Comparative Study Between Amorphous And Nanocrystalline Soft Magnetic Alloys For High-Frequency Power Electronics

AUG 26, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Soft Magnetic Alloys Evolution and Research Objectives

Soft magnetic materials have undergone significant evolution since their initial development in the early 20th century. The journey began with silicon steel, which dominated the market for decades before the revolutionary discovery of amorphous metal alloys in the 1970s. These materials, characterized by their disordered atomic structure, offered substantially reduced core losses compared to conventional crystalline materials, marking a paradigm shift in magnetic material technology.

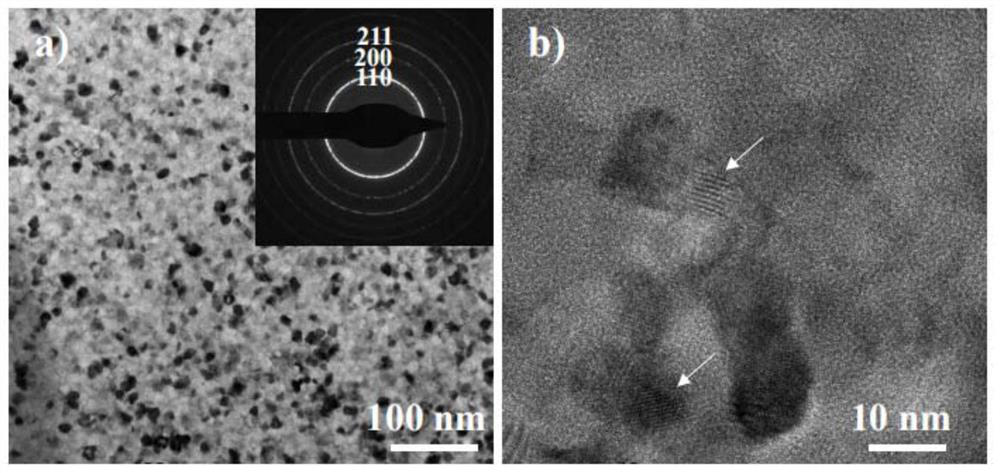

The 1980s witnessed another breakthrough with the development of nanocrystalline soft magnetic alloys, typically composed of Fe-Si-B with additions of Cu and Nb. These materials feature extremely fine grain structures (10-15 nm) embedded in an amorphous matrix, combining the advantages of both amorphous and crystalline structures while mitigating their respective limitations.

Recent decades have seen accelerated research in both amorphous and nanocrystalline materials, driven by the exponential growth in power electronics applications requiring higher switching frequencies. The push toward miniaturization, efficiency, and thermal management in modern power systems has created unprecedented demand for advanced soft magnetic materials capable of operating efficiently at frequencies ranging from hundreds of kilohertz to several megahertz.

Current research trends focus on optimizing composition and processing techniques to enhance specific properties such as saturation flux density, permeability stability at high temperatures, and core loss reduction at elevated frequencies. Particular attention is being paid to Fe-based amorphous and nanocrystalline alloys due to their superior combination of high saturation magnetization and low coercivity.

The primary objective of this technical research is to conduct a comprehensive comparative analysis between amorphous and nanocrystalline soft magnetic alloys specifically for high-frequency power electronic applications. This includes evaluating their fundamental magnetic properties, thermal stability, frequency-dependent behavior, and practical implementation challenges.

Additionally, this research aims to identify optimal material selection criteria for specific power electronic applications, including but not limited to switch-mode power supplies, wireless power transfer systems, electric vehicle powertrains, and renewable energy conversion systems. The study will establish clear performance benchmarks and develop predictive models for material behavior under various operating conditions.

The ultimate goal is to provide design engineers with actionable insights and selection guidelines that bridge the gap between materials science and practical engineering implementation, thereby accelerating the adoption of these advanced materials in next-generation power electronic systems.

The 1980s witnessed another breakthrough with the development of nanocrystalline soft magnetic alloys, typically composed of Fe-Si-B with additions of Cu and Nb. These materials feature extremely fine grain structures (10-15 nm) embedded in an amorphous matrix, combining the advantages of both amorphous and crystalline structures while mitigating their respective limitations.

Recent decades have seen accelerated research in both amorphous and nanocrystalline materials, driven by the exponential growth in power electronics applications requiring higher switching frequencies. The push toward miniaturization, efficiency, and thermal management in modern power systems has created unprecedented demand for advanced soft magnetic materials capable of operating efficiently at frequencies ranging from hundreds of kilohertz to several megahertz.

