Coating Selection For Damage Resistance In Touchpanels With Ultra-Thin Glass (UTG) For Flexible Displays

AUG 26, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

UTG Coating Technology Background and Objectives

Ultra-Thin Glass (UTG) technology has emerged as a revolutionary advancement in flexible display manufacturing, marking a significant departure from traditional rigid glass solutions. The evolution of UTG began in the early 2010s, with major breakthroughs occurring around 2018-2019 when commercial applications first became viable. This technology represents the convergence of glass manufacturing techniques and flexible electronics, enabling displays that can bend without compromising optical clarity or touch sensitivity.

The development trajectory of UTG has been characterized by progressive reductions in thickness, from early iterations at 100 microns to current versions measuring just 30 microns or less. This evolution has been driven by the growing demand for foldable smartphones, rollable displays, and wearable technology, all of which require display materials that combine flexibility with durability.

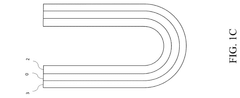

Despite its promising attributes, UTG faces significant challenges related to damage resistance. The inherent fragility of ultra-thin glass makes it susceptible to scratches, impacts, and stress fractures during normal usage. This vulnerability is particularly pronounced at fold points in foldable devices, where repeated mechanical stress creates micro-fractures that can propagate over time.

Protective coatings have emerged as a critical enabling technology for UTG implementation. The coating technology landscape has evolved from basic hardening layers to sophisticated multi-layer systems that provide both mechanical protection and enhanced functionality. Early coatings focused primarily on scratch resistance, while contemporary solutions address a broader spectrum of requirements including impact absorption, flexibility enhancement, and optical performance.

The primary technical objective in UTG coating development is to create a protective layer that maintains the glass's flexibility while significantly enhancing its damage resistance. This involves achieving seemingly contradictory properties: the coating must be hard enough to resist scratches yet flexible enough to bend repeatedly without delamination or cracking. Additionally, the coating must maintain perfect optical transparency and touch sensitivity.

Secondary objectives include developing coatings that are thin enough to not compromise device design, can be applied through scalable manufacturing processes, and remain stable over the product lifecycle despite exposure to environmental factors such as humidity, temperature fluctuations, and UV radiation. Cost-effectiveness and environmental sustainability have also become increasingly important considerations in coating technology development.

The technological trajectory points toward multi-functional coatings that not only protect UTG but also enhance its performance through features such as anti-reflection, anti-fingerprint, and anti-bacterial properties. Research is increasingly focused on nano-composite materials that can self-heal minor damage and adaptive coatings that can modify their properties in response to external stimuli.

The development trajectory of UTG has been characterized by progressive reductions in thickness, from early iterations at 100 microns to current versions measuring just 30 microns or less. This evolution has been driven by the growing demand for foldable smartphones, rollable displays, and wearable technology, all of which require display materials that combine flexibility with durability.

Despite its promising attributes, UTG faces significant challenges related to damage resistance. The inherent fragility of ultra-thin glass makes it susceptible to scratches, impacts, and stress fractures during normal usage. This vulnerability is particularly pronounced at fold points in foldable devices, where repeated mechanical stress creates micro-fractures that can propagate over time.

Protective coatings have emerged as a critical enabling technology for UTG implementation. The coating technology landscape has evolved from basic hardening layers to sophisticated multi-layer systems that provide both mechanical protection and enhanced functionality. Early coatings focused primarily on scratch resistance, while contemporary solutions address a broader spectrum of requirements including impact absorption, flexibility enhancement, and optical performance.

The primary technical objective in UTG coating development is to create a protective layer that maintains the glass's flexibility while significantly enhancing its damage resistance. This involves achieving seemingly contradictory properties: the coating must be hard enough to resist scratches yet flexible enough to bend repeatedly without delamination or cracking. Additionally, the coating must maintain perfect optical transparency and touch sensitivity.

Secondary objectives include developing coatings that are thin enough to not compromise device design, can be applied through scalable manufacturing processes, and remain stable over the product lifecycle despite exposure to environmental factors such as humidity, temperature fluctuations, and UV radiation. Cost-effectiveness and environmental sustainability have also become increasingly important considerations in coating technology development.

