Innovations In Ultra-Thin Glass Composition And Ion Exchange For Flexible Displays (UTG)

AUG 26, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

UTG Technology Background and Objectives

Ultra-thin glass (UTG) technology has evolved significantly over the past decade, transitioning from conventional glass manufacturing techniques to specialized processes designed specifically for flexible display applications. The journey began with traditional soda-lime glass, which proved inadequate for the demanding requirements of flexible displays due to its brittleness and thickness limitations. The breakthrough came with the development of aluminosilicate glass compositions that could be processed to thicknesses below 100 micrometers while maintaining structural integrity.

The evolution of UTG technology has been driven primarily by the consumer electronics industry's push toward foldable smartphones, rollable displays, and wearable devices. Since 2018, there has been an accelerated development curve, with major milestones including the commercialization of the first foldable smartphones utilizing UTG in 2019, followed by significant improvements in durability and bend radius capabilities in subsequent generations.

Current technical objectives for UTG innovation focus on several critical parameters. First is achieving consistent production of glass with thicknesses between 30-50 micrometers that can withstand repeated folding without developing micro-cracks. Second is enhancing the ion exchange process to create compression layers that improve surface hardness without compromising flexibility. Third is developing glass compositions that allow for a bend radius of less than 1mm while maintaining optical clarity and touch sensitivity.

The technical trajectory indicates a convergence of materials science and precision manufacturing, with particular emphasis on controlling the chemical composition at the molecular level. Researchers are exploring modified aluminosilicate formulations with increased concentrations of potassium and lithium oxides to facilitate more efficient ion exchange processes. Additionally, there is significant interest in hybrid glass-polymer composites that combine the optical clarity of glass with the flexibility of polymeric materials.

Industry projections suggest that the next generation of UTG will need to achieve thicknesses below 20 micrometers while simultaneously improving impact resistance by at least 25% compared to current standards. This represents a substantial engineering challenge that requires innovations in both material composition and processing techniques. The ultimate goal is to develop UTG that can be folded over 300,000 times without degradation, survive drops from 1.5 meters onto hard surfaces, and maintain perfect optical properties throughout its lifetime.

The technical evolution is expected to continue along two parallel paths: incremental improvements to existing aluminosilicate glass through refined ion exchange processes, and revolutionary approaches involving entirely new glass compositions or composite structures that fundamentally redefine the relationship between thinness and durability.

The evolution of UTG technology has been driven primarily by the consumer electronics industry's push toward foldable smartphones, rollable displays, and wearable devices. Since 2018, there has been an accelerated development curve, with major milestones including the commercialization of the first foldable smartphones utilizing UTG in 2019, followed by significant improvements in durability and bend radius capabilities in subsequent generations.

Current technical objectives for UTG innovation focus on several critical parameters. First is achieving consistent production of glass with thicknesses between 30-50 micrometers that can withstand repeated folding without developing micro-cracks. Second is enhancing the ion exchange process to create compression layers that improve surface hardness without compromising flexibility. Third is developing glass compositions that allow for a bend radius of less than 1mm while maintaining optical clarity and touch sensitivity.

The technical trajectory indicates a convergence of materials science and precision manufacturing, with particular emphasis on controlling the chemical composition at the molecular level. Researchers are exploring modified aluminosilicate formulations with increased concentrations of potassium and lithium oxides to facilitate more efficient ion exchange processes. Additionally, there is significant interest in hybrid glass-polymer composites that combine the optical clarity of glass with the flexibility of polymeric materials.

Industry projections suggest that the next generation of UTG will need to achieve thicknesses below 20 micrometers while simultaneously improving impact resistance by at least 25% compared to current standards. This represents a substantial engineering challenge that requires innovations in both material composition and processing techniques. The ultimate goal is to develop UTG that can be folded over 300,000 times without degradation, survive drops from 1.5 meters onto hard surfaces, and maintain perfect optical properties throughout its lifetime.

The technical evolution is expected to continue along two parallel paths: incremental improvements to existing aluminosilicate glass through refined ion exchange processes, and revolutionary approaches involving entirely new glass compositions or composite structures that fundamentally redefine the relationship between thinness and durability.

Market Demand Analysis for Flexible Display Glass

The flexible display market has witnessed exponential growth in recent years, driven primarily by consumer electronics applications. Market research indicates that the global flexible display market is projected to reach $15.1 billion by 2025, growing at a CAGR of 28.7% from 2020. Ultra-Thin Glass (UTG) technology has emerged as a critical component in this growth trajectory, addressing the limitations of plastic substrates while offering superior optical properties and scratch resistance.