Current research trends focus on optimizing composition and processing techniques to enhance specific properties such as saturation flux density, permeability stability at high temperatures, and core loss reduction at elevated frequencies. Particular attention is being paid to Fe-based amorphous and nanocrystalline alloys due to their superior combination of high saturation magnetization and low coercivity.

The primary objective of this technical research is to conduct a comprehensive comparative analysis between amorphous and nanocrystalline soft magnetic alloys specifically for high-frequency power electronic applications. This includes evaluating their fundamental magnetic properties, thermal stability, frequency-dependent behavior, and practical implementation challenges.

Additionally, this research aims to identify optimal material selection criteria for specific power electronic applications, including but not limited to switch-mode power supplies, wireless power transfer systems, electric vehicle powertrains, and renewable energy conversion systems. The study will establish clear performance benchmarks and develop predictive models for material behavior under various operating conditions.

The ultimate goal is to provide design engineers with actionable insights and selection guidelines that bridge the gap between materials science and practical engineering implementation, thereby accelerating the adoption of these advanced materials in next-generation power electronic systems.

Market Demand Analysis for High-Frequency Power Electronics

The high-frequency power electronics market is experiencing unprecedented growth, driven primarily by the increasing demand for efficient power conversion systems across multiple industries. The global power electronics market, valued at approximately $40 billion in 2022, is projected to reach $63 billion by 2028, with high-frequency applications representing one of the fastest-growing segments at a CAGR of 7.8%.

This market expansion is largely fueled by the rapid adoption of electric vehicles (EVs), where high-frequency power electronics are essential for efficient power conversion in charging infrastructure and onboard systems. The global EV market is expected to grow at a CAGR of 21.7% through 2030, creating substantial demand for advanced magnetic materials that can operate efficiently at high frequencies.

Renewable energy systems represent another significant market driver, with solar and wind power installations requiring high-performance power converters. The global renewable energy market, growing at 8.5% annually, demands increasingly efficient power electronics to minimize conversion losses and maximize energy harvest.

Consumer electronics and telecommunications infrastructure are also creating substantial demand for miniaturized, efficient power supplies. The deployment of 5G networks alone is expected to drive a 25% increase in demand for high-frequency magnetic components over the next five years.

Industrial automation and data centers represent additional growth sectors, with the latter experiencing particularly strong demand due to the expansion of cloud computing and AI applications. Data center power consumption is growing at approximately 10% annually, creating pressure for more efficient power conversion solutions.

Market analysis indicates a clear shift toward higher switching frequencies in power electronics, with frequencies above 100 kHz becoming increasingly common. This trend is driving demand for magnetic materials capable of maintaining high performance at these frequencies while minimizing core losses.

The market is particularly receptive to solutions that can reduce size and weight while improving efficiency. End users across industries are willing to pay premium prices for materials that enable smaller, lighter, and more efficient power electronic systems, with surveys indicating that a 10% improvement in efficiency can command a 15-20% price premium.

Regional analysis shows that Asia-Pacific dominates manufacturing capacity for soft magnetic materials, while North America and Europe lead in high-end applications and research. China's market share in soft magnetic material production has grown from 35% to over 50% in the past decade, though specialized high-performance materials remain concentrated in Japan, Europe, and the United States.

This market expansion is largely fueled by the rapid adoption of electric vehicles (EVs), where high-frequency power electronics are essential for efficient power conversion in charging infrastructure and onboard systems. The global EV market is expected to grow at a CAGR of 21.7% through 2030, creating substantial demand for advanced magnetic materials that can operate efficiently at high frequencies.

Renewable energy systems represent another significant market driver, with solar and wind power installations requiring high-performance power converters. The global renewable energy market, growing at 8.5% annually, demands increasingly efficient power electronics to minimize conversion losses and maximize energy harvest.

Consumer electronics and telecommunications infrastructure are also creating substantial demand for miniaturized, efficient power supplies. The deployment of 5G networks alone is expected to drive a 25% increase in demand for high-frequency magnetic components over the next five years.

Industrial automation and data centers represent additional growth sectors, with the latter experiencing particularly strong demand due to the expansion of cloud computing and AI applications. Data center power consumption is growing at approximately 10% annually, creating pressure for more efficient power conversion solutions.

Market analysis indicates a clear shift toward higher switching frequencies in power electronics, with frequencies above 100 kHz becoming increasingly common. This trend is driving demand for magnetic materials capable of maintaining high performance at these frequencies while minimizing core losses.

The market is particularly receptive to solutions that can reduce size and weight while improving efficiency. End users across industries are willing to pay premium prices for materials that enable smaller, lighter, and more efficient power electronic systems, with surveys indicating that a 10% improvement in efficiency can command a 15-20% price premium.

