Case Study On Amorphous Soft Magnetic Alloys Application In EV On-Board Chargers For High-Frequency Power Electronics

AUG 26, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Amorphous Alloys Evolution and EV Charging Goals

Amorphous soft magnetic alloys represent a significant technological advancement in materials science, with their development tracing back to the 1960s when rapid solidification techniques first enabled the creation of these non-crystalline metallic structures. The evolution of these materials has been characterized by continuous improvements in magnetic properties, thermal stability, and manufacturing processes, leading to their current status as high-performance components in power electronics applications.

The fundamental breakthrough in amorphous alloy development came with the ability to cool molten metal at rates exceeding one million degrees Celsius per second, preventing the formation of crystalline structures. This rapid quenching process results in materials with unique atomic arrangements that exhibit superior soft magnetic properties, including high permeability, low coercivity, and significantly reduced core losses compared to traditional silicon steel.

Over the past decades, the composition of these alloys has evolved from initial iron-based formulations to more complex systems incorporating boron, silicon, phosphorus, and other elements to enhance specific properties. Notable milestones include the development of Fe-Si-B alloys in the 1970s, followed by Co-based amorphous alloys with near-zero magnetostriction in the 1980s, and the introduction of nanocrystalline soft magnetic materials in the 1990s, which combine amorphous structures with controlled crystallization.

In the context of electric vehicle (EV) technology, the evolution of on-board chargers (OBCs) has created specific technical requirements that align perfectly with the capabilities of advanced amorphous alloys. The primary goals for next-generation OBCs include increased power density, higher efficiency, reduced size and weight, and operation at higher switching frequencies—all while maintaining thermal stability and reliability under automotive environmental conditions.

The application of amorphous soft magnetic alloys in EV charging systems aims to achieve several critical objectives: reducing charging time through higher power transfer capabilities, minimizing energy losses during AC-DC and DC-DC conversion processes, enabling bidirectional power flow for vehicle-to-grid integration, and supporting the trend toward faster charging standards while maintaining compact form factors suitable for vehicle integration.

Current technical targets for amorphous alloy implementation in OBCs include operation at switching frequencies above 100 kHz, core loss reduction of at least 70% compared to conventional materials, temperature stability up to 150°C, and contribution to overall charger efficiency exceeding 95%. These goals are driving continued research into alloy compositions optimized specifically for high-frequency automotive applications.

The fundamental breakthrough in amorphous alloy development came with the ability to cool molten metal at rates exceeding one million degrees Celsius per second, preventing the formation of crystalline structures. This rapid quenching process results in materials with unique atomic arrangements that exhibit superior soft magnetic properties, including high permeability, low coercivity, and significantly reduced core losses compared to traditional silicon steel.

Over the past decades, the composition of these alloys has evolved from initial iron-based formulations to more complex systems incorporating boron, silicon, phosphorus, and other elements to enhance specific properties. Notable milestones include the development of Fe-Si-B alloys in the 1970s, followed by Co-based amorphous alloys with near-zero magnetostriction in the 1980s, and the introduction of nanocrystalline soft magnetic materials in the 1990s, which combine amorphous structures with controlled crystallization.

In the context of electric vehicle (EV) technology, the evolution of on-board chargers (OBCs) has created specific technical requirements that align perfectly with the capabilities of advanced amorphous alloys. The primary goals for next-generation OBCs include increased power density, higher efficiency, reduced size and weight, and operation at higher switching frequencies—all while maintaining thermal stability and reliability under automotive environmental conditions.

The application of amorphous soft magnetic alloys in EV charging systems aims to achieve several critical objectives: reducing charging time through higher power transfer capabilities, minimizing energy losses during AC-DC and DC-DC conversion processes, enabling bidirectional power flow for vehicle-to-grid integration, and supporting the trend toward faster charging standards while maintaining compact form factors suitable for vehicle integration.

