Effects Of Minor Alloying Additions On Saturation Flux Of Amorphous Soft Magnetic Alloys In High-Frequency Power Electronics

AUG 26, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Amorphous Alloy Development History and Objectives

Amorphous soft magnetic alloys have revolutionized power electronics since their discovery in the 1960s. The journey began when Pol Duwez at Caltech first developed rapid solidification techniques capable of producing metallic glasses. This breakthrough laid the foundation for amorphous metals research, though initial applications were limited due to production constraints and incomplete understanding of their unique properties.

The 1970s marked significant advancement when Allied Signal (now Honeywell) commercialized the first amorphous metal ribbons under the Metglas® trademark. These Fe-based amorphous alloys demonstrated superior soft magnetic properties compared to conventional crystalline materials, particularly lower core losses at higher frequencies.

During the 1980s and 1990s, research focus shifted toward understanding the relationship between composition and magnetic properties. Scientists discovered that minor alloying additions could dramatically alter saturation flux density, permeability, and other critical parameters. This period saw the development of Fe-Si-B based amorphous alloys with improved saturation flux densities approaching 1.6-1.8 Tesla.

The early 2000s witnessed increased interest in amorphous alloys for high-frequency power electronics applications, driven by demands for miniaturization and efficiency in electronic devices. Researchers began systematic investigations into how trace elements like Cu, Nb, and rare earth elements could enhance saturation flux while maintaining the amorphous structure necessary for low core losses.

Recent developments have focused on nanocrystalline derivatives of amorphous alloys, where controlled crystallization of the amorphous precursor creates materials with even better combinations of high saturation flux and low losses. FINEMET, NANOPERM, and HITPERM represent successful examples of these advanced materials.

The primary objective in current amorphous alloy research is to overcome the fundamental trade-off between high saturation flux density and thermal stability. While Fe-rich compositions offer higher saturation flux, they typically exhibit lower glass-forming ability and reduced thermal stability. Conversely, alloys with better glass-forming ability often contain more non-magnetic elements, reducing their saturation magnetization.

Another critical objective is developing cost-effective manufacturing processes for amorphous alloys with optimized minor element additions. Current production methods limit thickness and geometry, restricting applications despite excellent magnetic properties. Researchers aim to develop new processing techniques that maintain the benefits of rapid solidification while allowing more complex geometries and larger volumes.

The 1970s marked significant advancement when Allied Signal (now Honeywell) commercialized the first amorphous metal ribbons under the Metglas® trademark. These Fe-based amorphous alloys demonstrated superior soft magnetic properties compared to conventional crystalline materials, particularly lower core losses at higher frequencies.

During the 1980s and 1990s, research focus shifted toward understanding the relationship between composition and magnetic properties. Scientists discovered that minor alloying additions could dramatically alter saturation flux density, permeability, and other critical parameters. This period saw the development of Fe-Si-B based amorphous alloys with improved saturation flux densities approaching 1.6-1.8 Tesla.

The early 2000s witnessed increased interest in amorphous alloys for high-frequency power electronics applications, driven by demands for miniaturization and efficiency in electronic devices. Researchers began systematic investigations into how trace elements like Cu, Nb, and rare earth elements could enhance saturation flux while maintaining the amorphous structure necessary for low core losses.

Recent developments have focused on nanocrystalline derivatives of amorphous alloys, where controlled crystallization of the amorphous precursor creates materials with even better combinations of high saturation flux and low losses. FINEMET, NANOPERM, and HITPERM represent successful examples of these advanced materials.

The primary objective in current amorphous alloy research is to overcome the fundamental trade-off between high saturation flux density and thermal stability. While Fe-rich compositions offer higher saturation flux, they typically exhibit lower glass-forming ability and reduced thermal stability. Conversely, alloys with better glass-forming ability often contain more non-magnetic elements, reducing their saturation magnetization.

Another critical objective is developing cost-effective manufacturing processes for amorphous alloys with optimized minor element additions. Current production methods limit thickness and geometry, restricting applications despite excellent magnetic properties. Researchers aim to develop new processing techniques that maintain the benefits of rapid solidification while allowing more complex geometries and larger volumes.

