Optical Coating Designs For Reflection Control Of Ultra-Thin Glass (UTG) In Flexible Displays

AUG 26, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

UTG Optical Coating Background and Objectives

Ultra-thin glass (UTG) has emerged as a transformative material in the flexible display industry, offering a unique combination of flexibility, durability, and optical clarity that traditional rigid glass cannot provide. The evolution of UTG technology can be traced back to the early 2010s when display manufacturers began exploring alternatives to plastic substrates for foldable devices. By 2019, commercial applications of UTG in foldable smartphones marked a significant milestone in display technology advancement.

The optical properties of UTG present both opportunities and challenges. While UTG offers superior transparency compared to plastic alternatives, its ultra-thin nature (typically less than 100 micrometers) creates unique optical phenomena that must be addressed through specialized coating designs. Reflection control becomes particularly critical as these displays are increasingly used in various lighting conditions, from bright outdoor environments to dimly lit indoor spaces.

Current technological trends indicate a growing emphasis on developing multi-functional optical coatings that can simultaneously address reflection control, enhance durability, and maintain flexibility. The industry is moving beyond simple anti-reflective coatings toward sophisticated multi-layer designs that can withstand repeated folding while maintaining optimal optical performance throughout the display's lifecycle.

The primary objective of UTG optical coating research is to develop coating architectures that can reduce surface reflections to below 1% across the visible spectrum while maintaining the mechanical flexibility required for foldable applications. Secondary objectives include enhancing scratch resistance, minimizing fingerprint visibility, and ensuring coating adhesion during repeated folding cycles exceeding 200,000 folds.

Another critical goal is to develop coating solutions that can be applied through industrially viable processes compatible with existing manufacturing infrastructure. This includes exploring low-temperature deposition methods that won't compromise the structural integrity of the ultra-thin glass substrate during application.

Looking forward, the technology roadmap for UTG optical coatings aims to achieve reflection values approaching the theoretical minimum while incorporating additional functionalities such as self-healing properties, antimicrobial surfaces, and adaptive optical responses. These advancements will be essential in supporting next-generation flexible display applications beyond smartphones, including rollable televisions, wearable devices, and automotive displays.

The successful development of advanced optical coating designs for UTG will play a pivotal role in determining the commercial viability and user experience of future flexible display products, making this a strategically important area for continued research and development investment.

The optical properties of UTG present both opportunities and challenges. While UTG offers superior transparency compared to plastic alternatives, its ultra-thin nature (typically less than 100 micrometers) creates unique optical phenomena that must be addressed through specialized coating designs. Reflection control becomes particularly critical as these displays are increasingly used in various lighting conditions, from bright outdoor environments to dimly lit indoor spaces.

Current technological trends indicate a growing emphasis on developing multi-functional optical coatings that can simultaneously address reflection control, enhance durability, and maintain flexibility. The industry is moving beyond simple anti-reflective coatings toward sophisticated multi-layer designs that can withstand repeated folding while maintaining optimal optical performance throughout the display's lifecycle.

The primary objective of UTG optical coating research is to develop coating architectures that can reduce surface reflections to below 1% across the visible spectrum while maintaining the mechanical flexibility required for foldable applications. Secondary objectives include enhancing scratch resistance, minimizing fingerprint visibility, and ensuring coating adhesion during repeated folding cycles exceeding 200,000 folds.

Another critical goal is to develop coating solutions that can be applied through industrially viable processes compatible with existing manufacturing infrastructure. This includes exploring low-temperature deposition methods that won't compromise the structural integrity of the ultra-thin glass substrate during application.

Looking forward, the technology roadmap for UTG optical coatings aims to achieve reflection values approaching the theoretical minimum while incorporating additional functionalities such as self-healing properties, antimicrobial surfaces, and adaptive optical responses. These advancements will be essential in supporting next-generation flexible display applications beyond smartphones, including rollable televisions, wearable devices, and automotive displays.

The successful development of advanced optical coating designs for UTG will play a pivotal role in determining the commercial viability and user experience of future flexible display products, making this a strategically important area for continued research and development investment.

