Improving Manufacturing Yield For Ultra-Thin Glass (UTG) In Flexible Displays

AUG 26, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

UTG Technology Background and Objectives

Ultra-Thin Glass (UTG) technology represents a significant advancement in display manufacturing, emerging as a critical component in the evolution of flexible display technologies. The development of UTG can be traced back to the early 2010s when display manufacturers began exploring alternatives to plastic substrates for foldable devices. UTG offers superior scratch resistance, improved optical clarity, and enhanced durability compared to polymer-based solutions, while maintaining the flexibility required for foldable and rollable displays.

The technological trajectory of UTG has been characterized by continuous innovation in glass formulation, thinning processes, and strengthening techniques. Initially limited to glass thicknesses of 100-200 micrometers, recent advancements have enabled the production of glass sheets as thin as 30 micrometers while maintaining structural integrity. This progression has been driven by the growing consumer demand for more durable and aesthetically pleasing flexible display devices.

Current manufacturing processes for UTG involve complex procedures including glass melting, forming, thinning, strengthening, and handling. The primary technical objective in this field is to significantly improve manufacturing yield rates, which currently remain below optimal levels due to the extreme fragility of ultra-thin glass during processing. Industry reports indicate yield rates as low as 60-70% for UTG production, substantially impacting production costs and scalability.

The specific technical goals for UTG yield improvement encompass several dimensions: reducing micro-fractures during processing, enhancing thickness uniformity across large glass sheets, developing more precise handling mechanisms, and implementing advanced inspection systems capable of detecting sub-micron defects. Additionally, there is a focus on improving the chemical strengthening processes to increase the mechanical resilience of UTG without compromising flexibility.

From a broader perspective, the advancement of UTG technology aims to enable mass production of next-generation display devices with improved form factors, including multi-fold designs and larger flexible surfaces. The technology is expected to expand beyond smartphones to larger devices such as tablets, laptops, and automotive displays, requiring further innovations in manufacturing techniques.

The ultimate objective of UTG technology development is to achieve a balance between thinness, flexibility, and durability while maintaining economically viable production yields. This balance is crucial for the widespread adoption of flexible display technologies across consumer electronics markets and represents the central challenge that current research and development efforts aim to address.

The technological trajectory of UTG has been characterized by continuous innovation in glass formulation, thinning processes, and strengthening techniques. Initially limited to glass thicknesses of 100-200 micrometers, recent advancements have enabled the production of glass sheets as thin as 30 micrometers while maintaining structural integrity. This progression has been driven by the growing consumer demand for more durable and aesthetically pleasing flexible display devices.

Current manufacturing processes for UTG involve complex procedures including glass melting, forming, thinning, strengthening, and handling. The primary technical objective in this field is to significantly improve manufacturing yield rates, which currently remain below optimal levels due to the extreme fragility of ultra-thin glass during processing. Industry reports indicate yield rates as low as 60-70% for UTG production, substantially impacting production costs and scalability.

The specific technical goals for UTG yield improvement encompass several dimensions: reducing micro-fractures during processing, enhancing thickness uniformity across large glass sheets, developing more precise handling mechanisms, and implementing advanced inspection systems capable of detecting sub-micron defects. Additionally, there is a focus on improving the chemical strengthening processes to increase the mechanical resilience of UTG without compromising flexibility.

From a broader perspective, the advancement of UTG technology aims to enable mass production of next-generation display devices with improved form factors, including multi-fold designs and larger flexible surfaces. The technology is expected to expand beyond smartphones to larger devices such as tablets, laptops, and automotive displays, requiring further innovations in manufacturing techniques.

The ultimate objective of UTG technology development is to achieve a balance between thinness, flexibility, and durability while maintaining economically viable production yields. This balance is crucial for the widespread adoption of flexible display technologies across consumer electronics markets and represents the central challenge that current research and development efforts aim to address.

Market Demand Analysis for Flexible Display Technologies

The flexible display market has experienced exponential growth over the past decade, driven primarily by consumer electronics applications. Market research indicates that the global flexible display market was valued at approximately $23.9 billion in 2022 and is projected to reach $86.7 billion by 2030, representing a compound annual growth rate (CAGR) of 17.4% during the forecast period. This remarkable growth trajectory underscores the significant market potential for Ultra-Thin Glass (UTG) technology.

