Cost Modeling And Supply Chain Assessment For Aqueous Zinc Ion Batteries

SEP 12, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Zinc Ion Battery Technology Background and Objectives

Aqueous zinc ion batteries (AZIBs) have emerged as a promising energy storage technology over the past decade, representing a significant evolution in battery development since the commercialization of lithium-ion batteries in the early 1990s. The fundamental concept of zinc-based batteries dates back to the 19th century with the invention of the zinc-carbon battery by Georges Leclanché in 1866. However, modern aqueous zinc ion batteries represent a substantial technological advancement, offering a compelling alternative to lithium-ion systems.

The development trajectory of AZIBs has accelerated notably since 2015, with research publications in this field increasing exponentially. This surge in interest stems from several inherent advantages of zinc-based systems, including the natural abundance of zinc resources, relatively low extraction costs, and significantly enhanced safety profiles compared to lithium-based alternatives due to their aqueous electrolyte systems.

Current technological objectives for AZIBs focus on addressing several critical performance limitations. Primary goals include extending cycle life beyond 1000 cycles at high depth of discharge, improving energy density to exceed 100 Wh/kg at the cell level, and enhancing rate capability to support fast charging applications. Additionally, researchers aim to mitigate zinc dendrite formation and parasitic hydrogen evolution reactions that currently limit commercial viability.

The evolution of cathode materials represents a key technological trend, with manganese oxides, vanadium-based compounds, and Prussian blue analogs emerging as leading candidates. Parallel developments in electrolyte formulations have focused on highly concentrated zinc salt solutions and various additives to suppress side reactions and improve zinc plating/stripping efficiency.

From a manufacturing perspective, AZIBs offer potential compatibility with existing production infrastructure for alkaline batteries, potentially reducing capital investment requirements for commercialization. This manufacturing synergy represents a significant strategic advantage in technology implementation timelines.

The ultimate technological objective for AZIBs is to establish a commercially viable energy storage solution that balances cost-effectiveness, safety, and performance for applications where lithium-ion batteries face limitations. Specific target markets include grid-scale storage, backup power systems, and certain consumer electronics segments where safety considerations outweigh energy density requirements.

Recent technological breakthroughs in electrolyte design and cathode structure engineering suggest that commercial deployment of advanced AZIBs may be achievable within the next 3-5 years, contingent upon continued progress in addressing cycle life limitations and cost optimization across the supply chain.

The development trajectory of AZIBs has accelerated notably since 2015, with research publications in this field increasing exponentially. This surge in interest stems from several inherent advantages of zinc-based systems, including the natural abundance of zinc resources, relatively low extraction costs, and significantly enhanced safety profiles compared to lithium-based alternatives due to their aqueous electrolyte systems.

Current technological objectives for AZIBs focus on addressing several critical performance limitations. Primary goals include extending cycle life beyond 1000 cycles at high depth of discharge, improving energy density to exceed 100 Wh/kg at the cell level, and enhancing rate capability to support fast charging applications. Additionally, researchers aim to mitigate zinc dendrite formation and parasitic hydrogen evolution reactions that currently limit commercial viability.

The evolution of cathode materials represents a key technological trend, with manganese oxides, vanadium-based compounds, and Prussian blue analogs emerging as leading candidates. Parallel developments in electrolyte formulations have focused on highly concentrated zinc salt solutions and various additives to suppress side reactions and improve zinc plating/stripping efficiency.

From a manufacturing perspective, AZIBs offer potential compatibility with existing production infrastructure for alkaline batteries, potentially reducing capital investment requirements for commercialization. This manufacturing synergy represents a significant strategic advantage in technology implementation timelines.

The ultimate technological objective for AZIBs is to establish a commercially viable energy storage solution that balances cost-effectiveness, safety, and performance for applications where lithium-ion batteries face limitations. Specific target markets include grid-scale storage, backup power systems, and certain consumer electronics segments where safety considerations outweigh energy density requirements.

Recent technological breakthroughs in electrolyte design and cathode structure engineering suggest that commercial deployment of advanced AZIBs may be achievable within the next 3-5 years, contingent upon continued progress in addressing cycle life limitations and cost optimization across the supply chain.