Market Analysis for UTG in Flexible Display Industry

The global market for Ultra-Thin Glass (UTG) in flexible displays has experienced exponential growth since 2019, driven primarily by the increasing demand for foldable smartphones and wearable devices. The market value reached approximately $1.2 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 28% through 2027, potentially reaching $4.1 billion by that time.

Consumer electronics represents the largest application segment for UTG, accounting for over 70% of the total market share. Within this segment, foldable smartphones dominate, with major players like Samsung, Huawei, and Motorola driving adoption. The wearable device market follows as the second-largest application area, with smartwatches and fitness trackers incorporating flexible display technologies.

Market research indicates that consumers are increasingly willing to pay premium prices for devices with flexible displays, particularly when the optical quality matches or exceeds that of traditional glass displays. A critical factor in this consumer acceptance is the reflection control properties of the display, which directly impacts visibility and perceived image quality.

Regional analysis shows Asia-Pacific leading the UTG market with approximately 65% market share, primarily due to the concentration of display manufacturers and smartphone assembly operations in countries like South Korea, China, and Taiwan. North America and Europe follow with roughly 20% and 12% market shares respectively, driven by high consumer adoption rates of premium electronic devices.

The supply chain for UTG remains relatively concentrated, with companies like Schott, Corning, and Samsung Display controlling significant portions of production capacity. This concentration has led to occasional supply constraints as demand continues to outpace manufacturing capabilities, particularly for specialized optical coatings that control reflection.

Market surveys reveal that anti-reflection properties rank among the top three features consumers consider when evaluating flexible display devices, alongside durability and color accuracy. Devices with superior reflection control command price premiums of 8-15% compared to those with standard optical properties.

Industry forecasts suggest that as UTG manufacturing scales up and optical coating technologies mature, production costs will decrease by approximately 30-40% over the next five years. This cost reduction is expected to accelerate adoption in mid-range devices, expanding the total addressable market significantly beyond current premium segments.

Consumer electronics represents the largest application segment for UTG, accounting for over 70% of the total market share. Within this segment, foldable smartphones dominate, with major players like Samsung, Huawei, and Motorola driving adoption. The wearable device market follows as the second-largest application area, with smartwatches and fitness trackers incorporating flexible display technologies.

Market research indicates that consumers are increasingly willing to pay premium prices for devices with flexible displays, particularly when the optical quality matches or exceeds that of traditional glass displays. A critical factor in this consumer acceptance is the reflection control properties of the display, which directly impacts visibility and perceived image quality.

Regional analysis shows Asia-Pacific leading the UTG market with approximately 65% market share, primarily due to the concentration of display manufacturers and smartphone assembly operations in countries like South Korea, China, and Taiwan. North America and Europe follow with roughly 20% and 12% market shares respectively, driven by high consumer adoption rates of premium electronic devices.

The supply chain for UTG remains relatively concentrated, with companies like Schott, Corning, and Samsung Display controlling significant portions of production capacity. This concentration has led to occasional supply constraints as demand continues to outpace manufacturing capabilities, particularly for specialized optical coatings that control reflection.

Market surveys reveal that anti-reflection properties rank among the top three features consumers consider when evaluating flexible display devices, alongside durability and color accuracy. Devices with superior reflection control command price premiums of 8-15% compared to those with standard optical properties.

Industry forecasts suggest that as UTG manufacturing scales up and optical coating technologies mature, production costs will decrease by approximately 30-40% over the next five years. This cost reduction is expected to accelerate adoption in mid-range devices, expanding the total addressable market significantly beyond current premium segments.

Current Challenges in UTG Reflection Control

Despite the promising applications of Ultra-Thin Glass (UTG) in flexible displays, significant challenges persist in controlling reflection properties, which directly impact display quality and user experience. The primary challenge lies in balancing optical performance with mechanical flexibility. Traditional anti-reflection coatings designed for rigid glass substrates often crack or delaminate when applied to UTG under bending stress, compromising both optical performance and mechanical durability.

