Transparent conductive films for solar cell electrode engineering

SEP 24, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

TCF Technology Background and Objectives

Transparent conductive films (TCFs) represent a critical component in modern solar cell technology, serving as electrodes that allow light to pass through while efficiently collecting and transporting electrical charges. The evolution of TCF technology can be traced back to the 1970s when indium tin oxide (ITO) emerged as the first widely adopted transparent conductor. Since then, the field has witnessed significant advancements driven by the growing demand for renewable energy solutions and the expansion of photovoltaic applications.

The technological trajectory of TCFs has been characterized by continuous improvements in optical transparency, electrical conductivity, mechanical flexibility, and cost-effectiveness. Early generations focused primarily on metal oxide-based films, while recent developments have expanded to include carbon-based nanomaterials, metal nanowires, and hybrid structures. This diversification reflects the industry's response to challenges such as indium scarcity, brittleness of conventional TCFs, and the need for compatibility with next-generation flexible solar devices.

Current market trends indicate a shift toward sustainable and earth-abundant materials for TCF fabrication, aligning with global initiatives for green technology adoption. The integration of TCFs in solar cells has evolved from simple planar electrodes to sophisticated engineered interfaces that enhance light management, charge extraction, and overall device performance. This progression underscores the interdisciplinary nature of TCF development, bridging materials science, optoelectronics, and manufacturing engineering.

The primary technical objectives for TCF advancement in solar cell applications include achieving sheet resistance below 10 Ω/sq while maintaining optical transparency above 90% in the visible spectrum. Additionally, there is a growing emphasis on developing TCFs that demonstrate long-term stability under environmental stressors, compatibility with roll-to-roll manufacturing processes, and reduced embodied energy in production.

Beyond performance metrics, contemporary TCF research aims to address broader sustainability goals by minimizing the use of rare elements, reducing processing temperatures, and enabling recyclability at end-of-life. These objectives reflect the maturation of the field from purely performance-driven innovation to holistic design approaches that consider the entire lifecycle of solar technologies.

The future trajectory of TCF technology is expected to converge with emerging trends in photovoltaics, including tandem and multi-junction architectures, building-integrated applications, and vehicle-integrated solar systems. This convergence necessitates TCFs with tailored properties for specific deployment scenarios, suggesting a move away from one-size-fits-all solutions toward application-optimized electrode engineering strategies.

The technological trajectory of TCFs has been characterized by continuous improvements in optical transparency, electrical conductivity, mechanical flexibility, and cost-effectiveness. Early generations focused primarily on metal oxide-based films, while recent developments have expanded to include carbon-based nanomaterials, metal nanowires, and hybrid structures. This diversification reflects the industry's response to challenges such as indium scarcity, brittleness of conventional TCFs, and the need for compatibility with next-generation flexible solar devices.

Current market trends indicate a shift toward sustainable and earth-abundant materials for TCF fabrication, aligning with global initiatives for green technology adoption. The integration of TCFs in solar cells has evolved from simple planar electrodes to sophisticated engineered interfaces that enhance light management, charge extraction, and overall device performance. This progression underscores the interdisciplinary nature of TCF development, bridging materials science, optoelectronics, and manufacturing engineering.

The primary technical objectives for TCF advancement in solar cell applications include achieving sheet resistance below 10 Ω/sq while maintaining optical transparency above 90% in the visible spectrum. Additionally, there is a growing emphasis on developing TCFs that demonstrate long-term stability under environmental stressors, compatibility with roll-to-roll manufacturing processes, and reduced embodied energy in production.

Beyond performance metrics, contemporary TCF research aims to address broader sustainability goals by minimizing the use of rare elements, reducing processing temperatures, and enabling recyclability at end-of-life. These objectives reflect the maturation of the field from purely performance-driven innovation to holistic design approaches that consider the entire lifecycle of solar technologies.

The future trajectory of TCF technology is expected to converge with emerging trends in photovoltaics, including tandem and multi-junction architectures, building-integrated applications, and vehicle-integrated solar systems. This convergence necessitates TCFs with tailored properties for specific deployment scenarios, suggesting a move away from one-size-fits-all solutions toward application-optimized electrode engineering strategies.

