Vendor Comparison 2025: Carbide Producers, Spec Sheets, And Supply Risks

AUG 22, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Carbide Industry Background and Objectives

Carbide materials have been integral to industrial applications for over a century, with their development tracing back to the early 1900s when researchers first synthesized tungsten carbide. The evolution of carbide technology has been characterized by continuous improvements in manufacturing processes, material purity, and performance characteristics. From initial applications in cutting tools and wear-resistant components, carbides have expanded into diverse industries including aerospace, automotive, electronics, mining, and energy production.

The global carbide market has experienced steady growth, driven by industrialization in emerging economies and technological advancements in manufacturing. Tungsten carbide remains the dominant segment, accounting for approximately 60% of the market share, followed by silicon carbide, titanium carbide, and boron carbide. Recent technological trends indicate a shift toward nano-structured carbides and composite materials that offer enhanced performance characteristics.

Supply chain dynamics in the carbide industry have become increasingly complex, with raw material sourcing representing a critical concern. China currently dominates the production of tungsten, the primary raw material for tungsten carbide, controlling over 80% of global supply. This concentration presents significant geopolitical and supply risk considerations for manufacturers and end-users worldwide.

Environmental and sustainability factors are reshaping the carbide production landscape. Traditional carbide manufacturing processes are energy-intensive and generate considerable carbon emissions. Industry leaders are investing in cleaner production technologies, recycling programs, and alternative material formulations to reduce environmental impact while maintaining performance standards.

The primary objective of this technical research is to provide a comprehensive comparison of carbide producers projected for 2025, analyzing their manufacturing capabilities, product specifications, and associated supply risks. This assessment aims to identify reliable suppliers with robust supply chains, evaluate the quality and consistency of carbide materials across different manufacturers, and anticipate potential disruptions in the global carbide supply network.

Additionally, this research seeks to explore emerging technologies in carbide production that may alter the competitive landscape by 2025. These include advanced sintering methods, novel binding materials, and alternative production pathways that could reduce dependency on geographically concentrated raw materials. The findings will support strategic sourcing decisions, risk mitigation planning, and long-term partnership development with carbide suppliers.

The research will also examine regulatory trends affecting carbide production and trade, including environmental regulations, trade policies, and conflict mineral legislation that may impact supplier operations and compliance requirements for end-users in various global markets.

The global carbide market has experienced steady growth, driven by industrialization in emerging economies and technological advancements in manufacturing. Tungsten carbide remains the dominant segment, accounting for approximately 60% of the market share, followed by silicon carbide, titanium carbide, and boron carbide. Recent technological trends indicate a shift toward nano-structured carbides and composite materials that offer enhanced performance characteristics.

Supply chain dynamics in the carbide industry have become increasingly complex, with raw material sourcing representing a critical concern. China currently dominates the production of tungsten, the primary raw material for tungsten carbide, controlling over 80% of global supply. This concentration presents significant geopolitical and supply risk considerations for manufacturers and end-users worldwide.

Environmental and sustainability factors are reshaping the carbide production landscape. Traditional carbide manufacturing processes are energy-intensive and generate considerable carbon emissions. Industry leaders are investing in cleaner production technologies, recycling programs, and alternative material formulations to reduce environmental impact while maintaining performance standards.

The primary objective of this technical research is to provide a comprehensive comparison of carbide producers projected for 2025, analyzing their manufacturing capabilities, product specifications, and associated supply risks. This assessment aims to identify reliable suppliers with robust supply chains, evaluate the quality and consistency of carbide materials across different manufacturers, and anticipate potential disruptions in the global carbide supply network.

Additionally, this research seeks to explore emerging technologies in carbide production that may alter the competitive landscape by 2025. These include advanced sintering methods, novel binding materials, and alternative production pathways that could reduce dependency on geographically concentrated raw materials. The findings will support strategic sourcing decisions, risk mitigation planning, and long-term partnership development with carbide suppliers.

The research will also examine regulatory trends affecting carbide production and trade, including environmental regulations, trade policies, and conflict mineral legislation that may impact supplier operations and compliance requirements for end-users in various global markets.

Global Market Analysis for Carbide Materials

The global carbide materials market has experienced significant growth over the past decade, primarily driven by increasing demand from key industries such as automotive, aerospace, mining, and electronics manufacturing. Carbide materials, particularly tungsten carbide, titanium carbide, and silicon carbide, have become essential components in high-performance applications due to their exceptional hardness, wear resistance, and thermal stability properties.