Regional analysis shows that Asia-Pacific dominates manufacturing capacity for soft magnetic materials, while North America and Europe lead in high-end applications and research. China's market share in soft magnetic material production has grown from 35% to over 50% in the past decade, though specialized high-performance materials remain concentrated in Japan, Europe, and the United States.

Current Status and Challenges in Soft Magnetic Materials

The global soft magnetic materials market is experiencing significant growth, driven by the increasing demand for high-frequency power electronics applications. Currently, the market is dominated by traditional silicon steel and ferrites, but amorphous and nanocrystalline soft magnetic alloys are rapidly gaining traction due to their superior performance characteristics at higher frequencies.

Amorphous soft magnetic alloys, developed in the 1970s, have reached commercial maturity with widespread applications in distribution transformers and inductors. These materials exhibit excellent soft magnetic properties including high permeability, low coercivity, and significantly reduced core losses compared to conventional crystalline materials. Major manufacturers like Hitachi Metals (Metglas), Vacuumschmelze, and Advanced Technology & Materials have established robust production capabilities.

Nanocrystalline soft magnetic alloys, emerging in the 1990s, represent the next generation of soft magnetic materials. These alloys typically consist of Fe-Si-B-Nb-Cu compositions with grain sizes of 10-15 nm, offering even better high-frequency performance than their amorphous counterparts. Companies like Hitachi Metals (Finemet), Vacuumschmelze (Vitroperm), and Magnetec have commercialized various nanocrystalline products.

Despite significant advancements, several technical challenges persist in both material categories. For amorphous alloys, limitations include relatively low saturation magnetization (typically 1.2-1.5 T), thickness constraints (typically limited to 15-30 μm), and brittleness that complicates processing and application. The rapid cooling rates required for production (106 K/s) also limit manufacturing scalability and increase production costs.

Nanocrystalline materials face challenges related to complex annealing processes needed to achieve optimal nanocrystalline structure. The precise control of crystallization kinetics remains difficult to maintain in large-scale production. Additionally, these materials often exhibit increased magnetostriction at high frequencies, leading to acoustic noise and mechanical degradation in certain applications.

Both material types face common challenges in high-frequency applications, including increased eddy current losses at frequencies above 100 kHz, thermal stability concerns at elevated operating temperatures, and mechanical fragility that complicates core assembly and limits design flexibility. The relatively high cost compared to conventional materials also remains a significant barrier to wider adoption.

Geographically, Japan leads in research and production capabilities for both amorphous and nanocrystalline materials, followed by Germany and China. Recent years have seen significant investment in production facilities in China, potentially shifting the manufacturing landscape. The United States maintains strong research capabilities but has limited domestic production capacity.

Amorphous soft magnetic alloys, developed in the 1970s, have reached commercial maturity with widespread applications in distribution transformers and inductors. These materials exhibit excellent soft magnetic properties including high permeability, low coercivity, and significantly reduced core losses compared to conventional crystalline materials. Major manufacturers like Hitachi Metals (Metglas), Vacuumschmelze, and Advanced Technology & Materials have established robust production capabilities.

Nanocrystalline soft magnetic alloys, emerging in the 1990s, represent the next generation of soft magnetic materials. These alloys typically consist of Fe-Si-B-Nb-Cu compositions with grain sizes of 10-15 nm, offering even better high-frequency performance than their amorphous counterparts. Companies like Hitachi Metals (Finemet), Vacuumschmelze (Vitroperm), and Magnetec have commercialized various nanocrystalline products.

Despite significant advancements, several technical challenges persist in both material categories. For amorphous alloys, limitations include relatively low saturation magnetization (typically 1.2-1.5 T), thickness constraints (typically limited to 15-30 μm), and brittleness that complicates processing and application. The rapid cooling rates required for production (106 K/s) also limit manufacturing scalability and increase production costs.

Nanocrystalline materials face challenges related to complex annealing processes needed to achieve optimal nanocrystalline structure. The precise control of crystallization kinetics remains difficult to maintain in large-scale production. Additionally, these materials often exhibit increased magnetostriction at high frequencies, leading to acoustic noise and mechanical degradation in certain applications.

Both material types face common challenges in high-frequency applications, including increased eddy current losses at frequencies above 100 kHz, thermal stability concerns at elevated operating temperatures, and mechanical fragility that complicates core assembly and limits design flexibility. The relatively high cost compared to conventional materials also remains a significant barrier to wider adoption.

Geographically, Japan leads in research and production capabilities for both amorphous and nanocrystalline materials, followed by Germany and China. Recent years have seen significant investment in production facilities in China, potentially shifting the manufacturing landscape. The United States maintains strong research capabilities but has limited domestic production capacity.

