Conformal Coating Vs Encapsulation: Moisture Control Comparisons

SEP 17, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Moisture Protection Technologies Background and Objectives

The evolution of electronic devices has been marked by increasing complexity and miniaturization, creating significant challenges for protecting sensitive components against environmental factors. Moisture, in particular, has emerged as one of the most destructive elements affecting electronic reliability and longevity. The history of moisture protection technologies dates back to the early days of electronics manufacturing, with rudimentary methods gradually evolving into sophisticated protection systems.

In the 1950s and 1960s, basic varnishes and lacquers were applied to circuit boards as primitive moisture barriers. By the 1970s, silicone-based conformal coatings gained popularity, offering improved protection while maintaining flexibility. The 1980s witnessed the emergence of specialized encapsulation techniques, particularly in military and aerospace applications where environmental resilience was paramount.

The technological trajectory has consistently moved toward developing materials and methods that provide superior moisture resistance while accommodating increasingly dense and heat-sensitive electronic components. This evolution has been driven by the expanding deployment of electronics in harsh environments, from automotive applications to industrial settings and outdoor installations.

Current industry trends indicate a growing divergence between conformal coating and encapsulation technologies, each evolving to address specific application requirements. Conformal coatings have become thinner, more uniform, and increasingly specialized for particular environmental challenges, while encapsulation technologies have developed toward lower stress formulations that minimize component damage while maximizing protection.

The primary objective of this technical research is to conduct a comprehensive comparative analysis of conformal coating versus encapsulation technologies specifically for moisture control applications. This analysis aims to establish quantifiable performance metrics for each approach across various environmental conditions, component types, and service lifespans.

Secondary objectives include identifying the cost-effectiveness ratio of each protection method, evaluating manufacturing process compatibility, and assessing environmental sustainability aspects of different moisture protection solutions. Additionally, this research seeks to map emerging technologies in both fields and predict future development trajectories based on current research activities and market demands.

The findings from this research will provide critical insights for engineering teams making protection strategy decisions, particularly for applications where moisture resistance represents a significant factor in product reliability. The ultimate goal is to develop a decision framework that optimizes moisture protection strategies based on specific application requirements, environmental exposure profiles, and economic constraints.

In the 1950s and 1960s, basic varnishes and lacquers were applied to circuit boards as primitive moisture barriers. By the 1970s, silicone-based conformal coatings gained popularity, offering improved protection while maintaining flexibility. The 1980s witnessed the emergence of specialized encapsulation techniques, particularly in military and aerospace applications where environmental resilience was paramount.

The technological trajectory has consistently moved toward developing materials and methods that provide superior moisture resistance while accommodating increasingly dense and heat-sensitive electronic components. This evolution has been driven by the expanding deployment of electronics in harsh environments, from automotive applications to industrial settings and outdoor installations.

Current industry trends indicate a growing divergence between conformal coating and encapsulation technologies, each evolving to address specific application requirements. Conformal coatings have become thinner, more uniform, and increasingly specialized for particular environmental challenges, while encapsulation technologies have developed toward lower stress formulations that minimize component damage while maximizing protection.

The primary objective of this technical research is to conduct a comprehensive comparative analysis of conformal coating versus encapsulation technologies specifically for moisture control applications. This analysis aims to establish quantifiable performance metrics for each approach across various environmental conditions, component types, and service lifespans.

Secondary objectives include identifying the cost-effectiveness ratio of each protection method, evaluating manufacturing process compatibility, and assessing environmental sustainability aspects of different moisture protection solutions. Additionally, this research seeks to map emerging technologies in both fields and predict future development trajectories based on current research activities and market demands.

The findings from this research will provide critical insights for engineering teams making protection strategy decisions, particularly for applications where moisture resistance represents a significant factor in product reliability. The ultimate goal is to develop a decision framework that optimizes moisture protection strategies based on specific application requirements, environmental exposure profiles, and economic constraints.