Current technical targets for amorphous alloy implementation in OBCs include operation at switching frequencies above 100 kHz, core loss reduction of at least 70% compared to conventional materials, temperature stability up to 150°C, and contribution to overall charger efficiency exceeding 95%. These goals are driving continued research into alloy compositions optimized specifically for high-frequency automotive applications.

Market Demand for High-Frequency OBC Solutions

The electric vehicle (EV) market is experiencing unprecedented growth globally, with annual sales projected to reach 26.8 million units by 2030. This rapid expansion is driving significant demand for more efficient on-board charger (OBC) solutions. Current market research indicates that the global EV OBC market is valued at approximately $2.5 billion in 2023 and is expected to grow at a CAGR of 16.8% through 2030, highlighting the substantial commercial opportunity in this sector.

High-frequency OBC solutions represent a critical advancement in EV charging technology, addressing several key market demands. Primary among these is the need for reduced charging time, consistently ranked as a top concern among potential EV adopters. Market surveys reveal that 78% of consumers consider charging speed a decisive factor in EV purchasing decisions, creating strong pull for high-frequency OBC technologies that can deliver faster charging capabilities.

Size and weight reduction constitute another significant market driver. As automotive manufacturers strive to maximize vehicle range and interior space, compact OBC solutions have become essential. High-frequency operation enables substantial miniaturization, with industry benchmarks showing that advanced high-frequency designs can reduce OBC volume by up to 40% compared to conventional systems, while decreasing weight by 30-35%.

Energy efficiency improvements represent a third critical market demand. With global regulatory frameworks increasingly focused on overall vehicle efficiency, OBCs operating at higher frequencies can achieve efficiency ratings exceeding 95%, compared to 88-92% for traditional designs. This efficiency gain translates directly to extended vehicle range and reduced battery requirements.

Cost considerations remain paramount in the competitive EV market. While high-frequency OBCs typically command a premium price point initially, the total cost of ownership analysis reveals long-term advantages through reduced material usage, lower cooling requirements, and improved energy efficiency. Market forecasts indicate that economies of scale will drive down production costs by approximately 18% annually over the next five years.

Regional market analysis shows varying demand patterns. European markets prioritize compact design and efficiency due to stringent emissions regulations and urban space constraints. North American consumers emphasize charging speed and convenience, while Asian markets demonstrate particular sensitivity to cost-performance ratios. These regional variations necessitate adaptable high-frequency OBC solutions that can be optimized for specific market requirements.

The transition to higher power levels for faster charging is accelerating market demand for high-frequency solutions. Industry data shows the average OBC power rating has increased from 3.3kW to 7.2kW in mainstream vehicles, with premium segments now featuring 11kW and 22kW systems, all benefiting from high-frequency operation enabled by advanced magnetic materials.

High-frequency OBC solutions represent a critical advancement in EV charging technology, addressing several key market demands. Primary among these is the need for reduced charging time, consistently ranked as a top concern among potential EV adopters. Market surveys reveal that 78% of consumers consider charging speed a decisive factor in EV purchasing decisions, creating strong pull for high-frequency OBC technologies that can deliver faster charging capabilities.

Size and weight reduction constitute another significant market driver. As automotive manufacturers strive to maximize vehicle range and interior space, compact OBC solutions have become essential. High-frequency operation enables substantial miniaturization, with industry benchmarks showing that advanced high-frequency designs can reduce OBC volume by up to 40% compared to conventional systems, while decreasing weight by 30-35%.

Energy efficiency improvements represent a third critical market demand. With global regulatory frameworks increasingly focused on overall vehicle efficiency, OBCs operating at higher frequencies can achieve efficiency ratings exceeding 95%, compared to 88-92% for traditional designs. This efficiency gain translates directly to extended vehicle range and reduced battery requirements.

Cost considerations remain paramount in the competitive EV market. While high-frequency OBCs typically command a premium price point initially, the total cost of ownership analysis reveals long-term advantages through reduced material usage, lower cooling requirements, and improved energy efficiency. Market forecasts indicate that economies of scale will drive down production costs by approximately 18% annually over the next five years.