The technological trajectory points toward multi-functional coatings that not only protect UTG but also enhance its performance through features such as anti-reflection, anti-fingerprint, and anti-bacterial properties. Research is increasingly focused on nano-composite materials that can self-heal minor damage and adaptive coatings that can modify their properties in response to external stimuli.

Market Demand Analysis for Flexible Display Protection

The flexible display market has witnessed exponential growth over the past five years, with a market value reaching $23.1 billion in 2022 and projected to surpass $42.5 billion by 2026. This remarkable expansion is primarily driven by increasing consumer demand for foldable smartphones, rollable displays, and wearable technology. Ultra-thin glass (UTG) has emerged as a critical component in these applications, offering superior optical clarity and scratch resistance compared to polymer alternatives.

Consumer research indicates that damage resistance ranks as the top priority for 78% of potential buyers when considering flexible display devices. This concern stems from the high replacement costs associated with damaged screens, which can represent up to 30% of the device's original price. The average consumer expects their flexible display device to maintain structural integrity for at least three years under normal usage conditions, creating significant market pressure for enhanced protective solutions.

The automotive industry represents a rapidly growing segment for flexible displays, with an anticipated compound annual growth rate of 24.3% through 2027. In this sector, displays must withstand extreme temperature variations, prolonged UV exposure, and potential impact from debris, necessitating specialized coating solutions beyond consumer electronics requirements.

Market analysis reveals a significant price sensitivity threshold for protective technologies. While consumers express willingness to pay a premium of 15-20% for demonstrably superior protection, this acceptance diminishes sharply beyond this range. This creates a defined innovation corridor for coating technologies that balance performance with cost-effectiveness.

Regional market dynamics show varying priorities, with North American and European consumers placing higher value on long-term durability, while Asian markets demonstrate greater interest in flexibility performance and aesthetic considerations. This geographical variation necessitates potentially different coating optimization strategies for global product deployment.

Enterprise customers in sectors such as healthcare, military, and industrial applications represent a smaller but higher-margin segment, demanding specialized coating solutions that can withstand harsh environmental conditions, chemical exposure, and intensive cleaning protocols. These applications often justify premium pricing for enhanced protective features.

The aftermarket for protective solutions represents an additional opportunity, currently valued at $3.7 billion annually. Third-party protective films and coatings face challenges in maintaining the flexibility and optical clarity of original equipment, creating opportunities for OEM-quality coating technologies that could be licensed to aftermarket providers.

Consumer research indicates that damage resistance ranks as the top priority for 78% of potential buyers when considering flexible display devices. This concern stems from the high replacement costs associated with damaged screens, which can represent up to 30% of the device's original price. The average consumer expects their flexible display device to maintain structural integrity for at least three years under normal usage conditions, creating significant market pressure for enhanced protective solutions.

The automotive industry represents a rapidly growing segment for flexible displays, with an anticipated compound annual growth rate of 24.3% through 2027. In this sector, displays must withstand extreme temperature variations, prolonged UV exposure, and potential impact from debris, necessitating specialized coating solutions beyond consumer electronics requirements.

Market analysis reveals a significant price sensitivity threshold for protective technologies. While consumers express willingness to pay a premium of 15-20% for demonstrably superior protection, this acceptance diminishes sharply beyond this range. This creates a defined innovation corridor for coating technologies that balance performance with cost-effectiveness.

Regional market dynamics show varying priorities, with North American and European consumers placing higher value on long-term durability, while Asian markets demonstrate greater interest in flexibility performance and aesthetic considerations. This geographical variation necessitates potentially different coating optimization strategies for global product deployment.

Enterprise customers in sectors such as healthcare, military, and industrial applications represent a smaller but higher-margin segment, demanding specialized coating solutions that can withstand harsh environmental conditions, chemical exposure, and intensive cleaning protocols. These applications often justify premium pricing for enhanced protective features.