Market Demand Analysis for Electronic Protection Solutions

The electronic protection solutions market has witnessed substantial growth in recent years, driven primarily by the increasing complexity and miniaturization of electronic components across various industries. The global market for conformal coatings and encapsulation materials was valued at approximately 12.3 billion USD in 2022, with projections indicating a compound annual growth rate of 5.7% through 2028. This growth trajectory is underpinned by the expanding application scope in automotive electronics, consumer electronics, aerospace, medical devices, and industrial control systems.

Consumer electronics represents the largest market segment, accounting for nearly 31% of the total demand. This is attributed to the proliferation of smartphones, wearables, and IoT devices that require robust protection against environmental factors, particularly moisture. The automotive sector follows closely, constituting about 27% of the market share, with the rapid adoption of advanced driver-assistance systems (ADAS) and electric vehicle technologies driving demand for reliable moisture protection solutions.

Regional analysis reveals that Asia-Pacific dominates the market with approximately 45% share, led by manufacturing powerhouses like China, Japan, South Korea, and Taiwan. North America and Europe collectively account for about 40% of the market, with particular strength in high-reliability applications for aerospace, defense, and medical sectors.

Market research indicates a growing preference for environmentally friendly protection solutions, with 68% of surveyed electronics manufacturers expressing interest in adopting sustainable coating and encapsulation materials. This trend is particularly pronounced in Europe, where regulatory frameworks like RoHS and REACH have accelerated the transition toward greener alternatives.

The moisture protection segment specifically has seen heightened demand, growing at 6.3% annually, exceeding the overall market growth rate. This is largely due to the increasing deployment of electronics in harsh environments and the rising costs associated with moisture-related failures, which are estimated to account for 20-30% of all electronic device failures in field applications.

Customer requirements are evolving toward solutions that offer not just moisture protection but comprehensive environmental shielding. Survey data shows that 73% of OEMs prioritize protection solutions that address multiple environmental threats simultaneously, including moisture, dust, chemicals, and temperature fluctuations, while maintaining electrical performance and thermal management capabilities.

Consumer electronics represents the largest market segment, accounting for nearly 31% of the total demand. This is attributed to the proliferation of smartphones, wearables, and IoT devices that require robust protection against environmental factors, particularly moisture. The automotive sector follows closely, constituting about 27% of the market share, with the rapid adoption of advanced driver-assistance systems (ADAS) and electric vehicle technologies driving demand for reliable moisture protection solutions.

Regional analysis reveals that Asia-Pacific dominates the market with approximately 45% share, led by manufacturing powerhouses like China, Japan, South Korea, and Taiwan. North America and Europe collectively account for about 40% of the market, with particular strength in high-reliability applications for aerospace, defense, and medical sectors.

Market research indicates a growing preference for environmentally friendly protection solutions, with 68% of surveyed electronics manufacturers expressing interest in adopting sustainable coating and encapsulation materials. This trend is particularly pronounced in Europe, where regulatory frameworks like RoHS and REACH have accelerated the transition toward greener alternatives.

The moisture protection segment specifically has seen heightened demand, growing at 6.3% annually, exceeding the overall market growth rate. This is largely due to the increasing deployment of electronics in harsh environments and the rising costs associated with moisture-related failures, which are estimated to account for 20-30% of all electronic device failures in field applications.

Customer requirements are evolving toward solutions that offer not just moisture protection but comprehensive environmental shielding. Survey data shows that 73% of OEMs prioritize protection solutions that address multiple environmental threats simultaneously, including moisture, dust, chemicals, and temperature fluctuations, while maintaining electrical performance and thermal management capabilities.

Current State and Challenges in Moisture Control Technologies

The global moisture control technology market is currently experiencing significant growth, driven by increasing demands in electronics, aerospace, automotive, and medical device industries. Conformal coating and encapsulation represent the two dominant approaches to moisture protection, with the global market for these technologies estimated to reach $15.2 billion by 2025, growing at a CAGR of 5.8%.

Conformal coating technology has evolved substantially over the past decade, with acrylic, silicone, polyurethane, epoxy, and parylene variants dominating the market. Recent advancements have focused on developing thinner coatings with enhanced moisture resistance properties, with typical modern coatings achieving moisture vapor transmission rates (MVTR) below 3.5 g/m²/day. However, these coatings still face challenges in extreme humidity environments exceeding 85% RH.

