Roll-To-Roll Processing Opportunities And Limitations For Ultra-Thin Glass (UTG) In Flexible Displays

AUG 26, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

UTG R2R Processing Evolution and Objectives

Roll-to-roll (R2R) processing for ultra-thin glass (UTG) has evolved significantly over the past decade, transforming from experimental laboratory techniques to commercially viable manufacturing processes. The evolution began with rudimentary handling methods that struggled with the inherent brittleness of glass substrates thinner than 100 micrometers. Early attempts in the 2010-2015 period faced high breakage rates and limited production speeds, making mass production economically unfeasible.

A pivotal advancement came with the development of temporary carrier systems around 2016, where UTG was temporarily bonded to more rigid substrates during processing and then released post-processing. This innovation dramatically reduced breakage rates from approximately 40% to under 10%, enabling longer production runs and wider web widths.

By 2018-2020, specialized tension control systems emerged, incorporating optical and mechanical sensors that could detect microscopic stress variations across the glass web. These systems allowed for real-time adjustments during processing, further reducing defect rates and enabling processing speeds to increase from initial rates of 2-3 meters per minute to 5-10 meters per minute in advanced production lines.

The current state of UTG R2R processing (2021-2023) features integrated multi-layer deposition capabilities, allowing for simultaneous application of functional layers such as barrier films, conductive materials, and protective coatings. This integration has reduced production steps and handling requirements, further minimizing breakage risks while enhancing throughput efficiency.

The primary objectives for UTG R2R processing development center on several key parameters. First is thickness reduction, with current commercial processes handling glass down to 30 micrometers, while research aims to enable reliable processing of 20-micrometer or thinner substrates. Speed enhancement represents another critical goal, with industry targeting processing rates of 15-20 meters per minute without compromising quality.

Yield improvement remains paramount, with current best-in-class operations achieving approximately 85-90% yield rates, while the industry standard hovers around 75-80%. The objective is to push yields consistently above 95% to make UTG economically competitive with alternative flexible substrate technologies.

Width expansion constitutes another significant goal, as current R2R systems typically process UTG webs of 400-600mm width. Increasing this to 1000mm or beyond would dramatically improve production economics and enable larger display applications. Finally, process integration aims to incorporate additional manufacturing steps into continuous R2R lines, reducing handling operations and associated breakage risks.

A pivotal advancement came with the development of temporary carrier systems around 2016, where UTG was temporarily bonded to more rigid substrates during processing and then released post-processing. This innovation dramatically reduced breakage rates from approximately 40% to under 10%, enabling longer production runs and wider web widths.

By 2018-2020, specialized tension control systems emerged, incorporating optical and mechanical sensors that could detect microscopic stress variations across the glass web. These systems allowed for real-time adjustments during processing, further reducing defect rates and enabling processing speeds to increase from initial rates of 2-3 meters per minute to 5-10 meters per minute in advanced production lines.

The current state of UTG R2R processing (2021-2023) features integrated multi-layer deposition capabilities, allowing for simultaneous application of functional layers such as barrier films, conductive materials, and protective coatings. This integration has reduced production steps and handling requirements, further minimizing breakage risks while enhancing throughput efficiency.

The primary objectives for UTG R2R processing development center on several key parameters. First is thickness reduction, with current commercial processes handling glass down to 30 micrometers, while research aims to enable reliable processing of 20-micrometer or thinner substrates. Speed enhancement represents another critical goal, with industry targeting processing rates of 15-20 meters per minute without compromising quality.

Yield improvement remains paramount, with current best-in-class operations achieving approximately 85-90% yield rates, while the industry standard hovers around 75-80%. The objective is to push yields consistently above 95% to make UTG economically competitive with alternative flexible substrate technologies.

Width expansion constitutes another significant goal, as current R2R systems typically process UTG webs of 400-600mm width. Increasing this to 1000mm or beyond would dramatically improve production economics and enable larger display applications. Finally, process integration aims to incorporate additional manufacturing steps into continuous R2R lines, reducing handling operations and associated breakage risks.

Flexible Display Market Demand Analysis

The flexible display market has witnessed exponential growth over the past decade, driven primarily by consumer electronics applications. Market research indicates that the global flexible display market is projected to reach $15.1 billion by 2025, growing at a CAGR of 28.3% from 2020. This remarkable growth trajectory is fueled by increasing consumer preference for sleeker, more durable, and innovative display technologies across multiple device categories.

