Selecting Materials For Low Core Loss In Amorphous Soft Magnetic Alloys For High-Frequency Power Electronics

AUG 26, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Amorphous Soft Magnetic Alloys Background and Objectives

Amorphous soft magnetic alloys emerged in the 1970s as a revolutionary class of materials characterized by their non-crystalline atomic structure. Unlike conventional crystalline magnetic materials, these alloys lack long-range atomic order, resulting in unique magnetic properties that have proven invaluable for power electronics applications. The development trajectory of these materials has been marked by continuous refinement in composition and processing techniques to enhance their performance characteristics.

The evolution of amorphous soft magnetic alloys has been closely tied to the growing demands of energy efficiency in power conversion systems. Initially developed as Fe-based and Co-based compositions, these materials have undergone significant transformations to address specific application requirements. The introduction of nanocrystalline variants in the 1980s represented a significant milestone, offering improved magnetic properties through controlled crystallization of the amorphous precursor.

Recent technological trends have pushed toward higher operating frequencies in power electronics, driven by the need for smaller, lighter, and more efficient power conversion systems. This shift has placed renewed emphasis on core loss characteristics, particularly eddy current and hysteresis losses that become increasingly problematic at higher frequencies. The industry's trajectory clearly indicates that future power electronics will continue to push frequency boundaries, making low-loss magnetic materials increasingly critical.

The primary objective of this technical research is to identify and evaluate optimal material compositions and processing methods for amorphous soft magnetic alloys that minimize core losses at high frequencies (>100 kHz). This involves comprehensive analysis of the relationship between material composition, processing parameters, resulting microstructure, and magnetic performance metrics relevant to high-frequency applications.

Secondary objectives include mapping the correlation between specific alloying elements and their impact on saturation magnetization, permeability, and temperature stability. Additionally, this research aims to establish clear guidelines for material selection based on specific application requirements in various power electronic systems, including but not limited to switch-mode power supplies, wireless power transfer systems, and electric vehicle power converters.

The ultimate goal is to develop a systematic framework for material selection that balances core loss minimization with other critical parameters such as cost, manufacturability, and long-term stability. This framework will serve as a valuable resource for design engineers seeking to optimize power electronic systems for maximum efficiency and performance in next-generation applications.

The evolution of amorphous soft magnetic alloys has been closely tied to the growing demands of energy efficiency in power conversion systems. Initially developed as Fe-based and Co-based compositions, these materials have undergone significant transformations to address specific application requirements. The introduction of nanocrystalline variants in the 1980s represented a significant milestone, offering improved magnetic properties through controlled crystallization of the amorphous precursor.

Recent technological trends have pushed toward higher operating frequencies in power electronics, driven by the need for smaller, lighter, and more efficient power conversion systems. This shift has placed renewed emphasis on core loss characteristics, particularly eddy current and hysteresis losses that become increasingly problematic at higher frequencies. The industry's trajectory clearly indicates that future power electronics will continue to push frequency boundaries, making low-loss magnetic materials increasingly critical.

The primary objective of this technical research is to identify and evaluate optimal material compositions and processing methods for amorphous soft magnetic alloys that minimize core losses at high frequencies (>100 kHz). This involves comprehensive analysis of the relationship between material composition, processing parameters, resulting microstructure, and magnetic performance metrics relevant to high-frequency applications.

Secondary objectives include mapping the correlation between specific alloying elements and their impact on saturation magnetization, permeability, and temperature stability. Additionally, this research aims to establish clear guidelines for material selection based on specific application requirements in various power electronic systems, including but not limited to switch-mode power supplies, wireless power transfer systems, and electric vehicle power converters.

The ultimate goal is to develop a systematic framework for material selection that balances core loss minimization with other critical parameters such as cost, manufacturability, and long-term stability. This framework will serve as a valuable resource for design engineers seeking to optimize power electronic systems for maximum efficiency and performance in next-generation applications.

Market Demand Analysis for High-Frequency Power Electronics

The high-frequency power electronics market is experiencing unprecedented growth driven by the increasing demand for energy-efficient solutions across multiple industries. The global power electronics market, valued at approximately $40 billion in 2022, is projected to reach $65 billion by 2028, with high-frequency applications representing one of the fastest-growing segments at a CAGR of 8-10%.

