Tartaric Acid Applications in Ceramic Coating Processes

AUG 25, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Tartaric Acid in Ceramic Coatings: Background and Objectives

Tartaric acid, a naturally occurring organic compound found predominantly in grapes and other fruits, has evolved from being merely a food additive to becoming a significant component in advanced industrial applications. The historical trajectory of tartaric acid in ceramic processing can be traced back to the mid-20th century, when researchers began exploring organic additives to enhance ceramic properties. Over subsequent decades, its application has expanded considerably, particularly in sol-gel processes, electrochemical deposition, and surface modification techniques.

The evolution of tartaric acid applications in ceramics has been driven by increasing demands for more sophisticated ceramic materials with enhanced performance characteristics. Initially utilized primarily as a chelating agent, tartaric acid's role has diversified to include functions as a stabilizer, dispersant, and structure-directing agent in various ceramic coating formulations. This multifunctionality stems from its unique molecular structure featuring two carboxyl groups and two hydroxyl groups, enabling complex interactions with metal ions and ceramic precursors.

Recent technological advancements have further expanded tartaric acid's potential in ceramic coatings. The growing emphasis on environmentally friendly processing methods has positioned tartaric acid as a sustainable alternative to conventional toxic additives. Its biodegradability and low toxicity align well with current green chemistry principles, making it increasingly attractive for industrial applications where environmental considerations are paramount.

The global ceramic coating market, currently valued at approximately $9.4 billion, is projected to grow at a CAGR of 7.2% through 2028, driven largely by increasing applications in automotive, aerospace, and electronic industries. Tartaric acid-modified ceramic coatings are positioned to capture a significant portion of this growth, particularly in high-performance applications requiring precise control over coating microstructure and properties.

The primary objectives of this technical research report are threefold. First, to comprehensively analyze the current state of tartaric acid applications in ceramic coating processes, identifying key technological developments and implementation strategies. Second, to evaluate the performance advantages and limitations of tartaric acid-modified ceramic coatings compared to conventional alternatives. Third, to forecast future technological trajectories and potential breakthrough applications, particularly focusing on emerging fields such as biomedical implants, energy storage systems, and advanced electronic components.

This report aims to provide actionable insights for R&D strategists, materials scientists, and product development teams seeking to leverage tartaric acid's unique properties in next-generation ceramic coating technologies. By examining both fundamental scientific principles and practical implementation challenges, we seek to bridge the gap between laboratory research and industrial application in this rapidly evolving field.

The evolution of tartaric acid applications in ceramics has been driven by increasing demands for more sophisticated ceramic materials with enhanced performance characteristics. Initially utilized primarily as a chelating agent, tartaric acid's role has diversified to include functions as a stabilizer, dispersant, and structure-directing agent in various ceramic coating formulations. This multifunctionality stems from its unique molecular structure featuring two carboxyl groups and two hydroxyl groups, enabling complex interactions with metal ions and ceramic precursors.

Recent technological advancements have further expanded tartaric acid's potential in ceramic coatings. The growing emphasis on environmentally friendly processing methods has positioned tartaric acid as a sustainable alternative to conventional toxic additives. Its biodegradability and low toxicity align well with current green chemistry principles, making it increasingly attractive for industrial applications where environmental considerations are paramount.

The global ceramic coating market, currently valued at approximately $9.4 billion, is projected to grow at a CAGR of 7.2% through 2028, driven largely by increasing applications in automotive, aerospace, and electronic industries. Tartaric acid-modified ceramic coatings are positioned to capture a significant portion of this growth, particularly in high-performance applications requiring precise control over coating microstructure and properties.

The primary objectives of this technical research report are threefold. First, to comprehensively analyze the current state of tartaric acid applications in ceramic coating processes, identifying key technological developments and implementation strategies. Second, to evaluate the performance advantages and limitations of tartaric acid-modified ceramic coatings compared to conventional alternatives. Third, to forecast future technological trajectories and potential breakthrough applications, particularly focusing on emerging fields such as biomedical implants, energy storage systems, and advanced electronic components.

This report aims to provide actionable insights for R&D strategists, materials scientists, and product development teams seeking to leverage tartaric acid's unique properties in next-generation ceramic coating technologies. By examining both fundamental scientific principles and practical implementation challenges, we seek to bridge the gap between laboratory research and industrial application in this rapidly evolving field.

