Material Cost Versus Performance Trade-Off Analysis For Amorphous Soft Magnetic Alloys In High-Frequency Power Electronics

AUG 26, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Amorphous Alloys Background and Performance Objectives

Amorphous soft magnetic alloys emerged in the 1970s when researchers at Allied Signal (now Honeywell) discovered that rapid solidification techniques could produce metallic glasses with unique magnetic properties. These materials, primarily composed of iron, boron, silicon, and other elements, exhibit a disordered atomic structure that fundamentally differentiates them from traditional crystalline magnetic materials. This structural characteristic enables amorphous alloys to demonstrate superior soft magnetic properties, including high permeability, low coercivity, and significantly reduced core losses.

The evolution of amorphous magnetic materials has been driven by increasing demands for energy efficiency in power electronics. Early applications focused on distribution transformers, where their reduced core losses translated to substantial energy savings. Over the past two decades, these materials have gained attention in high-frequency applications as switching frequencies in power electronics have steadily increased to reduce size and improve efficiency.

Current technological trends point toward the integration of wide-bandgap semiconductors (SiC, GaN) in power electronics, which operate efficiently at frequencies exceeding 100 kHz. This shift has intensified the need for magnetic materials capable of maintaining performance at these elevated frequencies while managing thermal challenges and minimizing losses.

The primary performance objectives for amorphous soft magnetic alloys in high-frequency power electronics include achieving saturation flux densities above 1.2 T to enable compact designs, maintaining permeability values above 10,000 across operating frequency ranges, and limiting core losses to less than 100 W/kg at 100 kHz and 0.1 T. Additionally, these materials must demonstrate thermal stability up to 150°C to accommodate the operating conditions of modern power electronic systems.

Cost considerations have become increasingly critical as these materials transition from niche applications to mainstream power electronics. The manufacturing processes for amorphous alloys, particularly the rapid quenching techniques required to achieve the amorphous structure, contribute significantly to their higher cost compared to traditional silicon steel. The industry aims to reduce production costs by 30-40% while maintaining or improving performance metrics.

The technical trajectory for these materials involves developing compositions that optimize the balance between magnetic performance and material cost. This includes exploring alternative element combinations that reduce dependency on expensive components like cobalt while maintaining essential magnetic characteristics. Concurrently, innovations in processing techniques aim to increase production efficiency and yield, directly addressing manufacturing cost challenges.

The evolution of amorphous magnetic materials has been driven by increasing demands for energy efficiency in power electronics. Early applications focused on distribution transformers, where their reduced core losses translated to substantial energy savings. Over the past two decades, these materials have gained attention in high-frequency applications as switching frequencies in power electronics have steadily increased to reduce size and improve efficiency.

Current technological trends point toward the integration of wide-bandgap semiconductors (SiC, GaN) in power electronics, which operate efficiently at frequencies exceeding 100 kHz. This shift has intensified the need for magnetic materials capable of maintaining performance at these elevated frequencies while managing thermal challenges and minimizing losses.

The primary performance objectives for amorphous soft magnetic alloys in high-frequency power electronics include achieving saturation flux densities above 1.2 T to enable compact designs, maintaining permeability values above 10,000 across operating frequency ranges, and limiting core losses to less than 100 W/kg at 100 kHz and 0.1 T. Additionally, these materials must demonstrate thermal stability up to 150°C to accommodate the operating conditions of modern power electronic systems.

Cost considerations have become increasingly critical as these materials transition from niche applications to mainstream power electronics. The manufacturing processes for amorphous alloys, particularly the rapid quenching techniques required to achieve the amorphous structure, contribute significantly to their higher cost compared to traditional silicon steel. The industry aims to reduce production costs by 30-40% while maintaining or improving performance metrics.

The technical trajectory for these materials involves developing compositions that optimize the balance between magnetic performance and material cost. This includes exploring alternative element combinations that reduce dependency on expensive components like cobalt while maintaining essential magnetic characteristics. Concurrently, innovations in processing techniques aim to increase production efficiency and yield, directly addressing manufacturing cost challenges.

Market Analysis for High-Frequency Power Electronics Materials

The global market for high-frequency power electronics materials is experiencing robust growth, driven by increasing demand for energy-efficient power conversion systems across multiple industries. The market value for soft magnetic materials used in power electronics reached approximately $2.1 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 8.3% through 2028, potentially reaching $3.4 billion by the end of the forecast period.