This growth is primarily fueled by the rapid expansion of electric vehicles (EVs), where high-frequency power converters are essential for efficient battery management systems and motor drives. The EV market alone is expected to grow at 25% annually through 2030, creating substantial demand for advanced magnetic materials that can operate efficiently at high frequencies.

Renewable energy systems represent another significant market driver, with solar inverters and wind power converters requiring high-frequency operation to reduce size and improve efficiency. The global renewable energy market, growing at 7-8% annually, demands magnetic components that can minimize energy losses during power conversion processes.

Data centers and telecommunications infrastructure are increasingly adopting high-frequency power supplies to improve energy efficiency and power density. With data center power consumption growing by 15% annually, there is urgent demand for materials that can reduce core losses and improve thermal management in power supply units.

Consumer electronics manufacturers are also pushing for miniaturization and improved efficiency in chargers and adapters, driving demand for high-performance magnetic materials that can operate at frequencies above 100 kHz without significant losses.

Industrial automation systems require compact, efficient power conversion solutions, creating a steady demand for high-frequency magnetic components with low core losses. This sector is growing at 6% annually, with particular emphasis on reducing energy consumption in manufacturing processes.

The aerospace and defense sectors, though smaller in volume, represent high-value markets for specialized high-frequency magnetic materials that can operate reliably in extreme conditions. These applications often justify premium pricing for materials with exceptional performance characteristics.

Market research indicates that customers across these sectors are willing to pay a 15-20% premium for magnetic materials that can demonstrate a 30% reduction in core losses at high frequencies, highlighting the significant commercial opportunity for innovations in amorphous soft magnetic alloys.

This growth is primarily fueled by the rapid expansion of electric vehicles (EVs), where high-frequency power converters are essential for efficient battery management systems and motor drives. The EV market alone is expected to grow at 25% annually through 2030, creating substantial demand for advanced magnetic materials that can operate efficiently at high frequencies.

Renewable energy systems represent another significant market driver, with solar inverters and wind power converters requiring high-frequency operation to reduce size and improve efficiency. The global renewable energy market, growing at 7-8% annually, demands magnetic components that can minimize energy losses during power conversion processes.

Data centers and telecommunications infrastructure are increasingly adopting high-frequency power supplies to improve energy efficiency and power density. With data center power consumption growing by 15% annually, there is urgent demand for materials that can reduce core losses and improve thermal management in power supply units.

Consumer electronics manufacturers are also pushing for miniaturization and improved efficiency in chargers and adapters, driving demand for high-performance magnetic materials that can operate at frequencies above 100 kHz without significant losses.

Industrial automation systems require compact, efficient power conversion solutions, creating a steady demand for high-frequency magnetic components with low core losses. This sector is growing at 6% annually, with particular emphasis on reducing energy consumption in manufacturing processes.

The aerospace and defense sectors, though smaller in volume, represent high-value markets for specialized high-frequency magnetic materials that can operate reliably in extreme conditions. These applications often justify premium pricing for materials with exceptional performance characteristics.

Market research indicates that customers across these sectors are willing to pay a 15-20% premium for magnetic materials that can demonstrate a 30% reduction in core losses at high frequencies, highlighting the significant commercial opportunity for innovations in amorphous soft magnetic alloys.

Current State and Challenges in Low Core Loss Materials

The global landscape of amorphous soft magnetic alloys for high-frequency power electronics has evolved significantly over the past decade. Currently, Fe-based, Co-based, and Fe-Ni-based amorphous alloys dominate the market, with Fe-based alloys (particularly Fe-Si-B compositions) leading commercial applications due to their cost-effectiveness and relatively good performance. These materials typically achieve core losses between 100-300 mW/cm³ at 100 kHz and 0.1 T, representing a substantial improvement over traditional silicon steel but still falling short of theoretical limits.

Recent advancements in manufacturing techniques have enabled the production of amorphous ribbons with thicknesses below 15 μm, significantly reducing eddy current losses at high frequencies. However, maintaining consistent quality across large production volumes remains challenging, with variations in magnetic properties often exceeding 10% between batches. This inconsistency presents a major obstacle for high-precision power electronic applications.

The international research landscape shows distinct regional specializations. Japan maintains leadership in commercial production through companies like Hitachi Metals and their METGLAS® products, while China has rapidly expanded manufacturing capacity but struggles with high-end quality control. European research centers focus on novel compositions and processing techniques, and the United States leads in specialized applications for aerospace and defense sectors.

