Duplex Stainless Steel Lifecycle: Fabrication Records, Repairs And Fitness-For-Service

SEP 15, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Duplex Steel Evolution and Development Objectives

Duplex stainless steels have evolved significantly since their inception in the early 20th century. The first patent for duplex stainless steel was granted in 1927 to Bain and Griffith, with the initial commercial production beginning in the 1930s. These early duplex alloys contained approximately 20% chromium and 8% nickel, providing a balanced microstructure of austenite and ferrite phases that offered superior strength and corrosion resistance compared to conventional austenitic stainless steels.

The evolution of duplex stainless steels can be categorized into distinct generations. The first generation, developed between the 1930s and 1960s, suffered from limitations in weldability and corrosion resistance due to technological constraints in steel manufacturing processes. The second generation emerged in the 1970s with the introduction of nitrogen as an alloying element, which significantly enhanced pitting corrosion resistance and structural stability during welding operations.

The 1980s marked a pivotal advancement with the development of super duplex stainless steels, containing higher chromium (25-26%), molybdenum (3-4%), and nitrogen content, which substantially improved resistance to pitting and crevice corrosion in aggressive environments. This innovation expanded the application range of duplex steels into more demanding sectors such as offshore oil and gas, chemical processing, and marine environments.

Recent developments have focused on lean duplex grades that maintain excellent mechanical properties while reducing costly alloying elements like nickel and molybdenum. These economical alternatives have broadened the market appeal of duplex stainless steels, particularly in construction and water treatment applications where cost considerations are paramount.

The primary objective in duplex stainless steel development has been to optimize the phase balance between austenite and ferrite, typically targeting a 50:50 ratio. This balance is crucial for achieving the desired combination of strength, ductility, and corrosion resistance. Modern metallurgical research aims to maintain this optimal phase balance throughout the material's lifecycle, including during fabrication processes such as welding, forming, and heat treatment.

Current development goals focus on enhancing the fitness-for-service aspects of duplex stainless steels by improving their resistance to various degradation mechanisms, including hydrogen embrittlement, stress corrosion cracking, and thermal aging. Additionally, there is significant interest in developing comprehensive fabrication records and repair protocols that ensure the long-term integrity of duplex stainless steel components in critical applications.

The future trajectory of duplex stainless steel development is oriented toward creating alloys with improved high-temperature stability, better weldability, and enhanced resistance to hydrogen-induced cracking, particularly for emerging applications in hydrogen energy infrastructure and advanced chemical processing facilities.

The evolution of duplex stainless steels can be categorized into distinct generations. The first generation, developed between the 1930s and 1960s, suffered from limitations in weldability and corrosion resistance due to technological constraints in steel manufacturing processes. The second generation emerged in the 1970s with the introduction of nitrogen as an alloying element, which significantly enhanced pitting corrosion resistance and structural stability during welding operations.

The 1980s marked a pivotal advancement with the development of super duplex stainless steels, containing higher chromium (25-26%), molybdenum (3-4%), and nitrogen content, which substantially improved resistance to pitting and crevice corrosion in aggressive environments. This innovation expanded the application range of duplex steels into more demanding sectors such as offshore oil and gas, chemical processing, and marine environments.

Recent developments have focused on lean duplex grades that maintain excellent mechanical properties while reducing costly alloying elements like nickel and molybdenum. These economical alternatives have broadened the market appeal of duplex stainless steels, particularly in construction and water treatment applications where cost considerations are paramount.

The primary objective in duplex stainless steel development has been to optimize the phase balance between austenite and ferrite, typically targeting a 50:50 ratio. This balance is crucial for achieving the desired combination of strength, ductility, and corrosion resistance. Modern metallurgical research aims to maintain this optimal phase balance throughout the material's lifecycle, including during fabrication processes such as welding, forming, and heat treatment.

Current development goals focus on enhancing the fitness-for-service aspects of duplex stainless steels by improving their resistance to various degradation mechanisms, including hydrogen embrittlement, stress corrosion cracking, and thermal aging. Additionally, there is significant interest in developing comprehensive fabrication records and repair protocols that ensure the long-term integrity of duplex stainless steel components in critical applications.

