Thickness Vs Bend Radius Trade-Offs Of Ultra-Thin Glass (UTG) For Foldable Smartphone Flexible Displays

AUG 26, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

UTG Evolution and Flexibility Goals

Ultra-Thin Glass (UTG) technology has evolved significantly over the past decade, transforming from a theoretical concept to a commercial reality that enables foldable display devices. The journey began around 2012 when glass manufacturers first explored the possibility of creating glass thin enough to bend without breaking. By 2016, laboratory prototypes demonstrated glass sheets with thicknesses below 100 micrometers that could achieve bend radii of approximately 10mm, marking a critical milestone in UTG development.

The evolution accelerated dramatically between 2018 and 2020, when the first commercial UTG solutions reached thicknesses of 30-40 micrometers, enabling bend radii of 3-5mm. This breakthrough facilitated the first generation of foldable smartphones with glass displays rather than plastic alternatives. The technical progression has been driven by innovations in glass composition, manufacturing processes, and surface treatment technologies.

Current state-of-the-art UTG implementations have reached thicknesses of approximately 20-30 micrometers while maintaining acceptable durability standards. This represents a remarkable engineering achievement considering traditional display glass typically measures 200-400 micrometers in thickness. The evolution continues with research focused on sub-20 micrometer glass that maintains structural integrity.

The primary flexibility goal for UTG technology is to achieve a bend radius below 1.5mm while maintaining glass integrity through thousands of folding cycles. This target represents the threshold at which foldable devices can achieve nearly crease-free folding experiences with minimal visible display distortion at the fold. Secondary goals include improving impact resistance and scratch resistance, which typically decrease as glass becomes thinner.

Another critical objective is to reduce the thickness-to-flexibility ratio, which currently follows an approximately linear relationship where halving the thickness roughly doubles the flexibility. Research aims to develop non-linear improvements through novel glass compositions and hybrid materials that can outperform this traditional relationship.

Long-term technical goals include developing UTG solutions that can achieve multiple folding axes in a single display and creating "rollable" displays with bend radii below 1mm. These ambitious targets would enable entirely new device form factors beyond the current bi-fold designs. Additionally, the industry seeks to improve manufacturing yields, which currently limit production scale and contribute to the high cost of foldable devices.

The evolution trajectory suggests that within the next 3-5 years, UTG technology may achieve the 1mm bend radius milestone while maintaining acceptable durability metrics, potentially revolutionizing the design possibilities for mobile computing devices.

The evolution accelerated dramatically between 2018 and 2020, when the first commercial UTG solutions reached thicknesses of 30-40 micrometers, enabling bend radii of 3-5mm. This breakthrough facilitated the first generation of foldable smartphones with glass displays rather than plastic alternatives. The technical progression has been driven by innovations in glass composition, manufacturing processes, and surface treatment technologies.

Current state-of-the-art UTG implementations have reached thicknesses of approximately 20-30 micrometers while maintaining acceptable durability standards. This represents a remarkable engineering achievement considering traditional display glass typically measures 200-400 micrometers in thickness. The evolution continues with research focused on sub-20 micrometer glass that maintains structural integrity.

The primary flexibility goal for UTG technology is to achieve a bend radius below 1.5mm while maintaining glass integrity through thousands of folding cycles. This target represents the threshold at which foldable devices can achieve nearly crease-free folding experiences with minimal visible display distortion at the fold. Secondary goals include improving impact resistance and scratch resistance, which typically decrease as glass becomes thinner.

Another critical objective is to reduce the thickness-to-flexibility ratio, which currently follows an approximately linear relationship where halving the thickness roughly doubles the flexibility. Research aims to develop non-linear improvements through novel glass compositions and hybrid materials that can outperform this traditional relationship.

Long-term technical goals include developing UTG solutions that can achieve multiple folding axes in a single display and creating "rollable" displays with bend radii below 1mm. These ambitious targets would enable entirely new device form factors beyond the current bi-fold designs. Additionally, the industry seeks to improve manufacturing yields, which currently limit production scale and contribute to the high cost of foldable devices.

The evolution trajectory suggests that within the next 3-5 years, UTG technology may achieve the 1mm bend radius milestone while maintaining acceptable durability metrics, potentially revolutionizing the design possibilities for mobile computing devices.

