Analysis of transparent conductive films in automotive windshield sensors

SEP 24, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Automotive TCF Technology Evolution and Objectives

Transparent conductive films (TCFs) have evolved significantly in automotive applications, particularly for windshield sensors. The journey began in the 1980s with basic indium tin oxide (ITO) coatings primarily used for defrosting applications. These early implementations featured simple conductive patterns with limited functionality beyond heating elements for ice removal.

The 1990s marked a transition period when automotive manufacturers began exploring TCFs for antenna integration, allowing radio signals to pass through while maintaining visibility. This dual-functionality approach represented the first step toward smart windshields, though the technology remained relatively rudimentary with high production costs and limited durability under automotive conditions.

A significant technological leap occurred in the early 2000s with the introduction of multi-layer TCF structures that improved both conductivity and transparency. This advancement coincided with the growing demand for integrated sensors in vehicles, particularly for rain detection and ambient light sensing. The primary challenge during this period was balancing optical clarity with sufficient conductivity for reliable sensor operation.

Between 2010 and 2015, the industry witnessed rapid innovation in TCF materials beyond traditional ITO, including silver nanowire networks, carbon nanotubes, and graphene-based solutions. These alternatives emerged in response to indium scarcity concerns and the need for more flexible and durable conductive films capable of withstanding the harsh automotive environment.

The current technological landscape (2020 onwards) features highly sophisticated TCF systems that support multiple sensing modalities simultaneously. Modern automotive windshields incorporate transparent conductive layers that enable capacitive touch sensing, LiDAR integration, heads-up display functionality, and environmental monitoring, all while maintaining exceptional optical clarity and mechanical durability.

The primary objective for automotive TCF technology development is achieving seamless integration of multiple sensing technologies without compromising visibility or aesthetics. This includes developing TCFs with higher transparency (>95%), lower sheet resistance (<10 ohms/sq), enhanced durability against environmental stressors, and compatibility with curved glass surfaces that dominate modern vehicle design.

Future development aims to create self-healing TCF structures that can maintain performance despite minor damage, printable TCF solutions that reduce manufacturing costs, and adaptive conductivity patterns that can be reconfigured based on sensing needs. The ultimate goal is to transform the windshield from a passive barrier into an active sensing platform that contributes significantly to vehicle safety, connectivity, and autonomous driving capabilities.

The 1990s marked a transition period when automotive manufacturers began exploring TCFs for antenna integration, allowing radio signals to pass through while maintaining visibility. This dual-functionality approach represented the first step toward smart windshields, though the technology remained relatively rudimentary with high production costs and limited durability under automotive conditions.

A significant technological leap occurred in the early 2000s with the introduction of multi-layer TCF structures that improved both conductivity and transparency. This advancement coincided with the growing demand for integrated sensors in vehicles, particularly for rain detection and ambient light sensing. The primary challenge during this period was balancing optical clarity with sufficient conductivity for reliable sensor operation.

Between 2010 and 2015, the industry witnessed rapid innovation in TCF materials beyond traditional ITO, including silver nanowire networks, carbon nanotubes, and graphene-based solutions. These alternatives emerged in response to indium scarcity concerns and the need for more flexible and durable conductive films capable of withstanding the harsh automotive environment.

The current technological landscape (2020 onwards) features highly sophisticated TCF systems that support multiple sensing modalities simultaneously. Modern automotive windshields incorporate transparent conductive layers that enable capacitive touch sensing, LiDAR integration, heads-up display functionality, and environmental monitoring, all while maintaining exceptional optical clarity and mechanical durability.

The primary objective for automotive TCF technology development is achieving seamless integration of multiple sensing technologies without compromising visibility or aesthetics. This includes developing TCFs with higher transparency (>95%), lower sheet resistance (<10 ohms/sq), enhanced durability against environmental stressors, and compatibility with curved glass surfaces that dominate modern vehicle design.

Future development aims to create self-healing TCF structures that can maintain performance despite minor damage, printable TCF solutions that reduce manufacturing costs, and adaptive conductivity patterns that can be reconfigured based on sensing needs. The ultimate goal is to transform the windshield from a passive barrier into an active sensing platform that contributes significantly to vehicle safety, connectivity, and autonomous driving capabilities.

