Ribbon Versus Bulk Amorphous Soft Magnetic Alloys For Transformer Core Applications In High-Frequency Power Electronics

AUG 26, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Amorphous Alloy Evolution and Research Objectives

Amorphous soft magnetic alloys have undergone significant evolution since their discovery in the 1960s, transitioning from laboratory curiosities to commercially viable materials for power electronics applications. The initial development focused on rapidly quenched ribbon forms, produced through melt spinning techniques that enabled cooling rates exceeding 10^6 K/s, necessary to prevent crystallization and maintain the amorphous structure. These ribbon materials, typically 20-30 μm thick, demonstrated superior magnetic properties compared to conventional silicon steel, including lower core losses and higher permeability.

The technological trajectory shifted in the 1990s with the emergence of bulk amorphous soft magnetic alloys, representing a paradigm shift in manufacturing capabilities. These materials, with thicknesses exceeding 1 mm, addressed many limitations of ribbon forms while maintaining the advantageous magnetic characteristics of the amorphous structure. The development of bulk amorphous alloys required innovative composition engineering to reduce critical cooling rates to manageable levels, primarily through the addition of elements like Zr, Nb, and B that enhance glass-forming ability.

Recent advancements have focused on optimizing composition and processing parameters to enhance specific properties relevant to high-frequency transformer applications. Fe-based amorphous alloys have gained prominence due to their cost-effectiveness and superior saturation magnetization, while Co-based variants offer exceptional permeability and temperature stability at the expense of higher material costs. The introduction of nanocrystalline variants through controlled annealing processes has further expanded the performance envelope of these materials.

The research objectives in this field are multifaceted, addressing both fundamental materials science challenges and practical implementation concerns. Primary goals include enhancing saturation flux density while maintaining low core losses at operating frequencies exceeding 20 kHz, which is critical for next-generation power electronics. Improving thermal stability to enable operation at temperatures above 150°C without degradation of magnetic properties represents another key objective, particularly for electric vehicle and aerospace applications.

Manufacturing scalability remains a significant research focus, with efforts directed toward developing cost-effective production methods for bulk amorphous alloys that maintain consistent properties throughout larger cross-sections. Additionally, research aims to optimize material formulations that reduce reliance on critical raw materials like cobalt, addressing supply chain vulnerabilities while maintaining performance metrics. The ultimate objective is to establish a comprehensive understanding of structure-property relationships in these complex alloy systems, enabling predictive design of compositions tailored for specific transformer applications in high-frequency power electronics.

The technological trajectory shifted in the 1990s with the emergence of bulk amorphous soft magnetic alloys, representing a paradigm shift in manufacturing capabilities. These materials, with thicknesses exceeding 1 mm, addressed many limitations of ribbon forms while maintaining the advantageous magnetic characteristics of the amorphous structure. The development of bulk amorphous alloys required innovative composition engineering to reduce critical cooling rates to manageable levels, primarily through the addition of elements like Zr, Nb, and B that enhance glass-forming ability.

Recent advancements have focused on optimizing composition and processing parameters to enhance specific properties relevant to high-frequency transformer applications. Fe-based amorphous alloys have gained prominence due to their cost-effectiveness and superior saturation magnetization, while Co-based variants offer exceptional permeability and temperature stability at the expense of higher material costs. The introduction of nanocrystalline variants through controlled annealing processes has further expanded the performance envelope of these materials.

The research objectives in this field are multifaceted, addressing both fundamental materials science challenges and practical implementation concerns. Primary goals include enhancing saturation flux density while maintaining low core losses at operating frequencies exceeding 20 kHz, which is critical for next-generation power electronics. Improving thermal stability to enable operation at temperatures above 150°C without degradation of magnetic properties represents another key objective, particularly for electric vehicle and aerospace applications.

Manufacturing scalability remains a significant research focus, with efforts directed toward developing cost-effective production methods for bulk amorphous alloys that maintain consistent properties throughout larger cross-sections. Additionally, research aims to optimize material formulations that reduce reliance on critical raw materials like cobalt, addressing supply chain vulnerabilities while maintaining performance metrics. The ultimate objective is to establish a comprehensive understanding of structure-property relationships in these complex alloy systems, enabling predictive design of compositions tailored for specific transformer applications in high-frequency power electronics.

Market Demand Analysis for High-Frequency Transformer Cores

The high-frequency transformer core market is experiencing significant growth driven by the rapid expansion of power electronics applications across multiple industries. Current market valuations indicate that the global high-frequency transformer market reached approximately 2.1 billion USD in 2022 and is projected to grow at a CAGR of 6.8% through 2030, with soft magnetic materials representing a substantial segment of this market.

The demand for high-frequency transformer cores is primarily fueled by the increasing adoption of power electronics in renewable energy systems, electric vehicles, data centers, and industrial automation. As these sectors continue to expand, the need for more efficient power conversion solutions becomes paramount, creating substantial market opportunities for advanced magnetic materials.

Electric vehicle (EV) charging infrastructure represents one of the fastest-growing application segments, with DC fast chargers requiring high-performance transformer cores capable of operating efficiently at frequencies between 20-100 kHz. This segment alone is expected to grow by over 30% annually as global EV adoption accelerates.

Renewable energy systems, particularly solar inverters and wind power converters, constitute another major demand driver. These applications require transformer cores that can handle high frequencies while maintaining low core losses to maximize overall system efficiency. The global solar inverter market, valued at 9.3 billion USD in 2022, directly influences demand for high-frequency magnetic components.