Amorphous soft magnetic alloys represent a significant segment within this market, accounting for roughly 18% of the total market share. This segment is expected to grow faster than the overall market at a CAGR of 10.2% due to the superior performance characteristics these materials offer for high-frequency applications.

The demand for amorphous soft magnetic alloys is particularly strong in renewable energy systems, electric vehicles, and advanced power grid infrastructure. The electric vehicle segment alone is expected to consume over 12,000 tons of these materials annually by 2025, representing a market value of approximately $320 million.

Regional analysis indicates that Asia-Pacific dominates the market with 45% share, followed by North America (28%) and Europe (22%). China leads manufacturing capacity, while Japan maintains technological leadership in high-performance amorphous alloy development. The United States and Germany are focusing on specialized applications requiring premium performance characteristics.

Price sensitivity varies significantly by application sector. Consumer electronics manufacturers prioritize cost optimization, while aerospace and medical device manufacturers are willing to pay premium prices for materials offering exceptional reliability and performance. The average price point for standard-grade amorphous alloys ranges from $15-25 per kilogram, while specialized high-performance variants command $40-60 per kilogram.

Key market drivers include the global push for energy efficiency, miniaturization of power electronic components, and increasing switching frequencies in modern power conversion systems. Regulatory frameworks promoting energy efficiency, particularly in Europe and North America, are accelerating adoption of advanced magnetic materials despite their higher initial costs.

Market challenges include supply chain vulnerabilities for critical raw materials like cobalt and rare earth elements, price volatility, and competition from alternative technologies such as GaN and SiC semiconductors that may reduce reliance on magnetic components in certain applications.

Amorphous soft magnetic alloys represent a significant segment within this market, accounting for roughly 18% of the total market share. This segment is expected to grow faster than the overall market at a CAGR of 10.2% due to the superior performance characteristics these materials offer for high-frequency applications.

The demand for amorphous soft magnetic alloys is particularly strong in renewable energy systems, electric vehicles, and advanced power grid infrastructure. The electric vehicle segment alone is expected to consume over 12,000 tons of these materials annually by 2025, representing a market value of approximately $320 million.

Regional analysis indicates that Asia-Pacific dominates the market with 45% share, followed by North America (28%) and Europe (22%). China leads manufacturing capacity, while Japan maintains technological leadership in high-performance amorphous alloy development. The United States and Germany are focusing on specialized applications requiring premium performance characteristics.

Price sensitivity varies significantly by application sector. Consumer electronics manufacturers prioritize cost optimization, while aerospace and medical device manufacturers are willing to pay premium prices for materials offering exceptional reliability and performance. The average price point for standard-grade amorphous alloys ranges from $15-25 per kilogram, while specialized high-performance variants command $40-60 per kilogram.

Key market drivers include the global push for energy efficiency, miniaturization of power electronic components, and increasing switching frequencies in modern power conversion systems. Regulatory frameworks promoting energy efficiency, particularly in Europe and North America, are accelerating adoption of advanced magnetic materials despite their higher initial costs.

Market challenges include supply chain vulnerabilities for critical raw materials like cobalt and rare earth elements, price volatility, and competition from alternative technologies such as GaN and SiC semiconductors that may reduce reliance on magnetic components in certain applications.

Current Limitations and Technical Challenges in Soft Magnetic Alloys

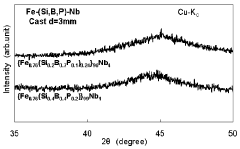

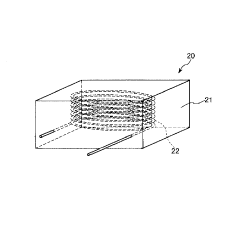

Despite significant advancements in amorphous soft magnetic alloys for high-frequency power electronics, several critical limitations and technical challenges persist. The manufacturing process of these materials, particularly rapid solidification techniques, remains complex and difficult to scale. The requirement for extremely high cooling rates (106 K/s) to achieve the amorphous structure limits production capabilities, resulting in thickness constraints typically below 50 μm for ribbons and 100 μm for bulk materials.