Market Analysis for High-Frequency Power Electronics Materials

The high-frequency power electronics market has experienced significant growth over the past decade, primarily driven by the increasing demand for efficient power conversion systems across various industries. The global market for high-frequency power electronics materials was valued at approximately $2.3 billion in 2022 and is projected to reach $4.1 billion by 2028, representing a compound annual growth rate (CAGR) of 9.8%.

Soft magnetic materials, particularly amorphous and nanocrystalline alloys, constitute a substantial segment of this market due to their superior performance in high-frequency applications. These materials are extensively utilized in power transformers, inductors, and other magnetic components that form the backbone of modern power electronic systems.

The automotive sector represents one of the fastest-growing application areas, with the transition to electric vehicles (EVs) creating unprecedented demand for high-performance magnetic materials. On-board chargers, DC-DC converters, and motor drive systems in EVs all benefit from advanced soft magnetic alloys with enhanced saturation flux density characteristics.

Renewable energy systems present another significant market opportunity. Solar inverters and wind power converters require efficient magnetic components that can operate at high frequencies with minimal losses. The global push toward green energy solutions has accelerated the adoption of advanced magnetic materials in these applications.

Consumer electronics and data centers collectively account for approximately 35% of the current market share. The miniaturization trend in consumer devices and the exponential growth in data processing requirements have intensified the need for magnetic materials that can deliver higher power density and efficiency.

Regionally, Asia-Pacific dominates the market with approximately 45% share, led by China, Japan, and South Korea. This dominance is attributed to the region's robust electronics manufacturing ecosystem and significant investments in renewable energy infrastructure. North America and Europe follow with market shares of 28% and 22% respectively, with particular strength in automotive and industrial applications.

The market is characterized by intense competition among material suppliers, with continuous innovation in alloy compositions being a key differentiator. End-users are increasingly willing to pay premium prices for materials that offer tangible improvements in device performance, efficiency, and reliability. This trend has created a favorable environment for research into minor alloying additions that can enhance saturation flux density without compromising other critical properties.

Soft magnetic materials, particularly amorphous and nanocrystalline alloys, constitute a substantial segment of this market due to their superior performance in high-frequency applications. These materials are extensively utilized in power transformers, inductors, and other magnetic components that form the backbone of modern power electronic systems.

The automotive sector represents one of the fastest-growing application areas, with the transition to electric vehicles (EVs) creating unprecedented demand for high-performance magnetic materials. On-board chargers, DC-DC converters, and motor drive systems in EVs all benefit from advanced soft magnetic alloys with enhanced saturation flux density characteristics.

Renewable energy systems present another significant market opportunity. Solar inverters and wind power converters require efficient magnetic components that can operate at high frequencies with minimal losses. The global push toward green energy solutions has accelerated the adoption of advanced magnetic materials in these applications.

Consumer electronics and data centers collectively account for approximately 35% of the current market share. The miniaturization trend in consumer devices and the exponential growth in data processing requirements have intensified the need for magnetic materials that can deliver higher power density and efficiency.

Regionally, Asia-Pacific dominates the market with approximately 45% share, led by China, Japan, and South Korea. This dominance is attributed to the region's robust electronics manufacturing ecosystem and significant investments in renewable energy infrastructure. North America and Europe follow with market shares of 28% and 22% respectively, with particular strength in automotive and industrial applications.

The market is characterized by intense competition among material suppliers, with continuous innovation in alloy compositions being a key differentiator. End-users are increasingly willing to pay premium prices for materials that offer tangible improvements in device performance, efficiency, and reliability. This trend has created a favorable environment for research into minor alloying additions that can enhance saturation flux density without compromising other critical properties.

Current Limitations in Amorphous Soft Magnetic Alloys

Despite significant advancements in amorphous soft magnetic alloys for high-frequency power electronics, several critical limitations persist that hinder their widespread adoption and optimal performance. The primary constraint remains the saturation flux density (Bs), which typically ranges between 1.2-1.7 T for commercial amorphous alloys—significantly lower than crystalline counterparts like silicon steel (up to 2.0 T). This limitation directly impacts power density and miniaturization capabilities of electronic components.