The aftermarket for protective solutions represents an additional opportunity, currently valued at $3.7 billion annually. Third-party protective films and coatings face challenges in maintaining the flexibility and optical clarity of original equipment, creating opportunities for OEM-quality coating technologies that could be licensed to aftermarket providers.

Current UTG Coating Technologies and Challenges

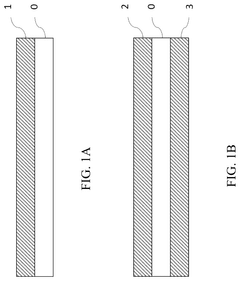

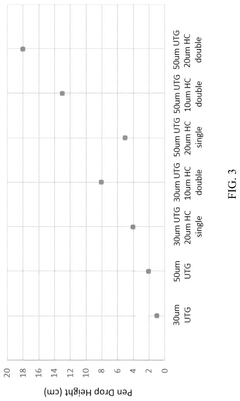

Ultra-thin glass (UTG) coating technologies have evolved significantly in recent years to address the unique challenges posed by flexible displays. Current UTG implementations primarily utilize three major coating technologies: hard coat polymers, ceramic-based coatings, and hybrid organic-inorganic solutions. Hard coat polymers, typically composed of silicone-based or acrylic materials, offer excellent flexibility and optical clarity but demonstrate limited scratch resistance compared to other solutions. These coatings are applied through processes such as dip coating or spin coating, achieving thicknesses between 2-10 μm.

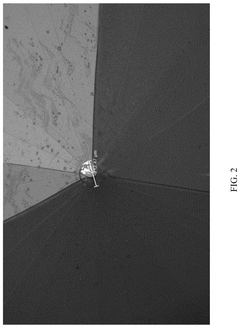

Ceramic-based coatings, including aluminum oxide and silicon nitride deposited through physical vapor deposition (PVD) or chemical vapor deposition (CVD), provide superior hardness (7-9 Mohs) and scratch resistance. However, they introduce challenges related to flexibility, often developing microcracks when subjected to repeated folding operations. The typical thickness of these coatings ranges from 50-500 nm, requiring precise deposition control to maintain optical performance.

Hybrid organic-inorganic solutions, such as sol-gel derived materials and nanocomposites, represent the cutting edge of UTG coating technology. These materials combine the flexibility of polymers with the hardness of ceramics through molecular-level integration. Application methods include spray coating and slot-die coating, with thicknesses typically ranging from 1-5 μm.

Despite these advancements, significant challenges persist in UTG coating technology. The fundamental "hardness-flexibility paradox" remains unresolved, as increasing coating hardness typically results in decreased flexibility and vice versa. This creates a difficult engineering trade-off that limits performance in foldable devices requiring both properties simultaneously.

Adhesion stability presents another major challenge, particularly during repeated folding operations where the different thermal expansion coefficients between the coating and UTG substrate can lead to delamination. Current adhesion promoters and surface treatments provide only partial solutions to this problem.

Optical performance maintenance represents a critical challenge, as coatings must maintain high transparency (>95%), low haze (<0.5%), and minimal color shift across thousands of folding cycles. Many current coatings show degradation in these properties over time, particularly at fold lines.

Manufacturing scalability also remains problematic, with high-performance coatings often requiring specialized equipment and precise environmental controls that limit mass production capabilities. Yield rates for premium UTG coatings typically range from 70-85%, significantly lower than conventional display glass manufacturing.

Cost considerations further complicate adoption, as advanced coating solutions can increase display module costs by 15-30%, creating market resistance despite performance improvements.

Ceramic-based coatings, including aluminum oxide and silicon nitride deposited through physical vapor deposition (PVD) or chemical vapor deposition (CVD), provide superior hardness (7-9 Mohs) and scratch resistance. However, they introduce challenges related to flexibility, often developing microcracks when subjected to repeated folding operations. The typical thickness of these coatings ranges from 50-500 nm, requiring precise deposition control to maintain optical performance.

