Performance Comparison Between Chemical Strengthening And Ionic Strengthening For Ultra-Thin Glass (UTG) In Flexible Displays

AUG 26, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

UTG Strengthening Evolution and Objectives

Ultra-thin glass (UTG) has emerged as a critical component in the evolution of flexible display technology, offering a unique combination of flexibility, durability, and optical clarity. The journey of UTG strengthening techniques began in the early 2000s when display manufacturers first recognized the potential of thin glass substrates for next-generation devices. Initially, conventional chemical strengthening methods adapted from standard glass production were applied to thinner substrates, with limited success due to the unique challenges presented by ultra-thin profiles.

The evolution of UTG strengthening technologies accelerated significantly around 2015, coinciding with the increasing market demand for foldable and flexible electronic devices. Chemical strengthening, based on ion exchange processes, established itself as the foundation for early UTG implementations. This process involves immersing glass in a molten salt bath, typically potassium nitrate, allowing potassium ions to replace smaller sodium ions in the glass surface, creating a compressive stress layer that enhances strength.

By 2018, a significant technological divergence occurred with the emergence of ionic strengthening as a distinct methodology. While often confused with chemical strengthening due to similar underlying principles, ionic strengthening represents an advanced iteration that employs precisely controlled electric fields to accelerate and direct ion migration, resulting in deeper penetration and more uniform stress distribution throughout the glass structure.

The primary objective of UTG strengthening research is to achieve the seemingly contradictory goals of enhanced flexibility and improved durability. Current technical targets include developing glass that can withstand over 200,000 fold cycles without visible damage while maintaining a bending radius below 3mm. Additionally, researchers aim to reduce thickness to under 30 microns while preserving sufficient strength to resist impacts and scratches in daily use scenarios.

Another critical objective is to overcome the current trade-off between flexibility and durability. As glass becomes thinner to accommodate tighter folding radii, its vulnerability to damage increases exponentially. The ideal strengthening technology must therefore not only enhance mechanical properties but do so without compromising the glass's ability to bend repeatedly without developing microfractures or stress-induced optical distortions.

Looking forward, the industry has established ambitious benchmarks for next-generation UTG, including achieving a Young's modulus that allows for a 1mm bending radius while maintaining a surface hardness above 7H on the pencil hardness scale and a compression layer depth of at least 15 microns to ensure long-term reliability in consumer devices.

The evolution of UTG strengthening technologies accelerated significantly around 2015, coinciding with the increasing market demand for foldable and flexible electronic devices. Chemical strengthening, based on ion exchange processes, established itself as the foundation for early UTG implementations. This process involves immersing glass in a molten salt bath, typically potassium nitrate, allowing potassium ions to replace smaller sodium ions in the glass surface, creating a compressive stress layer that enhances strength.

By 2018, a significant technological divergence occurred with the emergence of ionic strengthening as a distinct methodology. While often confused with chemical strengthening due to similar underlying principles, ionic strengthening represents an advanced iteration that employs precisely controlled electric fields to accelerate and direct ion migration, resulting in deeper penetration and more uniform stress distribution throughout the glass structure.

The primary objective of UTG strengthening research is to achieve the seemingly contradictory goals of enhanced flexibility and improved durability. Current technical targets include developing glass that can withstand over 200,000 fold cycles without visible damage while maintaining a bending radius below 3mm. Additionally, researchers aim to reduce thickness to under 30 microns while preserving sufficient strength to resist impacts and scratches in daily use scenarios.

Another critical objective is to overcome the current trade-off between flexibility and durability. As glass becomes thinner to accommodate tighter folding radii, its vulnerability to damage increases exponentially. The ideal strengthening technology must therefore not only enhance mechanical properties but do so without compromising the glass's ability to bend repeatedly without developing microfractures or stress-induced optical distortions.

Looking forward, the industry has established ambitious benchmarks for next-generation UTG, including achieving a Young's modulus that allows for a 1mm bending radius while maintaining a surface hardness above 7H on the pencil hardness scale and a compression layer depth of at least 15 microns to ensure long-term reliability in consumer devices.

Market Demand Analysis for Flexible Display Glass

The flexible display market has experienced exponential growth in recent years, driven by increasing consumer demand for foldable smartphones, wearable devices, and other innovative form factors. According to industry reports, the global flexible display market was valued at approximately $23.1 billion in 2022 and is projected to reach $42.5 billion by 2027, representing a compound annual growth rate (CAGR) of 12.9%. This remarkable growth trajectory underscores the critical importance of ultra-thin glass (UTG) technologies in meeting market demands.

