Transparent conductive films patents and intellectual property landscape

SEP 24, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

TCF Technology Background and Objectives

Transparent conductive films (TCFs) represent a critical technology in modern electronics, enabling the functionality of touchscreens, displays, photovoltaic cells, and numerous other optoelectronic devices. The evolution of TCFs began in the 1950s with the development of indium tin oxide (ITO) coatings, which revolutionized display technology by combining optical transparency with electrical conductivity. Over subsequent decades, TCF technology has undergone significant refinement, driven by the exponential growth of consumer electronics and the increasing demand for flexible, durable, and cost-effective solutions.

The technological trajectory of TCFs has been characterized by a persistent pursuit of materials that offer superior performance metrics: higher transparency, lower sheet resistance, enhanced mechanical flexibility, and reduced production costs. This evolution has accelerated notably since the early 2000s, coinciding with the proliferation of smartphones and touch-enabled devices, which created unprecedented market demand for advanced TCF solutions.

Current technological objectives in the TCF domain focus on overcoming the limitations of traditional ITO-based films, which despite their widespread adoption, suffer from brittleness, limited flexibility, and the scarcity of indium as a raw material. Research and development efforts are increasingly directed toward alternative materials including carbon nanotubes, graphene, metal nanowires (particularly silver), conductive polymers, and hybrid composites that combine multiple materials to achieve synergistic properties.

The intellectual property landscape surrounding TCFs has become increasingly complex and competitive, reflecting the strategic importance of this technology across multiple industries. Patent activity has intensified dramatically, with major technology companies, materials science firms, and academic institutions all contributing to a dense network of intellectual property claims covering novel materials, fabrication methods, and specific applications.

Key technological objectives driving current TCF innovation include achieving sheet resistance below 100 ohms/square while maintaining optical transparency above 90%, developing manufacturing processes compatible with roll-to-roll production for cost reduction, enhancing durability under repeated flexing for foldable device applications, and reducing environmental impact through indium-free compositions and eco-friendly manufacturing processes.

The geographical distribution of TCF technology development shows concentration in East Asia (particularly Japan, South Korea, and Taiwan), North America, and Europe, with emerging contributions from China and India. This distribution closely mirrors the global electronics manufacturing ecosystem, highlighting the integral relationship between TCF innovation and downstream applications in consumer electronics, automotive displays, and emerging technologies such as wearable devices and Internet of Things (IoT) sensors.

The technological trajectory of TCFs has been characterized by a persistent pursuit of materials that offer superior performance metrics: higher transparency, lower sheet resistance, enhanced mechanical flexibility, and reduced production costs. This evolution has accelerated notably since the early 2000s, coinciding with the proliferation of smartphones and touch-enabled devices, which created unprecedented market demand for advanced TCF solutions.

Current technological objectives in the TCF domain focus on overcoming the limitations of traditional ITO-based films, which despite their widespread adoption, suffer from brittleness, limited flexibility, and the scarcity of indium as a raw material. Research and development efforts are increasingly directed toward alternative materials including carbon nanotubes, graphene, metal nanowires (particularly silver), conductive polymers, and hybrid composites that combine multiple materials to achieve synergistic properties.

The intellectual property landscape surrounding TCFs has become increasingly complex and competitive, reflecting the strategic importance of this technology across multiple industries. Patent activity has intensified dramatically, with major technology companies, materials science firms, and academic institutions all contributing to a dense network of intellectual property claims covering novel materials, fabrication methods, and specific applications.

Key technological objectives driving current TCF innovation include achieving sheet resistance below 100 ohms/square while maintaining optical transparency above 90%, developing manufacturing processes compatible with roll-to-roll production for cost reduction, enhancing durability under repeated flexing for foldable device applications, and reducing environmental impact through indium-free compositions and eco-friendly manufacturing processes.

The geographical distribution of TCF technology development shows concentration in East Asia (particularly Japan, South Korea, and Taiwan), North America, and Europe, with emerging contributions from China and India. This distribution closely mirrors the global electronics manufacturing ecosystem, highlighting the integral relationship between TCF innovation and downstream applications in consumer electronics, automotive displays, and emerging technologies such as wearable devices and Internet of Things (IoT) sensors.