Smartphones represent the largest application segment, accounting for approximately 65% of the flexible display market. Major manufacturers including Samsung, Huawei, and Motorola have launched foldable smartphones utilizing Ultra-Thin Glass (UTG) technology, with consumer reception indicating strong interest despite premium pricing. Industry analysts report that foldable smartphone shipments reached 7.1 million units in 2021, with projections suggesting this could exceed 30 million units by 2025.

Wearable devices constitute the second-largest market segment, with smartwatches and fitness trackers incorporating curved displays to enhance user experience and comfort. This segment is growing at 32% annually, outpacing the overall market average. The automotive industry is also emerging as a significant demand driver, with curved dashboard displays and entertainment systems increasingly becoming standard features in mid to high-end vehicles.

Regional analysis reveals Asia-Pacific as the dominant market for flexible displays, accounting for 58% of global demand. This is attributed to the concentration of display manufacturers and consumer electronics assembly operations in countries like South Korea, Japan, China, and Taiwan. North America and Europe follow with 22% and 15% market share respectively, with adoption primarily in premium consumer electronics and automotive applications.

Consumer behavior studies indicate that flexibility, durability, and design aesthetics are the primary factors driving purchase decisions for devices with flexible displays. A recent survey of smartphone users revealed that 47% would consider paying a premium for foldable devices, highlighting significant market potential as manufacturing costs decrease and technology matures.

The integration of UTG in flexible displays addresses several key consumer pain points, particularly around scratch resistance and durability compared to polymer-based alternatives. Market feedback indicates consumers are willing to pay 15-20% more for devices utilizing glass-based flexible displays versus polymer-based options, suggesting strong value perception for UTG technology.

Supply chain analysis reveals growing investment in Roll-to-Roll (R2R) processing capabilities for UTG, with major glass manufacturers expanding production capacity to meet projected demand growth. This market momentum is creating opportunities for equipment manufacturers specializing in R2R processing technology tailored for ultra-thin glass substrates.

Smartphones represent the largest application segment, accounting for approximately 65% of the flexible display market. Major manufacturers including Samsung, Huawei, and Motorola have launched foldable smartphones utilizing Ultra-Thin Glass (UTG) technology, with consumer reception indicating strong interest despite premium pricing. Industry analysts report that foldable smartphone shipments reached 7.1 million units in 2021, with projections suggesting this could exceed 30 million units by 2025.

Wearable devices constitute the second-largest market segment, with smartwatches and fitness trackers incorporating curved displays to enhance user experience and comfort. This segment is growing at 32% annually, outpacing the overall market average. The automotive industry is also emerging as a significant demand driver, with curved dashboard displays and entertainment systems increasingly becoming standard features in mid to high-end vehicles.

Regional analysis reveals Asia-Pacific as the dominant market for flexible displays, accounting for 58% of global demand. This is attributed to the concentration of display manufacturers and consumer electronics assembly operations in countries like South Korea, Japan, China, and Taiwan. North America and Europe follow with 22% and 15% market share respectively, with adoption primarily in premium consumer electronics and automotive applications.

Consumer behavior studies indicate that flexibility, durability, and design aesthetics are the primary factors driving purchase decisions for devices with flexible displays. A recent survey of smartphone users revealed that 47% would consider paying a premium for foldable devices, highlighting significant market potential as manufacturing costs decrease and technology matures.

The integration of UTG in flexible displays addresses several key consumer pain points, particularly around scratch resistance and durability compared to polymer-based alternatives. Market feedback indicates consumers are willing to pay 15-20% more for devices utilizing glass-based flexible displays versus polymer-based options, suggesting strong value perception for UTG technology.

Supply chain analysis reveals growing investment in Roll-to-Roll (R2R) processing capabilities for UTG, with major glass manufacturers expanding production capacity to meet projected demand growth. This market momentum is creating opportunities for equipment manufacturers specializing in R2R processing technology tailored for ultra-thin glass substrates.

UTG R2R Technology Status and Barriers

The current state of Roll-to-Roll (R2R) processing for Ultra-Thin Glass (UTG) in flexible displays represents a significant technological advancement, yet faces considerable implementation challenges. R2R technology has evolved from traditional paper printing to advanced electronic manufacturing, enabling continuous production of flexible displays on UTG substrates. This manufacturing approach offers substantial advantages in throughput and cost efficiency compared to conventional batch processing methods.

