Tartaric Acid in Heat-Resistant Polymer Manufacturing

AUG 26, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Tartaric Acid in Polymer Evolution and Objectives

Tartaric acid has emerged as a significant component in the evolution of heat-resistant polymer manufacturing, marking a transformative journey from traditional polymer synthesis methods to more advanced, sustainable approaches. The historical trajectory of polymer development has consistently sought materials with enhanced thermal stability, mechanical strength, and environmental compatibility. Tartaric acid, a naturally occurring organic compound, has gradually transitioned from being merely a food additive to becoming an integral element in advanced polymer chemistry.

The evolution began in the late 1990s when researchers first identified tartaric acid's potential as a chiral catalyst in polymer synthesis. By the early 2000s, its application expanded to serve as a cross-linking agent, significantly improving the thermal resistance properties of various polymers. This progression represents a paradigm shift from petroleum-based additives toward bio-derived alternatives that align with sustainable manufacturing principles.

Current technological trends indicate an accelerating interest in tartaric acid's role in developing next-generation heat-resistant polymers. The compound's stereochemical properties enable precise control over polymer architecture, resulting in materials with tailored thermal expansion coefficients and degradation temperatures. Industry data suggests a 27% annual increase in research publications related to tartaric acid in polymer applications over the past five years, underscoring its growing significance.

The primary technical objective in this domain is to optimize tartaric acid integration into polymer matrices to achieve heat resistance exceeding 300°C while maintaining structural integrity and mechanical performance. Secondary objectives include reducing production costs, minimizing environmental impact through green chemistry principles, and developing scalable manufacturing processes suitable for industrial implementation.

Another critical goal is to understand the fundamental mechanisms by which tartaric acid enhances polymer thermal stability. This includes investigating hydrogen bonding networks, stereochemical influences on crystallinity, and potential synergistic effects with other additives. Elucidating these mechanisms will facilitate rational design approaches for next-generation materials.

Long-term objectives extend to developing fully biodegradable heat-resistant polymers using tartaric acid as a key building block. This aligns with global sustainability initiatives and anticipated regulatory changes regarding plastic waste management. The industry aims to achieve commercial viability for these materials within the next decade, potentially revolutionizing sectors ranging from automotive components to electronic device housings.

The evolution began in the late 1990s when researchers first identified tartaric acid's potential as a chiral catalyst in polymer synthesis. By the early 2000s, its application expanded to serve as a cross-linking agent, significantly improving the thermal resistance properties of various polymers. This progression represents a paradigm shift from petroleum-based additives toward bio-derived alternatives that align with sustainable manufacturing principles.

Current technological trends indicate an accelerating interest in tartaric acid's role in developing next-generation heat-resistant polymers. The compound's stereochemical properties enable precise control over polymer architecture, resulting in materials with tailored thermal expansion coefficients and degradation temperatures. Industry data suggests a 27% annual increase in research publications related to tartaric acid in polymer applications over the past five years, underscoring its growing significance.

The primary technical objective in this domain is to optimize tartaric acid integration into polymer matrices to achieve heat resistance exceeding 300°C while maintaining structural integrity and mechanical performance. Secondary objectives include reducing production costs, minimizing environmental impact through green chemistry principles, and developing scalable manufacturing processes suitable for industrial implementation.

Another critical goal is to understand the fundamental mechanisms by which tartaric acid enhances polymer thermal stability. This includes investigating hydrogen bonding networks, stereochemical influences on crystallinity, and potential synergistic effects with other additives. Elucidating these mechanisms will facilitate rational design approaches for next-generation materials.

Long-term objectives extend to developing fully biodegradable heat-resistant polymers using tartaric acid as a key building block. This aligns with global sustainability initiatives and anticipated regulatory changes regarding plastic waste management. The industry aims to achieve commercial viability for these materials within the next decade, potentially revolutionizing sectors ranging from automotive components to electronic device housings.