Consumer demand for foldable smartphones has been a significant catalyst for UTG development. Since Samsung's introduction of the first commercial foldable smartphone in 2019, market adoption has accelerated, with shipments of foldable devices increasing by 264% in 2021 alone. This rapid adoption demonstrates strong consumer interest in devices that combine portability with larger screen real estate.

Beyond smartphones, the flexible display glass market is expanding into diverse applications including wearable technology, automotive displays, and smart home devices. The wearable technology segment, particularly smartwatches and fitness trackers, represents the second-largest application area for flexible displays, with a market value of $3.2 billion in 2022 and projected growth of 31% annually through 2026.

Industry surveys reveal that consumers prioritize durability as a key purchasing factor for flexible display devices. Approximately 78% of potential buyers cite concerns about screen durability and longevity as primary considerations. This consumer sentiment has directly influenced R&D priorities in UTG technology, with manufacturers focusing on enhancing the ion exchange processes to improve glass strength while maintaining flexibility.

Regional analysis shows Asia-Pacific dominating the flexible display market, accounting for 63% of global production capacity. South Korea leads in technology innovation, while China is rapidly expanding manufacturing capabilities. North America and Europe represent significant consumer markets, with adoption rates growing by 42% and 37% respectively in 2022.

The business-to-business segment presents substantial growth opportunities for UTG technology. Commercial applications in retail, healthcare, and industrial environments are expected to grow at 34% annually through 2025. These sectors value the combination of durability and flexibility that UTG provides over alternative display technologies.

Supply chain analysis reveals increasing vertical integration among major players, with glass manufacturers forming strategic partnerships with display manufacturers to secure market position. This trend indicates industry recognition of UTG as a critical differentiator in the competitive landscape of next-generation display technologies.

Consumer demand for foldable smartphones has been a significant catalyst for UTG development. Since Samsung's introduction of the first commercial foldable smartphone in 2019, market adoption has accelerated, with shipments of foldable devices increasing by 264% in 2021 alone. This rapid adoption demonstrates strong consumer interest in devices that combine portability with larger screen real estate.

Beyond smartphones, the flexible display glass market is expanding into diverse applications including wearable technology, automotive displays, and smart home devices. The wearable technology segment, particularly smartwatches and fitness trackers, represents the second-largest application area for flexible displays, with a market value of $3.2 billion in 2022 and projected growth of 31% annually through 2026.

Industry surveys reveal that consumers prioritize durability as a key purchasing factor for flexible display devices. Approximately 78% of potential buyers cite concerns about screen durability and longevity as primary considerations. This consumer sentiment has directly influenced R&D priorities in UTG technology, with manufacturers focusing on enhancing the ion exchange processes to improve glass strength while maintaining flexibility.

Regional analysis shows Asia-Pacific dominating the flexible display market, accounting for 63% of global production capacity. South Korea leads in technology innovation, while China is rapidly expanding manufacturing capabilities. North America and Europe represent significant consumer markets, with adoption rates growing by 42% and 37% respectively in 2022.

The business-to-business segment presents substantial growth opportunities for UTG technology. Commercial applications in retail, healthcare, and industrial environments are expected to grow at 34% annually through 2025. These sectors value the combination of durability and flexibility that UTG provides over alternative display technologies.

Supply chain analysis reveals increasing vertical integration among major players, with glass manufacturers forming strategic partnerships with display manufacturers to secure market position. This trend indicates industry recognition of UTG as a critical differentiator in the competitive landscape of next-generation display technologies.

Current UTG Development Status and Challenges

Ultra-thin glass (UTG) technology has reached a critical development stage, with significant advancements in composition engineering and ion exchange processes. Currently, UTG with thicknesses between 30-100 micrometers has been successfully commercialized, primarily in foldable display applications. Leading manufacturers have achieved bend radii of 1-3mm while maintaining structural integrity through multiple folding cycles, representing a substantial improvement over earlier generations that could only withstand limited folding operations.

The global UTG market is experiencing rapid growth, with an estimated CAGR of 36% between 2021-2026, driven primarily by demand in the premium smartphone segment. However, widespread adoption faces several technical barriers. Glass brittleness remains the foremost challenge, as thinner glass inherently becomes more susceptible to fracture. Current UTG solutions still exhibit micro-crack formation after approximately 200,000 folding cycles, falling short of the industry target of 500,000 cycles for mainstream consumer adoption.