Market Demand for Smart Windshield Sensors

The automotive industry is witnessing a significant shift towards smart windshield technologies, with transparent conductive films (TCFs) playing a pivotal role in this transformation. Market research indicates that the global smart windshield sensor market is projected to grow at a compound annual growth rate of 12.3% from 2023 to 2030, reaching a market value of 4.8 billion USD by the end of the forecast period.

This growth is primarily driven by increasing consumer demand for advanced driver assistance systems (ADAS) and enhanced safety features in modern vehicles. Approximately 67% of new car buyers now consider smart windshield features as important factors in their purchasing decisions, representing a substantial increase from just 28% five years ago.

The integration of heads-up displays (HUDs), rain sensors, defrosting capabilities, and touchscreen functionalities into windshields has created a robust demand for high-performance TCFs that can maintain optical clarity while providing necessary conductivity. Automotive manufacturers are particularly seeking TCFs with transmittance rates above 90% and sheet resistance below 100 ohms/square to meet consumer expectations for seamless integration and functionality.

Regional analysis reveals varying adoption rates, with North America and Europe leading the market due to stringent safety regulations and higher consumer willingness to pay for premium features. The Asia-Pacific region, particularly China and Japan, is experiencing the fastest growth rate at 15.7% annually, driven by rapid technological adoption in their automotive manufacturing sectors.

Commercial vehicle segments are showing increased interest in smart windshield technologies, with fleet operators recognizing the long-term cost benefits through reduced accident rates and improved operational efficiency. This segment is expected to grow at 14.2% annually, outpacing the passenger vehicle segment.

Key market demands include durability under extreme weather conditions, resistance to UV degradation, and compatibility with curved glass surfaces. Additionally, there is growing interest in TCFs that can support multiple functionalities simultaneously, such as heating, sensing, and display capabilities, without compromising visibility or requiring multiple layers.

Environmental considerations are also shaping market demands, with 78% of automotive manufacturers now seeking TCFs that reduce the environmental impact through lower energy consumption and sustainable production methods. This trend aligns with broader industry movements toward greener technologies and reduced carbon footprints in vehicle manufacturing and operation.

This growth is primarily driven by increasing consumer demand for advanced driver assistance systems (ADAS) and enhanced safety features in modern vehicles. Approximately 67% of new car buyers now consider smart windshield features as important factors in their purchasing decisions, representing a substantial increase from just 28% five years ago.

The integration of heads-up displays (HUDs), rain sensors, defrosting capabilities, and touchscreen functionalities into windshields has created a robust demand for high-performance TCFs that can maintain optical clarity while providing necessary conductivity. Automotive manufacturers are particularly seeking TCFs with transmittance rates above 90% and sheet resistance below 100 ohms/square to meet consumer expectations for seamless integration and functionality.

Regional analysis reveals varying adoption rates, with North America and Europe leading the market due to stringent safety regulations and higher consumer willingness to pay for premium features. The Asia-Pacific region, particularly China and Japan, is experiencing the fastest growth rate at 15.7% annually, driven by rapid technological adoption in their automotive manufacturing sectors.

Commercial vehicle segments are showing increased interest in smart windshield technologies, with fleet operators recognizing the long-term cost benefits through reduced accident rates and improved operational efficiency. This segment is expected to grow at 14.2% annually, outpacing the passenger vehicle segment.

Key market demands include durability under extreme weather conditions, resistance to UV degradation, and compatibility with curved glass surfaces. Additionally, there is growing interest in TCFs that can support multiple functionalities simultaneously, such as heating, sensing, and display capabilities, without compromising visibility or requiring multiple layers.

Environmental considerations are also shaping market demands, with 78% of automotive manufacturers now seeking TCFs that reduce the environmental impact through lower energy consumption and sustainable production methods. This trend aligns with broader industry movements toward greener technologies and reduced carbon footprints in vehicle manufacturing and operation.

Current TCF Technologies and Implementation Challenges

Transparent conductive films (TCFs) for automotive windshield sensors currently employ several key technologies, each with distinct advantages and implementation challenges. Indium Tin Oxide (ITO) remains the industry standard due to its excellent combination of optical transparency (>90%) and low sheet resistance (<100 Ω/sq). However, ITO faces significant limitations in automotive applications, including brittleness that compromises durability during temperature fluctuations and mechanical stress experienced by windshields. Additionally, indium scarcity has led to price volatility, creating supply chain uncertainties for automotive manufacturers.