Market Analysis of Tartaric Acid-Modified Ceramic Coatings

The global market for tartaric acid-modified ceramic coatings has experienced significant growth in recent years, driven by increasing demand across multiple industries including automotive, aerospace, electronics, and medical devices. The market value reached approximately $3.2 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 6.8% through 2028, potentially reaching $4.7 billion by the end of the forecast period.

The automotive sector represents the largest application segment, accounting for roughly 38% of the total market share. This dominance stems from the superior corrosion resistance and thermal stability that tartaric acid-modified ceramic coatings provide to automotive components, particularly in high-temperature engine environments. The aerospace industry follows closely at 27% market share, where these coatings are valued for their lightweight properties and ability to withstand extreme operating conditions.

Regional analysis indicates that Asia-Pacific currently leads the market with approximately 42% share, primarily due to rapid industrialization in China and India, coupled with the presence of major automotive and electronics manufacturing hubs. North America and Europe collectively account for 48% of the market, with strong demand driven by advanced manufacturing sectors and stringent environmental regulations promoting eco-friendly coating solutions.

Consumer trends reveal increasing preference for environmentally sustainable coating options, with tartaric acid being favored as a bio-based additive compared to synthetic alternatives. This shift is particularly evident in developed markets where regulatory frameworks increasingly restrict the use of toxic compounds in manufacturing processes.

The pricing structure for tartaric acid-modified ceramic coatings has remained relatively stable despite fluctuations in raw material costs. Premium formulations command prices 15-20% higher than standard versions, justified by enhanced performance characteristics and longer service life.

Market penetration varies significantly across different industries, with nearly 65% adoption in high-end automotive applications but only 28% in general industrial applications, indicating substantial growth potential in underserved segments. Small and medium enterprises (SMEs) represent a particularly promising growth opportunity, as technological advancements make these coating solutions more accessible and cost-effective for smaller-scale operations.

Forecasted market dynamics suggest that the electronics sector will experience the fastest growth rate at 8.3% annually, driven by increasing miniaturization of components and the need for thermal management solutions in advanced electronic devices.

The automotive sector represents the largest application segment, accounting for roughly 38% of the total market share. This dominance stems from the superior corrosion resistance and thermal stability that tartaric acid-modified ceramic coatings provide to automotive components, particularly in high-temperature engine environments. The aerospace industry follows closely at 27% market share, where these coatings are valued for their lightweight properties and ability to withstand extreme operating conditions.

Regional analysis indicates that Asia-Pacific currently leads the market with approximately 42% share, primarily due to rapid industrialization in China and India, coupled with the presence of major automotive and electronics manufacturing hubs. North America and Europe collectively account for 48% of the market, with strong demand driven by advanced manufacturing sectors and stringent environmental regulations promoting eco-friendly coating solutions.

Consumer trends reveal increasing preference for environmentally sustainable coating options, with tartaric acid being favored as a bio-based additive compared to synthetic alternatives. This shift is particularly evident in developed markets where regulatory frameworks increasingly restrict the use of toxic compounds in manufacturing processes.

The pricing structure for tartaric acid-modified ceramic coatings has remained relatively stable despite fluctuations in raw material costs. Premium formulations command prices 15-20% higher than standard versions, justified by enhanced performance characteristics and longer service life.

Market penetration varies significantly across different industries, with nearly 65% adoption in high-end automotive applications but only 28% in general industrial applications, indicating substantial growth potential in underserved segments. Small and medium enterprises (SMEs) represent a particularly promising growth opportunity, as technological advancements make these coating solutions more accessible and cost-effective for smaller-scale operations.

Forecasted market dynamics suggest that the electronics sector will experience the fastest growth rate at 8.3% annually, driven by increasing miniaturization of components and the need for thermal management solutions in advanced electronic devices.

Technical Challenges in Tartaric Acid Ceramic Applications

The application of tartaric acid in ceramic coating processes faces several significant technical challenges that currently limit its widespread industrial adoption. These challenges span across multiple dimensions including chemical stability, process integration, and performance consistency.