Encapsulation technologies have similarly progressed, with potting compounds and molded encapsulants showing significant improvements in moisture barrier properties. Current high-performance encapsulants demonstrate MVTR values as low as 0.8 g/m²/day, offering superior protection compared to most conformal coatings. The trade-off remains in terms of weight, cost, and reworkability.

A critical challenge facing both technologies is the balance between protection efficacy and manufacturing integration. Conformal coatings offer easier application and inspection but provide less robust protection, while encapsulation delivers superior moisture resistance but complicates repairs and increases weight. This fundamental trade-off continues to drive research in hybrid solutions.

Material compatibility issues represent another significant hurdle, particularly for modern electronic components with increasingly diverse substrate materials. Both coating and encapsulation technologies can induce stress on components during thermal cycling, with coefficient of thermal expansion (CTE) mismatches causing reliability concerns in harsh environments.

Geographically, North America and Asia-Pacific lead in moisture control technology development, with Japan and South Korea demonstrating particular expertise in miniaturized encapsulation techniques. European manufacturers have focused on environmentally friendly formulations, addressing growing regulatory concerns about traditional solvent-based systems.

The environmental impact of moisture protection technologies has become increasingly important, with regulations like RoHS and REACH driving the development of water-based and UV-curable systems. However, these environmentally friendly alternatives often demonstrate 15-30% lower moisture protection performance compared to traditional solvent-based systems, presenting an ongoing technical challenge.

Conformal coating technology has evolved substantially over the past decade, with acrylic, silicone, polyurethane, epoxy, and parylene variants dominating the market. Recent advancements have focused on developing thinner coatings with enhanced moisture resistance properties, with typical modern coatings achieving moisture vapor transmission rates (MVTR) below 3.5 g/m²/day. However, these coatings still face challenges in extreme humidity environments exceeding 85% RH.

Encapsulation technologies have similarly progressed, with potting compounds and molded encapsulants showing significant improvements in moisture barrier properties. Current high-performance encapsulants demonstrate MVTR values as low as 0.8 g/m²/day, offering superior protection compared to most conformal coatings. The trade-off remains in terms of weight, cost, and reworkability.

A critical challenge facing both technologies is the balance between protection efficacy and manufacturing integration. Conformal coatings offer easier application and inspection but provide less robust protection, while encapsulation delivers superior moisture resistance but complicates repairs and increases weight. This fundamental trade-off continues to drive research in hybrid solutions.

Material compatibility issues represent another significant hurdle, particularly for modern electronic components with increasingly diverse substrate materials. Both coating and encapsulation technologies can induce stress on components during thermal cycling, with coefficient of thermal expansion (CTE) mismatches causing reliability concerns in harsh environments.

Geographically, North America and Asia-Pacific lead in moisture control technology development, with Japan and South Korea demonstrating particular expertise in miniaturized encapsulation techniques. European manufacturers have focused on environmentally friendly formulations, addressing growing regulatory concerns about traditional solvent-based systems.

The environmental impact of moisture protection technologies has become increasingly important, with regulations like RoHS and REACH driving the development of water-based and UV-curable systems. However, these environmentally friendly alternatives often demonstrate 15-30% lower moisture protection performance compared to traditional solvent-based systems, presenting an ongoing technical challenge.

Technical Comparison of Conformal Coating vs Encapsulation Solutions

01 Hydrophobic conformal coating materials

Hydrophobic materials such as silicones, fluoropolymers, and parylene are used in conformal coatings to provide excellent moisture resistance. These materials create a water-repellent barrier that prevents moisture ingress into electronic components. The hydrophobic nature of these coatings ensures long-term protection against humidity and condensation, making them ideal for applications in harsh environments where moisture control is critical.- Moisture-resistant conformal coating materials: Various materials can be used for conformal coatings that provide effective moisture barriers for electronic components. These include parylene coatings, silicone-based formulations, epoxy resins, and fluoropolymers. These materials create a protective layer that prevents moisture ingress while maintaining flexibility and adhesion to the substrate. The selection of coating material depends on the specific application requirements, environmental conditions, and the level of moisture protection needed.