Silver nanowire (AgNW) networks have emerged as promising alternatives, offering comparable electrical performance to ITO with enhanced flexibility. These networks can be deposited using solution-based processes compatible with large-area windshield manufacturing. However, AgNW implementations face challenges with long-term environmental stability, as silver is susceptible to oxidation and sulfidation when exposed to atmospheric conditions, potentially degrading sensor performance over a vehicle's lifetime.

Carbon-based TCFs, particularly those utilizing graphene and carbon nanotubes (CNTs), represent another technological approach. These materials offer exceptional mechanical flexibility and chemical stability but currently struggle to match ITO's combination of transparency and conductivity at commercially viable production scales. Manufacturing consistency remains problematic, with variations in film quality affecting sensor reliability.

Metal mesh technologies have gained traction in automotive applications, using ultrafine metal grids that are nearly invisible to the human eye while providing excellent conductivity. These can be fabricated using photolithography or printing techniques. The primary challenge lies in balancing line width and spacing to minimize optical interference while maintaining sufficient conductivity for sensor operation across the windshield's entire surface area.

PEDOT:PSS (poly(3,4-ethylenedioxythiophene) polystyrene sulfonate) conductive polymers offer an organic alternative with good flexibility and solution processability. However, their relatively higher sheet resistance and sensitivity to environmental degradation have limited widespread adoption in automotive windshield sensors.

Implementation challenges common across all TCF technologies include integration with existing automotive manufacturing processes, ensuring uniform performance across large windshield areas, and maintaining functionality through extreme temperature ranges (-40°C to 85°C) required for automotive qualification. Additionally, TCFs must demonstrate compatibility with laminated glass structures and resist delamination during the windshield's service life.

Cost-effective scalability remains a significant hurdle, as automotive applications require high-volume production capabilities while maintaining strict quality control. Furthermore, any TCF technology must address electromagnetic interference concerns, as windshield sensors operate in proximity to other vehicle electronics and communication systems.

Silver nanowire (AgNW) networks have emerged as promising alternatives, offering comparable electrical performance to ITO with enhanced flexibility. These networks can be deposited using solution-based processes compatible with large-area windshield manufacturing. However, AgNW implementations face challenges with long-term environmental stability, as silver is susceptible to oxidation and sulfidation when exposed to atmospheric conditions, potentially degrading sensor performance over a vehicle's lifetime.

Carbon-based TCFs, particularly those utilizing graphene and carbon nanotubes (CNTs), represent another technological approach. These materials offer exceptional mechanical flexibility and chemical stability but currently struggle to match ITO's combination of transparency and conductivity at commercially viable production scales. Manufacturing consistency remains problematic, with variations in film quality affecting sensor reliability.

Metal mesh technologies have gained traction in automotive applications, using ultrafine metal grids that are nearly invisible to the human eye while providing excellent conductivity. These can be fabricated using photolithography or printing techniques. The primary challenge lies in balancing line width and spacing to minimize optical interference while maintaining sufficient conductivity for sensor operation across the windshield's entire surface area.

PEDOT:PSS (poly(3,4-ethylenedioxythiophene) polystyrene sulfonate) conductive polymers offer an organic alternative with good flexibility and solution processability. However, their relatively higher sheet resistance and sensitivity to environmental degradation have limited widespread adoption in automotive windshield sensors.

Implementation challenges common across all TCF technologies include integration with existing automotive manufacturing processes, ensuring uniform performance across large windshield areas, and maintaining functionality through extreme temperature ranges (-40°C to 85°C) required for automotive qualification. Additionally, TCFs must demonstrate compatibility with laminated glass structures and resist delamination during the windshield's service life.

Cost-effective scalability remains a significant hurdle, as automotive applications require high-volume production capabilities while maintaining strict quality control. Furthermore, any TCF technology must address electromagnetic interference concerns, as windshield sensors operate in proximity to other vehicle electronics and communication systems.