Market Demand Analysis for Transparent Conductive Films

The transparent conductive films (TCF) market is experiencing robust growth driven by the proliferation of touch-enabled devices across multiple industries. Current market valuations place the global TCF market at approximately 5 billion USD, with projections indicating a compound annual growth rate of 8-10% through 2028. This growth trajectory is primarily fueled by increasing demand in consumer electronics, particularly smartphones, tablets, and wearable technology, which collectively account for over 60% of TCF applications.

The automotive sector represents an emerging high-potential market for TCF technology, with advanced infotainment systems and smart displays becoming standard features in modern vehicles. Industry analysts predict that automotive applications will see the fastest growth rate among all TCF market segments, potentially expanding at 12-15% annually as vehicle manufacturers continue to integrate more touch interfaces and heads-up displays.

Photovoltaic applications constitute another significant growth vector for TCF technology. As global renewable energy initiatives accelerate, the demand for high-performance transparent electrodes in solar cells continues to rise. The solar energy sector's TCF requirements emphasize cost-effectiveness alongside performance metrics, creating distinct market dynamics compared to consumer electronics applications.

Regional market analysis reveals Asia-Pacific as the dominant manufacturing hub, accounting for approximately 70% of global TCF production. This concentration stems from the region's established electronics manufacturing ecosystem. However, North America and Europe represent significant consumption markets with growing domestic production capabilities focused on specialized, high-performance TCF variants.

Material preferences within the market show interesting shifts. While indium tin oxide (ITO) remains the industry standard with approximately 75% market share, alternative materials are gaining traction due to indium's supply constraints and price volatility. Silver nanowire, PEDOT:PSS, graphene, and metal mesh technologies collectively represent the fastest-growing segment of the TCF market, expanding at nearly twice the rate of traditional ITO solutions.

End-user requirements continue to evolve, with increasing emphasis on flexibility, durability, and optical clarity. Market research indicates that manufacturers are willing to pay premium prices for TCF solutions that offer enhanced flexibility for curved displays and foldable devices, which are projected to grow at 25-30% annually through 2025. Additionally, environmental considerations are becoming more prominent in purchasing decisions, with TCF solutions offering reduced environmental impact commanding growing market interest.

The automotive sector represents an emerging high-potential market for TCF technology, with advanced infotainment systems and smart displays becoming standard features in modern vehicles. Industry analysts predict that automotive applications will see the fastest growth rate among all TCF market segments, potentially expanding at 12-15% annually as vehicle manufacturers continue to integrate more touch interfaces and heads-up displays.

Photovoltaic applications constitute another significant growth vector for TCF technology. As global renewable energy initiatives accelerate, the demand for high-performance transparent electrodes in solar cells continues to rise. The solar energy sector's TCF requirements emphasize cost-effectiveness alongside performance metrics, creating distinct market dynamics compared to consumer electronics applications.

Regional market analysis reveals Asia-Pacific as the dominant manufacturing hub, accounting for approximately 70% of global TCF production. This concentration stems from the region's established electronics manufacturing ecosystem. However, North America and Europe represent significant consumption markets with growing domestic production capabilities focused on specialized, high-performance TCF variants.

Material preferences within the market show interesting shifts. While indium tin oxide (ITO) remains the industry standard with approximately 75% market share, alternative materials are gaining traction due to indium's supply constraints and price volatility. Silver nanowire, PEDOT:PSS, graphene, and metal mesh technologies collectively represent the fastest-growing segment of the TCF market, expanding at nearly twice the rate of traditional ITO solutions.

End-user requirements continue to evolve, with increasing emphasis on flexibility, durability, and optical clarity. Market research indicates that manufacturers are willing to pay premium prices for TCF solutions that offer enhanced flexibility for curved displays and foldable devices, which are projected to grow at 25-30% annually through 2025. Additionally, environmental considerations are becoming more prominent in purchasing decisions, with TCF solutions offering reduced environmental impact commanding growing market interest.