Solar Cell Market Demand Analysis

The global solar cell market has witnessed substantial growth over the past decade, driven by increasing environmental concerns, government incentives, and declining manufacturing costs. As of 2023, the solar photovoltaic (PV) market is valued at approximately $176 billion, with projections indicating a compound annual growth rate (CAGR) of 8.3% through 2030. This growth trajectory underscores the expanding demand for advanced solar cell technologies, particularly those incorporating transparent conductive films (TCFs) for electrode engineering.

Residential solar installations represent the fastest-growing segment, expanding at 12.5% annually as homeowners increasingly adopt renewable energy solutions. Commercial and utility-scale installations follow closely, with growth rates of 9.7% and 7.2% respectively. This diversification across market segments creates multiple avenues for TCF technology implementation and optimization.

Geographically, Asia-Pacific dominates the solar market, accounting for 58% of global installations, with China alone representing 33% of worldwide capacity. Europe follows at 19%, while North America contributes 15% to the global market. Emerging markets in Latin America, Africa, and the Middle East are experiencing accelerated growth rates exceeding 15% annually, presenting new opportunities for TCF technology deployment.

The demand for higher-efficiency solar cells is particularly noteworthy, as consumers and utilities seek improved performance metrics. Current commercial silicon-based solar cells typically achieve 18-22% efficiency, while premium models incorporating advanced electrode technologies reach 23-25%. Market analysis indicates consumers are willing to pay a 15-20% premium for each percentage point increase in efficiency, creating strong economic incentives for TCF innovation.

Durability requirements are equally significant, with warranties now extending to 25-30 years for premium solar products. This longevity demand directly impacts electrode engineering specifications, as transparent conductive films must maintain performance under varied environmental conditions including temperature fluctuations, humidity, and UV exposure.

Cost sensitivity remains a critical market factor, with module prices declining approximately 70% over the past decade. This price pressure necessitates TCF solutions that balance performance with manufacturing economics. Current market pricing indicates acceptable cost thresholds of $8-12 per square meter for high-performance TCF materials, representing a significant constraint on material selection and processing methods.

Emerging market trends include building-integrated photovoltaics (BIPV), which is growing at 16% annually, and vehicle-integrated solar applications expanding at 22% yearly. Both applications place premium value on aesthetics and form factor, creating specialized demand for highly transparent and flexible electrode solutions that conventional TCF technologies struggle to address.

Residential solar installations represent the fastest-growing segment, expanding at 12.5% annually as homeowners increasingly adopt renewable energy solutions. Commercial and utility-scale installations follow closely, with growth rates of 9.7% and 7.2% respectively. This diversification across market segments creates multiple avenues for TCF technology implementation and optimization.

Geographically, Asia-Pacific dominates the solar market, accounting for 58% of global installations, with China alone representing 33% of worldwide capacity. Europe follows at 19%, while North America contributes 15% to the global market. Emerging markets in Latin America, Africa, and the Middle East are experiencing accelerated growth rates exceeding 15% annually, presenting new opportunities for TCF technology deployment.

The demand for higher-efficiency solar cells is particularly noteworthy, as consumers and utilities seek improved performance metrics. Current commercial silicon-based solar cells typically achieve 18-22% efficiency, while premium models incorporating advanced electrode technologies reach 23-25%. Market analysis indicates consumers are willing to pay a 15-20% premium for each percentage point increase in efficiency, creating strong economic incentives for TCF innovation.

Durability requirements are equally significant, with warranties now extending to 25-30 years for premium solar products. This longevity demand directly impacts electrode engineering specifications, as transparent conductive films must maintain performance under varied environmental conditions including temperature fluctuations, humidity, and UV exposure.

Cost sensitivity remains a critical market factor, with module prices declining approximately 70% over the past decade. This price pressure necessitates TCF solutions that balance performance with manufacturing economics. Current market pricing indicates acceptable cost thresholds of $8-12 per square meter for high-performance TCF materials, representing a significant constraint on material selection and processing methods.

Emerging market trends include building-integrated photovoltaics (BIPV), which is growing at 16% annually, and vehicle-integrated solar applications expanding at 22% yearly. Both applications place premium value on aesthetics and form factor, creating specialized demand for highly transparent and flexible electrode solutions that conventional TCF technologies struggle to address.

