Metrology And Non-Destructive Testing For Ultra-Thin Glass (UTG) In Flexible Displays

AUG 26, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

UTG Metrology Background and Objectives

Ultra-Thin Glass (UTG) has emerged as a transformative material in the flexible display industry, offering a unique combination of flexibility, durability, and optical clarity that traditional glass cannot provide. The evolution of UTG technology can be traced back to the early 2010s when display manufacturers began exploring alternatives to plastic substrates for foldable devices. The technological trajectory has accelerated significantly in the past five years, with major breakthroughs in manufacturing processes enabling glass thicknesses below 100 micrometers while maintaining structural integrity.

The development of UTG represents a critical inflection point in display technology, transitioning from rigid to truly flexible form factors. This evolution has been driven by consumer demand for more versatile, durable, and aesthetically pleasing devices that can be folded or rolled without compromising display quality. The market has responded with increasingly sophisticated UTG solutions, though significant technical challenges remain in mass production and quality assurance.

Current metrology and non-destructive testing (NDT) methods for UTG face substantial limitations when applied to ultra-thin substrates. Traditional optical inspection systems struggle with the transparency and reflective properties of UTG, while contact-based measurement techniques risk damaging these delicate materials. The industry urgently needs advanced metrology solutions capable of detecting micro-defects, thickness variations, and stress distributions in UTG without compromising the integrity of the glass.

The primary technical objectives for UTG metrology and NDT development include achieving sub-micron measurement precision, developing high-throughput inspection systems compatible with production environments, and creating multi-modal testing approaches that can characterize both physical and optical properties simultaneously. Additionally, there is a pressing need for real-time monitoring systems that can detect defects during the manufacturing process rather than in post-production quality control.

Looking forward, the industry aims to establish standardized testing protocols specifically designed for UTG materials, as current standards for conventional glass are inadequate for these ultra-thin substrates. Research efforts are focused on developing non-contact measurement technologies utilizing advanced optical, acoustic, and electromagnetic principles to characterize UTG properties without physical interaction.

The ultimate goal of UTG metrology advancement is to enable mass production of flexible display devices with consistent quality, longer lifespans, and enhanced performance characteristics. This requires not only detecting existing defects but also predicting potential failure points before they manifest, thereby improving yield rates and reducing manufacturing costs while ensuring consumer satisfaction with next-generation flexible display products.

The development of UTG represents a critical inflection point in display technology, transitioning from rigid to truly flexible form factors. This evolution has been driven by consumer demand for more versatile, durable, and aesthetically pleasing devices that can be folded or rolled without compromising display quality. The market has responded with increasingly sophisticated UTG solutions, though significant technical challenges remain in mass production and quality assurance.

Current metrology and non-destructive testing (NDT) methods for UTG face substantial limitations when applied to ultra-thin substrates. Traditional optical inspection systems struggle with the transparency and reflective properties of UTG, while contact-based measurement techniques risk damaging these delicate materials. The industry urgently needs advanced metrology solutions capable of detecting micro-defects, thickness variations, and stress distributions in UTG without compromising the integrity of the glass.

The primary technical objectives for UTG metrology and NDT development include achieving sub-micron measurement precision, developing high-throughput inspection systems compatible with production environments, and creating multi-modal testing approaches that can characterize both physical and optical properties simultaneously. Additionally, there is a pressing need for real-time monitoring systems that can detect defects during the manufacturing process rather than in post-production quality control.

Looking forward, the industry aims to establish standardized testing protocols specifically designed for UTG materials, as current standards for conventional glass are inadequate for these ultra-thin substrates. Research efforts are focused on developing non-contact measurement technologies utilizing advanced optical, acoustic, and electromagnetic principles to characterize UTG properties without physical interaction.

The ultimate goal of UTG metrology advancement is to enable mass production of flexible display devices with consistent quality, longer lifespans, and enhanced performance characteristics. This requires not only detecting existing defects but also predicting potential failure points before they manifest, thereby improving yield rates and reducing manufacturing costs while ensuring consumer satisfaction with next-generation flexible display products.