Global TCF Technology Status and Challenges

Transparent conductive films (TCFs) have become a critical component in modern electronic devices, with global research and development efforts intensifying across various regions. Currently, indium tin oxide (ITO) dominates the commercial TCF market due to its excellent combination of optical transparency and electrical conductivity. However, the technology faces significant challenges including indium scarcity, rising costs, and brittleness that limits application in flexible electronics.

In Asia, particularly in South Korea, Japan, and China, substantial advancements in TCF technology have been achieved, with these countries collectively holding approximately 65% of global TCF patents. Chinese companies and research institutions have dramatically increased their patent filings over the past decade, focusing on alternative materials such as silver nanowires and graphene-based solutions.

North American and European entities maintain strong positions in high-end TCF innovations, with companies like 3M, DuPont, and research universities developing next-generation materials. These regions focus more on novel approaches and fundamental breakthroughs rather than incremental improvements to existing technologies.

The primary technical challenges facing TCF development include achieving the optimal balance between transparency and conductivity, as these properties typically exhibit inverse relationships. Current solutions struggle to simultaneously achieve >90% transparency and <10 ohms/sq sheet resistance at commercially viable production costs.

Durability represents another significant hurdle, particularly for emerging applications in flexible and stretchable electronics. Many alternative TCF materials demonstrate excellent initial performance but suffer from conductivity degradation under repeated bending or environmental exposure. This limitation has prevented widespread commercial adoption despite promising laboratory results.

Manufacturing scalability continues to constrain the industry, with many novel TCF technologies demonstrating excellent properties in laboratory settings but facing significant challenges in scaling to mass production. Roll-to-roll processing compatibility, which is essential for cost-effective manufacturing, remains elusive for several promising TCF candidates.

Environmental concerns are increasingly influencing TCF development, with regulations on hazardous materials and sustainability requirements driving research toward greener alternatives. The industry is gradually shifting toward materials and processes with reduced environmental footprints, though this transition introduces additional technical complexities.

Standardization issues further complicate the TCF landscape, with inconsistent testing methodologies and performance metrics making direct comparisons between different technologies challenging. This fragmentation hinders technology evaluation and adoption decisions across the industry.

In Asia, particularly in South Korea, Japan, and China, substantial advancements in TCF technology have been achieved, with these countries collectively holding approximately 65% of global TCF patents. Chinese companies and research institutions have dramatically increased their patent filings over the past decade, focusing on alternative materials such as silver nanowires and graphene-based solutions.

North American and European entities maintain strong positions in high-end TCF innovations, with companies like 3M, DuPont, and research universities developing next-generation materials. These regions focus more on novel approaches and fundamental breakthroughs rather than incremental improvements to existing technologies.

The primary technical challenges facing TCF development include achieving the optimal balance between transparency and conductivity, as these properties typically exhibit inverse relationships. Current solutions struggle to simultaneously achieve >90% transparency and <10 ohms/sq sheet resistance at commercially viable production costs.

Durability represents another significant hurdle, particularly for emerging applications in flexible and stretchable electronics. Many alternative TCF materials demonstrate excellent initial performance but suffer from conductivity degradation under repeated bending or environmental exposure. This limitation has prevented widespread commercial adoption despite promising laboratory results.

Manufacturing scalability continues to constrain the industry, with many novel TCF technologies demonstrating excellent properties in laboratory settings but facing significant challenges in scaling to mass production. Roll-to-roll processing compatibility, which is essential for cost-effective manufacturing, remains elusive for several promising TCF candidates.

Environmental concerns are increasingly influencing TCF development, with regulations on hazardous materials and sustainability requirements driving research toward greener alternatives. The industry is gradually shifting toward materials and processes with reduced environmental footprints, though this transition introduces additional technical complexities.

Standardization issues further complicate the TCF landscape, with inconsistent testing methodologies and performance metrics making direct comparisons between different technologies challenging. This fragmentation hinders technology evaluation and adoption decisions across the industry.

