Carbide Recycling And Reclamation: Economics And Methods

AUG 22, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Carbide Recycling Background and Objectives

Carbide materials have been integral to industrial applications for over a century, with their exceptional hardness, wear resistance, and thermal stability making them indispensable in cutting tools, mining equipment, and various manufacturing processes. The evolution of carbide technology began in the early 20th century with the development of tungsten carbide, which revolutionized metal cutting operations. Since then, the industry has expanded to include various carbide compounds, including titanium carbide, tantalum carbide, and niobium carbide, each offering specific performance characteristics for specialized applications.

The growing concern over resource scarcity and environmental sustainability has shifted focus toward recycling and reclamation of these valuable materials. Carbides, particularly those containing tungsten, cobalt, and other strategic metals, represent significant economic value and environmental concern when disposed of improperly. The global tungsten carbide market alone is projected to reach $25.5 billion by 2027, highlighting the economic importance of effective recycling strategies.

Current recycling rates for carbide materials vary significantly across regions, with estimates suggesting that only 30-40% of end-of-life carbide tools and components are effectively reclaimed worldwide. This represents both a substantial economic loss and an environmental challenge, as mining and processing virgin carbide materials generate considerable carbon emissions and ecological disruption.

The technical objectives of carbide recycling and reclamation efforts focus on developing economically viable methods that maximize material recovery while minimizing energy consumption and environmental impact. These objectives include improving separation technologies for complex carbide composites, developing more efficient chemical processes for metal extraction, and creating standardized systems for collection and processing of end-of-life carbide products.

Recent technological advancements have enabled more sophisticated recycling approaches, moving beyond simple mechanical reprocessing to chemical and metallurgical methods that can achieve higher purity levels in recovered materials. These developments coincide with increasing regulatory pressure worldwide regarding responsible material management and circular economy principles.

The intersection of economic considerations and technical feasibility remains the central challenge in carbide recycling. While the intrinsic value of constituent materials (particularly tungsten, cobalt, and other strategic metals) provides economic incentive, the complexity and energy intensity of many reclamation processes can offset potential gains. Therefore, a comprehensive understanding of both the economic landscape and technical methodologies is essential for advancing sustainable practices in this critical industrial sector.

The growing concern over resource scarcity and environmental sustainability has shifted focus toward recycling and reclamation of these valuable materials. Carbides, particularly those containing tungsten, cobalt, and other strategic metals, represent significant economic value and environmental concern when disposed of improperly. The global tungsten carbide market alone is projected to reach $25.5 billion by 2027, highlighting the economic importance of effective recycling strategies.

Current recycling rates for carbide materials vary significantly across regions, with estimates suggesting that only 30-40% of end-of-life carbide tools and components are effectively reclaimed worldwide. This represents both a substantial economic loss and an environmental challenge, as mining and processing virgin carbide materials generate considerable carbon emissions and ecological disruption.

The technical objectives of carbide recycling and reclamation efforts focus on developing economically viable methods that maximize material recovery while minimizing energy consumption and environmental impact. These objectives include improving separation technologies for complex carbide composites, developing more efficient chemical processes for metal extraction, and creating standardized systems for collection and processing of end-of-life carbide products.

Recent technological advancements have enabled more sophisticated recycling approaches, moving beyond simple mechanical reprocessing to chemical and metallurgical methods that can achieve higher purity levels in recovered materials. These developments coincide with increasing regulatory pressure worldwide regarding responsible material management and circular economy principles.

The intersection of economic considerations and technical feasibility remains the central challenge in carbide recycling. While the intrinsic value of constituent materials (particularly tungsten, cobalt, and other strategic metals) provides economic incentive, the complexity and energy intensity of many reclamation processes can offset potential gains. Therefore, a comprehensive understanding of both the economic landscape and technical methodologies is essential for advancing sustainable practices in this critical industrial sector.

Market Analysis for Recycled Carbide Materials

The global market for recycled carbide materials has experienced significant growth over the past decade, driven by increasing raw material costs, environmental regulations, and sustainability initiatives across industries. Tungsten carbide, a primary component in cutting tools, mining equipment, and wear-resistant parts, has seen particularly strong demand for recycled alternatives due to its high intrinsic value and limited natural reserves.