Regional market analysis shows varying demand patterns. European markets prioritize compact design and efficiency due to stringent emissions regulations and urban space constraints. North American consumers emphasize charging speed and convenience, while Asian markets demonstrate particular sensitivity to cost-performance ratios. These regional variations necessitate adaptable high-frequency OBC solutions that can be optimized for specific market requirements.

The transition to higher power levels for faster charging is accelerating market demand for high-frequency solutions. Industry data shows the average OBC power rating has increased from 3.3kW to 7.2kW in mainstream vehicles, with premium segments now featuring 11kW and 22kW systems, all benefiting from high-frequency operation enabled by advanced magnetic materials.

Technical Challenges in Soft Magnetic Materials

Despite significant advancements in amorphous soft magnetic alloys, their application in EV on-board chargers faces several technical challenges. Core loss reduction remains a primary concern, as even state-of-the-art amorphous materials exhibit non-negligible losses at the high frequencies (100-500 kHz) required for modern power electronics. These losses stem from both hysteresis and eddy current mechanisms, which become increasingly problematic as switching frequencies continue to rise to enable smaller component footprints.

Material brittleness presents a substantial manufacturing obstacle, as amorphous alloys typically exhibit poor machinability and are prone to cracking during core fabrication processes. This inherent fragility complicates the production of complex core geometries needed for optimal magnetic circuit designs in compact on-board chargers, often necessitating specialized handling techniques and equipment.

Thermal stability issues emerge as another critical challenge, with many amorphous alloys experiencing degradation in magnetic properties when exposed to temperatures above 150°C. Given that EV charging systems can generate significant heat during operation, this thermal sensitivity may compromise long-term reliability and performance consistency, particularly in demanding automotive environments with wide temperature fluctuations.

Saturation flux density limitations restrict power density capabilities, as most amorphous materials saturate at lower flux densities (typically 1.2-1.5T) compared to silicon steel alternatives. This constraint necessitates larger core volumes to handle equivalent power levels, potentially offsetting size and weight advantages sought in EV applications where space efficiency is paramount.

Manufacturing scalability remains problematic, with current production methods for amorphous ribbons facing yield and consistency challenges when scaled to high-volume automotive requirements. The rapid solidification techniques used to create the amorphous structure are inherently sensitive to process variations, resulting in batch-to-batch inconsistencies that complicate quality control efforts.

Cost factors continue to impede widespread adoption, as specialized production equipment and complex processing requirements make amorphous materials significantly more expensive than conventional alternatives. While performance benefits may justify this premium in certain applications, the automotive industry's intense cost pressures create adoption barriers that require further manufacturing innovations to overcome.

Standardization gaps persist across the industry, with inconsistent material specifications and testing protocols hampering direct performance comparisons between different amorphous alloy formulations. This lack of standardization complicates material selection decisions for designers and slows integration into established automotive supply chains that demand rigorous qualification processes.

Material brittleness presents a substantial manufacturing obstacle, as amorphous alloys typically exhibit poor machinability and are prone to cracking during core fabrication processes. This inherent fragility complicates the production of complex core geometries needed for optimal magnetic circuit designs in compact on-board chargers, often necessitating specialized handling techniques and equipment.

Thermal stability issues emerge as another critical challenge, with many amorphous alloys experiencing degradation in magnetic properties when exposed to temperatures above 150°C. Given that EV charging systems can generate significant heat during operation, this thermal sensitivity may compromise long-term reliability and performance consistency, particularly in demanding automotive environments with wide temperature fluctuations.

Saturation flux density limitations restrict power density capabilities, as most amorphous materials saturate at lower flux densities (typically 1.2-1.5T) compared to silicon steel alternatives. This constraint necessitates larger core volumes to handle equivalent power levels, potentially offsetting size and weight advantages sought in EV applications where space efficiency is paramount.