Thermal stability presents another significant challenge, as most amorphous alloys begin to crystallize at temperatures between 450-550°C, restricting their application in high-temperature environments. The crystallization process irreversibly degrades their soft magnetic properties, making thermal management crucial yet problematic in compact power electronic designs.

Manufacturing constraints further complicate the situation. The rapid solidification techniques required to produce these materials limit thickness to typically 15-50 μm, creating challenges in handling and processing. The brittleness of amorphous ribbons also complicates core formation and assembly processes, increasing production costs and limiting geometric design options.

Compositional optimization faces fundamental trade-offs. While Fe-based amorphous alloys offer higher saturation flux, they typically exhibit higher core losses compared to Co-based alternatives. Minor alloying additions that enhance one property often degrade others—for instance, elements that increase saturation flux may simultaneously reduce thermal stability or increase coercivity.

Magnetostriction effects remain problematic in many compositions, causing acoustic noise and additional energy losses under AC conditions. This becomes particularly problematic at the high frequencies (>100 kHz) increasingly demanded by modern power electronics applications.

Economic factors also impose limitations, as the high cost of constituent elements (particularly cobalt) and complex manufacturing processes result in prices 3-5 times higher than conventional magnetic materials. This cost premium restricts market penetration despite performance advantages.

Recent research has focused on nanocrystalline derivatives and compositional fine-tuning, but fundamental physical limits appear to constrain maximum achievable saturation flux without sacrificing other critical properties. The delicate balance between glass-forming ability, magnetic saturation, and thermal stability represents a persistent materials science challenge that requires innovative approaches beyond conventional alloying strategies.

Thermal stability presents another significant challenge, as most amorphous alloys begin to crystallize at temperatures between 450-550°C, restricting their application in high-temperature environments. The crystallization process irreversibly degrades their soft magnetic properties, making thermal management crucial yet problematic in compact power electronic designs.

Manufacturing constraints further complicate the situation. The rapid solidification techniques required to produce these materials limit thickness to typically 15-50 μm, creating challenges in handling and processing. The brittleness of amorphous ribbons also complicates core formation and assembly processes, increasing production costs and limiting geometric design options.

Compositional optimization faces fundamental trade-offs. While Fe-based amorphous alloys offer higher saturation flux, they typically exhibit higher core losses compared to Co-based alternatives. Minor alloying additions that enhance one property often degrade others—for instance, elements that increase saturation flux may simultaneously reduce thermal stability or increase coercivity.

Magnetostriction effects remain problematic in many compositions, causing acoustic noise and additional energy losses under AC conditions. This becomes particularly problematic at the high frequencies (>100 kHz) increasingly demanded by modern power electronics applications.

Economic factors also impose limitations, as the high cost of constituent elements (particularly cobalt) and complex manufacturing processes result in prices 3-5 times higher than conventional magnetic materials. This cost premium restricts market penetration despite performance advantages.

Recent research has focused on nanocrystalline derivatives and compositional fine-tuning, but fundamental physical limits appear to constrain maximum achievable saturation flux without sacrificing other critical properties. The delicate balance between glass-forming ability, magnetic saturation, and thermal stability represents a persistent materials science challenge that requires innovative approaches beyond conventional alloying strategies.

Current Alloying Techniques for Flux Enhancement

01 Composition of amorphous soft magnetic alloys for high saturation flux

Specific compositions of amorphous soft magnetic alloys can be designed to achieve high saturation flux density. These typically include iron-based alloys with additions of elements such as cobalt, nickel, and metalloids like boron, silicon, and phosphorus in precise proportions. The balance between crystalline and amorphous phases in these alloys is critical for optimizing magnetic properties, particularly saturation flux density.- Composition of amorphous soft magnetic alloys for high saturation flux: Specific elemental compositions can significantly enhance the saturation flux density of amorphous soft magnetic alloys. These compositions typically include combinations of iron (Fe), cobalt (Co), and nickel (Ni) as base metals, with additions of metalloids such as boron (B), silicon (Si), and phosphorus (P). The precise ratio of these elements determines the magnetic properties, with higher Fe and Co content generally leading to higher saturation flux density while maintaining the amorphous structure.