- Encapsulation techniques for moisture control: Encapsulation methods provide comprehensive moisture protection by completely surrounding sensitive components. Techniques include vacuum encapsulation, potting compounds, and hermetic sealing. These approaches create a physical barrier that prevents moisture from reaching sensitive electronics. Advanced encapsulation may incorporate desiccants or moisture-absorbing materials within the encapsulant to actively control humidity levels inside the sealed environment, extending the lifetime of moisture-sensitive components.

- Application methods for uniform moisture protection: The effectiveness of moisture control depends significantly on the application method used for conformal coatings and encapsulants. Techniques include spray coating, dip coating, selective coating using automated systems, and vapor deposition processes. Each method offers different advantages in terms of coverage uniformity, thickness control, and ability to protect complex geometries. Proper application ensures complete coverage without voids or thin spots that could allow moisture penetration.

- Advanced moisture barrier technologies: Innovative approaches to moisture control include multi-layer barrier systems, nanocomposite coatings, and atomic layer deposition techniques. These technologies create highly effective moisture barriers through the combination of different materials or the precise deposition of ultra-thin protective layers. Some advanced solutions incorporate self-healing properties or active moisture management capabilities that can respond to changing environmental conditions, providing dynamic protection against humidity fluctuations.

- Testing and qualification of moisture protection systems: Ensuring the effectiveness of moisture control solutions requires rigorous testing and qualification procedures. Methods include accelerated aging tests, temperature-humidity-bias testing, water immersion tests, and moisture sensitivity level (MSL) classification. These evaluations help determine the long-term reliability of conformal coatings and encapsulation systems under various environmental conditions. Testing protocols may also include thermal cycling, salt spray exposure, and condensation testing to simulate real-world conditions that challenge moisture barriers.

02 Multi-layer encapsulation systems

Multi-layer encapsulation approaches combine different materials to enhance moisture protection. These systems typically include a primary moisture barrier layer, an intermediate adhesion layer, and an outer protective layer. Each layer serves a specific function in the moisture control strategy, with the combined structure providing superior protection compared to single-layer solutions. This approach is particularly effective for sensitive electronic components requiring long-term reliability in humid environments.Expand Specific Solutions03 Desiccant incorporation techniques

Desiccant materials can be incorporated into encapsulation compounds to actively absorb moisture that penetrates the coating. These moisture-scavenging additives provide an additional defense mechanism by trapping water molecules before they can reach sensitive components. Various types of desiccants including molecular sieves, silica gel, and calcium oxide can be integrated into the coating formulation or placed as separate components within the encapsulated package to maintain a dry internal environment.Expand Specific Solutions04 Vacuum and thermal processing methods

Specialized application techniques involving vacuum and thermal processing can significantly improve moisture control in conformal coatings. Vacuum deposition methods remove air and moisture before coating application, ensuring complete coverage without voids or bubbles that could trap moisture. Thermal curing processes help to drive out residual moisture and create more densely cross-linked polymer structures with enhanced barrier properties. These processing methods are critical for achieving optimal moisture resistance in high-reliability applications.Expand Specific Solutions05 Edge sealing and critical area protection

Special attention to edge sealing and critical area protection is essential for effective moisture control. Techniques include applying thicker coating at edges and corners where moisture ingress commonly occurs, using specialized edge sealants, and implementing selective area protection for moisture-sensitive components. These targeted approaches address the weakest points in the moisture barrier system, preventing water vapor from penetrating through edges, interfaces, and other vulnerable areas that might otherwise compromise the overall protection scheme.Expand Specific Solutions

Key Industry Players in Electronic Protection Materials

The conformal coating versus encapsulation market for moisture control is in a growth phase, driven by increasing demand for electronic component protection across industries. The market is expanding due to the rising complexity of electronic devices and harsh environment applications. Technologically, both methods are mature but evolving, with companies like 3M, Nordson, and BASF leading in conformal coating innovations, while Honeywell, Wacker Chemie, and LG Chem excel in encapsulation technologies. Siemens, Texas Instruments, and BYD are integrating these protection methods into their advanced electronics manufacturing processes. The competitive landscape shows specialization trends, with companies like Aculon developing niche nanotechnology-based solutions that bridge both protection methods for enhanced moisture resistance.