Market Demand Analysis for Flexible Display Technologies

The flexible display market has witnessed exponential growth over the past decade, driven primarily by consumer demand for more durable, lightweight, and innovative electronic devices. Market research indicates that the global flexible display market is projected to reach $42 billion by 2026, with a compound annual growth rate (CAGR) of approximately 28% from 2021 to 2026. Ultra-Thin Glass (UTG) has emerged as a critical component in this ecosystem, offering superior optical clarity, scratch resistance, and flexibility compared to alternative materials like polyimide films.

Consumer electronics, particularly smartphones and wearables, represent the largest application segment for flexible displays incorporating UTG. Major smartphone manufacturers have increasingly adopted foldable designs utilizing UTG technology, with shipments of foldable smartphones growing by 264% in 2021 alone. Market surveys indicate that consumers are willing to pay premium prices for devices featuring flexible displays, with durability and display quality cited as primary purchasing factors.

The automotive industry presents another significant growth opportunity for UTG-based flexible displays. Premium vehicle manufacturers are integrating curved and flexible displays into dashboards, center consoles, and entertainment systems. Industry forecasts suggest that the automotive display market will grow at a CAGR of 13.2% through 2027, with flexible displays representing an increasing share of this growth.

Healthcare and industrial applications are emerging as promising market segments for UTG technology. Medical devices with flexible displays offer improved ergonomics and portability, while industrial applications benefit from displays that can withstand harsh environments. These specialized markets demand rigorous quality control and reliability, highlighting the critical importance of advanced metrology and non-destructive testing methods for UTG.

Regional analysis reveals Asia-Pacific as the dominant manufacturing hub for flexible displays, with South Korea, China, and Japan leading production. However, North America and Europe represent significant consumer markets, with higher adoption rates for premium devices featuring cutting-edge display technologies.

Market challenges include high manufacturing costs, yield issues, and durability concerns. The average manufacturing cost of UTG-based flexible displays remains approximately 30% higher than conventional rigid displays, primarily due to complex production processes and quality control requirements. This cost differential underscores the importance of developing efficient metrology and non-destructive testing methods to improve yields and reduce production costs.

Consumer expectations regarding display lifetime and durability present another market challenge. Research indicates that consumers expect flexible displays to maintain performance for at least 3-5 years of regular use, necessitating robust quality assurance protocols throughout the manufacturing process.

Consumer electronics, particularly smartphones and wearables, represent the largest application segment for flexible displays incorporating UTG. Major smartphone manufacturers have increasingly adopted foldable designs utilizing UTG technology, with shipments of foldable smartphones growing by 264% in 2021 alone. Market surveys indicate that consumers are willing to pay premium prices for devices featuring flexible displays, with durability and display quality cited as primary purchasing factors.

The automotive industry presents another significant growth opportunity for UTG-based flexible displays. Premium vehicle manufacturers are integrating curved and flexible displays into dashboards, center consoles, and entertainment systems. Industry forecasts suggest that the automotive display market will grow at a CAGR of 13.2% through 2027, with flexible displays representing an increasing share of this growth.

Healthcare and industrial applications are emerging as promising market segments for UTG technology. Medical devices with flexible displays offer improved ergonomics and portability, while industrial applications benefit from displays that can withstand harsh environments. These specialized markets demand rigorous quality control and reliability, highlighting the critical importance of advanced metrology and non-destructive testing methods for UTG.

Regional analysis reveals Asia-Pacific as the dominant manufacturing hub for flexible displays, with South Korea, China, and Japan leading production. However, North America and Europe represent significant consumer markets, with higher adoption rates for premium devices featuring cutting-edge display technologies.

Market challenges include high manufacturing costs, yield issues, and durability concerns. The average manufacturing cost of UTG-based flexible displays remains approximately 30% higher than conventional rigid displays, primarily due to complex production processes and quality control requirements. This cost differential underscores the importance of developing efficient metrology and non-destructive testing methods to improve yields and reduce production costs.

Consumer expectations regarding display lifetime and durability present another market challenge. Research indicates that consumers expect flexible displays to maintain performance for at least 3-5 years of regular use, necessitating robust quality assurance protocols throughout the manufacturing process.