Comparative Analysis of Existing Alloy Solutions

01 Composition and structure of amorphous soft magnetic alloys

Amorphous soft magnetic alloys typically consist of iron-based, cobalt-based, or iron-cobalt-based compositions with additions of elements such as boron, silicon, phosphorus, and other metalloids. These alloys are characterized by their lack of long-range atomic order, which contributes to their unique magnetic properties. The specific composition can be tailored to achieve desired magnetic characteristics such as high permeability, low coercivity, and reduced core losses. The amorphous structure is typically achieved through rapid solidification techniques that prevent crystallization during the manufacturing process.- Composition and structure of amorphous soft magnetic alloys: Amorphous soft magnetic alloys typically consist of iron-based, cobalt-based, or iron-cobalt-based compositions with additions of elements like boron, silicon, and phosphorus. These alloys are characterized by their lack of long-range atomic order, which contributes to their unique magnetic properties. The specific composition can be tailored to achieve desired magnetic properties such as high permeability, low coercivity, and reduced core losses. The amorphous structure is typically achieved through rapid solidification techniques that prevent crystallization during cooling.

- Nanocrystalline soft magnetic alloy preparation methods: Nanocrystalline soft magnetic alloys are typically prepared through controlled crystallization of amorphous precursors. This process involves heat treatment of amorphous ribbons or powders under specific temperature and time conditions to induce partial crystallization, resulting in nanoscale crystallites embedded in an amorphous matrix. Advanced preparation methods include rapid quenching, melt spinning, mechanical alloying, and various annealing techniques. The processing parameters significantly influence the resulting nanostructure and consequently the magnetic properties of the alloys.

- Applications of amorphous and nanocrystalline soft magnetic alloys: Amorphous and nanocrystalline soft magnetic alloys find extensive applications in various fields due to their superior magnetic properties. They are widely used in power electronics as transformer cores, inductors, and chokes, offering higher efficiency and smaller size compared to conventional silicon steel. These materials are also employed in magnetic sensors, magnetic shielding, electric motors, and renewable energy systems. Their low core losses make them particularly valuable in high-frequency applications and energy-efficient devices, contributing to reduced energy consumption and improved performance.

- Enhancement of magnetic properties through alloying and processing: The magnetic properties of amorphous and nanocrystalline soft magnetic alloys can be significantly enhanced through careful selection of alloying elements and optimized processing techniques. Addition of elements such as niobium, copper, and rare earth metals can improve saturation magnetization, Curie temperature, and thermal stability. Post-processing treatments including magnetic field annealing, stress annealing, and controlled cooling can induce beneficial magnetic anisotropy. These enhancements result in materials with higher permeability, lower coercivity, reduced magnetostriction, and improved temperature stability for various applications.

- Recent innovations in amorphous and nanocrystalline magnetic materials: Recent innovations in amorphous and nanocrystalline soft magnetic materials focus on developing alloys with enhanced performance characteristics and expanded application ranges. These innovations include development of materials with ultra-high saturation flux density, extremely low core losses, and improved thermal stability. Novel processing techniques such as additive manufacturing and severe plastic deformation are being explored to create unique microstructures. Additionally, composite materials combining amorphous and nanocrystalline phases are being developed to achieve synergistic properties that cannot be obtained from single-phase materials, opening new possibilities for next-generation magnetic devices.

02 Nanocrystalline soft magnetic alloy preparation methods

Nanocrystalline soft magnetic alloys are typically prepared through controlled crystallization of amorphous precursors. This process involves heat treatment of amorphous ribbons or powders under specific temperature and time conditions to induce partial crystallization, resulting in nanoscale crystallites embedded in an amorphous matrix. Advanced preparation techniques include rapid solidification, melt spinning, mechanical alloying, and various annealing processes. The size, distribution, and volume fraction of nanocrystals significantly influence the magnetic properties of the resulting material, with optimal grain sizes typically ranging from 10-30 nanometers.Expand Specific Solutions03 Magnetic properties and performance optimization

Amorphous and nanocrystalline soft magnetic alloys exhibit superior magnetic properties including high saturation magnetization, low coercivity, high permeability, and reduced core losses. These properties can be optimized through composition adjustments, controlled annealing processes, and microstructural engineering. The magnetic performance can be further enhanced by applying magnetic field annealing, stress annealing, or other post-processing treatments. The balance between nanocrystalline and amorphous phases is critical for achieving optimal magnetic properties, with the exchange coupling between nanograins through the amorphous matrix contributing to the excellent soft magnetic behavior.Expand Specific Solutions04 Applications in power electronics and energy conversion

