Supply-Chain Considerations And Cost Models For Ultra-Thin Glass (UTG) In Flexible Displays

AUG 26, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

UTG Evolution and Objectives

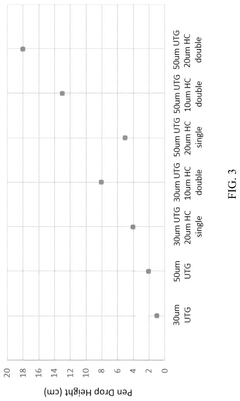

Ultra-Thin Glass (UTG) has emerged as a transformative material in the flexible display industry, evolving significantly over the past decade. The journey of UTG began around 2012 when glass manufacturers first explored the possibility of creating glass sheets thin enough to enable flexibility while maintaining the superior optical and barrier properties inherent to glass. Initially limited to thicknesses of 100-200 micrometers, technological advancements have now enabled commercial production of UTG as thin as 30 micrometers, with laboratory demonstrations achieving even 10 micrometers.

The evolution of UTG technology has been driven by the increasing demand for foldable and rollable display devices. Early iterations focused primarily on achieving basic flexibility, while subsequent developments have emphasized durability, bend radius reduction, and manufacturing scalability. A significant milestone occurred in 2019 when Samsung introduced the first commercially available foldable smartphone featuring UTG, marking the transition of this technology from research laboratories to mass-market consumer products.

The primary objective of UTG development is to create a cover material that combines the flexibility of plastic with the superior optical clarity, scratch resistance, and chemical stability of glass. This balance aims to overcome the limitations of plastic alternatives like polyimide films, which suffer from lower hardness, poorer optical properties, and greater susceptibility to environmental degradation. Additionally, UTG seeks to provide a premium tactile experience that consumers associate with traditional glass displays.

From a supply chain perspective, UTG development objectives include establishing cost-effective manufacturing processes capable of high-volume production while maintaining strict quality control. The technology aims to achieve thickness uniformity at scale, with variations typically required to be less than ±2 micrometers across large glass sheets. Another critical objective is the development of specialized handling and processing equipment that can manage extremely thin glass without breakage during manufacturing.

Looking forward, UTG technology aims to further reduce thickness to below 20 micrometers while simultaneously improving mechanical durability through advanced strengthening techniques such as ion exchange and specialized coatings. The ultimate goal is to enable displays with fold radii below 1mm without damage after hundreds of thousands of folding cycles, thereby supporting increasingly compact device designs and novel form factors such as tri-fold or rollable displays.

The evolution of UTG also encompasses sustainability objectives, with efforts directed toward reducing energy consumption in manufacturing processes and exploring recycling pathways for end-of-life products containing UTG components. These environmental considerations are becoming increasingly important as flexible display production volumes continue to grow exponentially.

The evolution of UTG technology has been driven by the increasing demand for foldable and rollable display devices. Early iterations focused primarily on achieving basic flexibility, while subsequent developments have emphasized durability, bend radius reduction, and manufacturing scalability. A significant milestone occurred in 2019 when Samsung introduced the first commercially available foldable smartphone featuring UTG, marking the transition of this technology from research laboratories to mass-market consumer products.

The primary objective of UTG development is to create a cover material that combines the flexibility of plastic with the superior optical clarity, scratch resistance, and chemical stability of glass. This balance aims to overcome the limitations of plastic alternatives like polyimide films, which suffer from lower hardness, poorer optical properties, and greater susceptibility to environmental degradation. Additionally, UTG seeks to provide a premium tactile experience that consumers associate with traditional glass displays.

From a supply chain perspective, UTG development objectives include establishing cost-effective manufacturing processes capable of high-volume production while maintaining strict quality control. The technology aims to achieve thickness uniformity at scale, with variations typically required to be less than ±2 micrometers across large glass sheets. Another critical objective is the development of specialized handling and processing equipment that can manage extremely thin glass without breakage during manufacturing.

Looking forward, UTG technology aims to further reduce thickness to below 20 micrometers while simultaneously improving mechanical durability through advanced strengthening techniques such as ion exchange and specialized coatings. The ultimate goal is to enable displays with fold radii below 1mm without damage after hundreds of thousands of folding cycles, thereby supporting increasingly compact device designs and novel form factors such as tri-fold or rollable displays.