Current TCF Technology Landscape and Challenges

Transparent conductive films (TCFs) represent a critical component in solar cell electrode engineering, with the current technological landscape characterized by a diverse range of materials and fabrication approaches. The dominant commercial TCF technology remains Indium Tin Oxide (ITO), which holds approximately 85% of the market share due to its excellent combination of optical transparency (>90%) and electrical conductivity (<10 Ω/sq). However, ITO faces significant challenges including indium scarcity, rising costs, and inherent brittleness that limits its application in flexible photovoltaics.

Alternative TCF technologies have emerged in response to these limitations. Metal nanowire networks, particularly those based on silver, have demonstrated promising performance with transparency exceeding 90% and sheet resistance below 20 Ω/sq. These materials offer mechanical flexibility and can be processed using solution-based techniques at lower temperatures than ITO, though they struggle with long-term stability and surface roughness issues that can compromise device performance.

Carbon-based TCFs, including graphene and carbon nanotube films, represent another significant category in the current landscape. While these materials offer exceptional mechanical properties and theoretical conductivity, practical implementations have yet to match ITO's performance consistently. Current carbon-based TCFs typically achieve sheet resistance values of 50-100 Ω/sq at 80-85% transparency, falling short of requirements for high-efficiency solar applications.

Conductive polymers, particularly PEDOT:PSS, have gained traction for specific solar cell architectures. Recent advancements in doping and processing have improved conductivity substantially, though stability under prolonged UV exposure and humidity remains problematic for long-term deployment in photovoltaic systems.

Metal mesh and grid technologies have advanced significantly, offering a hybrid approach that combines high conductivity pathways with transparent regions. These structures can achieve sheet resistance below 10 Ω/sq while maintaining over 85% transparency, though manufacturing scalability and optical effects like diffraction and haze present ongoing challenges.

The geographical distribution of TCF technology development shows concentration in East Asia for manufacturing (particularly Japan, South Korea, and China), while research innovation hubs exist across North America and Europe. This distribution creates supply chain vulnerabilities that have been highlighted by recent global disruptions.

Key technical challenges facing current TCF technologies include the trade-off between transparency and conductivity, scalable manufacturing processes compatible with roll-to-roll production, long-term stability under environmental stressors, and integration challenges with adjacent layers in solar cell architectures. Additionally, the industry faces pressure to develop solutions that reduce reliance on critical raw materials and lower embodied energy in manufacturing processes to improve overall sustainability metrics.

Alternative TCF technologies have emerged in response to these limitations. Metal nanowire networks, particularly those based on silver, have demonstrated promising performance with transparency exceeding 90% and sheet resistance below 20 Ω/sq. These materials offer mechanical flexibility and can be processed using solution-based techniques at lower temperatures than ITO, though they struggle with long-term stability and surface roughness issues that can compromise device performance.

Carbon-based TCFs, including graphene and carbon nanotube films, represent another significant category in the current landscape. While these materials offer exceptional mechanical properties and theoretical conductivity, practical implementations have yet to match ITO's performance consistently. Current carbon-based TCFs typically achieve sheet resistance values of 50-100 Ω/sq at 80-85% transparency, falling short of requirements for high-efficiency solar applications.

Conductive polymers, particularly PEDOT:PSS, have gained traction for specific solar cell architectures. Recent advancements in doping and processing have improved conductivity substantially, though stability under prolonged UV exposure and humidity remains problematic for long-term deployment in photovoltaic systems.

Metal mesh and grid technologies have advanced significantly, offering a hybrid approach that combines high conductivity pathways with transparent regions. These structures can achieve sheet resistance below 10 Ω/sq while maintaining over 85% transparency, though manufacturing scalability and optical effects like diffraction and haze present ongoing challenges.

The geographical distribution of TCF technology development shows concentration in East Asia for manufacturing (particularly Japan, South Korea, and China), while research innovation hubs exist across North America and Europe. This distribution creates supply chain vulnerabilities that have been highlighted by recent global disruptions.

Key technical challenges facing current TCF technologies include the trade-off between transparency and conductivity, scalable manufacturing processes compatible with roll-to-roll production, long-term stability under environmental stressors, and integration challenges with adjacent layers in solar cell architectures. Additionally, the industry faces pressure to develop solutions that reduce reliance on critical raw materials and lower embodied energy in manufacturing processes to improve overall sustainability metrics.