Global R2R UTG technology development is concentrated primarily in South Korea, Japan, and Germany, with companies like Corning, Schott, and Asahi Glass leading innovation. Recent advancements have enabled the production of glass as thin as 30 micrometers while maintaining sufficient flexibility and durability for display applications. However, this achievement represents just the beginning of the technology's potential.

Despite progress, several critical barriers impede widespread R2R UTG implementation. The most significant challenge remains glass handling during high-speed processing. UTG's extreme thinness makes it susceptible to breakage, wrinkling, and deformation when subjected to the mechanical stresses of R2R systems. Current web handling technologies struggle to maintain proper tension control without damaging the delicate glass substrate.

Temperature management presents another substantial obstacle. The processing of UTG often requires high-temperature steps that can induce thermal stress, potentially leading to substrate warping or fracture. Developing uniform heating and cooling mechanisms compatible with continuous processing remains technically demanding.

Alignment precision poses a third major barrier. R2R systems must maintain sub-micron registration accuracy across large web widths while operating at high speeds. This becomes particularly challenging with UTG due to its dimensional instability under varying environmental conditions and processing stresses.

Contamination control represents a persistent challenge in R2R UTG processing. Unlike cleanroom batch processing, maintaining ultra-clean conditions in a continuous production environment proves difficult. Particulate contamination can create defects that compromise both display performance and mechanical integrity.

Edge quality management also presents unique difficulties. UTG edges are particularly vulnerable to microcracks that can propagate across the substrate. Current cutting and edge sealing technologies require significant improvement to ensure reliable production at industrial scales.

The industry is actively addressing these barriers through innovations in non-contact handling systems, advanced tension control algorithms, and specialized coating technologies designed specifically for UTG substrates. Progress in these areas will determine the timeline for widespread commercial adoption of R2R UTG technology in next-generation flexible displays.

Global R2R UTG technology development is concentrated primarily in South Korea, Japan, and Germany, with companies like Corning, Schott, and Asahi Glass leading innovation. Recent advancements have enabled the production of glass as thin as 30 micrometers while maintaining sufficient flexibility and durability for display applications. However, this achievement represents just the beginning of the technology's potential.

Despite progress, several critical barriers impede widespread R2R UTG implementation. The most significant challenge remains glass handling during high-speed processing. UTG's extreme thinness makes it susceptible to breakage, wrinkling, and deformation when subjected to the mechanical stresses of R2R systems. Current web handling technologies struggle to maintain proper tension control without damaging the delicate glass substrate.

Temperature management presents another substantial obstacle. The processing of UTG often requires high-temperature steps that can induce thermal stress, potentially leading to substrate warping or fracture. Developing uniform heating and cooling mechanisms compatible with continuous processing remains technically demanding.

Alignment precision poses a third major barrier. R2R systems must maintain sub-micron registration accuracy across large web widths while operating at high speeds. This becomes particularly challenging with UTG due to its dimensional instability under varying environmental conditions and processing stresses.

Contamination control represents a persistent challenge in R2R UTG processing. Unlike cleanroom batch processing, maintaining ultra-clean conditions in a continuous production environment proves difficult. Particulate contamination can create defects that compromise both display performance and mechanical integrity.

Edge quality management also presents unique difficulties. UTG edges are particularly vulnerable to microcracks that can propagate across the substrate. Current cutting and edge sealing technologies require significant improvement to ensure reliable production at industrial scales.

The industry is actively addressing these barriers through innovations in non-contact handling systems, advanced tension control algorithms, and specialized coating technologies designed specifically for UTG substrates. Progress in these areas will determine the timeline for widespread commercial adoption of R2R UTG technology in next-generation flexible displays.

Current R2R Solutions for UTG Production

01 Manufacturing techniques for ultra-thin glass

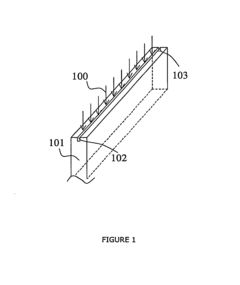

Various manufacturing techniques have been developed for producing ultra-thin glass (UTG) in roll-to-roll processing. These techniques include specialized drawing methods, controlled cooling processes, and precision thickness control mechanisms. The manufacturing processes focus on achieving uniform thickness, minimizing defects, and maintaining structural integrity while handling extremely thin glass substrates. Advanced production methods enable the creation of glass sheets with thicknesses in the micrometer range while preserving optical clarity and mechanical properties.- Roll-to-roll manufacturing processes for UTG: Roll-to-roll processing techniques for ultra-thin glass involve continuous production methods where the glass substrate is processed as it moves from one roll to another. This manufacturing approach enables high-throughput production of flexible UTG for various applications including displays and electronic devices. The process typically includes unwinding the glass from a supply roll, processing it through various stations (coating, patterning, etc.), and rewinding onto a take-up roll, all while maintaining precise tension control to prevent breakage of the fragile material.