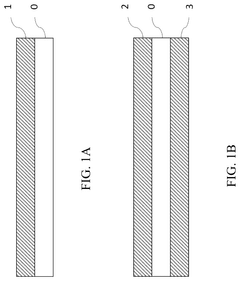

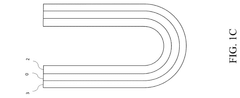

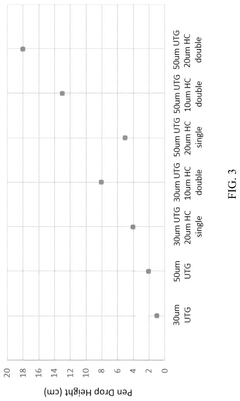

The thickness constraint presents another major hurdle. With UTG typically measuring between 30-100 micrometers, the available budget for optical coatings is severely limited. Conventional multi-layer coating stacks that effectively manage reflection on standard glass cannot be directly transferred to UTG without increasing the overall thickness and reducing flexibility—the very property that makes UTG valuable.

Environmental stability poses additional complications. Flexible displays experience more extreme environmental conditions than traditional displays, including repeated mechanical stress, temperature fluctuations during bending, and potential exposure to moisture at coating interfaces. These factors accelerate coating degradation and can lead to optical performance deterioration over time.

Manufacturing scalability remains problematic for UTG reflection control solutions. Current coating deposition techniques optimized for flat, rigid substrates must be adapted for the handling requirements of ultra-thin flexible glass. The yield rates for high-quality optical coatings on UTG are significantly lower than for conventional glass, driving up production costs.

Interference with touch functionality creates further complexity. Many flexible displays incorporate touch sensors, and optical coatings must be designed to maintain compatibility with these components without introducing electrical interference or reducing touch sensitivity.

Angular performance represents another technical barrier. As flexible displays may be viewed from various angles during normal use, especially when bent, optical coatings must maintain consistent anti-reflection properties across a wider range of viewing angles than traditional displays require.

The industry also faces challenges in measurement and quality control. Standard optical testing equipment and methodologies are designed for flat surfaces, making it difficult to accurately characterize the optical performance of coatings on curved or bendable UTG surfaces. This complicates both development and production quality assurance processes.

Addressing these interconnected challenges requires innovative approaches that fundamentally rethink optical coating designs specifically for the unique requirements of UTG in flexible display applications.

The thickness constraint presents another major hurdle. With UTG typically measuring between 30-100 micrometers, the available budget for optical coatings is severely limited. Conventional multi-layer coating stacks that effectively manage reflection on standard glass cannot be directly transferred to UTG without increasing the overall thickness and reducing flexibility—the very property that makes UTG valuable.

Environmental stability poses additional complications. Flexible displays experience more extreme environmental conditions than traditional displays, including repeated mechanical stress, temperature fluctuations during bending, and potential exposure to moisture at coating interfaces. These factors accelerate coating degradation and can lead to optical performance deterioration over time.

Manufacturing scalability remains problematic for UTG reflection control solutions. Current coating deposition techniques optimized for flat, rigid substrates must be adapted for the handling requirements of ultra-thin flexible glass. The yield rates for high-quality optical coatings on UTG are significantly lower than for conventional glass, driving up production costs.

Interference with touch functionality creates further complexity. Many flexible displays incorporate touch sensors, and optical coatings must be designed to maintain compatibility with these components without introducing electrical interference or reducing touch sensitivity.

Angular performance represents another technical barrier. As flexible displays may be viewed from various angles during normal use, especially when bent, optical coatings must maintain consistent anti-reflection properties across a wider range of viewing angles than traditional displays require.

The industry also faces challenges in measurement and quality control. Standard optical testing equipment and methodologies are designed for flat surfaces, making it difficult to accurately characterize the optical performance of coatings on curved or bendable UTG surfaces. This complicates both development and production quality assurance processes.

Addressing these interconnected challenges requires innovative approaches that fundamentally rethink optical coating designs specifically for the unique requirements of UTG in flexible display applications.

Existing Anti-Reflection Solutions for Ultra-Thin Glass

01 Multi-layer anti-reflection coatings for UTG

Multi-layer anti-reflection coatings can be applied to ultra-thin glass to effectively reduce reflection and increase light transmission. These coatings typically consist of alternating high and low refractive index materials, such as SiO2 and TiO2, deposited in precise thicknesses to create destructive interference of reflected light. The number of layers and their thickness can be optimized based on the specific wavelength range required for the application, providing customized reflection control for UTG in display devices.- Multi-layer anti-reflection coatings for UTG: Multi-layer optical coatings can be applied to ultra-thin glass to effectively control reflection. These coatings typically consist of alternating high and low refractive index materials that create destructive interference of reflected light waves. The thickness and number of layers can be optimized to achieve broad-spectrum anti-reflection properties while maintaining the flexibility and durability required for UTG applications. These designs can reduce reflection to less than 0.5% across visible wavelengths.