3M Innovative Properties Co.

Technical Solution: 3M has developed advanced conformal coating solutions utilizing fluoropolymer-based materials that provide exceptional moisture resistance while maintaining flexibility. Their technology employs vapor-phase deposition methods that create ultra-thin (5-25 micron) hydrophobic barriers with high dielectric strength. These coatings feature self-healing properties for minor scratches and incorporate UV tracers for quality control inspection. 3M's conformal coatings are designed to maintain effectiveness across extreme temperature ranges (-65°C to +200°C) and have demonstrated less than 0.1% moisture penetration in 1000-hour salt fog tests. Their proprietary application process ensures uniform coverage even on complex geometries with high aspect ratio features, addressing traditional weak points in moisture protection systems.

Strengths: Excellent moisture barrier properties with minimal thickness, allowing thermal dissipation; non-rigid coating permits component expansion without cracking; fast application and curing process suitable for high-volume manufacturing. Weaknesses: Higher initial cost compared to basic acrylic coatings; requires specialized application equipment; may need periodic reapplication in extremely harsh environments.

Nordson Corp.

Technical Solution: Nordson has pioneered precision dispensing systems specifically optimized for both conformal coating and encapsulation processes. Their technology focuses on automated selective application methods that can apply precisely controlled amounts of coating or encapsulant only where needed. For conformal coating, Nordson's systems utilize advanced vision-guided robotics with path optimization algorithms to ensure complete coverage while minimizing material usage. Their moisture control approach incorporates multi-layer coating strategies where different formulations are applied in sequence to create composite barriers with enhanced protection. For encapsulation, Nordson has developed low-pressure molding techniques that completely seal electronic components without the thermal stress associated with traditional potting methods. Their systems can apply materials with viscosities ranging from 1 to 1,000,000 centipoise, enabling use of advanced moisture-resistant formulations.

Strengths: Exceptional precision in material application reduces waste and ensures consistent coverage; automated systems increase throughput and repeatability; compatible with wide range of coating/encapsulation materials. Weaknesses: Significant capital investment required for automated dispensing systems; requires technical expertise for programming and maintenance; system changeovers between different material types can be time-consuming.

Critical Patents and Innovations in Moisture Protection

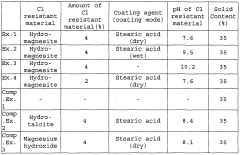

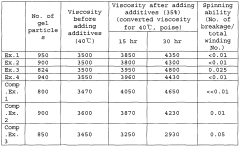

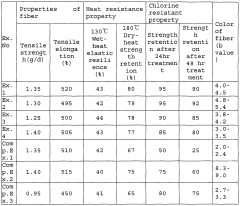

Chlorine resistant polyurethaneurea composition

PatentWO2008029996A1

Innovation

- The use of basic magnesium carbonate as a chlorine-resistant additive, optionally coated with substances like fatty acids or silanes, to enhance dispersiveness and moisture resistance, while maintaining compatibility with polyurethaneurea fibers.

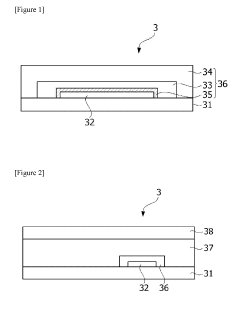

Encapsulating composition

PatentActiveUS20190309160A1

Innovation

- An encapsulating composition comprising an epoxy compound with an oxetane group and a photoinitiator, suitable for inkjet application, forms a sealing layer that provides excellent moisture barrier properties, adhesive strength, and curing sensitivity, enabling effective protection of organic electronic devices from external moisture and oxygen.