Hybrid organic-inorganic solutions, such as sol-gel derived materials and nanocomposites, represent the cutting edge of UTG coating technology. These materials combine the flexibility of polymers with the hardness of ceramics through molecular-level integration. Application methods include spray coating and slot-die coating, with thicknesses typically ranging from 1-5 μm.

Despite these advancements, significant challenges persist in UTG coating technology. The fundamental "hardness-flexibility paradox" remains unresolved, as increasing coating hardness typically results in decreased flexibility and vice versa. This creates a difficult engineering trade-off that limits performance in foldable devices requiring both properties simultaneously.

Adhesion stability presents another major challenge, particularly during repeated folding operations where the different thermal expansion coefficients between the coating and UTG substrate can lead to delamination. Current adhesion promoters and surface treatments provide only partial solutions to this problem.

Optical performance maintenance represents a critical challenge, as coatings must maintain high transparency (>95%), low haze (<0.5%), and minimal color shift across thousands of folding cycles. Many current coatings show degradation in these properties over time, particularly at fold lines.

Manufacturing scalability also remains problematic, with high-performance coatings often requiring specialized equipment and precise environmental controls that limit mass production capabilities. Yield rates for premium UTG coatings typically range from 70-85%, significantly lower than conventional display glass manufacturing.

Cost considerations further complicate adoption, as advanced coating solutions can increase display module costs by 15-30%, creating market resistance despite performance improvements.

Current Coating Formulations for UTG Protection

01 Hard coating materials for UTG protection

Various hard coating materials can be applied to ultra-thin glass to enhance its damage resistance. These include silicon-based compounds, metal oxides, and ceramic materials that form protective layers on the glass surface. These coatings significantly improve scratch resistance while maintaining the optical transparency of the UTG. The hardness of these coatings can be customized based on the specific application requirements, providing effective protection against daily wear and tear.- Hard coating materials for UTG protection: Various hard coating materials can be applied to ultra-thin glass to enhance its damage resistance. These include silicon-based compounds, ceramic materials, and metal oxides that form protective layers on the glass surface. These hard coatings significantly improve scratch resistance while maintaining the optical clarity of the UTG. The coatings are typically applied through processes like chemical vapor deposition or physical vapor deposition to ensure uniform coverage and strong adhesion to the glass substrate.

- Multi-layer coating structures for UTG: Multi-layer coating systems provide comprehensive protection for ultra-thin glass by combining different functional layers. These structures typically include a base adhesion layer, a main protective layer, and a top functional layer. Each layer serves a specific purpose, such as impact absorption, scratch resistance, or anti-fingerprint properties. The combination of different materials in a multi-layer structure allows for customized protection that addresses various types of damage while maintaining the flexibility and optical properties of the UTG.

- Polymer-based protective coatings: Polymer-based coatings offer excellent flexibility and impact resistance for ultra-thin glass applications. These coatings include polyurethane, polyimide, and modified acrylics that can absorb impact energy and prevent crack propagation. The polymer layers can be engineered to have self-healing properties that repair minor scratches when exposed to heat or light. These coatings are particularly valuable for foldable display applications where the glass must withstand repeated bending while maintaining protection against external damage.

- Nano-composite coatings for enhanced durability: Nano-composite coatings incorporate nanoscale particles within a polymer or ceramic matrix to enhance the damage resistance of ultra-thin glass. These nanoparticles, such as silica, alumina, or carbon nanotubes, significantly improve the mechanical properties of the coating without compromising transparency. The nano-composite structure creates multiple energy dissipation mechanisms that protect against impacts and scratches. These coatings can be engineered to provide additional functionalities such as anti-reflection, anti-static, or anti-bacterial properties while maintaining excellent damage resistance.

- Edge protection and reinforcement techniques: Specialized edge protection techniques are crucial for enhancing the overall damage resistance of ultra-thin glass. These include edge sealing compounds, reinforced edge structures, and tapered edge designs that minimize stress concentration at the vulnerable edges of UTG. Edge protection systems often use different materials or thicker coatings at the perimeter of the glass to provide additional reinforcement where damage is most likely to initiate. These techniques work in conjunction with surface coatings to provide comprehensive protection against cracks, chips, and other edge-related failures that commonly affect ultra-thin glass components.