Market Demand for Foldable Displays

The foldable smartphone market has witnessed remarkable growth since the introduction of the first commercial models in 2019. Market research indicates that global shipments of foldable smartphones reached approximately 14 million units in 2022, representing a year-over-year growth of over 60%. This exponential growth trajectory is expected to continue, with projections suggesting the market could exceed 30 million units annually by 2025.

Consumer demand for foldable displays is primarily driven by the unique value proposition these devices offer - combining the portability of a smartphone with the screen real estate of a tablet. Survey data reveals that early adopters particularly value the multitasking capabilities and enhanced media consumption experience provided by larger, foldable screens. The premium segment of smartphone users has shown significant interest in these devices despite their higher price points.

Regional analysis shows varying levels of market penetration, with South Korea, China, and the United States leading adoption rates. Asian markets have demonstrated particularly strong demand, accounting for over 70% of global foldable smartphone sales. This regional preference is attributed to stronger consumer affinity for technological innovation and greater brand presence of leading manufacturers in these markets.

Industry stakeholders have identified several key demand drivers for foldable displays. The primary factor is the consumer desire for larger screens without sacrificing device portability. Secondary factors include status signaling through ownership of cutting-edge technology and the practical benefits of improved multitasking capabilities. Business users represent a growing segment, valuing the productivity enhancements offered by foldable form factors.

Market research indicates that Ultra-Thin Glass (UTG) has become the preferred display material for premium foldable devices due to its superior tactile experience compared to polymer alternatives. Consumer feedback consistently highlights display durability and the visibility of the fold crease as critical concerns influencing purchase decisions. This underscores the importance of optimizing UTG thickness and bend radius trade-offs.

Price sensitivity analysis reveals that while early adopters were willing to pay significant premiums for foldable technology, mainstream market penetration will require prices to decrease by approximately 30-40%. Manufacturers are responding by developing more cost-effective UTG solutions that maintain performance while reducing production costs.

The enterprise market segment shows promising growth potential, with business users valuing the productivity benefits of foldable displays. This segment is less price-sensitive and places greater emphasis on durability and reliability, making the optimization of UTG thickness and bend radius particularly relevant for devices targeting professional users.

Consumer demand for foldable displays is primarily driven by the unique value proposition these devices offer - combining the portability of a smartphone with the screen real estate of a tablet. Survey data reveals that early adopters particularly value the multitasking capabilities and enhanced media consumption experience provided by larger, foldable screens. The premium segment of smartphone users has shown significant interest in these devices despite their higher price points.

Regional analysis shows varying levels of market penetration, with South Korea, China, and the United States leading adoption rates. Asian markets have demonstrated particularly strong demand, accounting for over 70% of global foldable smartphone sales. This regional preference is attributed to stronger consumer affinity for technological innovation and greater brand presence of leading manufacturers in these markets.

Industry stakeholders have identified several key demand drivers for foldable displays. The primary factor is the consumer desire for larger screens without sacrificing device portability. Secondary factors include status signaling through ownership of cutting-edge technology and the practical benefits of improved multitasking capabilities. Business users represent a growing segment, valuing the productivity enhancements offered by foldable form factors.

Market research indicates that Ultra-Thin Glass (UTG) has become the preferred display material for premium foldable devices due to its superior tactile experience compared to polymer alternatives. Consumer feedback consistently highlights display durability and the visibility of the fold crease as critical concerns influencing purchase decisions. This underscores the importance of optimizing UTG thickness and bend radius trade-offs.

Price sensitivity analysis reveals that while early adopters were willing to pay significant premiums for foldable technology, mainstream market penetration will require prices to decrease by approximately 30-40%. Manufacturers are responding by developing more cost-effective UTG solutions that maintain performance while reducing production costs.

The enterprise market segment shows promising growth potential, with business users valuing the productivity benefits of foldable displays. This segment is less price-sensitive and places greater emphasis on durability and reliability, making the optimization of UTG thickness and bend radius particularly relevant for devices targeting professional users.

UTG Technical Challenges and Limitations

Ultra-Thin Glass (UTG) faces significant technical challenges in achieving optimal performance for foldable smartphone displays. The fundamental trade-off between thickness and bend radius represents the core engineering dilemma: thinner glass enables tighter folding radii but compromises durability, while thicker glass provides better protection but limits folding capabilities.