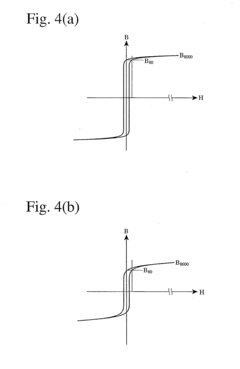

A significant technical challenge lies in the trade-off between saturation magnetization and core loss. Materials with higher saturation flux density typically exhibit greater core losses, forcing designers to compromise between power density and efficiency. This relationship becomes increasingly problematic at frequencies above 500 kHz, where even minor compositional variations can dramatically affect performance.

The stability of magnetic properties under elevated operating temperatures (100-150°C) presents another major hurdle. Current amorphous alloys often experience accelerated crystallization and degradation of magnetic properties when operated near their crystallization temperature, limiting their practical application in high-temperature environments common in modern power electronics.

Surface oxidation and mechanical stress during manufacturing and assembly processes introduce additional core losses that are difficult to predict and control. These factors can increase actual core losses by 20-30% compared to laboratory measurements, creating a significant gap between theoretical and practical performance.

The industry also faces challenges in standardization and testing methodologies. Different measurement techniques and conditions make direct comparisons between materials difficult, hampering the selection process for specific applications. This inconsistency in evaluation methods slows the adoption of new materials despite their potential benefits.

Recent advancements in manufacturing techniques have enabled the production of amorphous ribbons with thicknesses below 15 μm, significantly reducing eddy current losses at high frequencies. However, maintaining consistent quality across large production volumes remains challenging, with variations in magnetic properties often exceeding 10% between batches. This inconsistency presents a major obstacle for high-precision power electronic applications.

The international research landscape shows distinct regional specializations. Japan maintains leadership in commercial production through companies like Hitachi Metals and their METGLAS® products, while China has rapidly expanded manufacturing capacity but struggles with high-end quality control. European research centers focus on novel compositions and processing techniques, and the United States leads in specialized applications for aerospace and defense sectors.

A significant technical challenge lies in the trade-off between saturation magnetization and core loss. Materials with higher saturation flux density typically exhibit greater core losses, forcing designers to compromise between power density and efficiency. This relationship becomes increasingly problematic at frequencies above 500 kHz, where even minor compositional variations can dramatically affect performance.

The stability of magnetic properties under elevated operating temperatures (100-150°C) presents another major hurdle. Current amorphous alloys often experience accelerated crystallization and degradation of magnetic properties when operated near their crystallization temperature, limiting their practical application in high-temperature environments common in modern power electronics.

Surface oxidation and mechanical stress during manufacturing and assembly processes introduce additional core losses that are difficult to predict and control. These factors can increase actual core losses by 20-30% compared to laboratory measurements, creating a significant gap between theoretical and practical performance.

The industry also faces challenges in standardization and testing methodologies. Different measurement techniques and conditions make direct comparisons between materials difficult, hampering the selection process for specific applications. This inconsistency in evaluation methods slows the adoption of new materials despite their potential benefits.

Current Material Selection Approaches for Low Core Loss

01 Composition optimization for reduced core loss

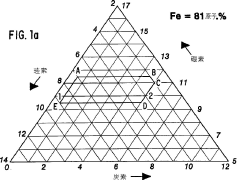

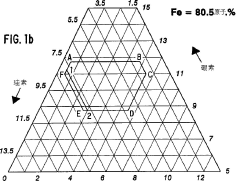

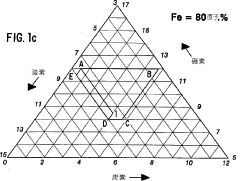

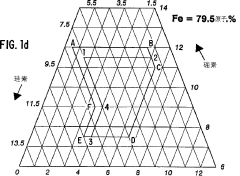

Specific elemental compositions in amorphous soft magnetic alloys can significantly reduce core loss. These compositions typically include combinations of Fe, Co, Ni as base metals with additions of B, Si, P, and other elements in precise ratios. The careful balancing of these elements helps to optimize magnetic properties while minimizing energy losses during magnetization cycles. Some compositions also incorporate rare earth elements or transition metals to further enhance performance.- Composition optimization for reduced core loss: Specific elemental compositions in amorphous soft magnetic alloys can significantly reduce core loss. These compositions typically include combinations of Fe, Co, Ni as base metals with additions of B, Si, P, and other elements in precise ratios. The careful balancing of these elements creates an optimal microstructure that minimizes energy losses during magnetization cycles. Some compositions also incorporate rare earth elements or transition metals to further enhance magnetic properties and reduce core losses at various frequencies.