Current TCF Solutions for Automotive Applications

01 Carbon nanotube-based transparent conductive films

Carbon nanotubes (CNTs) can be used to create highly transparent and conductive films. These films exhibit excellent electrical conductivity while maintaining high optical transparency, making them suitable for various electronic applications. The CNTs can be dispersed in solutions and deposited onto substrates using methods such as spray coating or vacuum filtration. The resulting films can be further enhanced by chemical treatments to improve their conductivity and transparency.- Carbon nanotube-based transparent conductive films: Carbon nanotubes (CNTs) can be used to create highly transparent and conductive films. These films exhibit excellent electrical conductivity while maintaining high optical transparency, making them suitable for various electronic applications. The manufacturing process typically involves dispersing CNTs in a solution, followed by deposition techniques such as spray coating or vacuum filtration. These films offer advantages including flexibility, chemical stability, and compatibility with various substrates.

- Metal oxide-based transparent conductive films: Metal oxides, particularly indium tin oxide (ITO), are widely used for transparent conductive films. These materials provide a combination of high electrical conductivity and optical transparency in the visible spectrum. The films are typically fabricated using techniques such as sputtering, chemical vapor deposition, or sol-gel methods. Metal oxide films can be applied to various substrates including glass and flexible polymers, enabling applications in displays, touch panels, and photovoltaic devices.

- Silver nanowire transparent conductive films: Silver nanowires can be used to create transparent conductive films with excellent performance characteristics. These films are fabricated by depositing networks of silver nanowires onto substrates, creating conductive pathways while maintaining optical transparency. The manufacturing process typically involves solution-based deposition methods followed by post-treatment to enhance conductivity. Silver nanowire films offer advantages including high flexibility, stretchability, and superior conductivity compared to some traditional transparent conductors.

- Graphene-based transparent conductive films: Graphene, a single layer of carbon atoms arranged in a hexagonal lattice, can be used to create highly transparent and conductive films. These films exhibit exceptional electrical properties, mechanical strength, and optical transparency. Fabrication methods include chemical vapor deposition, reduction of graphene oxide, or exfoliation techniques. Graphene-based transparent conductive films offer advantages including flexibility, chemical stability, and potential for low-cost manufacturing compared to traditional materials.

- Hybrid and composite transparent conductive films: Hybrid or composite transparent conductive films combine multiple materials to achieve enhanced performance characteristics. These films typically incorporate combinations of materials such as metal nanowires with metal oxides, carbon nanotubes with graphene, or conductive polymers with metallic components. The hybrid approach allows for optimization of electrical conductivity, optical transparency, mechanical flexibility, and environmental stability. These composite structures can overcome limitations of single-material films and enable customization for specific application requirements.

02 Metal oxide-based transparent conductive films

Metal oxides, particularly indium tin oxide (ITO), are widely used for transparent conductive films. These materials offer a good balance between electrical conductivity and optical transparency. The films can be deposited using various techniques such as sputtering, chemical vapor deposition, or sol-gel methods. Alternative metal oxides, such as zinc oxide and tin oxide, are also being developed to address the scarcity and cost issues associated with indium.Expand Specific Solutions03 Silver nanowire transparent conductive films

Silver nanowires can be used to create transparent conductive films with high flexibility and excellent electrical properties. These nanowires form a conductive network while allowing light to pass through the spaces between them. The films can be fabricated using solution-based processes such as spray coating, spin coating, or roll-to-roll printing. Silver nanowire films offer advantages such as mechanical flexibility, low sheet resistance, and high optical transparency, making them suitable for flexible electronics and touch screens.Expand Specific Solutions04 Graphene-based transparent conductive films

Graphene, a single layer of carbon atoms arranged in a hexagonal lattice, can be used to create transparent conductive films with exceptional properties. These films exhibit high electrical conductivity, optical transparency, and mechanical flexibility. Graphene can be synthesized using methods such as chemical vapor deposition or reduced graphene oxide. The resulting films can be transferred onto various substrates and integrated into electronic devices such as touch screens, solar cells, and flexible displays.Expand Specific Solutions05 Hybrid and composite transparent conductive films