Data center power supplies represent a third critical market segment, with the ongoing digital transformation driving unprecedented growth in computing infrastructure. Modern server power supplies operating at frequencies above 50 kHz require transformer cores with exceptional performance characteristics to meet efficiency standards like 80 Plus Titanium.

Consumer electronics and telecommunications equipment manufacturers are also significant consumers of high-frequency transformer cores, particularly for compact power adapters and fast-charging solutions. This segment values size reduction and efficiency improvements that advanced soft magnetic materials can provide.

Market analysis reveals a clear trend toward materials that enable higher operating frequencies, smaller form factors, and improved thermal performance. End users increasingly prioritize total cost of ownership over initial acquisition costs, recognizing that premium magnetic materials can deliver substantial energy savings over product lifetimes.

Regional demand patterns show Asia-Pacific leading market consumption, accounting for approximately 45% of global demand, followed by North America and Europe. China remains the largest single market, driven by its dominant position in electronics manufacturing and aggressive electrification initiatives.

AI and machine learning applications are emerging as a new frontier for high-frequency power electronics, with specialized computing hardware requiring increasingly sophisticated power delivery solutions that can operate at higher frequencies while maintaining exceptional efficiency.

The demand for high-frequency transformer cores is primarily fueled by the increasing adoption of power electronics in renewable energy systems, electric vehicles, data centers, and industrial automation. As these sectors continue to expand, the need for more efficient power conversion solutions becomes paramount, creating substantial market opportunities for advanced magnetic materials.

Electric vehicle (EV) charging infrastructure represents one of the fastest-growing application segments, with DC fast chargers requiring high-performance transformer cores capable of operating efficiently at frequencies between 20-100 kHz. This segment alone is expected to grow by over 30% annually as global EV adoption accelerates.

Renewable energy systems, particularly solar inverters and wind power converters, constitute another major demand driver. These applications require transformer cores that can handle high frequencies while maintaining low core losses to maximize overall system efficiency. The global solar inverter market, valued at 9.3 billion USD in 2022, directly influences demand for high-frequency magnetic components.

Data center power supplies represent a third critical market segment, with the ongoing digital transformation driving unprecedented growth in computing infrastructure. Modern server power supplies operating at frequencies above 50 kHz require transformer cores with exceptional performance characteristics to meet efficiency standards like 80 Plus Titanium.

Consumer electronics and telecommunications equipment manufacturers are also significant consumers of high-frequency transformer cores, particularly for compact power adapters and fast-charging solutions. This segment values size reduction and efficiency improvements that advanced soft magnetic materials can provide.

Market analysis reveals a clear trend toward materials that enable higher operating frequencies, smaller form factors, and improved thermal performance. End users increasingly prioritize total cost of ownership over initial acquisition costs, recognizing that premium magnetic materials can deliver substantial energy savings over product lifetimes.

Regional demand patterns show Asia-Pacific leading market consumption, accounting for approximately 45% of global demand, followed by North America and Europe. China remains the largest single market, driven by its dominant position in electronics manufacturing and aggressive electrification initiatives.

AI and machine learning applications are emerging as a new frontier for high-frequency power electronics, with specialized computing hardware requiring increasingly sophisticated power delivery solutions that can operate at higher frequencies while maintaining exceptional efficiency.

Current Status and Challenges in Soft Magnetic Materials

The global landscape of soft magnetic materials has witnessed significant evolution in recent years, with amorphous and nanocrystalline alloys emerging as frontrunners for high-frequency power electronic applications. Currently, ribbon-form amorphous alloys dominate commercial applications, manufactured primarily through rapid solidification techniques that enable cooling rates exceeding 10^6 K/s. These materials exhibit superior magnetic properties with low coercivity and high permeability, making them ideal for transformer cores operating at frequencies between 10 kHz and 100 kHz.

In contrast, bulk amorphous soft magnetic alloys represent a more recent technological development, offering three-dimensional form factors that overcome the dimensional limitations of ribbon-based materials. These bulk materials are typically produced through various casting methods, including suction casting and copper mold casting, achieving critical cooling rates of 10^2-10^3 K/s. However, their commercial adoption remains limited due to challenges in manufacturing consistency and scalability.

The technical landscape is further complicated by the emergence of nanocrystalline materials, which offer enhanced saturation magnetization compared to fully amorphous counterparts. Fe-based nanocrystalline alloys such as FINEMET and NANOPERM have demonstrated exceptional performance in high-frequency applications, though their brittleness presents significant processing challenges.

A critical challenge facing both ribbon and bulk amorphous materials is the trade-off between magnetic performance and thermal stability. While ribbon amorphous alloys exhibit excellent soft magnetic properties, their Curie temperatures typically range between 300-400°C, limiting their application in high-temperature environments. Bulk amorphous alloys can be engineered for higher thermal stability but often at the cost of reduced magnetic performance.

Manufacturing scalability represents another significant hurdle, particularly for bulk amorphous materials. While ribbon production has been industrialized for decades, the production of bulk amorphous components with consistent properties remains technically challenging and economically prohibitive for many applications. Current manufacturing capabilities limit bulk amorphous parts to relatively small dimensions, typically under 10mm in thickness.