- Nano-structured surface treatments for UTG: Nano-structured surface treatments can be applied to ultra-thin glass to reduce reflection through gradient refractive index effects. These treatments create sub-wavelength structures on the glass surface that gradually transition the refractive index from air to glass, minimizing reflection at interfaces. Techniques include moth-eye structures, nanoporous layers, and biomimetic surface patterns. These approaches are particularly effective for maintaining optical clarity while preserving the mechanical properties of UTG.

- Flexible hard coating technologies for UTG protection: Specialized hard coating technologies have been developed to protect ultra-thin glass while maintaining flexibility and optical properties. These coatings combine organic and inorganic materials to create hybrid structures that can withstand bending while providing scratch resistance and anti-reflection properties. The coatings are typically applied through vacuum deposition or solution processes and can incorporate siloxane-based compounds or metal oxide nanoparticles to achieve the desired combination of mechanical and optical properties.

- Edge sealing and coating uniformity techniques for UTG: Edge sealing and coating uniformity techniques are critical for ultra-thin glass applications to prevent delamination and ensure consistent optical performance. These methods include specialized edge treatment processes, gradient coating designs, and stress management techniques that accommodate the flexibility of UTG. Advanced deposition methods such as atomic layer deposition and ion-assisted evaporation can achieve highly uniform coatings even on curved or flexible UTG surfaces, maintaining reflection control across the entire glass area.

- Integration of functional optical coatings with UTG: Beyond basic reflection control, advanced functional optical coatings can be integrated with ultra-thin glass to provide additional properties. These include electrochromic layers that can dynamically control light transmission, photochromic coatings that respond to UV exposure, and selective wavelength filters. The integration requires careful material selection and deposition techniques to maintain the flexibility of UTG while adding these functional properties. These multi-functional coatings enable UTG to be used in advanced display technologies, smart windows, and flexible electronic devices.

02 Nano-textured surface treatments for UTG

Nano-textured surface treatments involve creating microscopic patterns on the UTG surface to reduce reflection through gradual refractive index matching between air and glass. These nano-structures can be created through processes like etching, lithography, or nano-imprinting. The resulting moth-eye-like structures effectively minimize reflection across a broad spectrum of wavelengths and viewing angles, making them particularly valuable for flexible display applications where traditional coatings might crack under bending stress.Expand Specific Solutions03 Hybrid organic-inorganic coating systems

Hybrid coating systems combine organic and inorganic materials to achieve optimal reflection control while maintaining the flexibility needed for UTG applications. These coatings typically incorporate siloxane-based materials with inorganic nanoparticles to create a durable yet flexible anti-reflection layer. The organic components provide flexibility and adhesion to the glass substrate, while the inorganic components contribute to the optical properties and durability. This approach addresses the unique challenges of coating UTG that must maintain optical performance while being bent or flexed.Expand Specific Solutions04 Edge-specific coating techniques for UTG

Edge-specific coating techniques focus on the particular challenges of controlling reflection at the edges of ultra-thin glass, which are often problematic areas in display applications. These methods involve specialized deposition processes that ensure uniform coating thickness even at the edges and corners of the glass. Some approaches include gradient coating designs that gradually change in thickness or composition toward the edges, or selective edge reinforcement techniques that provide both optical and mechanical benefits to the most vulnerable areas of UTG components.Expand Specific Solutions05 Self-healing anti-reflection coatings for UTG

Self-healing anti-reflection coatings incorporate materials that can repair minor scratches or damage, extending the usable lifetime of UTG in flexible devices. These innovative coatings typically contain polymeric materials with dynamic bonds that can reform after being broken, or microcapsules containing healing agents that are released when damage occurs. The self-healing properties are particularly valuable for UTG applications in foldable displays and other flexible electronics where the coating may experience repeated stress and potential damage during normal use.Expand Specific Solutions