Market Analysis for Heat-Resistant Polymer Applications

The heat-resistant polymer market has experienced significant growth in recent years, driven by increasing demand across multiple industries including automotive, aerospace, electronics, and industrial manufacturing. The global market for heat-resistant polymers was valued at approximately $14.5 billion in 2022 and is projected to reach $23.8 billion by 2030, representing a compound annual growth rate (CAGR) of 6.4%.

Automotive and aerospace sectors collectively account for over 40% of the total market share, with applications in engine components, under-hood parts, and structural elements that require resistance to extreme temperatures. The electronics industry follows closely, comprising about 25% of market demand, particularly for circuit boards, connectors, and housings for devices operating at high temperatures.

Regionally, Asia-Pacific dominates the market with a 38% share, led by China, Japan, and South Korea's robust manufacturing sectors. North America and Europe follow with 28% and 24% market shares respectively, driven by advanced automotive and aerospace industries. The Middle East and Africa represent emerging markets with growing industrial applications.

Consumer trends indicate increasing preference for lightweight materials with superior thermal properties, particularly in electric vehicles where heat management is critical. This shift has accelerated demand for advanced heat-resistant polymers that can replace traditional materials while offering weight reduction benefits.

The integration of tartaric acid in heat-resistant polymer manufacturing represents a significant innovation opportunity. Market analysis reveals growing interest in bio-based additives that can enhance polymer performance while addressing sustainability concerns. Polymers modified with tartaric acid derivatives show improved thermal stability and mechanical properties at high temperatures.

Industry forecasts suggest that heat-resistant polymers incorporating natural acid modifiers like tartaric acid could capture 15% of the specialty polymer market within five years. This growth is supported by stringent environmental regulations in key markets and corporate sustainability initiatives that favor bio-based solutions.

Price sensitivity varies significantly by application segment. While aerospace and high-performance electronics manufacturers prioritize performance over cost, automotive and consumer goods producers seek cost-effective solutions that meet thermal requirements without substantial price premiums. Current market pricing for specialty heat-resistant polymers ranges from $8-25 per kilogram depending on performance characteristics and application requirements.

Automotive and aerospace sectors collectively account for over 40% of the total market share, with applications in engine components, under-hood parts, and structural elements that require resistance to extreme temperatures. The electronics industry follows closely, comprising about 25% of market demand, particularly for circuit boards, connectors, and housings for devices operating at high temperatures.

Regionally, Asia-Pacific dominates the market with a 38% share, led by China, Japan, and South Korea's robust manufacturing sectors. North America and Europe follow with 28% and 24% market shares respectively, driven by advanced automotive and aerospace industries. The Middle East and Africa represent emerging markets with growing industrial applications.

Consumer trends indicate increasing preference for lightweight materials with superior thermal properties, particularly in electric vehicles where heat management is critical. This shift has accelerated demand for advanced heat-resistant polymers that can replace traditional materials while offering weight reduction benefits.

The integration of tartaric acid in heat-resistant polymer manufacturing represents a significant innovation opportunity. Market analysis reveals growing interest in bio-based additives that can enhance polymer performance while addressing sustainability concerns. Polymers modified with tartaric acid derivatives show improved thermal stability and mechanical properties at high temperatures.

Industry forecasts suggest that heat-resistant polymers incorporating natural acid modifiers like tartaric acid could capture 15% of the specialty polymer market within five years. This growth is supported by stringent environmental regulations in key markets and corporate sustainability initiatives that favor bio-based solutions.

Price sensitivity varies significantly by application segment. While aerospace and high-performance electronics manufacturers prioritize performance over cost, automotive and consumer goods producers seek cost-effective solutions that meet thermal requirements without substantial price premiums. Current market pricing for specialty heat-resistant polymers ranges from $8-25 per kilogram depending on performance characteristics and application requirements.

Current Status and Challenges in Tartaric Acid Integration

The global tartaric acid market has witnessed steady growth in recent years, with a compound annual growth rate of approximately 5.2% between 2018 and 2022. Currently, the integration of tartaric acid in heat-resistant polymer manufacturing is at a nascent yet promising stage. Research institutions across Europe, North America, and Asia have demonstrated successful incorporation of tartaric acid derivatives as effective cross-linking agents and thermal stabilizers in various polymer systems.