Core loss performance at high frequencies constitutes a fundamental challenge for both material types. Although amorphous materials offer significantly reduced hysteresis losses compared to silicon steel, eddy current losses become increasingly problematic at frequencies above 50 kHz, necessitating complex core designs and material modifications to maintain efficiency.

The geographical distribution of technical expertise shows concentration in Japan, the United States, and increasingly China, with companies like Hitachi Metals, Metglas, and Advanced Technology & Materials leading commercial development. Research institutions in Europe have made significant contributions to fundamental understanding, though commercial translation lags behind Asian counterparts.

In contrast, bulk amorphous soft magnetic alloys represent a more recent technological development, offering three-dimensional form factors that overcome the dimensional limitations of ribbon-based materials. These bulk materials are typically produced through various casting methods, including suction casting and copper mold casting, achieving critical cooling rates of 10^2-10^3 K/s. However, their commercial adoption remains limited due to challenges in manufacturing consistency and scalability.

The technical landscape is further complicated by the emergence of nanocrystalline materials, which offer enhanced saturation magnetization compared to fully amorphous counterparts. Fe-based nanocrystalline alloys such as FINEMET and NANOPERM have demonstrated exceptional performance in high-frequency applications, though their brittleness presents significant processing challenges.

A critical challenge facing both ribbon and bulk amorphous materials is the trade-off between magnetic performance and thermal stability. While ribbon amorphous alloys exhibit excellent soft magnetic properties, their Curie temperatures typically range between 300-400°C, limiting their application in high-temperature environments. Bulk amorphous alloys can be engineered for higher thermal stability but often at the cost of reduced magnetic performance.

Manufacturing scalability represents another significant hurdle, particularly for bulk amorphous materials. While ribbon production has been industrialized for decades, the production of bulk amorphous components with consistent properties remains technically challenging and economically prohibitive for many applications. Current manufacturing capabilities limit bulk amorphous parts to relatively small dimensions, typically under 10mm in thickness.

Core loss performance at high frequencies constitutes a fundamental challenge for both material types. Although amorphous materials offer significantly reduced hysteresis losses compared to silicon steel, eddy current losses become increasingly problematic at frequencies above 50 kHz, necessitating complex core designs and material modifications to maintain efficiency.

The geographical distribution of technical expertise shows concentration in Japan, the United States, and increasingly China, with companies like Hitachi Metals, Metglas, and Advanced Technology & Materials leading commercial development. Research institutions in Europe have made significant contributions to fundamental understanding, though commercial translation lags behind Asian counterparts.

Comparative Analysis of Ribbon vs Bulk Amorphous Solutions

01 Composition and structure of amorphous soft magnetic alloys

Amorphous soft magnetic alloys with specific compositions exhibit superior magnetic properties for transformer core applications. These alloys typically contain iron, boron, silicon, and other elements like cobalt or nickel in precise ratios to achieve optimal magnetic characteristics. The amorphous structure, achieved through rapid solidification techniques, results in reduced hysteresis losses and higher permeability compared to conventional crystalline materials. The specific atomic arrangement in these alloys contributes to their excellent soft magnetic properties.- Composition and structure of amorphous soft magnetic alloys: Amorphous soft magnetic alloys are typically composed of iron-based, cobalt-based, or iron-cobalt-based compositions with additions of elements like boron, silicon, and phosphorus. These alloys are produced in ribbon form through rapid solidification techniques such as melt spinning, or in bulk form through various casting methods. The amorphous structure, characterized by the absence of long-range atomic order, contributes to their superior magnetic properties including high permeability, low coercivity, and reduced core losses, making them ideal for transformer core applications.

- Core loss reduction techniques in transformer applications: Various techniques are employed to reduce core losses in amorphous soft magnetic alloy transformers. These include optimizing the alloy composition, controlling the ribbon thickness, implementing specific annealing treatments under magnetic fields, and designing core geometries that minimize flux leakage. Advanced lamination methods and core assembly techniques also help in reducing eddy current losses. These approaches collectively enhance energy efficiency and performance of transformers, particularly in high-frequency or high-power applications.

- Thermal treatment and magnetic annealing processes: Thermal treatment and magnetic annealing processes are crucial for optimizing the magnetic properties of amorphous soft magnetic alloys. These processes involve heating the alloy to specific temperatures below crystallization point, often in the presence of an applied magnetic field, followed by controlled cooling. Such treatments relieve internal stresses, induce beneficial magnetic anisotropy, and stabilize the magnetic domains, resulting in improved permeability, reduced coercivity, and enhanced overall transformer core performance.

- Nanocrystalline and composite magnetic materials: Nanocrystalline and composite magnetic materials represent an evolution of amorphous soft magnetic alloys, where controlled partial crystallization creates nanoscale crystalline phases embedded in an amorphous matrix. These materials combine the advantages of both amorphous and crystalline structures, offering superior magnetic properties such as higher saturation flux density, excellent temperature stability, and reduced magnetostriction. When used in transformer cores, they provide enhanced performance, particularly in high-frequency applications, with improved power density and efficiency.

- Core assembly techniques and transformer design optimization: Specialized core assembly techniques and design optimizations are essential for maximizing the performance of amorphous soft magnetic alloy transformer cores. These include wound core configurations, step-lap joint designs, and distributed gap approaches that minimize flux concentration and associated losses. Advanced cutting, stacking, and bonding methods address the mechanical brittleness of amorphous ribbons. Innovative core geometries and winding arrangements further optimize magnetic flux paths, reducing leakage inductance and improving overall transformer efficiency and power density.

