Transparent conductive films for energy efficient smart window technologies

SEP 24, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Smart Window TCF Background and Objectives

Transparent conductive films (TCFs) have emerged as a critical component in the evolution of smart window technologies over the past three decades. Initially developed for display applications, these films have transitioned into essential elements for energy-efficient building solutions. The fundamental principle behind TCFs involves materials that simultaneously exhibit high optical transparency and electrical conductivity—properties that are typically mutually exclusive in conventional materials.

The development trajectory of TCFs has progressed from traditional indium tin oxide (ITO) dominance to more sustainable and versatile alternatives including silver nanowires, carbon nanotubes, graphene, and metal mesh structures. This evolution has been driven by both material scarcity concerns and the expanding performance requirements for next-generation smart windows.

Smart windows utilizing TCFs can dynamically modulate solar radiation transmission through electrochromic, thermochromic, or photochromic mechanisms, offering unprecedented control over building energy consumption. The integration of these technologies into architectural glass represents a paradigm shift in how buildings interact with their environment, moving from passive elements to active, responsive systems.

The primary technical objective for TCF development in smart window applications centers on achieving an optimal balance between transparency (>90% in visible spectrum), conductivity (<10 ohms/sq sheet resistance), mechanical flexibility, and long-term environmental stability. Additionally, cost-effective manufacturing processes that can scale to architectural dimensions remain a critical goal for industry adoption.

Recent advancements have focused on enhancing the switching speed, durability, and energy efficiency of TCF-based smart windows. Particular emphasis has been placed on reducing power consumption during state transitions and maintaining optical clarity through thousands of switching cycles under varied environmental conditions.

The convergence of TCF technology with Internet of Things (IoT) capabilities represents another significant trend, enabling smart windows to become integral components of intelligent building management systems. This integration allows for automated response to environmental conditions and user preferences, further optimizing energy performance.

Looking forward, the technical roadmap for TCF-based smart windows aims to achieve zero-energy buildings through advanced materials engineering and system integration. The ultimate objective is to develop windows that not only regulate thermal transfer but also potentially generate energy through photovoltaic integration, transforming windows from energy liabilities into energy assets in the built environment.

The development trajectory of TCFs has progressed from traditional indium tin oxide (ITO) dominance to more sustainable and versatile alternatives including silver nanowires, carbon nanotubes, graphene, and metal mesh structures. This evolution has been driven by both material scarcity concerns and the expanding performance requirements for next-generation smart windows.

Smart windows utilizing TCFs can dynamically modulate solar radiation transmission through electrochromic, thermochromic, or photochromic mechanisms, offering unprecedented control over building energy consumption. The integration of these technologies into architectural glass represents a paradigm shift in how buildings interact with their environment, moving from passive elements to active, responsive systems.

The primary technical objective for TCF development in smart window applications centers on achieving an optimal balance between transparency (>90% in visible spectrum), conductivity (<10 ohms/sq sheet resistance), mechanical flexibility, and long-term environmental stability. Additionally, cost-effective manufacturing processes that can scale to architectural dimensions remain a critical goal for industry adoption.

Recent advancements have focused on enhancing the switching speed, durability, and energy efficiency of TCF-based smart windows. Particular emphasis has been placed on reducing power consumption during state transitions and maintaining optical clarity through thousands of switching cycles under varied environmental conditions.

The convergence of TCF technology with Internet of Things (IoT) capabilities represents another significant trend, enabling smart windows to become integral components of intelligent building management systems. This integration allows for automated response to environmental conditions and user preferences, further optimizing energy performance.

Looking forward, the technical roadmap for TCF-based smart windows aims to achieve zero-energy buildings through advanced materials engineering and system integration. The ultimate objective is to develop windows that not only regulate thermal transfer but also potentially generate energy through photovoltaic integration, transforming windows from energy liabilities into energy assets in the built environment.