Current UTG Testing Challenges and Limitations

Ultra-Thin Glass (UTG) testing for flexible displays faces significant challenges due to its unique physical properties and application requirements. The primary limitation stems from UTG's extreme thinness (typically 30-100 micrometers), making it highly susceptible to damage during conventional testing procedures. Traditional contact-based testing methods risk introducing micro-fractures or surface defects that may compromise the structural integrity of the glass, rendering standard testing protocols inadequate.

Dimensional metrology of UTG presents exceptional difficulties as the material's flexibility causes measurement inconsistencies under different stress conditions. Current optical measurement systems struggle to accurately assess thickness variations across large surface areas while maintaining the sub-micron precision required for quality control in display manufacturing. This challenge is compounded by the need to detect defects at multiple scales simultaneously - from nanometer-level surface irregularities to millimeter-scale structural anomalies.

Non-destructive testing (NDT) methods face sensitivity limitations when applied to UTG. Conventional techniques like ultrasonic testing encounter signal attenuation issues in ultra-thin materials, while X-ray methods may lack sufficient resolution to detect critical micro-defects without excessive radiation exposure that could potentially alter the material properties of the glass or adjacent display components.

The integration of UTG with other display components creates complex multilayer structures that obscure defect visibility and complicate signal interpretation. Testing systems must differentiate between defects in the UTG layer versus anomalies in adjacent layers such as polarizers, touch sensors, or organic light-emitting materials. Current imaging algorithms struggle with this multi-layer discrimination task, particularly at production speeds.

Real-time monitoring during the manufacturing process represents another significant challenge. The high-speed production lines used for flexible displays require instantaneous defect detection, but existing in-line inspection systems lack the combination of speed and precision needed for UTG quality assurance. This creates a bottleneck where manufacturers must choose between production efficiency and comprehensive quality control.

Environmental factors further complicate UTG testing, as the material's mechanical and optical properties can vary significantly with temperature and humidity changes. Testing systems must account for these environmental variables to deliver consistent results across different manufacturing conditions and global production facilities.

Finally, there exists a standardization gap in the industry. Unlike established glass products, UTG lacks universally accepted testing protocols and quality benchmarks. This absence of standardization hampers comparative analysis between different UTG solutions and creates uncertainty in reliability predictions for end products incorporating this advanced material.

Dimensional metrology of UTG presents exceptional difficulties as the material's flexibility causes measurement inconsistencies under different stress conditions. Current optical measurement systems struggle to accurately assess thickness variations across large surface areas while maintaining the sub-micron precision required for quality control in display manufacturing. This challenge is compounded by the need to detect defects at multiple scales simultaneously - from nanometer-level surface irregularities to millimeter-scale structural anomalies.

Non-destructive testing (NDT) methods face sensitivity limitations when applied to UTG. Conventional techniques like ultrasonic testing encounter signal attenuation issues in ultra-thin materials, while X-ray methods may lack sufficient resolution to detect critical micro-defects without excessive radiation exposure that could potentially alter the material properties of the glass or adjacent display components.

The integration of UTG with other display components creates complex multilayer structures that obscure defect visibility and complicate signal interpretation. Testing systems must differentiate between defects in the UTG layer versus anomalies in adjacent layers such as polarizers, touch sensors, or organic light-emitting materials. Current imaging algorithms struggle with this multi-layer discrimination task, particularly at production speeds.

Real-time monitoring during the manufacturing process represents another significant challenge. The high-speed production lines used for flexible displays require instantaneous defect detection, but existing in-line inspection systems lack the combination of speed and precision needed for UTG quality assurance. This creates a bottleneck where manufacturers must choose between production efficiency and comprehensive quality control.

Environmental factors further complicate UTG testing, as the material's mechanical and optical properties can vary significantly with temperature and humidity changes. Testing systems must account for these environmental variables to deliver consistent results across different manufacturing conditions and global production facilities.

Finally, there exists a standardization gap in the industry. Unlike established glass products, UTG lacks universally accepted testing protocols and quality benchmarks. This absence of standardization hampers comparative analysis between different UTG solutions and creates uncertainty in reliability predictions for end products incorporating this advanced material.