- Handling and transportation mechanisms for UTG: Specialized handling and transportation mechanisms are critical for processing ultra-thin glass in roll-to-roll systems. These mechanisms include tension control systems, non-contact transport methods, and specialized rollers designed to minimize stress on the glass. Advanced handling solutions incorporate sensors and feedback systems to detect potential issues and make real-time adjustments. The fragility of UTG requires precise engineering of transport paths to prevent cracking, scratching, or other damage during processing.

- Surface treatment and coating technologies for UTG: Surface treatment and coating technologies are essential for enhancing the properties of ultra-thin glass in roll-to-roll processing. These include anti-scratch coatings, anti-reflection treatments, and functional layers that improve durability and performance. Advanced coating methods such as vacuum deposition, sputtering, and chemical vapor deposition can be integrated into roll-to-roll lines. These treatments address key limitations of UTG by improving its resistance to mechanical damage while maintaining optical clarity and flexibility.

- Flexibility and bendability enhancement for UTG: Enhancing the flexibility and bendability of ultra-thin glass is a critical focus area in roll-to-roll processing. Various techniques are employed to improve the mechanical properties of UTG, including ion exchange strengthening, specialized edge treatment, and composite structures with polymer layers. These enhancements allow UTG to achieve smaller bend radii without fracturing, making it suitable for foldable and flexible display applications. The balance between flexibility and durability represents both an opportunity and limitation in UTG processing.

- Quality control and defect detection systems for UTG: Advanced quality control and defect detection systems are integrated into roll-to-roll processing lines for ultra-thin glass to ensure consistent product quality. These systems employ optical inspection, laser scanning, and machine vision technologies to detect microscopic defects in real-time. Automated monitoring systems track parameters such as thickness uniformity, surface quality, and mechanical integrity throughout the production process. Early detection of defects allows for process adjustments to minimize waste and maximize yield in UTG manufacturing.

02 Handling and transportation systems for UTG

Specialized handling and transportation systems are critical for roll-to-roll processing of ultra-thin glass. These systems include tension control mechanisms, precision rollers, and non-contact transport methods to prevent damage to the fragile glass. Advanced sensing technologies monitor the glass during processing to detect potential issues before they cause breakage. The handling systems must account for the flexibility of UTG while preventing excessive bending that could lead to fractures, ensuring continuous processing without interruptions due to material damage.Expand Specific Solutions03 Surface treatment and coating technologies

Surface treatment and coating technologies play a crucial role in enhancing the properties of ultra-thin glass during roll-to-roll processing. These include anti-scratch coatings, anti-reflective treatments, and functional layers that improve durability and performance. Plasma treatment methods and chemical vapor deposition techniques are employed to modify surface properties while maintaining the glass's transparency and flexibility. These treatments can significantly improve the scratch resistance, reduce reflectivity, and add functionality such as touch sensitivity or self-cleaning properties to the UTG.Expand Specific Solutions04 Flexibility and bending radius limitations

The flexibility and bending radius limitations of ultra-thin glass present both opportunities and challenges in roll-to-roll processing. While UTG offers greater flexibility compared to conventional glass, it still has specific bending radius limitations that must be considered in processing equipment design. Research focuses on improving the flexibility of UTG through specialized tempering processes, chemical strengthening, and composite structures. Understanding the relationship between glass thickness, composition, and minimum bending radius is essential for optimizing roll-to-roll processing parameters and preventing fractures during manufacturing.Expand Specific Solutions05 Integration with electronic components and display technologies

Roll-to-roll processing of ultra-thin glass enables integration with electronic components and advanced display technologies. The process allows for the deposition of conductive layers, transistor arrays, and other electronic elements directly onto the glass substrate. This integration is particularly valuable for flexible displays, touch panels, and other optoelectronic devices. The challenges include maintaining precise alignment during multiple processing steps, ensuring compatibility between the glass and electronic materials, and developing interconnection technologies that can withstand repeated flexing without failure.Expand Specific Solutions