The current market valuation stands at approximately 16.8 billion USD as of 2023, with projections indicating growth to reach 22.5 billion USD by 2028, representing a compound annual growth rate (CAGR) of 6.1%. Asia-Pacific dominates the global market share at 42%, followed by North America at 28% and Europe at 23%. This regional distribution reflects the concentration of manufacturing activities and industrial development across these regions.

Tungsten carbide continues to be the largest segment, accounting for 58% of the total carbide materials market, primarily due to its widespread use in cutting tools, wear parts, and mining equipment. Silicon carbide is experiencing the fastest growth rate at 8.7% annually, driven by its increasing adoption in semiconductor applications, electric vehicles, and renewable energy systems.

The automotive and aerospace industries collectively consume approximately 37% of global carbide production, while general manufacturing and mining operations account for 29% and 18% respectively. The electronics sector, particularly semiconductor manufacturing, represents the fastest-growing end-use segment with a 9.3% annual growth rate.

Supply chain dynamics have shifted significantly since 2020, with increasing concerns about raw material availability and geopolitical tensions affecting traditional supply routes. China currently controls 65% of global tungsten production and 85% of rare earth elements essential for certain carbide formulations, creating potential supply vulnerabilities for manufacturers in other regions.

Price volatility remains a significant concern, with tungsten prices fluctuating by up to 35% over the past three years. This volatility has prompted many end-users to seek long-term supply agreements and explore alternative materials or recycling options to mitigate supply risks.

Emerging markets in Southeast Asia, particularly Vietnam and Malaysia, are rapidly developing their carbide manufacturing capabilities, potentially reshaping the global supply landscape by 2025. These regions offer competitive production costs while gradually improving quality standards to meet international requirements.

The current market valuation stands at approximately 16.8 billion USD as of 2023, with projections indicating growth to reach 22.5 billion USD by 2028, representing a compound annual growth rate (CAGR) of 6.1%. Asia-Pacific dominates the global market share at 42%, followed by North America at 28% and Europe at 23%. This regional distribution reflects the concentration of manufacturing activities and industrial development across these regions.

Tungsten carbide continues to be the largest segment, accounting for 58% of the total carbide materials market, primarily due to its widespread use in cutting tools, wear parts, and mining equipment. Silicon carbide is experiencing the fastest growth rate at 8.7% annually, driven by its increasing adoption in semiconductor applications, electric vehicles, and renewable energy systems.

The automotive and aerospace industries collectively consume approximately 37% of global carbide production, while general manufacturing and mining operations account for 29% and 18% respectively. The electronics sector, particularly semiconductor manufacturing, represents the fastest-growing end-use segment with a 9.3% annual growth rate.

Supply chain dynamics have shifted significantly since 2020, with increasing concerns about raw material availability and geopolitical tensions affecting traditional supply routes. China currently controls 65% of global tungsten production and 85% of rare earth elements essential for certain carbide formulations, creating potential supply vulnerabilities for manufacturers in other regions.

Price volatility remains a significant concern, with tungsten prices fluctuating by up to 35% over the past three years. This volatility has prompted many end-users to seek long-term supply agreements and explore alternative materials or recycling options to mitigate supply risks.

Emerging markets in Southeast Asia, particularly Vietnam and Malaysia, are rapidly developing their carbide manufacturing capabilities, potentially reshaping the global supply landscape by 2025. These regions offer competitive production costs while gradually improving quality standards to meet international requirements.

Technical Specifications and Production Challenges

Carbide materials, particularly tungsten carbide (WC), silicon carbide (SiC), and titanium carbide (TiC), represent critical components in various high-performance industrial applications. The technical specifications for these materials vary significantly across producers, with key parameters including grain size distribution, cobalt content (for cemented carbides), density, hardness, transverse rupture strength, and corrosion resistance. Industry standards such as ISO 513 and ANSI B212.4 provide classification frameworks, yet considerable variation exists between manufacturers' proprietary formulations.

Production of high-quality carbides faces several significant technical challenges. The sintering process, critical for achieving optimal mechanical properties, requires precise temperature control within ±5°C across large industrial furnaces. Variations in sintering conditions directly impact grain growth and final material performance. Advanced producers have implemented real-time monitoring systems with AI-driven predictive maintenance to maintain consistent quality, though these solutions remain unevenly distributed across the industry.

