Tungsten Carbide Versus High-Speed Steel: Wear, Cost, And Productivity

AUG 22, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Cutting Tool Materials Evolution and Objectives

The evolution of cutting tool materials represents a critical progression in manufacturing technology, with significant advancements occurring from the early 20th century to present day. Initially, carbon steel tools dominated manufacturing until the 1900s, when high-speed steel (HSS) emerged as a revolutionary material capable of maintaining hardness at elevated temperatures, enabling faster cutting speeds and transforming production capabilities.

The mid-20th century witnessed the introduction of tungsten carbide, marking a paradigm shift in cutting tool performance. This cemented carbide offered substantially higher hardness, wear resistance, and thermal stability compared to HSS, allowing for significantly increased cutting speeds and productivity in machining operations. The subsequent development of coated carbides in the 1970s further enhanced tool life and performance through the application of titanium nitride (TiN), titanium carbonitride (TiCN), and aluminum oxide (Al₂O₃) coatings.

Recent decades have seen the emergence of advanced materials including ceramic tools, cubic boron nitride (CBN), and polycrystalline diamond (PCD), each offering specialized performance characteristics for specific applications. These ultra-hard materials have pushed the boundaries of machining capabilities, particularly in processing difficult-to-machine materials like hardened steels, superalloys, and composites.

The primary objectives driving cutting tool material evolution center on enhancing three critical performance metrics: wear resistance, cost-effectiveness, and productivity. Wear resistance directly impacts tool life, with tungsten carbide demonstrating superior durability compared to HSS in most applications, though at higher initial cost. This cost-benefit analysis forms a central consideration in material selection decisions across manufacturing industries.

Productivity improvements remain a fundamental goal, with modern carbide tools enabling cutting speeds 3-5 times faster than HSS counterparts. This translates to significant reductions in machining time and increased throughput in production environments. Additionally, the pursuit of enhanced thermal stability continues to drive innovation, as heat generation during cutting operations represents a primary factor in tool degradation.

The ongoing evolution of cutting tool materials aims to address emerging challenges in sustainable manufacturing, including the machining of advanced materials, reduction of coolant usage, and minimization of energy consumption. Future developments will likely focus on nano-structured coatings, hybrid materials, and tailored solutions that optimize the balance between wear resistance, cost, and productivity for specific machining applications.

The mid-20th century witnessed the introduction of tungsten carbide, marking a paradigm shift in cutting tool performance. This cemented carbide offered substantially higher hardness, wear resistance, and thermal stability compared to HSS, allowing for significantly increased cutting speeds and productivity in machining operations. The subsequent development of coated carbides in the 1970s further enhanced tool life and performance through the application of titanium nitride (TiN), titanium carbonitride (TiCN), and aluminum oxide (Al₂O₃) coatings.

Recent decades have seen the emergence of advanced materials including ceramic tools, cubic boron nitride (CBN), and polycrystalline diamond (PCD), each offering specialized performance characteristics for specific applications. These ultra-hard materials have pushed the boundaries of machining capabilities, particularly in processing difficult-to-machine materials like hardened steels, superalloys, and composites.

The primary objectives driving cutting tool material evolution center on enhancing three critical performance metrics: wear resistance, cost-effectiveness, and productivity. Wear resistance directly impacts tool life, with tungsten carbide demonstrating superior durability compared to HSS in most applications, though at higher initial cost. This cost-benefit analysis forms a central consideration in material selection decisions across manufacturing industries.

Productivity improvements remain a fundamental goal, with modern carbide tools enabling cutting speeds 3-5 times faster than HSS counterparts. This translates to significant reductions in machining time and increased throughput in production environments. Additionally, the pursuit of enhanced thermal stability continues to drive innovation, as heat generation during cutting operations represents a primary factor in tool degradation.

The ongoing evolution of cutting tool materials aims to address emerging challenges in sustainable manufacturing, including the machining of advanced materials, reduction of coolant usage, and minimization of energy consumption. Future developments will likely focus on nano-structured coatings, hybrid materials, and tailored solutions that optimize the balance between wear resistance, cost, and productivity for specific machining applications.

Market Demand Analysis for Advanced Cutting Tools

The global market for advanced cutting tools has been experiencing robust growth, driven by the increasing demand for precision machining across various industries. The cutting tools market, valued at approximately 39.5 billion USD in 2022, is projected to reach 52.3 billion USD by 2027, growing at a CAGR of 5.8%. Within this market, the comparison between tungsten carbide and high-speed steel (HSS) tools represents a critical decision point for manufacturers seeking optimal performance and cost-efficiency.