Market Analysis for Energy Efficient Windows

The global market for energy-efficient windows is experiencing robust growth, driven by increasing environmental awareness, stringent building energy codes, and rising energy costs. The smart window segment, particularly those utilizing transparent conductive films (TCFs), represents one of the fastest-growing sectors within this market. Current valuations place the global smart window market at approximately $5.3 billion in 2023, with projections indicating a compound annual growth rate (CAGR) of 12.4% through 2030.

Consumer demand for energy-efficient building solutions has surged significantly over the past decade. This trend is particularly evident in commercial construction, where smart windows can reduce HVAC energy consumption by 20-30% and lighting costs by up to 60%. Residential adoption is also accelerating, especially in regions with extreme climate conditions or high energy prices.

Geographically, North America currently leads the market with approximately 38% share, followed by Europe at 31% and Asia-Pacific at 24%. The Asia-Pacific region, however, is expected to witness the highest growth rate over the next five years, driven by rapid urbanization, increasing disposable incomes, and government initiatives promoting green building technologies in China, Japan, and South Korea.

Market segmentation reveals distinct customer preferences across different applications. Commercial buildings prioritize energy savings and occupant comfort, while residential consumers emphasize aesthetics and ease of operation alongside efficiency. Institutional buildings such as hospitals and educational facilities focus on durability and long-term performance metrics.

Key market drivers include increasingly stringent building energy codes worldwide, with the EU's Energy Performance of Buildings Directive and similar regulations in North America setting progressively higher standards for window thermal performance. Additionally, rising energy costs globally have shortened the return-on-investment period for premium window technologies, making them more attractive to cost-conscious consumers and businesses.

Market barriers include the relatively high initial cost of smart window technologies compared to conventional alternatives, with price premiums ranging from 30% to 200% depending on the specific technology. Technical challenges in scaling production while maintaining performance consistency also remain significant hurdles for manufacturers.

Future market trends indicate growing integration of smart windows with building automation systems and IoT platforms, creating additional value through data-driven optimization of building performance. The emergence of self-powered smart windows utilizing photovoltaic transparent films represents another promising development that could significantly expand market penetration by eliminating wiring requirements and reducing installation complexity.

Consumer demand for energy-efficient building solutions has surged significantly over the past decade. This trend is particularly evident in commercial construction, where smart windows can reduce HVAC energy consumption by 20-30% and lighting costs by up to 60%. Residential adoption is also accelerating, especially in regions with extreme climate conditions or high energy prices.

Geographically, North America currently leads the market with approximately 38% share, followed by Europe at 31% and Asia-Pacific at 24%. The Asia-Pacific region, however, is expected to witness the highest growth rate over the next five years, driven by rapid urbanization, increasing disposable incomes, and government initiatives promoting green building technologies in China, Japan, and South Korea.

Market segmentation reveals distinct customer preferences across different applications. Commercial buildings prioritize energy savings and occupant comfort, while residential consumers emphasize aesthetics and ease of operation alongside efficiency. Institutional buildings such as hospitals and educational facilities focus on durability and long-term performance metrics.

Key market drivers include increasingly stringent building energy codes worldwide, with the EU's Energy Performance of Buildings Directive and similar regulations in North America setting progressively higher standards for window thermal performance. Additionally, rising energy costs globally have shortened the return-on-investment period for premium window technologies, making them more attractive to cost-conscious consumers and businesses.

Market barriers include the relatively high initial cost of smart window technologies compared to conventional alternatives, with price premiums ranging from 30% to 200% depending on the specific technology. Technical challenges in scaling production while maintaining performance consistency also remain significant hurdles for manufacturers.

Future market trends indicate growing integration of smart windows with building automation systems and IoT platforms, creating additional value through data-driven optimization of building performance. The emergence of self-powered smart windows utilizing photovoltaic transparent films represents another promising development that could significantly expand market penetration by eliminating wiring requirements and reducing installation complexity.

TCF Technology Status and Barriers

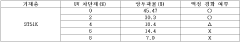

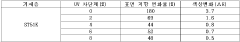

Transparent conductive films (TCFs) for smart windows have seen significant technological advancements globally, yet several critical barriers remain. Current state-of-the-art TCFs primarily utilize indium tin oxide (ITO), which dominates approximately 90% of the commercial market due to its excellent combination of optical transparency (>90%) and electrical conductivity (<100 Ω/sq). However, ITO faces substantial limitations including brittleness, high processing temperatures, and most critically, the scarcity and rising cost of indium.