02 Multi-layer coating structures for enhanced protection

Multi-layer coating systems provide comprehensive protection for ultra-thin glass by combining different functional layers. These structures typically include a base adhesion layer, a main protective layer, and a top functional layer. Each layer serves a specific purpose, such as impact absorption, scratch resistance, or anti-fingerprint properties. The combination of these layers creates a synergistic effect that enhances the overall damage resistance of UTG while maintaining flexibility and optical clarity.Expand Specific Solutions03 Flexible polymer-based protective coatings

Polymer-based coatings provide flexibility and impact resistance to ultra-thin glass. These coatings include polyurethane, silicone, and acrylic-based materials that can absorb shock and prevent crack propagation. The elasticity of these materials allows them to deform under impact and return to their original shape, protecting the underlying glass. These coatings are particularly useful for foldable or flexible display applications where the glass needs to withstand repeated bending without damage.Expand Specific Solutions04 Nano-composite coatings for UTG

Nano-composite coatings incorporate nanoparticles such as silica, alumina, or carbon nanotubes into a polymer matrix to enhance the mechanical properties of the protective layer. These nanoparticles significantly improve the hardness, scratch resistance, and impact resistance of the coating while maintaining transparency. The nano-scale distribution of particles creates a uniform protective layer that can effectively disperse impact energy and prevent damage to the underlying glass.Expand Specific Solutions05 Self-healing coating technologies

Self-healing coatings represent an advanced solution for UTG protection, capable of repairing minor scratches and damage automatically. These coatings contain microcapsules with healing agents or utilize materials with inherent self-healing properties activated by heat, light, or pressure. When damage occurs, the healing mechanism is triggered, filling in scratches and restoring the protective surface. This technology extends the lifespan of UTG by continuously maintaining the integrity of the protective coating.Expand Specific Solutions

Leading Manufacturers in UTG Coating Solutions

The ultra-thin glass (UTG) coating market for flexible displays is in a growth phase, with increasing demand driven by the expanding flexible display sector. Market size is projected to grow significantly as foldable devices gain popularity, particularly in smartphones and wearables. Technologically, the field is advancing rapidly but remains challenging, with companies at varying maturity levels. Industry leaders like Samsung Display, BOE, and Huawei have established strong positions through significant R&D investments, while specialized materials companies such as Nissan Chemical, SCHOTT Glass, and Triumph Science & Technology are developing innovative coating solutions. Chinese manufacturers including Tianma Microelectronics and Dongxu Technology are rapidly closing the technology gap with substantial investments in UTG coating capabilities.

Huawei Technologies Co., Ltd.

Technical Solution: Huawei has developed an advanced Diamond-like Carbon (DLC) coating system specifically engineered for UTG applications in flexible displays. Their solution employs a plasma-enhanced chemical vapor deposition (PECVD) process that creates an amorphous carbon layer with both sp2 (graphite-like) and sp3 (diamond-like) bonds, achieving a hardness of 15-20 GPa while maintaining flexibility. The coating thickness is precisely controlled between 200-500 nm to optimize the balance between protection and flexibility. Huawei's technology incorporates gradient composition throughout the coating depth, with higher sp3 content near the surface for maximum hardness and increasing sp2 content toward the UTG interface to enhance adhesion and flexibility. This gradient approach minimizes internal stress that could lead to coating failure during repeated folding. Additionally, Huawei has integrated fluorine-doped outer layers to provide hydrophobic and oleophobic properties, enhancing resistance to fingerprints and environmental contaminants. Their coating process includes a specialized adhesion-promoting interlayer between the UTG and DLC coating to ensure long-term durability through thousands of folding cycles.

Strengths: Exceptional hardness-to-flexibility ratio compared to conventional coatings, with superior scratch resistance approaching 7H on the pencil hardness scale. The gradient composition technology minimizes delamination issues. Weaknesses: The complex deposition process requires precise control of multiple parameters, leading to higher manufacturing costs and potential scalability challenges for mass production.