Current TCF Technical Solutions and Materials

01 Carbon nanotube-based transparent conductive films

Carbon nanotubes (CNTs) can be used to create transparent conductive films with excellent electrical conductivity and optical transparency. These films can be fabricated through various methods such as solution processing, direct growth, or transfer techniques. The unique properties of carbon nanotubes, including their high aspect ratio and superior electrical conductivity, make them suitable for applications in touch screens, displays, and flexible electronics.- Carbon nanotube-based transparent conductive films: Carbon nanotubes (CNTs) can be used to create highly transparent and conductive films. These films offer excellent electrical conductivity while maintaining high optical transparency, making them suitable for various electronic applications. The CNTs can be dispersed in solutions and deposited onto substrates using methods such as spray coating or vacuum filtration. These films can be further enhanced by doping or chemical treatments to improve their conductivity while maintaining transparency.

- Metal oxide-based transparent conductive films: Metal oxides, particularly indium tin oxide (ITO) and zinc oxide-based compounds, are widely used for transparent conductive films. These materials provide a good balance of optical transparency and electrical conductivity. The films can be deposited using various techniques such as sputtering, chemical vapor deposition, or sol-gel methods. Doping with additional elements can enhance the conductivity while maintaining high transparency, making these films suitable for displays, touch panels, and photovoltaic applications.

- Silver nanowire transparent conductive films: Silver nanowires can be used to create highly transparent and conductive films. These nanowires form a network structure that allows for high electrical conductivity while maintaining optical transparency. The films can be fabricated using solution-based processes such as spin coating, spray coating, or roll-to-roll printing, making them suitable for flexible electronic applications. The performance of these films can be enhanced by optimizing the nanowire dimensions, density, and junction resistance.

- Graphene-based transparent conductive films: Graphene, a single layer of carbon atoms arranged in a hexagonal lattice, can be used to create transparent conductive films with exceptional properties. These films offer high electrical conductivity, excellent optical transparency, and mechanical flexibility. Various methods can be used to produce graphene films, including chemical vapor deposition, reduced graphene oxide, and exfoliation techniques. The conductivity of graphene films can be further enhanced by doping or chemical functionalization while maintaining their transparency.

- Hybrid and composite transparent conductive films: Hybrid and composite materials combine different conductive materials to create transparent films with enhanced properties. These can include combinations of metal nanowires with carbon nanotubes, graphene with metal oxides, or conductive polymers with inorganic materials. The synergistic effects of these combinations can lead to improved electrical conductivity, optical transparency, mechanical flexibility, and environmental stability. These hybrid films are particularly promising for flexible electronics, solar cells, and touch screen applications.

02 Metal nanowire transparent conductive films

Metal nanowires, particularly silver nanowires, are widely used to create transparent conductive films with high conductivity and transparency. These nanowires can be deposited onto substrates using techniques such as spray coating, spin coating, or roll-to-roll processing. The resulting films offer flexibility, stretchability, and compatibility with various substrates, making them suitable for flexible displays, touch panels, and solar cells.Expand Specific Solutions03 Indium tin oxide (ITO) transparent conductive films

Indium tin oxide (ITO) is a widely used material for transparent conductive films due to its excellent combination of electrical conductivity and optical transparency. These films are typically deposited using techniques such as sputtering, chemical vapor deposition, or sol-gel methods. ITO films are commonly used in liquid crystal displays, touchscreens, and photovoltaic devices, though concerns about indium scarcity have led to research on alternative materials.Expand Specific Solutions04 Graphene-based transparent conductive films

Graphene, a single layer of carbon atoms arranged in a hexagonal lattice, can be used to create transparent conductive films with exceptional electrical, optical, and mechanical properties. These films can be produced through methods such as chemical vapor deposition, reduced graphene oxide, or exfoliation techniques. Graphene-based transparent conductive films offer advantages such as flexibility, chemical stability, and potentially lower cost compared to traditional materials.Expand Specific Solutions05 Hybrid and composite transparent conductive films

Hybrid or composite transparent conductive films combine multiple materials to achieve enhanced performance characteristics. These may include combinations of metal nanowires with carbon nanotubes, graphene with metal grids, or polymer composites with conductive fillers. By leveraging the strengths of different materials, these hybrid films can achieve improved conductivity, transparency, flexibility, and durability for applications in next-generation electronic devices.Expand Specific Solutions