Alternative TCF technologies have emerged to address these challenges. Silver nanowire networks offer comparable performance to ITO with sheet resistances below 10 Ω/sq while maintaining >90% transparency, plus the advantage of flexibility. However, they suffer from long-term stability issues, particularly oxidation and mechanical degradation under environmental stresses. Carbon-based materials such as graphene and carbon nanotubes present another promising direction, offering exceptional mechanical properties and potentially lower costs, but still struggle to match ITO's combination of transparency and conductivity in large-scale production.

Metal mesh structures have demonstrated excellent electrical properties with sheet resistances as low as 0.5 Ω/sq while maintaining high transparency, yet face challenges in manufacturing scalability and visible pattern issues that can interfere with optical clarity in window applications. PEDOT:PSS and other conductive polymers offer flexibility and solution processability but exhibit limited conductivity and environmental stability compared to inorganic alternatives.

Geographically, TCF technology development shows distinct patterns. East Asia, particularly Japan, South Korea, and China, leads in ITO production and application, while North America and Europe focus more on alternative TCF technologies. Recent research clusters in Singapore, Germany, and the United States are advancing hybrid TCF systems that combine multiple materials to overcome individual limitations.

The primary technical challenges facing TCF implementation in smart windows include achieving the optimal balance between transparency and conductivity, ensuring long-term environmental stability under varying temperature and humidity conditions, developing cost-effective large-area fabrication methods, and integrating TCFs with other smart window components such as electrochromic layers or thermochromic materials.

Manufacturing scalability represents another significant barrier, as laboratory-scale performance often deteriorates when technologies are transferred to mass production environments. Additionally, the integration of TCFs into existing window manufacturing processes requires compatibility with established production lines, which often necessitates significant process modifications or entirely new manufacturing approaches.

Alternative TCF technologies have emerged to address these challenges. Silver nanowire networks offer comparable performance to ITO with sheet resistances below 10 Ω/sq while maintaining >90% transparency, plus the advantage of flexibility. However, they suffer from long-term stability issues, particularly oxidation and mechanical degradation under environmental stresses. Carbon-based materials such as graphene and carbon nanotubes present another promising direction, offering exceptional mechanical properties and potentially lower costs, but still struggle to match ITO's combination of transparency and conductivity in large-scale production.

Metal mesh structures have demonstrated excellent electrical properties with sheet resistances as low as 0.5 Ω/sq while maintaining high transparency, yet face challenges in manufacturing scalability and visible pattern issues that can interfere with optical clarity in window applications. PEDOT:PSS and other conductive polymers offer flexibility and solution processability but exhibit limited conductivity and environmental stability compared to inorganic alternatives.

Geographically, TCF technology development shows distinct patterns. East Asia, particularly Japan, South Korea, and China, leads in ITO production and application, while North America and Europe focus more on alternative TCF technologies. Recent research clusters in Singapore, Germany, and the United States are advancing hybrid TCF systems that combine multiple materials to overcome individual limitations.

The primary technical challenges facing TCF implementation in smart windows include achieving the optimal balance between transparency and conductivity, ensuring long-term environmental stability under varying temperature and humidity conditions, developing cost-effective large-area fabrication methods, and integrating TCFs with other smart window components such as electrochromic layers or thermochromic materials.

Manufacturing scalability represents another significant barrier, as laboratory-scale performance often deteriorates when technologies are transferred to mass production environments. Additionally, the integration of TCFs into existing window manufacturing processes requires compatibility with established production lines, which often necessitates significant process modifications or entirely new manufacturing approaches.