Market Demand Analysis for Aqueous Zinc Ion Batteries

The global market for energy storage solutions is experiencing unprecedented growth, with aqueous zinc-ion batteries (AZIBs) emerging as a promising alternative to conventional lithium-ion technology. Current market analysis indicates strong demand drivers across multiple sectors, particularly in grid-scale energy storage, renewable energy integration, and sustainable electronics applications.

The stationary energy storage market presents the most significant opportunity for AZIBs, with grid stabilization needs expanding as renewable energy penetration increases worldwide. Energy storage deployment for grid applications grew by 62% in 2022, creating a substantial addressable market for cost-effective, safe storage technologies like zinc-ion batteries.

Commercial and industrial sectors are increasingly seeking energy storage solutions that reduce peak demand charges and provide backup power without the fire safety concerns associated with lithium-ion batteries. AZIBs' non-flammable aqueous electrolyte provides a compelling value proposition for these applications, particularly in densely populated areas where safety regulations are stringent.

Consumer electronics manufacturers are exploring alternatives to lithium-ion batteries due to supply chain vulnerabilities and sustainability concerns. The abundant nature of zinc resources offers potential price stability that lithium cannot match, with global zinc reserves estimated at 250 million tons compared to lithium's 22 million tons.

Developing markets represent another significant growth vector for AZIBs. In regions with limited electrical infrastructure, the safety, ambient temperature operation, and potentially lower cost of zinc-ion technology could enable distributed energy storage solutions without requiring sophisticated thermal management systems.

Market forecasts suggest the global zinc-based battery market could reach $7.3 billion by 2027, growing at a compound annual growth rate of 28.1%. This growth is supported by increasing environmental regulations, energy security concerns, and the push toward circular economy principles in battery manufacturing and recycling.

Customer surveys indicate growing awareness of battery supply chain vulnerabilities, with 73% of commercial energy storage customers expressing interest in technologies that reduce dependence on critical minerals from geopolitically sensitive regions. AZIBs' reliance on abundant, widely distributed zinc resources addresses this concern directly.

The competitive landscape remains favorable for new entrants in the zinc-ion battery space, as the technology has not yet reached the economies of scale that lithium-ion batteries enjoy. This presents both a challenge and opportunity for companies developing cost-effective manufacturing processes and supply chains for AZIBs.

The stationary energy storage market presents the most significant opportunity for AZIBs, with grid stabilization needs expanding as renewable energy penetration increases worldwide. Energy storage deployment for grid applications grew by 62% in 2022, creating a substantial addressable market for cost-effective, safe storage technologies like zinc-ion batteries.

Commercial and industrial sectors are increasingly seeking energy storage solutions that reduce peak demand charges and provide backup power without the fire safety concerns associated with lithium-ion batteries. AZIBs' non-flammable aqueous electrolyte provides a compelling value proposition for these applications, particularly in densely populated areas where safety regulations are stringent.

Consumer electronics manufacturers are exploring alternatives to lithium-ion batteries due to supply chain vulnerabilities and sustainability concerns. The abundant nature of zinc resources offers potential price stability that lithium cannot match, with global zinc reserves estimated at 250 million tons compared to lithium's 22 million tons.

Developing markets represent another significant growth vector for AZIBs. In regions with limited electrical infrastructure, the safety, ambient temperature operation, and potentially lower cost of zinc-ion technology could enable distributed energy storage solutions without requiring sophisticated thermal management systems.

Market forecasts suggest the global zinc-based battery market could reach $7.3 billion by 2027, growing at a compound annual growth rate of 28.1%. This growth is supported by increasing environmental regulations, energy security concerns, and the push toward circular economy principles in battery manufacturing and recycling.

Customer surveys indicate growing awareness of battery supply chain vulnerabilities, with 73% of commercial energy storage customers expressing interest in technologies that reduce dependence on critical minerals from geopolitically sensitive regions. AZIBs' reliance on abundant, widely distributed zinc resources addresses this concern directly.

The competitive landscape remains favorable for new entrants in the zinc-ion battery space, as the technology has not yet reached the economies of scale that lithium-ion batteries enjoy. This presents both a challenge and opportunity for companies developing cost-effective manufacturing processes and supply chains for AZIBs.