Hybrid and composite transparent conductive films combine different materials to achieve enhanced performance. These films may incorporate combinations of metal nanowires, carbon nanotubes, graphene, metal oxides, or conductive polymers. By combining materials with complementary properties, these hybrid films can achieve improved conductivity, transparency, flexibility, and stability. Various fabrication techniques, such as layer-by-layer assembly, co-deposition, or embedding, can be used to create these composite structures for applications in optoelectronic devices.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The transparent conductive film (TCF) market for automotive windshield sensors is currently in a growth phase, with increasing integration of advanced driver assistance systems driving demand. The market is projected to expand significantly as vehicles incorporate more smart glass technologies. Leading players demonstrate varying levels of technological maturity: established automotive glass manufacturers like Fuyao Glass and AGC Automotive have strong production capabilities, while technology companies such as LG Display, Nippon Sheet Glass, and Robert Bosch are advancing innovative TCF solutions with enhanced conductivity and transparency. Material specialists including Nitto Denko and LG Chem are developing next-generation films, while automotive OEMs like Hyundai Motor are integrating these technologies into vehicle design, creating a competitive ecosystem spanning materials science, electronics, and automotive engineering.

Fuyao Glass Industry Group Co., Ltd.

Technical Solution: Fuyao has developed advanced transparent conductive film (TCF) technology specifically for automotive windshield applications, focusing on indium tin oxide (ITO) based solutions. Their proprietary manufacturing process creates ultra-thin ITO films (typically 20-100nm) directly integrated into laminated windshield glass. The company has pioneered a specialized sputtering technique that ensures uniform conductivity across large windshield surfaces while maintaining over 90% visible light transmission. Their latest generation TCFs incorporate silver nanowire networks embedded within traditional ITO structures, creating a hybrid solution that addresses temperature variation challenges in automotive environments. Fuyao's films feature self-healing properties for minor scratches and enhanced durability against environmental factors, with demonstrated lifecycle testing exceeding 10 years of simulated exposure.

Strengths: Superior optical clarity (>90% transparency) while maintaining excellent conductivity; specialized manufacturing process optimized for curved windshield surfaces; enhanced durability against environmental factors. Weaknesses: Higher production costs compared to conventional solutions; requires specialized equipment for installation and repair; potential for delamination under extreme temperature cycling.

Nippon Sheet Glass Co., Ltd.

Technical Solution: Nippon Sheet Glass (NSG) has developed proprietary PLANIBEL TCF technology for automotive windshield sensors, utilizing a multi-layer approach that combines silver-based conductive layers with metal oxide buffer layers. Their solution features a unique "floating" conductive grid pattern that maintains electrical performance even when subjected to windshield curvature and thermal expansion. NSG's manufacturing process employs magnetron sputtering to create precisely controlled nanoscale layers with thickness variations under 2nm across the entire windshield surface. The company has also pioneered a patented edge sealing technology that prevents moisture ingress and oxidation of the conductive layers, extending operational lifespan to over 12 years in field testing. Their latest innovation incorporates carbon nanotube reinforcement at critical stress points, maintaining conductivity even after impact events that would compromise traditional TCF structures.

Strengths: Exceptional durability with demonstrated 12+ year operational lifespan; superior resistance to environmental degradation; maintains conductivity even after minor impact events. Weaknesses: Higher initial manufacturing costs; more complex production process requiring specialized equipment; slightly lower initial transparency (87-89%) compared to some competing solutions.

Critical Patents and Innovations in Windshield Sensor TCFs

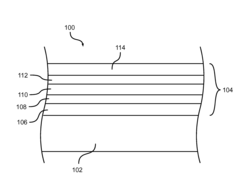

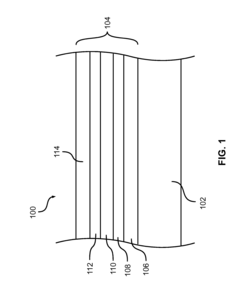

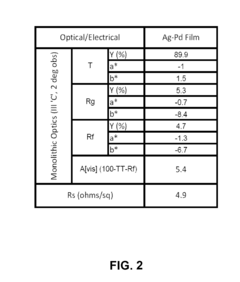

Transparent Conductive Films and Methods for Forming the Same

PatentInactiveUS20150162111A1

Innovation

- The use of a silver-palladium alloy combined with barrier layers, such as nickel, niobium, titanium, chromium, or molybdenum, to form a transparent conductive film stack that enhances durability and maintains suitable transparency and conductivity, achieved through physical vapor deposition and reactive sputtering processes.

Transparent conductive films, methods, and articles

PatentInactiveUS9175183B2

Innovation

- Development of flexible transparent conductive films with a substrate comprising at least 70 wt% ethylene terephthalate repeat units, a barrier layer of thermoplastic resin, and a transparent conductive layer of cellulose ester polymer, including silver nanowires, which reduces oligomer migration and haze without using costly PEN or low-oligomer PET films.