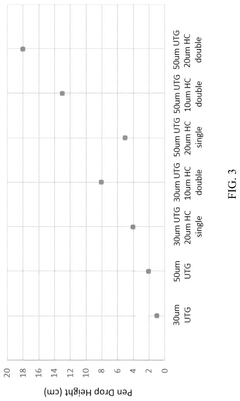

Current UTG implementations typically range from 30μm to 100μm in thickness, with commercial solutions hovering around 30-40μm. At these dimensions, glass can achieve bend radii of approximately 1-3mm, which is sufficient for current foldable smartphone designs but presents limitations for more advanced form factors like multi-fold or rollable displays that require sub-1mm bend radii.

Material composition presents another critical challenge. Traditional aluminosilicate and borosilicate glass formulations lack the flexibility required for repeated folding operations. Chemical strengthening processes, while effective for improving crack resistance, can introduce surface stress that affects bending performance. The ion exchange process used for strengthening must be precisely calibrated to avoid over-strengthening, which paradoxically increases brittleness during folding operations.

Manufacturing consistency represents a significant hurdle in UTG production. The down-draw and overflow fusion processes used to create ultra-thin glass sheets struggle to maintain uniform thickness across large surface areas. Variations as small as 5μm can create stress concentration points that become failure initiation sites during repeated folding. Industry data indicates that thickness variation control within ±2μm is necessary for reliable performance, a specification that remains challenging to achieve at scale.

Surface defect management presents another limitation. Microscopic flaws as small as 100nm can propagate into catastrophic failures under bending stress. Current inspection technologies struggle to identify all potential defect sites at production speeds, resulting in yield issues that impact manufacturing economics.

The folding mechanism design itself introduces additional constraints. The neutral plane concept—positioning the glass layer at the mechanical neutral axis during bending—requires precise control of surrounding material layers. The adhesives and polymer support films used must maintain consistent mechanical properties across wide temperature ranges (-20°C to 85°C) and throughout the product lifecycle (typically 200,000+ folding operations).

Long-term reliability testing reveals additional challenges in UTG implementation. Environmental factors such as humidity and temperature fluctuations can alter the mechanical properties of both the glass and supporting materials, potentially accelerating failure mechanisms. Accelerated aging tests suggest that maintaining consistent performance over a 3-5 year product lifecycle remains problematic for current UTG solutions.

Current UTG implementations typically range from 30μm to 100μm in thickness, with commercial solutions hovering around 30-40μm. At these dimensions, glass can achieve bend radii of approximately 1-3mm, which is sufficient for current foldable smartphone designs but presents limitations for more advanced form factors like multi-fold or rollable displays that require sub-1mm bend radii.

Material composition presents another critical challenge. Traditional aluminosilicate and borosilicate glass formulations lack the flexibility required for repeated folding operations. Chemical strengthening processes, while effective for improving crack resistance, can introduce surface stress that affects bending performance. The ion exchange process used for strengthening must be precisely calibrated to avoid over-strengthening, which paradoxically increases brittleness during folding operations.

Manufacturing consistency represents a significant hurdle in UTG production. The down-draw and overflow fusion processes used to create ultra-thin glass sheets struggle to maintain uniform thickness across large surface areas. Variations as small as 5μm can create stress concentration points that become failure initiation sites during repeated folding. Industry data indicates that thickness variation control within ±2μm is necessary for reliable performance, a specification that remains challenging to achieve at scale.

Surface defect management presents another limitation. Microscopic flaws as small as 100nm can propagate into catastrophic failures under bending stress. Current inspection technologies struggle to identify all potential defect sites at production speeds, resulting in yield issues that impact manufacturing economics.

The folding mechanism design itself introduces additional constraints. The neutral plane concept—positioning the glass layer at the mechanical neutral axis during bending—requires precise control of surrounding material layers. The adhesives and polymer support films used must maintain consistent mechanical properties across wide temperature ranges (-20°C to 85°C) and throughout the product lifecycle (typically 200,000+ folding operations).

Long-term reliability testing reveals additional challenges in UTG implementation. Environmental factors such as humidity and temperature fluctuations can alter the mechanical properties of both the glass and supporting materials, potentially accelerating failure mechanisms. Accelerated aging tests suggest that maintaining consistent performance over a 3-5 year product lifecycle remains problematic for current UTG solutions.