Amorphous and nanocrystalline soft magnetic alloys are widely used in power electronics and energy conversion applications due to their superior magnetic properties. These materials are employed in transformers, inductors, chokes, and magnetic cores for high-frequency applications, offering significant improvements in energy efficiency and size reduction. They are particularly valuable in renewable energy systems, electric vehicles, and high-efficiency power supplies where reduced core losses translate to improved system efficiency. The materials' ability to operate at higher frequencies while maintaining low losses makes them ideal for modern power electronic circuits requiring high power density and efficiency.Expand Specific Solutions05 Advanced manufacturing and processing techniques

Advanced manufacturing and processing techniques for amorphous and nanocrystalline soft magnetic alloys include precision melt spinning, controlled atmosphere processing, laser processing, and additive manufacturing. These techniques allow for the production of complex geometries, tailored microstructures, and enhanced magnetic properties. Post-processing methods such as precision cutting, stacking, and lamination are employed to create magnetic components with minimal degradation of magnetic properties. Recent innovations include the development of powder metallurgy routes for producing bulk amorphous and nanocrystalline components, as well as surface treatment methods to improve corrosion resistance and mechanical properties while preserving magnetic performance.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The high-frequency power electronics market for amorphous and nanocrystalline soft magnetic alloys is currently in a growth phase, with increasing adoption driven by energy efficiency demands. The global market size is expanding rapidly, projected to reach significant value as power electronics applications proliferate across automotive, renewable energy, and industrial sectors. Technologically, the field shows varying maturity levels among key players. Companies like Proterial, TDK, and VACUUMSCHMELZE demonstrate advanced capabilities in commercial production, while research institutions such as Ningbo Institute of Industrial Technology and universities like Zhejiang University are pushing boundaries in material innovation. Advanced Technology & Materials and Qingdao Yunlu have established strong positions in amorphous materials manufacturing, with multinational corporations like 3M and Murata integrating these materials into broader product portfolios.

TDK Corp.

Technical Solution: TDK has pioneered the development of METGLAS® amorphous alloys and NANOPERM® nanocrystalline materials for high-frequency power applications. Their technical solution centers on Fe-based nanocrystalline alloys with additions of Cu, Nb, and Si that enable superior performance in the 10kHz-1MHz frequency range. TDK's manufacturing process employs rapid quenching techniques to produce ultra-thin ribbons (typically 15-25μm) that are subsequently wound into cores with various geometries. Their proprietary heat treatment protocols create optimized nanocrystalline structures with grain sizes controlled to 10-20nm, resulting in exceptional soft magnetic properties. TDK's materials demonstrate core losses approximately 80% lower than conventional silicon steel at comparable frequencies and flux densities. The company has also developed specialized coating technologies to enhance insulation between layers, further reducing eddy current losses at high frequencies. Their materials maintain stable magnetic properties up to operating temperatures of 150°C, making them suitable for demanding automotive and industrial applications.

Strengths: Exceptional high-frequency performance with very low core losses; excellent temperature stability; comprehensive product lineup covering various core shapes and sizes. Weaknesses: Higher material costs compared to traditional ferrites; manufacturing complexity requiring specialized equipment; potential for brittleness requiring careful handling during assembly.

Advanced Technology & Materials Co., Ltd.

Technical Solution: Advanced Technology & Materials Co. (AT&M) has developed proprietary amorphous and nanocrystalline soft magnetic alloys specifically engineered for high-frequency power electronics applications. Their technical approach centers on Fe-Si-B-based amorphous alloys and Fe-Si-B-Cu-Nb nanocrystalline materials with precisely controlled compositions to achieve optimal performance in the 10kHz-500kHz frequency range. AT&M's manufacturing process employs advanced rapid quenching techniques to produce ultra-thin ribbons (typically 20-30μm), followed by specialized heat treatment protocols that create optimized nanocrystalline structures with grain sizes carefully controlled to 10-20nm. Their materials demonstrate saturation flux densities up to 1.3T while maintaining extremely low core losses (approximately 1/5 of silicon steel at comparable frequencies). AT&M has developed innovative core designs that maximize the performance advantages of their materials, including distributed gap configurations that enhance energy storage capabilities while minimizing fringing flux losses. Their materials maintain stable magnetic properties up to operating temperatures of 140°C and demonstrate excellent resistance to thermal aging, with less than 5% permeability degradation after 5000 hours at elevated temperatures.

Strengths: Cost-effective manufacturing capabilities with high volume production capacity; excellent balance of high saturation flux density and low losses; comprehensive product range covering various applications. Weaknesses: Less established global distribution network compared to competitors; somewhat limited customization capabilities for specialized applications; potential for quality variations between production batches.

