Carbide For Mining Tools: Impact Resistance And Abrasion Tests

AUG 22, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Carbide Mining Tools Evolution and Objectives

Carbide tools for mining applications have undergone significant evolution since their introduction in the early 20th century. Initially, steel tools dominated the mining industry until the 1920s when tungsten carbide was first developed and applied to cutting tools. This revolutionary material, composed of tungsten carbide particles embedded in a cobalt matrix, offered unprecedented hardness and wear resistance compared to traditional steel implements.

The 1950s marked a significant advancement with the introduction of cemented carbides specifically engineered for mining applications, featuring optimized cobalt binder percentages and grain sizes tailored to withstand the harsh conditions encountered in mining operations. By the 1970s, manufacturers began incorporating gradient structures and specialized coatings to enhance impact resistance while maintaining superior abrasion resistance.

The 1990s witnessed the emergence of nano-structured carbides and multi-carbide composites, which further improved the balance between toughness and wear resistance. These innovations addressed the persistent challenge of brittle fracture under high-impact conditions while maintaining cutting efficiency in abrasive environments.

Current technological objectives in carbide mining tools development focus on several key areas. Primary among these is enhancing impact resistance without compromising abrasion resistance – a critical balance for tools subjected to both crushing forces and continuous abrasive wear. Researchers aim to develop carbide compositions that can withstand impact forces exceeding 300 joules while maintaining wear rates below 0.1 mg/km under standardized testing conditions.

Another significant objective is the development of sustainable manufacturing processes that reduce cobalt dependency, given its classification as a critical raw material with supply chain vulnerabilities. Alternative binder systems incorporating nickel, iron, and chromium alloys are being investigated to maintain performance while reducing reliance on cobalt.

Extending tool lifespan represents another crucial goal, with industry targets set at increasing operational life by 30-50% compared to current standards. This objective is driven by the substantial economic impact of downtime in mining operations, where tool replacement can cost thousands of dollars in lost productivity.

The integration of sensor technologies for real-time monitoring of tool wear and performance optimization has emerged as a forward-looking objective, aligning with broader Industry 4.0 trends. These smart carbide tools aim to predict failure before it occurs, optimizing replacement schedules and minimizing unexpected downtime in critical mining operations.

The 1950s marked a significant advancement with the introduction of cemented carbides specifically engineered for mining applications, featuring optimized cobalt binder percentages and grain sizes tailored to withstand the harsh conditions encountered in mining operations. By the 1970s, manufacturers began incorporating gradient structures and specialized coatings to enhance impact resistance while maintaining superior abrasion resistance.

The 1990s witnessed the emergence of nano-structured carbides and multi-carbide composites, which further improved the balance between toughness and wear resistance. These innovations addressed the persistent challenge of brittle fracture under high-impact conditions while maintaining cutting efficiency in abrasive environments.

Current technological objectives in carbide mining tools development focus on several key areas. Primary among these is enhancing impact resistance without compromising abrasion resistance – a critical balance for tools subjected to both crushing forces and continuous abrasive wear. Researchers aim to develop carbide compositions that can withstand impact forces exceeding 300 joules while maintaining wear rates below 0.1 mg/km under standardized testing conditions.

Another significant objective is the development of sustainable manufacturing processes that reduce cobalt dependency, given its classification as a critical raw material with supply chain vulnerabilities. Alternative binder systems incorporating nickel, iron, and chromium alloys are being investigated to maintain performance while reducing reliance on cobalt.

Extending tool lifespan represents another crucial goal, with industry targets set at increasing operational life by 30-50% compared to current standards. This objective is driven by the substantial economic impact of downtime in mining operations, where tool replacement can cost thousands of dollars in lost productivity.

The integration of sensor technologies for real-time monitoring of tool wear and performance optimization has emerged as a forward-looking objective, aligning with broader Industry 4.0 trends. These smart carbide tools aim to predict failure before it occurs, optimizing replacement schedules and minimizing unexpected downtime in critical mining operations.

Market Demand Analysis for High-Performance Mining Tools

The global mining industry continues to demonstrate robust demand for high-performance tools, particularly those incorporating carbide technologies. Market research indicates that the mining equipment market is projected to reach $125 billion by 2025, with specialized cutting and drilling tools representing approximately 18% of this value. This growth is primarily driven by increasing mineral extraction activities in emerging economies and the need for more efficient operations in established mining regions.

Performance requirements for mining tools have evolved significantly, with durability under extreme conditions becoming a paramount concern for operators. Industry surveys reveal that tool failure and replacement costs account for up to 30% of operational expenses in hard rock mining operations. Consequently, mining companies are increasingly willing to invest in premium tools that demonstrate superior impact resistance and abrasion performance, even at higher initial acquisition costs.

The market segmentation shows distinct demand patterns across different mining sectors. Underground mining operations prioritize impact resistance due to the confined working environments and intermittent contact with heterogeneous rock formations. In contrast, surface mining and quarrying operations place greater emphasis on continuous abrasion resistance. This bifurcation has created specialized market niches for tool manufacturers who can demonstrate performance advantages in either category.