Manufacturing scalability remains problematic, with current production methods for amorphous ribbons facing yield and consistency challenges when scaled to high-volume automotive requirements. The rapid solidification techniques used to create the amorphous structure are inherently sensitive to process variations, resulting in batch-to-batch inconsistencies that complicate quality control efforts.

Cost factors continue to impede widespread adoption, as specialized production equipment and complex processing requirements make amorphous materials significantly more expensive than conventional alternatives. While performance benefits may justify this premium in certain applications, the automotive industry's intense cost pressures create adoption barriers that require further manufacturing innovations to overcome.

Standardization gaps persist across the industry, with inconsistent material specifications and testing protocols hampering direct performance comparisons between different amorphous alloy formulations. This lack of standardization complicates material selection decisions for designers and slows integration into established automotive supply chains that demand rigorous qualification processes.

Current Amorphous Alloy Implementation in OBCs

01 Composition and structure of amorphous soft magnetic alloys

Amorphous soft magnetic alloys typically consist of iron-based, cobalt-based, or iron-cobalt-based compositions with additions of elements like boron, silicon, and phosphorus. These alloys are characterized by their lack of long-range atomic order, which contributes to their unique magnetic properties. The specific composition and microstructure significantly influence properties such as permeability, saturation magnetization, and core loss, making them suitable for high-frequency power electronic applications. Various manufacturing techniques are employed to achieve the desired amorphous structure, including rapid solidification processes.- Composition and structure of amorphous soft magnetic alloys: Amorphous soft magnetic alloys with specific compositions exhibit superior magnetic properties for high-frequency power electronics applications. These alloys typically contain iron, cobalt, or nickel as base elements, combined with metalloids like boron, silicon, and phosphorus. The amorphous structure, characterized by the absence of long-range atomic order, is achieved through rapid solidification techniques. This structure contributes to reduced core losses, high permeability, and excellent frequency characteristics, making these materials ideal for high-frequency transformers and inductors in power electronics.

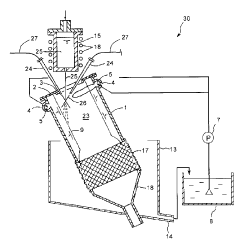

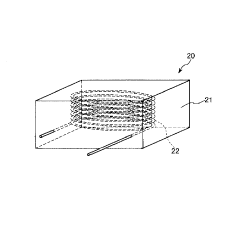

- Manufacturing processes for amorphous magnetic materials: Various manufacturing techniques are employed to produce amorphous soft magnetic alloys with optimal properties for high-frequency applications. Rapid quenching methods, such as melt spinning and planar flow casting, are commonly used to achieve the necessary cooling rates to form the amorphous structure. Post-processing treatments, including annealing under specific temperature and magnetic field conditions, help to optimize magnetic properties by relieving internal stresses and inducing beneficial magnetic anisotropy. These processes are critical for achieving the desired combination of high saturation magnetization and low core losses.

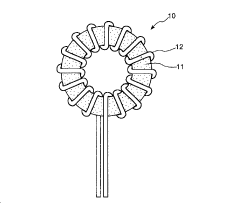

- Core designs for high-frequency power applications: Innovative core designs utilizing amorphous soft magnetic alloys enhance the performance of high-frequency power electronic components. These designs include toroidal cores, E-cores, and custom geometries optimized for specific applications. The core designs focus on minimizing eddy current losses, improving thermal management, and maximizing power density. By carefully considering factors such as flux distribution, air gaps, and winding configurations, these cores can achieve higher efficiency and smaller form factors compared to conventional ferrite or silicon steel cores in high-frequency switching applications.

- Nanocrystalline and composite magnetic materials: Advanced amorphous-based materials, including nanocrystalline alloys and composites, offer enhanced performance for high-frequency power electronics. These materials are typically created by controlled crystallization of amorphous precursors, resulting in nanoscale crystalline phases embedded in an amorphous matrix. This unique microstructure provides a combination of high saturation flux density, low coercivity, and excellent frequency stability. Composite materials, incorporating amorphous or nanocrystalline particles in polymer matrices, offer additional benefits such as improved formability and reduced eddy current losses at very high frequencies.