Nissan Chemical Corp.

Technical Solution: Nissan Chemical has developed a specialized silsesquioxane-based coating technology for UTG applications in flexible displays. Their approach utilizes ladder-type polysilsesquioxane (LPSQ) materials with precisely controlled cage structures that provide both hardness and flexibility at the molecular level. The coating system consists of a base layer of amino-functional silanes that create strong covalent bonds with the glass surface, followed by the main protective layer of LPSQ hybrid materials with embedded zirconia nanoparticles (10-30 nm) for enhanced hardness. The coating is applied through a solution-based process with controlled hydrolysis and condensation reactions, achieving uniform thickness between 2-6 micrometers. Nissan Chemical's technology incorporates a gradient cross-linking density throughout the coating depth, with higher cross-linking at the surface for maximum hardness (achieving 5H pencil hardness) and decreasing density toward the UTG interface to enhance flexibility during bending operations. The surface layer is modified with fluoroalkyl functional groups that provide excellent water and oil repellency, with contact angles exceeding 110° for both water and oils. The coating formulation also includes UV stabilizers and antioxidants to prevent degradation from environmental exposure, maintaining performance over the display lifetime.

Strengths: The molecular-level design of the silsesquioxane structure provides an exceptional balance of hardness and flexibility without the need for multiple distinct layers. The solution-based coating process is more cost-effective than vacuum deposition methods and can be easily scaled for mass production. Weaknesses: The coating hardness, while good, does not match the extreme hardness of DLC or other ceramic coatings. The curing process requires precise temperature control to achieve optimal cross-linking without introducing thermal stress to the UTG substrate.

Key Innovations in Scratch-Resistant Coating Materials

Foldable ultrathin glass with transparent, impact-resistant hard coating

PatentActiveUS12116308B2

Innovation

- A single-layer hard coating composed of silsesquioxane with a silicon-oxygen core framework directly bonded to the ultrathin tempered glass substrate, providing a surface hardness of at least 7H, hydrophobic properties, and improved impact resistance without the need for an adhesive layer, achieved through chemical tempering and specific molecular weight ranges of the silsesquioxane.

Coating composition for flexible display, preparation method and application

PatentActiveCN116554774A

Innovation

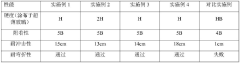

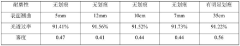

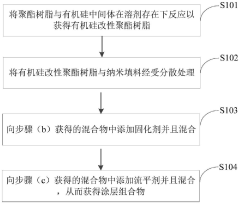

- A coating composition is used, including 25 to 60 weight percent of silicone-modified polyester resin, 5 to 25 weight percent of nanofiller, 10 to 30 weight percent of curing agent, and 3 to 6 weight percent of leveling agent. , and through specific preparation methods, including the reaction of polyester resin and silicone intermediates, nanofiller dispersion, curing agent and leveling agent addition, a coating composition with high hardness, wear resistance and good adhesion is formed.

Manufacturing Process Optimization for UTG Coatings

The optimization of manufacturing processes for Ultra-Thin Glass (UTG) coatings represents a critical factor in achieving damage-resistant touchpanels for flexible displays. Current manufacturing approaches face significant challenges related to uniformity, adhesion, and scalability when applying protective coatings to UTG substrates with thicknesses typically ranging from 30 to 100 micrometers.

Advanced deposition techniques have emerged as essential components in UTG coating optimization. Physical Vapor Deposition (PVD) methods, particularly magnetron sputtering, demonstrate superior coating uniformity across large-area UTG substrates while minimizing thermal stress. Recent innovations in rotary magnetron systems have improved throughput by 35% compared to traditional planar configurations, while maintaining coating thickness variations below ±3%.

Chemical Vapor Deposition (CVD) processes offer complementary advantages for specific coating types, particularly silicon-based hard coatings. Plasma-Enhanced CVD (PECVD) systems operating at temperatures below 100°C have successfully deposited silicon nitride and silicon carbide layers with excellent adhesion properties. The integration of in-line PECVD within roll-to-roll processing lines represents a significant advancement for continuous manufacturing of coated UTG.

