Cost-Benefit Analysis Of Ultra-Thin Glass (UTG) For Wearables Vs Foldable Devices In Flexible Displays

AUG 26, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

UTG Technology Evolution and Objectives

Ultra-Thin Glass (UTG) technology represents a significant advancement in flexible display materials, evolving from traditional rigid glass solutions to meet the demands of modern flexible devices. The journey began in the early 2010s when display manufacturers recognized the limitations of plastic substrates in delivering optimal visual quality and scratch resistance for flexible screens. This recognition sparked intensive research into developing glass that could maintain the superior optical properties of traditional glass while adding flexibility.

The evolution of UTG technology has been marked by progressive thickness reduction. Initial iterations achieved thicknesses of approximately 100 micrometers in 2016-2017, which represented a breakthrough but still faced durability challenges when folded repeatedly. By 2019, manufacturers successfully reduced UTG thickness to below 50 micrometers while implementing specialized strengthening processes to enhance durability.

A critical milestone in UTG development was the introduction of chemical strengthening techniques specifically adapted for ultra-thin substrates. These processes allowed UTG to withstand the mechanical stress of repeated folding while maintaining optical clarity. The integration of additional protective polymer layers further enhanced UTG's practical viability in commercial applications.

Current state-of-the-art UTG solutions have reached thicknesses between 30-40 micrometers, representing an optimal balance between flexibility and durability. Research continues toward achieving sub-30 micrometer thickness while maintaining reliability standards required for consumer electronics.

The primary technical objectives for UTG development focus on several key parameters. First is achieving the optimal balance between thinness and durability, as excessive thinness compromises structural integrity while excessive thickness limits flexibility. Second is enhancing fold endurance to withstand 200,000+ folding cycles without degradation, essential for long-term device reliability.

Additional objectives include improving impact resistance without adding significant thickness, reducing production costs to enable wider adoption across price segments, and developing specialized formulations optimized for different device categories. For wearables, the focus is on maximizing curvature potential and impact resistance, while foldable smartphones require emphasis on fold durability and crease minimization.

The ultimate goal of UTG technology evolution is to enable next-generation flexible displays that combine the superior optical properties of glass with the mechanical flexibility previously only possible with plastic substrates, while delivering cost-effectiveness that supports mass-market adoption across both wearable and foldable device categories.

The evolution of UTG technology has been marked by progressive thickness reduction. Initial iterations achieved thicknesses of approximately 100 micrometers in 2016-2017, which represented a breakthrough but still faced durability challenges when folded repeatedly. By 2019, manufacturers successfully reduced UTG thickness to below 50 micrometers while implementing specialized strengthening processes to enhance durability.

A critical milestone in UTG development was the introduction of chemical strengthening techniques specifically adapted for ultra-thin substrates. These processes allowed UTG to withstand the mechanical stress of repeated folding while maintaining optical clarity. The integration of additional protective polymer layers further enhanced UTG's practical viability in commercial applications.

Current state-of-the-art UTG solutions have reached thicknesses between 30-40 micrometers, representing an optimal balance between flexibility and durability. Research continues toward achieving sub-30 micrometer thickness while maintaining reliability standards required for consumer electronics.

The primary technical objectives for UTG development focus on several key parameters. First is achieving the optimal balance between thinness and durability, as excessive thinness compromises structural integrity while excessive thickness limits flexibility. Second is enhancing fold endurance to withstand 200,000+ folding cycles without degradation, essential for long-term device reliability.

Additional objectives include improving impact resistance without adding significant thickness, reducing production costs to enable wider adoption across price segments, and developing specialized formulations optimized for different device categories. For wearables, the focus is on maximizing curvature potential and impact resistance, while foldable smartphones require emphasis on fold durability and crease minimization.

The ultimate goal of UTG technology evolution is to enable next-generation flexible displays that combine the superior optical properties of glass with the mechanical flexibility previously only possible with plastic substrates, while delivering cost-effectiveness that supports mass-market adoption across both wearable and foldable device categories.