Current UTG Metrology Solutions and Methodologies

01 Optical measurement techniques for UTG

Optical methods are widely used for non-destructive testing of ultra-thin glass, including interferometry, reflectometry, and optical scanning. These techniques allow for precise measurement of thickness variations, surface topography, and defect detection without physical contact with the delicate glass. Advanced optical systems can achieve nanometer-level precision while scanning large areas efficiently, making them ideal for production environments where maintaining glass integrity is critical.- Optical measurement techniques for UTG: Various optical measurement techniques are employed for the metrology of ultra-thin glass, including interferometry, spectroscopy, and laser-based systems. These non-destructive methods can accurately measure thickness, flatness, and surface quality of UTG without damaging the delicate material. Advanced optical systems can detect defects at the nanometer scale and provide real-time measurements during manufacturing processes, which is crucial for quality control of flexible display components.

- Mechanical testing methods for UTG flexibility and durability: Non-destructive mechanical testing methods are used to evaluate the flexibility, durability, and mechanical properties of ultra-thin glass. These include controlled bending tests, stress analysis, and micro-hardness measurements that can determine the glass's resistance to fracture and deformation without causing damage. Testing equipment specifically designed for UTG can simulate real-world usage conditions to predict performance in flexible display applications while maintaining the structural integrity of the sample.

- Defect detection and quality control systems: Specialized systems for detecting defects and ensuring quality control in ultra-thin glass manufacturing incorporate machine vision, artificial intelligence, and automated inspection technologies. These systems can identify microscopic cracks, inclusions, bubbles, and other imperfections that might compromise the performance of UTG in electronic devices. Real-time monitoring during production allows for immediate adjustments to process parameters, reducing waste and ensuring consistent quality of the final product.

- Thickness uniformity measurement and control: Precise measurement and control of thickness uniformity is critical for ultra-thin glass performance in flexible displays. Advanced metrology systems employ multiple sensors and scanning technologies to map thickness variations across the entire glass surface with nanometer precision. These non-destructive methods can detect subtle thickness gradients that might affect optical properties or mechanical reliability. Continuous monitoring during manufacturing ensures consistent thickness profiles that meet the stringent requirements for foldable device applications.

- Surface characterization and coating inspection: Surface characterization techniques for ultra-thin glass include atomic force microscopy, ellipsometry, and specialized spectroscopic methods that can evaluate surface roughness, coating uniformity, and interface quality. These non-destructive testing approaches can verify the integrity of functional coatings applied to UTG, such as anti-fingerprint layers, anti-reflective treatments, or strengthening compounds. Accurate surface analysis ensures optimal optical performance and touch sensitivity in display applications while identifying potential adhesion or durability issues before device assembly.

02 Mechanical and acoustic testing methods

Mechanical and acoustic testing approaches provide valuable data on UTG structural integrity and mechanical properties. These methods include ultrasonic testing, acoustic microscopy, and vibration analysis that can detect internal defects, delamination, and microcracks not visible to optical systems. By analyzing sound wave propagation or mechanical response characteristics, these techniques can evaluate glass strength, elasticity, and identify potential failure points without causing damage to the ultra-thin substrate.Expand Specific Solutions03 Automated inspection systems for UTG production

Automated inspection systems integrate multiple sensing technologies with advanced image processing and machine learning algorithms to enable high-throughput quality control in UTG manufacturing. These systems can simultaneously monitor thickness uniformity, detect surface and subsurface defects, and identify contamination in real-time during production. The automation allows for 100% inspection rather than sampling, significantly improving yield rates while maintaining the strict quality standards required for flexible display applications.Expand Specific Solutions04 Stress and strain measurement in UTG

Specialized techniques for measuring stress and strain distribution in ultra-thin glass are essential for predicting performance under bending and folding conditions. These methods include photoelasticity, digital image correlation, and birefringence measurement that can visualize stress patterns and quantify mechanical behavior under various loading conditions. Understanding stress distribution helps optimize glass composition and processing parameters to enhance flexibility and durability for foldable display applications.Expand Specific Solutions05 In-situ monitoring and real-time metrology

In-situ monitoring systems enable real-time measurement and quality control during UTG manufacturing and processing. These technologies integrate sensors directly into production equipment to provide immediate feedback on critical parameters such as thickness, flatness, and defect formation. Real-time data allows for process adjustments before defects propagate, reducing waste and improving consistency. Advanced systems can also track glass properties during bending, lamination, and other converting processes to ensure final product quality.Expand Specific Solutions