Geographic demand analysis reveals particularly strong growth in regions with challenging geological conditions. Australia's hard rock mining sector, South Africa's deep mining operations, and Canada's remote mining sites represent premium markets where tool performance directly impacts operational viability. These regions show willingness to pay 40-60% price premiums for tools that can demonstrate measurable improvements in operational lifespan.

Recent industry trends indicate increasing customer sophistication regarding performance metrics. Mining companies are now routinely conducting their own comparative testing of tools from different suppliers, with standardized impact resistance and abrasion tests becoming key purchasing criteria. This shift has accelerated demand for tools with verifiable performance data rather than relying solely on manufacturer claims.

The aftermarket and service segment also presents significant opportunities, with an estimated annual value of $3.2 billion for replacement parts and reconditioning services. Mining operations increasingly seek suppliers who can provide comprehensive lifecycle support, including on-site performance monitoring and failure analysis services to optimize tool selection and application.

Performance requirements for mining tools have evolved significantly, with durability under extreme conditions becoming a paramount concern for operators. Industry surveys reveal that tool failure and replacement costs account for up to 30% of operational expenses in hard rock mining operations. Consequently, mining companies are increasingly willing to invest in premium tools that demonstrate superior impact resistance and abrasion performance, even at higher initial acquisition costs.

The market segmentation shows distinct demand patterns across different mining sectors. Underground mining operations prioritize impact resistance due to the confined working environments and intermittent contact with heterogeneous rock formations. In contrast, surface mining and quarrying operations place greater emphasis on continuous abrasion resistance. This bifurcation has created specialized market niches for tool manufacturers who can demonstrate performance advantages in either category.

Geographic demand analysis reveals particularly strong growth in regions with challenging geological conditions. Australia's hard rock mining sector, South Africa's deep mining operations, and Canada's remote mining sites represent premium markets where tool performance directly impacts operational viability. These regions show willingness to pay 40-60% price premiums for tools that can demonstrate measurable improvements in operational lifespan.

Recent industry trends indicate increasing customer sophistication regarding performance metrics. Mining companies are now routinely conducting their own comparative testing of tools from different suppliers, with standardized impact resistance and abrasion tests becoming key purchasing criteria. This shift has accelerated demand for tools with verifiable performance data rather than relying solely on manufacturer claims.

The aftermarket and service segment also presents significant opportunities, with an estimated annual value of $3.2 billion for replacement parts and reconditioning services. Mining operations increasingly seek suppliers who can provide comprehensive lifecycle support, including on-site performance monitoring and failure analysis services to optimize tool selection and application.

Current Carbide Technology Challenges in Mining Applications

Despite significant advancements in carbide technology for mining tools, several critical challenges persist that limit performance in extreme mining environments. The primary challenge remains achieving optimal balance between impact resistance and wear resistance. Current tungsten carbide grades that excel in abrasion resistance typically demonstrate insufficient toughness to withstand repeated impact loading, leading to premature tool failure through fracturing and chipping.

Material homogeneity presents another significant obstacle. Conventional powder metallurgy processes used in carbide manufacturing often result in microstructural inconsistencies, including cobalt pooling, carbide grain size variations, and porosity. These defects create stress concentration points that become failure initiation sites during high-impact mining operations, particularly in hard rock applications.

Thermal stability issues continue to plague carbide mining tools, especially in deep mining operations where temperatures can exceed 200°C. At elevated temperatures, many carbide compositions experience accelerated cobalt binder degradation, leading to reduced mechanical properties and premature tool failure. Current thermal stabilization techniques add significant manufacturing costs without fully resolving the problem.

Corrosion resistance remains inadequate in mining environments containing sulfides, chlorides, and acidic groundwater. The cobalt binder phase in conventional carbides is particularly susceptible to chemical attack, creating a progressive weakening mechanism that compounds with mechanical wear. While corrosion-resistant grades exist, they typically sacrifice either hardness or toughness to achieve chemical stability.

Manufacturing limitations constrain geometric optimization of carbide inserts. Complex cooling channels, variable thickness sections, and intricate edge geometries—all potentially beneficial for mining tool performance—remain difficult to produce consistently using traditional sintering methods. Advanced manufacturing techniques like additive manufacturing show promise but face challenges in achieving full density and maintaining precise carbide-to-binder ratios.

Cost considerations further complicate technology advancement. The mining industry's price sensitivity creates resistance to implementing premium carbide grades containing expensive elements like ruthenium, rhenium or chromium, despite their superior performance characteristics. This economic constraint slows the adoption of next-generation carbide technologies that could otherwise address current performance limitations.

Testing standardization represents another significant challenge. Current industry test methods often fail to accurately simulate the complex combination of impact, abrasion, and environmental factors present in actual mining operations, making it difficult to predict in-field performance from laboratory results.

Material homogeneity presents another significant obstacle. Conventional powder metallurgy processes used in carbide manufacturing often result in microstructural inconsistencies, including cobalt pooling, carbide grain size variations, and porosity. These defects create stress concentration points that become failure initiation sites during high-impact mining operations, particularly in hard rock applications.

Thermal stability issues continue to plague carbide mining tools, especially in deep mining operations where temperatures can exceed 200°C. At elevated temperatures, many carbide compositions experience accelerated cobalt binder degradation, leading to reduced mechanical properties and premature tool failure. Current thermal stabilization techniques add significant manufacturing costs without fully resolving the problem.