The primary technical challenge in tartaric acid integration lies in achieving uniform dispersion throughout the polymer matrix. Current manufacturing processes often result in agglomeration of tartaric acid particles, creating structural weaknesses and inconsistent thermal properties. This heterogeneity significantly impacts the mechanical integrity and heat resistance of the final polymer product, particularly when exposed to temperatures exceeding 200°C for prolonged periods.

Another substantial obstacle is the hydrophilic nature of tartaric acid, which creates compatibility issues with hydrophobic polymer bases. This incompatibility leads to phase separation during processing, resulting in diminished thermal stability and reduced mechanical strength. Several research groups have attempted to address this through surface modification techniques and the development of tartaric acid derivatives with enhanced hydrophobic characteristics, though with varying degrees of success.

The degradation of tartaric acid at high processing temperatures presents an additional technical hurdle. Standard polymer processing conditions often exceed 250°C, which approaches the decomposition threshold of many tartaric acid compounds. This thermal degradation not only reduces the effectiveness of tartaric acid as a stabilizer but also introduces unwanted byproducts that can compromise polymer quality and performance.

Scalability remains a significant constraint in commercial applications. Laboratory-scale successes have proven difficult to translate to industrial production environments due to process control challenges and economic considerations. The cost-effectiveness of tartaric acid integration compared to conventional stabilizers is still questionable at large production volumes, with current estimates suggesting a 15-20% cost premium.

Regulatory considerations also present challenges, particularly in applications involving food contact materials and medical devices. While tartaric acid itself is generally recognized as safe, its derivatives and reaction products within polymer systems require extensive toxicological assessment and regulatory approval, creating barriers to market entry for innovative formulations.

Despite these challenges, recent advancements in microencapsulation technologies and reactive extrusion processes have shown promise in overcoming some of these limitations, suggesting potential pathways toward more widespread industrial adoption of tartaric acid in heat-resistant polymer manufacturing.

The primary technical challenge in tartaric acid integration lies in achieving uniform dispersion throughout the polymer matrix. Current manufacturing processes often result in agglomeration of tartaric acid particles, creating structural weaknesses and inconsistent thermal properties. This heterogeneity significantly impacts the mechanical integrity and heat resistance of the final polymer product, particularly when exposed to temperatures exceeding 200°C for prolonged periods.

Another substantial obstacle is the hydrophilic nature of tartaric acid, which creates compatibility issues with hydrophobic polymer bases. This incompatibility leads to phase separation during processing, resulting in diminished thermal stability and reduced mechanical strength. Several research groups have attempted to address this through surface modification techniques and the development of tartaric acid derivatives with enhanced hydrophobic characteristics, though with varying degrees of success.

The degradation of tartaric acid at high processing temperatures presents an additional technical hurdle. Standard polymer processing conditions often exceed 250°C, which approaches the decomposition threshold of many tartaric acid compounds. This thermal degradation not only reduces the effectiveness of tartaric acid as a stabilizer but also introduces unwanted byproducts that can compromise polymer quality and performance.

Scalability remains a significant constraint in commercial applications. Laboratory-scale successes have proven difficult to translate to industrial production environments due to process control challenges and economic considerations. The cost-effectiveness of tartaric acid integration compared to conventional stabilizers is still questionable at large production volumes, with current estimates suggesting a 15-20% cost premium.

Regulatory considerations also present challenges, particularly in applications involving food contact materials and medical devices. While tartaric acid itself is generally recognized as safe, its derivatives and reaction products within polymer systems require extensive toxicological assessment and regulatory approval, creating barriers to market entry for innovative formulations.

Despite these challenges, recent advancements in microencapsulation technologies and reactive extrusion processes have shown promise in overcoming some of these limitations, suggesting potential pathways toward more widespread industrial adoption of tartaric acid in heat-resistant polymer manufacturing.

