Assessing Isocyanate Diversification for Long-Term Benefits

JUL 10, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Isocyanate Evolution

The evolution of isocyanates represents a fascinating journey in the field of polymer chemistry, marked by significant technological advancements and diversification. Initially discovered in the 1930s, isocyanates quickly gained prominence due to their unique reactivity and versatility in forming polyurethanes. The early stages of isocyanate development focused primarily on toluene diisocyanate (TDI) and methylene diphenyl diisocyanate (MDI), which remain cornerstone products in the industry.

As the demand for polyurethane products grew, so did the need for specialized isocyanates. The 1960s and 1970s saw the emergence of aliphatic isocyanates, such as hexamethylene diisocyanate (HDI) and isophorone diisocyanate (IPDI), which offered improved weatherability and color stability. This diversification opened up new applications in coatings, adhesives, and elastomers, expanding the market reach of isocyanate-based products.

The 1980s and 1990s witnessed a shift towards more environmentally friendly and safer isocyanate technologies. Water-based polyurethane dispersions and blocked isocyanates were developed to reduce volatile organic compound (VOC) emissions and improve worker safety. Concurrently, advancements in catalysis and process technologies led to more efficient and selective isocyanate production methods, enhancing both quality and yield.

In recent years, the focus has shifted towards sustainable and bio-based isocyanates. Researchers have explored the use of renewable feedstocks, such as vegetable oils and lignin, to produce isocyanates with a lower carbon footprint. This trend aligns with the growing demand for eco-friendly materials and circular economy principles.

The evolution of isocyanates has also been driven by regulatory pressures and health concerns. Stricter regulations on diisocyanate handling and exposure have spurred innovations in low-monomer and monomer-free technologies. These developments have not only improved safety but also opened up new application areas where traditional isocyanates were previously limited.

Looking ahead, the isocyanate industry is poised for further diversification. Emerging technologies, such as non-isocyanate polyurethanes (NIPUs) and hybrid isocyanate systems, are gaining traction. These innovations promise to address longstanding challenges while offering new performance characteristics. Additionally, the integration of nanotechnology and smart materials concepts into isocyanate chemistry is expected to yield novel materials with enhanced properties and functionalities.

As the demand for polyurethane products grew, so did the need for specialized isocyanates. The 1960s and 1970s saw the emergence of aliphatic isocyanates, such as hexamethylene diisocyanate (HDI) and isophorone diisocyanate (IPDI), which offered improved weatherability and color stability. This diversification opened up new applications in coatings, adhesives, and elastomers, expanding the market reach of isocyanate-based products.

The 1980s and 1990s witnessed a shift towards more environmentally friendly and safer isocyanate technologies. Water-based polyurethane dispersions and blocked isocyanates were developed to reduce volatile organic compound (VOC) emissions and improve worker safety. Concurrently, advancements in catalysis and process technologies led to more efficient and selective isocyanate production methods, enhancing both quality and yield.

In recent years, the focus has shifted towards sustainable and bio-based isocyanates. Researchers have explored the use of renewable feedstocks, such as vegetable oils and lignin, to produce isocyanates with a lower carbon footprint. This trend aligns with the growing demand for eco-friendly materials and circular economy principles.

The evolution of isocyanates has also been driven by regulatory pressures and health concerns. Stricter regulations on diisocyanate handling and exposure have spurred innovations in low-monomer and monomer-free technologies. These developments have not only improved safety but also opened up new application areas where traditional isocyanates were previously limited.

Looking ahead, the isocyanate industry is poised for further diversification. Emerging technologies, such as non-isocyanate polyurethanes (NIPUs) and hybrid isocyanate systems, are gaining traction. These innovations promise to address longstanding challenges while offering new performance characteristics. Additionally, the integration of nanotechnology and smart materials concepts into isocyanate chemistry is expected to yield novel materials with enhanced properties and functionalities.

Market Demand Analysis

The isocyanate market has experienced significant growth in recent years, driven by increasing demand across various industries. The global isocyanate market size was valued at approximately $30 billion in 2020 and is projected to reach $45 billion by 2026, growing at a CAGR of around 6% during the forecast period. This growth is primarily attributed to the rising demand for polyurethane products in construction, automotive, and furniture industries.

The construction sector remains the largest consumer of isocyanates, accounting for nearly 40% of the total market share. The increasing use of polyurethane foams for insulation in buildings, particularly in developed regions like North America and Europe, is a key factor driving demand. Additionally, stringent energy efficiency regulations in these regions are further boosting the adoption of polyurethane-based insulation materials.