Material brittleness presents another significant challenge, as amorphous alloys exhibit inherently low ductility compared to crystalline counterparts. This mechanical limitation complicates processing steps such as punching, cutting, and core assembly, often necessitating specialized handling equipment and increasing manufacturing costs.

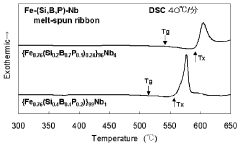

Thermal stability issues also plague these materials, with many amorphous alloys beginning to crystallize at temperatures between 400-600°C. This relatively low crystallization temperature restricts their application in high-temperature environments and complicates processing steps requiring elevated temperatures, such as certain coating or integration processes.

Magnetic saturation limitations represent a fundamental physical constraint, with Fe-based amorphous alloys typically achieving saturation flux densities of 1.5-1.7 T, lower than conventional silicon steel (around 2.0 T). This necessitates larger core sizes to achieve equivalent power handling capabilities, offsetting some of the efficiency advantages.

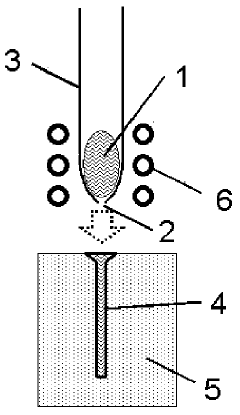

Cost factors remain a persistent barrier to widespread adoption. The specialized production equipment, precise process control requirements, and relatively low production volumes contribute to higher material costs compared to conventional magnetic materials. Current production methods for amorphous ribbons using techniques like melt spinning involve significant energy consumption and yield issues.

Compositional optimization presents ongoing challenges in balancing competing properties. Enhancing one characteristic (such as permeability) often comes at the expense of others (like saturation magnetization or Curie temperature), requiring careful material engineering and often application-specific formulations.

Integration challenges with existing manufacturing processes further complicate adoption. The unique physical properties of amorphous alloys often require modifications to established assembly techniques, particularly in automated production environments designed for traditional magnetic materials.

Material brittleness presents another significant challenge, as amorphous alloys exhibit inherently low ductility compared to crystalline counterparts. This mechanical limitation complicates processing steps such as punching, cutting, and core assembly, often necessitating specialized handling equipment and increasing manufacturing costs.

Thermal stability issues also plague these materials, with many amorphous alloys beginning to crystallize at temperatures between 400-600°C. This relatively low crystallization temperature restricts their application in high-temperature environments and complicates processing steps requiring elevated temperatures, such as certain coating or integration processes.

Magnetic saturation limitations represent a fundamental physical constraint, with Fe-based amorphous alloys typically achieving saturation flux densities of 1.5-1.7 T, lower than conventional silicon steel (around 2.0 T). This necessitates larger core sizes to achieve equivalent power handling capabilities, offsetting some of the efficiency advantages.

Cost factors remain a persistent barrier to widespread adoption. The specialized production equipment, precise process control requirements, and relatively low production volumes contribute to higher material costs compared to conventional magnetic materials. Current production methods for amorphous ribbons using techniques like melt spinning involve significant energy consumption and yield issues.

Compositional optimization presents ongoing challenges in balancing competing properties. Enhancing one characteristic (such as permeability) often comes at the expense of others (like saturation magnetization or Curie temperature), requiring careful material engineering and often application-specific formulations.

Integration challenges with existing manufacturing processes further complicate adoption. The unique physical properties of amorphous alloys often require modifications to established assembly techniques, particularly in automated production environments designed for traditional magnetic materials.

Cost-Performance Analysis of Current Amorphous Alloy Solutions

01 Composition optimization for cost-performance balance

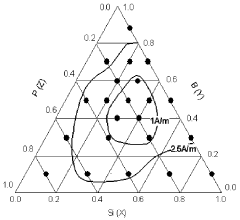

Amorphous soft magnetic alloys can be optimized by adjusting their chemical composition to achieve a balance between cost and performance. By reducing expensive elements like cobalt and substituting them with more economical alternatives such as iron, nickel, or manganese, manufacturers can lower production costs while maintaining acceptable magnetic properties. The careful selection of composition ratios helps in achieving desired saturation magnetization, permeability, and coercivity at reduced costs.- Composition optimization for cost-performance balance: Amorphous soft magnetic alloys can be optimized by carefully selecting their composition to balance cost and performance. By adjusting the ratios of expensive elements (like Co, Nb) with more economical ones (like Fe, Si), manufacturers can achieve acceptable magnetic properties at lower costs. Some formulations replace costly rare earth elements with more abundant metals while maintaining core magnetic characteristics, enabling cost-effective production without significant performance degradation.