Key Industry Players in UTG Manufacturing and Testing

The ultra-thin glass (UTG) metrology and non-destructive testing market for flexible displays is currently in a growth phase, with increasing adoption of foldable devices driving market expansion. The global market size is projected to grow significantly as flexible display technology becomes mainstream in consumer electronics. Technologically, the field is advancing rapidly with key players developing specialized solutions. Industry leaders like Corning, Samsung Display, and BOE Technology are pioneering advanced UTG manufacturing techniques, while companies such as SCHOTT Glass and Triumph Science & Technology are focusing on improving glass durability and flexibility. Testing equipment manufacturers including Konica Minolta and Robert Bosch are developing sophisticated non-destructive testing methods to ensure UTG quality and reliability in mass production environments.

Samsung Electronics Co., Ltd.

Technical Solution: Samsung Electronics has pioneered non-destructive testing methodologies for UTG in their flexible display production, implementing a multi-stage inspection system that combines optical coherence tomography (OCT) with laser scanning confocal microscopy. Their approach enables 3D topographical mapping of UTG surfaces with vertical resolution below 10nm while scanning areas up to 300mm × 300mm. Samsung's proprietary "Flex-Test" platform integrates stress simulation during optical inspection, allowing engineers to observe how micro-defects respond under various bending conditions in real-time. The company has also developed specialized polarized light analysis techniques that can detect stress patterns and potential fracture points in UTG layers as thin as 20μm. Their automated inspection systems employ deep learning algorithms trained on millions of defect images to achieve false positive rates below 0.01%, significantly improving production yields for flexible display components.

Strengths: Comprehensive testing approach that simulates real-world bending conditions; high-throughput inspection systems fully integrated into production lines; advanced AI-based defect classification. Weaknesses: Testing methodologies optimized primarily for their own display specifications; high operational costs for maintaining precision equipment calibration across global manufacturing facilities.

Huawei Technologies Co., Ltd.

Technical Solution: Huawei has developed an innovative UTG metrology system called "GlassScan" that employs a combination of optical and acoustic techniques for non-destructive testing. Their approach utilizes phase-shifting digital holography to create nanometer-resolution 3D maps of UTG surfaces, capable of detecting defects as small as 100nm across panels up to 8 inches. Huawei's system incorporates laser speckle pattern analysis that can identify internal stress distributions within UTG layers as thin as 30μm. Their proprietary algorithm analyzes diffraction patterns to predict potential failure points before they develop into visible defects. The company has also implemented a novel approach using guided acoustic waves that propagate through the glass substrate, with sensors detecting minute variations in wave propagation that indicate subsurface anomalies. This technique achieves 98.5% detection accuracy for internal defects while maintaining testing speeds compatible with mass production requirements of over 120 panels per hour.

Strengths: Exceptional detection capabilities for both surface and subsurface defects; high throughput testing suitable for production environments; advanced predictive analytics for early defect identification. Weaknesses: System requires precise environmental controls (temperature stability within ±0.5°C); relatively new technology with limited long-term reliability data; higher initial implementation costs compared to conventional optical inspection systems.

Critical Technologies in UTG Defect Detection

UTG ultra-thin flexible glass defect detection system

PatentPendingCN115326821A

Innovation

- The nano-ceramic suction cup is combined with the cloth filter layer. The suction force of the nano-ceramic suction cup is uniform and does not cause deformation. The cloth filter layer is made of nylon cloth or polyethylene cloth with a hardness lower than glass to avoid scratches and reduce interference with imaging.

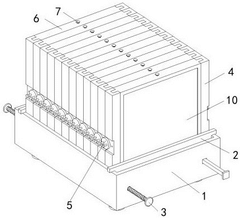

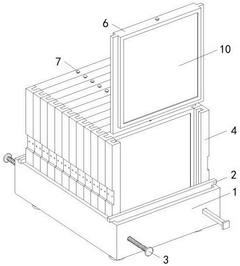

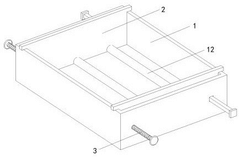

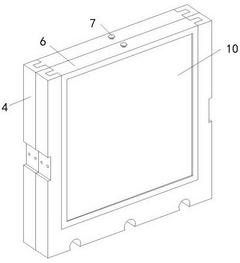

Static bending detection device for ultrathin flexible glass

PatentActiveCN221925967U

Innovation

- An ultra-thin flexible glass static bending detection device is designed, including a mounting base, a limit splint, a fastening screw, a peripheral frame, a positioning disk, a fixed insert plate, a transmission column, a connecting rod, an extrusion block, and a limit. The sliding plate and positioning slider, through the combination and adjustment mechanism of these components, can quickly adjust and stably fix the bending angle of the glass.