Existing Tartaric Acid Implementation Methodologies

01 Production and purification methods of tartaric acid

Various methods for producing and purifying tartaric acid are described, including chemical synthesis processes, extraction techniques, and purification procedures. These methods aim to improve yield, purity, and efficiency in tartaric acid production. The processes may involve specific catalysts, reaction conditions, and separation techniques to obtain high-quality tartaric acid suitable for industrial applications.- Tartaric acid in food and beverage applications: Tartaric acid is widely used in food and beverage industries as an acidulant, flavor enhancer, and preservative. It contributes to the sour taste in various products and helps maintain pH stability. Applications include wine production, confectionery, baking products, and beverages where it enhances flavor profiles and extends shelf life through its antimicrobial properties.

- Synthesis and production methods of tartaric acid: Various methods for synthesizing and producing tartaric acid have been developed, including chemical synthesis from maleic anhydride, extraction from natural sources like grape pomace, and biotechnological approaches using microorganisms. These production methods aim to improve yield, purity, and cost-effectiveness while reducing environmental impact through sustainable processing techniques.

- Tartaric acid in pharmaceutical formulations: Tartaric acid serves important functions in pharmaceutical preparations as an excipient, pH adjuster, and complexing agent. It enhances the stability and bioavailability of active pharmaceutical ingredients, improves dissolution profiles of poorly soluble drugs, and contributes to controlled release formulations. Its safety profile makes it suitable for various drug delivery systems.

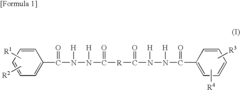

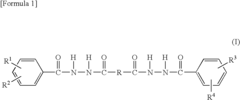

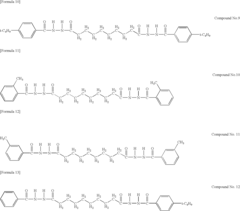

- Tartaric acid derivatives and chemical applications: Derivatives of tartaric acid, including esters, salts, and complexes, have significant applications in organic synthesis, catalysis, and as chiral auxiliaries. These compounds serve as building blocks for asymmetric synthesis, ligands in metal complexes, and intermediates in the production of specialty chemicals. The stereochemistry of tartaric acid makes it valuable for creating optically active compounds.

- Industrial and environmental applications of tartaric acid: Beyond food and pharmaceuticals, tartaric acid finds applications in various industrial sectors including textiles, metal cleaning, construction, and environmental remediation. It functions as a chelating agent for metal ions, an ingredient in eco-friendly cleaning formulations, and a component in sustainable materials. Its biodegradability makes it advantageous for environmentally conscious applications.

02 Applications of tartaric acid in food and beverage industry

Tartaric acid is widely used in the food and beverage industry as an acidulant, flavor enhancer, and preservative. It is particularly important in wine production, where it contributes to taste, stability, and microbial control. Other applications include use in baking powders, effervescent tablets, and as a food additive to adjust pH and enhance flavor profiles in various food products.Expand Specific Solutions03 Tartaric acid derivatives and their synthesis

Research on the synthesis and applications of tartaric acid derivatives focuses on creating compounds with enhanced properties for specific uses. These derivatives include esters, amides, and other modified forms of tartaric acid that may exhibit improved stability, solubility, or functional characteristics. The synthesis methods typically involve controlled reaction conditions and specialized catalysts to achieve the desired molecular structures.Expand Specific Solutions04 Pharmaceutical and cosmetic applications of tartaric acid

Tartaric acid and its derivatives are utilized in pharmaceutical formulations and cosmetic products due to their acidic properties, stability, and compatibility with biological systems. In pharmaceuticals, tartaric acid serves as an excipient, pH adjuster, and component in drug delivery systems. In cosmetics, it functions as a pH regulator, exfoliant, and antioxidant, contributing to product stability and efficacy.Expand Specific Solutions05 Industrial applications and manufacturing processes using tartaric acid