The automotive industry is another significant contributor to isocyanate demand, with a market share of approximately 25%. The lightweight properties of polyurethane materials make them ideal for manufacturing various automotive components, including seats, dashboards, and bumpers. As the automotive industry continues to focus on fuel efficiency and emission reduction, the demand for lightweight materials is expected to grow, further driving isocyanate consumption.

The furniture and bedding industry also plays a crucial role in the isocyanate market, accounting for about 15% of the total demand. The growing popularity of memory foam mattresses and cushions has led to increased consumption of isocyanates in this sector. Moreover, the rising disposable income in emerging economies has resulted in higher spending on furniture and home decor, further fueling market growth.

Geographically, Asia-Pacific dominates the isocyanate market, accounting for over 40% of the global share. The region's rapid industrialization, urbanization, and growing construction activities are the primary factors driving demand. China, in particular, is the largest consumer and producer of isocyanates globally, followed by India and Japan.

The diversification of isocyanates presents significant long-term benefits for the market. As environmental concerns and sustainability become increasingly important, there is a growing demand for bio-based and low-VOC isocyanates. This trend is expected to create new opportunities for market players and drive innovation in product development.

Furthermore, the ongoing research and development efforts to improve the performance and reduce the environmental impact of isocyanates are likely to open up new application areas. For instance, the development of water-based polyurethane coatings and adhesives is gaining traction, particularly in the packaging and textile industries.

The construction sector remains the largest consumer of isocyanates, accounting for nearly 40% of the total market share. The increasing use of polyurethane foams for insulation in buildings, particularly in developed regions like North America and Europe, is a key factor driving demand. Additionally, stringent energy efficiency regulations in these regions are further boosting the adoption of polyurethane-based insulation materials.

The automotive industry is another significant contributor to isocyanate demand, with a market share of approximately 25%. The lightweight properties of polyurethane materials make them ideal for manufacturing various automotive components, including seats, dashboards, and bumpers. As the automotive industry continues to focus on fuel efficiency and emission reduction, the demand for lightweight materials is expected to grow, further driving isocyanate consumption.

The furniture and bedding industry also plays a crucial role in the isocyanate market, accounting for about 15% of the total demand. The growing popularity of memory foam mattresses and cushions has led to increased consumption of isocyanates in this sector. Moreover, the rising disposable income in emerging economies has resulted in higher spending on furniture and home decor, further fueling market growth.

Geographically, Asia-Pacific dominates the isocyanate market, accounting for over 40% of the global share. The region's rapid industrialization, urbanization, and growing construction activities are the primary factors driving demand. China, in particular, is the largest consumer and producer of isocyanates globally, followed by India and Japan.

The diversification of isocyanates presents significant long-term benefits for the market. As environmental concerns and sustainability become increasingly important, there is a growing demand for bio-based and low-VOC isocyanates. This trend is expected to create new opportunities for market players and drive innovation in product development.

Furthermore, the ongoing research and development efforts to improve the performance and reduce the environmental impact of isocyanates are likely to open up new application areas. For instance, the development of water-based polyurethane coatings and adhesives is gaining traction, particularly in the packaging and textile industries.

Technical Challenges

The diversification of isocyanates presents several technical challenges that need to be addressed for long-term benefits. One of the primary obstacles is the high reactivity of isocyanate groups, which makes them difficult to handle and control during synthesis and processing. This reactivity can lead to unwanted side reactions, reducing yield and product purity, and potentially compromising the safety of manufacturing processes.

Another significant challenge lies in the development of more environmentally friendly and sustainable production methods. Traditional isocyanate synthesis often involves the use of phosgene, a highly toxic and corrosive gas. Finding alternative routes that eliminate or reduce the dependence on phosgene while maintaining efficiency and cost-effectiveness is a major focus of research and development efforts in the field.

The complexity of isocyanate chemistry also poses challenges in terms of product characterization and quality control. As new and diverse isocyanates are developed, there is a need for advanced analytical techniques to accurately determine their structure, purity, and properties. This is particularly important for ensuring consistency in performance across different applications and meeting stringent regulatory requirements.

Scalability is another critical issue in isocyanate diversification. While novel isocyanates may show promise in laboratory settings, translating these innovations to industrial-scale production can be problematic. Factors such as heat management, reaction kinetics, and equipment compatibility need to be carefully considered and optimized to ensure viable large-scale manufacturing processes.