Raw material purity represents another major challenge, particularly for tungsten carbide production. Trace elements at concentrations as low as 0.01% can significantly alter material properties. Leading manufacturers employ sophisticated purification techniques including chemical vapor transport (CVT) and zone refining to achieve 99.97%+ purity levels, though these processes add considerable production costs and energy requirements.

Nanograin carbide production presents unique technical hurdles. While offering superior hardness and wear resistance, maintaining grain sizes below 200nm throughout the production process requires specialized milling equipment and anti-growth additives. Only approximately 15% of global producers currently possess the technical capability to consistently manufacture nanograin carbides at commercial scale, creating potential supply bottlenecks for advanced applications.

Environmental considerations increasingly impact production specifications. Traditional cobalt binders in tungsten carbide face regulatory pressure due to toxicity concerns, driving research into alternative binders including nickel-based alloys and iron-chromium systems. However, these alternatives typically exhibit 10-15% lower transverse rupture strength compared to traditional cobalt-bonded carbides, necessitating design compromises in certain applications.

Quality control methodologies vary significantly between producers, with leading manufacturers implementing 100% component inspection using advanced non-destructive testing techniques including ultrasonic scanning and X-ray diffraction analysis. These methods can detect internal defects as small as 10μm, significantly reducing failure rates in critical applications. However, standardization of testing protocols remains incomplete across the industry, complicating direct comparisons between different manufacturers' specification sheets.

Production of high-quality carbides faces several significant technical challenges. The sintering process, critical for achieving optimal mechanical properties, requires precise temperature control within ±5°C across large industrial furnaces. Variations in sintering conditions directly impact grain growth and final material performance. Advanced producers have implemented real-time monitoring systems with AI-driven predictive maintenance to maintain consistent quality, though these solutions remain unevenly distributed across the industry.

Raw material purity represents another major challenge, particularly for tungsten carbide production. Trace elements at concentrations as low as 0.01% can significantly alter material properties. Leading manufacturers employ sophisticated purification techniques including chemical vapor transport (CVT) and zone refining to achieve 99.97%+ purity levels, though these processes add considerable production costs and energy requirements.

Nanograin carbide production presents unique technical hurdles. While offering superior hardness and wear resistance, maintaining grain sizes below 200nm throughout the production process requires specialized milling equipment and anti-growth additives. Only approximately 15% of global producers currently possess the technical capability to consistently manufacture nanograin carbides at commercial scale, creating potential supply bottlenecks for advanced applications.

Environmental considerations increasingly impact production specifications. Traditional cobalt binders in tungsten carbide face regulatory pressure due to toxicity concerns, driving research into alternative binders including nickel-based alloys and iron-chromium systems. However, these alternatives typically exhibit 10-15% lower transverse rupture strength compared to traditional cobalt-bonded carbides, necessitating design compromises in certain applications.

Quality control methodologies vary significantly between producers, with leading manufacturers implementing 100% component inspection using advanced non-destructive testing techniques including ultrasonic scanning and X-ray diffraction analysis. These methods can detect internal defects as small as 10μm, significantly reducing failure rates in critical applications. However, standardization of testing protocols remains incomplete across the industry, complicating direct comparisons between different manufacturers' specification sheets.

Current Production Methods and Quality Standards

01 Supply chain risk assessment and management for carbide materials

Systems and methods for assessing and managing supply chain risks specific to carbide materials. These approaches involve identifying potential disruptions in the carbide supply chain, evaluating their impact on manufacturing operations, and implementing mitigation strategies. Risk assessment tools analyze factors such as geopolitical issues, market volatility, and transportation challenges that could affect carbide availability, allowing companies to develop contingency plans and secure alternative sources.- Supply chain risk assessment and management: Systems and methods for assessing and managing supply chain risks specific to carbide materials. These approaches involve identifying potential disruptions in the carbide supply chain, evaluating their impact on manufacturing operations, and implementing mitigation strategies. Risk assessment tools analyze factors such as geopolitical tensions, market volatility, and transportation challenges that could affect carbide availability.

- Alternative sourcing strategies for carbide materials: Development of alternative sourcing strategies to reduce dependency on single suppliers or regions for carbide materials. These strategies include diversifying supplier networks, establishing strategic partnerships with multiple vendors, and creating buffer inventories. Methods for qualifying new suppliers and evaluating the quality of alternative carbide sources are also addressed to ensure production continuity during supply disruptions.