Current TCF Electrode Engineering Solutions

01 Carbon nanotube-based transparent conductive films

Carbon nanotubes (CNTs) can be used to create transparent conductive films with excellent electrical conductivity and optical transparency. These films are formed by depositing networks of carbon nanotubes on substrates, creating conductive pathways while maintaining high light transmission. The conductivity and transparency can be tuned by controlling the density and distribution of the nanotubes. These films offer advantages such as flexibility, chemical stability, and compatibility with various substrates.- Carbon nanotube-based transparent conductive films: Carbon nanotubes (CNTs) can be used to create transparent conductive films with excellent electrical conductivity while maintaining high optical transparency. These films offer flexibility and durability advantages over traditional transparent conductors. The CNT networks can be optimized through various processing techniques to achieve the desired balance between conductivity and transparency for applications in touch screens, displays, and flexible electronics.

- Metal oxide transparent conductive films: Metal oxide materials, particularly indium tin oxide (ITO), are widely used for transparent conductive films due to their combination of high electrical conductivity and optical transparency. These films can be deposited using various techniques such as sputtering, sol-gel, and chemical vapor deposition. The electrical and optical properties can be tuned by controlling the composition, thickness, and deposition parameters to meet specific application requirements.

- Silver nanowire transparent conductive films: Silver nanowire networks provide an alternative approach for creating transparent conductive films with high performance. These nanowires form a percolating network that allows electrical conductivity while maintaining optical transparency due to the spaces between nanowires. The performance of these films can be enhanced through optimization of nanowire dimensions, density, and post-treatment processes to reduce junction resistance and improve stability.

- Graphene-based transparent conductive films: Graphene, a single layer of carbon atoms arranged in a hexagonal lattice, offers exceptional electrical conductivity and optical transparency, making it an ideal material for transparent conductive films. Various methods have been developed to produce graphene films, including chemical vapor deposition, reduced graphene oxide, and exfoliation techniques. The conductivity and transparency of these films can be controlled by the number of layers, doping, and defect engineering.

- Hybrid and composite transparent conductive films: Hybrid and composite approaches combine different conductive materials to create transparent films with enhanced properties. These may include combinations of metal nanowires with graphene, carbon nanotubes with conductive polymers, or metal oxides with metallic grids. Such hybrid structures can overcome the limitations of individual materials, offering improved conductivity-transparency trade-offs, mechanical flexibility, and environmental stability for next-generation electronic devices.

02 Metal oxide transparent conductive films

Metal oxide materials, particularly indium tin oxide (ITO), are widely used for transparent conductive films due to their combination of high electrical conductivity and optical transparency. These films are typically deposited using techniques such as sputtering or chemical vapor deposition. The electrical and optical properties can be optimized by controlling the composition, thickness, and deposition parameters. Metal oxide films find applications in displays, touch panels, solar cells, and other optoelectronic devices.Expand Specific Solutions03 Metal nanowire transparent conductive films

Metal nanowires, particularly silver nanowires, can be used to create transparent conductive films with high conductivity and transparency. These films are typically formed by depositing a network of nanowires on a substrate, creating conductive pathways while allowing light to pass through the spaces between wires. The conductivity and transparency can be tuned by controlling the density and dimensions of the nanowires. These films offer advantages such as flexibility, stretchability, and compatibility with roll-to-roll processing.Expand Specific Solutions04 Graphene-based transparent conductive films

Graphene, a single layer of carbon atoms arranged in a hexagonal lattice, can be used to create transparent conductive films with exceptional electrical conductivity and optical transparency. These films can be produced through methods such as chemical vapor deposition or solution processing of graphene oxide. The conductivity and transparency can be tuned by controlling the number of layers, defect density, and doping level. Graphene-based films offer advantages such as flexibility, chemical stability, and potential for low-cost production.Expand Specific Solutions05 Composite and hybrid transparent conductive films

Composite and hybrid transparent conductive films combine different materials to achieve enhanced electrical and optical properties. These can include combinations of metal nanowires with graphene, carbon nanotubes with conductive polymers, or metal oxides with metal grids. By leveraging the strengths of different materials, these composite films can achieve higher conductivity while maintaining high transparency. Additionally, they can offer improved mechanical properties such as flexibility and durability, making them suitable for applications in flexible electronics and displays.Expand Specific Solutions