Current market valuations place the recycled carbide materials sector at approximately $2.3 billion globally, with projections indicating a compound annual growth rate of 6.8% through 2028. North America and Europe currently dominate the market, collectively accounting for over 65% of global recycled carbide consumption, though Asia-Pacific regions are demonstrating the fastest growth trajectory with China and India leading expansion.

The pricing structure for recycled carbide materials varies significantly based on purity levels and processing methods. High-grade recycled tungsten carbide powder can command 70-85% of virgin material prices, representing substantial cost savings for manufacturers while maintaining comparable performance characteristics. This price differential serves as the primary market driver, especially in price-sensitive industrial applications.

Market segmentation reveals that the cutting tool industry remains the largest consumer of recycled carbide materials, absorbing roughly 42% of total market volume. The mining sector follows at 28%, with automotive, aerospace, and general manufacturing collectively representing the remaining 30%. This distribution pattern has remained relatively stable, though aerospace applications show increasing adoption rates due to stringent sustainability mandates.

Supply chain dynamics present both opportunities and challenges for market growth. The collection infrastructure for end-of-life carbide tools remains fragmented in many regions, creating inefficiencies that impact material availability and pricing stability. Major recycling hubs have developed around industrial centers in Germany, the United States, Japan, and increasingly in China, where specialized processing facilities can achieve recovery rates exceeding 95% for tungsten content.

Customer behavior analysis indicates growing acceptance of recycled carbide materials, particularly among tier-one manufacturers seeking to reduce environmental footprints while maintaining cost competitiveness. However, certain high-precision applications in medical and aerospace sectors still demonstrate resistance due to perceived quality concerns, representing a market education opportunity.

The competitive landscape features both specialized recycling firms and vertically integrated tool manufacturers who have developed in-house recycling capabilities. This dual structure has intensified price competition while simultaneously driving technological innovation in reclamation processes. Market concentration remains moderate, with the top five players controlling approximately 38% of global capacity.

Current market valuations place the recycled carbide materials sector at approximately $2.3 billion globally, with projections indicating a compound annual growth rate of 6.8% through 2028. North America and Europe currently dominate the market, collectively accounting for over 65% of global recycled carbide consumption, though Asia-Pacific regions are demonstrating the fastest growth trajectory with China and India leading expansion.

The pricing structure for recycled carbide materials varies significantly based on purity levels and processing methods. High-grade recycled tungsten carbide powder can command 70-85% of virgin material prices, representing substantial cost savings for manufacturers while maintaining comparable performance characteristics. This price differential serves as the primary market driver, especially in price-sensitive industrial applications.

Market segmentation reveals that the cutting tool industry remains the largest consumer of recycled carbide materials, absorbing roughly 42% of total market volume. The mining sector follows at 28%, with automotive, aerospace, and general manufacturing collectively representing the remaining 30%. This distribution pattern has remained relatively stable, though aerospace applications show increasing adoption rates due to stringent sustainability mandates.

Supply chain dynamics present both opportunities and challenges for market growth. The collection infrastructure for end-of-life carbide tools remains fragmented in many regions, creating inefficiencies that impact material availability and pricing stability. Major recycling hubs have developed around industrial centers in Germany, the United States, Japan, and increasingly in China, where specialized processing facilities can achieve recovery rates exceeding 95% for tungsten content.

Customer behavior analysis indicates growing acceptance of recycled carbide materials, particularly among tier-one manufacturers seeking to reduce environmental footprints while maintaining cost competitiveness. However, certain high-precision applications in medical and aerospace sectors still demonstrate resistance due to perceived quality concerns, representing a market education opportunity.

The competitive landscape features both specialized recycling firms and vertically integrated tool manufacturers who have developed in-house recycling capabilities. This dual structure has intensified price competition while simultaneously driving technological innovation in reclamation processes. Market concentration remains moderate, with the top five players controlling approximately 38% of global capacity.