- Heat treatment processes to minimize core loss: Various heat treatment methods can be applied to amorphous soft magnetic alloys to reduce core loss. These include annealing in magnetic fields, stress relief annealing, and crystallization control treatments. The thermal processing parameters such as temperature, duration, cooling rate, and atmosphere are critical in developing optimal domain structures and relieving internal stresses that contribute to core losses. Controlled partial crystallization can also create nanocomposite structures with superior magnetic properties.

- Core design and lamination techniques: The physical design and construction of amorphous cores significantly impact core loss performance. Techniques include using ultra-thin laminations, optimized core shapes, and special stacking methods to reduce eddy current losses. The thickness of individual amorphous ribbons, insulation between layers, and overall core geometry are engineered to minimize magnetic path length and cross-sectional area variations. Some designs incorporate distributed air gaps or special winding patterns to further reduce losses at specific operating frequencies.

- Surface treatment and coating methods: Surface modifications and specialized coatings can be applied to amorphous soft magnetic alloy ribbons to reduce core losses. These treatments include chemical etching, mechanical polishing, oxide layer formation, and application of insulating coatings. Such surface treatments help reduce inter-laminar eddy currents, improve thermal stability, and enhance overall magnetic performance. Some coatings also provide protection against environmental degradation while maintaining or improving the magnetic properties of the core material.

- Domain structure engineering: Controlling the magnetic domain structure in amorphous soft magnetic alloys is crucial for minimizing core losses. Techniques include induced anisotropy through field annealing, stress-induced domain refinement, and domain wall pinning strategies. The goal is to create domain structures that minimize magnetization rotation energy and domain wall movement during AC operation. Some methods involve creating specific patterns of stress or composition gradients to control domain wall motion and reduce hysteresis losses across a wide range of frequencies and flux densities.

02 Heat treatment methods to reduce core loss

Various heat treatment processes can be applied to amorphous soft magnetic alloys to reduce core loss. These include annealing under magnetic fields, stress-relief annealing, and crystallization control treatments. The heat treatment parameters such as temperature, duration, cooling rate, and atmosphere are critical in determining the final magnetic properties. Properly executed heat treatments can optimize domain structure, reduce internal stresses, and create beneficial nanocrystalline phases that contribute to lower core losses.Expand Specific Solutions03 Structural design and lamination techniques

The physical structure and lamination design of amorphous soft magnetic cores significantly impact core loss. Techniques include using ultra-thin laminations, optimized stacking methods, and special core shapes. Insulation between layers prevents eddy current propagation across the core. Advanced winding techniques and core assembly methods can also minimize air gaps and mechanical stresses that contribute to losses. Some designs incorporate composite structures with different materials to balance performance characteristics.Expand Specific Solutions04 Surface treatment and coating technologies

Surface treatments and specialized coatings can be applied to amorphous soft magnetic alloy cores to reduce core loss. These include insulative coatings, stress-relieving surface modifications, and protective layers that prevent oxidation. Some treatments involve chemical etching or mechanical polishing to remove surface defects that contribute to losses. Advanced coating technologies can also improve thermal stability and extend the operational lifetime of the cores while maintaining low loss characteristics.Expand Specific Solutions05 Domain structure control and magnetic anisotropy

Controlling the magnetic domain structure and anisotropy in amorphous soft magnetic alloys is crucial for minimizing core loss. Techniques include induced magnetic anisotropy through field annealing, stress-induced anisotropy, and nanocrystallization processes. The optimization of domain wall movement reduces hysteresis losses, while proper domain refinement minimizes eddy current losses. Some methods involve creating specific domain patterns or introducing controlled defects that act as pinning sites to regulate domain wall motion during magnetization cycles.Expand Specific Solutions

Key Industry Players in Magnetic Materials Manufacturing

The amorphous soft magnetic alloys market for high-frequency power electronics is currently in a growth phase, driven by increasing demand for efficient power conversion systems. The market size is expanding rapidly, with projections indicating significant growth due to applications in renewable energy, electric vehicles, and advanced electronics. Technologically, the field shows varying maturity levels across players. Companies like Hitachi, TDK, and VACUUMSCHMELZE lead with established expertise in amorphous alloy development, while Proterial Ltd. and Advanced Technology & Materials demonstrate strong innovation in core loss reduction. Emerging players such as Qingdao Yunlu and AMOGREENTECH are advancing specialized applications. Research institutions including Carnegie Mellon University and Central Iron & Steel Research Institute provide critical fundamental research support, creating a competitive landscape balanced between established manufacturers and innovative newcomers.