Manufacturing scalability presents another significant hurdle. Current production methods struggle with yield rates, typically achieving only 60-70% for ultra-thin glass below 50 micrometers. The precision required for uniform thickness control at nanometer scales demands specialized equipment and stringent environmental conditions that limit mass production capabilities.

Ion exchange processes, while effective for strengthening, introduce their own complications. The conventional potassium-sodium ion exchange creates surface compression layers that can be compromised during bending. Recent innovations have explored dual-ion exchange techniques and gradient concentration profiles, but these approaches significantly increase production time and cost, with processing times extending to 10-15 hours compared to 4-6 hours for standard strengthened glass.

Geographically, South Korea and Japan lead UTG development, with companies like Schott, Corning, and Samsung subsidiary Dowoo Insys controlling approximately 85% of the global production capacity. Chinese manufacturers are rapidly investing in this technology, though they currently lag in proprietary composition formulations and high-precision processing equipment.

The thermal stability of UTG during high-temperature display manufacturing processes remains problematic. Current compositions experience dimensional instability at temperatures above 400°C, necessitating modifications to traditional display manufacturing processes or development of new glass formulations with higher transformation temperatures.

Surface quality consistency at ultra-thin dimensions represents another technical challenge, as microscopic defects that would be inconsequential in thicker glass become critical failure points in UTG applications. Advanced metrology systems capable of detecting sub-micron defects are essential but add significant complexity to the production line.

The global UTG market is experiencing rapid growth, with an estimated CAGR of 36% between 2021-2026, driven primarily by demand in the premium smartphone segment. However, widespread adoption faces several technical barriers. Glass brittleness remains the foremost challenge, as thinner glass inherently becomes more susceptible to fracture. Current UTG solutions still exhibit micro-crack formation after approximately 200,000 folding cycles, falling short of the industry target of 500,000 cycles for mainstream consumer adoption.

Manufacturing scalability presents another significant hurdle. Current production methods struggle with yield rates, typically achieving only 60-70% for ultra-thin glass below 50 micrometers. The precision required for uniform thickness control at nanometer scales demands specialized equipment and stringent environmental conditions that limit mass production capabilities.

Ion exchange processes, while effective for strengthening, introduce their own complications. The conventional potassium-sodium ion exchange creates surface compression layers that can be compromised during bending. Recent innovations have explored dual-ion exchange techniques and gradient concentration profiles, but these approaches significantly increase production time and cost, with processing times extending to 10-15 hours compared to 4-6 hours for standard strengthened glass.

Geographically, South Korea and Japan lead UTG development, with companies like Schott, Corning, and Samsung subsidiary Dowoo Insys controlling approximately 85% of the global production capacity. Chinese manufacturers are rapidly investing in this technology, though they currently lag in proprietary composition formulations and high-precision processing equipment.

The thermal stability of UTG during high-temperature display manufacturing processes remains problematic. Current compositions experience dimensional instability at temperatures above 400°C, necessitating modifications to traditional display manufacturing processes or development of new glass formulations with higher transformation temperatures.

Surface quality consistency at ultra-thin dimensions represents another technical challenge, as microscopic defects that would be inconsequential in thicker glass become critical failure points in UTG applications. Advanced metrology systems capable of detecting sub-micron defects are essential but add significant complexity to the production line.

Current Ion Exchange Strengthening Solutions

01 Manufacturing techniques for ultra-thin glass

Various manufacturing techniques are employed to produce ultra-thin glass (UTG) with enhanced flexibility and reduced thickness. These techniques include specialized drawing processes, chemical etching, and polishing methods that can achieve glass thicknesses below 100 micrometers while maintaining structural integrity. Advanced processing methods help control the glass composition and surface quality, which are critical for achieving the desired flexibility characteristics without compromising strength.- Manufacturing techniques for ultra-thin glass: Various manufacturing techniques are employed to produce ultra-thin glass (UTG) with enhanced flexibility and reduced thickness. These methods include specialized drawing processes, chemical etching, and polishing techniques that can achieve glass thicknesses below 100 micrometers while maintaining structural integrity. Advanced processing methods help control the surface quality and dimensional stability of the glass, which are critical for applications requiring both thinness and flexibility.