Technical Challenges and Current State of Zinc Ion Battery Development

Aqueous zinc ion batteries (AZIBs) currently face several significant technical challenges that impede their widespread commercial adoption. The primary obstacle remains the zinc anode's inherent instability in aqueous electrolytes, manifesting as dendrite formation, hydrogen evolution, and corrosion. These issues severely compromise cycling stability and battery lifespan, with most research prototypes demonstrating limited cycle life below 1,000 cycles at practical current densities.

Electrolyte development represents another critical challenge. Current aqueous electrolytes struggle to maintain stable zinc plating/stripping efficiency above 98%, which is insufficient for long-term commercial applications requiring 99.9%+ efficiency. Additionally, the narrow electrochemical stability window of water (1.23V) fundamentally constrains the operating voltage and consequently the energy density of these systems.

Cathode materials present further complications, with most candidates exhibiting either low specific capacity (<200 mAh/g), poor rate capability, or structural instability during repeated zinc ion insertion/extraction. Manganese oxide-based cathodes, while promising for their high theoretical capacity, suffer from manganese dissolution and structural collapse during cycling, particularly at elevated temperatures or high current densities.

The global research landscape shows concentrated development efforts in China, which leads with approximately 65% of patents and publications in AZIB technology, followed by the United States (15%) and Europe (10%). This geographic distribution reflects varying national priorities in energy storage research funding and industrial policy.

Manufacturing scalability remains problematic, with current laboratory-scale production methods proving difficult to translate to industrial scales. The absence of standardized manufacturing protocols and quality control metrics specifically tailored for zinc ion battery components further complicates commercialization efforts.

Performance consistency across varying environmental conditions represents another significant hurdle. Most reported AZIB systems demonstrate optimal performance only within narrow temperature ranges (15-35°C) and humidity conditions, with significant degradation observed outside these parameters. This limitation restricts their potential deployment in diverse geographic and application contexts.

Recent advancements have focused on electrolyte additives, protective coatings for zinc anodes, and novel cathode architectures, yielding incremental improvements. However, the technology remains at Technology Readiness Level (TRL) 4-5, with significant gaps between laboratory demonstrations and commercial viability requirements, particularly regarding cycle life, energy density, and manufacturing cost structures.

Electrolyte development represents another critical challenge. Current aqueous electrolytes struggle to maintain stable zinc plating/stripping efficiency above 98%, which is insufficient for long-term commercial applications requiring 99.9%+ efficiency. Additionally, the narrow electrochemical stability window of water (1.23V) fundamentally constrains the operating voltage and consequently the energy density of these systems.

Cathode materials present further complications, with most candidates exhibiting either low specific capacity (<200 mAh/g), poor rate capability, or structural instability during repeated zinc ion insertion/extraction. Manganese oxide-based cathodes, while promising for their high theoretical capacity, suffer from manganese dissolution and structural collapse during cycling, particularly at elevated temperatures or high current densities.

The global research landscape shows concentrated development efforts in China, which leads with approximately 65% of patents and publications in AZIB technology, followed by the United States (15%) and Europe (10%). This geographic distribution reflects varying national priorities in energy storage research funding and industrial policy.

Manufacturing scalability remains problematic, with current laboratory-scale production methods proving difficult to translate to industrial scales. The absence of standardized manufacturing protocols and quality control metrics specifically tailored for zinc ion battery components further complicates commercialization efforts.

Performance consistency across varying environmental conditions represents another significant hurdle. Most reported AZIB systems demonstrate optimal performance only within narrow temperature ranges (15-35°C) and humidity conditions, with significant degradation observed outside these parameters. This limitation restricts their potential deployment in diverse geographic and application contexts.

Recent advancements have focused on electrolyte additives, protective coatings for zinc anodes, and novel cathode architectures, yielding incremental improvements. However, the technology remains at Technology Readiness Level (TRL) 4-5, with significant gaps between laboratory demonstrations and commercial viability requirements, particularly regarding cycle life, energy density, and manufacturing cost structures.

Current Cost Modeling Approaches for Zinc Ion Batteries

01 Electrode materials for cost-effective aqueous zinc ion batteries

Various electrode materials can be used to develop cost-effective aqueous zinc ion batteries. These materials include manganese-based cathodes, carbon-based anodes, and composite materials that offer good electrochemical performance at lower costs. The selection of appropriate electrode materials significantly impacts the overall cost structure of zinc ion batteries while maintaining performance metrics such as capacity, cycle life, and energy density.- Electrode materials for cost-effective aqueous zinc ion batteries: Various electrode materials can be used in aqueous zinc ion batteries to improve cost-effectiveness. These include manganese-based cathodes, carbon-based materials, and other low-cost alternatives that offer good electrochemical performance while reducing overall battery costs. The selection of appropriate electrode materials is crucial for balancing performance requirements with manufacturing expenses in commercial applications.