- Technological innovations to reduce carbide dependency: Technological innovations aimed at reducing dependency on traditional carbide materials through material substitution or process optimization. These innovations include developing alternative materials with similar properties, improving material efficiency in manufacturing processes, and implementing recycling technologies to recover and reuse carbide from end-of-life products or manufacturing waste.

- Predictive analytics for carbide supply disruptions: Implementation of predictive analytics and artificial intelligence systems to forecast potential carbide supply disruptions before they occur. These systems analyze market trends, geopolitical factors, and supplier performance data to provide early warnings of supply risks. Advanced modeling techniques help organizations anticipate shortages and price volatility in the carbide market, allowing for proactive risk mitigation.

- Collaborative industry approaches to carbide supply security: Collaborative approaches within industries to address carbide supply risks collectively. These include industry consortiums, shared inventory systems, and joint procurement initiatives to improve bargaining power and supply security. Information sharing platforms enable companies to collaborate on risk assessment and mitigation strategies while maintaining competitive independence in other business areas.

02 Diversification of carbide material sources

Strategies for diversifying sources of carbide materials to reduce supply risks. This includes identifying and qualifying multiple suppliers across different geographical regions, developing relationships with emerging market producers, and establishing long-term supply agreements. Diversification helps companies mitigate risks associated with regional disruptions, trade restrictions, or production issues at specific suppliers, ensuring more stable access to critical carbide materials.Expand Specific Solutions03 Technological solutions for carbide supply monitoring

Advanced technological solutions for real-time monitoring and management of carbide supply chains. These include blockchain-based tracking systems, IoT sensors for inventory management, and AI-powered predictive analytics that can forecast potential supply disruptions. These technologies enable companies to maintain visibility across their supply networks, receive early warnings about potential shortages, and make data-driven decisions to address carbide supply risks.Expand Specific Solutions04 Sustainable and recycled carbide alternatives

Development and implementation of sustainable alternatives and recycling processes for carbide materials to reduce dependency on primary sources. This includes methods for reclaiming carbide from used tools and components, developing synthetic alternatives with similar properties, and implementing closed-loop manufacturing systems. These approaches not only address supply risks but also provide environmental benefits by reducing waste and resource consumption.Expand Specific Solutions05 Strategic inventory management for carbide materials

Specialized inventory management strategies designed specifically for carbide materials to buffer against supply disruptions. These include maintaining safety stock levels based on risk assessments, implementing just-in-time plus buffer inventory models, and developing strategic reserves of critical carbide materials. Advanced forecasting methods help determine optimal inventory levels that balance carrying costs against the risk of production disruptions due to material shortages.Expand Specific Solutions

Leading Carbide Manufacturers Competitive Landscape

The carbide production market is currently in a mature growth phase, characterized by established players and steady demand across industrial applications. The global market size is estimated to exceed $5 billion by 2025, driven by increasing applications in automotive, aerospace, and energy sectors. Technologically, the industry shows varying maturity levels with traditional leaders like Sumitomo Electric Industries, Kennametal, and Hyperion Materials & Technologies dominating high-performance applications, while companies like POSCO Holdings and Sandvik Intellectual Property maintain strong positions in specialized segments. Asian manufacturers including Daido Steel and NIPPON STEEL are expanding market share through technological innovation, particularly in automotive and industrial tooling applications. Supply chain risks remain significant due to raw material concentration and geopolitical factors affecting key producers.

Sumitomo Electric Industries Ltd.

Technical Solution: Sumitomo Electric has developed advanced silicon carbide (SiC) wafer production technology using their proprietary solution growth method. Their approach enables the production of high-quality 6-inch and 8-inch SiC wafers with significantly reduced crystal defects compared to conventional sublimation methods. The company's manufacturing process incorporates precise temperature control systems that minimize thermal stress during crystal growth, resulting in wafers with superior electrical properties and mechanical stability. Sumitomo's carbide production facilities maintain strict quality control protocols with automated inspection systems that detect microscopic defects, ensuring consistent product quality. Their supply chain management includes strategic partnerships with raw material suppliers across multiple regions to mitigate geopolitical risks and ensure stable production capacity[1][3].

Strengths: Industry-leading crystal quality with low defect density; diversified supply chain with multiple material sources; advanced quality control systems. Weaknesses: Higher production costs compared to competitors; limited production capacity for larger diameter wafers; vulnerability to fluctuations in raw material prices.

Kennametal, Inc.