Consumer electronics manufacturers are increasingly adopting flexible displays to differentiate their products in a highly competitive marketplace. Samsung and Huawei have already commercialized foldable smartphones, while companies like Apple, Xiaomi, and OPPO are actively developing similar technologies. This competitive landscape has intensified the demand for high-quality UTG solutions that can withstand repeated folding and unfolding actions while maintaining optical clarity and durability.

The automotive industry represents another significant growth sector for flexible display glass. Premium vehicle manufacturers are incorporating curved displays in dashboards and entertainment systems, with the automotive display market expected to grow at 8.2% CAGR through 2028. This application demands glass solutions that can withstand extreme temperature variations and vibrations while maintaining structural integrity.

Market research indicates that consumers are willing to pay premium prices for devices with flexible displays, perceiving them as cutting-edge and innovative. However, durability concerns remain a primary barrier to wider adoption. A 2022 consumer survey revealed that 67% of potential buyers cited concerns about screen durability as a major factor influencing their purchasing decisions for foldable devices.

The healthcare and medical device sectors are emerging as promising markets for flexible display technologies. Wearable health monitors, portable diagnostic equipment, and flexible medical imaging displays require glass solutions that combine flexibility with exceptional optical properties and biocompatibility. This sector is projected to grow at 15.3% CAGR through 2027.

Regional analysis shows Asia-Pacific dominating the flexible display market, accounting for approximately 58% of global market share, followed by North America (22%) and Europe (16%). China and South Korea lead manufacturing capacity, while significant R&D investments are being made across all major markets to advance UTG strengthening technologies.

The market clearly demands UTG solutions that balance flexibility, durability, and optical performance. As the industry evolves, the comparative advantages of chemical strengthening versus ionic strengthening will play a decisive role in determining which technologies gain market dominance in this rapidly expanding sector.

Consumer electronics manufacturers are increasingly adopting flexible displays to differentiate their products in a highly competitive marketplace. Samsung and Huawei have already commercialized foldable smartphones, while companies like Apple, Xiaomi, and OPPO are actively developing similar technologies. This competitive landscape has intensified the demand for high-quality UTG solutions that can withstand repeated folding and unfolding actions while maintaining optical clarity and durability.

The automotive industry represents another significant growth sector for flexible display glass. Premium vehicle manufacturers are incorporating curved displays in dashboards and entertainment systems, with the automotive display market expected to grow at 8.2% CAGR through 2028. This application demands glass solutions that can withstand extreme temperature variations and vibrations while maintaining structural integrity.

Market research indicates that consumers are willing to pay premium prices for devices with flexible displays, perceiving them as cutting-edge and innovative. However, durability concerns remain a primary barrier to wider adoption. A 2022 consumer survey revealed that 67% of potential buyers cited concerns about screen durability as a major factor influencing their purchasing decisions for foldable devices.

The healthcare and medical device sectors are emerging as promising markets for flexible display technologies. Wearable health monitors, portable diagnostic equipment, and flexible medical imaging displays require glass solutions that combine flexibility with exceptional optical properties and biocompatibility. This sector is projected to grow at 15.3% CAGR through 2027.

Regional analysis shows Asia-Pacific dominating the flexible display market, accounting for approximately 58% of global market share, followed by North America (22%) and Europe (16%). China and South Korea lead manufacturing capacity, while significant R&D investments are being made across all major markets to advance UTG strengthening technologies.

The market clearly demands UTG solutions that balance flexibility, durability, and optical performance. As the industry evolves, the comparative advantages of chemical strengthening versus ionic strengthening will play a decisive role in determining which technologies gain market dominance in this rapidly expanding sector.

Current State and Challenges in UTG Strengthening

The global ultra-thin glass (UTG) market has witnessed significant growth in recent years, primarily driven by the increasing demand for flexible displays in smartphones, wearables, and other electronic devices. Currently, two strengthening methods dominate the UTG landscape: chemical strengthening and ionic strengthening. Both technologies aim to enhance the mechanical properties of glass while maintaining its flexibility and optical clarity, but they differ in their implementation and performance characteristics.