The evolution of UTG also encompasses sustainability objectives, with efforts directed toward reducing energy consumption in manufacturing processes and exploring recycling pathways for end-of-life products containing UTG components. These environmental considerations are becoming increasingly important as flexible display production volumes continue to grow exponentially.

Flexible Display Market Analysis

The flexible display market has experienced remarkable growth in recent years, driven by increasing consumer demand for innovative form factors in electronic devices. The global flexible display market was valued at approximately $15.7 billion in 2020 and is projected to reach $62.3 billion by 2026, growing at a CAGR of 26.1% during the forecast period. This substantial growth trajectory is primarily fueled by the expanding adoption of flexible displays in smartphones, wearables, and automotive applications.

Smartphones represent the largest application segment, accounting for over 40% of the flexible display market share. Major smartphone manufacturers including Samsung, Apple, and Huawei have integrated flexible display technology into their premium product lines, with foldable smartphones emerging as a significant growth driver. The wearable device segment is experiencing the fastest growth rate, as flexible displays enable more ergonomic and versatile designs for smartwatches and fitness trackers.

Geographically, Asia Pacific dominates the flexible display market, with South Korea, China, and Japan leading in both production and consumption. This regional dominance is attributed to the presence of major display manufacturers and electronics OEMs. North America and Europe follow as significant markets, driven by high consumer purchasing power and early technology adoption trends.

OLED technology currently dominates the flexible display landscape, representing approximately 85% of the market. However, emerging technologies such as MicroLED are gaining traction due to their potential advantages in brightness, energy efficiency, and lifespan. The integration of Ultra-Thin Glass (UTG) as a cover material has become a critical differentiator in premium flexible display products, offering improved durability and scratch resistance compared to polymer-based alternatives.

Market analysis indicates that supply chain constraints represent a significant challenge for the flexible display industry. The production of UTG requires specialized manufacturing capabilities, with only a limited number of suppliers currently able to meet quality and volume requirements. This supply limitation has created bottlenecks and cost pressures throughout the value chain, particularly affecting smaller device manufacturers without vertical integration capabilities.

Consumer willingness to pay premium prices for flexible display devices remains strong, with market research showing that consumers are willing to pay 30-40% more for foldable smartphones compared to conventional models. However, price sensitivity varies significantly across different market segments and regions, suggesting the need for diversified pricing strategies as the technology matures and production scales.

Smartphones represent the largest application segment, accounting for over 40% of the flexible display market share. Major smartphone manufacturers including Samsung, Apple, and Huawei have integrated flexible display technology into their premium product lines, with foldable smartphones emerging as a significant growth driver. The wearable device segment is experiencing the fastest growth rate, as flexible displays enable more ergonomic and versatile designs for smartwatches and fitness trackers.

Geographically, Asia Pacific dominates the flexible display market, with South Korea, China, and Japan leading in both production and consumption. This regional dominance is attributed to the presence of major display manufacturers and electronics OEMs. North America and Europe follow as significant markets, driven by high consumer purchasing power and early technology adoption trends.

OLED technology currently dominates the flexible display landscape, representing approximately 85% of the market. However, emerging technologies such as MicroLED are gaining traction due to their potential advantages in brightness, energy efficiency, and lifespan. The integration of Ultra-Thin Glass (UTG) as a cover material has become a critical differentiator in premium flexible display products, offering improved durability and scratch resistance compared to polymer-based alternatives.

Market analysis indicates that supply chain constraints represent a significant challenge for the flexible display industry. The production of UTG requires specialized manufacturing capabilities, with only a limited number of suppliers currently able to meet quality and volume requirements. This supply limitation has created bottlenecks and cost pressures throughout the value chain, particularly affecting smaller device manufacturers without vertical integration capabilities.

Consumer willingness to pay premium prices for flexible display devices remains strong, with market research showing that consumers are willing to pay 30-40% more for foldable smartphones compared to conventional models. However, price sensitivity varies significantly across different market segments and regions, suggesting the need for diversified pricing strategies as the technology matures and production scales.

UTG Manufacturing Challenges

The manufacturing of Ultra-Thin Glass (UTG) for flexible displays presents significant technical challenges that impact the entire supply chain. The primary difficulty lies in producing glass sheets with thicknesses below 100 micrometers while maintaining structural integrity and optical quality. Traditional glass manufacturing processes like float glass production become increasingly complex at these dimensions, requiring specialized equipment and highly controlled environments.