02 Manufacturing processes for ribbon and bulk amorphous alloys

Various manufacturing techniques are employed to produce amorphous soft magnetic alloys in ribbon and bulk forms. For ribbon forms, rapid quenching methods like melt spinning are commonly used, where molten alloy is rapidly cooled on a rotating wheel to form thin ribbons with amorphous structure. For bulk forms, techniques such as suction casting, copper mold casting, and spark plasma sintering are utilized. These processes control the cooling rate to maintain the amorphous structure while achieving the desired dimensions and properties for transformer core applications.Expand Specific Solutions03 Core loss reduction and energy efficiency improvements

Amorphous soft magnetic alloys significantly reduce core losses in transformer applications, leading to improved energy efficiency. The absence of crystalline grain boundaries in these materials minimizes hysteresis losses, while their high electrical resistivity reduces eddy current losses. Various treatments including heat treatment under magnetic field, surface modification, and lamination techniques further enhance performance. These materials can achieve core loss reductions of up to 70-80% compared to conventional silicon steel, resulting in substantial energy savings in power distribution systems.Expand Specific Solutions04 Thermal stability and aging characteristics

The thermal stability and aging characteristics of amorphous soft magnetic alloys are critical for long-term transformer performance. These materials undergo structural relaxation and partial crystallization when exposed to elevated temperatures during operation. Controlled annealing processes can stabilize the magnetic properties and reduce aging effects. The addition of specific elements like chromium, molybdenum, or copper can enhance thermal stability. Understanding and managing these thermal behaviors is essential for maintaining consistent transformer core performance throughout the operational lifetime.Expand Specific Solutions05 Advanced transformer designs utilizing amorphous alloys

Innovative transformer designs leverage the unique properties of amorphous soft magnetic alloys to maximize performance benefits. These designs include specialized core geometries, optimized winding configurations, and hybrid cores combining amorphous and nanocrystalline materials. Distribution transformers with amorphous cores demonstrate superior efficiency under varying load conditions. Recent advancements include modular designs for easier manufacturing and maintenance, as well as integrated cooling systems to manage temperature rise. These advanced designs address challenges related to magnetostriction noise and mechanical fragility while maximizing the energy efficiency advantages of amorphous materials.Expand Specific Solutions

Key Manufacturers and Competitive Landscape

The market for ribbon versus bulk amorphous soft magnetic alloys in high-frequency power electronics transformer applications is currently in a growth phase, with increasing demand driven by energy efficiency requirements. The global market is expanding at approximately 8-10% annually, reaching an estimated $1.2 billion. Technologically, ribbon amorphous alloys are more mature, with companies like Metglas, Proterial, and Qingdao Yunlu leading commercial applications, while bulk amorphous alloys represent an emerging segment with significant R&D investment from JFE Steel, NIPPON STEEL, and Advanced Technology & Materials. Academic-industrial collaborations between institutions like Tohoku University and Central Iron & Steel Research Institute are accelerating material innovations, particularly in nanocrystalline compositions that offer superior performance at higher frequencies.

Qingdao Yunlu Advanced Materials Technology Co., Ltd.

Technical Solution: Qingdao Yunlu has developed proprietary amorphous and nanocrystalline ribbon technologies specifically optimized for high-frequency transformer applications. Their manufacturing process employs a single-roller rapid quenching technique that produces ultra-thin amorphous ribbons (15-25μm) with exceptional uniformity. Their Fe-based amorphous alloy compositions (Fe78Si9B13) achieve saturation inductions of 1.5-1.6T while maintaining high resistivity values (120-135 μΩ·cm). For higher frequency applications (20-100kHz), Yunlu has engineered specialized nanocrystalline ribbons through controlled crystallization processes, resulting in materials with permeability values of 50,000-100,000 and core losses below 50W/kg at 50kHz/0.5T. Their ribbon cores demonstrate 30-40% efficiency improvements over conventional ferrite materials in high-frequency DC-DC converters. Yunlu has also developed advanced core winding and annealing techniques that minimize stress-induced degradation of magnetic properties, enabling their ribbon cores to maintain performance advantages even after assembly into finished transformer products.

Strengths: Cost-effective manufacturing process allowing competitive pricing; customizable ribbon widths for different applications; excellent high-frequency performance; comprehensive technical support for implementation. Weaknesses: More limited global distribution network compared to larger competitors; somewhat lower saturation flux density than best-in-class materials; less established brand recognition in some markets; potential for quality variations between production batches.

NIPPON STEEL CORP.

Technical Solution: NIPPON STEEL has developed advanced nanocrystalline soft magnetic alloys marketed under their NANOMET® brand, which represents a hybrid approach between fully amorphous and crystalline materials. Their technology involves creating ribbon-form amorphous precursors through rapid solidification followed by controlled heat treatment to induce partial crystallization, resulting in nanocrystalline structures with grain sizes of 10-15nm embedded in an amorphous matrix. This unique microstructure achieves remarkable magnetic properties with saturation flux densities of 1.2-1.3T while maintaining extremely low core losses (<0.2W/kg at 50Hz/1.0T). For high-frequency transformer applications, NIPPON STEEL's Fe-Si-B-Cu-Nb based nanocrystalline ribbons demonstrate permeability values exceeding 100,000 and maintain stable magnetic properties up to 150°C. Their ribbon cores show particular advantages in the 10-100kHz range, where they exhibit approximately 1/3 the core losses of conventional amorphous materials and 1/10 the losses of silicon steel, making them ideal for high-efficiency power electronics.