- Manufacturing processes to optimize saturation flux density: Various manufacturing techniques can be employed to optimize the saturation flux density of amorphous soft magnetic alloys. Rapid solidification methods like melt spinning are commonly used to achieve the amorphous structure. Post-processing treatments such as annealing under specific temperature and magnetic field conditions can further enhance the saturation flux density by relieving internal stresses and inducing beneficial magnetic anisotropy without causing crystallization.

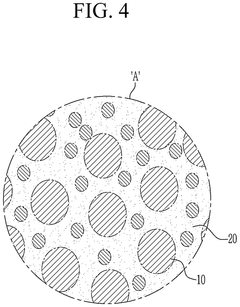

- Nanocrystalline phases in amorphous matrix for improved flux density: Controlled formation of nanocrystalline phases within an amorphous matrix can significantly improve saturation flux density. This approach combines the high saturation magnetization of crystalline phases with the low coercivity of amorphous structures. The size, distribution, and volume fraction of these nanocrystalline phases are critical parameters that can be tailored through heat treatment protocols to achieve optimal magnetic properties.

- Addition of rare earth elements to enhance magnetic properties: Incorporating small amounts of rare earth elements into amorphous soft magnetic alloys can significantly enhance their saturation flux density. Elements such as neodymium (Nd), dysprosium (Dy), and terbium (Tb) can modify the electronic structure of the alloy, leading to stronger magnetic moments. These additions must be carefully controlled to maintain the amorphous structure while maximizing the beneficial effects on magnetic properties.

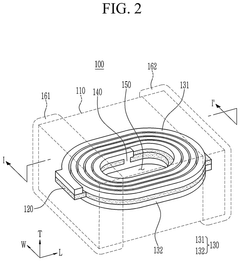

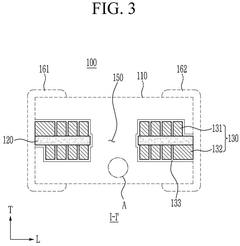

- Applications and device integration of high saturation flux alloys: Amorphous soft magnetic alloys with high saturation flux density find applications in various high-performance magnetic devices. These include power transformers, magnetic recording heads, magnetic sensors, and inductors for power electronics. The integration of these materials into devices requires specific design considerations to fully utilize their superior magnetic properties while addressing challenges related to mechanical properties, thermal stability, and manufacturing constraints.

02 Manufacturing processes to enhance saturation flux density

Various manufacturing processes can significantly impact the saturation flux density of amorphous soft magnetic alloys. Rapid solidification techniques, such as melt spinning, are commonly employed to create the amorphous structure. Post-processing treatments including annealing under magnetic fields, controlled crystallization, and stress relief treatments can further optimize the magnetic properties and increase saturation flux density.Expand Specific Solutions03 Nanocrystalline structures in amorphous matrices for improved flux density

The development of nanocrystalline structures within an amorphous matrix can significantly enhance saturation flux density. These structures typically consist of nanometer-sized crystalline phases dispersed throughout the amorphous material. The interaction between these nanocrystals and the surrounding amorphous matrix creates unique magnetic properties that can lead to higher saturation flux densities while maintaining low core losses.Expand Specific Solutions04 Application-specific alloy designs for optimal saturation flux

Amorphous soft magnetic alloys can be specifically designed for different applications requiring high saturation flux density. For power electronics and transformers, alloys with higher iron content are preferred. For high-frequency applications, alloys with balanced soft magnetic properties and saturation flux are developed. These application-specific designs consider factors such as operating temperature, frequency range, and required magnetic stability.Expand Specific Solutions05 Surface treatments and multilayer structures for enhanced magnetic properties

Surface treatments and the development of multilayer structures can enhance the saturation flux density of amorphous soft magnetic alloys. These include surface nitriding, oxidation control, and the creation of laminated structures with alternating amorphous and nanocrystalline layers. Such approaches can reduce surface defects that negatively impact magnetic properties and create synergistic effects between different layers to optimize overall saturation flux density.Expand Specific Solutions