Consumer demand for more durable, thinner, and flexible devices continues to rise, with smartphones representing the largest application segment. The foldable smartphone market alone is expected to grow at a CAGR of 21.3% through 2028. Major manufacturers including Samsung, Huawei, Motorola, and Xiaomi have already commercialized foldable devices, creating substantial demand for high-quality UTG solutions that can withstand repeated folding operations.

Beyond smartphones, emerging applications in wearable technology, automotive displays, and smart home devices are expanding the potential market for flexible display technologies. The wearable segment, including smartwatches and fitness trackers with curved displays, is projected to grow at 19.2% CAGR through 2030, creating additional demand vectors for UTG solutions.

Regional analysis reveals that Asia-Pacific dominates the flexible display market, accounting for over 60% of global production capacity. This concentration is primarily due to the presence of major display manufacturers and electronics companies in South Korea, Japan, China, and Taiwan. North America and Europe represent significant consumer markets but have limited manufacturing capabilities in this sector.

Industry surveys indicate that manufacturers are willing to pay premium prices for UTG solutions that can demonstrably improve yield rates. Current manufacturing yields for UTG in mass production typically range from 65-75%, significantly lower than the 85-90% yields achieved with conventional glass. Each percentage point improvement in yield can translate to millions in cost savings for large-scale production operations.

Customer requirements are increasingly stringent, with specifications demanding UTG with thickness below 30 micrometers that can withstand over 200,000 folding cycles while maintaining optical clarity above 90% transmittance. These technical requirements, coupled with cost pressures from device manufacturers, create a complex market environment where innovations in manufacturing yield become critical competitive differentiators.

Consumer demand for more durable, thinner, and flexible devices continues to rise, with smartphones representing the largest application segment. The foldable smartphone market alone is expected to grow at a CAGR of 21.3% through 2028. Major manufacturers including Samsung, Huawei, Motorola, and Xiaomi have already commercialized foldable devices, creating substantial demand for high-quality UTG solutions that can withstand repeated folding operations.

Beyond smartphones, emerging applications in wearable technology, automotive displays, and smart home devices are expanding the potential market for flexible display technologies. The wearable segment, including smartwatches and fitness trackers with curved displays, is projected to grow at 19.2% CAGR through 2030, creating additional demand vectors for UTG solutions.

Regional analysis reveals that Asia-Pacific dominates the flexible display market, accounting for over 60% of global production capacity. This concentration is primarily due to the presence of major display manufacturers and electronics companies in South Korea, Japan, China, and Taiwan. North America and Europe represent significant consumer markets but have limited manufacturing capabilities in this sector.

Industry surveys indicate that manufacturers are willing to pay premium prices for UTG solutions that can demonstrably improve yield rates. Current manufacturing yields for UTG in mass production typically range from 65-75%, significantly lower than the 85-90% yields achieved with conventional glass. Each percentage point improvement in yield can translate to millions in cost savings for large-scale production operations.

Customer requirements are increasingly stringent, with specifications demanding UTG with thickness below 30 micrometers that can withstand over 200,000 folding cycles while maintaining optical clarity above 90% transmittance. These technical requirements, coupled with cost pressures from device manufacturers, create a complex market environment where innovations in manufacturing yield become critical competitive differentiators.

Current UTG Manufacturing Challenges and Limitations

Ultra-Thin Glass (UTG) manufacturing for flexible displays faces significant yield challenges that impede mass production efficiency and cost-effectiveness. The primary limitation stems from the extreme thinness requirement—typically less than 100 micrometers—which makes the glass highly susceptible to fractures during processing. This fragility necessitates specialized handling equipment and environments that substantially increase production complexity and costs.

Material consistency presents another major challenge. Current manufacturing processes struggle to maintain uniform thickness across large glass sheets, resulting in optical distortions and structural weaknesses in the final product. These inconsistencies lead to high rejection rates during quality control inspections, further reducing overall yield.

Surface defects represent a critical limitation in UTG production. Microscopic scratches, bubbles, and inclusions that would be negligible in conventional glass become significant failure points in ultra-thin applications. The detection of these minute defects requires advanced inspection systems that add another layer of complexity to the manufacturing process.

The bending and forming processes essential for flexible display applications introduce additional stress points in the glass structure. Current thermal forming techniques often create micro-cracks that may not be immediately visible but can propagate during subsequent processing or end-user handling. This delayed failure mechanism is particularly problematic as defects may only become apparent after significant value has been added to the product.