Manufacturing sectors, particularly automotive, aerospace, and general engineering, constitute the primary demand drivers for advanced cutting tools. The automotive industry alone accounts for nearly 30% of the global cutting tool consumption, with increasing requirements for complex component machining and lightweight material processing. Aerospace follows closely at 22%, where the need for high-precision machining of difficult-to-cut materials like titanium alloys and composites continues to grow.

Regional analysis reveals that Asia-Pacific dominates the market with a 45% share, led by China's massive manufacturing base and India's rapidly growing industrial sector. North America and Europe follow with 25% and 20% market shares respectively, where the focus increasingly shifts toward high-performance cutting tools for specialized applications.

The demand for tungsten carbide tools has been growing at a faster rate (7.2% annually) compared to HSS tools (3.5%), reflecting the industry's shift toward harder materials and higher-speed machining processes. This trend is particularly evident in the aerospace and medical device manufacturing sectors, where material hardness and machining precision requirements continue to increase.

End-users are increasingly prioritizing total cost of ownership over initial purchase price, creating market opportunities for premium tungsten carbide tools that offer longer tool life and higher productivity despite higher upfront costs. Market surveys indicate that 68% of manufacturing companies are willing to invest in higher-priced cutting tools if demonstrable productivity gains can be achieved.

The growing adoption of CNC machining and automated production systems is further driving demand for cutting tools with consistent performance and predictable wear patterns. This trend favors tungsten carbide tools, which typically offer more predictable performance characteristics compared to HSS alternatives.

Environmental regulations and sustainability concerns are also influencing market dynamics, with manufacturers seeking cutting tools that minimize coolant usage and energy consumption. This has created a niche market for specialized coatings and tool designs that optimize performance while reducing environmental impact.

Manufacturing sectors, particularly automotive, aerospace, and general engineering, constitute the primary demand drivers for advanced cutting tools. The automotive industry alone accounts for nearly 30% of the global cutting tool consumption, with increasing requirements for complex component machining and lightweight material processing. Aerospace follows closely at 22%, where the need for high-precision machining of difficult-to-cut materials like titanium alloys and composites continues to grow.

Regional analysis reveals that Asia-Pacific dominates the market with a 45% share, led by China's massive manufacturing base and India's rapidly growing industrial sector. North America and Europe follow with 25% and 20% market shares respectively, where the focus increasingly shifts toward high-performance cutting tools for specialized applications.

The demand for tungsten carbide tools has been growing at a faster rate (7.2% annually) compared to HSS tools (3.5%), reflecting the industry's shift toward harder materials and higher-speed machining processes. This trend is particularly evident in the aerospace and medical device manufacturing sectors, where material hardness and machining precision requirements continue to increase.

End-users are increasingly prioritizing total cost of ownership over initial purchase price, creating market opportunities for premium tungsten carbide tools that offer longer tool life and higher productivity despite higher upfront costs. Market surveys indicate that 68% of manufacturing companies are willing to invest in higher-priced cutting tools if demonstrable productivity gains can be achieved.

The growing adoption of CNC machining and automated production systems is further driving demand for cutting tools with consistent performance and predictable wear patterns. This trend favors tungsten carbide tools, which typically offer more predictable performance characteristics compared to HSS alternatives.

Environmental regulations and sustainability concerns are also influencing market dynamics, with manufacturers seeking cutting tools that minimize coolant usage and energy consumption. This has created a niche market for specialized coatings and tool designs that optimize performance while reducing environmental impact.

Current State and Challenges in Tool Material Technology

The global cutting tool materials market is currently dominated by two primary materials: Tungsten Carbide (WC) and High-Speed Steel (HSS). Tungsten carbide tools represent approximately 65% of the market share, while HSS accounts for about 25%, with the remainder divided among ceramic, diamond, and other advanced materials. This distribution reflects the superior performance characteristics of carbide in modern manufacturing environments, though HSS maintains significant relevance in specific applications.

In terms of technological development, tungsten carbide tools have seen substantial advancements in recent years, particularly in coating technologies and microstructure engineering. Multi-layer PVD and CVD coatings have enhanced wear resistance by 30-40% compared to previous generations. Meanwhile, HSS technology has evolved more incrementally, with improvements primarily focused on heat treatment processes and alloying compositions to enhance hardness retention at elevated temperatures.