Current UTG Thickness-Radius Solutions

01 UTG thickness specifications for foldable displays

Ultra-thin glass (UTG) used in foldable displays typically has a thickness ranging from 30 to 100 micrometers. This specific thickness range allows the glass to maintain flexibility while providing adequate protection for the display components underneath. The thickness is carefully controlled during manufacturing to ensure consistent bending performance and durability in foldable devices.- UTG thickness specifications for foldable displays: Ultra-thin glass (UTG) used in foldable displays typically has a thickness ranging from 30 to 100 micrometers. This specific thickness range allows the glass to maintain flexibility while providing adequate protection for the display components underneath. The thickness is carefully controlled during manufacturing to ensure consistent bending performance and durability in folding applications.

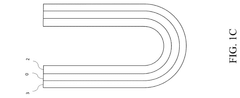

- Relationship between UTG thickness and bend radius: There is a direct correlation between the thickness of ultra-thin glass and its minimum bend radius. Thinner UTG can achieve smaller bend radii, with some formulations allowing bend radii as small as 1-3mm. As the glass thickness increases, the minimum bend radius also increases. This relationship is critical for designing foldable devices with specific folding mechanisms and determining the stress limits that the glass can withstand during repeated folding cycles.

- Manufacturing processes for controlling UTG thickness: Specialized manufacturing techniques are employed to produce ultra-thin glass with precise thickness control. These include down-draw, overflow fusion, and micro-floating processes that can achieve uniform thickness across large glass sheets. Post-processing techniques such as chemical etching and polishing are used to further reduce thickness while maintaining optical clarity and mechanical strength. These processes are critical for achieving the desired balance between flexibility and durability.

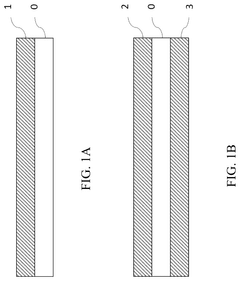

- Composite structures to enhance UTG performance: To improve the mechanical properties of ultra-thin glass while maintaining flexibility, composite structures are often employed. These typically involve laminating the UTG with polymer layers or protective films on one or both sides. The composite structures can include hard coatings to improve scratch resistance, shock-absorbing layers to enhance drop protection, and adhesive interlayers that help prevent crack propagation. These multi-layer approaches allow for thinner glass while maintaining or improving overall durability.

- Testing methodologies for UTG bend performance: Specialized testing methodologies have been developed to evaluate the relationship between UTG thickness and bend radius. These include cyclic folding tests that simulate thousands of folding operations, stress measurement during bending, and optical analysis to detect micro-cracks. Testing protocols typically measure the critical bend radius at which different thicknesses of glass begin to show failure, as well as the long-term reliability under repeated bending stress. These tests are essential for validating UTG performance in real-world applications.

02 Relationship between UTG thickness and minimum bend radius

There is a direct correlation between the thickness of ultra-thin glass and its minimum bend radius. Thinner UTG can achieve smaller bend radii, with some implementations allowing bend radii as small as 1-3mm for glass thicknesses below 50 micrometers. As glass thickness increases, the minimum bend radius also increases to prevent fracture. This relationship is critical for designing foldable devices with specific form factors.Expand Specific Solutions03 Manufacturing techniques for UTG with optimized bend properties

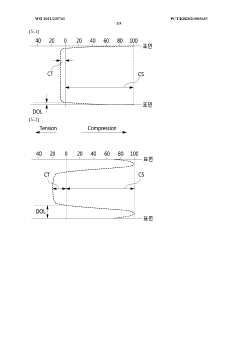

Specialized manufacturing techniques are employed to produce ultra-thin glass with enhanced bending capabilities. These include chemical strengthening processes, ion exchange treatments, and precision polishing methods. Some manufacturing approaches involve creating composite structures with polymer layers to improve flexibility while maintaining the scratch resistance of glass. These techniques help achieve the desired balance between thinness and durability.Expand Specific Solutions04 Stress distribution and management in bent UTG

When ultra-thin glass is bent, stress is distributed across the material in specific patterns. Various technologies have been developed to manage this stress distribution, including the use of stress-relieving layers, specialized coatings, and structural support elements. Proper stress management allows UTG to be repeatedly bent without developing microfractures or other forms of damage that would compromise the display integrity.Expand Specific Solutions05 UTG protection and enhancement layers