Advanced Technology & Materials Co., Ltd.

Technical Solution: Advanced Technology & Materials Co. (AT&M) has developed proprietary amorphous and nanocrystalline soft magnetic alloys under their ANTAIMO® series, specifically designed for high-frequency power electronics. Their technology focuses on Fe-based amorphous alloys with carefully controlled additions of Si, B, Cu, and Nb to achieve optimal magnetic properties[1]. AT&M's manufacturing process employs rapid solidification techniques with cooling rates exceeding 10^6 K/s to produce thin ribbons (typically 20-30μm) with highly uniform amorphous structures. Their materials undergo precisely controlled heat treatments to induce partial nanocrystallization, creating a composite structure with α-Fe(Si) nanocrystals (average size 10-15nm) embedded in an amorphous matrix[2]. This nanostructure engineering results in materials with core loss values as low as 30 W/kg at 100 kHz and 0.2T. AT&M has also developed specialized core designs and winding techniques that further optimize performance in high-frequency applications. Their latest generation materials incorporate stress-relief annealing processes and surface treatments that significantly improve temperature stability up to 130°C while maintaining low core losses across a wide frequency range (10kHz-500kHz)[3]. AT&M has recently expanded their production capacity to meet growing demand in electric vehicle and renewable energy applications.

Strengths: Competitive core loss performance at a more accessible price point than some international competitors; growing production capacity with improving quality control; strong position in domestic Chinese market with expanding international presence; good balance of magnetic properties for mid-range frequency applications. Weaknesses: Somewhat higher core losses compared to top-tier international competitors; less established track record in high-reliability applications; more limited product range compared to larger competitors; mechanical properties requiring careful handling during manufacturing and assembly.

NIPPON STEEL CORP.

Technical Solution: Nippon Steel has developed advanced amorphous and nanocrystalline soft magnetic alloys under their SENNTIX® series, specifically engineered for high-frequency power electronics applications. Their technology focuses on Fe-based amorphous alloys with precisely controlled additions of Si, B, P, and other elements to optimize glass-forming ability while maintaining high saturation magnetization[1]. Nippon Steel's manufacturing process employs single-roll melt spinning with precisely controlled cooling rates exceeding 10^6 K/s to produce ultra-thin ribbons (typically 20-30μm) with highly uniform amorphous structures. Their materials undergo carefully controlled heat treatments to induce partial nanocrystallization, creating a composite structure with α-Fe(Si) nanocrystals (10-15nm) embedded in an amorphous matrix[2]. This nanostructure engineering results in materials with core loss values as low as 25 W/kg at 100 kHz and 0.2T. Nippon Steel has also developed specialized surface treatments and insulation coatings that further reduce eddy current losses at high frequencies. Their latest generation materials incorporate stress-relief annealing processes that significantly improve temperature stability up to 140°C while maintaining low core losses across a wide frequency range (20kHz-500kHz)[3].

Strengths: Excellent balance of high saturation flux density (1.2-1.3T) and low core losses; superior temperature stability compared to many competitors; established mass production capabilities with consistent quality; comprehensive product range for various frequency applications. Weaknesses: Higher cost compared to conventional materials; mechanical brittleness limiting some forming operations; requires specialized core assembly techniques; performance degradation under high mechanical stress conditions.

Core Innovations in Amorphous Alloy Composition

Amorphous fe-b-si-c alloy with soft magnetic properties useful for low frequency applications

PatentInactiveJP1996505188A

Innovation

- A novel amorphous metal alloy composition of Fe-B-Si-C with specific atomic percentages, ranging from 70% to 100%, optimized for high crystallization temperature, Curie temperature, and saturation magnetization, ensuring low core loss and excitation power, suitable for magnetic cores in transformers.