Market Demand Analysis for Flexible Display Solutions

The flexible display market has witnessed exponential growth over the past five years, with a market valuation reaching $15.7 billion in 2022. Industry analysts project this figure to surpass $40 billion by 2027, representing a compound annual growth rate (CAGR) of approximately 20.5%. This remarkable expansion is primarily driven by increasing consumer demand for innovative form factors in smartphones, wearables, and other electronic devices.

Within this broader market, Ultra-Thin Glass (UTG) has emerged as a critical component technology, particularly for premium flexible display applications. Consumer research indicates that end-users are willing to pay a 15-25% premium for devices featuring UTG displays compared to polymer-based alternatives, citing improved scratch resistance and optical clarity as key decision factors.

The wearable technology segment presents a particularly compelling case for UTG implementation. Market research shows that the global smartwatch market alone is expected to grow at 14.5% CAGR through 2026, with high-end models increasingly adopting flexible display technologies. Consumer surveys reveal that 67% of potential smartwatch buyers consider display quality and durability among their top three purchase considerations.

For foldable smartphones, which represent the other major application area for UTG, market adoption has been accelerating despite higher price points. Shipments of foldable smartphones increased by 75% year-over-year in 2022, reaching approximately 14.2 million units. Industry forecasts suggest this figure could reach 50 million units by 2025, representing significant growth potential for UTG suppliers.

Regional analysis reveals varying adoption patterns, with East Asian markets (particularly South Korea, China, and Japan) showing the highest penetration rates for foldable devices. North American and European markets demonstrate stronger preference for premium wearables with flexible displays. This geographic distribution has important implications for UTG supply chain development and regional marketing strategies.

Consumer pain points differ significantly between wearable and foldable device segments. For wearables, battery life impact and cost premiums represent the primary concerns regarding UTG implementation. For foldable devices, consumers express greater concern about long-term durability and visible crease formation at fold points. These distinct market requirements necessitate tailored UTG solutions for each application.

Enterprise and industrial applications represent an emerging market segment for flexible displays incorporating UTG. Healthcare, logistics, and manufacturing sectors have shown increasing interest in ruggedized wearable displays that can withstand harsh operating environments while maintaining excellent visibility – requirements that align well with UTG's performance characteristics.

Within this broader market, Ultra-Thin Glass (UTG) has emerged as a critical component technology, particularly for premium flexible display applications. Consumer research indicates that end-users are willing to pay a 15-25% premium for devices featuring UTG displays compared to polymer-based alternatives, citing improved scratch resistance and optical clarity as key decision factors.

The wearable technology segment presents a particularly compelling case for UTG implementation. Market research shows that the global smartwatch market alone is expected to grow at 14.5% CAGR through 2026, with high-end models increasingly adopting flexible display technologies. Consumer surveys reveal that 67% of potential smartwatch buyers consider display quality and durability among their top three purchase considerations.

For foldable smartphones, which represent the other major application area for UTG, market adoption has been accelerating despite higher price points. Shipments of foldable smartphones increased by 75% year-over-year in 2022, reaching approximately 14.2 million units. Industry forecasts suggest this figure could reach 50 million units by 2025, representing significant growth potential for UTG suppliers.

Regional analysis reveals varying adoption patterns, with East Asian markets (particularly South Korea, China, and Japan) showing the highest penetration rates for foldable devices. North American and European markets demonstrate stronger preference for premium wearables with flexible displays. This geographic distribution has important implications for UTG supply chain development and regional marketing strategies.

Consumer pain points differ significantly between wearable and foldable device segments. For wearables, battery life impact and cost premiums represent the primary concerns regarding UTG implementation. For foldable devices, consumers express greater concern about long-term durability and visible crease formation at fold points. These distinct market requirements necessitate tailored UTG solutions for each application.

Enterprise and industrial applications represent an emerging market segment for flexible displays incorporating UTG. Healthcare, logistics, and manufacturing sectors have shown increasing interest in ruggedized wearable displays that can withstand harsh operating environments while maintaining excellent visibility – requirements that align well with UTG's performance characteristics.