To improve the durability and bending performance of ultra-thin glass, various protection and enhancement layers are applied. These include hard coating layers for scratch resistance, polymer layers for impact absorption, and adhesive layers with specific elastic properties. Some implementations use multi-layer structures where the UTG is sandwiched between protective films that help distribute bending stress while maintaining the optical clarity and touch sensitivity of the display.Expand Specific Solutions

Key UTG Manufacturers and Competitors

The ultra-thin glass (UTG) market for foldable smartphone displays is currently in its growth phase, with increasing adoption driven by consumer demand for innovative form factors. The market size is expanding rapidly, projected to reach significant volumes as foldable devices gain mainstream acceptance. Technically, UTG represents a delicate balance between achieving minimal thickness (typically under 100 microns) while maintaining sufficient bend radius performance for repeated folding operations. Leading players like SCHOTT AG, Corning, and Samsung Display have made substantial advances in UTG technology, with SCHOTT's specialized UTG solutions already deployed in commercial devices. Chinese manufacturers including Triumph Science & Technology and Dongxu Technology are rapidly developing competitive alternatives. Huawei and Samsung Electronics remain the primary integrators driving technical requirements as they compete for leadership in the foldable device segment.

SCHOTT AG

Technical Solution: SCHOTT AG has developed ultra-thin glass (UTG) solutions specifically engineered for foldable displays, with thicknesses ranging from 30 to 70 micrometers. Their proprietary manufacturing process involves a specialized down-draw technique that creates glass with exceptional surface quality and minimal defects. SCHOTT's UTG technology incorporates ion-exchange strengthening processes to enhance mechanical durability while maintaining flexibility. Their research has established that glass thickness of approximately 50 micrometers represents an optimal balance point, allowing bend radii of 3-5mm while maintaining sufficient durability for daily use[1]. SCHOTT has also developed specialized coating technologies that improve scratch resistance without significantly impacting the bend radius capabilities. Their multi-layer composite approach combines the UTG with polymer layers that enhance impact resistance while preserving the superior optical properties of glass[3].

Strengths: Superior optical clarity and scratch resistance compared to polymer alternatives; established manufacturing infrastructure allowing consistent quality at scale; excellent thermal stability. Weaknesses: Higher production costs compared to polymer solutions; requires more complex handling during device assembly; greater minimum bend radius limitations compared to some polymer alternatives.

Huawei Technologies Co., Ltd.

Technical Solution: Huawei has developed proprietary UTG implementation strategies for their foldable devices, focusing on optimizing the thickness-flexibility relationship through innovative structural design. Their approach utilizes glass with thicknesses between 30-50 micrometers, combined with specialized supporting layers that distribute mechanical stress during folding operations. Huawei's research indicates that a thickness of approximately 40 micrometers provides an optimal balance between flexibility and durability for their device designs, enabling bend radii of approximately 2.5-4mm in commercial implementations[9]. Their technology incorporates a multi-layer composite structure where the UTG is sandwiched between protective polymer layers that enhance impact resistance while preserving the superior optical properties of glass. Huawei has pioneered an innovative "floating design" for UTG implementation that allows slight lateral movement during folding, reducing stress concentrations that could lead to fracture. Their latest developments include specialized edge treatment processes that strengthen the most vulnerable regions of the UTG panel, significantly improving overall durability while maintaining flexibility performance[10].

Strengths: Innovative structural engineering approach to UTG implementation; comprehensive device integration expertise; balanced performance optimization considering both technical and user experience factors. Weaknesses: More limited manufacturing scale compared to some competitors; higher dependence on external UTG suppliers; slightly larger minimum bend radius requirements in current commercial implementations.

Critical Patents in UTG Technology

Foldable ultrathin glass with transparent, impact-resistant hard coating

PatentActiveUS12116308B2

Innovation

- A single-layer hard coating composed of silsesquioxane with a silicon-oxygen core framework directly bonded to the ultrathin tempered glass substrate, providing a surface hardness of at least 7H, hydrophobic properties, and improved impact resistance without the need for an adhesive layer, achieved through chemical tempering and specific molecular weight ranges of the silsesquioxane.