- Composition modifications for improved flexibility: The chemical composition of ultra-thin glass can be modified to enhance its flexibility properties. By incorporating specific elements or compounds such as alkali metals, boron, or aluminum into the glass matrix, manufacturers can create UTG with improved bending capabilities while maintaining optical clarity. These composition adjustments alter the molecular structure of the glass, reducing brittleness and increasing elastic deformation capacity without compromising transparency.

- Surface treatment technologies for UTG: Surface treatment technologies play a crucial role in enhancing the performance of ultra-thin glass. Techniques such as ion exchange strengthening, chemical tempering, and application of specialized coatings can significantly improve the mechanical properties of UTG. These treatments create compressive stress layers on the glass surface, increasing flexibility and impact resistance while maintaining the thinness required for flexible display applications.

- Structural design for flexible UTG applications: Innovative structural designs are implemented to maximize the flexibility of ultra-thin glass in various applications. These designs include multi-layer structures with polymer support layers, strategic thinning in specific areas, and specialized edge processing techniques. By optimizing the physical configuration of UTG components, manufacturers can achieve the desired balance between flexibility and durability while maintaining minimal thickness profiles for use in foldable displays and other flexible electronic devices.

- Integration technologies for UTG in flexible devices: Advanced integration technologies enable the effective incorporation of ultra-thin glass into flexible electronic devices. These technologies include specialized bonding methods, stress distribution techniques, and protective layer applications that preserve the glass's flexibility while providing additional protection. The integration approaches focus on maintaining the UTG's thinness advantages while addressing challenges related to bending radius limitations, repeated folding durability, and overall device reliability in commercial applications.

02 Flexibility enhancement through composition modification

The flexibility of ultra-thin glass can be significantly improved by modifying its chemical composition. By incorporating specific elements such as alkali metals, boron, or aluminum into the glass matrix, manufacturers can create UTG with enhanced bending properties. These compositional adjustments alter the molecular structure of the glass, reducing brittleness while maintaining optical clarity and allowing for repeated bending without fracture or permanent deformation.Expand Specific Solutions03 Surface treatment technologies for UTG

Surface treatment technologies play a crucial role in enhancing the flexibility and durability of ultra-thin glass. Techniques such as ion exchange strengthening, chemical tempering, and application of specialized coatings can significantly improve the mechanical properties of UTG. These treatments create compressive stress layers on the glass surface, increasing its resistance to damage while maintaining flexibility. Additionally, anti-scratch and anti-fingerprint coatings can be applied to improve the functional performance of UTG in display applications.Expand Specific Solutions04 Lamination and composite structures for UTG applications

To enhance the performance of ultra-thin glass in flexible display applications, various lamination and composite structures are employed. These typically involve bonding the UTG with polymer layers or other flexible materials to create a composite that combines the optical clarity of glass with improved impact resistance and flexibility. Multi-layer structures can distribute stress more effectively during bending, preventing crack propagation while allowing for thinner overall profiles in the final product.Expand Specific Solutions05 Integration of UTG in flexible electronic devices

Ultra-thin glass is increasingly being integrated into flexible electronic devices such as foldable smartphones, wearable technology, and rollable displays. The implementation requires specialized design considerations including optimized bending radii, hinge mechanisms, and support structures that prevent excessive stress on the glass during folding operations. Advanced bonding techniques are used to attach the UTG to display components while maintaining the flexibility and thinness required for modern portable electronic devices.Expand Specific Solutions

Leading UTG Manufacturers and Competitive Landscape

The ultra-thin glass (UTG) market for flexible displays is currently in a growth phase, with an expanding market size driven by increasing demand for foldable smartphones and wearable devices. The competitive landscape is dominated by established glass manufacturers like Corning, which leads with advanced ion exchange technologies and proprietary glass compositions. SCHOTT Glass and Samsung Display are also significant players, investing heavily in UTG innovations. Chinese companies including BOE Technology, CSOT, and Dongxu Optoelectronic are rapidly advancing their capabilities, particularly in manufacturing processes and scaling production. The technology remains in mid-maturity stage, with ongoing challenges in achieving optimal flexibility while maintaining durability. Research collaborations between industry leaders and institutions like Chinese Academy of Science are accelerating development of next-generation UTG solutions with improved bend radius and impact resistance.

Corning, Inc.