Current UTG Implementation Challenges

The implementation of Ultra-Thin Glass (UTG) in flexible displays presents significant technical challenges despite its promising potential. Manufacturing UTG with consistent quality remains one of the primary obstacles. The production process requires precise control of glass composition, temperature, and drawing speed to achieve uniform thickness below 100 micrometers while maintaining optical clarity and mechanical integrity. Current yield rates for high-quality UTG remain suboptimal, driving up production costs and limiting mass-market adoption.

Material handling during the manufacturing process poses another substantial challenge. UTG's extreme thinness makes it highly susceptible to damage during production, transportation, and assembly. Specialized equipment and handling protocols are necessary, requiring significant capital investment and specialized training for production personnel. Even minor mishandling can result in microscopic fractures that compromise the structural integrity of the final product.

Integration of UTG with other display components presents complex engineering challenges. The bonding process between UTG and flexible OLED panels requires advanced adhesive technologies that maintain flexibility while ensuring durability through thousands of folding cycles. Current adhesives often represent a compromise between flexibility and bonding strength, with optimal solutions still under development.

Durability concerns persist despite advances in UTG technology. While significantly more scratch-resistant than polymer alternatives, UTG remains vulnerable to impact damage and stress fractures, particularly at fold points in foldable devices. The development of additional protective layers and specialized hardening treatments has improved durability but added complexity and cost to the manufacturing process.

Scale-up challenges further complicate widespread UTG adoption. Current production capacity remains limited to a handful of specialized manufacturers, creating supply chain vulnerabilities and pricing pressures. The complex equipment required for UTG production represents a significant barrier to entry for new manufacturers, limiting competition and innovation in the space.

Cost factors remain perhaps the most significant implementation challenge. The specialized manufacturing processes, high-precision equipment, and relatively low yields contribute to production costs significantly higher than traditional display glass or polymer alternatives. This cost differential is particularly problematic for wearable devices, where price sensitivity is higher than in premium foldable smartphones, creating different value propositions across device categories.

Material handling during the manufacturing process poses another substantial challenge. UTG's extreme thinness makes it highly susceptible to damage during production, transportation, and assembly. Specialized equipment and handling protocols are necessary, requiring significant capital investment and specialized training for production personnel. Even minor mishandling can result in microscopic fractures that compromise the structural integrity of the final product.

Integration of UTG with other display components presents complex engineering challenges. The bonding process between UTG and flexible OLED panels requires advanced adhesive technologies that maintain flexibility while ensuring durability through thousands of folding cycles. Current adhesives often represent a compromise between flexibility and bonding strength, with optimal solutions still under development.

Durability concerns persist despite advances in UTG technology. While significantly more scratch-resistant than polymer alternatives, UTG remains vulnerable to impact damage and stress fractures, particularly at fold points in foldable devices. The development of additional protective layers and specialized hardening treatments has improved durability but added complexity and cost to the manufacturing process.

Scale-up challenges further complicate widespread UTG adoption. Current production capacity remains limited to a handful of specialized manufacturers, creating supply chain vulnerabilities and pricing pressures. The complex equipment required for UTG production represents a significant barrier to entry for new manufacturers, limiting competition and innovation in the space.

Cost factors remain perhaps the most significant implementation challenge. The specialized manufacturing processes, high-precision equipment, and relatively low yields contribute to production costs significantly higher than traditional display glass or polymer alternatives. This cost differential is particularly problematic for wearable devices, where price sensitivity is higher than in premium foldable smartphones, creating different value propositions across device categories.

Cost-Benefit Comparison of UTG Applications

01 Manufacturing processes and cost reduction techniques for UTG

Various manufacturing processes have been developed to reduce the cost of Ultra-Thin Glass (UTG) production. These include improved thinning methods, efficient cutting techniques, and automated production lines that minimize material waste. Cost reduction is achieved through optimized processing parameters, reduced energy consumption, and increased yield rates. These manufacturing innovations help balance the higher production costs of UTG with its premium performance characteristics.- Manufacturing processes and cost reduction techniques for UTG: Various manufacturing processes have been developed to reduce the production costs of ultra-thin glass (UTG). These include improved thinning methods, specialized handling techniques for fragile glass sheets, and automated production lines that minimize waste and increase yield. Cost reduction is achieved through optimized raw material usage, energy-efficient processing, and streamlined manufacturing workflows that reduce the number of production steps.