Temperature management during coating application presents a particular challenge, as UTG substrates exhibit thermal sensitivity that can lead to warping or stress-induced defects. Optimized thermal profiles utilizing gradual heating and cooling cycles have reduced defect rates by approximately 40% in production environments. Additionally, the implementation of real-time temperature monitoring using infrared imaging systems enables precise process control within ±2°C across the substrate.

Post-deposition treatment processes significantly impact coating performance and durability. UV curing of hybrid organic-inorganic coatings has demonstrated superior results when implemented with controlled atmosphere chambers and precision UV dosage control. Similarly, thermal annealing processes conducted under carefully controlled temperature gradients have improved coating adhesion strength by up to 25% while simultaneously enhancing scratch resistance.

Quality control integration within the manufacturing process represents another critical optimization area. In-line optical monitoring systems utilizing spectroscopic ellipsometry can detect coating thickness variations in real-time, allowing for immediate process adjustments. Advanced surface metrology techniques, including white light interferometry and atomic force microscopy, have been successfully implemented as sampling-based quality control measures, reducing defect escape rates to below 0.5%.

The economic viability of optimized manufacturing processes depends heavily on throughput and yield metrics. Recent industry benchmarks indicate that optimized coating lines can achieve throughputs exceeding 15 square meters per hour while maintaining yields above 92% for premium UTG applications. These performance metrics represent significant improvements over earlier generation processes, which typically operated at 8-10 square meters per hour with yields below 85%.

Advanced deposition techniques have emerged as essential components in UTG coating optimization. Physical Vapor Deposition (PVD) methods, particularly magnetron sputtering, demonstrate superior coating uniformity across large-area UTG substrates while minimizing thermal stress. Recent innovations in rotary magnetron systems have improved throughput by 35% compared to traditional planar configurations, while maintaining coating thickness variations below ±3%.

Chemical Vapor Deposition (CVD) processes offer complementary advantages for specific coating types, particularly silicon-based hard coatings. Plasma-Enhanced CVD (PECVD) systems operating at temperatures below 100°C have successfully deposited silicon nitride and silicon carbide layers with excellent adhesion properties. The integration of in-line PECVD within roll-to-roll processing lines represents a significant advancement for continuous manufacturing of coated UTG.

Temperature management during coating application presents a particular challenge, as UTG substrates exhibit thermal sensitivity that can lead to warping or stress-induced defects. Optimized thermal profiles utilizing gradual heating and cooling cycles have reduced defect rates by approximately 40% in production environments. Additionally, the implementation of real-time temperature monitoring using infrared imaging systems enables precise process control within ±2°C across the substrate.

Post-deposition treatment processes significantly impact coating performance and durability. UV curing of hybrid organic-inorganic coatings has demonstrated superior results when implemented with controlled atmosphere chambers and precision UV dosage control. Similarly, thermal annealing processes conducted under carefully controlled temperature gradients have improved coating adhesion strength by up to 25% while simultaneously enhancing scratch resistance.

Quality control integration within the manufacturing process represents another critical optimization area. In-line optical monitoring systems utilizing spectroscopic ellipsometry can detect coating thickness variations in real-time, allowing for immediate process adjustments. Advanced surface metrology techniques, including white light interferometry and atomic force microscopy, have been successfully implemented as sampling-based quality control measures, reducing defect escape rates to below 0.5%.

The economic viability of optimized manufacturing processes depends heavily on throughput and yield metrics. Recent industry benchmarks indicate that optimized coating lines can achieve throughputs exceeding 15 square meters per hour while maintaining yields above 92% for premium UTG applications. These performance metrics represent significant improvements over earlier generation processes, which typically operated at 8-10 square meters per hour with yields below 85%.

Environmental Impact of Advanced Display Coatings

The environmental impact of advanced display coatings for ultra-thin glass (UTG) in flexible displays represents a critical consideration in the sustainable development of next-generation touchscreen technologies. As the industry shifts toward more durable and flexible display solutions, the environmental footprint of specialized coatings demands thorough examination.