Leading Manufacturers and Research Institutions

The amorphous soft magnetic alloys market for high-frequency power electronics is currently in a growth phase, driven by increasing demand for efficient power conversion systems. The global market size is expanding rapidly, estimated to reach several billion dollars by 2025, with Asia-Pacific leading in production and consumption. Technologically, the field is advancing from early commercial maturity toward optimization, with companies focusing on enhancing saturation flux density through minor alloying additions. Key players include established materials specialists like Metglas, VACUUMSCHMELZE, and Proterial Ltd. (formerly Hitachi Metals), who lead in commercial production, while TDK, NIPPON STEEL, and Qingdao Yunlu are making significant R&D investments. Academic-industrial collaborations involving Tohoku University, Zhejiang University, and Beihang University are accelerating innovation in composition optimization and manufacturing processes to overcome current performance limitations.

Metglas, Inc.

Technical Solution: Metglas has developed proprietary Fe-based amorphous alloy compositions with minor additions of B, Si, and P that significantly enhance saturation flux density while maintaining excellent soft magnetic properties. Their FINEMET® nanocrystalline alloys incorporate precise amounts of Cu and Nb as minor alloying elements that act as nucleating agents during controlled crystallization, resulting in materials with saturation flux densities exceeding 1.2T while maintaining low core losses at high frequencies (>100kHz). The company employs rapid solidification techniques with cooling rates of 10^6 K/s to produce ultra-thin ribbons (15-25μm) that effectively suppress the formation of crystalline structures, enabling higher Fe content (>80 at%) than conventional amorphous alloys without sacrificing soft magnetic performance. Recent developments include Co-Fe-based formulations with Si and B additions that achieve saturation flux densities up to 1.8T while maintaining high electrical resistivity necessary for high-frequency applications.

Strengths: Industry-leading expertise in rapid solidification technology allowing precise control of minor alloying elements; established manufacturing infrastructure for consistent large-scale production; comprehensive material characterization capabilities. Weaknesses: Higher production costs compared to conventional silicon steel; limited thickness options constraining some power density applications; sensitivity to thermal stress requiring careful handling during core manufacturing.

NIPPON STEEL CORP.

Technical Solution: NIPPON STEEL has pioneered advanced Fe-Si-B-P amorphous alloys with carefully controlled minor additions of Cu and Nb that enable nanocrystallization through optimized heat treatment protocols. Their proprietary NANOMET® series achieves saturation flux densities of 1.2-1.6T while maintaining core losses below 300 W/kg at 100kHz/0.1T. The company utilizes a sophisticated melt-spinning process with precisely controlled wheel speeds (30-60 m/s) and nozzle configurations to produce amorphous ribbons with exceptional thickness uniformity (±1μm tolerance), critical for consistent high-frequency performance. NIPPON STEEL's recent innovation involves the addition of trace amounts (0.1-0.5 at%) of rare earth elements like Nd and Sm that modify the local atomic structure, increasing saturation magnetization by up to 15% compared to conventional Fe-based amorphous alloys. Their manufacturing process incorporates in-line quality monitoring using laser diffraction and eddy current testing to ensure consistent magnetic properties across production batches, essential for high-volume power electronics applications.

Strengths: Extensive metallurgical expertise allowing precise control of minor alloying elements; vertically integrated production from raw materials to finished cores; strong intellectual property portfolio covering composition and processing. Weaknesses: Higher material costs compared to conventional magnetic materials; limited formability requiring specialized core assembly techniques; susceptibility to embrittlement with certain alloying additions requiring careful handling.

Key Patents in Minor Element Doping Technologies

Soft magnetic alloy

PatentWO2017069465A1

Innovation

- A soft magnetic alloy with a chemical formula of FeaXbYcZd, where Z includes zirconium, hafnium, niobium, tantalum, chromium, molybdenum, cobalt, and nickel, with specific atomic percentages, is developed, allowing for amorphous or nanocrystalline formation and achieving a saturation magnetic flux density of 170 emu/g or more.

Soft magnetic alloy powder and electronic components including the same

PatentPendingUS20250153243A1

Innovation

- A soft magnetic alloy powder is developed, comprising a core with an amorphous phase Fe—Co alloy or a mixture of amorphous and nanocrystalline phases, coated with a Co oxide layer, achieving an amorphous rate of 95% or more and an average coating thickness of 4 nm to 50 nm.