Environmental Impact and Sustainability Considerations

The environmental impact of electronic protection methods has become increasingly important as industries face stricter regulations and growing consumer demand for sustainable practices. When comparing conformal coating and encapsulation for moisture control, their environmental footprints differ significantly across multiple dimensions.

Conformal coating typically uses acrylic, silicone, polyurethane, or epoxy-based materials that contain varying levels of volatile organic compounds (VOCs). Traditional solvent-based coatings release substantial VOCs during application and curing, contributing to air pollution and potential health hazards. However, the industry has made significant progress with water-based and UV-curable conformal coatings that dramatically reduce VOC emissions by up to 95% compared to conventional formulations.

Encapsulation materials, particularly potting compounds, often contain higher volumes of synthetic polymers and chemical hardeners. Their production generally requires more raw materials and energy than conformal coatings, resulting in a larger carbon footprint. Nevertheless, encapsulated components typically enjoy longer operational lifespans, which can offset the initial environmental impact through reduced electronic waste generation over time.

End-of-life considerations reveal further distinctions between these protection methods. Conformal coatings can often be removed using specialized solvents, facilitating component repair and recycling. This repairability extends product lifecycles and reduces electronic waste. Conversely, encapsulated assemblies present significant recycling challenges, as the hardened compounds are difficult to separate from valuable components without destructive processes.

Recent innovations have introduced bio-based alternatives for both protection methods. Plant-derived conformal coatings using cashew nutshell liquid (CNSL) derivatives have demonstrated comparable moisture protection while reducing petroleum dependency. Similarly, encapsulation compounds incorporating recycled materials and biodegradable elements are emerging, though their moisture resistance properties currently lag behind conventional options.

Manufacturing process efficiency also factors into sustainability assessments. Conformal coating typically requires less energy during application and curing compared to encapsulation processes. Selective coating technologies have further improved material efficiency by reducing overspray waste by up to 30%, while automated dispensing systems for encapsulation have similarly enhanced material utilization rates.

Water consumption and contamination risks differ between these technologies as well. Conformal coating cleaning processes often require significant water usage and generate contaminated wastewater requiring treatment. Encapsulation generally demands less water during manufacturing but presents greater challenges for wastewater treatment due to the complex chemical composition of residual materials.

Conformal coating typically uses acrylic, silicone, polyurethane, or epoxy-based materials that contain varying levels of volatile organic compounds (VOCs). Traditional solvent-based coatings release substantial VOCs during application and curing, contributing to air pollution and potential health hazards. However, the industry has made significant progress with water-based and UV-curable conformal coatings that dramatically reduce VOC emissions by up to 95% compared to conventional formulations.

Encapsulation materials, particularly potting compounds, often contain higher volumes of synthetic polymers and chemical hardeners. Their production generally requires more raw materials and energy than conformal coatings, resulting in a larger carbon footprint. Nevertheless, encapsulated components typically enjoy longer operational lifespans, which can offset the initial environmental impact through reduced electronic waste generation over time.

End-of-life considerations reveal further distinctions between these protection methods. Conformal coatings can often be removed using specialized solvents, facilitating component repair and recycling. This repairability extends product lifecycles and reduces electronic waste. Conversely, encapsulated assemblies present significant recycling challenges, as the hardened compounds are difficult to separate from valuable components without destructive processes.

Recent innovations have introduced bio-based alternatives for both protection methods. Plant-derived conformal coatings using cashew nutshell liquid (CNSL) derivatives have demonstrated comparable moisture protection while reducing petroleum dependency. Similarly, encapsulation compounds incorporating recycled materials and biodegradable elements are emerging, though their moisture resistance properties currently lag behind conventional options.

Manufacturing process efficiency also factors into sustainability assessments. Conformal coating typically requires less energy during application and curing compared to encapsulation processes. Selective coating technologies have further improved material efficiency by reducing overspray waste by up to 30%, while automated dispensing systems for encapsulation have similarly enhanced material utilization rates.

Water consumption and contamination risks differ between these technologies as well. Conformal coating cleaning processes often require significant water usage and generate contaminated wastewater requiring treatment. Encapsulation generally demands less water during manufacturing but presents greater challenges for wastewater treatment due to the complex chemical composition of residual materials.