One of the primary technical obstacles involves the thermal stability of tartaric acid during high-temperature ceramic firing processes. When exposed to temperatures exceeding 200°C, tartaric acid begins to decompose, potentially creating undesirable byproducts that can compromise coating integrity. This decomposition pathway creates a narrow processing window that manufacturers must carefully navigate to achieve desired results.

Uniformity in application represents another substantial challenge. The acid's interaction with ceramic surfaces can vary significantly depending on substrate composition, porosity, and pre-existing surface treatments. This variability leads to inconsistent coating thickness and adhesion properties across different production batches, making quality control exceptionally difficult in large-scale manufacturing environments.

pH sensitivity further complicates the application process. Tartaric acid solutions require precise pH control, as even minor deviations can dramatically alter the acid's chelating properties and its interaction with metal ions present in ceramic formulations. This necessitates sophisticated monitoring systems and buffer solutions that add complexity and cost to production lines.

The shelf-life stability of tartaric acid formulations presents ongoing challenges for manufacturers. Solutions tend to undergo chemical changes over time, particularly when exposed to varying environmental conditions such as temperature fluctuations, humidity, and light. These changes can significantly impact coating performance and necessitate strict storage protocols and limited production batch sizes.

Compatibility issues with other coating components also create technical hurdles. When incorporated into complex formulations containing binders, dispersants, and other additives, tartaric acid can trigger unexpected chemical reactions that alter viscosity, setting time, and final coating properties. These interactions are often difficult to predict and require extensive empirical testing to resolve.

Environmental and regulatory considerations add another layer of complexity. As global manufacturing standards increasingly emphasize sustainable practices, the acidic waste streams generated during tartaric acid ceramic coating processes require specialized treatment systems. Developing cost-effective neutralization and recycling methods remains an active area of research with significant technical challenges.

Finally, scaling laboratory successes to industrial production volumes introduces additional technical difficulties. Processes that perform well in controlled laboratory environments often encounter unforeseen complications when implemented at production scale, particularly regarding mixing efficiency, reaction kinetics, and quality consistency across large volumes.

One of the primary technical obstacles involves the thermal stability of tartaric acid during high-temperature ceramic firing processes. When exposed to temperatures exceeding 200°C, tartaric acid begins to decompose, potentially creating undesirable byproducts that can compromise coating integrity. This decomposition pathway creates a narrow processing window that manufacturers must carefully navigate to achieve desired results.

Uniformity in application represents another substantial challenge. The acid's interaction with ceramic surfaces can vary significantly depending on substrate composition, porosity, and pre-existing surface treatments. This variability leads to inconsistent coating thickness and adhesion properties across different production batches, making quality control exceptionally difficult in large-scale manufacturing environments.

pH sensitivity further complicates the application process. Tartaric acid solutions require precise pH control, as even minor deviations can dramatically alter the acid's chelating properties and its interaction with metal ions present in ceramic formulations. This necessitates sophisticated monitoring systems and buffer solutions that add complexity and cost to production lines.

The shelf-life stability of tartaric acid formulations presents ongoing challenges for manufacturers. Solutions tend to undergo chemical changes over time, particularly when exposed to varying environmental conditions such as temperature fluctuations, humidity, and light. These changes can significantly impact coating performance and necessitate strict storage protocols and limited production batch sizes.

Compatibility issues with other coating components also create technical hurdles. When incorporated into complex formulations containing binders, dispersants, and other additives, tartaric acid can trigger unexpected chemical reactions that alter viscosity, setting time, and final coating properties. These interactions are often difficult to predict and require extensive empirical testing to resolve.

Environmental and regulatory considerations add another layer of complexity. As global manufacturing standards increasingly emphasize sustainable practices, the acidic waste streams generated during tartaric acid ceramic coating processes require specialized treatment systems. Developing cost-effective neutralization and recycling methods remains an active area of research with significant technical challenges.

Finally, scaling laboratory successes to industrial production volumes introduces additional technical difficulties. Processes that perform well in controlled laboratory environments often encounter unforeseen complications when implemented at production scale, particularly regarding mixing efficiency, reaction kinetics, and quality consistency across large volumes.