Material Characterization Methods for Amorphous Alloys

Characterizing amorphous soft magnetic alloys requires specialized techniques that differ significantly from those used for crystalline materials. Vibrating Sample Magnetometry (VSM) stands as a primary method for determining saturation flux density and magnetic moment in these materials. This technique measures magnetic properties by oscillating a sample within a uniform magnetic field and detecting the induced voltage in pickup coils. For high-frequency power electronics applications, VSM provides critical data on how minor alloying additions affect the saturation flux density, which directly impacts power density capabilities.

X-ray Diffraction (XRD) analysis confirms the amorphous structure and detects any nanocrystalline phases that may form during processing or with alloying additions. The characteristic broad diffraction peak, rather than sharp crystalline peaks, verifies the amorphous nature. When minor elements like Cu, Nb, or B are added to Fe-based or Co-based amorphous alloys, XRD can detect structural changes that correlate with altered saturation flux properties.

Transmission Electron Microscopy (TEM) enables direct visualization of the atomic arrangement in amorphous alloys at nanometer scale. This technique is particularly valuable for identifying localized ordering or clustering effects caused by minor alloying elements, which can significantly influence saturation flux density. High-resolution TEM combined with selected area electron diffraction patterns provides insights into how elements like Si, P, or rare earth metals modify the amorphous matrix.

Mössbauer spectroscopy offers element-specific information about the local magnetic environment in Fe-containing amorphous alloys. This technique can reveal how minor additions alter the hyperfine field distribution, providing insights into magnetic moment changes at the atomic level. For high-frequency applications, understanding these atomic-level interactions helps explain macroscopic changes in saturation flux.

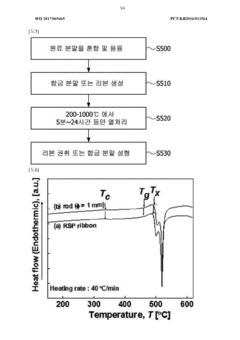

Differential Scanning Calorimetry (DSC) measures crystallization temperatures and thermal stability, which correlate with magnetic performance at elevated operating temperatures in power electronics. Minor alloying additions often modify crystallization behavior, and DSC can quantify these effects, helping predict long-term stability of magnetic properties under thermal cycling conditions.

Electrical resistivity measurements complement magnetic characterization by providing information on electron transport properties. Higher resistivity generally correlates with reduced eddy current losses at high frequencies, making this parameter crucial for power electronics applications. Minor alloying elements can significantly alter resistivity, thereby affecting overall performance in high-frequency operation.

X-ray Diffraction (XRD) analysis confirms the amorphous structure and detects any nanocrystalline phases that may form during processing or with alloying additions. The characteristic broad diffraction peak, rather than sharp crystalline peaks, verifies the amorphous nature. When minor elements like Cu, Nb, or B are added to Fe-based or Co-based amorphous alloys, XRD can detect structural changes that correlate with altered saturation flux properties.

Transmission Electron Microscopy (TEM) enables direct visualization of the atomic arrangement in amorphous alloys at nanometer scale. This technique is particularly valuable for identifying localized ordering or clustering effects caused by minor alloying elements, which can significantly influence saturation flux density. High-resolution TEM combined with selected area electron diffraction patterns provides insights into how elements like Si, P, or rare earth metals modify the amorphous matrix.

Mössbauer spectroscopy offers element-specific information about the local magnetic environment in Fe-containing amorphous alloys. This technique can reveal how minor additions alter the hyperfine field distribution, providing insights into magnetic moment changes at the atomic level. For high-frequency applications, understanding these atomic-level interactions helps explain macroscopic changes in saturation flux.

Differential Scanning Calorimetry (DSC) measures crystallization temperatures and thermal stability, which correlate with magnetic performance at elevated operating temperatures in power electronics. Minor alloying additions often modify crystallization behavior, and DSC can quantify these effects, helping predict long-term stability of magnetic properties under thermal cycling conditions.