The primary technical challenges facing both materials center around performance limitations in extreme machining conditions. Tungsten carbide, while offering superior hardness and wear resistance, exhibits brittleness that can lead to catastrophic failure under interrupted cutting or high-impact applications. Current research aims to address this through gradient structures and nano-grain compositions, which have shown promising results in laboratory settings but face scalability issues in mass production.

High-speed steel tools struggle with thermal stability above 600°C, significantly limiting their application in high-speed machining of harder materials. The development of powder metallurgy HSS has partially addressed this limitation, improving hot hardness by approximately 15%, but still falls short of carbide performance in high-temperature applications. The cost-performance balance remains a critical consideration, with tungsten carbide tools typically costing 3-5 times more than comparable HSS tools but offering 5-10 times longer tool life.

Environmental and supply chain challenges have emerged as significant concerns in recent years. Tungsten is classified as a critical raw material with concentrated supply sources, primarily in China (over 80% of global production), creating potential geopolitical vulnerabilities. Additionally, the energy-intensive production processes for both materials face increasing scrutiny under tightening environmental regulations, with carbide production generating approximately 30% higher carbon emissions per unit compared to HSS manufacturing.

Recycling technologies represent another technical challenge, with current recovery rates for tungsten from used carbide tools at approximately 35-40%, while HSS recycling achieves rates of 60-70% due to simpler material composition. Improving these rates is crucial for sustainability and reducing dependency on primary raw material sources.

In terms of technological development, tungsten carbide tools have seen substantial advancements in recent years, particularly in coating technologies and microstructure engineering. Multi-layer PVD and CVD coatings have enhanced wear resistance by 30-40% compared to previous generations. Meanwhile, HSS technology has evolved more incrementally, with improvements primarily focused on heat treatment processes and alloying compositions to enhance hardness retention at elevated temperatures.

The primary technical challenges facing both materials center around performance limitations in extreme machining conditions. Tungsten carbide, while offering superior hardness and wear resistance, exhibits brittleness that can lead to catastrophic failure under interrupted cutting or high-impact applications. Current research aims to address this through gradient structures and nano-grain compositions, which have shown promising results in laboratory settings but face scalability issues in mass production.

High-speed steel tools struggle with thermal stability above 600°C, significantly limiting their application in high-speed machining of harder materials. The development of powder metallurgy HSS has partially addressed this limitation, improving hot hardness by approximately 15%, but still falls short of carbide performance in high-temperature applications. The cost-performance balance remains a critical consideration, with tungsten carbide tools typically costing 3-5 times more than comparable HSS tools but offering 5-10 times longer tool life.

Environmental and supply chain challenges have emerged as significant concerns in recent years. Tungsten is classified as a critical raw material with concentrated supply sources, primarily in China (over 80% of global production), creating potential geopolitical vulnerabilities. Additionally, the energy-intensive production processes for both materials face increasing scrutiny under tightening environmental regulations, with carbide production generating approximately 30% higher carbon emissions per unit compared to HSS manufacturing.

Recycling technologies represent another technical challenge, with current recovery rates for tungsten from used carbide tools at approximately 35-40%, while HSS recycling achieves rates of 60-70% due to simpler material composition. Improving these rates is crucial for sustainability and reducing dependency on primary raw material sources.

Comparative Analysis of WC and HSS Technical Solutions

01 Wear resistance comparison between tungsten carbide and high-speed steel

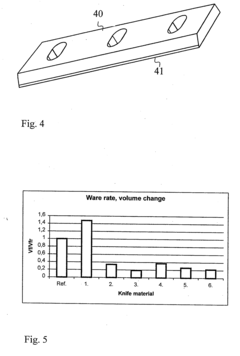

Tungsten carbide generally exhibits superior wear resistance compared to high-speed steel in various applications. This is due to its higher hardness and better resistance to abrasion. The microstructure of tungsten carbide, consisting of hard carbide particles in a metal binder, contributes to its excellent wear properties. In contrast, high-speed steel, while more tough and less brittle, tends to wear faster under similar conditions, especially in high-temperature applications or when cutting hard materials.- Comparative wear resistance of tungsten carbide and high-speed steel: Tungsten carbide generally exhibits superior wear resistance compared to high-speed steel in various applications. This is due to its higher hardness, better thermal stability, and resistance to abrasion. The microstructure of tungsten carbide, consisting of hard carbide particles in a metal binder, contributes to its excellent wear performance even under harsh conditions. High-speed steel, while less wear-resistant, offers good toughness and is suitable for applications where impact resistance is needed alongside moderate wear resistance.