Chemical strengthening processes, while necessary to improve durability, introduce their own set of challenges. The ion exchange process used to strengthen UTG must be precisely controlled to prevent warping or optical distortions. The time-intensive nature of these treatments creates production bottlenecks that limit throughput and increase manufacturing costs.

Edge finishing represents another significant yield limitation. Conventional cutting and edge processing techniques often create micro-fractures at the glass edges that can propagate across the entire sheet. Alternative techniques like laser cutting improve edge quality but introduce thermal stress that must be carefully managed to prevent glass failure.

Integration challenges with other display components further complicate manufacturing. The bonding of UTG with flexible substrates and electronic components requires precise alignment and controlled adhesion processes. Current techniques often result in delamination or interface bubbles that compromise display integrity and functionality.

Environmental sensitivity during manufacturing also impacts yield rates. UTG production requires stringently controlled temperature, humidity, and cleanliness conditions. Minor variations in these parameters can significantly affect glass properties and processing behavior, necessitating expensive environmental control systems that increase production costs.

Material consistency presents another major challenge. Current manufacturing processes struggle to maintain uniform thickness across large glass sheets, resulting in optical distortions and structural weaknesses in the final product. These inconsistencies lead to high rejection rates during quality control inspections, further reducing overall yield.

Surface defects represent a critical limitation in UTG production. Microscopic scratches, bubbles, and inclusions that would be negligible in conventional glass become significant failure points in ultra-thin applications. The detection of these minute defects requires advanced inspection systems that add another layer of complexity to the manufacturing process.

The bending and forming processes essential for flexible display applications introduce additional stress points in the glass structure. Current thermal forming techniques often create micro-cracks that may not be immediately visible but can propagate during subsequent processing or end-user handling. This delayed failure mechanism is particularly problematic as defects may only become apparent after significant value has been added to the product.

Chemical strengthening processes, while necessary to improve durability, introduce their own set of challenges. The ion exchange process used to strengthen UTG must be precisely controlled to prevent warping or optical distortions. The time-intensive nature of these treatments creates production bottlenecks that limit throughput and increase manufacturing costs.

Edge finishing represents another significant yield limitation. Conventional cutting and edge processing techniques often create micro-fractures at the glass edges that can propagate across the entire sheet. Alternative techniques like laser cutting improve edge quality but introduce thermal stress that must be carefully managed to prevent glass failure.

Integration challenges with other display components further complicate manufacturing. The bonding of UTG with flexible substrates and electronic components requires precise alignment and controlled adhesion processes. Current techniques often result in delamination or interface bubbles that compromise display integrity and functionality.

Environmental sensitivity during manufacturing also impacts yield rates. UTG production requires stringently controlled temperature, humidity, and cleanliness conditions. Minor variations in these parameters can significantly affect glass properties and processing behavior, necessitating expensive environmental control systems that increase production costs.

Current Yield Improvement Solutions for UTG Manufacturing

01 Manufacturing process optimization for UTG

Various manufacturing process optimizations can significantly improve the yield of ultra-thin glass production. These include precise temperature control during forming, optimized cooling rates, and specialized handling techniques to prevent defects. Advanced process monitoring systems can detect and correct deviations in real-time, while automated quality control checkpoints throughout the production line help identify and remove defective pieces before further processing.- Manufacturing process optimization for UTG: Various manufacturing process optimizations can significantly improve the yield of ultra-thin glass production. These include precise temperature control during forming, optimized cooling rates, and specialized handling techniques to prevent defects. Advanced process monitoring systems can detect and correct deviations in real-time, while automated quality control systems help identify and remove defective pieces early in the production cycle, thereby increasing overall yield.

- Surface treatment techniques for UTG: Surface treatment techniques play a crucial role in enhancing the yield of ultra-thin glass manufacturing. These include chemical strengthening processes, anti-scratch coatings, and surface polishing methods that improve durability while maintaining transparency. Advanced etching techniques can remove micro-defects from the glass surface, while specialized coatings can enhance flexibility and impact resistance, reducing breakage during both manufacturing and end-use applications.

- Equipment and tooling innovations for UTG production: Specialized equipment and tooling innovations have been developed specifically for ultra-thin glass manufacturing to improve yield. These include precision cutting tools that minimize edge defects, custom handling systems that reduce stress on the glass during transport between process stages, and advanced forming equipment designed specifically for ultra-thin applications. Specialized molds and dies with nano-precision surfaces help create more uniform glass sheets with fewer defects.