Leading Companies in TCF and Solar Cell Industries

The transparent conductive film (TCF) market for solar cell electrodes is in a growth phase, driven by increasing solar energy adoption worldwide. The market is expected to expand significantly due to rising demand for renewable energy solutions. Technologically, the field is advancing rapidly with companies like Mitsubishi Materials, FUJIFILM, and AGC developing innovative materials with improved conductivity and transparency. Changzhou Almaden and LONGi Leye are pioneering anti-reflective coatings and specialized photovoltaic applications, while research institutions like Max Planck Society and Shanghai Jiao Tong University contribute fundamental breakthroughs. The competitive landscape features established Japanese corporations alongside emerging Chinese manufacturers, with increasing focus on nanomaterials and polymer-based solutions from companies like Nanoenics and Nanotek Instruments to enhance efficiency and reduce production costs.

Sumitomo Metal Mining Co. Ltd.

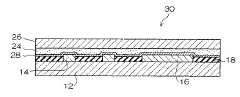

Technical Solution: Sumitomo Metal Mining has pioneered advanced transparent conductive films based on their proprietary ATO (antimony-doped tin oxide) and ITO (indium tin oxide) technologies specifically optimized for solar cell applications. Their approach involves a specialized sputtering technique that creates highly crystalline films with controlled grain boundaries to minimize electron scattering. The company has developed a unique composition that incorporates trace amounts of molybdenum to enhance conductivity without sacrificing transparency, achieving sheet resistance below 8 ohms/square with over 92% transparency in the visible range. Sumitomo's technology also features a patented multi-layer architecture that includes an ultra-thin metal oxide buffer layer to improve adhesion and reduce interfacial recombination. Their most recent innovation involves a solution-processed TCO that can be applied using roll-to-roll manufacturing, significantly reducing production costs while maintaining performance comparable to vacuum-deposited films.

Strengths: Exceptional balance of transparency and conductivity; excellent uniformity over large areas; reduced indium content compared to conventional ITO; compatibility with various deposition methods. Weaknesses: Higher material costs for highest-performance formulations; requires precise process control; some formulations have limited flexibility.

Changzhou Almaden Co., Ltd.

Technical Solution: Changzhou Almaden has developed a specialized transparent conductive film technology for solar applications based on fluorine-doped tin oxide (FTO) films. Their proprietary atmospheric pressure chemical vapor deposition (APCVD) process creates highly uniform FTO layers with controlled texture for enhanced light trapping. The company's technology achieves sheet resistance values of 7-15 ohms/square while maintaining transparency above 85% across the solar spectrum. A key innovation is their multi-stage deposition process that creates graded doping profiles, optimizing the trade-off between conductivity and transparency. Almaden has also developed a post-deposition treatment that improves the interface between the TCO and subsequent layers, reducing contact resistance and improving cell efficiency. Their FTO films are particularly notable for their excellent thermal stability, making them suitable for high-temperature cell processing steps.

Strengths: Cost-effective production at industrial scale; excellent thermal and chemical stability; good compatibility with various cell architectures. Weaknesses: Slightly lower transparency compared to ITO alternatives; requires specialized deposition equipment; limited flexibility for thin-film applications.

Key Innovations in TCF Material Science

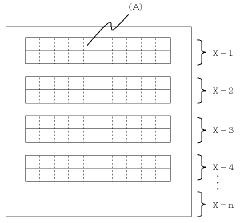

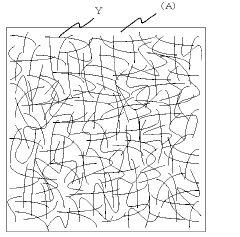

Transparent conductive electrode film and use thereof

PatentInactiveJP2016201214A

Innovation

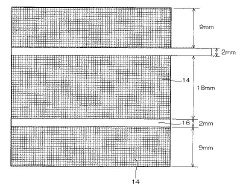

- Integration of parallel conductive metal wires with a mesh-like carbon nanotube (CNT) layer on a transparent film, creating a hybrid electrode structure with enhanced conductivity while maintaining transparency.

- Mesh-like application of carbon nanotubes that likely creates additional conductive pathways between the metal wires, potentially improving overall conductivity and providing redundancy in the conductive network.