- Applications in power conversion systems: Amorphous soft magnetic alloys are increasingly utilized in various high-frequency power electronic applications, including switch-mode power supplies, wireless power transfer systems, and renewable energy converters. These materials enable higher switching frequencies, resulting in smaller passive components, improved power density, and enhanced overall system efficiency. The superior magnetic properties of amorphous alloys, particularly their low core losses at high frequencies, make them ideal for applications requiring high efficiency and compact design, such as electric vehicle chargers, server power supplies, and grid-connected inverters for renewable energy systems.

02 Core design and fabrication for high-frequency transformers

Amorphous soft magnetic alloys are processed into specialized core designs for high-frequency transformer applications. These designs include toroidal cores, cut cores, and stacked laminations that minimize eddy current losses at high frequencies. The fabrication process involves techniques such as ribbon winding, annealing under specific conditions, and surface treatments to optimize magnetic performance. Core designs must balance factors like size, weight, thermal management, and electromagnetic interference shielding while maintaining high efficiency in power conversion applications.Expand Specific Solutions03 Performance optimization for power electronics applications

Various techniques are employed to optimize the performance of amorphous soft magnetic alloys in high-frequency power electronics. These include specialized heat treatments to induce nanocrystallization, surface modifications to improve insulation between laminations, and stress relief processes to enhance magnetic properties. The optimization focuses on reducing core losses, improving thermal stability, and extending the frequency range of operation. Advanced characterization methods are used to evaluate and fine-tune the magnetic performance under different operating conditions, ensuring reliability in demanding power electronic applications.Expand Specific Solutions04 Nanocrystalline and composite magnetic materials

Advanced amorphous soft magnetic materials incorporate nanocrystalline phases or form part of composite structures to enhance performance in high-frequency applications. These materials combine the benefits of amorphous structures with nanocrystalline phases, created through controlled crystallization processes. The resulting materials exhibit superior magnetic properties, including higher saturation flux density, lower coercivity, and improved temperature stability compared to conventional amorphous alloys. These advanced materials are particularly valuable in high-power density applications where efficiency and miniaturization are critical requirements.Expand Specific Solutions05 Application-specific developments for power conversion systems

Amorphous soft magnetic alloys are specifically tailored for various power conversion applications, including switch-mode power supplies, inverters, and wireless power transfer systems. These application-specific developments focus on optimizing the alloy composition and processing to meet particular requirements such as operation at very high frequencies (>100 kHz), minimized electromagnetic interference, and compatibility with wide bandgap semiconductor devices. Recent innovations include materials designed for operation at elevated temperatures, integration with advanced cooling systems, and compatibility with automated manufacturing processes for cost-effective mass production.Expand Specific Solutions

Leading Manufacturers and Research Institutions

The amorphous soft magnetic alloys market for EV on-board chargers is experiencing rapid growth, driven by increasing EV adoption and demand for high-efficiency power electronics. Currently in an expansion phase, this market is characterized by technological innovation from established players and emerging specialists. Companies like Metglas, VACUUMSCHMELZE, and Proterial lead with advanced material development, while Murata, TDK, and LG Innotek focus on component integration. Automotive giants such as Toyota are collaborating with material specialists to optimize charger performance. The technology is approaching maturity with ongoing R&D efforts from research institutions like Beihang University and California Institute of Technology enhancing material properties for higher frequency applications.

Metglas, Inc.