Core Technical Innovations in Magnetic Material Design

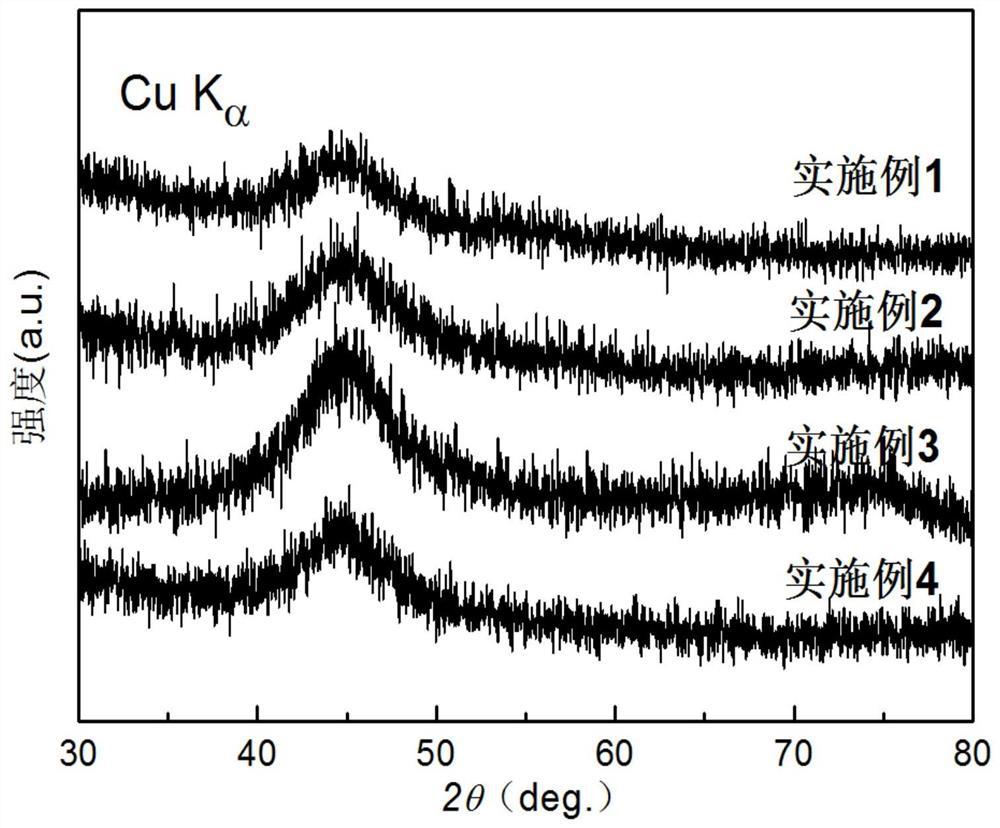

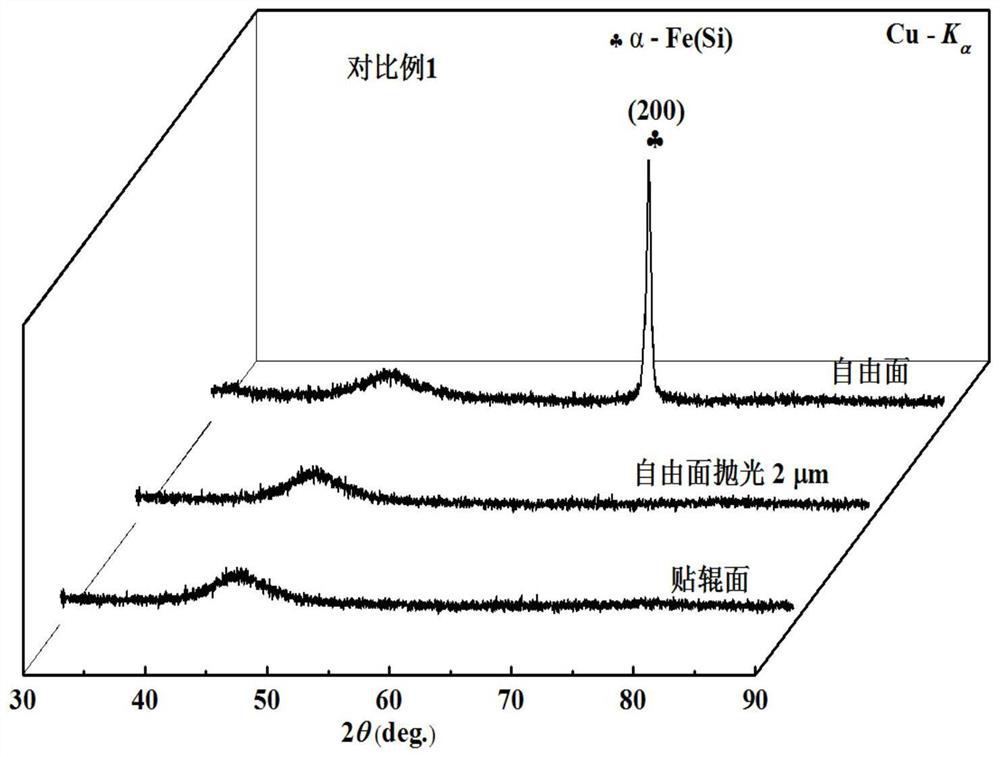

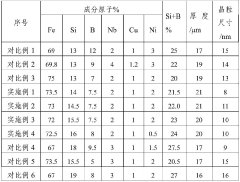

A kind of nanocrystalline soft magnetic alloy, amorphous soft magnetic alloy and preparation method thereof

PatentActiveCN110670000B

Innovation

- Nanocrystalline soft magnetic alloys and amorphous soft magnetic alloys with elements such as Fe, Cu, Si, B, Nb, etc. are used, Mn and Cr elements are added, and the high-frequency magnetic properties and amorphous formation of the alloy are optimized through multi-stage rate annealing heat treatment. ability.

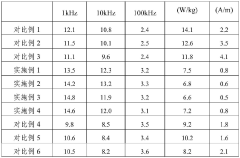

Amorphous nanocrystalline soft magnetic alloy thin strip and magnetic core

PatentWO2024130936A1

Innovation

- By adjusting the content of metalloid elements Si and B and adding Ni element, an amorphous alloy thin strip is prepared, and its composition and annealing treatment conditions are optimized to form an amorphous nanocrystalline soft magnetic alloy strip with high magnetic permeability and low frequency dispersion. material, ensuring that the performance of the strip is improved at frequencies of 1kHz, 10kHz and 100kHz.

Energy Efficiency Impact Assessment

The adoption of advanced soft magnetic materials in power electronics has profound implications for energy efficiency across multiple sectors. Amorphous and nanocrystalline alloys demonstrate significantly lower core losses compared to conventional silicon steel, with reductions ranging from 60% to 80% at high frequencies. This translates directly into improved energy conversion efficiency in power electronic systems, particularly in switching power supplies, inverters, and motor drives.

When implemented in high-frequency transformers and inductors, these advanced materials enable operation at frequencies of 20 kHz to 100 kHz with minimal losses, compared to traditional materials that become inefficient above 10 kHz. The resulting energy savings in data centers utilizing these materials in power distribution units can reach 2-3% overall, which represents substantial energy conservation given that data centers consume approximately 1-2% of global electricity.

In renewable energy applications, power converters incorporating amorphous and nanocrystalline cores demonstrate efficiency improvements of 1-2% compared to conventional designs. While this percentage appears modest, it translates to significant energy savings over the 20-25 year lifespan of solar inverters and wind power converters, potentially saving hundreds of megawatt-hours per installation.