Key Industry Players in UTG R2R Processing

The roll-to-roll processing market for ultra-thin glass (UTG) in flexible displays is currently in its growth phase, with an expanding market size driven by increasing demand for foldable smartphones and wearable devices. The technology is approaching maturity but still faces challenges in scaling production while maintaining quality. Leading players include Corning, which dominates with advanced glass formulations, and SCHOTT AG, offering specialized UTG solutions. Asian manufacturers like Samsung Display, BOE Technology, and LG Electronics are rapidly advancing their capabilities, while companies such as Dongxu Technology and Triumph Science focus on production process improvements. Research institutions like Industrial Technology Research Institute provide critical innovation support. The competitive landscape is characterized by strategic partnerships between glass manufacturers and display producers to overcome technical limitations in handling and processing UTG at scale.

Corning, Inc.

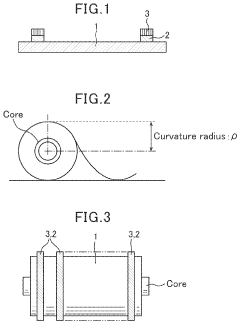

Technical Solution: Corning has developed proprietary Willow Glass technology specifically for roll-to-roll (R2R) processing of ultra-thin glass (UTG) for flexible displays. Their UTG solution features glass as thin as 100 micrometers that can be rolled around a 5cm diameter cylinder without damage. The company employs a specialized fusion draw process that creates inherently flat, smooth glass with uniform thickness, critical for maintaining display quality in flexible applications. Corning's R2R processing technology incorporates specialized handling systems using non-contact air bearings and precision tension control to prevent surface damage during manufacturing. Their UTG incorporates ion-exchange strengthening technology that creates compressive stress layers on the glass surface, significantly improving flexibility and durability while maintaining optical clarity. Corning has also developed specialized edge finishing techniques to minimize edge flaws that could propagate into cracks during bending, addressing one of the key limitations of UTG in flexible applications.

Strengths: Superior optical properties compared to polymer alternatives, excellent barrier properties against oxygen and moisture, higher temperature stability allowing for higher-quality display processing, and established manufacturing infrastructure. Weaknesses: More brittle than polymer alternatives requiring specialized handling equipment, higher initial processing costs, and thickness limitations that still present challenges for extreme folding applications.

Samsung Display Co., Ltd.

Technical Solution: Samsung Display has developed a comprehensive UTG solution for flexible displays that integrates with their roll-to-roll processing capabilities. Their technology utilizes a specialized glass composition with modified network formers that enhance flexibility while maintaining display-grade optical properties. Samsung's approach includes a proprietary multi-layer structure where the UTG (approximately 30 micrometers thick) is combined with polymer layers that provide additional support and impact resistance. Their R2R processing system incorporates advanced tension control mechanisms and specialized rollers with micro-structured surfaces that minimize contact points with the glass. Samsung has implemented real-time optical monitoring systems throughout the R2R process to detect defects as small as 3 micrometers, ensuring quality control during high-speed production. The company has also developed specialized bonding technologies that create strong interfaces between the UTG and other display components while accommodating the differential movement during flexing. Their manufacturing process includes a proprietary stress relief treatment that reduces internal stresses in the glass, significantly improving flexibility and reducing the minimum bending radius to under 1.5mm for commercial applications.

Strengths: Vertical integration with display manufacturing capabilities allowing for optimized end-to-end production, extensive experience with commercial flexible display products, and proven reliability in consumer devices. Weaknesses: Proprietary technology with limited availability to other manufacturers, still requires protective polymer layers for consumer applications, and faces challenges with scaling to larger display sizes while maintaining uniform properties.

Critical Patents in UTG R2R Manufacturing

Glass roll with resin film

PatentActiveUS11926140B2

Innovation

- A glass roll with a resin film laminated to the glass film using an adhesive with a controlled creep amount and slip constant, where the adhesive's creep is set to 50 μm or less and the slip constant is 2×10−16 or less, to prevent crack development and static fracture by managing stress and deformation.