- Versatile electrode film design applicable for both solar cell panels and LED panels, suggesting excellent bidirectional electrical properties (both for current collection and distribution).

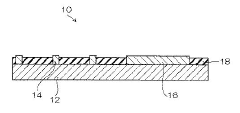

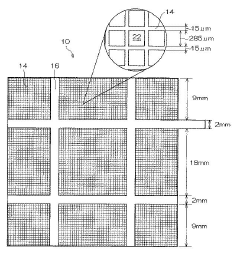

Transparent conductive film, method of manufacturing the same, electronic device, and organic thin film solar cell

PatentInactiveJP2012059417A

Innovation

- A transparent conductive film is developed where the conductive mesh and bus lines are composed of the same silver-based composition, formed through a patterned conductive layer using a silver halide and hydrophilic polymer, ensuring good conductivity and transparency without ITO.

Environmental Impact and Sustainability Considerations

The environmental impact of transparent conductive films (TCFs) in solar cell electrode engineering extends beyond their primary function of enhancing energy conversion efficiency. Traditional TCF materials, particularly indium tin oxide (ITO), present significant sustainability challenges due to the scarcity of indium resources. Current global reserves of indium are estimated to be depleted within 20-30 years at current consumption rates, raising critical concerns about long-term viability of ITO-based technologies.

Manufacturing processes for conventional TCFs often involve energy-intensive vacuum deposition techniques and high-temperature treatments, resulting in substantial carbon footprints. These processes typically consume 5-10 times more energy than solution-based alternatives, contributing significantly to greenhouse gas emissions throughout the production lifecycle. Additionally, the etching processes employed in TCF patterning frequently utilize hazardous chemicals such as strong acids and heavy metal compounds, posing environmental contamination risks.

Recent life cycle assessments reveal that alternative TCF materials offer promising environmental advantages. Carbon-based TCFs (graphene, carbon nanotubes) demonstrate up to 70% reduction in embodied energy compared to ITO, while metal nanowire networks can reduce water consumption by approximately 60%. These alternatives often enable lower-temperature processing, further reducing energy requirements during manufacturing.

End-of-life considerations represent another critical environmental dimension. The recyclability of TCF materials varies significantly, with conventional ITO-coated substrates presenting challenges for material recovery. Emerging TCF technologies incorporating biodegradable substrates and water-soluble components offer improved end-of-life scenarios, potentially reducing electronic waste accumulation.

The sustainability profile of TCFs must also account for their contribution to renewable energy generation. Enhanced electrode performance directly impacts solar cell efficiency and longevity, potentially offsetting initial environmental impacts through increased clean energy production. Studies indicate that a 1% improvement in solar cell efficiency through advanced TCF engineering can reduce the carbon payback period by approximately 8-12 months.

Regulatory frameworks increasingly influence TCF development trajectories. The European Union's Restriction of Hazardous Substances (RoHS) directive and similar global initiatives are driving research toward less toxic alternatives. Meanwhile, emerging circular economy policies are incentivizing designs that facilitate material recovery and reuse, potentially transforming the TCF manufacturing landscape toward closed-loop systems.

Manufacturing processes for conventional TCFs often involve energy-intensive vacuum deposition techniques and high-temperature treatments, resulting in substantial carbon footprints. These processes typically consume 5-10 times more energy than solution-based alternatives, contributing significantly to greenhouse gas emissions throughout the production lifecycle. Additionally, the etching processes employed in TCF patterning frequently utilize hazardous chemicals such as strong acids and heavy metal compounds, posing environmental contamination risks.

Recent life cycle assessments reveal that alternative TCF materials offer promising environmental advantages. Carbon-based TCFs (graphene, carbon nanotubes) demonstrate up to 70% reduction in embodied energy compared to ITO, while metal nanowire networks can reduce water consumption by approximately 60%. These alternatives often enable lower-temperature processing, further reducing energy requirements during manufacturing.

End-of-life considerations represent another critical environmental dimension. The recyclability of TCF materials varies significantly, with conventional ITO-coated substrates presenting challenges for material recovery. Emerging TCF technologies incorporating biodegradable substrates and water-soluble components offer improved end-of-life scenarios, potentially reducing electronic waste accumulation.