Leading Manufacturers and Research Institutions in UTG Coatings

The optical coating market for ultra-thin glass (UTG) in flexible displays is currently in a growth phase, with increasing demand driven by the expanding flexible display sector. The market size is projected to grow significantly as foldable smartphones and other flexible display applications gain mainstream adoption. Technologically, this field is advancing rapidly but remains moderately mature, with key players developing specialized solutions. Companies like Samsung Display, BOE Technology, and Huawei are leading innovation with significant R&D investments, while specialized materials firms such as Toray Industries and Dongwoo Fine-Chem provide critical coating technologies. Chinese manufacturers including China Star Optoelectronics and Triumph Science & Technology are rapidly advancing their capabilities, challenging established players. The competitive landscape features both display giants and specialized coating technology providers working to address reflection control challenges while maintaining optical clarity and durability.

BOE Technology Group Co., Ltd.

Technical Solution: BOE has developed a comprehensive optical coating solution for UTG in flexible displays focusing on maintaining optical clarity while enhancing durability. Their approach utilizes a multi-layer coating system with alternating high and low refractive index materials (primarily SiO2 and TiO2) to create broadband anti-reflection properties. BOE's coating design incorporates specialized nano-composite layers that absorb mechanical stress during bending while maintaining optical performance. Their process employs magnetron sputtering technology to achieve precise thickness control down to ±2nm across large substrate areas. The company has also pioneered a gradient-index coating approach where the refractive index gradually changes through the coating thickness, reducing internal stress and improving adhesion to the UTG substrate. This technology has enabled BOE to achieve reflection values below 1.2% across the visible spectrum while maintaining transmission above 92% in their flexible OLED displays.

Strengths: Large-scale manufacturing capability; innovative gradient-index coating approach reduces internal stress; strong integration with display manufacturing processes. Weaknesses: Coating uniformity challenges on larger display areas; some formulations show higher susceptibility to fingerprints and smudges; durability in extreme environmental conditions remains a challenge.

Samsung Display Co., Ltd.

Technical Solution: Samsung Display has pioneered advanced optical coating technologies for UTG in flexible displays, particularly for their foldable smartphones. Their proprietary coating design incorporates multi-layer anti-reflection (AR) coatings with precisely controlled thickness and refractive index profiles. The company utilizes ion beam sputtering and plasma-enhanced chemical vapor deposition (PECVD) techniques to create nanometer-precision coatings that maintain optical clarity while enhancing durability. Their UTG implementation includes specialized hard coating layers that reduce surface reflections to under 1% while maintaining over 93% light transmission. Samsung's coating architecture incorporates both inorganic (SiO2, TiO2, Al2O3) and organic materials in alternating layers to optimize optical performance while maintaining flexibility through hundreds of thousands of folding cycles.

Strengths: Industry-leading expertise in mass production of flexible displays with UTG; proprietary coating formulations that balance optical performance with mechanical durability; extensive patent portfolio. Weaknesses: Higher manufacturing costs compared to conventional glass solutions; some coating formulations may still show degradation after extended folding cycles; technology heavily protected by patents limiting industry adoption.

Key Patents and Innovations in UTG Optical Coatings

Foldable ultrathin glass with transparent, impact-resistant hard coating

PatentActiveUS12116308B2

Innovation

- A single-layer hard coating composed of silsesquioxane with a silicon-oxygen core framework directly bonded to the ultrathin tempered glass substrate, providing a surface hardness of at least 7H, hydrophobic properties, and improved impact resistance without the need for an adhesive layer, achieved through chemical tempering and specific molecular weight ranges of the silsesquioxane.

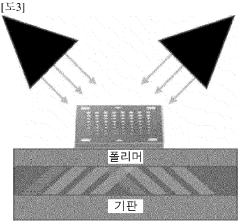

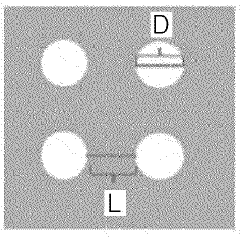

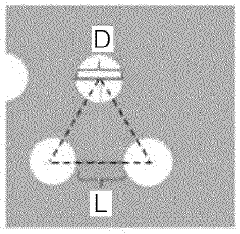

Method for forming three-dimensional structure by using UV parallel light in multilayered stacked structure, and three-dimensional structure formed by method

PatentWO2024085704A1

Innovation

- A method involving the application of a composition with a polymer, photoinitiator, and curing agent on a substrate, followed by UV parallel light irradiation through a photo mask to form a skeletal support and buffer portion with varying hardness, enhancing impact resistance and low-reflection coating.