Corrosion resistance remains inadequate in mining environments containing sulfides, chlorides, and acidic groundwater. The cobalt binder phase in conventional carbides is particularly susceptible to chemical attack, creating a progressive weakening mechanism that compounds with mechanical wear. While corrosion-resistant grades exist, they typically sacrifice either hardness or toughness to achieve chemical stability.

Manufacturing limitations constrain geometric optimization of carbide inserts. Complex cooling channels, variable thickness sections, and intricate edge geometries—all potentially beneficial for mining tool performance—remain difficult to produce consistently using traditional sintering methods. Advanced manufacturing techniques like additive manufacturing show promise but face challenges in achieving full density and maintaining precise carbide-to-binder ratios.

Cost considerations further complicate technology advancement. The mining industry's price sensitivity creates resistance to implementing premium carbide grades containing expensive elements like ruthenium, rhenium or chromium, despite their superior performance characteristics. This economic constraint slows the adoption of next-generation carbide technologies that could otherwise address current performance limitations.

Testing standardization represents another significant challenge. Current industry test methods often fail to accurately simulate the complex combination of impact, abrasion, and environmental factors present in actual mining operations, making it difficult to predict in-field performance from laboratory results.

Current Testing Methodologies for Impact and Abrasion Resistance

01 Tungsten carbide compositions for improved impact resistance

Tungsten carbide-based materials can be formulated with specific binder compositions to enhance impact resistance while maintaining abrasion resistance. These compositions typically include cobalt or nickel binders in optimized proportions. The grain size and distribution of carbide particles significantly affect the balance between toughness and wear resistance. Fine-grained structures generally provide better impact resistance while maintaining adequate hardness for abrasion applications.- Tungsten carbide composites for enhanced impact and abrasion resistance: Tungsten carbide composites are widely used in applications requiring high impact and abrasion resistance. These composites typically consist of tungsten carbide particles embedded in a metal matrix, such as cobalt or nickel. The combination of hard carbide particles with a ductile metal binder provides an optimal balance of hardness and toughness, making these materials ideal for cutting tools, mining equipment, and wear-resistant components. The size, distribution, and volume fraction of carbide particles can be tailored to optimize performance for specific applications.

- Ceramic-reinforced carbide materials for extreme wear conditions: Ceramic-reinforced carbide materials incorporate additional ceramic phases such as alumina, silicon carbide, or titanium nitride into traditional carbide compositions to further enhance wear resistance under extreme conditions. These multi-phase materials exhibit superior performance in high-temperature, high-stress environments where conventional carbides might fail. The ceramic reinforcements help to prevent crack propagation and improve thermal stability, while maintaining the base carbide's excellent hardness and wear resistance. These advanced materials find applications in metal cutting, rock drilling, and other severe service environments.

- Surface treatment and coating technologies for carbide components: Various surface treatment and coating technologies can significantly improve the impact and abrasion resistance of carbide components. Techniques such as physical vapor deposition (PVD), chemical vapor deposition (CVD), and thermal spraying allow the application of ultra-hard coatings like diamond-like carbon, titanium nitride, or chromium carbide onto carbide substrates. These coatings provide an additional wear-resistant layer while the carbide substrate maintains structural integrity. Surface treatments may also include shot peening or laser surface modification to induce compressive stresses that enhance impact resistance.

- Nanostructured carbide materials with improved mechanical properties: Nanostructured carbide materials feature grain sizes in the nanometer range, which leads to significantly improved mechanical properties compared to conventional carbides. The reduced grain size enhances hardness, toughness, and wear resistance simultaneously - a combination difficult to achieve with traditional microstructured materials. These nanostructured carbides can be produced through various methods including mechanical alloying, spark plasma sintering, or controlled precipitation. The fine-grained structure provides more grain boundaries that impede crack propagation, resulting in superior impact resistance while maintaining excellent abrasion resistance.

- Polymer-carbide composites for specialized applications: Polymer-carbide composites combine the hardness and wear resistance of carbide particles with the flexibility, lightweight nature, and processing advantages of polymer matrices. These composites can be tailored for specific applications by adjusting the carbide content, particle size distribution, and polymer type. The polymer matrix provides impact absorption and crack resistance, while the carbide particles deliver abrasion resistance. These materials are particularly useful in applications where weight reduction is important or where complex shapes are required. Common applications include protective coatings, industrial components subject to sliding wear, and specialized tooling.