Global Carbide Recycling Status and Challenges

The global carbide recycling landscape presents a complex picture of varying adoption rates and technological capabilities across different regions. In developed economies such as Western Europe, North America, and Japan, sophisticated recycling infrastructure has been established with recovery rates reaching 30-50% for tungsten carbide tools and components. These regions benefit from stringent environmental regulations, advanced collection systems, and significant investments in recycling technologies.

In contrast, emerging economies in Asia, particularly China and India, are rapidly expanding their carbide recycling capabilities but face challenges related to informal collection networks and inconsistent processing standards. China has emerged as a dominant player, processing approximately 60% of the world's recycled tungsten carbide, leveraging its position as both a major consumer and producer of carbide materials.

The technical challenges in global carbide recycling are multifaceted. Separation of carbide from other materials remains a significant hurdle, particularly for coated tools or composite components. Current mechanical separation methods achieve only 85-90% purity, necessitating additional chemical processing that increases costs and environmental impact. The energy intensity of recycling processes also presents challenges, with high-temperature treatments requiring 4,000-5,000 kWh per ton of processed material.

Environmental regulations have become increasingly influential in shaping the carbide recycling industry. The European Union's REACH regulations and similar frameworks in North America have classified certain tungsten compounds as substances of concern, driving investment in cleaner recycling technologies. However, regulatory disparities between regions create uneven playing fields and opportunities for regulatory arbitrage.

Economic barriers further complicate the global recycling landscape. The volatility of raw material prices directly impacts recycling economics, with tungsten price fluctuations of up to 50% observed in recent years. When virgin material prices drop, recycling operations often struggle to remain competitive. Additionally, the high capital costs for establishing advanced recycling facilities—ranging from $5-20 million for industrial-scale operations—limit market entry and expansion.

Logistical challenges in collection and transportation also constrain global recycling rates. The dispersed nature of carbide waste generation, particularly from small and medium enterprises, makes efficient collection difficult. Transportation costs can represent 15-25% of total recycling expenses, especially when cross-border movement is involved, often subject to complex waste shipment regulations.

In contrast, emerging economies in Asia, particularly China and India, are rapidly expanding their carbide recycling capabilities but face challenges related to informal collection networks and inconsistent processing standards. China has emerged as a dominant player, processing approximately 60% of the world's recycled tungsten carbide, leveraging its position as both a major consumer and producer of carbide materials.

The technical challenges in global carbide recycling are multifaceted. Separation of carbide from other materials remains a significant hurdle, particularly for coated tools or composite components. Current mechanical separation methods achieve only 85-90% purity, necessitating additional chemical processing that increases costs and environmental impact. The energy intensity of recycling processes also presents challenges, with high-temperature treatments requiring 4,000-5,000 kWh per ton of processed material.

Environmental regulations have become increasingly influential in shaping the carbide recycling industry. The European Union's REACH regulations and similar frameworks in North America have classified certain tungsten compounds as substances of concern, driving investment in cleaner recycling technologies. However, regulatory disparities between regions create uneven playing fields and opportunities for regulatory arbitrage.

Economic barriers further complicate the global recycling landscape. The volatility of raw material prices directly impacts recycling economics, with tungsten price fluctuations of up to 50% observed in recent years. When virgin material prices drop, recycling operations often struggle to remain competitive. Additionally, the high capital costs for establishing advanced recycling facilities—ranging from $5-20 million for industrial-scale operations—limit market entry and expansion.

Logistical challenges in collection and transportation also constrain global recycling rates. The dispersed nature of carbide waste generation, particularly from small and medium enterprises, makes efficient collection difficult. Transportation costs can represent 15-25% of total recycling expenses, especially when cross-border movement is involved, often subject to complex waste shipment regulations.

Current Carbide Reclamation Methodologies

01 Chemical processes for carbide recycling

Various chemical processes can be employed to recycle and reclaim carbide materials. These processes involve chemical treatments to separate and recover valuable components from carbide waste. The methods may include dissolution, precipitation, and chemical conversion techniques that allow for the extraction of tungsten, cobalt, and other valuable metals from spent carbide tools and scraps. These chemical approaches enable efficient recovery of materials while minimizing environmental impact.- Mechanical processing methods for carbide recycling: Various mechanical methods can be employed for recycling carbide materials, including crushing, grinding, and separation techniques. These processes help to break down carbide-containing waste into reusable components. Specialized equipment such as crushers, mills, and separators are used to process the carbide materials efficiently. Mechanical recycling is often the first step in the reclamation process, preparing materials for further chemical or thermal treatment.

