system facilitates trade while ensuring consistent safety information accompanies tartaric acid-containing adhesives regardless of their country of origin or destination.

European regulations present additional complexity through the REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) framework, which requires comprehensive safety data for chemicals used in industrial applications. Tartaric acid, while naturally occurring, must still meet stringent documentation requirements when incorporated into high-performance adhesive formulations. The European Chemicals Agency (ECHA) classification system further categorizes tartaric acid based on its potential hazards in concentrated industrial applications.

Safety standards for tartaric acid-based adhesives extend beyond regulatory compliance to include industry-specific certifications. ASTM D4236 standards for art materials and ISO 10993 for biocompatibility testing become relevant when these adhesives are used in consumer products or medical applications. Manufacturers must conduct extensive testing to demonstrate that tartaric acid components do not leach or migrate from the cured adhesive under expected use conditions.

Occupational safety considerations represent another critical dimension of compliance. Workers handling concentrated tartaric acid during adhesive manufacturing require appropriate personal protective equipment (PPE) and ventilation systems as outlined in OSHA standards. Safety Data Sheets (SDS) must accurately reflect the concentration-dependent hazard profile of tartaric acid, which can cause eye and respiratory irritation at high concentrations despite its generally low toxicity profile.

Environmental regulations increasingly impact adhesive formulations containing tartaric acid. While the biodegradability of tartaric acid represents an advantage over petroleum-based alternatives, manufacturers must still document environmental fate and transport characteristics. The growing emphasis on sustainable chemistry has prompted voluntary certification programs like EPA's Safer Choice, which evaluates the environmental and health impacts of chemical components in consumer and industrial products.

Global harmonization efforts, particularly the Globally Harmonized System of Classification and Labelling of Chemicals (GHS), have standardized hazard communication requirements for tartaric acid across international markets. This system facilitates trade while ensuring consistent safety information accompanies tartaric acid-containing adhesives regardless of their country of origin or destination.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!