- Cost-effectiveness analysis between tungsten carbide and high-speed steel: While tungsten carbide tools and components typically have a higher initial cost compared to high-speed steel alternatives, they often provide better long-term economic value due to extended service life and reduced replacement frequency. The total cost of ownership analysis shows that tungsten carbide can be more cost-effective in high-wear applications despite the higher upfront investment. High-speed steel remains economically advantageous for less demanding applications or where frequent resharpening is possible and tool breakage risk is high.

- Productivity improvements through material selection: The selection between tungsten carbide and high-speed steel significantly impacts manufacturing productivity. Tungsten carbide tools allow for higher cutting speeds and feed rates, reducing machining time and increasing output. They maintain their cutting edge longer, resulting in fewer tool changes and reduced downtime. High-speed steel offers advantages in situations requiring frequent tool geometry modifications or when processing certain materials that might cause brittle failure in carbide tools. The optimal material choice depends on specific application requirements, production volume, and machine capabilities.

- Composite and coated materials combining properties of both materials: Innovative approaches combine the beneficial properties of tungsten carbide and high-speed steel through composite structures or coating technologies. These include high-speed steel substrates with tungsten carbide coatings, gradient materials with varying compositions, and composite tools with strategic placement of each material. Such hybrid solutions aim to achieve optimal performance by leveraging the toughness of high-speed steel with the wear resistance of tungsten carbide, resulting in tools that offer improved durability, reduced costs, and enhanced productivity compared to single-material options.

- Application-specific performance optimization: The optimal choice between tungsten carbide and high-speed steel varies significantly based on specific applications. For high-temperature operations, tungsten carbide maintains hardness at elevated temperatures better than standard high-speed steel. In applications involving impact or vibration, specially formulated high-speed steel may outperform tungsten carbide due to superior toughness. The material selection process should consider factors such as workpiece material, cutting parameters, cooling conditions, and tool geometry to maximize tool life, surface finish quality, and overall productivity while minimizing costs.

02 Cost considerations and economic analysis

While tungsten carbide tools and components are typically more expensive initially than high-speed steel alternatives, they often provide better long-term economic value due to extended service life and reduced replacement frequency. The higher cost of tungsten carbide is attributed to the price of raw materials, particularly tungsten, and more complex manufacturing processes. However, the total cost of ownership analysis frequently favors tungsten carbide when considering productivity gains, reduced downtime, and fewer tool changes, especially in high-volume production environments.Expand Specific Solutions03 Productivity improvements through material selection

The selection between tungsten carbide and high-speed steel significantly impacts productivity in manufacturing operations. Tungsten carbide tools generally allow for higher cutting speeds and feed rates, reducing cycle times and increasing output. They maintain their cutting edge longer, resulting in fewer tool changes and less machine downtime. High-speed steel, while less productive in terms of pure cutting performance, offers advantages in applications requiring toughness and shock resistance, and may be preferred where frequent tool breakage would otherwise impair productivity.Expand Specific Solutions04 Composite and coated materials for optimized performance

Innovative approaches combine the beneficial properties of both tungsten carbide and high-speed steel through composite structures or coatings. High-speed steel substrates coated with tungsten carbide layers provide improved wear resistance while maintaining the toughness of the base material. Similarly, gradient materials with varying compositions throughout the component optimize performance for specific applications. These hybrid solutions aim to balance wear resistance, cost, and productivity requirements, offering tailored performance characteristics that neither material alone can provide.Expand Specific Solutions05 Application-specific material selection criteria

The optimal choice between tungsten carbide and high-speed steel depends heavily on the specific application requirements. Factors influencing selection include operating temperature, workpiece material hardness, cutting speed, impact conditions, and required surface finish. Tungsten carbide excels in high-temperature applications, hard material cutting, and where dimensional stability is critical. High-speed steel remains advantageous for interrupted cutting, where shock resistance is needed, or in applications requiring frequent resharpening or customization of tool geometry on-site.Expand Specific Solutions