Methods for Substrate and Device Fabrications

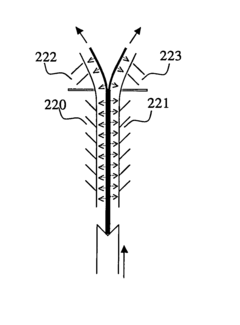

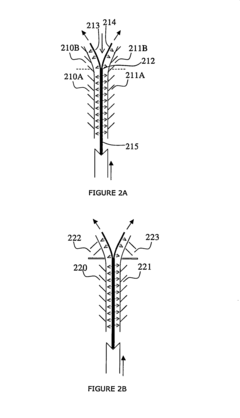

PatentInactiveUS20150170967A1

Innovation

- A novel method using laser irradiation on the substrate sidewall for thinning, which includes a combination of laser anneal and mechanical forces to separate and thin substrates, offering a low-cost and efficient process suitable for various substrate materials, including glass, silicon, and sapphire, with minimal kerf loss and debris formation.

Supply Chain Considerations for UTG Production

The UTG supply chain represents a complex ecosystem that requires careful orchestration of multiple stakeholders across different geographical regions. Currently, the supply chain for ultra-thin glass in flexible displays is characterized by a high degree of vertical integration, with major glass manufacturers like Corning, Schott, and AGC dominating the upstream production of specialized glass substrates. These manufacturers have established proprietary processes for producing glass with thicknesses below 100 micrometers while maintaining the necessary optical and mechanical properties.

Material sourcing presents a significant challenge in the UTG supply chain, as the production requires high-purity silica and specialty additives that are often geographically concentrated. The limited number of suppliers capable of providing these materials at the required quality standards creates potential bottlenecks and price volatility risks.

The roll-to-roll processing of UTG introduces unique supply chain considerations compared to traditional glass manufacturing. Specialized equipment for handling, processing, and quality control of continuous rolls of ultra-thin glass is produced by a limited number of equipment manufacturers, primarily based in Germany, Japan, and South Korea. This equipment concentration creates dependencies that can impact production scaling and technology transfer.

Transportation and logistics for UTG present particular challenges due to the fragile nature of the material. Custom packaging solutions and handling protocols have been developed to minimize breakage during transit, but these add significant costs and complexity to the supply chain. Regional manufacturing clusters have emerged as a strategy to mitigate these challenges, with display manufacturers often establishing facilities in proximity to UTG suppliers.

Inventory management strategies for UTG differ significantly from traditional display materials due to the higher value and more limited shelf life of certain processed UTG components. Just-in-time manufacturing approaches are increasingly being adopted, requiring sophisticated coordination between UTG suppliers and display manufacturers.

The global distribution of the UTG supply chain reveals interesting patterns, with raw material extraction predominantly occurring in China, Australia, and parts of Africa, while high-precision processing is concentrated in East Asia, particularly South Korea, Japan, and Taiwan. Final assembly of flexible displays incorporating UTG is increasingly distributed across Southeast Asia, with Vietnam and Malaysia emerging as important manufacturing hubs.

Supply chain resilience has become a critical consideration following recent global disruptions. Manufacturers are increasingly implementing dual-sourcing strategies for critical components and materials, though the specialized nature of UTG production limits the effectiveness of such approaches in the short term.

Material sourcing presents a significant challenge in the UTG supply chain, as the production requires high-purity silica and specialty additives that are often geographically concentrated. The limited number of suppliers capable of providing these materials at the required quality standards creates potential bottlenecks and price volatility risks.

The roll-to-roll processing of UTG introduces unique supply chain considerations compared to traditional glass manufacturing. Specialized equipment for handling, processing, and quality control of continuous rolls of ultra-thin glass is produced by a limited number of equipment manufacturers, primarily based in Germany, Japan, and South Korea. This equipment concentration creates dependencies that can impact production scaling and technology transfer.

Transportation and logistics for UTG present particular challenges due to the fragile nature of the material. Custom packaging solutions and handling protocols have been developed to minimize breakage during transit, but these add significant costs and complexity to the supply chain. Regional manufacturing clusters have emerged as a strategy to mitigate these challenges, with display manufacturers often establishing facilities in proximity to UTG suppliers.

Inventory management strategies for UTG differ significantly from traditional display materials due to the higher value and more limited shelf life of certain processed UTG components. Just-in-time manufacturing approaches are increasingly being adopted, requiring sophisticated coordination between UTG suppliers and display manufacturers.

The global distribution of the UTG supply chain reveals interesting patterns, with raw material extraction predominantly occurring in China, Australia, and parts of Africa, while high-precision processing is concentrated in East Asia, particularly South Korea, Japan, and Taiwan. Final assembly of flexible displays incorporating UTG is increasingly distributed across Southeast Asia, with Vietnam and Malaysia emerging as important manufacturing hubs.