The transportation sector also benefits substantially, with electric vehicle onboard chargers utilizing these materials showing 3-5% higher efficiency. This improvement extends vehicle range and reduces charging time, addressing key adoption barriers for electric mobility. Additionally, the reduced cooling requirements for these more efficient components further enhance system-level energy savings.

Industrial motor drives incorporating high-frequency soft magnetic components can achieve variable speed operation with minimal losses, resulting in energy consumption reductions of 10-15% compared to fixed-speed systems. This represents one of the largest potential energy savings applications, as industrial motors consume approximately 30% of all electricity globally.

From a lifecycle perspective, the embodied energy in manufacturing these advanced materials is typically recovered within 1-2 years of operation through improved efficiency. The long-term environmental impact assessment indicates that widespread adoption of these materials in power electronics could contribute to carbon emission reductions of 50-100 million tons annually by 2030, representing a significant contribution to global climate goals.

When implemented in high-frequency transformers and inductors, these advanced materials enable operation at frequencies of 20 kHz to 100 kHz with minimal losses, compared to traditional materials that become inefficient above 10 kHz. The resulting energy savings in data centers utilizing these materials in power distribution units can reach 2-3% overall, which represents substantial energy conservation given that data centers consume approximately 1-2% of global electricity.

In renewable energy applications, power converters incorporating amorphous and nanocrystalline cores demonstrate efficiency improvements of 1-2% compared to conventional designs. While this percentage appears modest, it translates to significant energy savings over the 20-25 year lifespan of solar inverters and wind power converters, potentially saving hundreds of megawatt-hours per installation.

The transportation sector also benefits substantially, with electric vehicle onboard chargers utilizing these materials showing 3-5% higher efficiency. This improvement extends vehicle range and reduces charging time, addressing key adoption barriers for electric mobility. Additionally, the reduced cooling requirements for these more efficient components further enhance system-level energy savings.