Cost-Benefit Analysis of Protection Methods

When evaluating moisture protection strategies for electronic components, cost-benefit analysis provides critical insights for decision-making. Conformal coating typically represents a lower initial investment, with material costs ranging from $0.30 to $3.00 per square foot depending on the type (acrylic, silicone, urethane, epoxy, or parylene). Application equipment for conformal coating can be relatively inexpensive, starting from $5,000 for basic spray systems, though automated selective coating equipment may cost $50,000-$150,000.

Encapsulation presents higher upfront costs, with potting compounds ranging from $15 to $60 per pound, and specialized mixing and dispensing equipment requiring investments of $20,000-$100,000. However, this analysis must extend beyond initial expenditure to consider total cost of ownership.

The labor requirements differ significantly between methods. Conformal coating processes can be automated but often require masking of sensitive areas, adding labor costs of approximately $10-25 per hour. Encapsulation typically demands less masking but requires precise mixing ratios and careful dispensing, with similar hourly labor rates but potentially fewer total hours.

Maintenance considerations favor encapsulation in harsh environments. While conformal coatings may require periodic inspection and reapplication every 3-5 years (costing $0.50-$5.00 per square foot), properly formulated encapsulants can last the entire product lifecycle without maintenance, eliminating recurring costs.

Failure rate analysis reveals that conformal coating provides adequate protection in moderate moisture conditions with approximately 2-5% failure rates over five years. Encapsulation reduces this to 0.5-2% in similar conditions, and maintains superior performance in extreme environments where conformal coating failure rates may exceed 15%.

Production throughput also impacts cost-effectiveness. Conformal coating curing times range from minutes to hours, while encapsulants may require 24-48 hours for complete curing, potentially creating production bottlenecks that increase indirect costs by 10-20%.

Weight and space considerations present another dimension of analysis. Conformal coating adds negligible weight (1-5 grams per square foot), while encapsulation can add 50-500 grams depending on volume. For weight-sensitive applications like aerospace, this difference translates to significant operational costs over the product lifecycle.

The return on investment timeline typically favors conformal coating for short-lifecycle products (1-3 years) or moderate environments, while encapsulation demonstrates superior ROI for long-lifecycle applications (5+ years) or harsh conditions, despite higher initial costs.

Encapsulation presents higher upfront costs, with potting compounds ranging from $15 to $60 per pound, and specialized mixing and dispensing equipment requiring investments of $20,000-$100,000. However, this analysis must extend beyond initial expenditure to consider total cost of ownership.

The labor requirements differ significantly between methods. Conformal coating processes can be automated but often require masking of sensitive areas, adding labor costs of approximately $10-25 per hour. Encapsulation typically demands less masking but requires precise mixing ratios and careful dispensing, with similar hourly labor rates but potentially fewer total hours.

Maintenance considerations favor encapsulation in harsh environments. While conformal coatings may require periodic inspection and reapplication every 3-5 years (costing $0.50-$5.00 per square foot), properly formulated encapsulants can last the entire product lifecycle without maintenance, eliminating recurring costs.

Failure rate analysis reveals that conformal coating provides adequate protection in moderate moisture conditions with approximately 2-5% failure rates over five years. Encapsulation reduces this to 0.5-2% in similar conditions, and maintains superior performance in extreme environments where conformal coating failure rates may exceed 15%.

Production throughput also impacts cost-effectiveness. Conformal coating curing times range from minutes to hours, while encapsulants may require 24-48 hours for complete curing, potentially creating production bottlenecks that increase indirect costs by 10-20%.

Weight and space considerations present another dimension of analysis. Conformal coating adds negligible weight (1-5 grams per square foot), while encapsulation can add 50-500 grams depending on volume. For weight-sensitive applications like aerospace, this difference translates to significant operational costs over the product lifecycle.

The return on investment timeline typically favors conformal coating for short-lifecycle products (1-3 years) or moderate environments, while encapsulation demonstrates superior ROI for long-lifecycle applications (5+ years) or harsh conditions, despite higher initial costs.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!