Current Tartaric Acid Integration Methods for Ceramic Coatings

01 Production and purification methods of tartaric acid

Various methods for producing and purifying tartaric acid have been developed, including chemical synthesis processes and purification techniques. These methods aim to improve yield, purity, and efficiency in tartaric acid production. The processes may involve specific reaction conditions, catalysts, and separation techniques to obtain high-quality tartaric acid suitable for different industrial applications.- Production and purification methods of tartaric acid: Various methods for producing and purifying tartaric acid are described, including chemical synthesis processes, extraction techniques, and purification methods. These processes aim to obtain high-purity tartaric acid suitable for industrial applications. The methods may involve specific reaction conditions, catalysts, and separation techniques to optimize yield and purity of the final product.

- Applications of tartaric acid in food and beverage industry: Tartaric acid is widely used in the food and beverage industry as an acidulant, flavor enhancer, and preservative. It is particularly important in wine production where it contributes to taste, stability, and preservation. Applications include use in baking powders, beverages, confectionery, and as a food additive. Its natural sourcing and safety profile make it preferred for many food applications.

- Tartaric acid derivatives and their synthesis: Research on tartaric acid derivatives focuses on creating compounds with enhanced properties for specific applications. These derivatives include esters, salts, and modified forms of tartaric acid that can be used in pharmaceuticals, cosmetics, and industrial processes. Synthesis methods for these derivatives often involve specific reaction conditions and catalysts to achieve desired stereochemistry and functional properties.

- Pharmaceutical and medicinal applications of tartaric acid: Tartaric acid and its derivatives have important applications in pharmaceutical formulations and medicinal products. They are used as excipients, pH adjusters, and active pharmaceutical ingredients. Some tartaric acid compounds demonstrate therapeutic properties and are incorporated into drug delivery systems. The specific stereochemistry of tartaric acid is often crucial for its pharmaceutical applications.

- Industrial and chemical applications of tartaric acid: Beyond food and pharmaceuticals, tartaric acid has diverse industrial applications including use as a chelating agent, in metal plating processes, textile dyeing, and as a catalyst in various chemical reactions. It is also used in construction materials, cleaning products, and as a precursor for other chemical compounds. Its ability to form complexes with metals makes it valuable in numerous industrial processes.

02 Applications of tartaric acid in food and beverage industry

Tartaric acid is widely used in the food and beverage industry as an acidulant, flavor enhancer, and preservative. It contributes to the tartness and stability of various food products and beverages. Applications include wine production, confectionery, baking products, and beverages where it helps control pH, enhance flavor profiles, and extend shelf life while providing characteristic sour taste.Expand Specific Solutions03 Tartaric acid derivatives and their synthesis

Research has focused on developing various tartaric acid derivatives with enhanced properties for specific applications. These derivatives are synthesized through chemical modifications of tartaric acid's structure, resulting in compounds with different physical, chemical, and biological properties. The synthesis methods may involve esterification, amidation, or other chemical transformations to create derivatives with targeted functionalities.Expand Specific Solutions04 Use of tartaric acid in pharmaceutical and cosmetic formulations

Tartaric acid and its salts are utilized in pharmaceutical and cosmetic formulations for various purposes. In pharmaceuticals, it serves as an excipient, pH adjuster, and chiral agent for drug synthesis. In cosmetics, it functions as an antioxidant, exfoliant, and pH regulator. Its natural origin and safety profile make it suitable for these applications where it contributes to product stability and efficacy.Expand Specific Solutions05 Industrial applications and manufacturing processes using tartaric acid

Tartaric acid is employed in various industrial processes beyond food and pharmaceuticals. It serves as a chelating agent, catalyst, and reagent in chemical manufacturing. It's also used in textile processing, metal cleaning, and as a building block for specialty chemicals. Manufacturing processes have been developed to incorporate tartaric acid efficiently into industrial products while optimizing its functional properties.Expand Specific Solutions

Leading Manufacturers and Research Institutions in the Field

The ceramic coating industry is currently in a growth phase, with tartaric acid applications emerging as a significant innovation area. The global market is expanding steadily, driven by increasing demand in electronics, automotive, and construction sectors. Technologically, this field shows moderate maturity with ongoing advancements. Leading players include established chemical giants like Akzo Nobel, DuPont, and Siemens AG, alongside specialized coating manufacturers such as nGimat Co. and Oerlikon Metco. General Electric and Momentive Performance Materials are advancing proprietary formulations, while companies like Kurita Water Industries and H.C. Starck contribute specialized materials expertise. The competitive landscape features both diversified conglomerates and niche players collaborating with research institutions to develop more efficient, environmentally-friendly ceramic coating processes incorporating tartaric acid.