Industrial motor drives incorporating high-frequency soft magnetic components can achieve variable speed operation with minimal losses, resulting in energy consumption reductions of 10-15% compared to fixed-speed systems. This represents one of the largest potential energy savings applications, as industrial motors consume approximately 30% of all electricity globally.

From a lifecycle perspective, the embodied energy in manufacturing these advanced materials is typically recovered within 1-2 years of operation through improved efficiency. The long-term environmental impact assessment indicates that widespread adoption of these materials in power electronics could contribute to carbon emission reductions of 50-100 million tons annually by 2030, representing a significant contribution to global climate goals.

Manufacturing Process Optimization Strategies

Manufacturing process optimization for soft magnetic alloys represents a critical factor in determining their performance characteristics and commercial viability. When comparing amorphous and nanocrystalline soft magnetic alloys for high-frequency power electronics applications, several key optimization strategies must be considered to enhance their production efficiency and material properties.

The rapid solidification process, fundamental to both alloy types, requires precise control of cooling rates exceeding 10^6 K/s. For amorphous alloys, melt spinning techniques have been refined to achieve uniform ribbon thickness between 20-30 μm, with recent innovations focusing on double-roller methods that improve thickness consistency and reduce internal stress distributions.

Nanocrystalline alloys demand a two-stage manufacturing approach: initial rapid quenching followed by controlled heat treatment. The annealing process requires temperature precision within ±3°C and carefully regulated heating/cooling rates to achieve optimal grain size distribution (typically 10-15 nm). Recent developments include magnetic field annealing techniques that induce beneficial anisotropy and enhance permeability characteristics.

Surface quality optimization represents another crucial manufacturing consideration. Advanced surface treatment methods, including electrolytic polishing and specialized coating technologies, have demonstrated 15-20% improvements in high-frequency performance by reducing surface irregularities that contribute to eddy current losses. These treatments are particularly important for nanocrystalline materials where surface defects can disproportionately affect overall performance.

Cost-efficiency strategies have emerged as manufacturing volumes increase. Continuous casting processes have reduced production costs by approximately 30% compared to batch processing methods. Additionally, recycling of edge trim materials and optimization of raw material compositions have further improved economic viability while maintaining performance specifications.

Quality control innovations, including in-line laser scanning and real-time magnetic property assessment, have significantly reduced rejection rates. Advanced statistical process control methods now enable manufacturers to maintain property variations within ±5% of target specifications, a substantial improvement over previous ±12% variations typical of earlier production methods.

Environmental considerations have also driven manufacturing optimizations, with newer processes reducing energy consumption by 25-40% compared to conventional methods. Water-based cooling systems and closed-loop material recovery have further enhanced sustainability metrics while simultaneously improving product consistency.

The rapid solidification process, fundamental to both alloy types, requires precise control of cooling rates exceeding 10^6 K/s. For amorphous alloys, melt spinning techniques have been refined to achieve uniform ribbon thickness between 20-30 μm, with recent innovations focusing on double-roller methods that improve thickness consistency and reduce internal stress distributions.

Nanocrystalline alloys demand a two-stage manufacturing approach: initial rapid quenching followed by controlled heat treatment. The annealing process requires temperature precision within ±3°C and carefully regulated heating/cooling rates to achieve optimal grain size distribution (typically 10-15 nm). Recent developments include magnetic field annealing techniques that induce beneficial anisotropy and enhance permeability characteristics.

Surface quality optimization represents another crucial manufacturing consideration. Advanced surface treatment methods, including electrolytic polishing and specialized coating technologies, have demonstrated 15-20% improvements in high-frequency performance by reducing surface irregularities that contribute to eddy current losses. These treatments are particularly important for nanocrystalline materials where surface defects can disproportionately affect overall performance.

Cost-efficiency strategies have emerged as manufacturing volumes increase. Continuous casting processes have reduced production costs by approximately 30% compared to batch processing methods. Additionally, recycling of edge trim materials and optimization of raw material compositions have further improved economic viability while maintaining performance specifications.

Quality control innovations, including in-line laser scanning and real-time magnetic property assessment, have significantly reduced rejection rates. Advanced statistical process control methods now enable manufacturers to maintain property variations within ±5% of target specifications, a substantial improvement over previous ±12% variations typical of earlier production methods.

Environmental considerations have also driven manufacturing optimizations, with newer processes reducing energy consumption by 25-40% compared to conventional methods. Water-based cooling systems and closed-loop material recovery have further enhanced sustainability metrics while simultaneously improving product consistency.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!