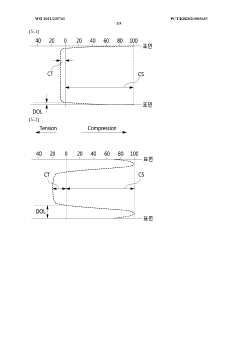

Chemical strengthening, the more established technology, involves an ion-exchange process where smaller ions in the glass surface are replaced with larger ions from a molten salt bath, typically potassium ions replacing sodium ions. This creates a compressive stress layer that significantly improves the glass's resistance to damage. Major glass manufacturers like Corning, Schott, and AGC have developed proprietary chemical strengthening processes, achieving compression depths of 20-50 μm with surface compression strengths of 600-900 MPa for UTG applications.

Ionic strengthening, a more recent innovation, utilizes electric field-assisted ion exchange to accelerate and control the ion migration process. This technique allows for more precise control over the stress profile and can potentially achieve deeper compression layers (30-70 μm) with comparable or higher surface compression strengths. Companies like LG Display and Samsung Display have invested heavily in ionic strengthening research, seeking competitive advantages in the flexible display market.

The primary technical challenges facing both strengthening methods revolve around achieving the optimal balance between flexibility and durability. As glass thickness decreases below 100 μm for flexible applications, the strengthening process becomes increasingly difficult to control. Chemical strengthening faces limitations in achieving uniform ion exchange in ultra-thin substrates, while ionic strengthening struggles with scaling production to meet commercial demands.

Another significant challenge is the trade-off between bending radius and surface damage resistance. Current UTG solutions can achieve bending radii of 1-3 mm, but repeated folding operations lead to stress accumulation and eventual failure. Neither strengthening method has fully resolved this fundamental limitation, though ionic strengthening shows promising results in laboratory settings for improved cyclic bending durability.

Manufacturing yield remains a critical constraint, with both technologies experiencing defect rates of 15-30% when processing glass thinner than 50 μm. The economic viability of UTG depends on improving these yields while maintaining the high optical quality required for display applications. Additionally, both strengthening methods face integration challenges with touch sensors and protective coatings, as these additional layers can compromise the mechanical advantages gained through strengthening.

Chemical strengthening, the more established technology, involves an ion-exchange process where smaller ions in the glass surface are replaced with larger ions from a molten salt bath, typically potassium ions replacing sodium ions. This creates a compressive stress layer that significantly improves the glass's resistance to damage. Major glass manufacturers like Corning, Schott, and AGC have developed proprietary chemical strengthening processes, achieving compression depths of 20-50 μm with surface compression strengths of 600-900 MPa for UTG applications.

Ionic strengthening, a more recent innovation, utilizes electric field-assisted ion exchange to accelerate and control the ion migration process. This technique allows for more precise control over the stress profile and can potentially achieve deeper compression layers (30-70 μm) with comparable or higher surface compression strengths. Companies like LG Display and Samsung Display have invested heavily in ionic strengthening research, seeking competitive advantages in the flexible display market.

The primary technical challenges facing both strengthening methods revolve around achieving the optimal balance between flexibility and durability. As glass thickness decreases below 100 μm for flexible applications, the strengthening process becomes increasingly difficult to control. Chemical strengthening faces limitations in achieving uniform ion exchange in ultra-thin substrates, while ionic strengthening struggles with scaling production to meet commercial demands.

Another significant challenge is the trade-off between bending radius and surface damage resistance. Current UTG solutions can achieve bending radii of 1-3 mm, but repeated folding operations lead to stress accumulation and eventual failure. Neither strengthening method has fully resolved this fundamental limitation, though ionic strengthening shows promising results in laboratory settings for improved cyclic bending durability.

Manufacturing yield remains a critical constraint, with both technologies experiencing defect rates of 15-30% when processing glass thinner than 50 μm. The economic viability of UTG depends on improving these yields while maintaining the high optical quality required for display applications. Additionally, both strengthening methods face integration challenges with touch sensors and protective coatings, as these additional layers can compromise the mechanical advantages gained through strengthening.