The sustainability profile of TCFs must also account for their contribution to renewable energy generation. Enhanced electrode performance directly impacts solar cell efficiency and longevity, potentially offsetting initial environmental impacts through increased clean energy production. Studies indicate that a 1% improvement in solar cell efficiency through advanced TCF engineering can reduce the carbon payback period by approximately 8-12 months.

Regulatory frameworks increasingly influence TCF development trajectories. The European Union's Restriction of Hazardous Substances (RoHS) directive and similar global initiatives are driving research toward less toxic alternatives. Meanwhile, emerging circular economy policies are incentivizing designs that facilitate material recovery and reuse, potentially transforming the TCF manufacturing landscape toward closed-loop systems.

Cost-Performance Analysis of TCF Technologies

The economic viability of transparent conductive films (TCFs) in solar cell applications hinges on the delicate balance between performance metrics and production costs. Traditional indium tin oxide (ITO) remains the industry benchmark, offering excellent transparency (>90%) and low sheet resistance (<10 Ω/sq), but at premium costs due to indium scarcity and energy-intensive deposition processes. Current market pricing for ITO ranges from $10-15/m² for standard applications to $30-40/m² for high-performance requirements.

Emerging alternatives present varying cost-performance profiles. Silver nanowire networks deliver comparable electrical performance to ITO at potentially lower manufacturing costs ($8-12/m²), but face challenges in long-term stability and integration complexity. Carbon-based materials like graphene and carbon nanotubes offer sustainable alternatives with production costs estimated at $5-20/m², though their electrical performance currently lags behind ITO by 15-30%.

Metal mesh technologies demonstrate excellent conductivity with moderate transparency at competitive price points ($7-15/m²), making them increasingly attractive for large-area applications. PEDOT:PSS and other conductive polymers represent the lowest-cost option ($3-8/m²) but suffer from performance limitations that restrict their application to specific solar cell architectures.

Manufacturing scalability significantly impacts the cost structure of TCF technologies. Roll-to-roll processing capabilities provide substantial cost advantages for metal meshes and polymer-based solutions, potentially reducing production expenses by 30-50% compared to batch processing methods required for high-quality ITO deposition.

Lifecycle cost analysis reveals additional considerations beyond initial production expenses. ITO-based electrodes typically demonstrate superior durability with 10+ year lifespans in field conditions, while newer alternatives may require replacement or exhibit performance degradation within 3-7 years, affecting total ownership costs despite lower initial investments.

The performance-to-cost ratio continues to evolve as manufacturing processes mature. Current industry metrics suggest that metal mesh and silver nanowire technologies are approaching cost parity with ITO while delivering 85-95% of the performance benefits. This convergence point represents the current sweet spot for commercial solar applications seeking to optimize efficiency without prohibitive cost increases.

Emerging alternatives present varying cost-performance profiles. Silver nanowire networks deliver comparable electrical performance to ITO at potentially lower manufacturing costs ($8-12/m²), but face challenges in long-term stability and integration complexity. Carbon-based materials like graphene and carbon nanotubes offer sustainable alternatives with production costs estimated at $5-20/m², though their electrical performance currently lags behind ITO by 15-30%.

Metal mesh technologies demonstrate excellent conductivity with moderate transparency at competitive price points ($7-15/m²), making them increasingly attractive for large-area applications. PEDOT:PSS and other conductive polymers represent the lowest-cost option ($3-8/m²) but suffer from performance limitations that restrict their application to specific solar cell architectures.

Manufacturing scalability significantly impacts the cost structure of TCF technologies. Roll-to-roll processing capabilities provide substantial cost advantages for metal meshes and polymer-based solutions, potentially reducing production expenses by 30-50% compared to batch processing methods required for high-quality ITO deposition.

Lifecycle cost analysis reveals additional considerations beyond initial production expenses. ITO-based electrodes typically demonstrate superior durability with 10+ year lifespans in field conditions, while newer alternatives may require replacement or exhibit performance degradation within 3-7 years, affecting total ownership costs despite lower initial investments.

The performance-to-cost ratio continues to evolve as manufacturing processes mature. Current industry metrics suggest that metal mesh and silver nanowire technologies are approaching cost parity with ITO while delivering 85-95% of the performance benefits. This convergence point represents the current sweet spot for commercial solar applications seeking to optimize efficiency without prohibitive cost increases.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!