Current TCF Solutions for Smart Windows

01 Carbon nanotube-based transparent conductive films

Carbon nanotubes (CNTs) can be used to create transparent conductive films with excellent electrical conductivity while maintaining high transparency. These films can be fabricated through various methods such as solution processing or direct growth. The unique structure of carbon nanotubes allows for a network that conducts electricity efficiently while allowing light to pass through, making them suitable for applications in touch screens, displays, and solar cells.- Carbon nanotube-based transparent conductive films: Carbon nanotubes (CNTs) can be used to create transparent conductive films with excellent electrical conductivity while maintaining high optical transparency. These films can be fabricated through various methods such as solution processing, vacuum filtration, or direct growth. The unique structure of carbon nanotubes allows for a network that conducts electricity efficiently while allowing light to pass through. These films can be further enhanced by doping or functionalization to improve their conductivity without sacrificing transparency.

- Metal oxide transparent conductive films: Metal oxides, particularly indium tin oxide (ITO), are widely used for transparent conductive films due to their combination of high transparency in the visible spectrum and good electrical conductivity. These films can be deposited using techniques such as sputtering, chemical vapor deposition, or sol-gel methods. The electrical and optical properties can be tuned by controlling the composition, thickness, and deposition parameters. Alternative metal oxides like zinc oxide, aluminum-doped zinc oxide, and fluorine-doped tin oxide are also being developed to address cost and supply concerns associated with indium.

- Silver nanowire transparent conductive films: Silver nanowire networks offer a promising alternative for transparent conductive films with excellent flexibility and stretchability. These films consist of randomly distributed silver nanowires that form a conductive network while allowing light transmission through the spaces between wires. The conductivity and transparency can be balanced by controlling the nanowire density, length, and diameter. Post-treatment processes such as thermal annealing or pressing can reduce junction resistance between nanowires, further enhancing the electrical performance while maintaining high transparency.

- Graphene-based transparent conductive films: Graphene, a single layer of carbon atoms arranged in a hexagonal lattice, can be used to create highly transparent and conductive films. These films exhibit exceptional electrical conductivity, optical transparency, and mechanical flexibility. Various methods for producing graphene-based transparent conductive films include chemical vapor deposition, reduced graphene oxide, and transfer techniques. The conductivity can be enhanced through chemical doping, while maintaining transparency above 90%. Hybrid structures combining graphene with other materials like metal nanowires or conductive polymers can offer synergistic improvements in performance.

- Conductive polymer transparent films: Conductive polymers such as PEDOT:PSS (poly(3,4-ethylenedioxythiophene) polystyrene sulfonate) can be formulated into transparent conductive films through solution processing techniques. These films offer advantages including flexibility, solution processability, and compatibility with roll-to-roll manufacturing. The conductivity and transparency can be optimized through various treatments such as addition of polar solvents, acid treatment, or thermal annealing. Conductive polymer films are particularly suitable for applications requiring mechanical flexibility and can be combined with other materials to create hybrid structures with enhanced performance.

02 Metal oxide transparent conductive films

Metal oxides, particularly indium tin oxide (ITO), are widely used as transparent conductive materials. These films offer a good balance between optical transparency and electrical conductivity. The properties can be tuned by controlling the deposition parameters, doping levels, and post-treatment processes. Metal oxide films can be deposited using various techniques such as sputtering, chemical vapor deposition, and sol-gel methods.Expand Specific Solutions03 Silver nanowire transparent conductive films

Silver nanowires can form networks that provide excellent electrical conductivity while maintaining high optical transparency. These films can be fabricated through solution-based processes, making them suitable for flexible electronics. The aspect ratio of the nanowires and the network density are critical parameters that affect the balance between transparency and conductivity. Silver nanowire films offer advantages such as mechanical flexibility and lower processing temperatures compared to traditional transparent conductors.Expand Specific Solutions04 Graphene-based transparent conductive films

Graphene, a single layer of carbon atoms arranged in a hexagonal lattice, can be used to create highly transparent and conductive films. These films exhibit exceptional electrical properties while maintaining optical transparency above 90%. Various methods such as chemical vapor deposition, reduced graphene oxide, and transfer techniques are used to fabricate graphene-based transparent conductive films. The conductivity can be further enhanced through doping or hybridization with other materials.Expand Specific Solutions05 Composite and hybrid transparent conductive films