Major Manufacturers and Suppliers in Cutting Tool Industry

The tungsten carbide versus high-speed steel market is currently in a mature growth phase, with global demand driven by manufacturing, automotive, aerospace, and energy sectors. The market size is estimated at approximately $15-18 billion annually, with tungsten carbide commanding a premium price point but offering superior wear resistance and productivity benefits. Leading players include Kennametal and Sumitomo Electric Industries dominating the tungsten carbide segment, while Crucible Materials and Nachi-Fujikoshi maintain strong positions in high-speed steel. The technology landscape shows increasing innovation in coating technologies and hybrid materials, with research institutions like Beijing University of Technology and Xi'an Jiaotong University collaborating with manufacturers to develop next-generation cutting tools that balance performance and cost considerations.

Kennametal, Inc.

Technical Solution: Kennametal has developed advanced tungsten carbide solutions that significantly outperform high-speed steel in demanding applications. Their proprietary KenTIP FS modular drill system combines a tungsten carbide drill tip with a steel body, offering the wear resistance of carbide with the cost efficiency of steel. This hybrid approach delivers up to 200% longer tool life compared to conventional HSS tools while maintaining competitive pricing. Kennametal's tungsten carbide grades feature nano-grain structures and specialized cobalt binders that enhance both toughness and wear resistance. Their PVD and CVD coating technologies further extend tool life by adding layers of TiAlN or AlCrN that reduce friction and heat generation during cutting operations. For high-temperature applications, Kennametal's KC5010 grade with proprietary platinum group metal (PGM) additives maintains hardness at temperatures where HSS would rapidly soften, enabling cutting speeds 3-5 times higher than possible with high-speed steel.

Strengths: Superior wear resistance allowing higher cutting speeds (up to 5x faster than HSS), excellent heat resistance maintaining hardness at high temperatures, and significantly longer tool life reducing replacement frequency and downtime. Weaknesses: Higher initial investment cost compared to HSS tools, greater brittleness requiring more precise machining parameters, and more complex resharpening processes requiring specialized equipment.

Sumitomo Electric Industries Ltd.

Technical Solution: Sumitomo Electric has developed advanced tungsten carbide solutions that significantly outperform high-speed steel through their proprietary "Super ZF" and "Super FF" grades. These ultra-fine grain carbide materials (grain size <0.5μm) maintain exceptional hardness (up to 93 HRA) while achieving fracture toughness values that approach those of HSS tools. Their patented Multi-Layer Coating (MLC) technology applies alternating layers of TiAlN and AlCrN with precisely controlled thicknesses, creating thermal barriers that allow tungsten carbide tools to operate at cutting speeds up to 300m/min—approximately 5 times faster than HSS equivalents. Sumitomo's economic analysis demonstrates that while their premium carbide tools cost 3-5 times more initially than HSS alternatives, the productivity gains from faster cutting speeds and reduced downtime typically result in 30-50% lower cost-per-part. For heavy machining operations, their proprietary "Tough Grip" technology incorporates specialized surface treatments that enhance chip evacuation and reduce built-up edge formation, addressing one of the traditional weaknesses of carbide compared to HSS. Sumitomo has also pioneered recycling programs that recover up to 95% of tungsten from used tools, significantly reducing the environmental impact and resource concerns associated with tungsten carbide.

Strengths: Ultra-fine grain structure providing exceptional hardness while maintaining adequate toughness, advanced multi-layer coatings delivering superior heat and wear resistance, and optimized geometries for specific applications resulting in longer tool life. Weaknesses: Significantly higher initial investment compared to HSS tools, greater sensitivity to improper handling and machine setup, and more complex resharpening requirements limiting field maintenance options.

Key Patents and Innovations in Cutting Tool Materials

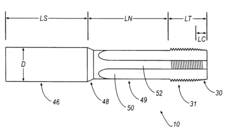

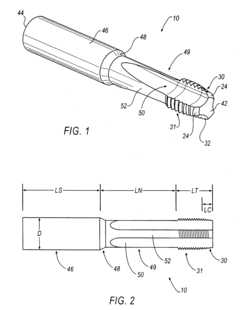

Precision cemented carbide threading tap

PatentInactiveUS20040170482A1

Innovation

- A precision cemented carbide tap with a fully cylindrical shank and threaded body that is concentric to within 10 microns, allowing for improved accuracy and speed by using precision hydraulic holders and synchronous tapping machines, and optionally coated with wear-resistant and friction-reducing layers.