Temperature control represents a critical challenge in UTG production. The glass must be heated to precise temperatures during forming and annealing processes, with even minor temperature variations potentially causing defects such as warping, stress points, or optical distortions. This necessitates advanced thermal management systems that add considerable cost to manufacturing facilities.

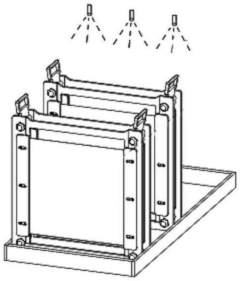

Handling ultra-thin glass during production presents another major obstacle. The extreme fragility of UTG sheets requires specialized robotic systems and vacuum-based transfer mechanisms to move the material between processing stations without introducing cracks or surface defects. These handling systems significantly increase capital expenditure for manufacturers entering the UTG market.

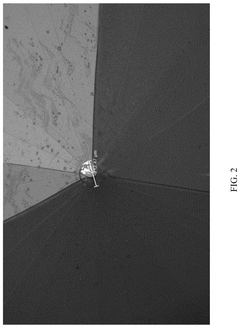

Surface quality control remains particularly challenging for UTG production. Even microscopic defects can compromise the structural integrity and optical performance of the final product. Manufacturers must implement sophisticated inspection systems using high-resolution cameras and laser scanning technology to detect surface imperfections at the nanometer scale, further adding to production costs.

Chemical strengthening processes, essential for improving UTG durability, introduce additional complexity. The ion exchange process used to strengthen glass must be precisely controlled to prevent distortion while achieving the required mechanical properties. This process requires specialized chemical baths and extended processing times, creating potential bottlenecks in high-volume production scenarios.

Yield management represents perhaps the most significant economic challenge in UTG manufacturing. Current production processes typically experience yield rates of 60-70%, substantially lower than the 85-90% achieved in standard glass production. Each rejected panel represents wasted material and processing costs, driving up the effective price per usable unit and creating supply constraints for downstream device manufacturers.

Scaling production to meet growing demand for flexible displays presents additional challenges. The specialized equipment required for UTG manufacturing has limited availability, with only a handful of suppliers worldwide capable of providing the necessary tools. This equipment scarcity creates potential supply bottlenecks and increases dependency on key equipment vendors, introducing additional risk factors into the supply chain.

Temperature control represents a critical challenge in UTG production. The glass must be heated to precise temperatures during forming and annealing processes, with even minor temperature variations potentially causing defects such as warping, stress points, or optical distortions. This necessitates advanced thermal management systems that add considerable cost to manufacturing facilities.

Handling ultra-thin glass during production presents another major obstacle. The extreme fragility of UTG sheets requires specialized robotic systems and vacuum-based transfer mechanisms to move the material between processing stations without introducing cracks or surface defects. These handling systems significantly increase capital expenditure for manufacturers entering the UTG market.

Surface quality control remains particularly challenging for UTG production. Even microscopic defects can compromise the structural integrity and optical performance of the final product. Manufacturers must implement sophisticated inspection systems using high-resolution cameras and laser scanning technology to detect surface imperfections at the nanometer scale, further adding to production costs.

Chemical strengthening processes, essential for improving UTG durability, introduce additional complexity. The ion exchange process used to strengthen glass must be precisely controlled to prevent distortion while achieving the required mechanical properties. This process requires specialized chemical baths and extended processing times, creating potential bottlenecks in high-volume production scenarios.

Yield management represents perhaps the most significant economic challenge in UTG manufacturing. Current production processes typically experience yield rates of 60-70%, substantially lower than the 85-90% achieved in standard glass production. Each rejected panel represents wasted material and processing costs, driving up the effective price per usable unit and creating supply constraints for downstream device manufacturers.

Scaling production to meet growing demand for flexible displays presents additional challenges. The specialized equipment required for UTG manufacturing has limited availability, with only a handful of suppliers worldwide capable of providing the necessary tools. This equipment scarcity creates potential supply bottlenecks and increases dependency on key equipment vendors, introducing additional risk factors into the supply chain.