Composite or hybrid transparent conductive films combine different materials to achieve enhanced performance. These can include combinations of metal nanowires with graphene, carbon nanotubes with conductive polymers, or metal oxides with metallic grids. The synergistic effects of these combinations can lead to improved conductivity without sacrificing transparency. Additionally, these hybrid structures often offer improved mechanical flexibility and stability compared to single-material films.Expand Specific Solutions

Smart Window Industry Competitive Landscape

The transparent conductive films (TCF) market for energy-efficient smart windows is currently in a growth phase, with increasing adoption driven by sustainability demands and energy efficiency regulations. The market is projected to expand significantly as smart building technologies gain traction globally. Technologically, the field shows varying maturity levels, with established players like FUJIFILM, Eastman Chemical, and Sharp offering commercial solutions, while research institutions such as The Regents of the University of California and Chinese Academy of Science institutes drive innovation. Companies like Changzhou Almaden and DREAM GLASS are specializing in smart window applications, while materials giants including BASF, Kaneka, and Toyobo are developing advanced film technologies. The competitive landscape features a mix of electronics manufacturers, chemical companies, and specialized materials providers competing to improve transparency, conductivity, durability, and cost-effectiveness.

Changzhou Almaden Co., Ltd.

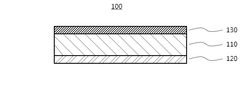

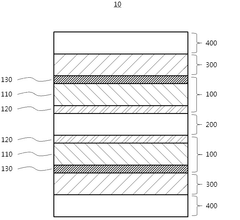

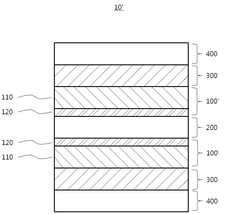

Technical Solution: Changzhou Almaden has developed advanced transparent conductive film technology specifically engineered for energy-efficient smart windows. Their proprietary approach combines low-emissivity (Low-E) coatings with transparent conductive oxide (TCO) layers to create multifunctional films that provide both passive and active energy management. The company's core technology utilizes magnetron sputtering to deposit ultra-thin silver layers (15-20nm) sandwiched between dielectric oxide layers, creating a structure that reflects infrared radiation while allowing visible light transmission above 70%. For active control, Almaden integrates these films with electrochromic materials using a proprietary lamination process that ensures long-term adhesion and performance stability. Their manufacturing capabilities include large-format production lines capable of processing glass panels up to 3m × 6m, making them suitable for commercial building applications. Almaden has also pioneered the integration of transparent conductive films with vacuum-insulated glass (VIG) technology, creating smart windows with exceptional thermal insulation properties (U-values below 0.3 W/m²K) while maintaining dynamic light control capabilities.

Strengths: Vertical integration from raw materials to finished smart windows ensures quality control; established mass production capabilities reduce costs; combined passive and active energy management maximizes efficiency. Weaknesses: Higher initial cost compared to conventional windows; complex manufacturing process requires significant capital investment; control systems require specialized expertise for installation and maintenance.

Sharp Corp.

Technical Solution: Sharp has developed advanced transparent conductive films (TCFs) for energy-efficient smart windows using indium tin oxide (ITO) and silver nanowire technologies. Their proprietary IGZO (Indium Gallium Zinc Oxide) technology enables ultra-thin, highly transparent conductive layers with superior electron mobility. Sharp's smart window solutions incorporate electrochromic materials that change opacity when voltage is applied, allowing dynamic control of light transmission and heat. Their multi-layer film structure includes a transparent conductive oxide layer, an ion storage layer, an electrolyte, and an electrochromic layer that together enable rapid switching between transparent and tinted states. Sharp has also pioneered the integration of these films with photovoltaic elements, creating windows that not only regulate light and heat but also generate electricity. Their manufacturing process employs advanced sputtering techniques and roll-to-roll processing to achieve uniform coating on large glass surfaces, essential for commercial building applications.