Material Compatibility and Durability Considerations

Material compatibility represents a critical consideration in the development of optical coatings for ultra-thin glass (UTG) in flexible displays. The interface between coating materials and UTG substrates must maintain strong adhesion during repeated bending cycles, which presents significant engineering challenges. Thermal expansion coefficient mismatches between coating layers and UTG can lead to delamination, cracking, or peeling during temperature fluctuations that occur in both manufacturing processes and daily device operation.

The chemical compatibility between coating materials and UTG requires careful evaluation, as certain coating compounds may react with glass components over time, particularly under high humidity or temperature conditions. This chemical interaction can compromise both optical performance and mechanical integrity. Research indicates that silicon-based interlayers often provide superior adhesion properties while maintaining optical transparency when applied between UTG and subsequent coating layers.

Durability considerations extend beyond mere adhesion to include resistance against environmental stressors. Optical coatings for UTG must withstand humidity, temperature cycling, UV exposure, and chemical contaminants while maintaining consistent optical properties. Accelerated aging tests reveal that multi-layer designs incorporating both inorganic and organic materials often provide superior environmental stability compared to single-material approaches.

Mechanical durability presents perhaps the most demanding challenge for UTG optical coatings. Unlike traditional rigid displays, flexible displays undergo thousands of bending cycles throughout their operational lifetime. Coating materials must maintain their optical properties while accommodating strain values that can exceed 1% at the bend radius. Recent innovations have focused on nanocomposite coatings that incorporate elastomeric components to absorb mechanical stress without compromising optical clarity.

Manufacturing compatibility further complicates material selection, as coating processes must operate within temperature limits that prevent UTG deformation. Traditional high-temperature deposition techniques often prove unsuitable, necessitating the development of low-temperature alternatives such as plasma-enhanced chemical vapor deposition (PECVD) and atomic layer deposition (ALD) methods specifically optimized for UTG substrates.

Long-term stability testing protocols have emerged as essential tools for evaluating coating durability, with industry standards now requiring demonstration of optical performance retention after 200,000+ folding cycles. Materials that exhibit self-healing properties or incorporate sacrificial layers that can absorb mechanical damage without affecting optical performance represent promising research directions for next-generation UTG coatings.

The chemical compatibility between coating materials and UTG requires careful evaluation, as certain coating compounds may react with glass components over time, particularly under high humidity or temperature conditions. This chemical interaction can compromise both optical performance and mechanical integrity. Research indicates that silicon-based interlayers often provide superior adhesion properties while maintaining optical transparency when applied between UTG and subsequent coating layers.

Durability considerations extend beyond mere adhesion to include resistance against environmental stressors. Optical coatings for UTG must withstand humidity, temperature cycling, UV exposure, and chemical contaminants while maintaining consistent optical properties. Accelerated aging tests reveal that multi-layer designs incorporating both inorganic and organic materials often provide superior environmental stability compared to single-material approaches.

Mechanical durability presents perhaps the most demanding challenge for UTG optical coatings. Unlike traditional rigid displays, flexible displays undergo thousands of bending cycles throughout their operational lifetime. Coating materials must maintain their optical properties while accommodating strain values that can exceed 1% at the bend radius. Recent innovations have focused on nanocomposite coatings that incorporate elastomeric components to absorb mechanical stress without compromising optical clarity.

Manufacturing compatibility further complicates material selection, as coating processes must operate within temperature limits that prevent UTG deformation. Traditional high-temperature deposition techniques often prove unsuitable, necessitating the development of low-temperature alternatives such as plasma-enhanced chemical vapor deposition (PECVD) and atomic layer deposition (ALD) methods specifically optimized for UTG substrates.