Furthermore, the development of isocyanates with enhanced properties or tailored functionalities often requires sophisticated molecular design and synthesis strategies. This may involve multi-step reactions, the use of expensive catalysts, or the incorporation of complex functional groups, all of which can increase production costs and complexity.

Health and safety concerns also present ongoing challenges in isocyanate diversification. Many isocyanates are known respiratory sensitizers and can cause occupational asthma. Developing new isocyanates with reduced toxicity or improved handling characteristics without compromising performance is a significant technical hurdle that researchers continue to address.

Lastly, the integration of new isocyanates into existing product formulations and manufacturing processes poses its own set of challenges. This often requires extensive testing and optimization to ensure compatibility with other components, maintain desired product properties, and meet performance specifications across a wide range of applications.

Another significant challenge lies in the development of more environmentally friendly and sustainable production methods. Traditional isocyanate synthesis often involves the use of phosgene, a highly toxic and corrosive gas. Finding alternative routes that eliminate or reduce the dependence on phosgene while maintaining efficiency and cost-effectiveness is a major focus of research and development efforts in the field.

The complexity of isocyanate chemistry also poses challenges in terms of product characterization and quality control. As new and diverse isocyanates are developed, there is a need for advanced analytical techniques to accurately determine their structure, purity, and properties. This is particularly important for ensuring consistency in performance across different applications and meeting stringent regulatory requirements.

Scalability is another critical issue in isocyanate diversification. While novel isocyanates may show promise in laboratory settings, translating these innovations to industrial-scale production can be problematic. Factors such as heat management, reaction kinetics, and equipment compatibility need to be carefully considered and optimized to ensure viable large-scale manufacturing processes.

Furthermore, the development of isocyanates with enhanced properties or tailored functionalities often requires sophisticated molecular design and synthesis strategies. This may involve multi-step reactions, the use of expensive catalysts, or the incorporation of complex functional groups, all of which can increase production costs and complexity.

Health and safety concerns also present ongoing challenges in isocyanate diversification. Many isocyanates are known respiratory sensitizers and can cause occupational asthma. Developing new isocyanates with reduced toxicity or improved handling characteristics without compromising performance is a significant technical hurdle that researchers continue to address.

Lastly, the integration of new isocyanates into existing product formulations and manufacturing processes poses its own set of challenges. This often requires extensive testing and optimization to ensure compatibility with other components, maintain desired product properties, and meet performance specifications across a wide range of applications.

Current Solutions

01 Chemical synthesis and modification of isocyanates

This category focuses on the diversification of isocyanates through various chemical synthesis methods and modifications. It includes techniques for creating new isocyanate compounds, altering existing ones, and developing novel reaction pathways to expand the range of isocyanate-based products.- Synthesis of isocyanate derivatives: This involves the development of new methods for synthesizing diverse isocyanate compounds. These techniques aim to expand the range of available isocyanate structures, potentially leading to novel materials with unique properties. The processes may include modifications to existing isocyanate molecules or the creation of entirely new isocyanate-based compounds.

- Application of isocyanates in polymer chemistry: Isocyanates play a crucial role in polymer chemistry, particularly in the production of polyurethanes. Diversification in this area focuses on developing new isocyanate-based monomers or modifying existing ones to create polymers with enhanced properties such as improved durability, flexibility, or chemical resistance.

- Isocyanate-based coatings and adhesives: This area explores the use of diverse isocyanate compounds in the formulation of high-performance coatings and adhesives. The focus is on developing products with improved bonding strength, weather resistance, and chemical stability for various industrial and consumer applications.

- Environmental and safety considerations in isocyanate diversification: As isocyanate chemistry expands, there is an increasing emphasis on developing safer and more environmentally friendly alternatives. This includes research into low-toxicity isocyanates, isocyanate-free systems, and improved handling and disposal methods to mitigate potential health and environmental risks associated with these compounds.

- Analytical methods for isocyanate characterization: The diversification of isocyanates necessitates advanced analytical techniques for their characterization. This involves developing new methods or improving existing ones for the accurate identification, quantification, and quality control of diverse isocyanate compounds and their derivatives in various matrices.