Key Industry Players and Patent Holders

The transparent conductive films (TCF) market is in a growth phase, with increasing demand driven by touch screens, displays, and photovoltaic applications. The global market size is projected to reach approximately $8-10 billion by 2025, growing at a CAGR of 8-10%. Technologically, the field is transitioning from traditional ITO (Indium Tin Oxide) dominance to alternative materials like silver nanowires and metal mesh. Leading players include Nitto Denko and Toyobo from Japan, who hold significant patent portfolios in optical films and functional materials. C3 Nano and Nuovo Film are advancing silver nanowire technologies, while established chemical companies like DuPont, LG Chem, and Eastman Chemical are developing proprietary TCF formulations. Asian manufacturers, particularly from Japan, South Korea, and China, dominate the competitive landscape with vertically integrated production capabilities.

Nitto Denko Corp.

Technical Solution: Nitto Denko has established a strong position in transparent conductive film technology with their ELECRYSTA™ platform. Their approach combines ultra-thin metal oxide layers with proprietary polymer substrates and specialized surface treatments. Nitto's patented manufacturing process involves high-precision sputtering techniques that create uniform conductive layers with thickness control at the nanometer scale. Their technology achieves sheet resistance of 50-100 ohms/square while maintaining transparency above 85%. Nitto Denko holds over 120 patents covering specialized ITO formulations, multi-layer film structures, and surface modification techniques that enhance durability and flexibility. Their recent innovations include self-healing TCFs that can recover from minor scratches and cracks through thermal or optical stimulation, extending the operational lifetime of devices using their films. Nitto has also developed specialized barrier layers that prevent oxygen and moisture penetration, critical for OLED applications.

Strengths: Exceptional uniformity across large areas, superior environmental stability, and excellent adhesion to various substrate materials. Weaknesses: Moderate flexibility compared to nanowire-based solutions, and relatively higher manufacturing costs due to vacuum-based deposition processes.

LG Chem Ltd.

Technical Solution: LG Chem has developed an extensive portfolio of transparent conductive film technologies, with significant focus on hybrid systems combining different conductive materials. Their flagship technology utilizes a multi-layer approach with PEDOT:PSS conductive polymers and metal nanowire networks. LG Chem's patented process involves specialized formulation of PEDOT:PSS with proprietary additives that enhance conductivity while maintaining transparency. Their manufacturing technique includes precision coating methods and post-treatment processes that optimize the interface between conductive layers. LG Chem's TCFs achieve sheet resistance of 40-60 ohms/square with transparency above 88%. Their IP portfolio includes over 150 patents covering material formulations, multi-layer structures, and manufacturing processes optimized for large-area applications like touch panels and OLED displays.

Strengths: Excellent cost-performance ratio, high production scalability, and good compatibility with various substrate materials including flexible polymers. Weaknesses: Moderate environmental stability requiring additional protective layers in harsh conditions, and slightly lower optical clarity compared to pure metal nanowire solutions.

Critical Patents and IP Analysis in TCF Domain

Transparent conductive film

PatentWO2014004194A8

Innovation

- A transparent conductive film comprising a transparent substrate with a primer layer formed from a hydroxy-functional polymer and a heat curable monomer, and a conductive layer made from a cellulose ester polymer and silver nanowires, which provides improved adhesion and conductivity.

Transparent conductive film and method for producing transparent conductive film

PatentInactiveUS20100323186A1

Innovation

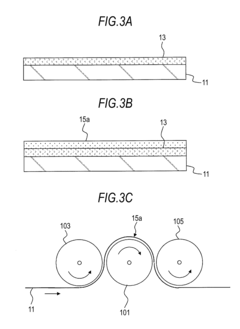

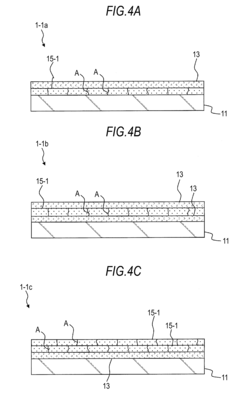

- A transparent conductive film structure is developed with a light-transmissive film base, a carbon nanotube layer, and a crack-containing metal oxide layer deposited on top, where the metal oxide layer is intentionally formed with cracks to prevent further cracking when the film is bent, maintaining high conductivity and flexibility.