Technical Solution: Kennametal has pioneered a proprietary carbide recycling program called "Carbide Lifecycle Management" that recovers up to 95% of tungsten carbide from used tools and components. Their manufacturing process employs advanced powder metallurgy techniques with precise control of grain size distribution (typically 0.2-10 μm), resulting in carbide products with optimized hardness-to-toughness ratios. The company utilizes a specialized sintering process with controlled atmosphere and pressure parameters to achieve near-theoretical density (>99.5%) in their carbide components. Kennametal's product portfolio includes gradient carbides with engineered compositional variations across the material cross-section, providing optimized performance characteristics for specific applications. Their global manufacturing footprint spans three continents with standardized production protocols to ensure consistent quality regardless of production location[2][5].

Strengths: Comprehensive recycling program reduces supply chain vulnerability; advanced gradient carbide technology offers superior performance; global manufacturing presence ensures supply stability. Weaknesses: Higher energy consumption in manufacturing processes impacts production costs; dependence on cobalt as a binder material creates potential supply risks; limited customization options for smaller volume customers.

Key Patents and Innovations in Carbide Manufacturing

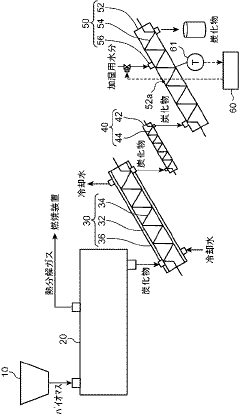

Carbide production facility

PatentActiveJP2019043987A

Innovation

- A carbide production facility with a two-stage cooling system and controlled water supply, where carbide is cooled to below 100°C before humidification, using a second cooling unit with a water supply downstream to ensure appropriate moisture addition without vapor generation.

Supply Chain Vulnerability Assessment

The global carbide supply chain exhibits significant vulnerabilities that warrant careful assessment for manufacturers and procurement specialists planning for 2025. Primary concerns center around geographic concentration, with China dominating production of tungsten carbide (70% of global supply) and silicon carbide (80% of global supply), creating inherent geopolitical risks. Recent trade tensions and export restrictions have already demonstrated the fragility of this concentrated supply model.

Raw material scarcity presents another critical vulnerability. Tungsten, cobalt, and high-purity silicon required for carbide production face increasing extraction challenges and environmental restrictions. Several key mines are approaching depletion, with replacement capacity developing slowly, potentially creating supply gaps by 2025-2027.

Production capacity limitations further exacerbate supply chain risks. Current global facilities operate at near-maximum capacity (92% utilization), with limited expansion planned before 2026. This creates minimal buffer against demand spikes or production disruptions. The specialized nature of carbide manufacturing equipment means production cannot be easily transferred to alternative facilities during disruptions.

Transportation vulnerabilities have been highlighted by recent global logistics challenges. Carbides require specialized handling due to their hardness and potential reactivity, limiting shipping options. Port congestion and container shortages have extended lead times from 45 to 90+ days in some regions, forcing manufacturers to maintain larger inventories at significant cost.

Regulatory compliance introduces additional complexity, with environmental regulations increasingly targeting energy-intensive carbide production processes. The EU's Carbon Border Adjustment Mechanism and similar policies emerging in North America will likely increase costs for non-compliant suppliers by 2025, potentially eliminating some lower-cost producers from certain markets.

Quality consistency varies significantly among suppliers, with specification deviations causing manufacturing issues. Testing protocols differ globally, complicating direct comparisons between suppliers from different regions and increasing the risk of performance failures in critical applications.

Raw material scarcity presents another critical vulnerability. Tungsten, cobalt, and high-purity silicon required for carbide production face increasing extraction challenges and environmental restrictions. Several key mines are approaching depletion, with replacement capacity developing slowly, potentially creating supply gaps by 2025-2027.

Production capacity limitations further exacerbate supply chain risks. Current global facilities operate at near-maximum capacity (92% utilization), with limited expansion planned before 2026. This creates minimal buffer against demand spikes or production disruptions. The specialized nature of carbide manufacturing equipment means production cannot be easily transferred to alternative facilities during disruptions.

Transportation vulnerabilities have been highlighted by recent global logistics challenges. Carbides require specialized handling due to their hardness and potential reactivity, limiting shipping options. Port congestion and container shortages have extended lead times from 45 to 90+ days in some regions, forcing manufacturers to maintain larger inventories at significant cost.