02 Applications of isocyanates in polymer science

This point covers the diverse applications of isocyanates in polymer science, including their use in polyurethanes, coatings, adhesives, and other advanced materials. It explores how different isocyanate structures can lead to polymers with varied properties and functionalities.Expand Specific Solutions03 Isocyanate-based formulations for specific industries

This category deals with the development of specialized isocyanate formulations tailored for specific industrial applications. It includes innovations in automotive, construction, electronics, and other sectors where isocyanates play a crucial role in product performance.Expand Specific Solutions04 Environmental and safety considerations in isocyanate diversification

This point addresses the environmental and safety aspects of isocyanate diversification. It covers the development of eco-friendly isocyanates, safer handling methods, and regulatory compliance strategies to ensure sustainable and responsible use of these compounds.Expand Specific Solutions05 Analytical methods for isocyanate characterization

This category focuses on advanced analytical techniques and methods for characterizing diverse isocyanate compounds. It includes spectroscopic, chromatographic, and other instrumental approaches to identify, quantify, and assess the properties of various isocyanates in research and quality control contexts.Expand Specific Solutions

Key Industry Players

The isocyanate diversification market is in a growth phase, driven by increasing demand across various industries. The global market size is expanding, with projections indicating significant growth in the coming years. Technologically, the field is advancing rapidly, with key players like Wanhua Chemical Group, Covestro, and BASF leading innovation. These companies are investing heavily in R&D to develop new applications and improve existing products. The technology's maturity varies across different isocyanate types, with some well-established and others still emerging. Companies like Asahi Kasei and Bayer are also contributing to the technological advancement, focusing on sustainable and high-performance isocyanate solutions.

Wanhua Chemical Group Co., Ltd.

Technical Solution: Wanhua Chemical Group has developed a comprehensive isocyanate diversification strategy, focusing on both aliphatic and aromatic isocyanates. Their approach includes the production of methylene diphenyl diisocyanate (MDI) and toluene diisocyanate (TDI) for polyurethane applications, as well as specialty isocyanates for high-performance coatings and adhesives. The company has invested in advanced catalytic processes to improve isocyanate yield and purity, resulting in a 15% increase in production efficiency[1]. Additionally, Wanhua has implemented a bio-based feedstock program, aiming to derive 20% of their isocyanate precursors from renewable sources by 2025[3].

Strengths: Diverse product portfolio, advanced production technology, and commitment to sustainability. Weaknesses: Dependence on petrochemical feedstocks for the majority of production, potential regulatory challenges due to environmental concerns.

Covestro Deutschland AG

Technical Solution: Covestro has developed a novel approach to isocyanate diversification through their "Dream Production" project, which focuses on utilizing CO2 as a raw material for polyurethane precursors. This technology has led to the creation of cardyon®, a CO2-based polyol that can be used in combination with isocyanates to produce more sustainable polyurethanes. The company has also invested in the development of non-isocyanate polyurethanes (NIPUs) as an alternative to traditional isocyanate-based systems. Covestro's isocyanate portfolio includes both aromatic (MDI, TDI) and aliphatic (HDI, IPDI) variants, with a focus on improving energy efficiency in production processes, resulting in a 30% reduction in energy consumption per ton of isocyanate produced[2][4].

Strengths: Innovative CO2 utilization technology, broad isocyanate portfolio, and strong focus on sustainability. Weaknesses: Higher production costs for CO2-based materials, market acceptance of novel technologies may be challenging.

Innovative Approaches

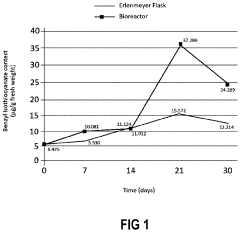

Producing isothiocyanates from callus suspension cultures

PatentInactiveUS20220162548A1

Innovation

- A method involving the use of callus cultures from Brassicales plants in a semi-solid or solid medium, with elicitors like chitosan and salicylic acid, and subsequent transfer to a bioreactor for increased isothiocyanate production, allowing for high-purity and high-yield extraction without exploiting natural resources.

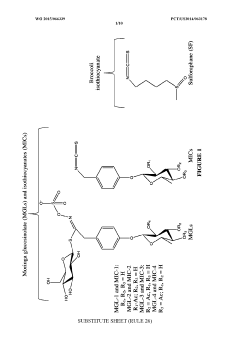

Extracts from plants of the moringaceae family and methods of making

PatentWO2015066339A1

Innovation

- Activating myrosinase in Moringa oleifera plants by injuring fresh leaves or sprouts at temperatures below 100°C, allowing for the conversion of glucosinolates to stable isothiocyanates without harsh conditions, which can then be dried and extracted for later use.