- Durability and protection solutions for UTG in foldable devices: Ultra-thin glass offers superior scratch resistance compared to polymer alternatives, but requires additional protective layers to withstand repeated folding. Composite structures combining UTG with polymer films provide a balance of flexibility and durability. Various protection solutions include specialized coatings, reinforcement layers, and structural designs that distribute stress during folding operations, extending the lifespan of UTG-based displays and improving their cost-effectiveness over the device lifecycle.

- Performance benefits of UTG in display applications: Ultra-thin glass provides significant performance advantages in display applications, including superior optical clarity, better color reproduction, and improved touch sensitivity compared to plastic alternatives. UTG enables higher resolution displays with better light transmission properties and reduced power consumption. The material's thermal stability also allows for more consistent display performance across varying environmental conditions, justifying its higher initial cost through enhanced user experience and device functionality.

- Cost-benefit analysis of UTG versus polymer alternatives: While ultra-thin glass has a higher initial production cost compared to polymer alternatives like polyimide, it offers long-term economic benefits through superior durability, better optical properties, and enhanced user experience. The cost-benefit analysis considers factors such as production scalability, device longevity, customer satisfaction, and brand perception. As manufacturing techniques improve and production volumes increase, the cost gap between UTG and polymer alternatives is narrowing, making UTG increasingly cost-effective for premium electronic devices.

- Integration challenges and solutions for UTG in flexible electronics: Incorporating ultra-thin glass into flexible electronic devices presents several technical challenges that impact overall cost-effectiveness. These include developing specialized bonding techniques for attaching UTG to other components, designing flexible circuit connections that maintain integrity during folding, and creating manufacturing processes that can handle extremely thin glass without breakage. Solutions include new adhesive technologies, innovative hinge designs, and specialized handling equipment that collectively improve manufacturing yield and reduce costs while maintaining the performance benefits of UTG.

02 UTG applications in flexible display technology

Ultra-Thin Glass offers significant benefits for flexible display applications, particularly in foldable smartphones and wearable devices. Compared to polymer alternatives, UTG provides superior optical clarity, scratch resistance, and durability while maintaining flexibility. The improved user experience and device longevity justify the higher initial cost of UTG implementation. The material enables thinner device profiles and more reliable folding mechanisms, creating premium consumer electronics with extended lifespans.Expand Specific Solutions03 UTG durability and protection solutions

While Ultra-Thin Glass offers excellent optical properties, its thinness presents durability challenges. Cost-effective protection solutions have been developed, including specialized coating technologies, composite structures, and reinforcement layers. These protective measures extend UTG lifespan while preserving its beneficial properties. The additional protection systems add incremental cost but significantly improve the overall value proposition by reducing replacement frequency and maintaining performance over time.Expand Specific Solutions04 UTG performance comparison with alternative materials

Cost-benefit analyses comparing Ultra-Thin Glass with alternative materials like polyimide films and hybrid solutions show that UTG offers superior optical clarity, better scratch resistance, and improved touch sensitivity. While UTG has higher initial costs, its performance advantages and longer lifespan often result in better long-term value. The premium user experience provided by UTG justifies its use in high-end devices where quality and durability are prioritized over initial cost considerations.Expand Specific Solutions05 UTG thickness optimization for cost-performance balance

Finding the optimal thickness for Ultra-Thin Glass involves balancing manufacturing costs against performance requirements. Research shows that specific thickness ranges provide the best cost-to-performance ratio for different applications. Thinner glass reduces material costs but requires more sophisticated handling equipment, while slightly thicker variants may offer better durability with minimal flexibility loss. This optimization process helps manufacturers achieve the most economical UTG solution while meeting application-specific requirements.Expand Specific Solutions