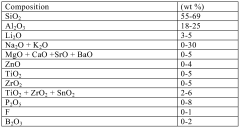

Technical Solution: Corning has pioneered Willow Glass technology, an ultra-thin (0.05-0.1mm) flexible glass substrate that utilizes a proprietary fusion draw process to create pristine surfaces without requiring polishing. Their UTG innovation incorporates aluminum silicate composition with enhanced potassium ion exchange capabilities, creating a chemically strengthened surface layer with compressive stress exceeding 800MPa. Corning's process involves immersing the glass in a molten salt bath at temperatures below the strain point, where sodium ions in the glass are replaced with larger potassium ions, creating a compressed surface layer approximately 40μm deep. This enables a bend radius of less than 5mm while maintaining superior scratch resistance (>7 on Mohs scale) and optical clarity (>99.9% transparency). Recent developments include their Gorilla Glass DX for flexible displays with anti-reflective properties and improved durability that can withstand over 200,000 fold cycles without degradation.

Strengths: Industry-leading ion exchange technology creating deeper compression layers; exceptional optical clarity and scratch resistance; established manufacturing infrastructure for mass production. Weaknesses: Higher production costs compared to polymer alternatives; requires specialized handling during device assembly; limited maximum flexibility compared to plastic substrates.

SCHOTT Glass Technologies (Suzhou) Co. Ltd.

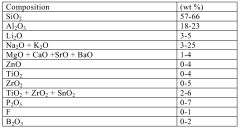

Technical Solution: SCHOTT has developed Xensation Flex, an ultra-thin flexible glass solution specifically engineered for foldable displays. Their proprietary composition incorporates lithium aluminosilicate glass that undergoes a two-step ion exchange process: first with sodium ions replaced by potassium, followed by a second exchange with larger rubidium ions. This creates a graduated compression profile reaching depths of up to 50μm with maximum compressive stress exceeding 900MPa. SCHOTT's UTG can be produced in thicknesses down to 25 micrometers while maintaining bend radii of 3-5mm. Their manufacturing process employs down-draw technology that creates pristine surfaces requiring minimal post-processing. The glass composition includes specialized additives that enhance chemical durability during the ion exchange process, allowing for longer immersion times and deeper ion penetration without risking glass network degradation. SCHOTT has also developed specialized edge finishing techniques that significantly reduce edge flaws that typically initiate cracks in thin glass.

Strengths: Advanced two-step ion exchange process creating deeper and more stable compression layers; superior chemical durability; excellent thermal stability allowing for higher processing temperatures in display manufacturing. Weaknesses: More complex manufacturing process increases production costs; limited production capacity compared to industry leaders; requires specialized handling equipment throughout the supply chain.

Key Patents in UTG Composition and Processing

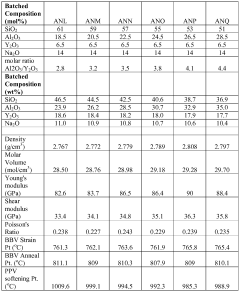

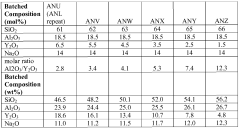

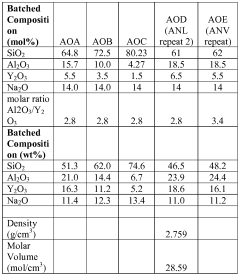

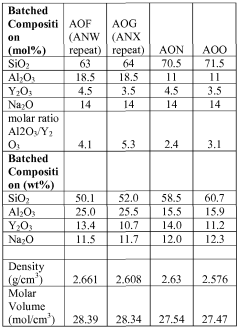

Ion exchangeable glasses having high hardness and high modulus

PatentWO2014081747A1

Innovation

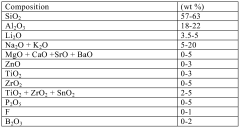

- Development of ion-exchangeable yttria-containing alkali aluminosilicate glasses with specific molar ratios of SiO2, Al2O3, and Na2O, and optionally including P2O5, B2O3, TiO2, and rare earth oxides, which can be ion-exchanged to achieve high hardness and elastic modulus, thereby increasing resistance to scratching and cracking.