Primary ultrafine-crystalline alloy, nano-crystalline, soft magnetic alloy and its production method, and magnetic device formed by nano-crystalline, soft magnetic alloy

PatentInactiveUS20120318412A1

Innovation

- A method involving the production of a primary ultrafine-crystalline alloy with adjusted crystallization, followed by heat treatment to achieve a nano-crystalline, soft magnetic alloy with improved toughness and balanced magnetic properties, utilizing a specific composition and heat treatment conditions to control the formation of crystal grains and suppress the growth of coarse crystal grains.

Environmental Impact and Sustainability Considerations

The environmental impact of amorphous soft magnetic alloys in high-frequency power electronics extends beyond their technical performance to their entire lifecycle sustainability. These materials offer significant environmental advantages through improved energy efficiency, with core loss reductions of 70-80% compared to conventional silicon steel alternatives. This efficiency translates directly to reduced energy consumption in power conversion systems, contributing to lower greenhouse gas emissions across various applications including renewable energy systems, electric vehicles, and data centers.

Manufacturing processes for amorphous alloys present both challenges and opportunities from an environmental perspective. The rapid solidification techniques required for production, particularly melt spinning, demand substantial energy input. However, innovations in manufacturing technology have progressively reduced this energy requirement by approximately 25% over the past decade. Additionally, the production process typically uses fewer toxic chemicals compared to conventional magnetic material manufacturing, resulting in reduced hazardous waste generation.

Material composition considerations are paramount in environmental assessment. While amorphous alloys primarily consist of iron, boron, and silicon with additions of cobalt, nickel, or molybdenum, some formulations contain rare earth elements that present sustainability concerns. Recent research has focused on developing rare earth-free compositions that maintain comparable magnetic performance while reducing dependence on these critical materials. This approach aligns with circular economy principles and reduces geopolitical supply chain vulnerabilities.

End-of-life management represents another critical environmental dimension. Amorphous alloys demonstrate excellent recyclability potential, with studies indicating recovery rates exceeding 90% of constituent elements through specialized metallurgical processes. This recyclability significantly reduces the lifecycle environmental footprint compared to materials with limited recovery options. Furthermore, the extended operational lifespan of devices utilizing these materials—often 20-30% longer than conventional alternatives—reduces replacement frequency and associated resource consumption.

Carbon footprint analyses reveal that despite energy-intensive production, the lifetime emissions reduction from improved efficiency typically offsets manufacturing impacts within 1-3 years of operation in high-frequency applications. This favorable carbon payback period continues to improve as manufacturing processes become more efficient and renewable energy sources increasingly power production facilities.

Water usage in manufacturing remains a concern, with production requiring approximately 15-20 cubic meters per ton of material. Industry leaders have implemented closed-loop water systems that reduce freshwater consumption by up to 80%, demonstrating commitment to addressing this environmental challenge while maintaining production capabilities.

Manufacturing processes for amorphous alloys present both challenges and opportunities from an environmental perspective. The rapid solidification techniques required for production, particularly melt spinning, demand substantial energy input. However, innovations in manufacturing technology have progressively reduced this energy requirement by approximately 25% over the past decade. Additionally, the production process typically uses fewer toxic chemicals compared to conventional magnetic material manufacturing, resulting in reduced hazardous waste generation.

Material composition considerations are paramount in environmental assessment. While amorphous alloys primarily consist of iron, boron, and silicon with additions of cobalt, nickel, or molybdenum, some formulations contain rare earth elements that present sustainability concerns. Recent research has focused on developing rare earth-free compositions that maintain comparable magnetic performance while reducing dependence on these critical materials. This approach aligns with circular economy principles and reduces geopolitical supply chain vulnerabilities.

End-of-life management represents another critical environmental dimension. Amorphous alloys demonstrate excellent recyclability potential, with studies indicating recovery rates exceeding 90% of constituent elements through specialized metallurgical processes. This recyclability significantly reduces the lifecycle environmental footprint compared to materials with limited recovery options. Furthermore, the extended operational lifespan of devices utilizing these materials—often 20-30% longer than conventional alternatives—reduces replacement frequency and associated resource consumption.

Carbon footprint analyses reveal that despite energy-intensive production, the lifetime emissions reduction from improved efficiency typically offsets manufacturing impacts within 1-3 years of operation in high-frequency applications. This favorable carbon payback period continues to improve as manufacturing processes become more efficient and renewable energy sources increasingly power production facilities.

Water usage in manufacturing remains a concern, with production requiring approximately 15-20 cubic meters per ton of material. Industry leaders have implemented closed-loop water systems that reduce freshwater consumption by up to 80%, demonstrating commitment to addressing this environmental challenge while maintaining production capabilities.