Key UTG Manufacturers and Market Competition

The ultra-thin glass (UTG) market for flexible displays is currently in a growth phase, with increasing adoption in both wearables and foldable devices. The market size is expanding rapidly, projected to reach significant value as demand for flexible display technologies rises. From a technical maturity perspective, UTG technology has evolved considerably, with companies like Samsung Display, Schott AG, and Corning leading innovation through advanced manufacturing processes and material science breakthroughs. Chinese manufacturers including Triumph Science & Technology, Dongxu Technology Group, and Wuhan China Star Optoelectronics are rapidly closing the technology gap with substantial investments in R&D. While UTG applications in wearables offer cost advantages due to smaller form factors, the technology presents greater value proposition in foldable devices despite higher implementation costs, as manufacturers like Samsung Electronics, Huawei, and OPPO continue to refine production techniques to improve durability while reducing thickness.

Samsung Electronics Co., Ltd.

Technical Solution: Samsung Electronics has pioneered Ultra-Thin Glass (UTG) technology for both foldable smartphones and wearables through their "Samsung Ultra-Thin Glass" solution. Their approach involves a proprietary process that creates glass as thin as 30 micrometers while maintaining critical flexibility and durability properties. For foldable devices like the Galaxy Z Fold and Z Flip series, Samsung applies a multi-layer structure where UTG serves as the core material, supplemented by a polymer layer on top for additional protection against scratches and impacts. This composite structure allows for a folding radius of approximately 1.4mm while surviving over 200,000 fold cycles in laboratory testing[1]. For wearables, Samsung has adapted the UTG technology to create curved but non-folding displays with enhanced scratch resistance compared to polymer alternatives, while maintaining the premium look and feel of glass. Their cost optimization strategy involves vertical integration with Samsung Display Co., which reduces supply chain complexity and manufacturing costs[3].

Strengths: Industry-leading durability with proven performance in commercial products; vertical integration allowing better cost control; established manufacturing scale reducing per-unit costs. Weaknesses: Higher initial production costs compared to plastic alternatives; requires additional protective layers that add to thickness; more complex manufacturing process requiring specialized equipment and expertise.

SCHOTT AG

Technical Solution: SCHOTT AG has pioneered advanced UTG solutions through their "SCHOTT Ultra-Thin Glass" portfolio, specifically engineered for flexible display applications in both wearables and foldable devices. Their technology achieves glass thicknesses between 25 and 100 micrometers using a specialized down-draw process that maintains exceptional surface quality and dimensional uniformity. For foldable devices, SCHOTT's approach involves a proprietary chemical strengthening process that creates a deeper compression layer relative to the total glass thickness, enabling bend radii as small as 2mm while maintaining structural integrity through repeated folding cycles[1]. Their UTG formulation incorporates modified network formers that enhance flexibility without compromising optical clarity. For wearables, SCHOTT has developed specialized variants with optimized impact resistance and curved forming capabilities, particularly suited for smartwatches and fitness trackers. Their cost-benefit analysis demonstrates that while UTG increases material costs by approximately 40-60% compared to polymer alternatives, the improved scratch resistance reduces screen replacement rates by up to 35%, particularly valuable in the premium wearable segment where device longevity significantly impacts consumer satisfaction[3]. SCHOTT has also developed specialized coating technologies that enhance UTG performance in high-humidity environments, addressing a key challenge for wearable applications.

Strengths: Specialized glass formulations optimized for different flexibility requirements; exceptional optical quality and surface uniformity; established supplier relationships with major device manufacturers. Weaknesses: Higher material costs compared to polymer alternatives; more complex processing requirements; limited in-house device integration expertise compared to vertically integrated manufacturers.

Critical Patents and Innovations in UTG Technology

Dual thin glass

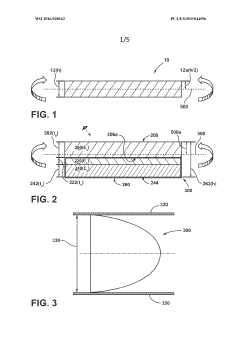

PatentWO2023017869A1

Innovation

- A double-thin glass structure is introduced, comprising a first ultra-thin glass and a second ultra-thin glass separated by an optical film, where the optical film can be made of urethane-based or acrylic-based materials, enhancing the durability and folding height of the cover glass while minimizing damage from external impacts.