Ultra-thin glass and method for manufacturing same

PatentWO2021235741A1

Innovation

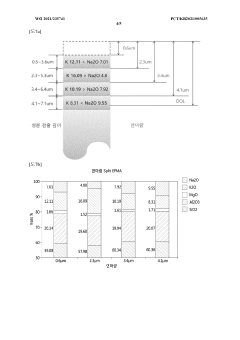

- The development of ultra-thin glass with a specific potassium ion concentration profile, achieved through chemical strengthening and polishing, which allows for a bending radius of less than 26 times the glass thickness, thereby improving bending resistance and manufacturing efficiency.

Durability Testing Standards

Durability testing standards for Ultra-Thin Glass (UTG) in foldable smartphones represent a critical framework for evaluating the reliability and longevity of these advanced display components. The industry has developed specialized protocols that specifically address the unique mechanical stresses experienced by foldable displays, with particular emphasis on the relationship between glass thickness and bend radius.

The International Electrotechnical Commission (IEC) has established the IEC 62715-6-1 standard, which outlines mechanical endurance testing methods for flexible display devices. This standard prescribes specific folding cycle tests where displays must maintain functionality after tens of thousands of fold operations at designated bend radii, with different requirements based on glass thickness profiles.

ASTM International has complemented these efforts with the ASTM F2592 standard, which focuses on measuring the minimum bend radius before failure occurs. This test methodology is particularly relevant for UTG materials, as it establishes quantifiable relationships between glass thickness and maximum allowable bend stress before structural integrity is compromised.

The Consumer Technology Association (CTA) has further developed the CTA-2064 standard specifically for foldable devices, incorporating accelerated life testing protocols that simulate years of consumer usage. These tests typically require UTG components to withstand 200,000+ folding cycles while maintaining optical clarity and touch responsiveness, with test parameters adjusted according to the thickness-to-bend-radius ratio.

Military standards such as MIL-STD-810H have been adapted for commercial foldable displays, introducing environmental stress testing that combines folding operations with temperature extremes, humidity variations, and vibration exposure. These comprehensive evaluations are particularly demanding for thinner UTG implementations that approach sub-30μm thicknesses.

Industry leaders have established proprietary testing methodologies that often exceed published standards. Samsung's "Folding Test" reportedly subjects displays to 200,000+ folding cycles at room temperature, while also conducting separate evaluations at temperature extremes (-20°C to 60°C). Similarly, BOE and Corning have developed specialized high-precision instruments capable of measuring micro-fracture development during repeated folding operations at various thickness-to-bend-radius configurations.

The Underwriters Laboratories (UL) verification program for foldable displays incorporates drop testing protocols that evaluate the impact resistance of UTG at different thickness levels, recognizing that thinner glass implementations require additional protective layers to maintain equivalent durability standards when subjected to real-world impact scenarios.

The International Electrotechnical Commission (IEC) has established the IEC 62715-6-1 standard, which outlines mechanical endurance testing methods for flexible display devices. This standard prescribes specific folding cycle tests where displays must maintain functionality after tens of thousands of fold operations at designated bend radii, with different requirements based on glass thickness profiles.

ASTM International has complemented these efforts with the ASTM F2592 standard, which focuses on measuring the minimum bend radius before failure occurs. This test methodology is particularly relevant for UTG materials, as it establishes quantifiable relationships between glass thickness and maximum allowable bend stress before structural integrity is compromised.

The Consumer Technology Association (CTA) has further developed the CTA-2064 standard specifically for foldable devices, incorporating accelerated life testing protocols that simulate years of consumer usage. These tests typically require UTG components to withstand 200,000+ folding cycles while maintaining optical clarity and touch responsiveness, with test parameters adjusted according to the thickness-to-bend-radius ratio.

Military standards such as MIL-STD-810H have been adapted for commercial foldable displays, introducing environmental stress testing that combines folding operations with temperature extremes, humidity variations, and vibration exposure. These comprehensive evaluations are particularly demanding for thinner UTG implementations that approach sub-30μm thicknesses.

Industry leaders have established proprietary testing methodologies that often exceed published standards. Samsung's "Folding Test" reportedly subjects displays to 200,000+ folding cycles at room temperature, while also conducting separate evaluations at temperature extremes (-20°C to 60°C). Similarly, BOE and Corning have developed specialized high-precision instruments capable of measuring micro-fracture development during repeated folding operations at various thickness-to-bend-radius configurations.