Strengths: Exceptional combination of high permeability and low core losses; excellent temperature stability; superior frequency characteristics up to several hundred kHz; consistent magnetic properties. Weaknesses: Higher production costs compared to conventional materials; limited physical strength requiring protective packaging; more complex manufacturing process requiring precise heat treatment; thickness limitations inherent to ribbon production methods.

Critical Patents and Innovations in Amorphous Alloy Processing

System and method for treating an amorphous alloy ribbon

PatentInactiveEP2501831A1

Innovation

- An in-line annealing method that rapidly heats and cools the amorphous alloy ribbon at rates greater than 103 °C/sec, applying mechanical constraints to maintain a specific shape and preserve ductility, allowing for efficient rolling into cores without crystallization, thereby reducing core loss and improving magnetic properties.

Soft magnetic alloy ribbon and its production method, and magnetic device having soft magnetic alloy ribbon

PatentActiveUS20110272065A1

Innovation

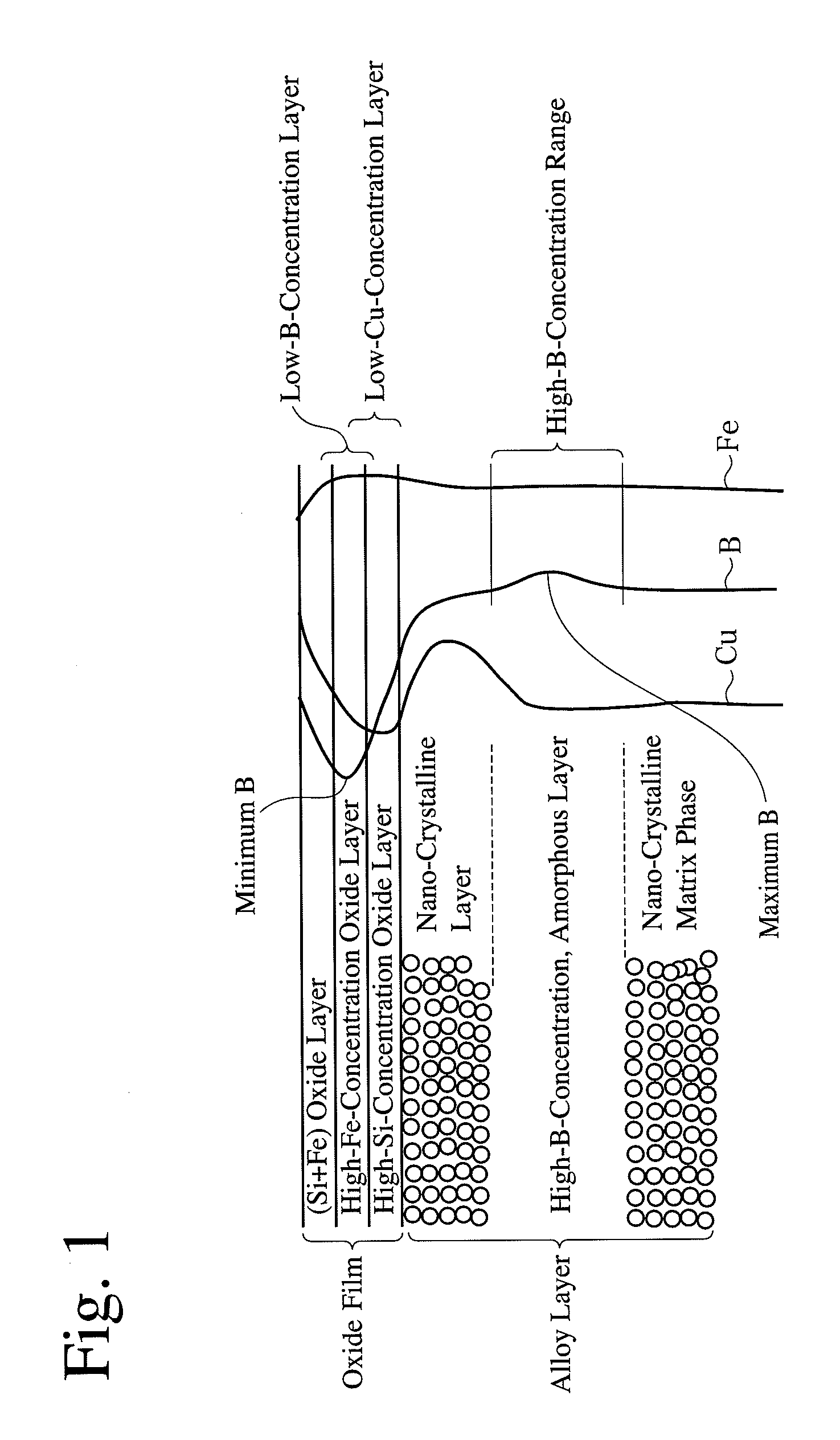

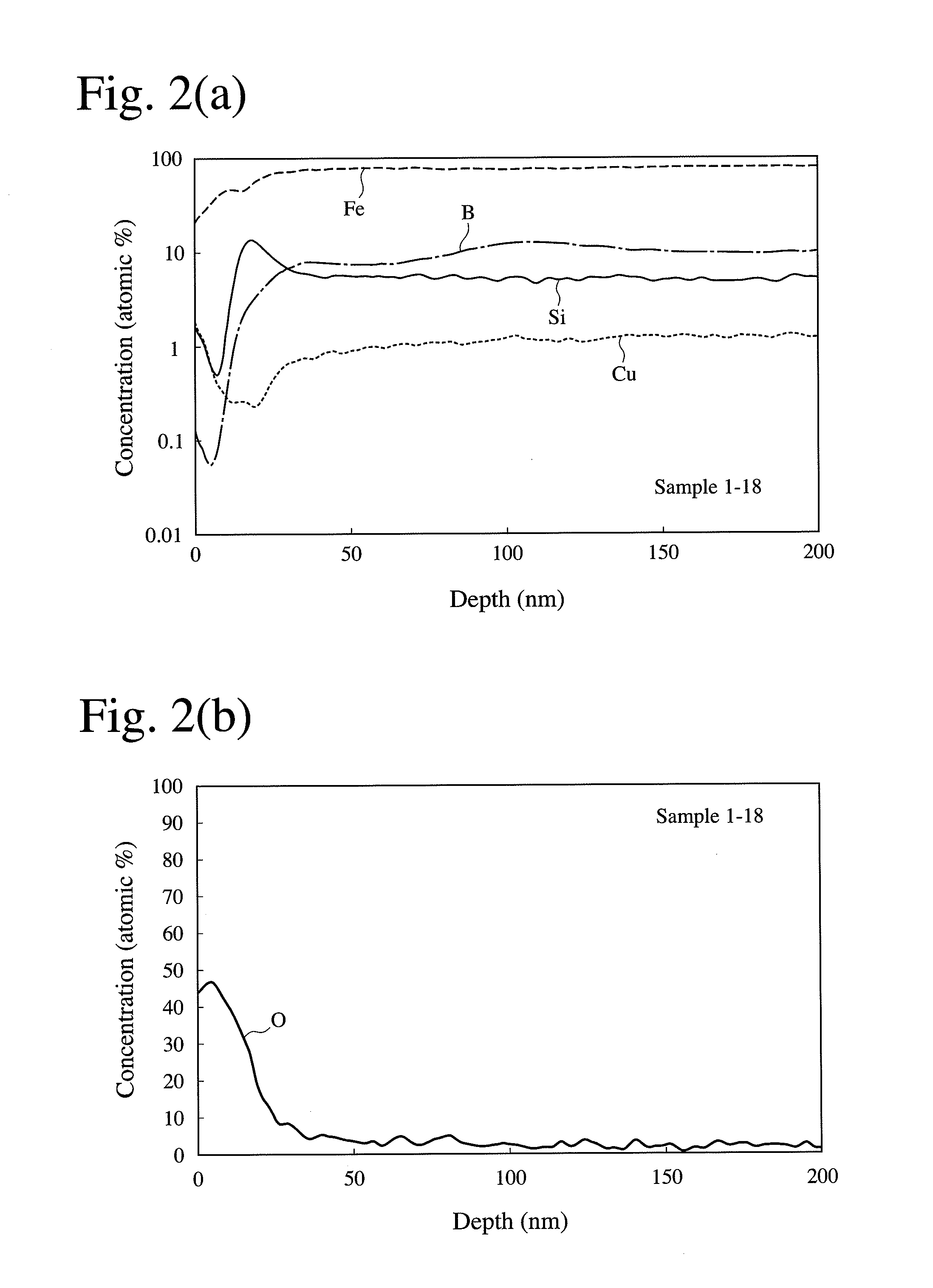

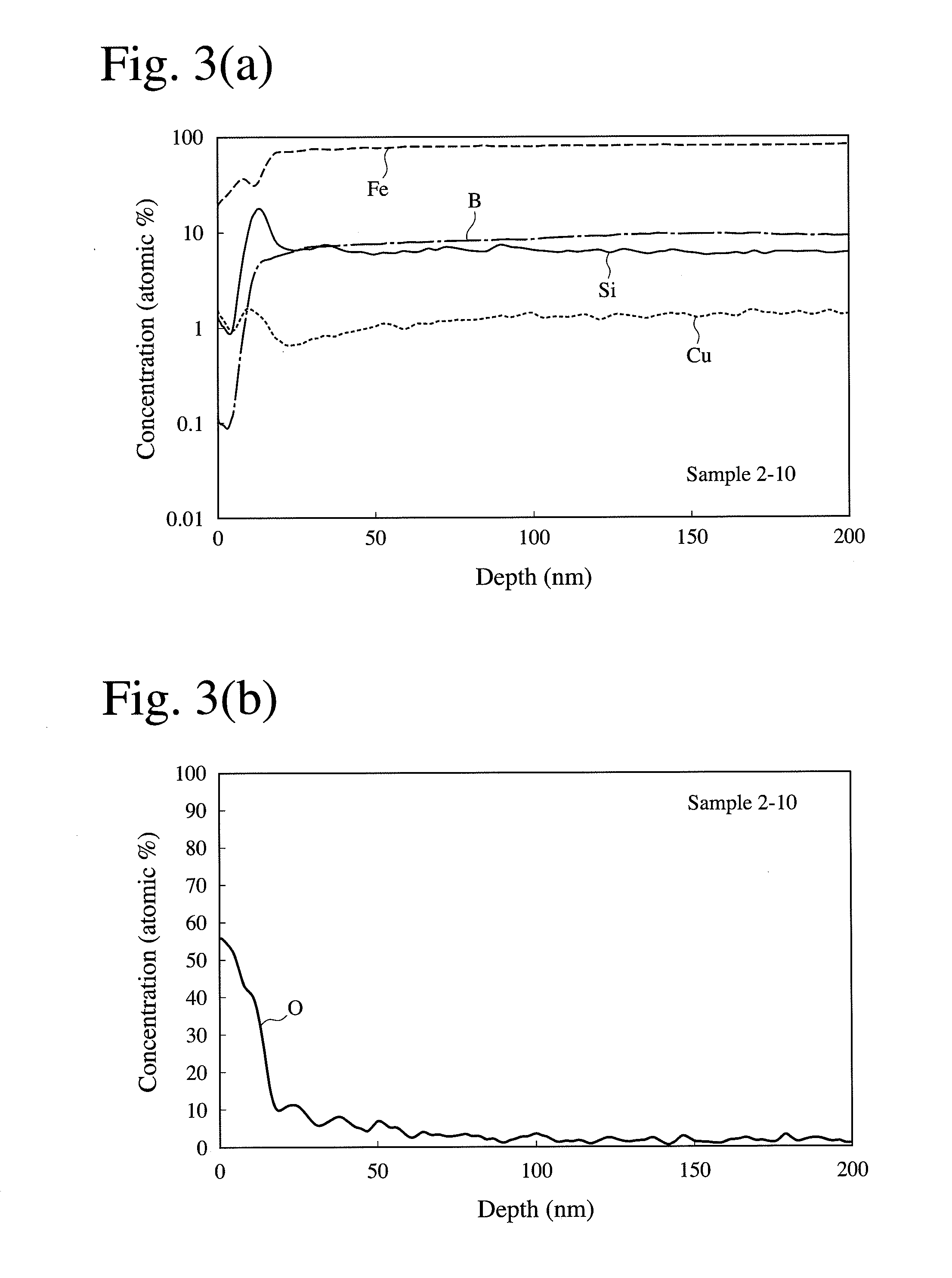

- The development of an Fe-based soft magnetic alloy ribbon with a specific composition and production method, involving a quenching process followed by annealing in an atmosphere with controlled oxygen concentration, to create a structure with fine crystal grains dispersed in an amorphous phase and a surface oxide film with distinct B and Cu concentration layers, enhancing magnetic properties and insulation.

Energy Efficiency and Thermal Management Considerations