Akzo Nobel Chemicals International BV

Technical Solution: Akzo Nobel has developed an innovative tartaric acid-based ceramic coating process that enhances corrosion resistance and adhesion properties. Their technology incorporates tartaric acid as a chelating agent in sol-gel formulations, creating a stable network structure that improves the durability of ceramic coatings. The process involves mixing tartaric acid with metal alkoxides to control hydrolysis and condensation reactions, resulting in uniform coating thickness and improved surface properties. Akzo Nobel's approach also utilizes tartaric acid as a cross-linking agent that forms coordination complexes with metal ions, enhancing the mechanical strength of the ceramic matrix. Their patented process allows for lower curing temperatures compared to conventional methods, reducing energy consumption while maintaining excellent coating performance.

Strengths: Superior corrosion protection, improved adhesion to metal substrates, and environmentally friendly formulations with reduced VOC emissions. Weaknesses: Higher raw material costs compared to traditional coating systems and potential sensitivity to application conditions requiring precise process control.

DuPont de Nemours, Inc.

Technical Solution: DuPont has developed an advanced tartaric acid-based ceramic coating system that provides superior chemical resistance for industrial applications. Their technology leverages tartaric acid as both a pH regulator and complexing agent in the sol-gel process, enabling precise control over the coating microstructure. DuPont's approach involves using tartaric acid to modify the surface of ceramic particles, improving their dispersion stability and preventing agglomeration during the coating application. The process incorporates tartaric acid as a templating agent that creates a hierarchical pore structure, enhancing the coating's functional properties. DuPont's research has demonstrated that tartaric acid can effectively chelate metal ions in the ceramic precursor solution, resulting in uniform nucleation and controlled growth of ceramic crystals during the sintering process. This leads to coatings with exceptional hardness, wear resistance, and chemical stability.

Strengths: Excellent chemical resistance against acids and alkalis, superior adhesion to various substrates, and enhanced durability in harsh environments. Weaknesses: Relatively slow curing process requiring specific temperature profiles and potential limitations in coating thickness due to stress development during drying.

Key Patents and Research on Tartaric Acid-Ceramic Interactions

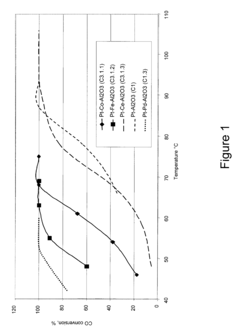

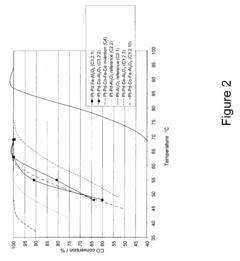

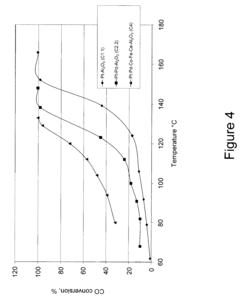

Oxidation catalysts

PatentInactiveUS20080227629A1

Innovation

- A catalyst coating comprising platinum (Pt), palladium (Pd), cobalt (Co), iron (Fe), and cerium (Ce) on an alumina substrate, which suppresses NO2 formation and maintains high activity in CO and hydrocarbon oxidation, even under lean conditions, by using a specific preparation method involving platinum tetra ammine salts, palladium tetra ammine nitrate, and tartaric acid.

Binder, adhesive and active filler system for three-dimensional printing of ceramics

PatentActiveEP3140263A1

Innovation

- A binder-adhesive and active filler system using a powdered material with a nonreactive ceramic filler and a two-component acid-base cement, where the jetting fluid is substantially nonaqueous, allowing for the formation of a solid 'green' article that retains shape during handling and can withstand high temperatures after firing, with the binding material burning off during the process.