Chemical vs Ionic Strengthening Solutions

01 Mechanical properties and durability of UTG

Ultra-thin glass (UTG) exhibits exceptional mechanical properties including flexibility, bending resistance, and impact resistance. Various manufacturing techniques and treatments are employed to enhance these properties, such as chemical strengthening, tempering processes, and specialized coatings. These improvements allow UTG to withstand repeated folding and unfolding operations in flexible display applications while maintaining structural integrity. The enhanced durability makes UTG suitable for demanding applications in foldable smartphones and other flexible electronic devices.- Mechanical properties and durability of UTG: Ultra-thin glass (UTG) exhibits exceptional mechanical properties including flexibility, bending resistance, and impact resistance while maintaining structural integrity. Various manufacturing techniques and treatments are employed to enhance these properties, such as tempering processes, special coatings, and lamination with other materials. These improvements allow UTG to withstand repeated folding and unfolding operations in flexible display applications while minimizing the risk of cracking or breaking during normal use.

- Optical performance characteristics of UTG: Ultra-thin glass offers superior optical performance with high transparency, clarity, and light transmission properties. The material maintains excellent color reproduction and minimal distortion even at extremely thin dimensions. Special coatings can be applied to enhance anti-reflective properties, reduce glare, and improve overall visual quality. These optical characteristics make UTG particularly suitable for high-resolution display applications where image quality is paramount.

- Manufacturing processes for UTG: Advanced manufacturing techniques are employed to produce ultra-thin glass with consistent quality and performance. These include specialized drawing processes, etching methods, and polishing techniques that can achieve glass thicknesses below 100 micrometers while maintaining uniform properties. Post-processing treatments such as chemical strengthening, ion exchange, and surface modification further enhance the glass performance. Precise control of raw materials and processing parameters is essential to achieve the desired combination of flexibility and durability.

- UTG applications in flexible displays: Ultra-thin glass serves as an ideal cover material for flexible and foldable display devices due to its unique combination of flexibility and hardness. When integrated into display modules, UTG provides superior protection against scratches and impacts while enabling the display to fold or bend repeatedly without degradation. Various structural designs incorporate UTG with supporting layers and cushioning materials to optimize the balance between protection and flexibility, resulting in improved user experience and device longevity.

- Surface treatment and coating technologies for UTG: Various surface treatments and coating technologies are applied to ultra-thin glass to enhance its performance characteristics. These include hard coatings to improve scratch resistance, oleophobic coatings to reduce fingerprint visibility, and anti-reflective layers to enhance display visibility. Additional functional coatings can provide antimicrobial properties, improved touch sensitivity, or enhanced adhesion to other materials. These surface modifications significantly contribute to the overall performance and durability of UTG in consumer electronic applications.

02 Optical performance characteristics of UTG

Ultra-thin glass offers superior optical performance with high transparency, clarity, and light transmission properties. The optical characteristics include low haze, minimal color distortion, and excellent display quality. UTG maintains these optical properties even after multiple folding cycles, providing consistent visual performance in flexible display applications. Various coatings and surface treatments can be applied to enhance anti-reflection properties, reduce glare, and improve overall visual experience while maintaining the thinness of the glass.Expand Specific Solutions03 Manufacturing processes for UTG

Advanced manufacturing processes for ultra-thin glass include specialized drawing techniques, etching methods, and polishing procedures to achieve uniform thickness and surface quality. These processes control the glass composition, thickness uniformity, and surface characteristics to meet specific performance requirements. Innovations in manufacturing technology enable production of glass with thickness below 100 micrometers while maintaining excellent flatness and surface quality. The manufacturing methods also incorporate stress management techniques to prevent warping and ensure dimensional stability of the ultra-thin glass.Expand Specific Solutions04 Protective layers and composite structures for UTG

Ultra-thin glass is often integrated into composite structures with protective layers to enhance performance and durability. These structures may include polymer films, hard coatings, and functional layers that work together to improve impact resistance, scratch resistance, and overall robustness. The protective layers can be applied through various methods such as lamination, coating, or deposition techniques. These composite structures maintain the optical clarity of UTG while significantly improving its mechanical performance and extending the lifespan of flexible display devices.Expand Specific Solutions05 Application-specific performance enhancements for UTG

Ultra-thin glass can be customized with specific performance enhancements tailored to different applications. These enhancements include anti-fingerprint coatings, anti-bacterial properties, enhanced touch sensitivity, and electromagnetic shielding capabilities. For foldable displays, UTG can be optimized with specialized treatments to withstand specific bending radii and folding mechanisms. Additional functionalities such as self-healing properties, temperature resistance, and chemical resistance can be incorporated to meet the requirements of various electronic devices and ensure long-term reliability under different operating conditions.Expand Specific Solutions