Current UTG Production Methods

01 Manufacturing processes for Ultra-Thin Glass (UTG)

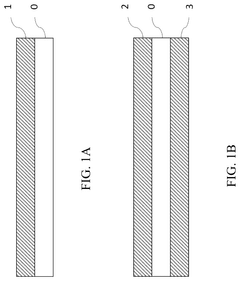

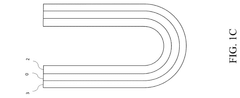

Various manufacturing processes are employed to produce Ultra-Thin Glass for flexible displays. These processes include specialized drawing techniques, etching methods, and polishing procedures that enable the production of glass with thicknesses below 100 micrometers while maintaining strength and flexibility. Advanced manufacturing techniques help optimize the balance between thinness and durability, which is crucial for applications in foldable devices.- Manufacturing processes for UTG production: Various manufacturing processes are employed to produce ultra-thin glass (UTG) for flexible displays and other applications. These processes include specialized drawing techniques, etching methods, and polishing procedures that enable the production of glass with thicknesses below 100 microns while maintaining strength and flexibility. Advanced manufacturing technologies help optimize the production yield and quality of UTG, which directly impacts the supply chain efficiency and cost structure.

- Supply chain integration and management: The UTG supply chain involves multiple stakeholders including raw material suppliers, glass manufacturers, processing companies, and device makers. Effective integration and management of this supply chain is critical for ensuring consistent quality, reducing costs, and meeting market demands. This includes logistics optimization, inventory management, and strategic partnerships between suppliers and manufacturers to streamline the flow of materials and finished products.

- Cost modeling and economic analysis: Cost modeling for UTG production encompasses raw material costs, processing expenses, equipment depreciation, and yield considerations. Economic analyses help manufacturers optimize their production parameters and pricing strategies. These models account for factors such as economies of scale, technological advancements, and market competition. Understanding the cost structure is essential for manufacturers to remain competitive while delivering high-quality UTG products to the market.

- Material innovations and enhancements: Ongoing research focuses on enhancing UTG materials through composition modifications, strengthening techniques, and surface treatments. These innovations aim to improve the mechanical properties, flexibility, and durability of UTG while maintaining optical clarity. Advanced materials science approaches, including novel glass formulations and hybrid materials, contribute to the development of UTG with superior performance characteristics for next-generation display applications.

- Application-specific UTG solutions: Different applications require customized UTG solutions with specific thickness, flexibility, and durability characteristics. Manufacturers develop specialized UTG products for foldable smartphones, wearable devices, automotive displays, and other applications. These application-specific solutions involve tailored manufacturing processes and material compositions to meet the unique requirements of each use case, which influences both the supply chain configuration and cost structure.

02 Supply chain optimization for UTG production

The supply chain for Ultra-Thin Glass involves multiple stakeholders including raw material suppliers, glass manufacturers, processing facilities, and device makers. Optimization strategies focus on reducing transportation costs, improving inventory management, and establishing strategic partnerships to ensure consistent quality and timely delivery. Vertical integration within the supply chain helps companies maintain better control over costs and quality throughout the production process.Expand Specific Solutions03 Cost modeling and reduction strategies for UTG

Cost models for Ultra-Thin Glass production consider factors such as raw material costs, energy consumption, yield rates, equipment depreciation, and labor expenses. Strategies for cost reduction include improving production yield, implementing automation, optimizing material usage, and scaling up production volumes. Advanced cost modeling techniques help manufacturers identify cost drivers and implement targeted improvements to maintain competitive pricing in the market.Expand Specific Solutions04 Integration of UTG in display devices

The integration of Ultra-Thin Glass into display devices requires specialized handling techniques, bonding methods, and protective layers. The assembly process must account for the fragility of thin glass while ensuring proper adhesion to other components. Innovations in this area focus on improving the durability of the final product, reducing thickness of the overall display stack, and enhancing the user experience with better touch sensitivity and visual clarity.Expand Specific Solutions05 Quality control and testing methods for UTG

Quality control for Ultra-Thin Glass involves rigorous testing protocols to ensure consistent thickness, surface quality, mechanical strength, and optical properties. Advanced inspection systems use machine vision, laser measurement, and stress testing to identify defects. Statistical process control methods help manufacturers maintain quality standards while minimizing waste. These quality assurance processes are critical for ensuring the reliability of UTG in consumer electronics applications.Expand Specific Solutions