02 Ceramic-carbide composite materials for wear applications

Composite materials combining ceramic matrices with carbide reinforcements offer enhanced abrasion and impact resistance. These materials utilize the hardness of ceramics with the toughness of carbide particles to create wear-resistant surfaces. The interface between the ceramic matrix and carbide particles is engineered to optimize stress transfer and crack deflection mechanisms. These composites are particularly effective in high-temperature applications where traditional materials would fail.Expand Specific Solutions03 Surface treatment and coating technologies for carbide materials

Various surface treatment methods can be applied to carbide materials to enhance their impact and abrasion resistance. These include physical vapor deposition, chemical vapor deposition, and thermal spray techniques that create protective layers on carbide substrates. Multi-layer coating systems can be designed with gradient properties to optimize both impact absorption and wear resistance. Post-treatment processes such as heat treatment or shot peening can further improve the performance of coated carbide materials.Expand Specific Solutions04 Carbide reinforced polymer and metal matrix composites

Incorporating carbide particles into polymer or metal matrices creates composite materials with superior impact and abrasion resistance. The matrix material provides toughness and impact absorption while the carbide particles contribute hardness and wear resistance. The size, shape, and distribution of carbide particles can be tailored to specific application requirements. Chemical bonding between the matrix and carbide particles is critical for optimal performance and durability under impact and abrasive conditions.Expand Specific Solutions05 Novel carbide formulations for extreme wear environments

Advanced carbide formulations have been developed specifically for environments requiring exceptional impact and abrasion resistance. These materials often incorporate multiple carbide types (such as titanium carbide, vanadium carbide, and chromium carbide) in optimized ratios. Nano-structured carbides offer improved performance through refined microstructures that resist crack propagation. Gradient structures with varying carbide compositions throughout the material provide optimized performance zones for different types of wear mechanisms.Expand Specific Solutions

Leading Manufacturers and Competitors in Mining Carbide Industry

The carbide mining tools market is currently in a growth phase, characterized by increasing demand for high-performance tools with superior impact resistance and abrasion properties. The global market size is estimated to exceed $5 billion, driven by expanding mining activities worldwide. Technologically, the sector shows varying maturity levels, with industry leaders like Sandvik and Kennametal demonstrating advanced capabilities through extensive R&D investments. Other significant players including Hyperion Materials & Technologies, Boart Longyear, and Shareate Tools are actively competing through specialized offerings. Chinese manufacturers such as Advanced Technology & Materials and Zhuzhou Changjiang Carbide are rapidly advancing their technical capabilities, challenging traditional Western dominance through cost-effective solutions while progressively improving quality standards.

Kennametal, Inc.

Technical Solution: Kennametal has pioneered the KenCast™ technology for mining tools, featuring a proprietary matrix of tungsten carbide particles (WC) with optimized cobalt binder percentages (ranging from 8-16%) specifically engineered for different mining applications. Their impact resistance testing employs a pendulum impact tester with instrumented data collection that measures both crack initiation energy and propagation resistance at temperatures ranging from -20°C to 200°C to simulate various mining environments. For abrasion testing, Kennametal utilizes a combination of ASTM B611 testing and their proprietary High Stress Gouging Abrasion Test (HSGAT) that simulates the extreme conditions found in dragline bucket teeth and loader edges[2]. Their latest innovation includes nano-grain carbide inserts with grain sizes below 0.5μm that demonstrate up to 40% improvement in impact resistance while maintaining comparable wear resistance to conventional grades[4].

Strengths: Advanced nano-grain technology provides exceptional toughness-to-hardness ratio; comprehensive application-specific grade development with tailored solutions for different mining operations. Weaknesses: Higher manufacturing costs for specialized grades; some advanced materials require more frequent retipping compared to conventional options in certain high-impact applications.

Sandvik Aktiebolag

Technical Solution: Sandvik has developed a comprehensive carbide technology for mining tools featuring their patented Cemented Carbide with optimized cobalt binder content (typically 6-12%) and tungsten carbide grain size distribution (0.5-5μm). Their impact resistance testing methodology employs repeated impact loading at controlled energy levels (up to 500J) to simulate real mining conditions, while their abrasion testing utilizes both ASTM G65 procedure and proprietary rock-on-disc tests that better replicate actual mining environments. Sandvik's PowerCarbide™ grades specifically balance toughness and wear resistance through gradient structures where the carbide composition transitions from a tough core to a wear-resistant surface[1]. Their testing protocols incorporate digital image analysis to quantify crack propagation patterns and wear mechanisms, enabling precise material optimization for specific mining applications ranging from coal to hard rock excavation[3].

Strengths: Industry-leading gradient carbide technology provides superior crack resistance while maintaining wear performance; comprehensive testing protocols that accurately simulate real mining conditions. Weaknesses: Premium pricing structure compared to competitors; some specialized grades require complex manufacturing processes that limit production capacity for certain tool types.