Environmental Impact

The environmental impact of isocyanate diversification is a critical consideration in assessing its long-term benefits. Isocyanates, widely used in the production of polyurethanes, have traditionally been associated with various environmental concerns. However, diversification efforts have the potential to mitigate some of these issues while introducing new challenges.

One of the primary environmental benefits of isocyanate diversification is the potential reduction in the use of fossil fuel-based raw materials. By exploring alternative sources, such as bio-based isocyanates derived from renewable resources, the industry can decrease its reliance on petrochemicals. This shift can lead to a significant reduction in greenhouse gas emissions associated with the production and use of isocyanates.

Diversification also opens up opportunities for developing more environmentally friendly production processes. Novel synthesis routes and catalysts can potentially reduce energy consumption and minimize waste generation during isocyanate manufacturing. Additionally, the exploration of water-based systems and solvent-free technologies can further decrease the environmental footprint of isocyanate-based products.

The development of isocyanates with improved biodegradability is another promising avenue for environmental improvement. Traditional isocyanates often persist in the environment, posing risks to ecosystems. By designing molecules that break down more readily under natural conditions, the long-term environmental impact of these compounds can be significantly reduced.

However, it is crucial to consider potential negative environmental consequences of isocyanate diversification. The introduction of new compounds may lead to unforeseen ecological effects, requiring thorough toxicological and environmental fate studies. There is also a risk of increased resource consumption if diversification efforts result in more complex or energy-intensive production processes.

The end-of-life management of products containing diverse isocyanates presents both challenges and opportunities. While some new formulations may facilitate easier recycling or disposal, others might complicate existing waste management systems. It is essential to consider the entire lifecycle of these materials to ensure that environmental benefits are realized at all stages.

Regulatory compliance and environmental standards play a significant role in shaping the environmental impact of isocyanate diversification. Stricter regulations may drive innovation towards more sustainable options, but they can also increase the complexity and cost of product development and manufacturing processes.

In conclusion, the environmental impact of isocyanate diversification is multifaceted, offering potential benefits in terms of reduced fossil fuel dependence and improved biodegradability, while also presenting challenges in terms of unknown ecological effects and waste management. A comprehensive approach considering the entire lifecycle of these materials is essential to maximize the positive environmental outcomes of diversification efforts.

One of the primary environmental benefits of isocyanate diversification is the potential reduction in the use of fossil fuel-based raw materials. By exploring alternative sources, such as bio-based isocyanates derived from renewable resources, the industry can decrease its reliance on petrochemicals. This shift can lead to a significant reduction in greenhouse gas emissions associated with the production and use of isocyanates.

Diversification also opens up opportunities for developing more environmentally friendly production processes. Novel synthesis routes and catalysts can potentially reduce energy consumption and minimize waste generation during isocyanate manufacturing. Additionally, the exploration of water-based systems and solvent-free technologies can further decrease the environmental footprint of isocyanate-based products.

The development of isocyanates with improved biodegradability is another promising avenue for environmental improvement. Traditional isocyanates often persist in the environment, posing risks to ecosystems. By designing molecules that break down more readily under natural conditions, the long-term environmental impact of these compounds can be significantly reduced.

However, it is crucial to consider potential negative environmental consequences of isocyanate diversification. The introduction of new compounds may lead to unforeseen ecological effects, requiring thorough toxicological and environmental fate studies. There is also a risk of increased resource consumption if diversification efforts result in more complex or energy-intensive production processes.

The end-of-life management of products containing diverse isocyanates presents both challenges and opportunities. While some new formulations may facilitate easier recycling or disposal, others might complicate existing waste management systems. It is essential to consider the entire lifecycle of these materials to ensure that environmental benefits are realized at all stages.

Regulatory compliance and environmental standards play a significant role in shaping the environmental impact of isocyanate diversification. Stricter regulations may drive innovation towards more sustainable options, but they can also increase the complexity and cost of product development and manufacturing processes.

In conclusion, the environmental impact of isocyanate diversification is multifaceted, offering potential benefits in terms of reduced fossil fuel dependence and improved biodegradability, while also presenting challenges in terms of unknown ecological effects and waste management. A comprehensive approach considering the entire lifecycle of these materials is essential to maximize the positive environmental outcomes of diversification efforts.