- Chemical processes for carbide recovery: Chemical processes are utilized to extract and recover valuable carbide materials from waste products. These methods involve the use of specific chemical reagents to dissolve, separate, and purify carbide compounds. Techniques such as leaching, precipitation, and solvent extraction are commonly employed. Chemical recovery processes are particularly effective for reclaiming high-purity carbide materials from complex waste streams, enabling the extraction of valuable components while minimizing environmental impact.

- Thermal treatment for carbide reclamation: Thermal treatment methods are employed in carbide recycling to process and transform waste materials. These techniques include pyrolysis, sintering, and high-temperature reduction processes that help separate carbide components from other materials. The controlled application of heat facilitates the breakdown of complex carbide-containing waste into recoverable elements. Thermal processes are particularly effective for treating carbide-containing composites and can result in high-quality reclaimed materials suitable for reuse in manufacturing.

- Integrated systems for carbide waste management: Integrated systems combine multiple technologies and processes to efficiently manage and recycle carbide waste. These comprehensive solutions incorporate collection, sorting, processing, and reclamation stages within a single operational framework. Such systems often feature automated components and digital monitoring to optimize the recycling process. By integrating various recycling methods, these systems maximize resource recovery while minimizing energy consumption and environmental impact, providing a holistic approach to carbide waste management.

- Innovative technologies for sustainable carbide recycling: Emerging technologies are being developed to enhance the sustainability and efficiency of carbide recycling processes. These innovations include advanced separation techniques, novel catalytic methods, and environmentally friendly extraction processes. Some approaches focus on reducing energy consumption and minimizing waste generation during the recycling process. These cutting-edge technologies aim to improve recovery rates of valuable materials from carbide waste while reducing the environmental footprint of recycling operations.

02 Mechanical processing systems for carbide reclamation

Mechanical systems and equipment designed specifically for processing and reclaiming carbide materials involve physical separation techniques such as crushing, grinding, and sorting. These systems may include specialized machinery for size reduction, classification, and separation of different components in carbide waste. The mechanical processing approach allows for efficient handling of large volumes of carbide scrap and prepares the material for subsequent recovery steps.Expand Specific Solutions03 Thermal treatment methods for carbide recovery

Thermal treatment methods utilize high temperatures to process and recover valuable materials from carbide waste. These techniques may include roasting, smelting, or pyrolysis processes that break down carbide compounds and allow for the separation and recovery of constituent metals. Thermal approaches are particularly effective for certain types of carbide materials and can achieve high recovery rates while transforming waste into reusable resources.Expand Specific Solutions04 Integrated recycling systems and management approaches

Comprehensive systems that integrate multiple recycling technologies and management approaches for carbide materials focus on optimizing the entire recycling process chain. These systems may combine collection, sorting, processing, and recovery steps in a coordinated manner. They often incorporate digital tracking, quality control measures, and logistics management to ensure efficient recovery of carbide materials from various waste streams. Such integrated approaches maximize resource recovery while minimizing environmental impact.Expand Specific Solutions05 Novel carbide reclamation technologies

Innovative and emerging technologies for carbide recycling and reclamation represent cutting-edge approaches to material recovery. These may include advanced separation techniques, novel chemical processes, or specialized equipment designed specifically for carbide materials. Such technologies often focus on improving recovery rates, reducing energy consumption, or enabling the recycling of previously difficult-to-process carbide forms. These innovations help to address challenges in traditional recycling methods and expand the range of recyclable carbide materials.Expand Specific Solutions

Leading Companies in Carbide Recycling Industry

The carbide recycling and reclamation market is currently in a growth phase, driven by increasing environmental regulations and resource scarcity concerns. The global market size is estimated to be expanding at a CAGR of 5-7%, with particularly strong demand in industrial manufacturing sectors. From a technological maturity perspective, the field shows varied development levels across different methods. Leading companies like BASF, Mitsubishi Materials, and Element Six have established commercial-scale recycling operations, while academic institutions including Tohoku University and Peking University are advancing novel techniques. Emerging players such as Redwood Materials and Lyten are introducing innovative approaches focused on sustainability. The competitive landscape features both traditional materials companies and specialized recycling firms, with increasing collaboration between industry and research institutions to improve economic viability of reclamation processes.