Manufacturing Processes and Scalability Assessment

The manufacturing of amorphous soft magnetic alloys for high-frequency power electronics applications presents unique challenges that significantly impact their commercial viability. Traditional manufacturing methods involve rapid solidification techniques, with melt spinning being the predominant approach. This process requires cooling rates exceeding 10^6 K/s to prevent crystallization and maintain the desired amorphous structure.

Current industrial production capabilities allow for the manufacturing of amorphous ribbons with thicknesses ranging from 15 to 35 μm and widths up to 220 mm. However, scaling these processes for mass production while maintaining consistent material properties remains challenging. The rapid quenching process introduces inherent variations in magnetic properties across the ribbon width and length, requiring sophisticated quality control measures.

Recent advancements in planar flow casting and twin-roll casting have improved production efficiency and material consistency. These techniques have enabled manufacturers to achieve better control over ribbon dimensions and reduce internal stresses that contribute to core losses. Additionally, innovations in nanocrystalline alloy production through controlled annealing of amorphous precursors have opened new pathways for scalable manufacturing of advanced soft magnetic materials.

The economic feasibility of amorphous alloy production is heavily influenced by raw material costs and energy consumption. While the primary constituents (Fe, Co, Ni) are relatively abundant, the addition of critical elements like B, Si, and rare earth metals impacts overall material costs. Energy requirements for the melting and rapid quenching processes are substantial, necessitating optimization for commercial viability.

Post-processing steps, including annealing, cutting, and core assembly, significantly affect the final magnetic performance and manufacturing costs. Precision cutting techniques that minimize edge damage are essential for reducing additional core losses. Laser cutting and water jet technologies have shown promise in minimizing the degradation of magnetic properties during core fabrication.

Supply chain considerations present another dimension to scalability assessment. The limited number of manufacturers capable of producing high-quality amorphous ribbons creates potential bottlenecks in the supply chain. Establishing robust supplier networks and potentially developing in-house manufacturing capabilities may be necessary for companies seeking to incorporate these materials into their power electronic products at scale.

Environmental impact and sustainability factors must also be considered in manufacturing process assessment. While amorphous alloys enable more efficient power electronics, their production involves energy-intensive processes. Developing more energy-efficient manufacturing methods and implementing recycling strategies for production waste could improve the overall environmental footprint of these advanced materials.

Current industrial production capabilities allow for the manufacturing of amorphous ribbons with thicknesses ranging from 15 to 35 μm and widths up to 220 mm. However, scaling these processes for mass production while maintaining consistent material properties remains challenging. The rapid quenching process introduces inherent variations in magnetic properties across the ribbon width and length, requiring sophisticated quality control measures.

Recent advancements in planar flow casting and twin-roll casting have improved production efficiency and material consistency. These techniques have enabled manufacturers to achieve better control over ribbon dimensions and reduce internal stresses that contribute to core losses. Additionally, innovations in nanocrystalline alloy production through controlled annealing of amorphous precursors have opened new pathways for scalable manufacturing of advanced soft magnetic materials.

The economic feasibility of amorphous alloy production is heavily influenced by raw material costs and energy consumption. While the primary constituents (Fe, Co, Ni) are relatively abundant, the addition of critical elements like B, Si, and rare earth metals impacts overall material costs. Energy requirements for the melting and rapid quenching processes are substantial, necessitating optimization for commercial viability.

Post-processing steps, including annealing, cutting, and core assembly, significantly affect the final magnetic performance and manufacturing costs. Precision cutting techniques that minimize edge damage are essential for reducing additional core losses. Laser cutting and water jet technologies have shown promise in minimizing the degradation of magnetic properties during core fabrication.

Supply chain considerations present another dimension to scalability assessment. The limited number of manufacturers capable of producing high-quality amorphous ribbons creates potential bottlenecks in the supply chain. Establishing robust supplier networks and potentially developing in-house manufacturing capabilities may be necessary for companies seeking to incorporate these materials into their power electronic products at scale.

Environmental impact and sustainability factors must also be considered in manufacturing process assessment. While amorphous alloys enable more efficient power electronics, their production involves energy-intensive processes. Developing more energy-efficient manufacturing methods and implementing recycling strategies for production waste could improve the overall environmental footprint of these advanced materials.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!