IP Litigation Landscape in TCF Industry

The Transparent Conductive Films (TCF) industry has witnessed a significant increase in intellectual property litigation over the past decade, reflecting the growing commercial importance and competitive landscape of this technology. Major litigation cases have centered around key patents related to indium tin oxide (ITO) alternatives, manufacturing processes, and novel material compositions.

Several landmark cases have shaped the TCF intellectual property environment. In 2015, the dispute between Nitto Denko and 3M over silver nanowire technology established important precedents regarding the scope of protection for nanomaterial-based TCFs. Similarly, the 2018 litigation between Cambrios and C3Nano highlighted the competitive tensions in the metal nanowire segment, resulting in cross-licensing agreements that have influenced subsequent market dynamics.

Patent infringement claims in the TCF sector typically focus on three main areas: material composition, manufacturing processes, and end-product integration techniques. The geographical distribution of litigation shows concentration in the United States, Japan, South Korea, and increasingly China, corresponding to the major manufacturing hubs and markets for TCF technologies.

The litigation landscape reveals strategic patterns among industry players. Established corporations with extensive patent portfolios often engage in defensive litigation to protect market share, while emerging companies frequently face challenges when entering the market due to the dense patent thicket. This has led to the formation of patent pools and strategic alliances to navigate the complex IP environment.

Recent trends indicate a shift toward litigation involving carbon-based TCF technologies, particularly graphene and carbon nanotubes, as these materials gain commercial traction. Additionally, litigation related to flexible and stretchable TCF applications has increased, reflecting the growing importance of these properties in next-generation electronic devices.

The outcomes of TCF litigation have had substantial impacts on market access and technology development trajectories. Injunctions and significant damages awards have altered competitive dynamics, while licensing agreements resulting from litigation have facilitated technology diffusion across the industry. These legal proceedings have also influenced R&D strategies, with companies increasingly focusing on creating distinct technological approaches to avoid potential infringement claims.

Looking forward, the TCF litigation landscape is expected to intensify as new applications in emerging sectors such as wearable electronics, automotive displays, and photovoltaics create additional value for TCF intellectual property. This will likely drive further consolidation of patent portfolios through mergers, acquisitions, and strategic licensing arrangements.

Several landmark cases have shaped the TCF intellectual property environment. In 2015, the dispute between Nitto Denko and 3M over silver nanowire technology established important precedents regarding the scope of protection for nanomaterial-based TCFs. Similarly, the 2018 litigation between Cambrios and C3Nano highlighted the competitive tensions in the metal nanowire segment, resulting in cross-licensing agreements that have influenced subsequent market dynamics.

Patent infringement claims in the TCF sector typically focus on three main areas: material composition, manufacturing processes, and end-product integration techniques. The geographical distribution of litigation shows concentration in the United States, Japan, South Korea, and increasingly China, corresponding to the major manufacturing hubs and markets for TCF technologies.

The litigation landscape reveals strategic patterns among industry players. Established corporations with extensive patent portfolios often engage in defensive litigation to protect market share, while emerging companies frequently face challenges when entering the market due to the dense patent thicket. This has led to the formation of patent pools and strategic alliances to navigate the complex IP environment.

Recent trends indicate a shift toward litigation involving carbon-based TCF technologies, particularly graphene and carbon nanotubes, as these materials gain commercial traction. Additionally, litigation related to flexible and stretchable TCF applications has increased, reflecting the growing importance of these properties in next-generation electronic devices.

The outcomes of TCF litigation have had substantial impacts on market access and technology development trajectories. Injunctions and significant damages awards have altered competitive dynamics, while licensing agreements resulting from litigation have facilitated technology diffusion across the industry. These legal proceedings have also influenced R&D strategies, with companies increasingly focusing on creating distinct technological approaches to avoid potential infringement claims.