Fraunhofer-Gesellschaft eV

Technical Solution: Fraunhofer has developed a comprehensive carbide recycling platform combining mechanical, thermal and chemical processes tailored to different carbide waste streams. Their flagship technology is a hybrid recycling approach that first employs precision mechanical separation to isolate carbide-containing components, followed by selective oxidation under controlled atmosphere conditions. This process converts tungsten carbide to tungsten oxide intermediates at temperatures optimized between 700-850°C, reducing energy requirements by approximately 35% compared to conventional methods. The subsequent hydrogen reduction process recovers high-purity tungsten powder suitable for direct reuse in carbide production. Fraunhofer's system incorporates real-time monitoring and adaptive process control, allowing for processing of variable feedstock compositions with consistent output quality. Economic analysis demonstrates that their method achieves production costs 25-30% lower than virgin material when processing industrial grade scrap, with carbon footprint reductions of approximately 60% across the full lifecycle.

Strengths: Flexible processing capabilities for diverse carbide waste streams; optimized energy efficiency through precise process control; demonstrated economic viability at industrial scale. Weaknesses: Complex multi-stage process requires sophisticated control systems; higher capital costs than simpler recycling methods; optimal efficiency requires pre-sorted input materials.

Element Six GmbH

Technical Solution: Element Six has pioneered advanced thermal-chemical processes for synthetic diamond and tungsten carbide recycling. Their proprietary technology employs a multi-stage approach beginning with mechanical pre-treatment to separate different components, followed by hydrometallurgical processing using specialized acid leaching techniques that selectively dissolve binder metals while preserving carbide structures. The company has developed a novel low-temperature oxidation process that operates at 400-600°C (significantly lower than conventional methods requiring 800-1000°C), reducing energy consumption by approximately 40%. Their system achieves material recovery rates of up to 98% for tungsten and 95% for cobalt from carbide scrap. Element Six has also implemented a comprehensive logistics network that collects used carbide tools from industrial customers across Europe, creating a circular economy model that reduces raw material dependency by an estimated 30% in their manufacturing operations.

Strengths: Industry-leading recovery rates; energy-efficient low-temperature process; established collection infrastructure supporting circular economy principles. Weaknesses: Process requires handling of hazardous chemicals; complex multi-stage approach increases operational complexity; economic viability depends on sufficient collection volumes.

Key Patents and Innovations in Carbide Recovery

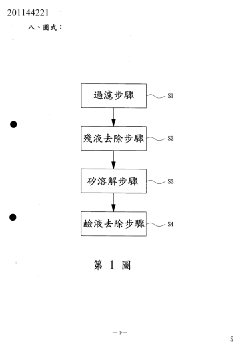

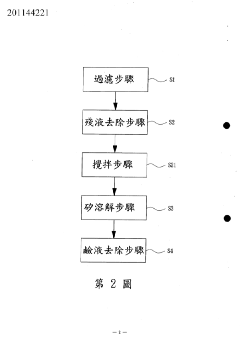

A method for the silicon carbide recycling

PatentInactiveTW201144221A

Innovation

- A method involving filtration, residual liquid removal, silicon dissolution, and alkaline solution removal to recover silicon carbide without the need for separation aids, organic solvents, or high-speed centrifugation, utilizing filtration, heating, and alkaline solutions to separate and purify silicon carbide and silicon.

A process for recycling waste carbide

PatentActiveGB2537510B8

Innovation

- Direct electrolysis of waste carbide as anode in molten salt medium, eliminating traditional chemical processing steps.