Key UTG Suppliers and Display Manufacturers

The ultra-thin glass (UTG) market for flexible displays is currently in a growth phase, with increasing adoption in foldable smartphones and wearable devices. The global market size is projected to expand significantly, driven by consumer demand for innovative form factors. Technologically, UTG remains challenging to manufacture at scale, with varying degrees of maturity among key players. Companies like Corning, Samsung Display, and BOE Technology have established strong positions through vertical integration and proprietary manufacturing processes. Chinese firms including Triumph Science & Technology, Dongxu Technology Group, and CSOT are rapidly advancing their capabilities, particularly in cost-effective production methods. Western companies maintain advantages in high-precision manufacturing, while Asian manufacturers excel in scaling production and supply chain optimization for consumer electronics applications.

China National Building Material Group Co., Ltd.

Technical Solution: CNBM has developed an advanced float glass production technology specifically optimized for UTG manufacturing, capable of producing glass sheets with thicknesses ranging from 50-150 microns. Their approach integrates modified tin bath compositions and controlled cooling processes to achieve the necessary thinness while maintaining structural integrity. The company has established a regionalized supply chain model with manufacturing hubs strategically located near major display production centers in China, reducing logistics costs by up to 40% compared to imported alternatives[5]. CNBM's cost model leverages China's scale advantages in raw material sourcing and processing, with vertical integration from silica mining to finished glass production. Their manufacturing process incorporates specialized handling systems using electrostatic carriers and non-contact air bearing transport to minimize damage during production. The company has invested in specialized annealing techniques that reduce internal stress in UTG, improving yield rates to approximately 85% for sub-100 micron glass[6].

Strengths: Cost advantages through vertical integration from raw materials to finished glass; domestic supply chain reduces logistics costs and delivery times for Chinese display manufacturers; government support provides favorable investment conditions for capacity expansion. Weaknesses: Less established track record in ultra-premium display applications compared to international competitors; quality consistency challenges when scaling to highest purity requirements; limited international distribution network.

Corning, Inc.

Technical Solution: Corning has developed a proprietary fusion draw process for manufacturing ultra-thin glass (UTG) that enables production of glass as thin as 30 microns while maintaining exceptional surface quality and dimensional stability. Their Willow Glass technology specifically targets flexible displays with a thickness range of 100-200 microns, allowing for a bending radius of less than 2mm. The company has implemented a roll-to-roll manufacturing process that significantly reduces production costs by approximately 30% compared to traditional sheet-based methods[1]. Corning's supply chain model integrates vertical manufacturing capabilities from raw materials to finished glass, with strategic manufacturing facilities in Asia (particularly South Korea and Taiwan) to minimize logistics costs and delivery times to display manufacturers. Their cost model incorporates economies of scale with high-volume production lines capable of producing over 500,000 square meters of UTG annually[2].

Strengths: Proprietary fusion draw process enables superior surface quality and uniformity; established global supply chain with strategic positioning near major display manufacturers; economies of scale through high-volume production. Weaknesses: Higher initial capital investment requirements compared to plastic alternatives; more complex handling and processing requirements during manufacturing; potential for yield loss during extreme bending operations.

Critical Patents in UTG Processing

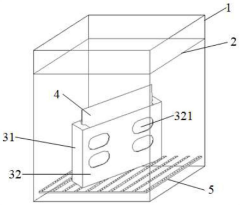

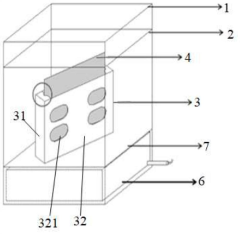

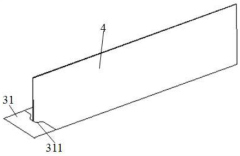

Ultra-thin glass cover plate processing technology

PatentActiveCN113582553A

Innovation

- Chemical etching is used to passivate the edges of ultra-thin glass, combined with laser cutting and surface etching optimization, and hydrofluoric acid/nitric acid/sulfuric acid solution is used for immersion etching to repair chipping defects and improve the bending performance and impact resistance of the glass. Strength, while using ultrasonic vibrators and foam tubes to reduce the production of fixture marks.