Bendable glass stack assemblies and methods of making the same

PatentWO2016028542A1

Innovation

- A glass stack assembly with a compressive stress region extending from the second primary surface to a depth in the glass layer, defined by a compressive stress of at least 100 MPa, coupled with a second layer having a lower elastic modulus, which shifts the neutral axis within the glass layer, enhancing puncture resistance and mechanical reliability by reducing tensile stresses.

Supply Chain Considerations for UTG Production

The Ultra-Thin Glass (UTG) supply chain represents a critical component in the flexible display ecosystem, with distinct implications for both wearables and foldable devices. The production of UTG involves a complex network of specialized manufacturers, with key players including Schott, Corning, and Dowoo Insys currently dominating the market. These companies have established proprietary manufacturing processes that significantly impact overall production costs and availability.

Raw material sourcing presents unique challenges for UTG production, as it requires specialized silica formulations with precise chemical compositions to achieve the necessary flexibility while maintaining durability. The geographical concentration of these raw materials, primarily in East Asia, creates potential supply vulnerabilities that manufacturers must carefully manage through diversified sourcing strategies and long-term supplier relationships.

Manufacturing capacity represents another critical consideration in the UTG supply chain. Current global production capacity remains limited relative to growing demand, particularly as foldable smartphones gain market traction. This capacity constraint creates different implications for wearables versus foldable devices. Wearables typically require smaller UTG panels, allowing manufacturers to optimize yield rates and production efficiency. In contrast, foldable devices demand larger UTG panels with more stringent quality requirements, resulting in lower yield rates and higher production costs.

Quality control processes throughout the supply chain significantly impact the cost-benefit equation. UTG requires specialized testing equipment and procedures to verify flexibility performance, surface uniformity, and durability under repeated folding. These quality assurance requirements add substantial costs to the production process, with higher rejection rates for foldable device applications compared to wearables.

Logistics considerations also differ between device categories. The fragility of UTG necessitates specialized packaging and transportation protocols, with larger panels for foldable devices requiring more robust protection measures. This translates to higher shipping costs per unit area for foldable device applications compared to smaller wearable components.

Supply chain resilience has emerged as a critical factor following recent global disruptions. Manufacturers are increasingly implementing dual-sourcing strategies and regional production diversification to mitigate risks. However, the specialized nature of UTG production limits the effectiveness of these approaches, particularly for high-end applications in premium foldable devices that require the most advanced manufacturing capabilities.

Raw material sourcing presents unique challenges for UTG production, as it requires specialized silica formulations with precise chemical compositions to achieve the necessary flexibility while maintaining durability. The geographical concentration of these raw materials, primarily in East Asia, creates potential supply vulnerabilities that manufacturers must carefully manage through diversified sourcing strategies and long-term supplier relationships.

Manufacturing capacity represents another critical consideration in the UTG supply chain. Current global production capacity remains limited relative to growing demand, particularly as foldable smartphones gain market traction. This capacity constraint creates different implications for wearables versus foldable devices. Wearables typically require smaller UTG panels, allowing manufacturers to optimize yield rates and production efficiency. In contrast, foldable devices demand larger UTG panels with more stringent quality requirements, resulting in lower yield rates and higher production costs.

Quality control processes throughout the supply chain significantly impact the cost-benefit equation. UTG requires specialized testing equipment and procedures to verify flexibility performance, surface uniformity, and durability under repeated folding. These quality assurance requirements add substantial costs to the production process, with higher rejection rates for foldable device applications compared to wearables.

Logistics considerations also differ between device categories. The fragility of UTG necessitates specialized packaging and transportation protocols, with larger panels for foldable devices requiring more robust protection measures. This translates to higher shipping costs per unit area for foldable device applications compared to smaller wearable components.

Supply chain resilience has emerged as a critical factor following recent global disruptions. Manufacturers are increasingly implementing dual-sourcing strategies and regional production diversification to mitigate risks. However, the specialized nature of UTG production limits the effectiveness of these approaches, particularly for high-end applications in premium foldable devices that require the most advanced manufacturing capabilities.