- Zero-emission process with no solid/liquid/gas waste, making it environmentally friendly compared to conventional recycling methods.

- Simple process flow with vacuum dehydration of molten salt followed by electrolysis and metal powder collection, reducing operational complexity.

Economic Feasibility and ROI Analysis

The economic feasibility of carbide recycling and reclamation processes represents a critical factor in determining their industrial adoption. Current market analysis indicates that virgin tungsten carbide materials cost between $20-45 per kilogram, while recycled carbide can be produced at approximately 40-60% of this cost, creating a compelling economic incentive for recycling operations.

Return on investment calculations for carbide recycling facilities demonstrate varying payback periods depending on scale and technology employed. Small-scale operations utilizing zinc recycling methods typically achieve ROI within 24-36 months, while larger industrial facilities employing chemical dissolution techniques may require 36-48 months to reach profitability, but subsequently deliver higher margins due to economies of scale.

Capital expenditure requirements present significant barriers to entry, with comprehensive recycling facilities requiring initial investments ranging from $2-10 million depending on capacity and technological sophistication. However, modular approaches to facility development allow for phased investment, reducing initial capital requirements while enabling operational scaling as market position strengthens.

Operational costs constitute a major consideration in economic feasibility assessments. Energy consumption represents 15-25% of operational expenses, with chemical recycling methods generally requiring greater energy inputs than mechanical or metallurgical approaches. Labor costs account for 20-30% of operational expenses, though automation trends are gradually reducing this proportion in modern facilities.

Market volatility significantly impacts economic feasibility, with tungsten carbide prices fluctuating by up to 30% annually based on global supply dynamics. This volatility necessitates hedging strategies and diversified customer bases to maintain profitability through market cycles. Facilities capable of processing multiple carbide types demonstrate greater resilience to market fluctuations.

Regulatory compliance costs are increasingly influencing economic calculations, with environmental regulations adding 5-15% to operational expenses depending on jurisdiction. However, these costs are partially offset by growing premium pricing for sustainably sourced materials, with environmentally certified recycled carbide commanding 10-20% price premiums in certain markets.

Long-term economic modeling suggests that carbide recycling operations achieving 85%+ material recovery rates maintain profitability even during periods of depressed raw material pricing, provided facilities operate at minimum 70% capacity utilization. This resilience, combined with projected supply constraints for virgin materials, indicates favorable long-term economics for well-designed recycling operations.

Return on investment calculations for carbide recycling facilities demonstrate varying payback periods depending on scale and technology employed. Small-scale operations utilizing zinc recycling methods typically achieve ROI within 24-36 months, while larger industrial facilities employing chemical dissolution techniques may require 36-48 months to reach profitability, but subsequently deliver higher margins due to economies of scale.

Capital expenditure requirements present significant barriers to entry, with comprehensive recycling facilities requiring initial investments ranging from $2-10 million depending on capacity and technological sophistication. However, modular approaches to facility development allow for phased investment, reducing initial capital requirements while enabling operational scaling as market position strengthens.

Operational costs constitute a major consideration in economic feasibility assessments. Energy consumption represents 15-25% of operational expenses, with chemical recycling methods generally requiring greater energy inputs than mechanical or metallurgical approaches. Labor costs account for 20-30% of operational expenses, though automation trends are gradually reducing this proportion in modern facilities.

Market volatility significantly impacts economic feasibility, with tungsten carbide prices fluctuating by up to 30% annually based on global supply dynamics. This volatility necessitates hedging strategies and diversified customer bases to maintain profitability through market cycles. Facilities capable of processing multiple carbide types demonstrate greater resilience to market fluctuations.

Regulatory compliance costs are increasingly influencing economic calculations, with environmental regulations adding 5-15% to operational expenses depending on jurisdiction. However, these costs are partially offset by growing premium pricing for sustainably sourced materials, with environmentally certified recycled carbide commanding 10-20% price premiums in certain markets.

Long-term economic modeling suggests that carbide recycling operations achieving 85%+ material recovery rates maintain profitability even during periods of depressed raw material pricing, provided facilities operate at minimum 70% capacity utilization. This resilience, combined with projected supply constraints for virgin materials, indicates favorable long-term economics for well-designed recycling operations.