Energy efficiency is a critical factor in the selection between ribbon and bulk amorphous soft magnetic alloys for transformer core applications in high-frequency power electronics. Ribbon amorphous alloys typically demonstrate lower core losses at high frequencies compared to their bulk counterparts, resulting in improved energy efficiency. This advantage stems from their ultra-thin structure (typically 20-30 μm), which effectively limits eddy current losses. Recent studies indicate that ribbon-based transformers can achieve efficiency improvements of 15-20% over conventional silicon steel cores when operating at frequencies above 20 kHz.

Thermal management considerations differ significantly between these two material formats. Ribbon amorphous cores, despite their superior electrical performance, present challenges in heat dissipation due to their laminated structure and the presence of adhesives or coatings between layers. The thermal conductivity of ribbon amorphous cores typically ranges from 5-10 W/m·K, which is lower than bulk amorphous alloys that can reach 15-20 W/m·K. This difference becomes particularly significant in high-power density applications where effective heat removal is essential.

Bulk amorphous alloys offer advantages in thermal stability and heat distribution uniformity. Their more substantial cross-sectional area provides better pathways for heat transfer, reducing hotspot formation that can accelerate magnetic aging and potentially lead to catastrophic failure. Thermal imaging studies have shown that temperature gradients across bulk amorphous cores can be 30-40% lower than in equivalent ribbon-based designs under identical operating conditions.

The cooling system requirements also vary between these materials. Ribbon-based transformers often require more sophisticated cooling solutions, including forced air or liquid cooling systems in high-power applications. In contrast, bulk amorphous cores may operate effectively with simpler cooling arrangements, potentially reducing system complexity and maintenance requirements. This difference can significantly impact the total cost of ownership when considering long-term operational expenses.

Energy efficiency and thermal management are intrinsically linked in high-frequency transformer applications. Higher operating temperatures in poorly managed thermal systems lead to increased resistive losses and can accelerate the degradation of magnetic properties. Research indicates that for every 10°C increase in operating temperature, the expected service life of magnetic components may decrease by 10-15%. Therefore, the selection between ribbon and bulk amorphous materials must balance immediate efficiency gains against long-term reliability and performance stability under thermal stress.

Thermal management considerations differ significantly between these two material formats. Ribbon amorphous cores, despite their superior electrical performance, present challenges in heat dissipation due to their laminated structure and the presence of adhesives or coatings between layers. The thermal conductivity of ribbon amorphous cores typically ranges from 5-10 W/m·K, which is lower than bulk amorphous alloys that can reach 15-20 W/m·K. This difference becomes particularly significant in high-power density applications where effective heat removal is essential.

Bulk amorphous alloys offer advantages in thermal stability and heat distribution uniformity. Their more substantial cross-sectional area provides better pathways for heat transfer, reducing hotspot formation that can accelerate magnetic aging and potentially lead to catastrophic failure. Thermal imaging studies have shown that temperature gradients across bulk amorphous cores can be 30-40% lower than in equivalent ribbon-based designs under identical operating conditions.