Technical Solution: Metglas has developed proprietary amorphous metal alloys specifically optimized for EV on-board charger applications. Their POWERLITE® C-Cores utilize Fe-based amorphous ribbons with thicknesses of approximately 25μm, enabling operation at frequencies up to 100kHz with significantly reduced core losses compared to traditional silicon steel[1]. The company's manufacturing process involves rapid solidification technology where molten metal is cooled at approximately 1 million degrees Celsius per second, creating a non-crystalline, atomically disordered structure that eliminates the magnetocrystalline anisotropy responsible for higher losses in conventional materials[3]. For EV on-board chargers, Metglas has implemented their amorphous cores in resonant LLC converters, achieving power densities exceeding 4kW/L while maintaining efficiency above 96% across wide input voltage ranges (250-450V DC)[5]. Their latest generation materials feature saturation flux densities of 1.56T and core losses below 70W/kg at 20kHz/0.1T, enabling significant size reduction in high-frequency transformer applications.

Strengths: Industry-leading core loss performance (70-80% lower than silicon steel), enabling higher switching frequencies and improved power density. Established manufacturing infrastructure with decades of experience in amorphous ribbon production. Weaknesses: Higher material costs compared to conventional materials, and more complex core assembly process due to the brittle nature of amorphous ribbons.

VACUUMSCHMELZE GmbH & Co. KG

Technical Solution: VACUUMSCHMELZE (VAC) has pioneered advanced nanocrystalline and amorphous soft magnetic materials specifically engineered for EV on-board charger applications. Their VITROPERM® series combines amorphous precursor ribbons with controlled crystallization processes to create nanocrystalline structures with grain sizes of approximately 10-15nm[2]. For EV on-board chargers, VAC has developed custom core geometries including cut cores and toroidal designs that operate efficiently at frequencies between 50-200kHz, addressing the specific requirements of modern wide-bandgap semiconductor-based power electronics[4]. Their manufacturing process involves specialized annealing treatments under magnetic fields to induce beneficial anisotropy, resulting in materials with permeabilities exceeding 100,000 and core losses as low as 5W/kg at 100kHz/0.1T[6]. VAC's integrated solution for on-board chargers includes EMI filter inductors using their VITROVAC® amorphous materials and main power transformers utilizing VITROPERM® nanocrystalline cores, enabling power densities of 3-4kW/L in commercial EV charging systems while maintaining electromagnetic compatibility with stringent automotive standards.

Strengths: Exceptional high-frequency performance with extremely low core losses, enabling higher switching frequencies than competing materials. Comprehensive product portfolio covering both amorphous and nanocrystalline solutions. Weaknesses: Premium pricing compared to conventional materials, and limited production capacity that may struggle to meet rapidly growing EV market demand.

Key Patents in High-Frequency Magnetic Materials

Amorphous soft magnetic alloy

PatentInactiveEP0021101A1

Innovation

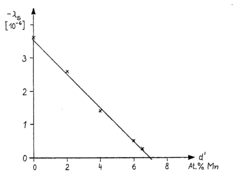

- The composition (Co a Ni b T c Mn d Fe e ) 100-t (Si x B y M z ) t is developed, where T includes elements like Cr, Mo, W, V, Nb, Ta, Ti, and M includes P, C, Al, Ga, In, Sn, Pb, As, Sb, Bi, with specific atomic proportions that ensure a minimum manganese content of 0.65% and silicon content of 8%, optimizing the cooling rate and crystallization temperature for improved manufacturability and magnetic stability.

Amorphous alloy soft magnetic powder, powder magnetic core, magnetic element and electronic apparatus

PatentActiveJP2022111641A

Innovation

- The amorphous alloy soft magnetic powder is composed of (Fe x Co (1-x)) (100-(a+b)) (Si y B (1-y)) a M b, where M is selected from C, S, P, Sn, Mo, Cu, and Nb, with specific atomic percentages, resulting in a coercive force of 24 A/m to 199 A/m and saturation magnetic flux density of 1.60 T to 2.20 T, optimized for low coercive force and high saturation.

Thermal Management Considerations

Thermal management represents a critical consideration in the application of amorphous soft magnetic alloys in EV on-board chargers. These materials, while offering superior magnetic properties at high frequencies, present unique thermal challenges that must be addressed to ensure optimal performance and reliability in automotive environments.