Key Technical Innovations in Carbide Composition and Structure

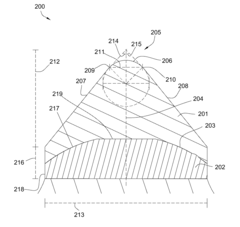

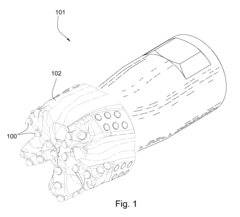

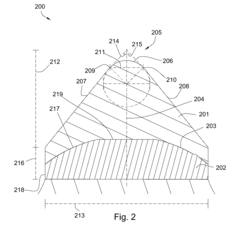

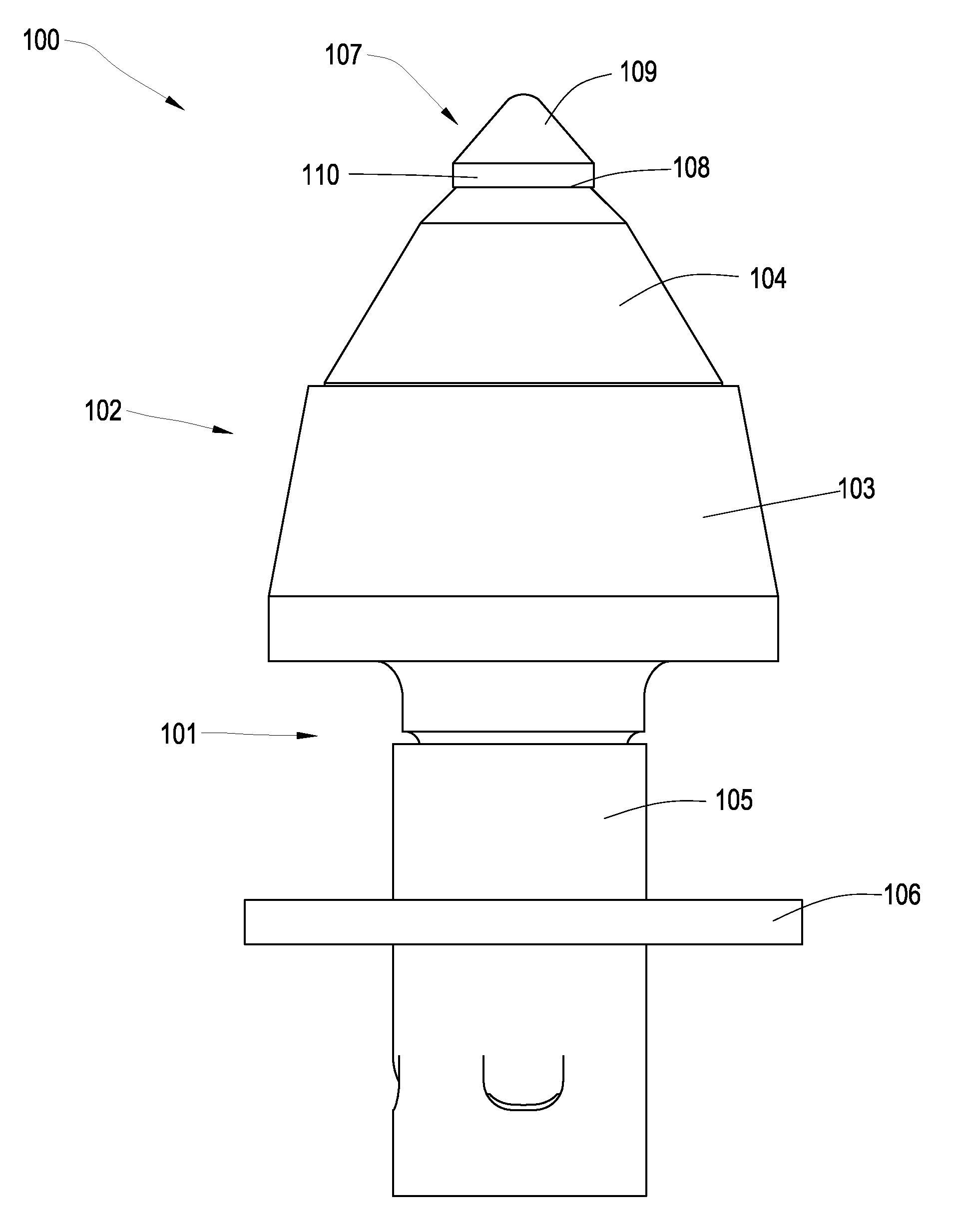

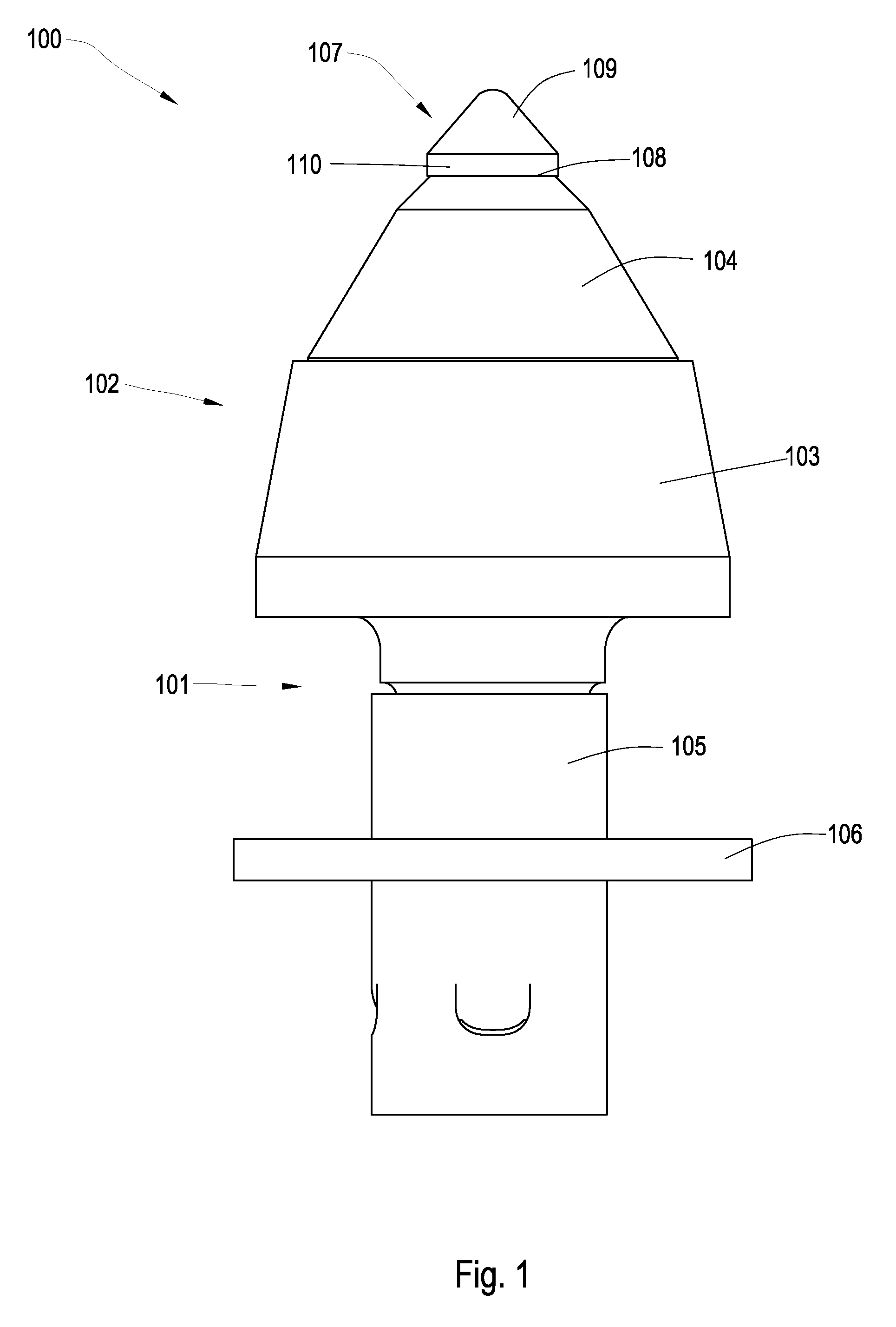

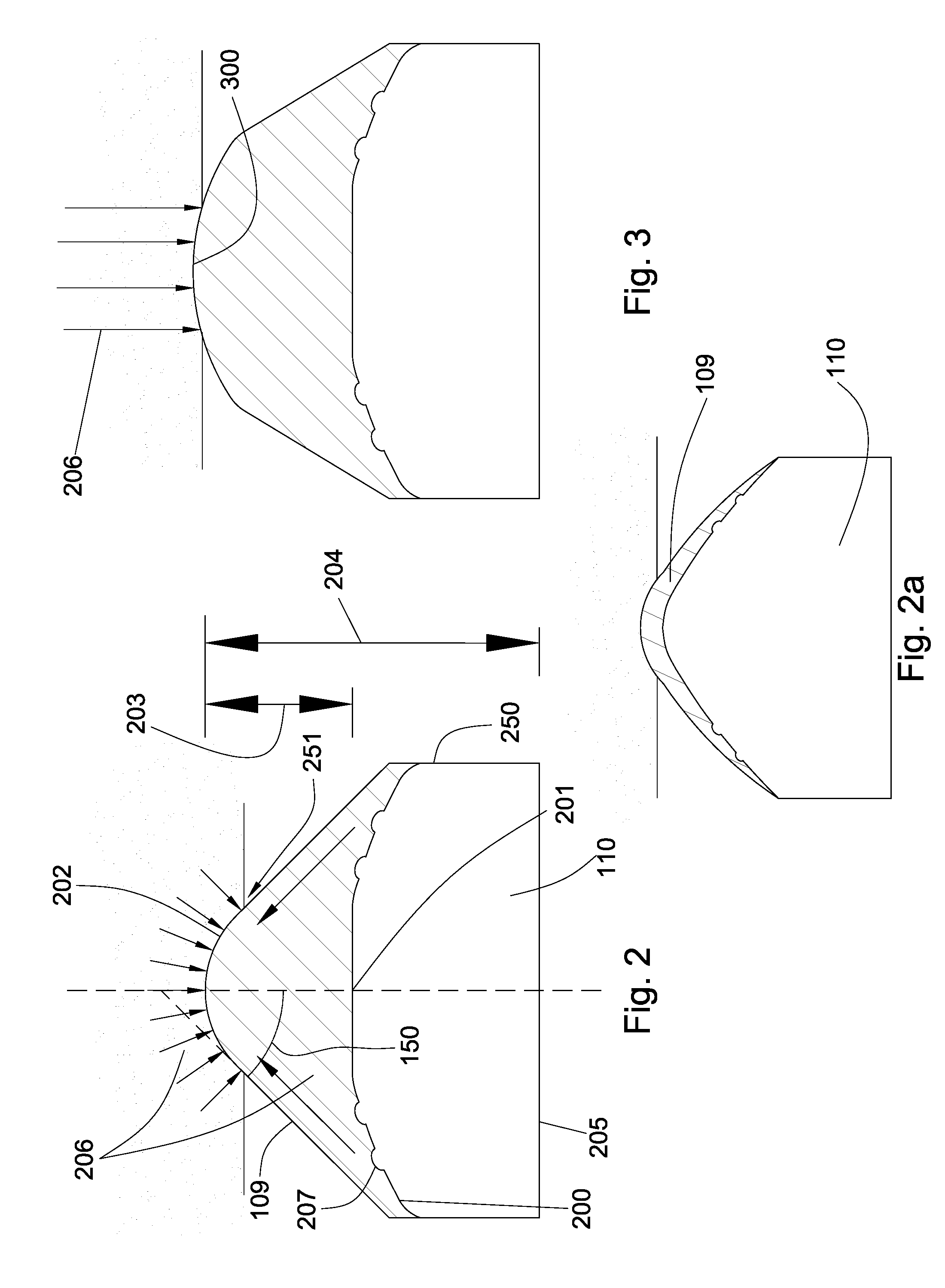

High Impact Resistant Tool with an Apex Width between a First and Second Transitions

PatentActiveUS20100263939A1

Innovation

- A high-impact resistant tool is developed by bonding a sintered polycrystalline diamond body with a curved surface to a cemented metal carbide substrate, featuring a pointed geometry with a narrow apex and varying curvature, which provides enhanced bonding strength and improved wear characteristics.

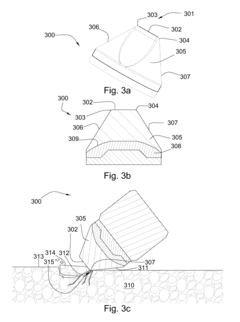

Thick Pointed Superhard Material

PatentActiveUS20090051211A1

Innovation

- A high impact resistant tool with a superhard material bonded to a cemented metal carbide substrate at a non-planar interface, featuring a tapered surface with a sharp apex and varying thickness, designed to distribute impact forces and prevent chipping, incorporating nodules, grooves, or dimples for enhanced bonding.

Safety Standards and Compliance for Mining Tool Materials

The mining industry operates under stringent safety regulations that directly impact the selection and testing of carbide materials for mining tools. International standards such as ISO 13043 and ASTM F2413 establish baseline requirements for impact resistance and abrasion testing of mining tool materials. These standards ensure that carbide components can withstand the extreme conditions encountered in mining operations while minimizing risks to workers.