The cooling system requirements also vary between these materials. Ribbon-based transformers often require more sophisticated cooling solutions, including forced air or liquid cooling systems in high-power applications. In contrast, bulk amorphous cores may operate effectively with simpler cooling arrangements, potentially reducing system complexity and maintenance requirements. This difference can significantly impact the total cost of ownership when considering long-term operational expenses.

Energy efficiency and thermal management are intrinsically linked in high-frequency transformer applications. Higher operating temperatures in poorly managed thermal systems lead to increased resistive losses and can accelerate the degradation of magnetic properties. Research indicates that for every 10°C increase in operating temperature, the expected service life of magnetic components may decrease by 10-15%. Therefore, the selection between ribbon and bulk amorphous materials must balance immediate efficiency gains against long-term reliability and performance stability under thermal stress.

Manufacturing Scalability and Cost-Effectiveness Assessment

The manufacturing scalability and cost-effectiveness of amorphous soft magnetic alloys represent critical factors in their industrial adoption for transformer core applications in high-frequency power electronics. When comparing ribbon and bulk amorphous materials, significant differences emerge in production methodologies that directly impact economic viability.

Ribbon amorphous alloys, typically produced through rapid solidification techniques such as melt spinning, benefit from decades of manufacturing refinement. This established production infrastructure allows for relatively high-volume manufacturing capabilities, with global production capacity exceeding 200,000 tons annually. The process involves forcing molten metal through a nozzle onto a rapidly rotating copper wheel, creating thin ribbons (20-30 μm thickness) that solidify at cooling rates of 10^6 K/s. This manufacturing approach offers good reproducibility and quality control at scale.

However, ribbon manufacturing faces inherent limitations in production width (typically 5-25 cm), necessitating stacking or winding processes to create transformer cores. This additional processing increases labor costs and introduces potential quality variations. The brittle nature of ribbon materials also presents handling challenges during assembly operations, potentially increasing defect rates in high-volume production environments.

In contrast, bulk amorphous alloys, produced through methods such as suction casting or copper mold casting, offer potential advantages in simplified core assembly due to their three-dimensional formability. These manufacturing techniques can produce components with thicknesses ranging from 0.5 to several millimeters, potentially reducing assembly steps and associated labor costs. However, the production throughput remains significantly lower than ribbon manufacturing, with current global capacity estimated below 5,000 tons annually.

From a cost perspective, ribbon amorphous materials benefit from economies of scale, with raw material costs typically representing 65-75% of total production expenses. Bulk amorphous production currently faces higher per-unit costs due to lower production volumes, more complex casting equipment requirements, and higher rejection rates. Industry analyses indicate that ribbon amorphous cores currently maintain a 15-30% cost advantage over comparable bulk amorphous alternatives for medium-volume applications.

Future manufacturing economics will likely be influenced by technological developments in both production methodologies. Advances in continuous casting techniques for bulk amorphous materials could significantly improve throughput and yield rates, potentially narrowing the cost gap. Similarly, innovations in automated core assembly for ribbon materials could reduce labor costs and improve consistency. Material composition optimization may also impact manufacturing economics by potentially reducing reliance on costly elements like cobalt or niobium in certain applications.

Ribbon amorphous alloys, typically produced through rapid solidification techniques such as melt spinning, benefit from decades of manufacturing refinement. This established production infrastructure allows for relatively high-volume manufacturing capabilities, with global production capacity exceeding 200,000 tons annually. The process involves forcing molten metal through a nozzle onto a rapidly rotating copper wheel, creating thin ribbons (20-30 μm thickness) that solidify at cooling rates of 10^6 K/s. This manufacturing approach offers good reproducibility and quality control at scale.

However, ribbon manufacturing faces inherent limitations in production width (typically 5-25 cm), necessitating stacking or winding processes to create transformer cores. This additional processing increases labor costs and introduces potential quality variations. The brittle nature of ribbon materials also presents handling challenges during assembly operations, potentially increasing defect rates in high-volume production environments.

In contrast, bulk amorphous alloys, produced through methods such as suction casting or copper mold casting, offer potential advantages in simplified core assembly due to their three-dimensional formability. These manufacturing techniques can produce components with thicknesses ranging from 0.5 to several millimeters, potentially reducing assembly steps and associated labor costs. However, the production throughput remains significantly lower than ribbon manufacturing, with current global capacity estimated below 5,000 tons annually.

From a cost perspective, ribbon amorphous materials benefit from economies of scale, with raw material costs typically representing 65-75% of total production expenses. Bulk amorphous production currently faces higher per-unit costs due to lower production volumes, more complex casting equipment requirements, and higher rejection rates. Industry analyses indicate that ribbon amorphous cores currently maintain a 15-30% cost advantage over comparable bulk amorphous alternatives for medium-volume applications.

Future manufacturing economics will likely be influenced by technological developments in both production methodologies. Advances in continuous casting techniques for bulk amorphous materials could significantly improve throughput and yield rates, potentially narrowing the cost gap. Similarly, innovations in automated core assembly for ribbon materials could reduce labor costs and improve consistency. Material composition optimization may also impact manufacturing economics by potentially reducing reliance on costly elements like cobalt or niobium in certain applications.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!