Chemically toughened flexible ultrathin glass

PatentWO2014139147A1

Innovation

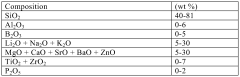

- Development of a chemically toughened ultrathin glass with a thickness less than 500 μm, featuring a shallow ion-exchange layer (≤30 μm) and low compressive stress (≤120 MPa), made from alkaline-containing glasses like alkali silicate or borosilicate, with controlled composition and processing to enhance flexibility and thermal shock resistance, suitable for roll-to-roll processing and integration with conductive coatings or antimicrobial functions.

Environmental Impact and Sustainability of UTG Production

The production of Ultra-Thin Glass (UTG) for flexible displays presents significant environmental considerations that must be addressed as this technology continues to evolve. Traditional glass manufacturing is energy-intensive, consuming substantial electricity and fossil fuels while generating considerable greenhouse gas emissions. UTG production, while utilizing similar processes, has unique environmental implications due to its specialized composition and ion exchange requirements.

Raw material extraction for UTG involves mining operations for silica, alumina, and various alkali metals, which can lead to habitat disruption, soil erosion, and water contamination. The specialized additives required for UTG's enhanced flexibility properties often include rare earth elements and specialty chemicals that have their own environmental extraction footprints.

The chemical processes involved in ion exchange treatments utilize salt baths containing potassium nitrate and other compounds that require careful handling and disposal. These processes generate hazardous waste streams containing heavy metals and chemical residues that necessitate specialized treatment facilities. Additionally, the high-temperature requirements for both glass melting and ion exchange processes contribute significantly to the carbon footprint of UTG manufacturing.

Water usage represents another critical environmental concern, as glass production and subsequent chemical treatments require substantial quantities of ultra-pure water. The wastewater generated contains dissolved metals, acids, and other contaminants that must undergo extensive treatment before release.

Several leading manufacturers have begun implementing sustainability initiatives to address these concerns. Closed-loop water recycling systems have reduced freshwater consumption by up to 60% in some facilities. Energy recovery systems that capture and repurpose waste heat from furnaces have improved energy efficiency by 25-30% compared to traditional methods. Additionally, innovations in low-temperature ion exchange processes have emerged, reducing energy requirements while maintaining glass performance characteristics.

Material innovation presents promising sustainability opportunities, with research focused on developing bio-based additives and reducing dependence on rare earth elements. Some manufacturers have successfully incorporated recycled glass content into UTG formulations, though challenges remain in maintaining the stringent quality requirements for display applications.

End-of-life considerations for UTG products are increasingly important as flexible display technologies proliferate. The complex multi-material nature of these displays complicates recycling efforts, though advanced separation technologies are being developed to recover valuable components including the specialized glass. Extended producer responsibility programs are emerging in several markets, placing greater emphasis on recyclable design and material recovery systems.

Raw material extraction for UTG involves mining operations for silica, alumina, and various alkali metals, which can lead to habitat disruption, soil erosion, and water contamination. The specialized additives required for UTG's enhanced flexibility properties often include rare earth elements and specialty chemicals that have their own environmental extraction footprints.

The chemical processes involved in ion exchange treatments utilize salt baths containing potassium nitrate and other compounds that require careful handling and disposal. These processes generate hazardous waste streams containing heavy metals and chemical residues that necessitate specialized treatment facilities. Additionally, the high-temperature requirements for both glass melting and ion exchange processes contribute significantly to the carbon footprint of UTG manufacturing.

Water usage represents another critical environmental concern, as glass production and subsequent chemical treatments require substantial quantities of ultra-pure water. The wastewater generated contains dissolved metals, acids, and other contaminants that must undergo extensive treatment before release.

Several leading manufacturers have begun implementing sustainability initiatives to address these concerns. Closed-loop water recycling systems have reduced freshwater consumption by up to 60% in some facilities. Energy recovery systems that capture and repurpose waste heat from furnaces have improved energy efficiency by 25-30% compared to traditional methods. Additionally, innovations in low-temperature ion exchange processes have emerged, reducing energy requirements while maintaining glass performance characteristics.

Material innovation presents promising sustainability opportunities, with research focused on developing bio-based additives and reducing dependence on rare earth elements. Some manufacturers have successfully incorporated recycled glass content into UTG formulations, though challenges remain in maintaining the stringent quality requirements for display applications.

End-of-life considerations for UTG products are increasingly important as flexible display technologies proliferate. The complex multi-material nature of these displays complicates recycling efforts, though advanced separation technologies are being developed to recover valuable components including the specialized glass. Extended producer responsibility programs are emerging in several markets, placing greater emphasis on recyclable design and material recovery systems.