Regulatory bodies including the Mine Safety and Health Administration (MSHA) in the United States and similar organizations worldwide mandate compliance with specific material performance criteria. For carbide mining tools, these regulations typically require documented evidence of impact resistance testing at temperatures ranging from -40°C to +60°C to account for varied mining environments. Additionally, abrasion resistance must meet minimum thresholds established through standardized testing protocols such as ASTM G65 or equivalent methods.

Material certification processes represent a critical component of compliance frameworks. Manufacturers must obtain and maintain proper documentation verifying that carbide compositions meet safety standards before implementation in mining operations. This certification typically includes chemical composition analysis, mechanical property verification, and performance testing results that demonstrate conformity with applicable standards.

Risk assessment protocols specifically addressing material failure modes have become increasingly important in regulatory frameworks. Modern safety standards require manufacturers to conduct and document comprehensive failure mode and effects analyses (FMEA) for carbide components, with particular emphasis on catastrophic failure scenarios that could endanger mining personnel.

Environmental considerations have also been integrated into safety compliance requirements for mining tool materials. Regulations increasingly address the potential for harmful dust generation during carbide tool wear, requiring manufacturers to demonstrate that their materials minimize respirable crystalline silica and other hazardous particulates during normal operation and breakage events.

Testing certification requirements have evolved to include third-party verification of impact and abrasion test results. Independent laboratories must now validate manufacturer claims regarding carbide performance, creating a more robust compliance ecosystem. These certification processes typically involve standardized testing methodologies that simulate real-world mining conditions, including cyclic impact loading and accelerated wear testing in the presence of abrasive minerals common to mining operations.

Recent regulatory trends indicate movement toward harmonized global standards for mining tool materials, with particular emphasis on improving traceability throughout the supply chain. This development aims to ensure that all carbide components used in mining operations can be traced to properly certified manufacturing processes that comply with relevant safety standards.

Regulatory bodies including the Mine Safety and Health Administration (MSHA) in the United States and similar organizations worldwide mandate compliance with specific material performance criteria. For carbide mining tools, these regulations typically require documented evidence of impact resistance testing at temperatures ranging from -40°C to +60°C to account for varied mining environments. Additionally, abrasion resistance must meet minimum thresholds established through standardized testing protocols such as ASTM G65 or equivalent methods.

Material certification processes represent a critical component of compliance frameworks. Manufacturers must obtain and maintain proper documentation verifying that carbide compositions meet safety standards before implementation in mining operations. This certification typically includes chemical composition analysis, mechanical property verification, and performance testing results that demonstrate conformity with applicable standards.