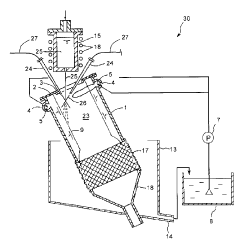

- Processing techniques affecting cost-performance ratio: Various processing techniques can significantly impact the cost-performance trade-off in amorphous soft magnetic alloys. Methods such as rapid solidification, controlled annealing, and precision heat treatment can enhance magnetic properties without adding expensive elements. Advanced manufacturing processes like melt spinning and controlled cooling rates can produce alloys with superior performance characteristics while keeping production costs manageable, offering an optimal balance between manufacturing expenses and magnetic performance.

- Nanocrystalline structure development for enhanced performance: Developing nanocrystalline structures within amorphous soft magnetic alloys provides a pathway to enhance performance without proportional cost increases. By controlling the partial crystallization of amorphous materials, manufacturers can achieve improved magnetic permeability and reduced core losses. This approach allows for the use of less expensive base compositions while achieving performance characteristics that approach those of more costly fully amorphous alloys, representing an effective cost-performance optimization strategy.

- Application-specific alloy formulations: Tailoring amorphous soft magnetic alloys for specific applications offers an effective approach to optimize the cost-performance trade-off. Rather than using premium alloys universally, manufacturers can design compositions that prioritize only the essential properties needed for particular applications. For high-frequency applications, formulations may emphasize low core losses, while power distribution applications might prioritize high saturation flux density, allowing for cost optimization based on actual performance requirements rather than maximizing all properties.

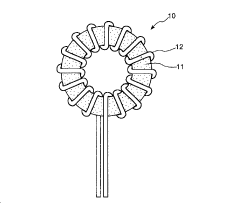

- Multilayer and composite structures: Developing multilayer or composite structures that combine amorphous soft magnetic alloys with other materials offers an innovative approach to the cost-performance trade-off. By creating laminated structures with thin layers of premium amorphous materials bonded to less expensive magnetic or non-magnetic substrates, manufacturers can achieve enhanced performance in specific directions or frequencies while reducing overall material costs. These composite approaches allow for strategic placement of high-performance materials only where they deliver the greatest benefit.

02 Processing techniques affecting cost-efficiency

Various processing techniques can significantly impact the cost-performance ratio of amorphous soft magnetic alloys. Rapid solidification methods like melt spinning can be optimized to reduce energy consumption while maintaining the amorphous structure. Heat treatment processes can be fine-tuned to enhance magnetic properties without requiring expensive equipment. Additionally, innovative casting and annealing techniques can reduce material waste and processing time, leading to more cost-effective production while preserving essential magnetic characteristics.Expand Specific Solutions03 Nanocrystalline structure for enhanced performance

Introducing controlled nanocrystallization in amorphous soft magnetic alloys can significantly improve their magnetic performance without substantial cost increases. By applying specific heat treatments to amorphous precursors, a nanocrystalline structure can be developed that exhibits superior soft magnetic properties including higher saturation flux density and lower core losses. This approach allows manufacturers to achieve enhanced performance characteristics while using relatively economical base compositions, thus offering an advantageous cost-performance trade-off.Expand Specific Solutions04 Application-specific alloy design

Designing amorphous soft magnetic alloys for specific applications can optimize the cost-performance trade-off. Rather than creating universal alloys with unnecessarily high specifications, tailoring the composition and processing for particular use cases allows manufacturers to meet required performance parameters without excessive costs. For high-frequency applications, alloys can be optimized for low core losses, while power distribution applications might prioritize high saturation flux density, each with different cost implications and material requirements.Expand Specific Solutions05 Manufacturing scale and production efficiency