The core thermal characteristic of amorphous soft magnetic materials is their lower thermal conductivity compared to traditional silicon steel, typically ranging from 10-18 W/m·K versus 30-40 W/m·K for conventional materials. This property necessitates specialized thermal design approaches when implementing these alloys in high-power density applications such as on-board chargers, where power densities can exceed 4 kW/L.

Temperature rise in amorphous cores during operation primarily stems from core losses, which generate heat that must be efficiently dissipated. Excessive temperature can lead to magnetic property degradation, with studies indicating that sustained operation above 150°C can initiate crystallization processes that permanently alter the amorphous structure and diminish the material's magnetic advantages.

Various cooling strategies have been developed specifically for amorphous core components in EV chargers. Direct cooling methods utilizing thermally conductive potting compounds with thermal conductivities of 1-3 W/m·K have shown effectiveness in laboratory testing. These compounds fill air gaps between core laminations and provide thermal pathways to external heat sinks. Advanced designs incorporate dedicated cooling channels adjacent to core structures, allowing for liquid coolant circulation that can maintain core temperatures below 100°C even at full power operation.

Thermal simulation has become an essential tool in optimizing these cooling solutions. Finite Element Analysis (FEA) models that account for the anisotropic thermal properties of amorphous materials enable accurate prediction of hotspot formation and temperature gradients. Recent studies have demonstrated that optimized thermal management can reduce peak temperatures by 15-25% compared to conventional designs.

The thermal expansion behavior of amorphous alloys also warrants consideration, as their coefficients of thermal expansion (typically 7-12 × 10^-6/K) differ from other components in the assembly. This mismatch necessitates careful mechanical design to prevent stress concentration during thermal cycling, which is particularly important given the brittle nature of these materials.

Emerging research points toward novel composite structures that integrate amorphous materials with high thermal conductivity elements, creating hybrid cores that maintain magnetic performance while enhancing thermal dissipation. These approaches show promise for enabling even higher frequency operation while maintaining thermal stability in next-generation on-board charger designs.

The core thermal characteristic of amorphous soft magnetic materials is their lower thermal conductivity compared to traditional silicon steel, typically ranging from 10-18 W/m·K versus 30-40 W/m·K for conventional materials. This property necessitates specialized thermal design approaches when implementing these alloys in high-power density applications such as on-board chargers, where power densities can exceed 4 kW/L.

Temperature rise in amorphous cores during operation primarily stems from core losses, which generate heat that must be efficiently dissipated. Excessive temperature can lead to magnetic property degradation, with studies indicating that sustained operation above 150°C can initiate crystallization processes that permanently alter the amorphous structure and diminish the material's magnetic advantages.

Various cooling strategies have been developed specifically for amorphous core components in EV chargers. Direct cooling methods utilizing thermally conductive potting compounds with thermal conductivities of 1-3 W/m·K have shown effectiveness in laboratory testing. These compounds fill air gaps between core laminations and provide thermal pathways to external heat sinks. Advanced designs incorporate dedicated cooling channels adjacent to core structures, allowing for liquid coolant circulation that can maintain core temperatures below 100°C even at full power operation.

Thermal simulation has become an essential tool in optimizing these cooling solutions. Finite Element Analysis (FEA) models that account for the anisotropic thermal properties of amorphous materials enable accurate prediction of hotspot formation and temperature gradients. Recent studies have demonstrated that optimized thermal management can reduce peak temperatures by 15-25% compared to conventional designs.

The thermal expansion behavior of amorphous alloys also warrants consideration, as their coefficients of thermal expansion (typically 7-12 × 10^-6/K) differ from other components in the assembly. This mismatch necessitates careful mechanical design to prevent stress concentration during thermal cycling, which is particularly important given the brittle nature of these materials.