Environmental Durability and Safety Standards

Transparent conductive films (TCFs) in automotive windshield sensors must withstand extreme environmental conditions while maintaining consistent performance throughout the vehicle's lifecycle. These films face temperature variations ranging from -40°C in arctic conditions to over 80°C in direct sunlight, requiring exceptional thermal stability. Testing protocols typically include thermal cycling tests where materials undergo repeated temperature fluctuations to simulate years of environmental exposure.

Humidity resistance represents another critical durability factor, as moisture infiltration can cause delamination, oxidation, and conductivity degradation. Industry standards mandate humidity resistance tests at 85% relative humidity for extended periods, with some premium automotive applications requiring performance maintenance at 95% humidity. Salt spray resistance testing is equally important, particularly for vehicles operating in coastal regions or winter conditions where road salt is common.

UV radiation poses a significant challenge to TCF longevity, potentially causing yellowing, brittleness, and conductivity loss over time. Modern automotive TCFs incorporate UV stabilizers and specialized coatings to maintain optical clarity and electrical performance after extended sun exposure. Accelerated weathering chambers that simulate years of UV exposure in compressed timeframes have become standard testing equipment for automotive suppliers.

From a safety perspective, TCFs must comply with stringent automotive standards including FMVSS 205 (Federal Motor Vehicle Safety Standard) in the US and ECE R43 in Europe. These regulations govern windshield optical clarity, fragmentation patterns, and impact resistance. TCFs must not compromise visibility under any lighting conditions, maintaining at least 70% light transmission in areas critical for driver vision.

Electromagnetic compatibility (EMC) standards are increasingly important as vehicles incorporate more electronic systems. TCFs must not generate electromagnetic interference that could affect critical vehicle systems like braking or navigation. Standards such as ISO 11452 and CISPR 25 establish testing protocols for automotive electromagnetic compatibility.

Abrasion resistance represents another critical durability parameter, as windshields encounter environmental particles, wiper action, and cleaning processes. Industry-standard tests include Taber abrasion testing and sand drop impact simulations. Premium automotive applications typically require TCFs to maintain 95% of their electrical conductivity and optical clarity after standardized abrasion testing protocols.

Humidity resistance represents another critical durability factor, as moisture infiltration can cause delamination, oxidation, and conductivity degradation. Industry standards mandate humidity resistance tests at 85% relative humidity for extended periods, with some premium automotive applications requiring performance maintenance at 95% humidity. Salt spray resistance testing is equally important, particularly for vehicles operating in coastal regions or winter conditions where road salt is common.

UV radiation poses a significant challenge to TCF longevity, potentially causing yellowing, brittleness, and conductivity loss over time. Modern automotive TCFs incorporate UV stabilizers and specialized coatings to maintain optical clarity and electrical performance after extended sun exposure. Accelerated weathering chambers that simulate years of UV exposure in compressed timeframes have become standard testing equipment for automotive suppliers.

From a safety perspective, TCFs must comply with stringent automotive standards including FMVSS 205 (Federal Motor Vehicle Safety Standard) in the US and ECE R43 in Europe. These regulations govern windshield optical clarity, fragmentation patterns, and impact resistance. TCFs must not compromise visibility under any lighting conditions, maintaining at least 70% light transmission in areas critical for driver vision.

Electromagnetic compatibility (EMC) standards are increasingly important as vehicles incorporate more electronic systems. TCFs must not generate electromagnetic interference that could affect critical vehicle systems like braking or navigation. Standards such as ISO 11452 and CISPR 25 establish testing protocols for automotive electromagnetic compatibility.

Abrasion resistance represents another critical durability parameter, as windshields encounter environmental particles, wiper action, and cleaning processes. Industry-standard tests include Taber abrasion testing and sand drop impact simulations. Premium automotive applications typically require TCFs to maintain 95% of their electrical conductivity and optical clarity after standardized abrasion testing protocols.