Risk assessment protocols specifically addressing material failure modes have become increasingly important in regulatory frameworks. Modern safety standards require manufacturers to conduct and document comprehensive failure mode and effects analyses (FMEA) for carbide components, with particular emphasis on catastrophic failure scenarios that could endanger mining personnel.

Environmental considerations have also been integrated into safety compliance requirements for mining tool materials. Regulations increasingly address the potential for harmful dust generation during carbide tool wear, requiring manufacturers to demonstrate that their materials minimize respirable crystalline silica and other hazardous particulates during normal operation and breakage events.

Testing certification requirements have evolved to include third-party verification of impact and abrasion test results. Independent laboratories must now validate manufacturer claims regarding carbide performance, creating a more robust compliance ecosystem. These certification processes typically involve standardized testing methodologies that simulate real-world mining conditions, including cyclic impact loading and accelerated wear testing in the presence of abrasive minerals common to mining operations.

Recent regulatory trends indicate movement toward harmonized global standards for mining tool materials, with particular emphasis on improving traceability throughout the supply chain. This development aims to ensure that all carbide components used in mining operations can be traced to properly certified manufacturing processes that comply with relevant safety standards.

Environmental Impact of Carbide Manufacturing and Usage

The manufacturing and usage of carbide materials for mining tools present significant environmental challenges that warrant careful consideration. The production process of tungsten carbide, the primary material used in mining tools, involves extensive mining operations for raw tungsten ore, which contributes to habitat destruction, soil erosion, and potential water contamination. These extraction activities often occur in ecologically sensitive areas, causing long-term environmental degradation that extends beyond the immediate mining sites.

Chemical processing during carbide manufacturing introduces additional environmental concerns. The conversion of tungsten ore to tungsten carbide requires substantial energy inputs and generates hazardous waste byproducts, including heavy metals and toxic chemicals. These substances can persist in the environment, potentially contaminating soil and groundwater if not properly managed. Furthermore, the carbon footprint associated with the high-temperature processes required for carbide production contributes significantly to greenhouse gas emissions.

The cobalt binder commonly used in tungsten carbide composites presents particular environmental challenges. Cobalt mining is associated with severe environmental degradation, especially in regions like the Democratic Republic of Congo, where regulatory oversight may be limited. The extraction and processing of cobalt release pollutants that can contaminate local water sources and agricultural lands, affecting both ecosystem health and human communities dependent on these resources.

During the operational phase, carbide mining tools generate fine dust particles that contain tungsten, cobalt, and other potentially harmful elements. Without proper containment measures, these particles can become airborne or wash into water systems, creating long-term environmental and health hazards. The impact resistance and abrasion tests themselves may contribute to environmental contamination if testing debris and worn materials are not properly collected and disposed of.

End-of-life management presents another significant environmental challenge. Recycling rates for tungsten carbide remain suboptimal, with many used tools ending up in landfills. The durability that makes carbide valuable for mining applications also means these materials persist in the environment for extended periods. Innovative recycling technologies are emerging but have not yet been widely implemented across the industry, resulting in continued resource depletion and waste accumulation.

Recent regulatory developments have begun addressing these environmental impacts. Several jurisdictions have implemented stricter standards for carbide manufacturing emissions and waste management. Additionally, certification schemes are emerging to promote environmentally responsible sourcing of tungsten and cobalt, though compliance remains voluntary in many regions. These regulatory frameworks will likely continue to evolve as environmental impacts become better understood and quantified.

Chemical processing during carbide manufacturing introduces additional environmental concerns. The conversion of tungsten ore to tungsten carbide requires substantial energy inputs and generates hazardous waste byproducts, including heavy metals and toxic chemicals. These substances can persist in the environment, potentially contaminating soil and groundwater if not properly managed. Furthermore, the carbon footprint associated with the high-temperature processes required for carbide production contributes significantly to greenhouse gas emissions.

The cobalt binder commonly used in tungsten carbide composites presents particular environmental challenges. Cobalt mining is associated with severe environmental degradation, especially in regions like the Democratic Republic of Congo, where regulatory oversight may be limited. The extraction and processing of cobalt release pollutants that can contaminate local water sources and agricultural lands, affecting both ecosystem health and human communities dependent on these resources.

During the operational phase, carbide mining tools generate fine dust particles that contain tungsten, cobalt, and other potentially harmful elements. Without proper containment measures, these particles can become airborne or wash into water systems, creating long-term environmental and health hazards. The impact resistance and abrasion tests themselves may contribute to environmental contamination if testing debris and worn materials are not properly collected and disposed of.

End-of-life management presents another significant environmental challenge. Recycling rates for tungsten carbide remain suboptimal, with many used tools ending up in landfills. The durability that makes carbide valuable for mining applications also means these materials persist in the environment for extended periods. Innovative recycling technologies are emerging but have not yet been widely implemented across the industry, resulting in continued resource depletion and waste accumulation.

Recent regulatory developments have begun addressing these environmental impacts. Several jurisdictions have implemented stricter standards for carbide manufacturing emissions and waste management. Additionally, certification schemes are emerging to promote environmentally responsible sourcing of tungsten and cobalt, though compliance remains voluntary in many regions. These regulatory frameworks will likely continue to evolve as environmental impacts become better understood and quantified.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!