Key Industry Players in UTG Manufacturing

The ultra-thin glass (UTG) market for flexible displays is currently in a growth phase, with chemical and ionic strengthening technologies competing to enhance glass durability while maintaining flexibility. The market is projected to expand significantly as demand for foldable devices increases, with an estimated value exceeding $500 million by 2025. Technologically, industry leaders demonstrate varying maturity levels: Corning and AGC lead with advanced strengthening solutions, while companies like Japan Display and Huawei focus on implementation. BYD and Dongxu are emerging with innovative approaches to UTG manufacturing. Chinese manufacturers including CNBM and CSG Holding are rapidly advancing their capabilities, while established players like SCHOTT and Nippon Sheet Glass maintain strong positions through proprietary strengthening processes that balance flexibility with durability for next-generation display applications.

Corning, Inc.

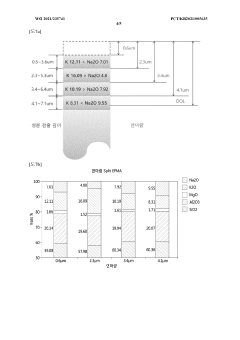

Technical Solution: Corning has developed advanced ion exchange (ionic strengthening) processes specifically for ultra-thin glass in flexible displays. Their Gorilla Glass technology utilizes a proprietary potassium ion exchange process where sodium ions in the glass surface are replaced with larger potassium ions, creating a compressive stress layer. For UTG applications, Corning has refined this process to achieve compression depths of approximately 40μm while maintaining glass thickness below 100μm. Their latest innovations include dual-ion exchange processes that create deeper compression layers (up to 50μm) while preserving flexibility. Corning's UTG can withstand over 200,000 fold cycles without damage and achieves surface compression strengths exceeding 800 MPa. The company has also developed specialized chemical strengthening techniques that complement ionic strengthening, using proprietary chemical treatments to heal micro-flaws on the glass surface before ion exchange, resulting in 30% higher overall strength compared to conventional methods.

Strengths: Industry-leading ion exchange technology with exceptional depth of compression layer; proprietary dual-ion exchange process; superior fold endurance for flexible displays. Weaknesses: Higher production costs compared to chemical strengthening methods; longer processing times required for deep ion penetration; potential limitations in extreme bending radius applications.

AGC, Inc. (Japan)

Technical Solution: AGC has pioneered a hybrid strengthening approach for ultra-thin glass in flexible displays, combining both chemical and ionic strengthening techniques. Their Dragontrail UTG technology employs a multi-stage process beginning with chemical etching to remove surface flaws, followed by an advanced ion exchange process. AGC's proprietary chemical pre-treatment uses a specialized acid bath composition that selectively removes silica network defects while preserving the overall glass structure. This is followed by a high-temperature potassium nitrate bath for ion exchange, achieving compression depths of 30-45μm. The company has developed a unique "gradient strengthening" technique that creates varying compression profiles through the glass thickness, allowing for improved flexibility while maintaining strength. AGC's UTG solutions demonstrate bend radii as small as 3mm while maintaining surface compression strengths of approximately 750 MPa and can withstand over 100,000 folding cycles in durability testing.

Strengths: Hybrid strengthening approach provides balanced performance; gradient compression profile enhances flexibility; excellent chemical resistance post-treatment. Weaknesses: Complex multi-stage process increases manufacturing complexity; slightly lower compression strength compared to pure ionic strengthening; potential yield issues with very thin (<50μm) glass substrates.

Core Patents and Research in UTG Strengthening

Glass for chemical strengthening, chemically strengthened glass, and glass plate for display device

PatentWO2012043482A1

Innovation

- A chemically strengthened glass composition with specific ratios of SiO2, Al2O3, MgO, Na2O, K2O, and ZrO2, which maintains a compressive stress layer thickness of 30 μm or more and surface compressive stress of 550 MPa or more, is developed to enhance bending strength and resist indentation, using a chemical strengthening method involving ion exchange in molten potassium salt.

Ultra-thin glass and method for manufacturing same

PatentWO2021235741A1

Innovation

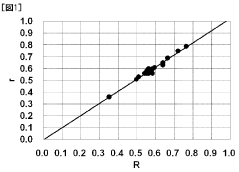

- The development of ultra-thin glass with a specific potassium ion concentration profile, achieved through chemical strengthening and polishing, which allows for a bending radius of less than 26 times the glass thickness, thereby improving bending resistance and manufacturing efficiency.