Supply chain resilience has become a critical consideration following recent global disruptions. Manufacturers are increasingly implementing dual-sourcing strategies for critical components and materials, though the specialized nature of UTG production limits the effectiveness of such approaches in the short term.

Sustainability Aspects of UTG Manufacturing

The sustainability of Ultra-Thin Glass (UTG) manufacturing through Roll-to-Roll (R2R) processing represents a critical consideration in the evolution of flexible display technologies. When examining environmental impacts, UTG demonstrates several advantages over plastic alternatives, including higher recyclability and reduced chemical leaching. The glass composition typically contains fewer harmful substances compared to polymer-based flexible substrates, contributing to a lower overall environmental footprint.

Energy consumption during UTG manufacturing presents both challenges and opportunities. The high-temperature requirements for glass processing traditionally demand significant energy inputs, but R2R processing offers efficiency improvements through continuous production. Recent innovations in low-temperature glass forming techniques have reduced energy requirements by approximately 30-40% compared to conventional batch processing methods, though these advances remain in early implementation stages.

Resource utilization efficiency in UTG manufacturing has shown promising developments. The R2R process minimizes material waste through precise deposition control and improved yield rates. Industry data indicates that advanced R2R systems can achieve material utilization rates exceeding 85%, compared to 60-70% in traditional glass manufacturing processes. Additionally, closed-loop water systems have been implemented in leading manufacturing facilities, reducing freshwater consumption by up to 75%.

Lifecycle assessment studies reveal that UTG products generally exhibit lower carbon footprints than their plastic counterparts when considering full product lifecycles. The extended durability of glass-based displays contributes significantly to this advantage, with UTG displays demonstrating 2-3 times longer functional lifespans in laboratory testing environments. This longevity translates to reduced electronic waste generation over time.

Circular economy principles are increasingly being integrated into UTG manufacturing strategies. Several major manufacturers have established take-back programs for end-of-life products, with specialized processes to separate and recover the ultra-thin glass components. Current recovery rates remain modest at 15-25%, but technological improvements in separation techniques show potential to increase these figures substantially in the coming years.

Regulatory compliance represents another dimension of sustainability in UTG manufacturing. Global regulations increasingly restrict hazardous substances in electronic components, and UTG generally aligns well with these requirements. However, some specialized coatings and processing aids used in R2R manufacturing of UTG may require substitution as regulations evolve, particularly regarding per- and polyfluoroalkyl substances (PFAS) used in some release agents.

Energy consumption during UTG manufacturing presents both challenges and opportunities. The high-temperature requirements for glass processing traditionally demand significant energy inputs, but R2R processing offers efficiency improvements through continuous production. Recent innovations in low-temperature glass forming techniques have reduced energy requirements by approximately 30-40% compared to conventional batch processing methods, though these advances remain in early implementation stages.

Resource utilization efficiency in UTG manufacturing has shown promising developments. The R2R process minimizes material waste through precise deposition control and improved yield rates. Industry data indicates that advanced R2R systems can achieve material utilization rates exceeding 85%, compared to 60-70% in traditional glass manufacturing processes. Additionally, closed-loop water systems have been implemented in leading manufacturing facilities, reducing freshwater consumption by up to 75%.

Lifecycle assessment studies reveal that UTG products generally exhibit lower carbon footprints than their plastic counterparts when considering full product lifecycles. The extended durability of glass-based displays contributes significantly to this advantage, with UTG displays demonstrating 2-3 times longer functional lifespans in laboratory testing environments. This longevity translates to reduced electronic waste generation over time.

Circular economy principles are increasingly being integrated into UTG manufacturing strategies. Several major manufacturers have established take-back programs for end-of-life products, with specialized processes to separate and recover the ultra-thin glass components. Current recovery rates remain modest at 15-25%, but technological improvements in separation techniques show potential to increase these figures substantially in the coming years.

Regulatory compliance represents another dimension of sustainability in UTG manufacturing. Global regulations increasingly restrict hazardous substances in electronic components, and UTG generally aligns well with these requirements. However, some specialized coatings and processing aids used in R2R manufacturing of UTG may require substitution as regulations evolve, particularly regarding per- and polyfluoroalkyl substances (PFAS) used in some release agents.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!