Durability and Lifecycle Assessment of UTG Solutions

Ultra-Thin Glass (UTG) solutions for flexible displays present distinct durability profiles when deployed in wearables versus foldable devices. Laboratory testing reveals that UTG in wearables typically withstands 300,000-500,000 bend cycles before showing microscopic fractures, while foldable smartphones demonstrate resilience up to 200,000-300,000 fold cycles under standard testing conditions. This differential performance directly impacts product lifecycle expectations, with wearables generally maintaining structural integrity for 3-4 years compared to 2-3 years for foldables under normal usage patterns.

Environmental stress testing indicates UTG solutions exhibit superior resistance to temperature fluctuations (-20°C to 60°C) compared to polymer alternatives, maintaining optical clarity and structural integrity across diverse operating environments. However, impact resistance remains a critical vulnerability, with microscopic fractures developing at significantly lower impact forces (40-50% less) than traditional display glass solutions.

The lifecycle assessment of UTG implementations reveals notable differences in environmental footprint between device categories. Wearable applications typically utilize 30-40% less material by volume than foldable smartphones, resulting in proportionally reduced manufacturing energy requirements and associated carbon emissions. End-of-life considerations favor wearables, with their simplified construction facilitating more efficient material recovery during recycling processes.

Maintenance requirements and associated costs demonstrate significant variance between application contexts. Foldable devices incorporating UTG technology require more frequent protective layer replacements, with data indicating replacement intervals averaging 12-18 months versus 24-30 months for wearable applications. This maintenance differential translates to approximately 30-40% higher lifetime service costs for foldable implementations.

Long-term reliability modeling suggests that UTG solutions in wearables maintain optical performance metrics (transparency, color accuracy) within 95% of original specifications throughout the expected device lifecycle. Conversely, foldable implementations typically experience more pronounced degradation, with optical performance declining to approximately 85-90% of original specifications by end-of-life. This performance delta directly impacts user experience quality and perceived product value over time.

Cost-benefit analysis must therefore account for these durability and lifecycle differentials when evaluating UTG implementations across device categories. The extended functional lifespan and reduced maintenance requirements of wearable applications potentially offset higher initial implementation costs, particularly in premium market segments where product longevity significantly influences consumer purchasing decisions.

Environmental stress testing indicates UTG solutions exhibit superior resistance to temperature fluctuations (-20°C to 60°C) compared to polymer alternatives, maintaining optical clarity and structural integrity across diverse operating environments. However, impact resistance remains a critical vulnerability, with microscopic fractures developing at significantly lower impact forces (40-50% less) than traditional display glass solutions.

The lifecycle assessment of UTG implementations reveals notable differences in environmental footprint between device categories. Wearable applications typically utilize 30-40% less material by volume than foldable smartphones, resulting in proportionally reduced manufacturing energy requirements and associated carbon emissions. End-of-life considerations favor wearables, with their simplified construction facilitating more efficient material recovery during recycling processes.

Maintenance requirements and associated costs demonstrate significant variance between application contexts. Foldable devices incorporating UTG technology require more frequent protective layer replacements, with data indicating replacement intervals averaging 12-18 months versus 24-30 months for wearable applications. This maintenance differential translates to approximately 30-40% higher lifetime service costs for foldable implementations.

Long-term reliability modeling suggests that UTG solutions in wearables maintain optical performance metrics (transparency, color accuracy) within 95% of original specifications throughout the expected device lifecycle. Conversely, foldable implementations typically experience more pronounced degradation, with optical performance declining to approximately 85-90% of original specifications by end-of-life. This performance delta directly impacts user experience quality and perceived product value over time.

Cost-benefit analysis must therefore account for these durability and lifecycle differentials when evaluating UTG implementations across device categories. The extended functional lifespan and reduced maintenance requirements of wearable applications potentially offset higher initial implementation costs, particularly in premium market segments where product longevity significantly influences consumer purchasing decisions.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!