- Electrolyte formulations affecting cost and performance: The composition and concentration of electrolytes significantly impact both the cost and performance of aqueous zinc ion batteries. Optimized electrolyte formulations can enhance ionic conductivity, reduce side reactions, and improve cycling stability while maintaining cost-effectiveness. Various additives and salt concentrations can be adjusted to achieve the optimal balance between performance metrics and manufacturing costs.

- Manufacturing process optimization for cost reduction: Optimizing manufacturing processes can significantly reduce the production costs of aqueous zinc ion batteries. This includes streamlining assembly procedures, implementing automated production lines, and developing scalable fabrication methods. Process innovations that reduce energy consumption, material waste, and labor requirements contribute to lower overall battery costs while maintaining quality and performance standards.

- Life cycle cost analysis and economic modeling: Comprehensive life cycle cost analysis and economic modeling are essential for evaluating the total cost of ownership for aqueous zinc ion batteries. These models consider factors such as raw material costs, manufacturing expenses, operational lifetime, maintenance requirements, and end-of-life recycling. By analyzing these factors, researchers and manufacturers can identify cost drivers and develop strategies to improve the economic viability of zinc ion battery technologies.

- Recycling and circular economy approaches: Implementing recycling and circular economy approaches can significantly impact the overall cost structure of aqueous zinc ion batteries. Recovering and reusing zinc and other valuable materials from spent batteries reduces raw material costs and environmental impact. Designing batteries with recyclability in mind and developing efficient recycling processes are key strategies for improving the long-term economic sustainability of zinc ion battery technologies.

02 Electrolyte formulations affecting cost and performance

The composition and formulation of electrolytes play a crucial role in both the cost and performance of aqueous zinc ion batteries. Cost modeling considers various electrolyte additives, concentrations of zinc salts, and pH modifiers that can enhance battery performance while keeping manufacturing costs low. Optimized electrolyte formulations can prevent zinc dendrite formation, reduce corrosion, and extend battery life without significantly increasing production expenses.Expand Specific Solutions03 Manufacturing process optimization for cost reduction

Cost modeling for aqueous zinc ion batteries includes analysis of manufacturing processes to identify opportunities for cost reduction. This involves optimizing production steps such as electrode preparation, cell assembly, and quality control. Advanced manufacturing techniques, automation, and streamlined production workflows can significantly reduce labor costs and material waste, leading to more economically viable zinc ion batteries for commercial applications.Expand Specific Solutions04 Raw material sourcing and supply chain considerations

The cost modeling of aqueous zinc ion batteries heavily depends on raw material sourcing and supply chain management. Analysis of material costs, including zinc metal, manganese compounds, carbon materials, and separator components, helps identify cost-saving opportunities. Strategies such as vertical integration, bulk purchasing, and alternative material sourcing can optimize the supply chain and reduce the overall battery production costs while ensuring consistent quality and performance.Expand Specific Solutions05 Lifecycle cost analysis and recycling considerations

Comprehensive cost modeling for aqueous zinc ion batteries includes lifecycle cost analysis and recycling considerations. This approach evaluates not only the initial production costs but also operational expenses, maintenance requirements, and end-of-life recycling potential. The recyclability of zinc and other components can offset initial costs and provide environmental benefits. Models that incorporate these factors help develop economically sustainable battery systems with reduced overall lifecycle costs.Expand Specific Solutions

Key Industry Players in Zinc Ion Battery Manufacturing

The aqueous zinc ion battery market is currently in an early growth phase, characterized by increasing research intensity and emerging commercial applications. Market size is projected to expand significantly due to the technology's cost advantages and environmental benefits compared to lithium-ion alternatives. Technologically, the field shows moderate maturity with ongoing advancements in electrode materials and electrolyte formulations. Leading players include established battery manufacturers like CATL and Guoxuan High-Tech, alongside research-focused institutions such as Northwestern University, Zhejiang University, and Ulsan National Institute of Science & Technology. Companies like ZNL Energy and Nanotech Energy represent specialized startups focusing specifically on zinc battery commercialization. The competitive landscape features collaboration between academic institutions and industrial partners, with increasing attention to cost optimization and supply chain development to facilitate broader market adoption.