Foldable ultrathin glass with transparent, impact-resistant hard coating

PatentActiveUS12116308B2

Innovation

- A single-layer hard coating composed of silsesquioxane with a silicon-oxygen core framework directly bonded to the ultrathin tempered glass substrate, providing a surface hardness of at least 7H, hydrophobic properties, and improved impact resistance without the need for an adhesive layer, achieved through chemical tempering and specific molecular weight ranges of the silsesquioxane.

Supply Chain Resilience Strategies

The resilience of the Ultra-Thin Glass (UTG) supply chain has become increasingly critical as flexible displays gain market traction. Traditional supply chain models are inadequate for this specialized material, necessitating robust strategies to mitigate disruptions and ensure continuity of production.

Diversification of supplier networks represents a primary resilience strategy for UTG manufacturers. By establishing relationships with multiple glass suppliers across different geographical regions, display manufacturers can reduce dependency on single sources. Companies like Samsung Display and LG Display have already implemented dual-sourcing approaches, partnering with both Corning and Schott for their UTG requirements, effectively reducing regional concentration risks.

Vertical integration has emerged as another key strategy, with major players investing in their own UTG production capabilities. This approach provides greater control over quality standards and production timelines while reducing external dependencies. BOE Technology Group's recent $2.8 billion investment in UTG manufacturing facilities exemplifies this trend, allowing them to secure approximately 30% of their UTG needs internally.

Strategic inventory management tailored specifically for UTG components has become essential. The implementation of buffer stock systems that account for the unique handling requirements of ultra-thin glass materials helps manufacturers weather short-term supply disruptions. Industry leaders maintain approximately 2-3 months of critical UTG inventory, balancing carrying costs against potential production interruptions.

Advanced forecasting and demand planning systems utilizing AI and machine learning algorithms are being deployed to anticipate market fluctuations. These systems analyze historical data, consumer trends, and macroeconomic indicators to optimize UTG production schedules and inventory levels, reducing both overstock and stockout scenarios.

Collaborative supplier development programs represent a forward-looking approach to supply chain resilience. Display manufacturers are actively investing in their UTG suppliers' capabilities through technology sharing, process improvement initiatives, and financial support for capacity expansion. These partnerships strengthen the entire supply ecosystem while ensuring consistent quality and innovation.

Risk monitoring and early warning systems focused on UTG supply chains provide real-time visibility into potential disruptions. These systems track political instability, natural disaster risks, transportation bottlenecks, and other factors that could impact UTG availability, allowing for proactive mitigation measures before production is affected.

Diversification of supplier networks represents a primary resilience strategy for UTG manufacturers. By establishing relationships with multiple glass suppliers across different geographical regions, display manufacturers can reduce dependency on single sources. Companies like Samsung Display and LG Display have already implemented dual-sourcing approaches, partnering with both Corning and Schott for their UTG requirements, effectively reducing regional concentration risks.

Vertical integration has emerged as another key strategy, with major players investing in their own UTG production capabilities. This approach provides greater control over quality standards and production timelines while reducing external dependencies. BOE Technology Group's recent $2.8 billion investment in UTG manufacturing facilities exemplifies this trend, allowing them to secure approximately 30% of their UTG needs internally.

Strategic inventory management tailored specifically for UTG components has become essential. The implementation of buffer stock systems that account for the unique handling requirements of ultra-thin glass materials helps manufacturers weather short-term supply disruptions. Industry leaders maintain approximately 2-3 months of critical UTG inventory, balancing carrying costs against potential production interruptions.

Advanced forecasting and demand planning systems utilizing AI and machine learning algorithms are being deployed to anticipate market fluctuations. These systems analyze historical data, consumer trends, and macroeconomic indicators to optimize UTG production schedules and inventory levels, reducing both overstock and stockout scenarios.

Collaborative supplier development programs represent a forward-looking approach to supply chain resilience. Display manufacturers are actively investing in their UTG suppliers' capabilities through technology sharing, process improvement initiatives, and financial support for capacity expansion. These partnerships strengthen the entire supply ecosystem while ensuring consistent quality and innovation.

Risk monitoring and early warning systems focused on UTG supply chains provide real-time visibility into potential disruptions. These systems track political instability, natural disaster risks, transportation bottlenecks, and other factors that could impact UTG availability, allowing for proactive mitigation measures before production is affected.