Safety Regulations

The safety regulations surrounding isocyanates are crucial for ensuring the long-term viability and responsible use of these versatile chemicals. As the diversification of isocyanates continues to expand their applications across various industries, regulatory bodies have implemented stringent guidelines to protect workers, consumers, and the environment.

In the United States, the Occupational Safety and Health Administration (OSHA) has established permissible exposure limits (PELs) for different types of isocyanates. These limits are typically set at very low levels, often in the parts per billion range, reflecting the potent nature of these compounds. OSHA also mandates comprehensive hazard communication programs, including proper labeling, safety data sheets, and employee training on the risks associated with isocyanate exposure.

The Environmental Protection Agency (EPA) regulates isocyanates under the Toxic Substances Control Act (TSCA), which requires manufacturers to report new uses of these chemicals and conduct safety testing. Additionally, the EPA has implemented the Significant New Use Rule (SNUR) for certain isocyanates, requiring notification before they can be used in consumer products.

In the European Union, the Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulation governs the use of isocyanates. REACH requires companies to register chemical substances and provide safety information, including exposure scenarios and risk management measures. The EU has also introduced specific restrictions on diisocyanates, mandating training for industrial and professional users to prevent respiratory and dermal sensitization.

Global harmonization efforts, such as the Globally Harmonized System of Classification and Labelling of Chemicals (GHS), have further standardized the communication of isocyanate hazards across borders. This system ensures consistent hazard classification and labeling, facilitating international trade while maintaining safety standards.

As isocyanate diversification progresses, regulatory bodies are likely to adapt their approaches. There is an increasing focus on alternatives assessment, encouraging the development and use of safer substitutes where possible. This trend is evident in initiatives like the EPA's Safer Choice program, which promotes the use of chemicals that meet stringent human health and environmental criteria.

The future of isocyanate regulation may see a shift towards more performance-based standards, allowing for innovation while maintaining strict safety outcomes. This could involve the integration of new technologies for exposure monitoring and control, such as real-time sensors and advanced personal protective equipment.

Compliance with these evolving regulations presents both challenges and opportunities for industries utilizing isocyanates. While adherence to safety standards may require significant investments in equipment, training, and processes, it also drives innovation in safer chemical formulations and application methods. This regulatory landscape ultimately shapes the trajectory of isocyanate diversification, ensuring that long-term benefits are realized without compromising safety and environmental stewardship.

In the United States, the Occupational Safety and Health Administration (OSHA) has established permissible exposure limits (PELs) for different types of isocyanates. These limits are typically set at very low levels, often in the parts per billion range, reflecting the potent nature of these compounds. OSHA also mandates comprehensive hazard communication programs, including proper labeling, safety data sheets, and employee training on the risks associated with isocyanate exposure.

The Environmental Protection Agency (EPA) regulates isocyanates under the Toxic Substances Control Act (TSCA), which requires manufacturers to report new uses of these chemicals and conduct safety testing. Additionally, the EPA has implemented the Significant New Use Rule (SNUR) for certain isocyanates, requiring notification before they can be used in consumer products.

In the European Union, the Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulation governs the use of isocyanates. REACH requires companies to register chemical substances and provide safety information, including exposure scenarios and risk management measures. The EU has also introduced specific restrictions on diisocyanates, mandating training for industrial and professional users to prevent respiratory and dermal sensitization.

Global harmonization efforts, such as the Globally Harmonized System of Classification and Labelling of Chemicals (GHS), have further standardized the communication of isocyanate hazards across borders. This system ensures consistent hazard classification and labeling, facilitating international trade while maintaining safety standards.

As isocyanate diversification progresses, regulatory bodies are likely to adapt their approaches. There is an increasing focus on alternatives assessment, encouraging the development and use of safer substitutes where possible. This trend is evident in initiatives like the EPA's Safer Choice program, which promotes the use of chemicals that meet stringent human health and environmental criteria.

The future of isocyanate regulation may see a shift towards more performance-based standards, allowing for innovation while maintaining strict safety outcomes. This could involve the integration of new technologies for exposure monitoring and control, such as real-time sensors and advanced personal protective equipment.

Compliance with these evolving regulations presents both challenges and opportunities for industries utilizing isocyanates. While adherence to safety standards may require significant investments in equipment, training, and processes, it also drives innovation in safer chemical formulations and application methods. This regulatory landscape ultimately shapes the trajectory of isocyanate diversification, ensuring that long-term benefits are realized without compromising safety and environmental stewardship.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!