Environmental Impact and Regulatory Compliance

Carbide recycling and reclamation processes have significant environmental implications that must be carefully managed to ensure sustainability and regulatory compliance. Traditional carbide disposal methods often involve landfilling, which can lead to soil and groundwater contamination due to the leaching of heavy metals such as cobalt, tungsten, and nickel. These contaminants pose serious ecological risks and potential human health hazards when they enter water systems or food chains.

The recycling processes themselves also generate environmental concerns. Pyrometallurgical methods produce air emissions containing particulate matter and potentially harmful compounds, while hydrometallurgical approaches involve chemical solutions that require proper treatment before discharge. Energy consumption across all recycling methods contributes to carbon footprints, with high-temperature processes being particularly energy-intensive.

Regulatory frameworks governing carbide recycling vary significantly across regions but generally fall under hazardous waste management regulations. In the United States, the Resource Conservation and Recovery Act (RCRA) classifies many carbide wastes as hazardous due to their metal content, imposing strict handling, transportation, and processing requirements. The European Union's Waste Electrical and Electronic Equipment (WEEE) Directive and Restriction of Hazardous Substances (RoHS) Directive similarly regulate carbide-containing products and their disposal.

Companies engaged in carbide recycling must obtain appropriate permits and licenses, which typically require regular environmental monitoring, reporting, and compliance audits. These regulatory requirements add operational costs but ensure that recycling activities do not create new environmental problems while solving others.

Recent regulatory trends show increasing stringency in emissions standards and waste classification. Several jurisdictions have implemented extended producer responsibility (EPR) programs that place greater accountability on manufacturers for the end-of-life management of their products, including those containing carbide materials.

Best practices in environmentally responsible carbide recycling include closed-loop water systems to minimize discharge, advanced air filtration technologies to capture particulates and fumes, and energy efficiency measures to reduce carbon emissions. Leading companies are implementing ISO 14001 environmental management systems and conducting life cycle assessments to quantify and minimize their environmental impact.

The economic implications of environmental compliance are substantial but increasingly viewed as necessary investments rather than burdensome costs. Companies that proactively exceed regulatory requirements often gain competitive advantages through improved corporate reputation, access to environmentally conscious markets, and reduced liability risks.

The recycling processes themselves also generate environmental concerns. Pyrometallurgical methods produce air emissions containing particulate matter and potentially harmful compounds, while hydrometallurgical approaches involve chemical solutions that require proper treatment before discharge. Energy consumption across all recycling methods contributes to carbon footprints, with high-temperature processes being particularly energy-intensive.

Regulatory frameworks governing carbide recycling vary significantly across regions but generally fall under hazardous waste management regulations. In the United States, the Resource Conservation and Recovery Act (RCRA) classifies many carbide wastes as hazardous due to their metal content, imposing strict handling, transportation, and processing requirements. The European Union's Waste Electrical and Electronic Equipment (WEEE) Directive and Restriction of Hazardous Substances (RoHS) Directive similarly regulate carbide-containing products and their disposal.

Companies engaged in carbide recycling must obtain appropriate permits and licenses, which typically require regular environmental monitoring, reporting, and compliance audits. These regulatory requirements add operational costs but ensure that recycling activities do not create new environmental problems while solving others.

Recent regulatory trends show increasing stringency in emissions standards and waste classification. Several jurisdictions have implemented extended producer responsibility (EPR) programs that place greater accountability on manufacturers for the end-of-life management of their products, including those containing carbide materials.

Best practices in environmentally responsible carbide recycling include closed-loop water systems to minimize discharge, advanced air filtration technologies to capture particulates and fumes, and energy efficiency measures to reduce carbon emissions. Leading companies are implementing ISO 14001 environmental management systems and conducting life cycle assessments to quantify and minimize their environmental impact.

The economic implications of environmental compliance are substantial but increasingly viewed as necessary investments rather than burdensome costs. Companies that proactively exceed regulatory requirements often gain competitive advantages through improved corporate reputation, access to environmentally conscious markets, and reduced liability risks.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!