Strengths: Superior optical clarity with over 90% transparency in clear state; excellent durability with 100,000+ switching cycles; integrated energy harvesting capabilities. Weaknesses: Higher production costs compared to conventional window technologies; requires specialized installation and control systems; performance degradation in extreme temperature conditions.

Key Patents and Innovations in TCF Technology

Transparent conductive film with color

PatentActiveKR1020200050047A

Innovation

- A transparent conductive film comprising a transparent substrate layer, adhesive layer, chip-dyed film, and transparent conductive layer, with specific resistance and light transmittance values, to provide a black color and controlled light transmittance.

Transparent conductive film, preparation method thereof and smart window

PatentActiveKR1020190056059A

Innovation

- A transparent conductive film with a functional coating layer containing urethane acrylate oligomer and acrylic monomer is applied, enhancing adhesion to PVB and preventing oligomer migration.

Environmental Impact and Sustainability Assessment

The environmental impact of transparent conductive films (TCFs) in smart window technologies extends far beyond their immediate energy-saving benefits. Life cycle assessments reveal that traditional TCF production processes, particularly those using indium tin oxide (ITO), generate significant carbon emissions and consume substantial energy during manufacturing. The extraction of rare earth elements like indium presents additional environmental concerns, including habitat disruption, water pollution, and resource depletion. These environmental costs must be weighed against the long-term benefits of reduced building energy consumption.

Alternative TCF materials show promising sustainability profiles. Carbon-based materials such as graphene and carbon nanotubes offer lower environmental footprints compared to metal-based alternatives, with reduced dependency on scarce resources. Similarly, silver nanowire networks and PEDOT:PSS polymer-based films demonstrate lower embodied energy in production processes, though challenges remain in scaling these technologies while maintaining environmental advantages.

The end-of-life management of smart windows presents both challenges and opportunities. Current recycling infrastructure is inadequately equipped to handle the complex material composition of TCF-enabled smart windows. Developing effective recovery methods for valuable materials like silver and indium could significantly improve the sustainability profile of these technologies. Design for disassembly approaches are emerging as potential solutions to facilitate more efficient recycling and material recovery.

When evaluating the net environmental benefit of smart windows, energy payback periods become a critical metric. Research indicates that smart windows can achieve energy payback within 2-5 years in most climate zones, with the greatest benefits observed in regions with extreme temperature variations. This favorable ratio improves as manufacturing processes become more efficient and as the operational lifespan of smart windows extends beyond the current average of 15-20 years.

Regulatory frameworks are increasingly influencing the development trajectory of TCF technologies. The European Union's Restriction of Hazardous Substances (RoHS) directive and similar regulations worldwide are driving innovation toward less toxic and more recyclable materials. Meanwhile, green building certification programs like LEED and BREEAM are creating market incentives for environmentally superior window technologies, accelerating industry adoption of more sustainable TCF solutions.

Alternative TCF materials show promising sustainability profiles. Carbon-based materials such as graphene and carbon nanotubes offer lower environmental footprints compared to metal-based alternatives, with reduced dependency on scarce resources. Similarly, silver nanowire networks and PEDOT:PSS polymer-based films demonstrate lower embodied energy in production processes, though challenges remain in scaling these technologies while maintaining environmental advantages.

The end-of-life management of smart windows presents both challenges and opportunities. Current recycling infrastructure is inadequately equipped to handle the complex material composition of TCF-enabled smart windows. Developing effective recovery methods for valuable materials like silver and indium could significantly improve the sustainability profile of these technologies. Design for disassembly approaches are emerging as potential solutions to facilitate more efficient recycling and material recovery.

When evaluating the net environmental benefit of smart windows, energy payback periods become a critical metric. Research indicates that smart windows can achieve energy payback within 2-5 years in most climate zones, with the greatest benefits observed in regions with extreme temperature variations. This favorable ratio improves as manufacturing processes become more efficient and as the operational lifespan of smart windows extends beyond the current average of 15-20 years.

Regulatory frameworks are increasingly influencing the development trajectory of TCF technologies. The European Union's Restriction of Hazardous Substances (RoHS) directive and similar regulations worldwide are driving innovation toward less toxic and more recyclable materials. Meanwhile, green building certification programs like LEED and BREEAM are creating market incentives for environmentally superior window technologies, accelerating industry adoption of more sustainable TCF solutions.