- Defect detection and quality control systems: Advanced defect detection and quality control systems are essential for improving UTG manufacturing yield. These include high-resolution optical inspection systems, laser scanning technology, and AI-powered defect recognition algorithms that can identify microscopic flaws invisible to the human eye. Inline monitoring systems track glass quality throughout the production process, allowing for immediate adjustments to prevent yield loss and ensuring only high-quality UTG reaches final assembly.

- Material composition and formulation improvements: Innovations in glass material composition and formulation have led to significant improvements in UTG manufacturing yield. Modified glass compositions with enhanced flexibility properties reduce breakage during processing, while specialized additives improve thermal stability during forming operations. Novel glass formulations that require lower processing temperatures can reduce thermal stress and associated defects, and hybrid materials combining glass with other substances can provide improved mechanical properties while maintaining optical clarity.

02 Surface treatment techniques for UTG

Surface treatment techniques play a crucial role in enhancing the yield of ultra-thin glass manufacturing. These include chemical strengthening processes, anti-scratch coatings, and specialized polishing methods that reduce surface defects. Plasma treatment and ion exchange processes can improve the mechanical properties of UTG while maintaining optical clarity. These treatments help reduce breakage during subsequent processing steps and improve overall manufacturing yield.Expand Specific Solutions03 Handling and transportation systems for UTG

Specialized handling and transportation systems are essential for improving the yield of ultra-thin glass manufacturing. These include vacuum-based handling tools, cushioned conveyor systems, and robotic arms with precise movement control. Advanced sensing technologies ensure proper positioning and prevent excessive stress during transfers between processing stations. Customized packaging solutions protect the glass during storage and transportation, further reducing yield losses.Expand Specific Solutions04 Defect detection and quality control for UTG

Advanced defect detection and quality control systems are critical for improving UTG manufacturing yield. These include high-resolution optical inspection systems, laser scanning technology, and AI-powered defect recognition algorithms. In-line monitoring tools can detect micro-cracks, bubbles, and thickness variations that might lead to failures. Early detection allows for process adjustments and helps identify systematic issues in the production line, significantly improving overall yield rates.Expand Specific Solutions05 Material composition and formulation for UTG

The material composition and formulation significantly impact the manufacturing yield of ultra-thin glass. Optimized glass compositions with carefully selected additives can enhance flexibility and reduce brittleness. Incorporating specific elements like boron, aluminum, or alkali metals in precise ratios improves the glass's thermal stability during processing. Novel glass formulations may include nano-materials or specialized dopants that enhance mechanical properties while maintaining the optical clarity required for display applications.Expand Specific Solutions

Key Players in UTG and Flexible Display Industry

The ultra-thin glass (UTG) manufacturing yield improvement market is currently in a growth phase, with increasing demand driven by the expanding flexible display industry. The market size is projected to grow significantly as foldable smartphones and other flexible display applications gain mainstream adoption. Technologically, UTG production remains challenging, with only a few companies demonstrating mature capabilities. Corning leads with advanced glass formulation expertise and proprietary manufacturing processes, while BOE Technology and Samsung Display are advancing rapidly in integration capabilities. Chinese players like Triumph Science & Technology and CNBM Bengbu are investing heavily to close the technology gap. Schott AG has established a strong position with specialized glass solutions, while companies like Dongxu Technology are focusing on cost-effective manufacturing approaches. The competitive landscape shows a mix of established glass manufacturers and display technology companies racing to overcome the significant technical barriers to high-yield UTG production.

Corning, Inc.

Technical Solution: Corning has developed a proprietary fusion draw process for manufacturing ultra-thin glass (UTG) for flexible displays. This process involves melting glass in a refractory vessel, then allowing it to flow down both sides of a V-shaped trough (isopipe) where the two streams reunite at the bottom to form a single sheet. This technique produces exceptionally flat, clean surfaces without requiring polishing. For UTG specifically, Corning has enhanced this process with precision thickness control mechanisms that can consistently produce glass as thin as 30 microns while maintaining structural integrity[1]. Their ColdForm™ technology allows UTG to be bent at room temperature without damage by implementing specialized surface treatments that strengthen the molecular bonds at the glass surface. Additionally, Corning has developed ion exchange processes specifically optimized for UTG that create compressive stress layers to improve flexibility and durability while minimizing fracture risks during manufacturing[2]. Their yield improvement strategy incorporates real-time optical monitoring systems that detect microscopic defects during production, allowing immediate process adjustments to prevent propagation of defects.