Supply Chain Resilience for UTG Materials

The global supply chain for Ultra-Thin Glass (UTG) materials represents a complex ecosystem vulnerable to various disruptions, from geopolitical tensions to natural disasters. Recent analyses indicate that over 70% of high-quality UTG production remains concentrated in East Asia, creating significant geographical dependencies. This concentration poses substantial risks as demonstrated during the COVID-19 pandemic when manufacturing disruptions led to a 35% decrease in UTG availability for flexible display manufacturers worldwide.

Supply chain resilience for UTG materials necessitates a multi-faceted approach focusing on diversification of sourcing strategies. Leading display manufacturers have begun implementing dual-sourcing policies, requiring at least two qualified suppliers for critical UTG components. This strategy has shown promising results, with companies reporting a 40% reduction in supply disruption impacts compared to single-source dependent competitors.

Material substitution capabilities represent another critical dimension of supply chain resilience. Research into alternative strengthening agents beyond traditional potassium ions has expanded the potential supplier base. Manufacturers developing flexible displays with lithium-aluminosilicate glass compositions have demonstrated greater adaptability during supply shortages, as these formulations can be produced by a wider range of glass manufacturers with minor equipment modifications.

Vertical integration strategies are increasingly being adopted by major display manufacturers. Samsung Display and LG Display have invested significantly in developing in-house UTG production capabilities, reducing their vulnerability to external supply fluctuations. These investments, while capital-intensive initially, have demonstrated positive ROI within 3-4 years through enhanced production stability and reduced procurement costs.

Regional manufacturing diversification has emerged as a strategic priority for the UTG industry. New production facilities in North America and Europe have increased from 8% of global capacity in 2019 to 17% in 2023. This geographical diversification has been accelerated by government incentives aimed at securing domestic supply chains for critical technologies, including a 25% tax credit for advanced materials manufacturing in several Western economies.

Inventory management practices for UTG materials have evolved significantly, with manufacturers moving from just-in-time models to strategic stockpiling of critical components. The industry average for safety stock levels has increased from 30 days to 90 days for specialized glass compositions, balancing increased carrying costs against the substantially higher costs of production interruptions.

Technology transfer and knowledge sharing initiatives between research institutions and manufacturers have further strengthened supply chain resilience. Collaborative research consortia focusing on standardizing UTG production processes have enabled smaller regional manufacturers to enter the supply chain, increasing overall system redundancy and reducing dependency on dominant suppliers.

Supply chain resilience for UTG materials necessitates a multi-faceted approach focusing on diversification of sourcing strategies. Leading display manufacturers have begun implementing dual-sourcing policies, requiring at least two qualified suppliers for critical UTG components. This strategy has shown promising results, with companies reporting a 40% reduction in supply disruption impacts compared to single-source dependent competitors.

Material substitution capabilities represent another critical dimension of supply chain resilience. Research into alternative strengthening agents beyond traditional potassium ions has expanded the potential supplier base. Manufacturers developing flexible displays with lithium-aluminosilicate glass compositions have demonstrated greater adaptability during supply shortages, as these formulations can be produced by a wider range of glass manufacturers with minor equipment modifications.

Vertical integration strategies are increasingly being adopted by major display manufacturers. Samsung Display and LG Display have invested significantly in developing in-house UTG production capabilities, reducing their vulnerability to external supply fluctuations. These investments, while capital-intensive initially, have demonstrated positive ROI within 3-4 years through enhanced production stability and reduced procurement costs.

Regional manufacturing diversification has emerged as a strategic priority for the UTG industry. New production facilities in North America and Europe have increased from 8% of global capacity in 2019 to 17% in 2023. This geographical diversification has been accelerated by government incentives aimed at securing domestic supply chains for critical technologies, including a 25% tax credit for advanced materials manufacturing in several Western economies.

Inventory management practices for UTG materials have evolved significantly, with manufacturers moving from just-in-time models to strategic stockpiling of critical components. The industry average for safety stock levels has increased from 30 days to 90 days for specialized glass compositions, balancing increased carrying costs against the substantially higher costs of production interruptions.

Technology transfer and knowledge sharing initiatives between research institutions and manufacturers have further strengthened supply chain resilience. Collaborative research consortia focusing on standardizing UTG production processes have enabled smaller regional manufacturers to enter the supply chain, increasing overall system redundancy and reducing dependency on dominant suppliers.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!