The scale of manufacturing and production efficiency significantly impacts the cost-performance trade-off for amorphous soft magnetic alloys. Large-scale production can reduce per-unit costs through economies of scale, while improved ribbon casting techniques can increase yield and quality consistency. Innovations in continuous processing methods and quality control systems help minimize defects and waste, allowing manufacturers to produce high-performance alloys at competitive prices. Optimizing these manufacturing parameters enables better balancing of material costs against magnetic performance.Expand Specific Solutions

Leading Manufacturers and Research Institutions in Magnetic Alloys

The amorphous soft magnetic alloys market for high-frequency power electronics is currently in a growth phase, with increasing adoption driven by energy efficiency demands. The global market size is expanding rapidly, estimated to reach several billion dollars by 2025, fueled by applications in renewable energy and electric vehicles. Technologically, the field shows varying maturity levels across players. Leading companies like VACUUMSCHMELZE, TDK Corp., and Hitachi Metals (now Proterial Ltd.) demonstrate advanced capabilities with established product lines, while emerging players such as Qingdao Yunlu and Advanced Technology & Materials Co. are rapidly developing competitive offerings. Research institutions including Tohoku University and Beihang University are driving fundamental innovations, collaborating with industrial partners to overcome the critical material cost versus performance trade-offs that currently limit wider market penetration.

Qingdao Yunlu Advanced Materials Technology Co., Ltd.

Technical Solution: Qingdao Yunlu has developed a comprehensive range of amorphous and nanocrystalline soft magnetic alloys specifically engineered for cost-effective high-frequency power electronics applications. Their technology focuses on Fe-based amorphous compositions with optimized Si, B, and P content to achieve excellent magnetic properties while using more affordable raw materials. Yunlu employs a proprietary rapid quenching process that produces amorphous ribbons with thicknesses ranging from 15-30μm, carefully controlled to balance performance with manufacturing yield. Their cost-performance optimization strategy includes developing specialized Fe78Si9B13 and Fe73.5Si13.5B9Cu1Nb3 compositions that minimize the use of expensive elements while maintaining essential magnetic characteristics. Yunlu has also implemented innovative annealing processes that create optimized domain structures without requiring expensive equipment. Their materials achieve saturation flux densities of 1.2-1.56T while maintaining core losses below 250W/kg at 20kHz and 0.2T. Additionally, Yunlu has developed cost-effective surface treatments that improve the ribbons' stacking factor and corrosion resistance, enhancing long-term reliability in various operating environments.

Strengths: Highly competitive pricing compared to Japanese and European alternatives while maintaining good performance metrics. Flexible manufacturing capabilities allow for customized solutions for specific applications. Weaknesses: Somewhat less consistent quality control compared to industry leaders. Limited technical support and application engineering resources compared to larger multinational corporations.

NIPPON STEEL CORP.

Technical Solution: Nippon Steel has developed proprietary amorphous and nanocrystalline soft magnetic alloys specifically designed for high-frequency power electronics applications. Their technology centers on Fe-Si-B-Cu-Nb compositions with precisely controlled trace elements to optimize magnetic properties while managing raw material costs. Nippon Steel employs a sophisticated single-roll rapid quenching process that produces ultra-thin amorphous ribbons (typically 18-25μm), which are essential for minimizing eddy current losses at high frequencies. Their manufacturing approach includes proprietary heat treatment protocols that create optimized nanocrystalline structures with grain sizes below 15nm, resulting in excellent soft magnetic properties. Nippon Steel's cost-performance optimization includes strategic substitution of certain expensive elements while maintaining key performance metrics. Their latest materials achieve saturation flux densities of approximately 1.2T while keeping core losses below 150W/kg at 20kHz and 0.2T. Additionally, they've developed specialized surface treatments that improve the ribbons' stacking factor and reduce interlaminar losses, further enhancing performance in high-frequency applications.

Strengths: Exceptional balance between cost and performance, with materials optimized for specific frequency ranges. Advanced manufacturing capabilities allow for consistent quality and reliable supply chain. Weaknesses: Higher initial investment costs compared to conventional materials. Limited flexibility in core shapes due to the inherent brittleness of amorphous ribbons.

Key Patents and Breakthroughs in Amorphous Alloy Formulations

Soft magnetic amorphous alloy

PatentWO2009037824A1

Innovation

- A soft magnetic amorphous alloy composition {Fea(SixByPz)1-a}100-bLb is developed, where L is one or more elements selected from Al, Cr, Zr, Nb, Mo, Hf, Ta, and W, with specific atomic percentage ranges for a, b, x, y, and z, enhancing amorphous formability, saturation magnetic flux density, and corrosion resistance.