Strengths: Industry-leading fusion draw process creates pristine surfaces without polishing, reducing defect sources. Ion exchange strengthening technology enables superior flexibility without compromising durability. Advanced in-line inspection systems improve yield rates. Weaknesses: Higher production costs compared to competing technologies. Process requires extremely precise temperature control, making scaling challenging. Limited flexibility compared to polymer alternatives despite improvements.

Dongxu Technology Group Co. Ltd.

Technical Solution: Dongxu Technology Group has developed a specialized manufacturing system for ultra-thin glass production focused on maximizing yield for flexible display applications. Their approach centers on a modified slot-draw process where molten glass is extruded through precision-engineered platinum slots to form sheets with thicknesses as low as 20 microns. This direct formation method eliminates the need for subsequent thinning processes that can introduce defects. Dongxu has enhanced this basic process with their proprietary "Thermal Gradient Control System" that creates precisely managed cooling zones to minimize stress-induced defects during solidification[9]. The company has also developed specialized glass formulations with modified alkali content that improve flexibility while maintaining optical clarity. To address handling challenges, Dongxu has implemented a "Continuous Roll Processing" system where the UTG is temporarily laminated to a flexible carrier film immediately after formation, allowing roll-to-roll processing that significantly reduces breakage. Their manufacturing facilities incorporate advanced environmental control systems that maintain temperature stability within ±0.5°C and humidity control within ±2% to prevent thermal stress-induced defects. Dongxu's yield improvement strategy also includes an "Automated Defect Classification" system that uses machine vision and deep learning algorithms to categorize defects by type and severity, enabling targeted process improvements[10].

Strengths: Direct slot-draw process eliminates thinning steps, reducing potential defect sources. Continuous Roll Processing system significantly improves handling efficiency and reduces breakage. Specialized glass formulations provide good balance of flexibility and durability. Weaknesses: Process requires extremely precise temperature control throughout the production line. Limited production scale compared to global leaders. Temporary lamination process adds complexity and potential contamination sources.

Critical Patents and Innovations in UTG Production

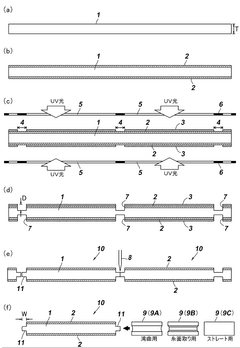

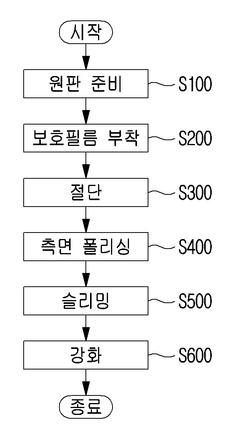

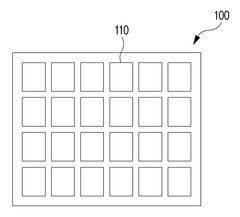

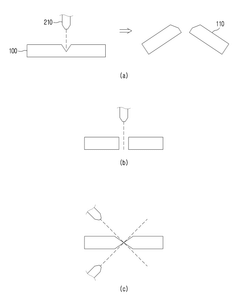

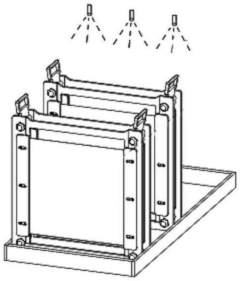

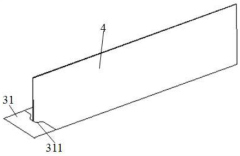

Manufacturing method for ultra thin flexible glass and ultra thin glasses manufactured by the same

PatentActiveKR1020230037134A

Innovation

- A method involving laser cutting, side polishing, slimming, and chemical strengthening is employed, where protective films are attached to glass original plates, followed by laser cutting, vertical stacking for side polishing, and final slimming and strengthening processes to minimize defects and improve reliability.