Cost Optimization Models for UTG Implementation

Optimizing the cost structure for Ultra-Thin Glass (UTG) implementation requires sophisticated modeling approaches that account for the unique characteristics of this advanced material. Traditional cost models often fail to capture the complexities associated with UTG manufacturing, supply chain dynamics, and implementation processes in flexible display production environments.

The development of comprehensive cost optimization models for UTG begins with detailed component-level analysis. This includes quantifying material costs across the entire value chain, from raw materials to finished components, while accounting for yield variations at different production stages. Research indicates that UTG material costs currently represent approximately 15-20% of the total flexible display module cost, with significant potential for reduction through optimization strategies.

Process-based cost modeling (PBCM) has emerged as a particularly effective approach for UTG implementation. This methodology breaks down manufacturing processes into discrete steps, assigning costs to each operation while considering equipment utilization, labor requirements, and energy consumption. PBCM enables manufacturers to identify cost hotspots in the UTG implementation workflow, revealing opportunities for targeted optimization efforts that maximize return on investment.

Scale economies play a crucial role in UTG cost optimization. Analysis of production volume scenarios demonstrates that UTG manufacturing costs can decrease by 30-40% when scaling from pilot production to mass production volumes exceeding 1 million units monthly. This scale effect is more pronounced for UTG than for plastic alternatives due to the higher initial capital investment requirements for glass processing equipment.

Supply chain integration models represent another vital dimension of UTG cost optimization. Vertical integration strategies, where display manufacturers develop in-house UTG processing capabilities, show potential cost advantages of 12-18% compared to outsourced models. However, these benefits must be weighed against the substantial capital expenditure requirements and technological expertise needed to establish such capabilities.

Risk-adjusted cost modeling is increasingly important for UTG implementation decisions. These models incorporate probability distributions for key variables such as yield rates, material price fluctuations, and equipment downtime. Monte Carlo simulations based on these distributions provide more realistic cost projections than deterministic models, enabling more informed investment decisions in UTG technology.

Lifecycle cost analysis extends the optimization framework beyond manufacturing to include implementation, maintenance, and end-of-life considerations. This holistic approach reveals that while UTG may have higher initial implementation costs compared to plastic alternatives, its superior durability and performance characteristics often result in lower total cost of ownership over the product lifecycle, particularly for premium device segments where longevity and quality are paramount.

The development of comprehensive cost optimization models for UTG begins with detailed component-level analysis. This includes quantifying material costs across the entire value chain, from raw materials to finished components, while accounting for yield variations at different production stages. Research indicates that UTG material costs currently represent approximately 15-20% of the total flexible display module cost, with significant potential for reduction through optimization strategies.

Process-based cost modeling (PBCM) has emerged as a particularly effective approach for UTG implementation. This methodology breaks down manufacturing processes into discrete steps, assigning costs to each operation while considering equipment utilization, labor requirements, and energy consumption. PBCM enables manufacturers to identify cost hotspots in the UTG implementation workflow, revealing opportunities for targeted optimization efforts that maximize return on investment.

Scale economies play a crucial role in UTG cost optimization. Analysis of production volume scenarios demonstrates that UTG manufacturing costs can decrease by 30-40% when scaling from pilot production to mass production volumes exceeding 1 million units monthly. This scale effect is more pronounced for UTG than for plastic alternatives due to the higher initial capital investment requirements for glass processing equipment.

Supply chain integration models represent another vital dimension of UTG cost optimization. Vertical integration strategies, where display manufacturers develop in-house UTG processing capabilities, show potential cost advantages of 12-18% compared to outsourced models. However, these benefits must be weighed against the substantial capital expenditure requirements and technological expertise needed to establish such capabilities.

Risk-adjusted cost modeling is increasingly important for UTG implementation decisions. These models incorporate probability distributions for key variables such as yield rates, material price fluctuations, and equipment downtime. Monte Carlo simulations based on these distributions provide more realistic cost projections than deterministic models, enabling more informed investment decisions in UTG technology.

Lifecycle cost analysis extends the optimization framework beyond manufacturing to include implementation, maintenance, and end-of-life considerations. This holistic approach reveals that while UTG may have higher initial implementation costs compared to plastic alternatives, its superior durability and performance characteristics often result in lower total cost of ownership over the product lifecycle, particularly for premium device segments where longevity and quality are paramount.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!