Amorphous alloy soft magnetic powder, powder magnetic core, magnetic element and electronic apparatus

PatentActiveJP2022111641A

Innovation

- The amorphous alloy soft magnetic powder is composed of (Fe x Co (1-x)) (100-(a+b)) (Si y B (1-y)) a M b, where M is selected from C, S, P, Sn, Mo, Cu, and Nb, with specific atomic percentages, resulting in a coercive force of 24 A/m to 199 A/m and saturation magnetic flux density of 1.60 T to 2.20 T, optimized for low coercive force and high saturation.

Supply Chain Considerations for Rare Earth Elements

The supply chain for rare earth elements represents a critical factor in the production and cost structure of amorphous soft magnetic alloys used in high-frequency power electronics. While these alloys typically contain minimal or no rare earth elements compared to other magnetic materials, the broader supply chain considerations remain relevant due to interconnected material markets and manufacturing dependencies.

Global rare earth element production is heavily concentrated, with China dominating approximately 85% of the world's supply. This geographic concentration creates inherent supply vulnerabilities for manufacturers of advanced magnetic materials, including those producing amorphous soft magnetic alloys. Recent geopolitical tensions have highlighted the strategic importance of these elements, prompting price volatility that indirectly affects the entire magnetic materials ecosystem.

Alternative sourcing strategies are emerging as countries recognize the strategic importance of rare earth supply chains. The United States, Australia, and several European nations have initiated projects to develop domestic rare earth mining and processing capabilities. These initiatives may eventually provide more stable supply alternatives, potentially reducing cost fluctuations in the broader magnetic materials market that indirectly impact amorphous alloy production.

Processing and refining capabilities represent another critical supply chain bottleneck. The complex metallurgical processes required to produce high-purity rare earth oxides and metals are technically demanding and environmentally challenging. This expertise remains concentrated in a limited number of facilities globally, creating additional supply chain vulnerabilities that can affect pricing across the magnetic materials spectrum.

Recycling and material recovery present promising opportunities to mitigate supply risks. End-of-life electronics contain recoverable rare earth elements, and improved recycling technologies could reduce dependence on primary mining. For manufacturers of amorphous soft magnetic alloys, these circular economy approaches may help stabilize material costs by reducing market pressure on virgin material supplies.

Transportation logistics and inventory management strategies have gained importance as companies seek to mitigate supply disruptions. Just-in-time manufacturing approaches are being reconsidered in favor of strategic stockpiling of critical materials. This shift in supply chain management philosophy affects cost structures and production planning for manufacturers throughout the magnetic materials value chain, including those producing amorphous soft magnetic alloys for high-frequency power electronics.

Global rare earth element production is heavily concentrated, with China dominating approximately 85% of the world's supply. This geographic concentration creates inherent supply vulnerabilities for manufacturers of advanced magnetic materials, including those producing amorphous soft magnetic alloys. Recent geopolitical tensions have highlighted the strategic importance of these elements, prompting price volatility that indirectly affects the entire magnetic materials ecosystem.

Alternative sourcing strategies are emerging as countries recognize the strategic importance of rare earth supply chains. The United States, Australia, and several European nations have initiated projects to develop domestic rare earth mining and processing capabilities. These initiatives may eventually provide more stable supply alternatives, potentially reducing cost fluctuations in the broader magnetic materials market that indirectly impact amorphous alloy production.

Processing and refining capabilities represent another critical supply chain bottleneck. The complex metallurgical processes required to produce high-purity rare earth oxides and metals are technically demanding and environmentally challenging. This expertise remains concentrated in a limited number of facilities globally, creating additional supply chain vulnerabilities that can affect pricing across the magnetic materials spectrum.

Recycling and material recovery present promising opportunities to mitigate supply risks. End-of-life electronics contain recoverable rare earth elements, and improved recycling technologies could reduce dependence on primary mining. For manufacturers of amorphous soft magnetic alloys, these circular economy approaches may help stabilize material costs by reducing market pressure on virgin material supplies.