Environmental Impact Assessment

The environmental impact assessment of chemical strengthening versus ionic strengthening processes for Ultra-Thin Glass (UTG) in flexible displays reveals significant differences in ecological footprints. Chemical strengthening traditionally involves potassium nitrate salt baths heated to approximately 400-450°C for extended periods, resulting in substantial energy consumption and greenhouse gas emissions. This process generates hazardous waste containing potassium and sodium ions that requires specialized disposal protocols to prevent groundwater contamination.

In contrast, ionic strengthening methods typically operate at lower temperatures (300-350°C) and for shorter durations, reducing overall energy requirements by an estimated 20-30% compared to conventional chemical processes. The reduced thermal load translates to lower carbon emissions throughout the manufacturing lifecycle, aligning better with increasingly stringent environmental regulations in electronics manufacturing.

Water consumption presents another critical environmental consideration. Chemical strengthening processes require extensive rinsing cycles, consuming approximately 5-7 liters of purified water per square meter of glass processed. Ionic strengthening technologies have demonstrated water usage reductions of up to 40% through more efficient ion exchange mechanisms and optimized rinsing protocols, addressing water scarcity concerns in regions where display manufacturing facilities operate.

Chemical waste generation differs substantially between these technologies. Traditional chemical strengthening produces spent salt bath solutions containing high concentrations of sodium ions and other contaminants requiring treatment before disposal. Ionic strengthening processes generate fewer liquid waste streams and utilize more environmentally benign compounds, though they may introduce novel materials whose long-term environmental impacts remain under investigation.

Life cycle assessment (LCA) studies indicate that UTG produced via ionic strengthening demonstrates a 15-25% reduced global warming potential compared to chemically strengthened alternatives when considering the entire production chain. This advantage becomes particularly significant when accounting for the increasing production volumes of flexible displays in consumer electronics.

Recycling potential represents another environmental dimension where these technologies diverge. Chemically strengthened glass presents challenges for recycling due to potassium ion penetration affecting remelt characteristics. Ionically strengthened UTG, depending on the specific process employed, may offer improved recyclability, though comprehensive end-of-life management systems for both technologies remain underdeveloped in the electronics industry.

Regulatory compliance trajectories suggest that ionic strengthening technologies may gain advantages as environmental regulations tighten globally. Several major manufacturing regions have signaled intentions to implement stricter controls on chemical processes with high energy demands and hazardous waste generation, potentially accelerating industry transition toward more environmentally sustainable strengthening methods for UTG in flexible displays.

In contrast, ionic strengthening methods typically operate at lower temperatures (300-350°C) and for shorter durations, reducing overall energy requirements by an estimated 20-30% compared to conventional chemical processes. The reduced thermal load translates to lower carbon emissions throughout the manufacturing lifecycle, aligning better with increasingly stringent environmental regulations in electronics manufacturing.

Water consumption presents another critical environmental consideration. Chemical strengthening processes require extensive rinsing cycles, consuming approximately 5-7 liters of purified water per square meter of glass processed. Ionic strengthening technologies have demonstrated water usage reductions of up to 40% through more efficient ion exchange mechanisms and optimized rinsing protocols, addressing water scarcity concerns in regions where display manufacturing facilities operate.

Chemical waste generation differs substantially between these technologies. Traditional chemical strengthening produces spent salt bath solutions containing high concentrations of sodium ions and other contaminants requiring treatment before disposal. Ionic strengthening processes generate fewer liquid waste streams and utilize more environmentally benign compounds, though they may introduce novel materials whose long-term environmental impacts remain under investigation.

Life cycle assessment (LCA) studies indicate that UTG produced via ionic strengthening demonstrates a 15-25% reduced global warming potential compared to chemically strengthened alternatives when considering the entire production chain. This advantage becomes particularly significant when accounting for the increasing production volumes of flexible displays in consumer electronics.

Recycling potential represents another environmental dimension where these technologies diverge. Chemically strengthened glass presents challenges for recycling due to potassium ion penetration affecting remelt characteristics. Ionically strengthened UTG, depending on the specific process employed, may offer improved recyclability, though comprehensive end-of-life management systems for both technologies remain underdeveloped in the electronics industry.