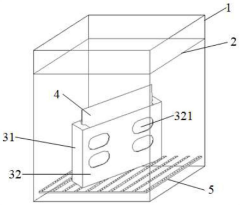

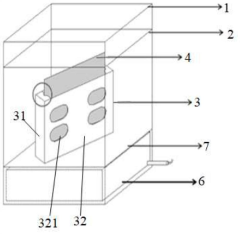

Ultra-thin glass cover plate processing technology

PatentActiveCN113582553A

Innovation

- Chemical etching is used to passivate the edges of ultra-thin glass, combined with laser cutting and surface etching optimization, and hydrofluoric acid/nitric acid/sulfuric acid solution is used for immersion etching to repair chipping defects and improve the bending performance and impact resistance of the glass. Strength, while using ultrasonic vibrators and foam tubes to reduce the production of fixture marks.

Supply Chain Optimization for UTG Production

The optimization of the Ultra-Thin Glass (UTG) supply chain represents a critical factor in improving manufacturing yields for flexible displays. Current UTG production involves complex logistics networks spanning multiple countries and suppliers, creating numerous vulnerabilities that impact final product quality. Material sourcing presents particular challenges, as the specialized silica formulations and chemical strengthening compounds required for UTG production often come from limited suppliers with varying quality control standards.

Inventory management practices significantly influence manufacturing yields, with just-in-time delivery systems proving problematic for UTG production due to the material's sensitivity to environmental conditions during transport and storage. Extended warehousing periods frequently result in microscopic degradation that manifests as defects during the manufacturing process. Companies achieving higher yields typically implement climate-controlled transportation and storage facilities throughout their supply chains.

Supplier qualification and development programs have emerged as essential components of successful UTG production ecosystems. Leading manufacturers have established rigorous certification processes for suppliers, including regular audits and technical assistance programs to ensure consistent material quality. These collaborative approaches have demonstrated measurable improvements in first-pass yield rates, with some manufacturers reporting 15-20% yield increases after implementing comprehensive supplier development initiatives.

Vertical integration strategies are increasingly being adopted by major display manufacturers to gain greater control over the UTG supply chain. Samsung Display and LG Display have made significant investments in acquiring or developing in-house capabilities for key UTG production processes, reducing their dependence on external suppliers for critical components. This approach has enabled more consistent quality control and faster implementation of process improvements across the production lifecycle.

Digital supply chain management tools utilizing IoT sensors and blockchain technology are being deployed to monitor material conditions throughout the supply chain. These systems provide real-time tracking of environmental parameters such as temperature, humidity, and vibration during transport and storage, allowing for immediate intervention when conditions deviate from specifications. Early adopters report significant reductions in material rejection rates and improved traceability for quality issues.

Regional supply chain diversification has become a strategic priority following recent global disruptions. Manufacturers are establishing redundant supply networks across multiple geographic regions to mitigate risks associated with localized disruptions. This approach, while requiring higher initial investment, has demonstrated improved resilience and consistency in material quality, contributing to more stable manufacturing yields over time.

Inventory management practices significantly influence manufacturing yields, with just-in-time delivery systems proving problematic for UTG production due to the material's sensitivity to environmental conditions during transport and storage. Extended warehousing periods frequently result in microscopic degradation that manifests as defects during the manufacturing process. Companies achieving higher yields typically implement climate-controlled transportation and storage facilities throughout their supply chains.

Supplier qualification and development programs have emerged as essential components of successful UTG production ecosystems. Leading manufacturers have established rigorous certification processes for suppliers, including regular audits and technical assistance programs to ensure consistent material quality. These collaborative approaches have demonstrated measurable improvements in first-pass yield rates, with some manufacturers reporting 15-20% yield increases after implementing comprehensive supplier development initiatives.

Vertical integration strategies are increasingly being adopted by major display manufacturers to gain greater control over the UTG supply chain. Samsung Display and LG Display have made significant investments in acquiring or developing in-house capabilities for key UTG production processes, reducing their dependence on external suppliers for critical components. This approach has enabled more consistent quality control and faster implementation of process improvements across the production lifecycle.

Digital supply chain management tools utilizing IoT sensors and blockchain technology are being deployed to monitor material conditions throughout the supply chain. These systems provide real-time tracking of environmental parameters such as temperature, humidity, and vibration during transport and storage, allowing for immediate intervention when conditions deviate from specifications. Early adopters report significant reductions in material rejection rates and improved traceability for quality issues.