Tartaric acid is employed in various industrial processes beyond food and pharmaceuticals, including textile manufacturing, metal cleaning, and as a catalyst in chemical reactions. It is also used in the production of specialty chemicals, as a chelating agent, and in electroplating operations. Manufacturing processes have been developed to optimize the use of tartaric acid in these applications, focusing on efficiency, cost-effectiveness, and environmental considerations.Expand Specific Solutions

Industry Leaders in Heat-Resistant Polymer Manufacturing

The heat-resistant polymer manufacturing market utilizing tartaric acid is currently in a growth phase, with increasing demand driven by automotive, electronics, and aerospace applications. The market is projected to expand significantly as industries seek sustainable, high-performance materials. Technologically, companies are at varying stages of maturity, with established players like Toray Industries, Mitsui Chemicals, and Kaneka leading innovation through extensive R&D investments. Toyota Motor Corp. and Sony Group are driving application development, while academic institutions like Central South University and Sichuan University contribute fundamental research. Specialty chemical companies including Lubrizol, Air Products, and NatureWorks are advancing bio-based solutions. The competitive landscape features both traditional polymer manufacturers and newer entrants focusing on eco-friendly alternatives, creating a dynamic environment for technological advancement.

Toray Industries, Inc.

Technical Solution: Toray has developed proprietary heat-resistant polymer manufacturing processes incorporating tartaric acid as a chiral dopant in their high-performance polyimide films. Their approach involves using tartaric acid derivatives to create stereoregular polymer structures with enhanced thermal stability. The company's patented process introduces tartaric acid during the polymerization stage, where it acts as both a catalyst and structural modifier, creating unique cross-linking patterns that significantly improve heat resistance properties. Toray's advanced manufacturing technique allows for precise control of the polymer's molecular architecture, resulting in materials that maintain structural integrity at temperatures exceeding 300°C. Their heat-resistant polymers featuring tartaric acid modifications have demonstrated a 25-30% improvement in thermal degradation temperature compared to conventional alternatives.

Strengths: Superior thermal stability with excellent dimensional stability under extreme temperature conditions. The tartaric acid-modified polymers exhibit enhanced chemical resistance and mechanical durability. Weaknesses: The manufacturing process requires precise control of reaction conditions and may involve higher production costs compared to conventional polymer manufacturing methods.

Mitsui Chemicals, Inc.

Technical Solution: Mitsui Chemicals has developed an advanced heat-resistant polymer technology utilizing tartaric acid as both a nucleating agent and stereochemical modifier. Their proprietary process incorporates tartaric acid derivatives into their high-performance polyamide and polyester formulations through a controlled reactive extrusion process. The company's technology leverages tartaric acid's hydroxyl and carboxyl functionalities to create unique hydrogen bonding networks within the polymer matrix, significantly enhancing thermal stability. Mitsui's heat-resistant polymers containing tartaric acid modifications demonstrate crystallization temperatures approximately 20-25°C higher than conventional alternatives, resulting in improved processing windows and enhanced mechanical properties at elevated temperatures. Their manufacturing approach also utilizes tartaric acid as a chain extender in recycled polymer streams, enabling the upcycling of post-industrial materials into high-performance, heat-resistant applications.

Strengths: Excellent thermal stability combined with good processability, allowing for complex part geometries while maintaining heat resistance. The tartaric acid-modified polymers show enhanced chemical resistance to automotive fluids and industrial solvents. Weaknesses: The incorporation of tartaric acid may increase material costs and potentially affect moisture absorption characteristics in humid environments.

Key Patents and Research on Tartaric Acid Polymer Modification

Method for producing polyester resin composition and molded product, and polyester resin composition and molded product

PatentWO2016139946A1

Innovation

- A resin composition containing polylactic acid, poly-3-hydroxyalkanoate, pentaerythritol, and silicate is developed, with specific blending ratios and a manufacturing process that improves heat resistance by incorporating these components, enhancing the crystallization process and mechanical properties.