Electrical resistivity measurements complement magnetic characterization by providing information on electron transport properties. Higher resistivity generally correlates with reduced eddy current losses at high frequencies, making this parameter crucial for power electronics applications. Minor alloying elements can significantly alter resistivity, thereby affecting overall performance in high-frequency operation.

Environmental Impact of Advanced Magnetic Materials

The environmental impact of advanced magnetic materials, particularly amorphous soft magnetic alloys used in high-frequency power electronics, represents a critical consideration in sustainable technology development. These materials offer significant environmental advantages through improved energy efficiency, which directly translates to reduced carbon emissions across various applications.

The manufacturing process of amorphous soft magnetic alloys with minor alloying additions typically requires less energy compared to conventional crystalline magnetic materials. The rapid solidification techniques used in their production, while energy-intensive, result in materials that deliver superior performance over their lifecycle, creating a net positive environmental impact. Furthermore, the precise control of minor alloying elements such as copper, niobium, or boron can optimize magnetic properties without requiring environmentally problematic rare earth elements.

Power electronics utilizing these advanced magnetic materials demonstrate substantially reduced core losses, particularly at high frequencies. This efficiency improvement directly contributes to energy conservation in renewable energy systems, electric vehicles, and grid infrastructure. Quantitative studies indicate that replacing conventional silicon steel with optimized amorphous alloys in power conversion systems can reduce energy losses by 40-80%, depending on operating conditions and frequency ranges.

The extended operational lifespan of devices incorporating these materials further enhances their environmental credentials. The superior thermal stability and corrosion resistance achieved through minor alloying additions result in reduced replacement frequency and associated manufacturing impacts. This durability aspect is particularly valuable in renewable energy applications where component longevity directly affects the overall environmental footprint of the system.

End-of-life considerations for amorphous magnetic alloys present both challenges and opportunities. While their complex composition may complicate traditional recycling processes, their high content of valuable metals like iron, cobalt, and specialized alloying elements makes them attractive candidates for advanced recovery techniques. Emerging recycling technologies specifically designed for these materials are showing promise in closing the material loop and further reducing environmental impact.

The reduced size and weight of magnetic components enabled by high-saturation flux materials also contributes to material efficiency across supply chains. This miniaturization effect cascades through product lifecycles, reducing transportation emissions and resource requirements for supporting structures and systems. In automotive applications, this weight reduction directly translates to improved fuel efficiency or extended range in electric vehicles.

The manufacturing process of amorphous soft magnetic alloys with minor alloying additions typically requires less energy compared to conventional crystalline magnetic materials. The rapid solidification techniques used in their production, while energy-intensive, result in materials that deliver superior performance over their lifecycle, creating a net positive environmental impact. Furthermore, the precise control of minor alloying elements such as copper, niobium, or boron can optimize magnetic properties without requiring environmentally problematic rare earth elements.

Power electronics utilizing these advanced magnetic materials demonstrate substantially reduced core losses, particularly at high frequencies. This efficiency improvement directly contributes to energy conservation in renewable energy systems, electric vehicles, and grid infrastructure. Quantitative studies indicate that replacing conventional silicon steel with optimized amorphous alloys in power conversion systems can reduce energy losses by 40-80%, depending on operating conditions and frequency ranges.

The extended operational lifespan of devices incorporating these materials further enhances their environmental credentials. The superior thermal stability and corrosion resistance achieved through minor alloying additions result in reduced replacement frequency and associated manufacturing impacts. This durability aspect is particularly valuable in renewable energy applications where component longevity directly affects the overall environmental footprint of the system.

End-of-life considerations for amorphous magnetic alloys present both challenges and opportunities. While their complex composition may complicate traditional recycling processes, their high content of valuable metals like iron, cobalt, and specialized alloying elements makes them attractive candidates for advanced recovery techniques. Emerging recycling technologies specifically designed for these materials are showing promise in closing the material loop and further reducing environmental impact.

The reduced size and weight of magnetic components enabled by high-saturation flux materials also contributes to material efficiency across supply chains. This miniaturization effect cascades through product lifecycles, reducing transportation emissions and resource requirements for supporting structures and systems. In automotive applications, this weight reduction directly translates to improved fuel efficiency or extended range in electric vehicles.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!