Looking forward, the TCF litigation landscape is expected to intensify as new applications in emerging sectors such as wearable electronics, automotive displays, and photovoltaics create additional value for TCF intellectual property. This will likely drive further consolidation of patent portfolios through mergers, acquisitions, and strategic licensing arrangements.

Licensing Strategies and Freedom to Operate

In the transparent conductive films (TCF) market, strategic licensing approaches are essential for companies to navigate the complex intellectual property landscape. Major TCF patent holders like Nitto Denko, 3M, and Cambrios have established diverse licensing models ranging from exclusive technology transfers to cross-licensing agreements. These arrangements allow smaller manufacturers to access critical technologies while providing revenue streams for innovation leaders.

Freedom to operate (FTO) analysis has become a fundamental requirement for TCF market participants. Companies must conduct thorough patent searches and clearance analyses before product development to identify potential infringement risks. This process typically involves mapping the patent landscape across jurisdictions where manufacturing or sales will occur, with particular attention to ITO alternatives where patent density is highest.

Risk mitigation strategies in the TCF sector often include design-around solutions, where companies modify their technologies to avoid infringing existing patents. For instance, several manufacturers have developed modified silver nanowire formulations or unique deposition methods that achieve similar performance while circumventing protected intellectual property.

Patent pools have emerged as an effective mechanism for TCF technology access, particularly for touch panel applications. These collaborative arrangements allow multiple patent holders to license their technologies collectively, reducing transaction costs and litigation risks. The Touch Panel Patent Consortium represents a notable example, facilitating broader technology adoption while ensuring fair compensation for innovators.

Geographic considerations significantly impact licensing strategies, as patent protection for TCF technologies varies across regions. While comprehensive protection exists in North America, Europe, and East Asia, emerging markets often present fewer IP restrictions, creating strategic manufacturing opportunities but also potential enforcement challenges for patent holders.

Defensive patent acquisition has become increasingly common among TCF manufacturers seeking to secure operational freedom. Companies frequently purchase patents not for direct implementation but to establish bargaining positions for cross-licensing negotiations or to prevent competitors from asserting infringement claims.

The evolving TCF patent landscape necessitates continuous monitoring and adaptive licensing strategies. As next-generation materials like graphene and metal mesh gain commercial traction, companies must reassess their IP positions and licensing requirements to maintain competitive advantages while minimizing legal exposure.

Freedom to operate (FTO) analysis has become a fundamental requirement for TCF market participants. Companies must conduct thorough patent searches and clearance analyses before product development to identify potential infringement risks. This process typically involves mapping the patent landscape across jurisdictions where manufacturing or sales will occur, with particular attention to ITO alternatives where patent density is highest.

Risk mitigation strategies in the TCF sector often include design-around solutions, where companies modify their technologies to avoid infringing existing patents. For instance, several manufacturers have developed modified silver nanowire formulations or unique deposition methods that achieve similar performance while circumventing protected intellectual property.

Patent pools have emerged as an effective mechanism for TCF technology access, particularly for touch panel applications. These collaborative arrangements allow multiple patent holders to license their technologies collectively, reducing transaction costs and litigation risks. The Touch Panel Patent Consortium represents a notable example, facilitating broader technology adoption while ensuring fair compensation for innovators.

Geographic considerations significantly impact licensing strategies, as patent protection for TCF technologies varies across regions. While comprehensive protection exists in North America, Europe, and East Asia, emerging markets often present fewer IP restrictions, creating strategic manufacturing opportunities but also potential enforcement challenges for patent holders.

Defensive patent acquisition has become increasingly common among TCF manufacturers seeking to secure operational freedom. Companies frequently purchase patents not for direct implementation but to establish bargaining positions for cross-licensing negotiations or to prevent competitors from asserting infringement claims.

The evolving TCF patent landscape necessitates continuous monitoring and adaptive licensing strategies. As next-generation materials like graphene and metal mesh gain commercial traction, companies must reassess their IP positions and licensing requirements to maintain competitive advantages while minimizing legal exposure.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!