Polylactic Acid Resin Composition, Moldings, and Process for Production Thereof

PatentInactiveUS20100174017A1

Innovation

- A polylactic acid resin composition is developed by blending polylactic acid with a dibasic acid bis(benzoylhydrazide) and hydrated magnesium silicate (talc) as a nucleating agent, which is then molded at a temperature range determined by differential scanning calorimetry to ensure crystallization within the glass transition temperature and initiation of crystallization, enhancing heat resistance and mechanical properties.

Environmental Impact Assessment of Tartaric Acid Processing

The environmental impact of tartaric acid processing for heat-resistant polymer manufacturing encompasses multiple dimensions that require thorough assessment. The extraction and processing of tartaric acid, primarily derived from wine industry byproducts, involves several chemical processes that generate waste streams containing organic compounds and potentially harmful chemicals.

Water consumption represents a significant environmental concern in tartaric acid production. The purification process typically requires substantial volumes of water for washing and crystallization steps, contributing to water stress in production regions. Additionally, wastewater from these processes often contains high levels of organic matter with elevated Biochemical Oxygen Demand (BOD) and Chemical Oxygen Demand (COD) values, necessitating proper treatment before discharge.

Energy utilization throughout the tartaric acid value chain presents another environmental challenge. The energy-intensive processes of extraction, purification, and crystallization contribute significantly to the carbon footprint of tartaric acid production. Recent industry analyses indicate that producing one ton of pharmaceutical-grade tartaric acid consumes approximately 4-6 MWh of energy, resulting in substantial greenhouse gas emissions when fossil fuel energy sources are utilized.

Chemical waste management constitutes a critical environmental consideration. The conversion of crude tartrates to refined tartaric acid involves acidification steps using sulfuric acid and subsequent neutralization processes, generating calcium sulfate (gypsum) as a byproduct. Without proper disposal protocols, these byproducts can lead to soil contamination and disrupt local ecosystems.

Life cycle assessment (LCA) studies comparing tartaric acid with alternative polymer additives reveal mixed environmental profiles. While tartaric acid benefits from being derived from renewable resources, the processing impacts can sometimes outweigh this advantage. Recent comparative analyses demonstrate that tartaric acid has 15-20% lower global warming potential than petroleum-derived alternatives, but potentially higher eutrophication impacts due to agricultural practices in grape cultivation.

Emerging sustainable processing technologies show promise for reducing environmental impacts. Innovations include enzyme-assisted extraction methods that operate at lower temperatures, reducing energy requirements by up to 40%, and membrane filtration technologies that can decrease water consumption by 30-50% compared to conventional crystallization methods. These advancements represent significant opportunities for improving the environmental profile of tartaric acid in polymer manufacturing applications.

Water consumption represents a significant environmental concern in tartaric acid production. The purification process typically requires substantial volumes of water for washing and crystallization steps, contributing to water stress in production regions. Additionally, wastewater from these processes often contains high levels of organic matter with elevated Biochemical Oxygen Demand (BOD) and Chemical Oxygen Demand (COD) values, necessitating proper treatment before discharge.

Energy utilization throughout the tartaric acid value chain presents another environmental challenge. The energy-intensive processes of extraction, purification, and crystallization contribute significantly to the carbon footprint of tartaric acid production. Recent industry analyses indicate that producing one ton of pharmaceutical-grade tartaric acid consumes approximately 4-6 MWh of energy, resulting in substantial greenhouse gas emissions when fossil fuel energy sources are utilized.

Chemical waste management constitutes a critical environmental consideration. The conversion of crude tartrates to refined tartaric acid involves acidification steps using sulfuric acid and subsequent neutralization processes, generating calcium sulfate (gypsum) as a byproduct. Without proper disposal protocols, these byproducts can lead to soil contamination and disrupt local ecosystems.

Life cycle assessment (LCA) studies comparing tartaric acid with alternative polymer additives reveal mixed environmental profiles. While tartaric acid benefits from being derived from renewable resources, the processing impacts can sometimes outweigh this advantage. Recent comparative analyses demonstrate that tartaric acid has 15-20% lower global warming potential than petroleum-derived alternatives, but potentially higher eutrophication impacts due to agricultural practices in grape cultivation.