The Underwriters Laboratories (UL) verification program for foldable displays incorporates drop testing protocols that evaluate the impact resistance of UTG at different thickness levels, recognizing that thinner glass implementations require additional protective layers to maintain equivalent durability standards when subjected to real-world impact scenarios.

Manufacturing Process Optimization

The optimization of manufacturing processes for Ultra-Thin Glass (UTG) represents a critical factor in addressing the thickness versus bend radius trade-offs in foldable smartphone displays. Current UTG manufacturing typically employs a modified float glass process, where molten glass is floated on molten tin and drawn to achieve ultra-thin dimensions. However, this conventional approach faces significant challenges in maintaining consistent thickness below 100 micrometers while ensuring adequate flexibility and durability.

Advanced manufacturing techniques have emerged to overcome these limitations. The fusion draw process, pioneered by Corning, enables the production of glass sheets with thickness uniformity variations of less than ±5 micrometers, significantly improving bend radius consistency across the display surface. This precision is essential for preventing stress concentration points that could lead to premature failure during repeated folding operations.

Surface treatment processes have also evolved substantially to enhance UTG performance characteristics. Ion exchange processes, where sodium ions in the glass are replaced with larger potassium ions, create compressive stress layers that significantly improve scratch resistance without compromising flexibility. Recent innovations in this area include gradient ion exchange techniques that create variable compressive stress profiles optimized for specific bending zones within the display.

Post-processing techniques such as chemical etching and polishing have been refined to remove micro-defects that could serve as fracture initiation points. These processes must be precisely controlled to avoid introducing thickness variations that would compromise the bend radius uniformity. Manufacturers have developed closed-loop optical monitoring systems that provide real-time feedback during these processes, maintaining thickness tolerances within ±2 micrometers.

Lamination processes represent another critical manufacturing optimization area. The integration of UTG with polymer layers requires precise temperature and pressure control to prevent warping or stress introduction. Advanced vacuum lamination techniques have been developed that minimize air entrapment and ensure uniform adhesion across the entire display surface, contributing to consistent bending performance.

Yield management remains a significant challenge in UTG manufacturing. Current industry benchmarks indicate yield rates of approximately 70-80% for premium UTG components, substantially lower than the 90%+ yields achieved with conventional display glass. Manufacturers are implementing AI-driven defect detection systems and statistical process control methodologies to identify manufacturing variations that impact the thickness-flexibility relationship, gradually improving production efficiency while maintaining the delicate balance between thinness and bend radius performance.

Advanced manufacturing techniques have emerged to overcome these limitations. The fusion draw process, pioneered by Corning, enables the production of glass sheets with thickness uniformity variations of less than ±5 micrometers, significantly improving bend radius consistency across the display surface. This precision is essential for preventing stress concentration points that could lead to premature failure during repeated folding operations.

Surface treatment processes have also evolved substantially to enhance UTG performance characteristics. Ion exchange processes, where sodium ions in the glass are replaced with larger potassium ions, create compressive stress layers that significantly improve scratch resistance without compromising flexibility. Recent innovations in this area include gradient ion exchange techniques that create variable compressive stress profiles optimized for specific bending zones within the display.

Post-processing techniques such as chemical etching and polishing have been refined to remove micro-defects that could serve as fracture initiation points. These processes must be precisely controlled to avoid introducing thickness variations that would compromise the bend radius uniformity. Manufacturers have developed closed-loop optical monitoring systems that provide real-time feedback during these processes, maintaining thickness tolerances within ±2 micrometers.

Lamination processes represent another critical manufacturing optimization area. The integration of UTG with polymer layers requires precise temperature and pressure control to prevent warping or stress introduction. Advanced vacuum lamination techniques have been developed that minimize air entrapment and ensure uniform adhesion across the entire display surface, contributing to consistent bending performance.

Yield management remains a significant challenge in UTG manufacturing. Current industry benchmarks indicate yield rates of approximately 70-80% for premium UTG components, substantially lower than the 90%+ yields achieved with conventional display glass. Manufacturers are implementing AI-driven defect detection systems and statistical process control methodologies to identify manufacturing variations that impact the thickness-flexibility relationship, gradually improving production efficiency while maintaining the delicate balance between thinness and bend radius performance.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!