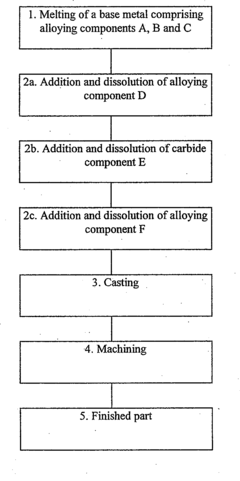

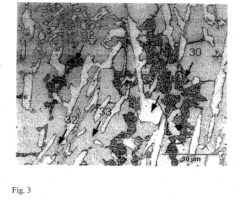

Iron-Base Alloy Containing Chromium-Tungsten Carbide And a Method Of Producing It

PatentInactiveUS20090123324A1

Innovation

- A method involving the melting of a base metal with added carbide particles, which are dissolved through diffusion, along with a solution-limiting alloying component to control solubility and enhance carbide properties, allowing for the reuse of worn-out cemented carbide tools and reducing processing steps.

Economic Impact and Total Cost of Ownership Analysis

The economic analysis of tungsten carbide versus high-speed steel tools reveals significant differences in their total cost of ownership across various industrial applications. Initial acquisition costs for tungsten carbide tools typically range 2-3 times higher than comparable high-speed steel options, creating a substantial entry barrier for small to medium enterprises with limited capital resources. However, this cost differential must be evaluated against the complete operational lifecycle.

When examining long-term economic impact, tungsten carbide demonstrates superior performance metrics that translate into tangible financial benefits. Production efficiency increases of 30-50% are commonly reported when switching from high-speed steel to tungsten carbide tools, primarily due to higher cutting speeds and reduced downtime for tool changes. This productivity enhancement directly impacts manufacturing throughput and capacity utilization rates.

Tool replacement frequency represents another critical economic factor. High-speed steel tools typically require replacement after processing 5,000-10,000 parts in moderate machining conditions, while equivalent tungsten carbide tools often maintain performance through 25,000-50,000 parts. This 5:1 longevity ratio significantly reduces both direct replacement costs and associated labor expenses for tool changes and machine recalibration.

Energy consumption patterns also favor tungsten carbide in the economic equation. The superior hardness and thermal properties of tungsten carbide allow for more efficient cutting processes that require 15-25% less energy input compared to high-speed steel alternatives. For energy-intensive manufacturing operations, these savings compound substantially over extended production runs.

Scrap rate reduction represents an often overlooked economic benefit. Tungsten carbide tools maintain dimensional accuracy and surface finish quality for longer periods, resulting in average scrap rate reductions of 3-7% compared to high-speed steel. In precision manufacturing sectors where material costs are significant, this improvement directly enhances profit margins.

The break-even analysis indicates that despite higher initial investment, tungsten carbide tools typically achieve cost parity with high-speed steel within 3-6 months of implementation in medium to high-volume production environments. Beyond this threshold, the economic advantages accelerate, with ROI calculations showing 18-24 month payback periods even when accounting for all transition costs including operator training and process optimization.

When examining long-term economic impact, tungsten carbide demonstrates superior performance metrics that translate into tangible financial benefits. Production efficiency increases of 30-50% are commonly reported when switching from high-speed steel to tungsten carbide tools, primarily due to higher cutting speeds and reduced downtime for tool changes. This productivity enhancement directly impacts manufacturing throughput and capacity utilization rates.

Tool replacement frequency represents another critical economic factor. High-speed steel tools typically require replacement after processing 5,000-10,000 parts in moderate machining conditions, while equivalent tungsten carbide tools often maintain performance through 25,000-50,000 parts. This 5:1 longevity ratio significantly reduces both direct replacement costs and associated labor expenses for tool changes and machine recalibration.

Energy consumption patterns also favor tungsten carbide in the economic equation. The superior hardness and thermal properties of tungsten carbide allow for more efficient cutting processes that require 15-25% less energy input compared to high-speed steel alternatives. For energy-intensive manufacturing operations, these savings compound substantially over extended production runs.

Scrap rate reduction represents an often overlooked economic benefit. Tungsten carbide tools maintain dimensional accuracy and surface finish quality for longer periods, resulting in average scrap rate reductions of 3-7% compared to high-speed steel. In precision manufacturing sectors where material costs are significant, this improvement directly enhances profit margins.