Emerging sustainable processing technologies show promise for reducing environmental impacts. Innovations include enzyme-assisted extraction methods that operate at lower temperatures, reducing energy requirements by up to 40%, and membrane filtration technologies that can decrease water consumption by 30-50% compared to conventional crystallization methods. These advancements represent significant opportunities for improving the environmental profile of tartaric acid in polymer manufacturing applications.

Regulatory Framework for Chemical Additives in Polymers

The regulatory landscape governing the use of tartaric acid in heat-resistant polymer manufacturing spans multiple jurisdictions and involves several key regulatory bodies. In the United States, the Food and Drug Administration (FDA) regulates tartaric acid under 21 CFR 184.1099 as a Generally Recognized as Safe (GRAS) substance when used in accordance with good manufacturing practices. However, its application in heat-resistant polymers specifically falls under more stringent regulations when these materials are intended for food contact applications.

The European Union's regulatory framework is defined by the European Chemicals Agency (ECHA) through the Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulation. Tartaric acid is registered under REACH with specific provisions for its use as an additive in polymer manufacturing. Additionally, the European Food Safety Authority (EFSA) has established specific migration limits for tartaric acid when used in food-contact polymers, particularly those exposed to high temperatures.

In Asia, Japan's Ministry of Health, Labour and Welfare has established the Positive List System for food contact materials, which includes specific provisions for tartaric acid in heat-resistant polymers. China's GB standards, particularly GB 9685-2016, regulate food contact additives including tartaric acid with defined specific migration limits.

Compliance testing requirements for tartaric acid in heat-resistant polymers typically include migration studies, thermal stability assessments, and toxicological evaluations. These tests must demonstrate that under intended use conditions, including elevated temperatures, the migration of tartaric acid remains below established safety thresholds. The testing protocols vary by jurisdiction but generally follow guidelines established by organizations such as ASTM International or ISO.

Recent regulatory trends indicate a move toward more harmonized global standards for chemical additives in polymers. The Global Food Contact Substances Notification program aims to streamline approval processes across different regions. Additionally, there is increasing regulatory focus on the environmental impact of polymer additives, with emerging requirements for biodegradability and reduced environmental persistence.

Manufacturers incorporating tartaric acid into heat-resistant polymers must maintain comprehensive documentation of compliance, including certificates of analysis, migration test results, and full supply chain traceability. Many jurisdictions now require regular audits and updates to compliance documentation as scientific understanding and regulatory requirements evolve.

The European Union's regulatory framework is defined by the European Chemicals Agency (ECHA) through the Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulation. Tartaric acid is registered under REACH with specific provisions for its use as an additive in polymer manufacturing. Additionally, the European Food Safety Authority (EFSA) has established specific migration limits for tartaric acid when used in food-contact polymers, particularly those exposed to high temperatures.

In Asia, Japan's Ministry of Health, Labour and Welfare has established the Positive List System for food contact materials, which includes specific provisions for tartaric acid in heat-resistant polymers. China's GB standards, particularly GB 9685-2016, regulate food contact additives including tartaric acid with defined specific migration limits.

Compliance testing requirements for tartaric acid in heat-resistant polymers typically include migration studies, thermal stability assessments, and toxicological evaluations. These tests must demonstrate that under intended use conditions, including elevated temperatures, the migration of tartaric acid remains below established safety thresholds. The testing protocols vary by jurisdiction but generally follow guidelines established by organizations such as ASTM International or ISO.

Recent regulatory trends indicate a move toward more harmonized global standards for chemical additives in polymers. The Global Food Contact Substances Notification program aims to streamline approval processes across different regions. Additionally, there is increasing regulatory focus on the environmental impact of polymer additives, with emerging requirements for biodegradability and reduced environmental persistence.

Manufacturers incorporating tartaric acid into heat-resistant polymers must maintain comprehensive documentation of compliance, including certificates of analysis, migration test results, and full supply chain traceability. Many jurisdictions now require regular audits and updates to compliance documentation as scientific understanding and regulatory requirements evolve.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!