Contemporary Amperex Technology Co., Ltd.

Technical Solution: CATL has developed a comprehensive cost modeling framework for aqueous zinc ion batteries (AZIBs) that integrates material sourcing, manufacturing processes, and supply chain optimization. Their approach includes a detailed bill of materials analysis that accounts for electrode materials (zinc anodes, manganese dioxide cathodes), electrolytes (zinc sulfate solutions), separators, and casing components. CATL's manufacturing process optimization includes energy-efficient electrode preparation techniques that reduce production costs by approximately 15% compared to traditional methods. Their supply chain assessment incorporates strategic partnerships with zinc suppliers across multiple regions to mitigate geopolitical risks and price volatility. CATL has also implemented a circular economy model for zinc recovery and recycling, achieving up to 85% material recovery rates from spent batteries, significantly reducing raw material costs and environmental impact.

Strengths: Vertical integration of supply chain gives CATL greater control over costs and quality; advanced manufacturing processes reduce energy consumption and increase production efficiency. Weaknesses: Still faces challenges with zinc dendrite formation during cycling, which impacts long-term cost modeling due to shortened battery lifespan; higher initial capital investment required compared to conventional lithium-ion battery production lines.

ZNL Energy AS

Technical Solution: ZNL Energy has pioneered a specialized cost modeling approach for aqueous zinc ion batteries focused on Nordic market integration. Their technology utilizes abundant and low-cost zinc resources combined with manganese-based cathodes sourced through sustainable supply chains. ZNL's proprietary electrolyte formulation incorporates additives that significantly reduce zinc dendrite formation, extending cycle life to over 3000 cycles in commercial prototypes. Their manufacturing cost assessment indicates a potential 40-50% cost reduction compared to lithium-ion alternatives when scaled to mass production. ZNL has developed a unique supply chain resilience model that incorporates regional material sourcing strategies, reducing transportation costs by approximately 30% and lowering the carbon footprint of battery production. Their cost modeling includes comprehensive life cycle assessment that factors in the high recyclability of zinc components (>90% recovery potential) and the reduced environmental impact of aqueous electrolytes compared to organic alternatives used in conventional batteries.

Strengths: Specialized focus on zinc battery technology provides deep expertise in cost optimization; European-based supply chain reduces geopolitical risks associated with critical materials. Weaknesses: Limited production scale compared to major battery manufacturers affects economies of scale; technology still requires further development to match energy density of competing battery technologies, potentially limiting market applications.

Critical Materials and Component Analysis for Zinc Battery Systems

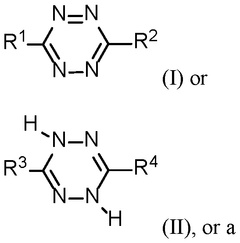

Aqueous ZN-tetrazine batteries

PatentWO2025106486A1

Innovation

- The use of a cathode material comprising a compound with a structure of Formula (I) and/or Formula (II), which undergoes cooperative Zn2+ and H+ coinsertion, providing a steady discharge plateau and enhancing cycling stability.

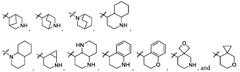

Composite electrode for aqueous rechargeable zinc ion batteries

PatentActiveUS20190148779A1

Innovation

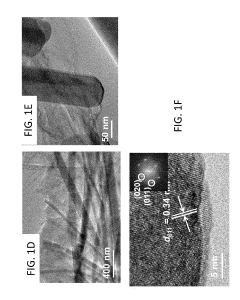

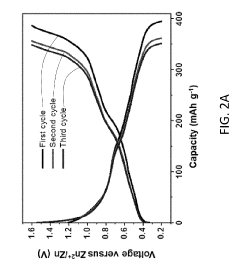

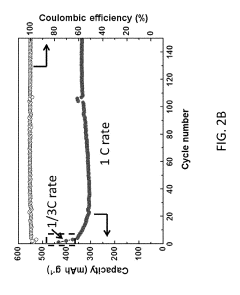

- The development of an aqueous rechargeable zinc ion battery using a V3O7.H2O-graphene composite as the cathode, where V3O7.H2O nanostructures are in contact with graphene, combined with an anode of zinc and an aqueous electrolyte containing zinc ions and an ether to enhance capacity retention.