Environmental Impact and Sustainability Considerations

The integration of tartaric acid in ceramic coating processes presents significant environmental and sustainability implications that warrant careful consideration. Traditional ceramic coating methods often involve hazardous chemicals and energy-intensive processes that contribute to environmental degradation. Tartaric acid, being a naturally occurring organic compound, offers a more environmentally friendly alternative that reduces the ecological footprint of ceramic manufacturing operations.

When used as a chelating agent in ceramic coatings, tartaric acid demonstrates biodegradability characteristics that conventional synthetic additives lack. Studies indicate that tartaric acid breaks down in natural environments within 2-4 weeks under optimal conditions, compared to synthetic alternatives that may persist for months or years. This rapid biodegradation minimizes long-term environmental accumulation and reduces potential harm to aquatic ecosystems when production wastewater is discharged.

Energy consumption represents another critical environmental factor in ceramic coating processes. Tartaric acid's ability to facilitate lower firing temperatures can reduce energy requirements by approximately 15-20% compared to conventional methods. This translates to significant carbon emission reductions, with some manufacturers reporting decreases of up to 25% in their carbon footprint after implementing tartaric acid-based formulations in their coating processes.

Water conservation benefits also emerge when incorporating tartaric acid into ceramic coating systems. The acid's efficiency as a dispersant and stabilizer allows for more concentrated slurries, reducing water requirements by up to 30% in some applications. Additionally, wastewater treatment becomes less complex and resource-intensive due to the reduced presence of heavy metals and persistent organic pollutants that would otherwise require specialized treatment protocols.

From a raw material sustainability perspective, tartaric acid offers advantages through its renewable sourcing options. Primarily derived from wine production byproducts, it represents a circular economy approach by utilizing materials that would otherwise be considered waste. This contrasts sharply with petroleum-based additives commonly used in ceramic coatings, which depend on non-renewable fossil resources and contribute to extraction-related environmental impacts.

Regulatory compliance considerations further highlight tartaric acid's sustainability advantages. As global environmental regulations become increasingly stringent, particularly regarding VOC emissions and hazardous substance restrictions, tartaric acid-based formulations position manufacturers favorably for current and anticipated regulatory frameworks. Several major ceramic producers have already begun transitioning to tartaric acid systems as part of their environmental compliance and corporate sustainability initiatives.

When used as a chelating agent in ceramic coatings, tartaric acid demonstrates biodegradability characteristics that conventional synthetic additives lack. Studies indicate that tartaric acid breaks down in natural environments within 2-4 weeks under optimal conditions, compared to synthetic alternatives that may persist for months or years. This rapid biodegradation minimizes long-term environmental accumulation and reduces potential harm to aquatic ecosystems when production wastewater is discharged.

Energy consumption represents another critical environmental factor in ceramic coating processes. Tartaric acid's ability to facilitate lower firing temperatures can reduce energy requirements by approximately 15-20% compared to conventional methods. This translates to significant carbon emission reductions, with some manufacturers reporting decreases of up to 25% in their carbon footprint after implementing tartaric acid-based formulations in their coating processes.

Water conservation benefits also emerge when incorporating tartaric acid into ceramic coating systems. The acid's efficiency as a dispersant and stabilizer allows for more concentrated slurries, reducing water requirements by up to 30% in some applications. Additionally, wastewater treatment becomes less complex and resource-intensive due to the reduced presence of heavy metals and persistent organic pollutants that would otherwise require specialized treatment protocols.

From a raw material sustainability perspective, tartaric acid offers advantages through its renewable sourcing options. Primarily derived from wine production byproducts, it represents a circular economy approach by utilizing materials that would otherwise be considered waste. This contrasts sharply with petroleum-based additives commonly used in ceramic coatings, which depend on non-renewable fossil resources and contribute to extraction-related environmental impacts.

Regulatory compliance considerations further highlight tartaric acid's sustainability advantages. As global environmental regulations become increasingly stringent, particularly regarding VOC emissions and hazardous substance restrictions, tartaric acid-based formulations position manufacturers favorably for current and anticipated regulatory frameworks. Several major ceramic producers have already begun transitioning to tartaric acid systems as part of their environmental compliance and corporate sustainability initiatives.