Transportation logistics and inventory management strategies have gained importance as companies seek to mitigate supply disruptions. Just-in-time manufacturing approaches are being reconsidered in favor of strategic stockpiling of critical materials. This shift in supply chain management philosophy affects cost structures and production planning for manufacturers throughout the magnetic materials value chain, including those producing amorphous soft magnetic alloys for high-frequency power electronics.

Environmental Impact Assessment of Manufacturing Processes

The manufacturing processes of amorphous soft magnetic alloys for high-frequency power electronics applications present significant environmental considerations that must be factored into any comprehensive cost-performance analysis. These specialized materials require energy-intensive production methods, particularly during the rapid solidification process where molten metal must be cooled at rates exceeding one million degrees Celsius per second to achieve the desired amorphous structure.

Primary environmental concerns include high energy consumption during manufacturing, with estimates suggesting that producing one kilogram of amorphous ribbon may require 2-3 times more energy than conventional silicon steel production. This energy intensity translates directly to increased carbon emissions, particularly in regions where electricity generation relies heavily on fossil fuels.

Water usage represents another critical environmental factor, as cooling systems for rapid solidification processes demand substantial water resources. Additionally, the chemical etching and surface treatment processes employed to enhance magnetic properties often utilize hazardous substances including acids and organic solvents, creating potential for water contamination if waste streams are improperly managed.

Material efficiency must also be considered, as current manufacturing techniques for amorphous alloys can generate significant waste during edge trimming and quality control rejections. Industry data suggests yield rates typically range between 70-85%, meaning substantial material may be discarded during production, though recycling capabilities are improving.

Lifecycle assessment studies indicate that despite higher environmental impacts during manufacturing, amorphous soft magnetic materials may offer net environmental benefits through operational efficiency. Their superior performance in high-frequency applications can reduce energy losses by 30-80% compared to conventional materials, potentially offsetting initial manufacturing impacts over the product lifecycle.

Recent innovations in manufacturing processes show promise for reducing environmental footprint. These include waterless cooling techniques, solvent-free surface treatments, and improved process control systems that minimize waste generation. Several leading manufacturers have implemented closed-loop water systems and energy recovery technologies that have reduced water consumption by up to 40% and energy requirements by 15-25% compared to earlier production methods.

Regulatory frameworks increasingly influence manufacturing decisions, with stricter controls on hazardous materials and emissions driving innovation toward cleaner production methods. Companies investing in environmentally optimized manufacturing processes may gain competitive advantages through regulatory compliance and alignment with sustainability-focused market demands.

Primary environmental concerns include high energy consumption during manufacturing, with estimates suggesting that producing one kilogram of amorphous ribbon may require 2-3 times more energy than conventional silicon steel production. This energy intensity translates directly to increased carbon emissions, particularly in regions where electricity generation relies heavily on fossil fuels.

Water usage represents another critical environmental factor, as cooling systems for rapid solidification processes demand substantial water resources. Additionally, the chemical etching and surface treatment processes employed to enhance magnetic properties often utilize hazardous substances including acids and organic solvents, creating potential for water contamination if waste streams are improperly managed.

Material efficiency must also be considered, as current manufacturing techniques for amorphous alloys can generate significant waste during edge trimming and quality control rejections. Industry data suggests yield rates typically range between 70-85%, meaning substantial material may be discarded during production, though recycling capabilities are improving.

Lifecycle assessment studies indicate that despite higher environmental impacts during manufacturing, amorphous soft magnetic materials may offer net environmental benefits through operational efficiency. Their superior performance in high-frequency applications can reduce energy losses by 30-80% compared to conventional materials, potentially offsetting initial manufacturing impacts over the product lifecycle.

Recent innovations in manufacturing processes show promise for reducing environmental footprint. These include waterless cooling techniques, solvent-free surface treatments, and improved process control systems that minimize waste generation. Several leading manufacturers have implemented closed-loop water systems and energy recovery technologies that have reduced water consumption by up to 40% and energy requirements by 15-25% compared to earlier production methods.

Regulatory frameworks increasingly influence manufacturing decisions, with stricter controls on hazardous materials and emissions driving innovation toward cleaner production methods. Companies investing in environmentally optimized manufacturing processes may gain competitive advantages through regulatory compliance and alignment with sustainability-focused market demands.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!