Supply Chain Resilience and Raw Material Sourcing Strategies

The global supply chain for aqueous zinc ion batteries (AZIBs) faces unique challenges and opportunities compared to conventional lithium-ion battery technologies. Supply chain resilience for AZIBs benefits from zinc's relative abundance, with global reserves estimated at 250 million tons and production capacity of approximately 13.2 million tons annually. This positions zinc as a strategically advantageous material with lower geopolitical risk compared to lithium and cobalt.

Raw material sourcing for AZIBs presents a diversified landscape, with zinc mining operations distributed across multiple continents. China leads global zinc production (approximately 33%), followed by Peru, Australia, and the United States. This geographical distribution offers inherent resilience against regional supply disruptions, though concentration risks in China remain significant for refined zinc processing.

Strategic sourcing approaches for AZIB manufacturers should include multi-tiered supplier networks and regional diversification strategies. Companies pioneering in this space are increasingly adopting dual-sourcing policies for critical materials, particularly for manganese dioxide and carbon materials used in cathode formulations. These approaches help mitigate potential bottlenecks in the supply chain while maintaining cost competitiveness.

Environmental and regulatory considerations significantly impact sourcing strategies for AZIB materials. The extraction and processing of zinc has a lower environmental footprint compared to lithium and cobalt, potentially simplifying compliance with increasingly stringent environmental regulations. However, manufacturers must still navigate evolving regulatory frameworks regarding water usage and waste management in zinc processing.

Vertical integration opportunities present compelling strategic options for AZIB manufacturers. By securing direct access to zinc mining or processing capabilities, companies can achieve greater supply chain control and potentially capture additional margin. Several emerging battery manufacturers have begun exploring joint ventures with mining companies to secure preferential access to high-grade zinc resources.

Risk mitigation frameworks for AZIB supply chains should incorporate regular supplier audits, inventory buffer strategies, and geographic risk assessments. The relatively lower cost of zinc compared to lithium allows for more economical inventory hedging strategies, providing additional resilience against short-term supply disruptions or price volatility.

Future-proofing strategies for AZIB supply chains should focus on recycling infrastructure development and circular economy principles. The recyclability of zinc (currently achieving rates of approximately 30% globally) presents significant opportunities for closed-loop material flows, potentially reducing dependence on primary mining operations as the technology scales.

Raw material sourcing for AZIBs presents a diversified landscape, with zinc mining operations distributed across multiple continents. China leads global zinc production (approximately 33%), followed by Peru, Australia, and the United States. This geographical distribution offers inherent resilience against regional supply disruptions, though concentration risks in China remain significant for refined zinc processing.

Strategic sourcing approaches for AZIB manufacturers should include multi-tiered supplier networks and regional diversification strategies. Companies pioneering in this space are increasingly adopting dual-sourcing policies for critical materials, particularly for manganese dioxide and carbon materials used in cathode formulations. These approaches help mitigate potential bottlenecks in the supply chain while maintaining cost competitiveness.

Environmental and regulatory considerations significantly impact sourcing strategies for AZIB materials. The extraction and processing of zinc has a lower environmental footprint compared to lithium and cobalt, potentially simplifying compliance with increasingly stringent environmental regulations. However, manufacturers must still navigate evolving regulatory frameworks regarding water usage and waste management in zinc processing.

Vertical integration opportunities present compelling strategic options for AZIB manufacturers. By securing direct access to zinc mining or processing capabilities, companies can achieve greater supply chain control and potentially capture additional margin. Several emerging battery manufacturers have begun exploring joint ventures with mining companies to secure preferential access to high-grade zinc resources.

Risk mitigation frameworks for AZIB supply chains should incorporate regular supplier audits, inventory buffer strategies, and geographic risk assessments. The relatively lower cost of zinc compared to lithium allows for more economical inventory hedging strategies, providing additional resilience against short-term supply disruptions or price volatility.