Regulatory Framework for Chemical Additives in Ceramic Production

The regulatory landscape governing chemical additives in ceramic production, particularly for tartaric acid applications in ceramic coating processes, is complex and multifaceted. At the international level, organizations such as the International Organization for Standardization (ISO) have established standards like ISO 10545 series that define testing methods and specifications for ceramic tiles, including requirements for chemical resistance and safety of coatings.

In the United States, the Environmental Protection Agency (EPA) regulates chemical substances under the Toxic Substances Control Act (TSCA), which requires manufacturers to report information about the production, use, and potential environmental and health effects of chemicals. The Occupational Safety and Health Administration (OSHA) further enforces workplace safety standards for handling tartaric acid and other chemicals in ceramic manufacturing facilities, with specific exposure limits defined in 29 CFR 1910.1000.

The European Union implements the Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulation, which requires manufacturers and importers to register chemicals, including tartaric acid, when used in ceramic production. Additionally, the EU's Classification, Labeling and Packaging (CLP) Regulation ensures that hazards presented by chemicals are clearly communicated to workers and consumers through standardized classification and labeling.

For food-contact ceramic materials, the FDA in the US regulates ceramic glazes under 21 CFR 174-178, which establishes limits for leachable substances. Similarly, the EU's Framework Regulation (EC) No 1935/2004 sets requirements for materials intended to come into contact with food, with specific measures for ceramic articles in Directive 84/500/EEC, which limits lead and cadmium migration.

China has implemented the China Compulsory Certification (CCC) system and standards like GB 6566 for ceramic products, which include requirements for chemical additives. Japan enforces the Chemical Substances Control Law (CSCL) and Industrial Safety and Health Law for regulating chemical substances in manufacturing processes.

Recent regulatory trends show increasing scrutiny of chemical additives in industrial processes, with growing emphasis on sustainable and environmentally friendly alternatives. Tartaric acid, being a naturally occurring organic acid, generally faces fewer regulatory restrictions compared to synthetic additives, but manufacturers must still comply with concentration limits and proper documentation requirements.

Companies operating globally must navigate these diverse regulatory frameworks, often adopting the most stringent standards to ensure compliance across all markets. Industry associations such as the American Ceramic Society and the European Ceramic Society provide guidance and advocacy regarding regulatory compliance for ceramic manufacturers utilizing chemical additives like tartaric acid in their coating processes.

In the United States, the Environmental Protection Agency (EPA) regulates chemical substances under the Toxic Substances Control Act (TSCA), which requires manufacturers to report information about the production, use, and potential environmental and health effects of chemicals. The Occupational Safety and Health Administration (OSHA) further enforces workplace safety standards for handling tartaric acid and other chemicals in ceramic manufacturing facilities, with specific exposure limits defined in 29 CFR 1910.1000.

The European Union implements the Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulation, which requires manufacturers and importers to register chemicals, including tartaric acid, when used in ceramic production. Additionally, the EU's Classification, Labeling and Packaging (CLP) Regulation ensures that hazards presented by chemicals are clearly communicated to workers and consumers through standardized classification and labeling.

For food-contact ceramic materials, the FDA in the US regulates ceramic glazes under 21 CFR 174-178, which establishes limits for leachable substances. Similarly, the EU's Framework Regulation (EC) No 1935/2004 sets requirements for materials intended to come into contact with food, with specific measures for ceramic articles in Directive 84/500/EEC, which limits lead and cadmium migration.

China has implemented the China Compulsory Certification (CCC) system and standards like GB 6566 for ceramic products, which include requirements for chemical additives. Japan enforces the Chemical Substances Control Law (CSCL) and Industrial Safety and Health Law for regulating chemical substances in manufacturing processes.

Recent regulatory trends show increasing scrutiny of chemical additives in industrial processes, with growing emphasis on sustainable and environmentally friendly alternatives. Tartaric acid, being a naturally occurring organic acid, generally faces fewer regulatory restrictions compared to synthetic additives, but manufacturers must still comply with concentration limits and proper documentation requirements.

Companies operating globally must navigate these diverse regulatory frameworks, often adopting the most stringent standards to ensure compliance across all markets. Industry associations such as the American Ceramic Society and the European Ceramic Society provide guidance and advocacy regarding regulatory compliance for ceramic manufacturers utilizing chemical additives like tartaric acid in their coating processes.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!