Long-term stability testing protocols have emerged as essential tools for evaluating coating durability, with industry standards now requiring demonstration of optical performance retention after 200,000+ folding cycles. Materials that exhibit self-healing properties or incorporate sacrificial layers that can absorb mechanical damage without affecting optical performance represent promising research directions for next-generation UTG coatings.

Environmental Impact of Optical Coating Processes

The optical coating processes used for reflection control in ultra-thin glass (UTG) applications present significant environmental considerations that warrant careful examination. These processes typically involve vacuum deposition techniques such as physical vapor deposition (PVD), chemical vapor deposition (CVD), and sputtering, all of which consume substantial energy resources. The high-temperature vacuum chambers required for these processes demand continuous power supply, contributing to considerable carbon emissions, particularly in regions where electricity generation relies heavily on fossil fuels.

Material waste represents another critical environmental concern. The deposition efficiency of optical coating processes rarely reaches 100%, resulting in significant material wastage. Precious metals like silver and rare earth elements used in advanced coatings face supply constraints and environmentally damaging extraction processes. Additionally, the chemicals employed in pre-coating surface preparation and post-coating cleaning often include volatile organic compounds (VOCs), acids, and solvents that pose risks to both human health and the environment if not properly managed.

Water usage in optical coating facilities presents a further environmental challenge. The cleaning processes necessary for achieving the pristine surfaces required for high-quality optical coatings consume substantial volumes of ultra-pure water. The purification of this water demands energy-intensive processes, while the resulting wastewater contains contaminants requiring specialized treatment before discharge.

Recent industry trends show promising developments in more sustainable coating technologies. Atomic layer deposition (ALD) offers improved material efficiency with its precise layer-by-layer deposition approach, significantly reducing waste compared to traditional methods. Solution-based coating techniques operating at ambient temperatures and pressures are also emerging as lower-energy alternatives to vacuum-based processes, though they currently face challenges in achieving the optical performance required for UTG applications.

Regulatory frameworks worldwide are increasingly addressing the environmental impact of coating processes. The European Union's REACH regulations restrict the use of certain hazardous substances, while various international standards now mandate life cycle assessments for manufacturing processes. These evolving regulations are driving manufacturers to develop greener alternatives and implement closed-loop systems that recover and reuse materials and solvents.

The industry's response includes initiatives to recover precious metals from coating targets and implement energy recovery systems that capture and repurpose heat generated during the coating process. Some facilities have successfully implemented water recycling systems that reduce freshwater consumption by up to 80%, demonstrating the potential for significant environmental improvements through thoughtful process engineering.

Material waste represents another critical environmental concern. The deposition efficiency of optical coating processes rarely reaches 100%, resulting in significant material wastage. Precious metals like silver and rare earth elements used in advanced coatings face supply constraints and environmentally damaging extraction processes. Additionally, the chemicals employed in pre-coating surface preparation and post-coating cleaning often include volatile organic compounds (VOCs), acids, and solvents that pose risks to both human health and the environment if not properly managed.

Water usage in optical coating facilities presents a further environmental challenge. The cleaning processes necessary for achieving the pristine surfaces required for high-quality optical coatings consume substantial volumes of ultra-pure water. The purification of this water demands energy-intensive processes, while the resulting wastewater contains contaminants requiring specialized treatment before discharge.

Recent industry trends show promising developments in more sustainable coating technologies. Atomic layer deposition (ALD) offers improved material efficiency with its precise layer-by-layer deposition approach, significantly reducing waste compared to traditional methods. Solution-based coating techniques operating at ambient temperatures and pressures are also emerging as lower-energy alternatives to vacuum-based processes, though they currently face challenges in achieving the optical performance required for UTG applications.

Regulatory frameworks worldwide are increasingly addressing the environmental impact of coating processes. The European Union's REACH regulations restrict the use of certain hazardous substances, while various international standards now mandate life cycle assessments for manufacturing processes. These evolving regulations are driving manufacturers to develop greener alternatives and implement closed-loop systems that recover and reuse materials and solvents.

The industry's response includes initiatives to recover precious metals from coating targets and implement energy recovery systems that capture and repurpose heat generated during the coating process. Some facilities have successfully implemented water recycling systems that reduce freshwater consumption by up to 80%, demonstrating the potential for significant environmental improvements through thoughtful process engineering.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!