Regulatory compliance introduces additional complexity, with environmental regulations increasingly targeting energy-intensive carbide production processes. The EU's Carbon Border Adjustment Mechanism and similar policies emerging in North America will likely increase costs for non-compliant suppliers by 2025, potentially eliminating some lower-cost producers from certain markets.

Quality consistency varies significantly among suppliers, with specification deviations causing manufacturing issues. Testing protocols differ globally, complicating direct comparisons between suppliers from different regions and increasing the risk of performance failures in critical applications.

Raw Material Sourcing and Sustainability Considerations

The sourcing of raw materials for carbide production presents significant challenges and opportunities in the evolving landscape of industrial manufacturing. Primary materials such as tungsten, titanium, tantalum, and vanadium are geographically concentrated, with China controlling approximately 80% of global tungsten production, while significant titanium reserves are distributed across Australia, South Africa, and Canada. This concentration creates inherent supply vulnerabilities that manufacturers must strategically address through diversification strategies.

Supply chain resilience has become a critical consideration following recent global disruptions. Leading carbide producers are implementing multi-sourcing approaches, establishing strategic stockpiles, and developing alternative material formulations to mitigate potential shortages. Companies like Kennametal and Sandvik have pioneered vertical integration models, securing priority access to critical raw materials while reducing exposure to market volatility.

Environmental sustainability represents an increasingly important dimension in raw material sourcing decisions. The extraction and processing of carbide precursor materials typically generate substantial carbon emissions and waste products. Industry leaders are responding by implementing closed-loop recycling programs that recover valuable materials from end-of-life carbide products. These initiatives not only reduce environmental impact but also decrease dependency on virgin material extraction.

Regulatory compliance adds another layer of complexity to the sourcing landscape. The EU's Conflict Minerals Regulation and similar frameworks in North America mandate supply chain due diligence for materials originating from conflict-affected regions. Forward-thinking carbide producers are implementing blockchain-based traceability systems to authenticate material origins and ensure ethical sourcing practices throughout their supply networks.

Emerging technologies are transforming sustainability approaches within the industry. Advanced material science is enabling the development of carbide formulations that maintain performance while reducing reliance on scarce elements. Simultaneously, green processing technologies are minimizing the environmental footprint of carbide production through energy-efficient sintering processes and water recycling systems.

The economic implications of sustainable sourcing strategies cannot be overlooked. While implementing responsible sourcing practices typically requires upfront investment, leading manufacturers are recognizing long-term benefits including reduced regulatory risks, enhanced brand reputation, and improved resilience against supply disruptions. Companies that proactively address these considerations are positioning themselves advantageously for the increasingly sustainability-conscious industrial marketplace of 2025 and beyond.

Supply chain resilience has become a critical consideration following recent global disruptions. Leading carbide producers are implementing multi-sourcing approaches, establishing strategic stockpiles, and developing alternative material formulations to mitigate potential shortages. Companies like Kennametal and Sandvik have pioneered vertical integration models, securing priority access to critical raw materials while reducing exposure to market volatility.

Environmental sustainability represents an increasingly important dimension in raw material sourcing decisions. The extraction and processing of carbide precursor materials typically generate substantial carbon emissions and waste products. Industry leaders are responding by implementing closed-loop recycling programs that recover valuable materials from end-of-life carbide products. These initiatives not only reduce environmental impact but also decrease dependency on virgin material extraction.

Regulatory compliance adds another layer of complexity to the sourcing landscape. The EU's Conflict Minerals Regulation and similar frameworks in North America mandate supply chain due diligence for materials originating from conflict-affected regions. Forward-thinking carbide producers are implementing blockchain-based traceability systems to authenticate material origins and ensure ethical sourcing practices throughout their supply networks.

Emerging technologies are transforming sustainability approaches within the industry. Advanced material science is enabling the development of carbide formulations that maintain performance while reducing reliance on scarce elements. Simultaneously, green processing technologies are minimizing the environmental footprint of carbide production through energy-efficient sintering processes and water recycling systems.

The economic implications of sustainable sourcing strategies cannot be overlooked. While implementing responsible sourcing practices typically requires upfront investment, leading manufacturers are recognizing long-term benefits including reduced regulatory risks, enhanced brand reputation, and improved resilience against supply disruptions. Companies that proactively address these considerations are positioning themselves advantageously for the increasingly sustainability-conscious industrial marketplace of 2025 and beyond.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!