Regional supply chain diversification has become a strategic priority following recent global disruptions. Manufacturers are establishing redundant supply networks across multiple geographic regions to mitigate risks associated with localized disruptions. This approach, while requiring higher initial investment, has demonstrated improved resilience and consistency in material quality, contributing to more stable manufacturing yields over time.

Environmental Impact and Sustainability Considerations

The manufacturing of Ultra-Thin Glass (UTG) for flexible displays presents significant environmental challenges that must be addressed to ensure sustainable industry growth. The production process involves energy-intensive operations including high-temperature glass formation, chemical treatments, and precision grinding, collectively contributing to substantial carbon emissions. Current estimates suggest that UTG manufacturing generates approximately 30-40% more greenhouse gas emissions per square meter compared to traditional display glass production, primarily due to the specialized processes required to achieve ultra-thin dimensions while maintaining durability.

Water consumption represents another critical environmental concern, with UTG production requiring extensive purification processes and chemical baths. A single manufacturing facility can consume millions of gallons of water annually, with much of this water containing chemical contaminants that require specialized treatment before discharge. Leading manufacturers have begun implementing closed-loop water recycling systems, reducing freshwater requirements by up to 60% in optimized facilities.

Chemical usage in UTG production presents both environmental and health considerations. The etching and strengthening processes utilize hydrofluoric acid, potassium salts, and various metal compounds that can pose ecological hazards if improperly managed. Recent innovations in chemical recovery systems have demonstrated potential to reclaim up to 75% of these materials, significantly reducing waste generation while improving economic efficiency.

End-of-life considerations for UTG products remain underdeveloped, with limited recycling infrastructure currently available for composite display materials. The intimate bonding between glass, adhesives, and electronic components creates separation challenges that impede effective recycling. Research into soluble adhesives and mechanical separation techniques shows promise for improving recyclability rates, potentially increasing recovery from the current 15-20% to over 50% within five years.

The industry is increasingly adopting life cycle assessment (LCA) methodologies to quantify environmental impacts across the entire UTG value chain. These assessments reveal opportunities for improvement, particularly in energy efficiency and material selection. Several manufacturers have established sustainability roadmaps targeting carbon neutrality by 2030-2035, with intermediate goals for renewable energy adoption, water conservation, and chemical use reduction.

Regulatory frameworks worldwide are evolving to address electronic component sustainability, with the European Union's Waste Electrical and Electronic Equipment (WEEE) Directive and similar regulations in Asia imposing increasingly stringent requirements on manufacturers. Forward-thinking companies are proactively developing design-for-environment strategies that anticipate these regulatory trends while creating competitive advantages through sustainability leadership.

Water consumption represents another critical environmental concern, with UTG production requiring extensive purification processes and chemical baths. A single manufacturing facility can consume millions of gallons of water annually, with much of this water containing chemical contaminants that require specialized treatment before discharge. Leading manufacturers have begun implementing closed-loop water recycling systems, reducing freshwater requirements by up to 60% in optimized facilities.

Chemical usage in UTG production presents both environmental and health considerations. The etching and strengthening processes utilize hydrofluoric acid, potassium salts, and various metal compounds that can pose ecological hazards if improperly managed. Recent innovations in chemical recovery systems have demonstrated potential to reclaim up to 75% of these materials, significantly reducing waste generation while improving economic efficiency.

End-of-life considerations for UTG products remain underdeveloped, with limited recycling infrastructure currently available for composite display materials. The intimate bonding between glass, adhesives, and electronic components creates separation challenges that impede effective recycling. Research into soluble adhesives and mechanical separation techniques shows promise for improving recyclability rates, potentially increasing recovery from the current 15-20% to over 50% within five years.

The industry is increasingly adopting life cycle assessment (LCA) methodologies to quantify environmental impacts across the entire UTG value chain. These assessments reveal opportunities for improvement, particularly in energy efficiency and material selection. Several manufacturers have established sustainability roadmaps targeting carbon neutrality by 2030-2035, with intermediate goals for renewable energy adoption, water conservation, and chemical use reduction.

Regulatory frameworks worldwide are evolving to address electronic component sustainability, with the European Union's Waste Electrical and Electronic Equipment (WEEE) Directive and similar regulations in Asia imposing increasingly stringent requirements on manufacturers. Forward-thinking companies are proactively developing design-for-environment strategies that anticipate these regulatory trends while creating competitive advantages through sustainability leadership.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!