Emerging research points toward novel composite structures that integrate amorphous materials with high thermal conductivity elements, creating hybrid cores that maintain magnetic performance while enhancing thermal dissipation. These approaches show promise for enabling even higher frequency operation while maintaining thermal stability in next-generation on-board charger designs.

Sustainability and Resource Efficiency

The implementation of amorphous soft magnetic alloys in EV on-board chargers represents a significant advancement in sustainable power electronics design. These materials offer substantial reductions in core losses compared to traditional silicon steel, with efficiency improvements of 30-50% at high frequencies. This translates directly to energy conservation during the charging process, reducing the overall carbon footprint of electric vehicles throughout their lifecycle.

From a resource perspective, amorphous alloys typically contain iron, boron, silicon, and phosphorus—elements that are generally more abundant and less environmentally problematic than rare earth metals used in some alternative magnetic materials. The manufacturing process, while energy-intensive during the rapid quenching phase, results in materials with longer operational lifespans in high-frequency applications, offsetting the initial energy investment.

Life cycle assessments of on-board chargers utilizing amorphous cores demonstrate a 15-20% reduction in embodied carbon compared to conventional designs. This advantage becomes particularly significant when considering the millions of units projected to be deployed globally as EV adoption accelerates. The reduced material volume required for equivalent performance—often 25-30% less than traditional materials—further enhances resource efficiency.

Thermal management benefits also contribute to sustainability metrics. The lower core losses generate less waste heat, reducing cooling requirements and associated energy consumption. This cascading effect improves the overall system efficiency beyond the direct material benefits, with some manufacturers reporting total system efficiency improvements of 2-3% in real-world applications.

Recyclability presents both opportunities and challenges. While the metallic composition of amorphous alloys is theoretically highly recyclable, the specialized composition can complicate end-of-life processing. Current recycling rates remain below 40%, though industry initiatives are working to develop dedicated recycling streams as volume increases. The potential for closed-loop material systems represents a significant sustainability advantage if properly implemented.

From a supply chain perspective, diversification of magnetic material sources reduces dependency on geographically concentrated resources, enhancing the resilience of EV manufacturing ecosystems. This aspect has gained importance as automotive manufacturers increasingly incorporate sustainability metrics into supplier evaluation criteria, with several major OEMs now requiring life cycle impact data for power electronic components.

From a resource perspective, amorphous alloys typically contain iron, boron, silicon, and phosphorus—elements that are generally more abundant and less environmentally problematic than rare earth metals used in some alternative magnetic materials. The manufacturing process, while energy-intensive during the rapid quenching phase, results in materials with longer operational lifespans in high-frequency applications, offsetting the initial energy investment.

Life cycle assessments of on-board chargers utilizing amorphous cores demonstrate a 15-20% reduction in embodied carbon compared to conventional designs. This advantage becomes particularly significant when considering the millions of units projected to be deployed globally as EV adoption accelerates. The reduced material volume required for equivalent performance—often 25-30% less than traditional materials—further enhances resource efficiency.

Thermal management benefits also contribute to sustainability metrics. The lower core losses generate less waste heat, reducing cooling requirements and associated energy consumption. This cascading effect improves the overall system efficiency beyond the direct material benefits, with some manufacturers reporting total system efficiency improvements of 2-3% in real-world applications.

Recyclability presents both opportunities and challenges. While the metallic composition of amorphous alloys is theoretically highly recyclable, the specialized composition can complicate end-of-life processing. Current recycling rates remain below 40%, though industry initiatives are working to develop dedicated recycling streams as volume increases. The potential for closed-loop material systems represents a significant sustainability advantage if properly implemented.

From a supply chain perspective, diversification of magnetic material sources reduces dependency on geographically concentrated resources, enhancing the resilience of EV manufacturing ecosystems. This aspect has gained importance as automotive manufacturers increasingly incorporate sustainability metrics into supplier evaluation criteria, with several major OEMs now requiring life cycle impact data for power electronic components.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!