The break-even analysis indicates that despite higher initial investment, tungsten carbide tools typically achieve cost parity with high-speed steel within 3-6 months of implementation in medium to high-volume production environments. Beyond this threshold, the economic advantages accelerate, with ROI calculations showing 18-24 month payback periods even when accounting for all transition costs including operator training and process optimization.

Sustainability and Environmental Considerations in Tool Manufacturing

The manufacturing processes for both tungsten carbide and high-speed steel tools present significant environmental challenges that require careful consideration in today's sustainability-focused industrial landscape. Tungsten carbide production involves mining of rare earth metals, which often results in substantial habitat disruption, soil erosion, and water contamination. The extraction process is energy-intensive, generating considerable carbon emissions. Additionally, the refining and sintering processes for tungsten carbide require temperatures exceeding 1400°C, further increasing the carbon footprint of these tools.

High-speed steel manufacturing, while utilizing more abundant raw materials, still demands significant energy inputs for alloying and heat treatment processes. The production typically involves multiple heating and cooling cycles, contributing to higher energy consumption compared to some alternative materials. However, HSS tools generally require less extreme processing temperatures than tungsten carbide, potentially resulting in lower overall energy requirements per unit produced.

Waste management presents another critical environmental consideration. Tungsten carbide production generates hazardous waste containing heavy metals and chemical compounds that require specialized disposal methods. The cobalt binder commonly used in tungsten carbide is particularly problematic from an environmental and health perspective. Conversely, HSS manufacturing produces metal scraps that are more readily recyclable within existing metal recovery systems.

Tool lifespan significantly impacts overall environmental sustainability. While tungsten carbide tools typically last 2-5 times longer than HSS equivalents in many applications, this extended service life must be weighed against their more resource-intensive production. The longer lifespan of carbide tools means fewer replacements and consequently reduced manufacturing emissions over time, potentially offsetting their higher initial environmental cost.

Recycling capabilities differ substantially between these materials. HSS tools are more easily recycled through conventional metal recycling streams, with recovery rates exceeding 90% in efficient systems. Tungsten carbide recycling, while technically feasible and economically attractive due to tungsten's value, requires specialized processes to separate the carbide from binder materials. Current industry recycling rates for tungsten carbide range from 30-60%, indicating significant room for improvement.

Recent innovations in manufacturing technologies are addressing these environmental concerns. Powder metallurgy techniques are reducing material waste in both HSS and carbide production. Additionally, alternative binder materials for tungsten carbide are being developed to replace cobalt, potentially reducing toxicity concerns while maintaining performance characteristics.

High-speed steel manufacturing, while utilizing more abundant raw materials, still demands significant energy inputs for alloying and heat treatment processes. The production typically involves multiple heating and cooling cycles, contributing to higher energy consumption compared to some alternative materials. However, HSS tools generally require less extreme processing temperatures than tungsten carbide, potentially resulting in lower overall energy requirements per unit produced.

Waste management presents another critical environmental consideration. Tungsten carbide production generates hazardous waste containing heavy metals and chemical compounds that require specialized disposal methods. The cobalt binder commonly used in tungsten carbide is particularly problematic from an environmental and health perspective. Conversely, HSS manufacturing produces metal scraps that are more readily recyclable within existing metal recovery systems.

Tool lifespan significantly impacts overall environmental sustainability. While tungsten carbide tools typically last 2-5 times longer than HSS equivalents in many applications, this extended service life must be weighed against their more resource-intensive production. The longer lifespan of carbide tools means fewer replacements and consequently reduced manufacturing emissions over time, potentially offsetting their higher initial environmental cost.

Recycling capabilities differ substantially between these materials. HSS tools are more easily recycled through conventional metal recycling streams, with recovery rates exceeding 90% in efficient systems. Tungsten carbide recycling, while technically feasible and economically attractive due to tungsten's value, requires specialized processes to separate the carbide from binder materials. Current industry recycling rates for tungsten carbide range from 30-60%, indicating significant room for improvement.

Recent innovations in manufacturing technologies are addressing these environmental concerns. Powder metallurgy techniques are reducing material waste in both HSS and carbide production. Additionally, alternative binder materials for tungsten carbide are being developed to replace cobalt, potentially reducing toxicity concerns while maintaining performance characteristics.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!