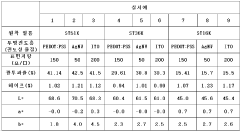

Cost-Performance Analysis of TCF Materials

The cost-performance ratio of transparent conductive films (TCFs) represents a critical factor in the commercial viability of smart window technologies. Current market-leading TCF material, indium tin oxide (ITO), offers excellent optical transparency (>90%) and low sheet resistance (<100 Ω/sq), but faces significant cost challenges due to indium's scarcity, with prices fluctuating between $500-800/kg in recent years. Manufacturing processes for ITO also require high-temperature vacuum deposition, further increasing production costs to approximately $8-15 per square meter.

Alternative TCF materials demonstrate varying cost-performance profiles. Silver nanowire networks provide comparable electrical performance to ITO at potentially lower manufacturing costs ($5-10/m²) due to solution-based processing methods, but suffer from stability issues that may increase lifetime costs. PEDOT:PSS polymer films offer the lowest initial production costs ($3-7/m²) but exhibit higher sheet resistance, limiting their application in larger window formats.

Carbon-based materials such as graphene and carbon nanotubes present promising long-term alternatives with theoretical performance exceeding ITO. However, current manufacturing limitations result in higher production costs ($20-30/m²) and inconsistent quality, making them economically unviable for mass-market applications despite their abundant raw materials.

Metal mesh structures fabricated through printing techniques offer a balanced approach with moderate costs ($7-12/m²) and good electrical properties, though visible patterns may impact aesthetic requirements for premium window applications. Emerging hybrid systems combining two or more TCF materials show potential to optimize the cost-performance ratio by leveraging complementary properties.

Scale economies significantly impact TCF costs, with production volume discounts potentially reducing unit costs by 30-50% for established technologies. This creates market entry barriers for newer TCF materials despite their theoretical advantages. Environmental compliance costs also affect the total cost equation, with ITO and silver-based solutions facing increasing regulatory scrutiny and potential future cost penalties.

Lifecycle cost analysis reveals that while initial material costs favor alternatives like PEDOT:PSS, the durability and performance stability of ITO often results in lower total ownership costs over a 15-20 year window installation lifespan. This cost-performance balance continues to evolve as manufacturing innovations and material science advances drive improvements across all TCF categories.

Alternative TCF materials demonstrate varying cost-performance profiles. Silver nanowire networks provide comparable electrical performance to ITO at potentially lower manufacturing costs ($5-10/m²) due to solution-based processing methods, but suffer from stability issues that may increase lifetime costs. PEDOT:PSS polymer films offer the lowest initial production costs ($3-7/m²) but exhibit higher sheet resistance, limiting their application in larger window formats.

Carbon-based materials such as graphene and carbon nanotubes present promising long-term alternatives with theoretical performance exceeding ITO. However, current manufacturing limitations result in higher production costs ($20-30/m²) and inconsistent quality, making them economically unviable for mass-market applications despite their abundant raw materials.

Metal mesh structures fabricated through printing techniques offer a balanced approach with moderate costs ($7-12/m²) and good electrical properties, though visible patterns may impact aesthetic requirements for premium window applications. Emerging hybrid systems combining two or more TCF materials show potential to optimize the cost-performance ratio by leveraging complementary properties.

Scale economies significantly impact TCF costs, with production volume discounts potentially reducing unit costs by 30-50% for established technologies. This creates market entry barriers for newer TCF materials despite their theoretical advantages. Environmental compliance costs also affect the total cost equation, with ITO and silver-based solutions facing increasing regulatory scrutiny and potential future cost penalties.

Lifecycle cost analysis reveals that while initial material costs favor alternatives like PEDOT:PSS, the durability and performance stability of ITO often results in lower total ownership costs over a 15-20 year window installation lifespan. This cost-performance balance continues to evolve as manufacturing innovations and material science advances drive improvements across all TCF categories.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!