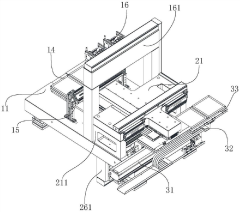

Manufacturing Integration of UTG Testing Systems

The integration of metrology and non-destructive testing systems into UTG manufacturing processes represents a critical challenge for flexible display production. Current manufacturing lines must be adapted to incorporate sophisticated testing equipment without compromising throughput or yield rates. Leading display manufacturers have developed custom integration approaches that position testing stations at strategic points throughout the production workflow, particularly after critical processes such as glass thinning, lamination, and bending operations.

Inline testing systems have emerged as the preferred solution, allowing real-time quality control without removing panels from the production line. These systems typically employ optical coherence tomography (OCT), automated optical inspection (AOI), and laser-based thickness measurement tools mounted directly on conveyor systems. The integration architecture generally follows a distributed model, with different testing methodologies applied at various production stages rather than concentrated at the end of the line.

Data management infrastructure represents another crucial integration component, with manufacturing execution systems (MES) collecting and analyzing test results in real-time. This enables statistical process control and early detection of systematic defects. Advanced implementations incorporate machine learning algorithms that can identify subtle patterns in defect occurrence, allowing for predictive maintenance and process optimization before yield rates decline significantly.

Physical integration challenges include vibration isolation, clean room compatibility, and spatial constraints. Testing equipment must operate in Class 100 or better environments while maintaining nanometer-level measurement precision. Manufacturers have developed specialized mounting systems with active vibration cancellation to address these concerns. Additionally, testing systems must accommodate the increasing size of display mother glass, which now exceeds 2.5m × 2.8m in Gen 10.5 fabs.

Integration timelines typically require 3-6 months for full implementation, with initial calibration and validation phases accounting for approximately 40% of this period. Cost considerations are substantial, with integrated testing systems representing 15-20% of total line investment. However, ROI analysis indicates these systems typically pay for themselves within 12-18 months through reduced scrap rates and improved yield.

Standardization efforts are underway through industry consortia like the Flexible Display Alliance and SEMI, aiming to establish common testing protocols and integration specifications. These initiatives seek to reduce implementation costs and accelerate adoption across the industry, particularly as UTG technology expands beyond premium smartphone segments into broader consumer electronics applications.

Inline testing systems have emerged as the preferred solution, allowing real-time quality control without removing panels from the production line. These systems typically employ optical coherence tomography (OCT), automated optical inspection (AOI), and laser-based thickness measurement tools mounted directly on conveyor systems. The integration architecture generally follows a distributed model, with different testing methodologies applied at various production stages rather than concentrated at the end of the line.

Data management infrastructure represents another crucial integration component, with manufacturing execution systems (MES) collecting and analyzing test results in real-time. This enables statistical process control and early detection of systematic defects. Advanced implementations incorporate machine learning algorithms that can identify subtle patterns in defect occurrence, allowing for predictive maintenance and process optimization before yield rates decline significantly.

Physical integration challenges include vibration isolation, clean room compatibility, and spatial constraints. Testing equipment must operate in Class 100 or better environments while maintaining nanometer-level measurement precision. Manufacturers have developed specialized mounting systems with active vibration cancellation to address these concerns. Additionally, testing systems must accommodate the increasing size of display mother glass, which now exceeds 2.5m × 2.8m in Gen 10.5 fabs.

Integration timelines typically require 3-6 months for full implementation, with initial calibration and validation phases accounting for approximately 40% of this period. Cost considerations are substantial, with integrated testing systems representing 15-20% of total line investment. However, ROI analysis indicates these systems typically pay for themselves within 12-18 months through reduced scrap rates and improved yield.