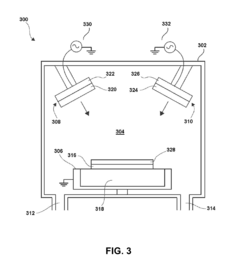

Manufacturing Scalability and Cost Analysis

The manufacturing scalability of transparent conductive films (TCFs) for automotive windshield sensors represents a critical factor in their commercial viability. Current production methods vary significantly in terms of throughput capacity and cost efficiency. Indium Tin Oxide (ITO) remains the industry standard with well-established manufacturing processes, primarily utilizing physical vapor deposition (PVD) techniques. However, ITO production faces significant scalability challenges, including the limited global supply of indium, high-temperature requirements exceeding 300°C, and vacuum processing needs that increase capital expenditure and operational costs.

Alternative TCF technologies demonstrate varying degrees of manufacturing readiness. Silver nanowire (AgNW) networks offer promising scalability through solution-based roll-to-roll processing, potentially reducing production costs by 30-40% compared to ITO. The manufacturing throughput for AgNW films can reach up to 120 meters per minute, significantly outpacing ITO production rates. However, challenges remain in ensuring uniform dispersion and preventing agglomeration during large-scale production.

Carbon-based alternatives such as graphene and carbon nanotubes present attractive theoretical properties but face substantial manufacturing hurdles. Current production yields remain low, with high-quality graphene films typically produced at less than 10 meters per hour. The cost implications are substantial, with graphene TCFs currently estimated at 5-8 times the cost of conventional ITO films for automotive applications.

Metal mesh technologies have demonstrated excellent scalability through established printing and lithography techniques. Recent advancements in nanoimprint lithography have enabled production speeds of up to 60 meters per minute with feature sizes below 5 μm. The capital investment for metal mesh production lines ranges from $15-30 million, comparable to modernized ITO facilities but with potentially higher throughput.

Cost analysis reveals that material expenses constitute 40-60% of total production costs for most TCF technologies. ITO's material cost has fluctuated significantly due to indium price volatility, ranging from $500-900/kg over the past decade. Labor costs vary by production location, with Asian manufacturing hubs maintaining a 15-25% cost advantage over European and North American facilities. Energy consumption represents another significant cost factor, with ITO requiring approximately 2.5-3.5 kWh per square meter of film produced, compared to 1.2-2.0 kWh for solution-processed alternatives.

Economies of scale significantly impact unit costs, with production volumes exceeding 500,000 square meters annually typically achieving 30-40% cost reductions compared to small-batch production. As automotive sensor integration increases, manufacturers achieving these volumes will gain substantial competitive advantages in the rapidly expanding market for smart windshield technologies.

Alternative TCF technologies demonstrate varying degrees of manufacturing readiness. Silver nanowire (AgNW) networks offer promising scalability through solution-based roll-to-roll processing, potentially reducing production costs by 30-40% compared to ITO. The manufacturing throughput for AgNW films can reach up to 120 meters per minute, significantly outpacing ITO production rates. However, challenges remain in ensuring uniform dispersion and preventing agglomeration during large-scale production.

Carbon-based alternatives such as graphene and carbon nanotubes present attractive theoretical properties but face substantial manufacturing hurdles. Current production yields remain low, with high-quality graphene films typically produced at less than 10 meters per hour. The cost implications are substantial, with graphene TCFs currently estimated at 5-8 times the cost of conventional ITO films for automotive applications.

Metal mesh technologies have demonstrated excellent scalability through established printing and lithography techniques. Recent advancements in nanoimprint lithography have enabled production speeds of up to 60 meters per minute with feature sizes below 5 μm. The capital investment for metal mesh production lines ranges from $15-30 million, comparable to modernized ITO facilities but with potentially higher throughput.

Cost analysis reveals that material expenses constitute 40-60% of total production costs for most TCF technologies. ITO's material cost has fluctuated significantly due to indium price volatility, ranging from $500-900/kg over the past decade. Labor costs vary by production location, with Asian manufacturing hubs maintaining a 15-25% cost advantage over European and North American facilities. Energy consumption represents another significant cost factor, with ITO requiring approximately 2.5-3.5 kWh per square meter of film produced, compared to 1.2-2.0 kWh for solution-processed alternatives.

Economies of scale significantly impact unit costs, with production volumes exceeding 500,000 square meters annually typically achieving 30-40% cost reductions compared to small-batch production. As automotive sensor integration increases, manufacturers achieving these volumes will gain substantial competitive advantages in the rapidly expanding market for smart windshield technologies.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!