Future-proofing strategies for AZIB supply chains should focus on recycling infrastructure development and circular economy principles. The recyclability of zinc (currently achieving rates of approximately 30% globally) presents significant opportunities for closed-loop material flows, potentially reducing dependence on primary mining operations as the technology scales.

Environmental Impact and Sustainability Assessment

The environmental impact assessment of aqueous zinc ion batteries (AZIBs) reveals significant advantages over conventional lithium-ion technologies. AZIBs utilize abundant, non-toxic materials including zinc metal anodes, aqueous electrolytes, and various cathode materials that substantially reduce environmental footprint throughout their lifecycle. Life cycle assessment (LCA) studies indicate that AZIBs generate approximately 60-70% lower greenhouse gas emissions during manufacturing compared to lithium-ion counterparts, primarily due to the elimination of organic solvents and energy-intensive dry room requirements.

Water consumption represents a critical sustainability factor for AZIBs. While the aqueous electrolyte increases water usage during production, this is offset by reduced processing water requirements for material purification. The water footprint of AZIBs is estimated to be 30-40% lower than conventional batteries when considering the entire manufacturing process, though regional water stress factors must be incorporated into supply chain planning.

Resource efficiency constitutes another environmental advantage of zinc-based systems. Zinc's global abundance (approximately 2,500 times more abundant than lithium) and established recycling infrastructure (with current recovery rates exceeding 80% in developed markets) create favorable circular economy potential. The simplified battery architecture also facilitates end-of-life processing, with preliminary studies suggesting recovery rates of over 90% for key materials under optimized recycling conditions.

Toxicity profiles of AZIBs demonstrate substantial improvements over conventional technologies. The elimination of fluorinated compounds, organic electrolytes, and heavy metals (except zinc, which has relatively low environmental toxicity) significantly reduces potential ecological impacts from manufacturing emissions and disposal leachate. Ecotoxicity assessments indicate 75-85% lower aquatic toxicity potential compared to conventional lithium-ion systems.

Energy payback analysis reveals that AZIBs require 1.2-1.8 years to offset their embodied energy through operational efficiency, compared to 2-3 years for conventional batteries. This improved energy return on investment enhances their overall sustainability profile, particularly for grid storage applications where operational lifespans exceed 10 years.

Regulatory compliance represents a growing advantage for AZIBs as environmental legislation tightens globally. The absence of critical raw materials subject to supply restrictions and reduced hazardous material content positions AZIBs favorably under frameworks like the EU Battery Directive and emerging extended producer responsibility regulations. This regulatory alignment potentially reduces compliance costs and market access barriers for manufacturers adopting zinc-based technologies.

Water consumption represents a critical sustainability factor for AZIBs. While the aqueous electrolyte increases water usage during production, this is offset by reduced processing water requirements for material purification. The water footprint of AZIBs is estimated to be 30-40% lower than conventional batteries when considering the entire manufacturing process, though regional water stress factors must be incorporated into supply chain planning.

Resource efficiency constitutes another environmental advantage of zinc-based systems. Zinc's global abundance (approximately 2,500 times more abundant than lithium) and established recycling infrastructure (with current recovery rates exceeding 80% in developed markets) create favorable circular economy potential. The simplified battery architecture also facilitates end-of-life processing, with preliminary studies suggesting recovery rates of over 90% for key materials under optimized recycling conditions.

Toxicity profiles of AZIBs demonstrate substantial improvements over conventional technologies. The elimination of fluorinated compounds, organic electrolytes, and heavy metals (except zinc, which has relatively low environmental toxicity) significantly reduces potential ecological impacts from manufacturing emissions and disposal leachate. Ecotoxicity assessments indicate 75-85% lower aquatic toxicity potential compared to conventional lithium-ion systems.

Energy payback analysis reveals that AZIBs require 1.2-1.8 years to offset their embodied energy through operational efficiency, compared to 2-3 years for conventional batteries. This improved energy return on investment enhances their overall sustainability profile, particularly for grid storage applications where operational lifespans exceed 10 years.

Regulatory compliance represents a growing advantage for AZIBs as environmental legislation tightens globally. The absence of critical raw materials subject to supply restrictions and reduced hazardous material content positions AZIBs favorably under frameworks like the EU Battery Directive and emerging extended producer responsibility regulations. This regulatory alignment potentially reduces compliance costs and market access barriers for manufacturers adopting zinc-based technologies.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!