Standardization efforts are underway through industry consortia like the Flexible Display Alliance and SEMI, aiming to establish common testing protocols and integration specifications. These initiatives seek to reduce implementation costs and accelerate adoption across the industry, particularly as UTG technology expands beyond premium smartphone segments into broader consumer electronics applications.

Reliability Standards for Flexible Display Components

The reliability standards for flexible display components, particularly those incorporating Ultra-Thin Glass (UTG), have evolved significantly to address the unique challenges posed by these advanced materials. Industry standards organizations such as ASTM International, IEC, and JEDEC have developed specialized testing protocols specifically for flexible display technologies, with UTG requiring particularly stringent criteria due to its critical role in device durability.

These standards typically define minimum performance requirements across multiple stress dimensions, including mechanical flexibility (bend radius and cycles), impact resistance, and environmental durability. For UTG specifically, standards typically require survival of 100,000 to 200,000 folding cycles at specified bend radii (typically 1.5-3mm), while maintaining optical and functional integrity. This represents a significant advancement over earlier standards for plastic-based flexible substrates.

Temperature and humidity reliability standards have also been adapted for UTG implementations, with typical requirements including functionality across -40°C to 85°C operational range and survival of 1,000 hours at 85°C/85% relative humidity without delamination or optical degradation. These environmental standards are particularly crucial for consumer electronics applications where devices may experience extreme conditions.

The reliability assessment methodology for UTG components typically follows a multi-tiered approach, beginning with accelerated life testing under controlled laboratory conditions, followed by simulated real-world usage scenarios. Non-destructive testing methods such as optical coherence tomography and ultrasonic imaging have been incorporated into these standards to enable in-process quality verification without compromising the integrity of the ultra-thin materials.

Major device manufacturers have also established their own proprietary reliability standards that often exceed industry minimums. Samsung's UTG implementation, for example, reportedly undergoes testing for 200,000 fold cycles, while Corning's Willow Glass specifications include additional requirements for chemical resistance and scratch performance that go beyond basic industry standards.

Certification processes for UTG components typically require third-party verification through accredited testing laboratories, with documentation of both the testing methodology and results. This certification has become increasingly important as consumer expectations for device longevity have risen, particularly given the premium pricing of flexible display devices.

As the technology continues to mature, reliability standards are expected to evolve further, with increasing focus on quantifiable metrics for micro-crack detection, delamination resistance, and long-term optical stability under real-world usage conditions.

These standards typically define minimum performance requirements across multiple stress dimensions, including mechanical flexibility (bend radius and cycles), impact resistance, and environmental durability. For UTG specifically, standards typically require survival of 100,000 to 200,000 folding cycles at specified bend radii (typically 1.5-3mm), while maintaining optical and functional integrity. This represents a significant advancement over earlier standards for plastic-based flexible substrates.

Temperature and humidity reliability standards have also been adapted for UTG implementations, with typical requirements including functionality across -40°C to 85°C operational range and survival of 1,000 hours at 85°C/85% relative humidity without delamination or optical degradation. These environmental standards are particularly crucial for consumer electronics applications where devices may experience extreme conditions.

The reliability assessment methodology for UTG components typically follows a multi-tiered approach, beginning with accelerated life testing under controlled laboratory conditions, followed by simulated real-world usage scenarios. Non-destructive testing methods such as optical coherence tomography and ultrasonic imaging have been incorporated into these standards to enable in-process quality verification without compromising the integrity of the ultra-thin materials.

Major device manufacturers have also established their own proprietary reliability standards that often exceed industry minimums. Samsung's UTG implementation, for example, reportedly undergoes testing for 200,000 fold cycles, while Corning's Willow Glass specifications include additional requirements for chemical resistance and scratch performance that go beyond basic industry standards.

Certification processes for UTG components typically require third-party verification through accredited testing laboratories, with documentation of both the testing methodology and results. This certification has become increasingly important as consumer expectations for device longevity have risen, particularly given the premium pricing of flexible display devices.

As the technology continues to mature, reliability standards are expected to evolve further, with increasing focus on quantifiable metrics for micro-crack detection, delamination resistance, and long-term optical stability under real-world usage conditions.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!