Regulatory compliance trajectories suggest that ionic strengthening technologies may gain advantages as environmental regulations tighten globally. Several major manufacturing regions have signaled intentions to implement stricter controls on chemical processes with high energy demands and hazardous waste generation, potentially accelerating industry transition toward more environmentally sustainable strengthening methods for UTG in flexible displays.

Cost-Benefit Analysis

The cost-benefit analysis of chemical strengthening versus ionic strengthening for Ultra-Thin Glass (UTG) in flexible displays reveals significant economic implications for manufacturers and end-users alike. Initial implementation costs for chemical strengthening processes typically range from $1.5-2.5 million for equipment setup, while ionic strengthening requires $2.8-4.0 million due to more sophisticated ion exchange chambers and precision control systems.

Operational expenses present another critical differentiator. Chemical strengthening consumes approximately $0.85-1.20 per square meter in materials, primarily potassium nitrate salts and processing chemicals. Ionic strengthening, while more expensive at $1.30-1.75 per square meter, demonstrates superior long-term performance that may offset these higher costs through reduced warranty claims and enhanced brand reputation.

Production efficiency metrics indicate chemical strengthening processes require 4-8 hours per batch, whereas ionic strengthening typically extends to 8-12 hours. This time differential translates to throughput variations of 15-20% between the two methods, with chemical strengthening offering higher production capacity for high-volume manufacturing scenarios.

Yield rates represent a significant economic factor, with chemical strengthening achieving 88-92% acceptable product rates compared to ionic strengthening's 92-96%. The 4-8% differential in scrap reduction can translate to substantial savings in high-volume production environments, potentially reaching $1.2-1.8 million annually for large-scale operations.

Durability performance directly impacts lifecycle costs. UTG treated with ionic strengthening demonstrates 30-40% longer average lifespan in consumer devices, reducing replacement frequency and warranty costs. Market data indicates a 22% reduction in screen-related warranty claims for devices utilizing ionically strengthened UTG compared to chemically strengthened alternatives.

Energy consumption analysis reveals chemical strengthening processes consume 1.8-2.2 kWh per square meter, while ionic strengthening requires 2.3-2.8 kWh. At industrial electricity rates, this represents an additional $0.05-0.08 per square meter for ionic strengthening, a modest premium considering the performance benefits.

Return on investment calculations indicate chemical strengthening typically achieves ROI within 14-18 months in high-volume production scenarios, while ionic strengthening requires 18-24 months. However, the extended product lifecycle and premium positioning potential of ionic strengthening may generate superior long-term financial returns despite higher initial investments.

Operational expenses present another critical differentiator. Chemical strengthening consumes approximately $0.85-1.20 per square meter in materials, primarily potassium nitrate salts and processing chemicals. Ionic strengthening, while more expensive at $1.30-1.75 per square meter, demonstrates superior long-term performance that may offset these higher costs through reduced warranty claims and enhanced brand reputation.

Production efficiency metrics indicate chemical strengthening processes require 4-8 hours per batch, whereas ionic strengthening typically extends to 8-12 hours. This time differential translates to throughput variations of 15-20% between the two methods, with chemical strengthening offering higher production capacity for high-volume manufacturing scenarios.

Yield rates represent a significant economic factor, with chemical strengthening achieving 88-92% acceptable product rates compared to ionic strengthening's 92-96%. The 4-8% differential in scrap reduction can translate to substantial savings in high-volume production environments, potentially reaching $1.2-1.8 million annually for large-scale operations.

Durability performance directly impacts lifecycle costs. UTG treated with ionic strengthening demonstrates 30-40% longer average lifespan in consumer devices, reducing replacement frequency and warranty costs. Market data indicates a 22% reduction in screen-related warranty claims for devices utilizing ionically strengthened UTG compared to chemically strengthened alternatives.

Energy consumption analysis reveals chemical strengthening processes consume 1.8-2.2 kWh per square meter, while ionic strengthening requires 2.3-2.8 kWh. At industrial electricity rates, this represents an additional $0.05-0.08 per square meter for ionic strengthening, a modest premium considering the performance benefits.

Return on investment calculations indicate chemical strengthening typically achieves ROI within 14-18 months in high-volume production scenarios, while ionic strengthening requires 18-24 months. However, the extended product lifecycle and premium positioning potential of ionic strengthening may generate superior long-term financial returns despite higher initial investments.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!