Manufacturing processes for high-performance coatings typically involve energy-intensive deposition techniques such as physical vapor deposition (PVD) and chemical vapor deposition (CVD). These processes consume significant electrical energy and often utilize rare earth elements or precious metals like indium, which face supply constraints and environmental concerns related to mining practices. The carbon footprint associated with these manufacturing methods remains substantially higher than conventional glass production.

Coating formulations for UTG frequently contain fluoropolymers, silicones, and various nanoparticles that enhance damage resistance while maintaining optical clarity. However, many of these compounds pose environmental challenges due to their persistence in ecosystems and potential toxicity. Particularly concerning are per- and polyfluoroalkyl substances (PFAS) used in oleophobic coatings, which have been identified as "forever chemicals" that do not naturally degrade in the environment.

Waste management presents another significant challenge, as the composite nature of coated UTG complicates recycling efforts. The bonding between substrate materials and specialized coatings often requires energy-intensive separation processes or renders complete recycling impossible. Current estimates suggest that less than 20% of display materials incorporating advanced coatings enter effective recycling streams.

Water usage and contamination represent additional environmental concerns. Coating application and cleaning processes typically require ultra-pure water in substantial quantities, while wastewater may contain trace amounts of potentially harmful chemicals. Recent industry initiatives have focused on closed-loop water systems, but implementation remains inconsistent across global manufacturing facilities.

Emerging alternatives show promise for reducing environmental impact. Bio-based coating materials derived from cellulose and other renewable resources are under development, though they currently lag behind synthetic options in performance metrics. Additionally, advancements in atomic layer deposition (ALD) technology offer more precise coating application with reduced material waste, potentially decreasing overall environmental impact by 30-40% compared to traditional methods.

Regulatory frameworks worldwide are increasingly addressing the environmental implications of advanced coatings. The European Union's REACH regulations and similar initiatives in other regions are driving manufacturers toward greener alternatives and improved lifecycle management for coating technologies in flexible display applications.

Manufacturing processes for high-performance coatings typically involve energy-intensive deposition techniques such as physical vapor deposition (PVD) and chemical vapor deposition (CVD). These processes consume significant electrical energy and often utilize rare earth elements or precious metals like indium, which face supply constraints and environmental concerns related to mining practices. The carbon footprint associated with these manufacturing methods remains substantially higher than conventional glass production.

Coating formulations for UTG frequently contain fluoropolymers, silicones, and various nanoparticles that enhance damage resistance while maintaining optical clarity. However, many of these compounds pose environmental challenges due to their persistence in ecosystems and potential toxicity. Particularly concerning are per- and polyfluoroalkyl substances (PFAS) used in oleophobic coatings, which have been identified as "forever chemicals" that do not naturally degrade in the environment.

Waste management presents another significant challenge, as the composite nature of coated UTG complicates recycling efforts. The bonding between substrate materials and specialized coatings often requires energy-intensive separation processes or renders complete recycling impossible. Current estimates suggest that less than 20% of display materials incorporating advanced coatings enter effective recycling streams.

Water usage and contamination represent additional environmental concerns. Coating application and cleaning processes typically require ultra-pure water in substantial quantities, while wastewater may contain trace amounts of potentially harmful chemicals. Recent industry initiatives have focused on closed-loop water systems, but implementation remains inconsistent across global manufacturing facilities.

Emerging alternatives show promise for reducing environmental impact. Bio-based coating materials derived from cellulose and other renewable resources are under development, though they currently lag behind synthetic options in performance metrics. Additionally, advancements in atomic layer deposition (ALD) technology offer more precise coating application with reduced material waste, potentially decreasing overall environmental impact by 30-40% compared to traditional methods.

Regulatory frameworks worldwide are increasingly addressing the environmental implications of advanced coatings. The European Union's REACH regulations and similar initiatives in other regions are driving manufacturers toward greener alternatives and improved lifecycle management for coating technologies in flexible display applications.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!