The future trajectory of duplex stainless steel development is oriented toward creating alloys with improved high-temperature stability, better weldability, and enhanced resistance to hydrogen-induced cracking, particularly for emerging applications in hydrogen energy infrastructure and advanced chemical processing facilities.

Market Analysis of Duplex Stainless Steel Applications

The global market for duplex stainless steel has experienced significant growth over the past decade, driven primarily by its superior combination of strength and corrosion resistance compared to conventional stainless steel grades. The oil and gas industry remains the largest consumer of duplex stainless steel, accounting for approximately 30% of total consumption, particularly in offshore platforms, pipelines, and processing equipment where exposure to harsh marine environments necessitates materials with exceptional corrosion resistance.

Chemical processing represents the second-largest application sector, where duplex grades are preferred for their resistance to stress corrosion cracking in chloride-containing environments. This sector has shown steady growth at around 5-7% annually, with particular demand in chemical transport systems and pressure vessels.

Desalination plants have emerged as a rapidly expanding market segment for duplex stainless steel, growing at nearly 10% annually in regions facing freshwater scarcity. The material's resistance to seawater corrosion makes it ideal for critical components in these facilities, extending operational lifespans and reducing lifecycle costs despite higher initial investment.

Regionally, Europe leads in duplex stainless steel consumption, followed closely by Asia-Pacific where industrialization in China and India has accelerated demand. North America represents a mature but stable market, particularly in oil and gas applications along the Gulf Coast. The Middle East shows the fastest regional growth rate due to expanding desalination capacity and petroleum infrastructure development.

Price sensitivity remains a significant market factor, with duplex grades typically commanding a 30-40% premium over austenitic stainless steels. However, lifecycle cost analyses increasingly favor duplex materials when considering reduced maintenance requirements, longer service life, and improved fitness-for-service metrics, especially in critical applications where failure costs are substantial.

Market trends indicate growing interest in lean duplex grades that offer improved economics while maintaining adequate performance characteristics for less demanding applications. This segment has grown by approximately 15% annually as manufacturers seek cost-effective alternatives to both traditional austenitic grades and standard duplex alloys.

The fabrication records and repair history tracking market has also expanded as asset owners recognize the value of comprehensive lifecycle documentation for fitness-for-service assessments. Digital solutions for material traceability and maintenance history have seen adoption rates increase by 25% over the past five years, creating a complementary service market around duplex stainless steel applications.

Chemical processing represents the second-largest application sector, where duplex grades are preferred for their resistance to stress corrosion cracking in chloride-containing environments. This sector has shown steady growth at around 5-7% annually, with particular demand in chemical transport systems and pressure vessels.

Desalination plants have emerged as a rapidly expanding market segment for duplex stainless steel, growing at nearly 10% annually in regions facing freshwater scarcity. The material's resistance to seawater corrosion makes it ideal for critical components in these facilities, extending operational lifespans and reducing lifecycle costs despite higher initial investment.

Regionally, Europe leads in duplex stainless steel consumption, followed closely by Asia-Pacific where industrialization in China and India has accelerated demand. North America represents a mature but stable market, particularly in oil and gas applications along the Gulf Coast. The Middle East shows the fastest regional growth rate due to expanding desalination capacity and petroleum infrastructure development.

Price sensitivity remains a significant market factor, with duplex grades typically commanding a 30-40% premium over austenitic stainless steels. However, lifecycle cost analyses increasingly favor duplex materials when considering reduced maintenance requirements, longer service life, and improved fitness-for-service metrics, especially in critical applications where failure costs are substantial.

Market trends indicate growing interest in lean duplex grades that offer improved economics while maintaining adequate performance characteristics for less demanding applications. This segment has grown by approximately 15% annually as manufacturers seek cost-effective alternatives to both traditional austenitic grades and standard duplex alloys.

The fabrication records and repair history tracking market has also expanded as asset owners recognize the value of comprehensive lifecycle documentation for fitness-for-service assessments. Digital solutions for material traceability and maintenance history have seen adoption rates increase by 25% over the past five years, creating a complementary service market around duplex stainless steel applications.

Current Challenges in Duplex Steel Lifecycle Management

Despite significant advancements in duplex stainless steel (DSS) applications, the industry faces substantial challenges in lifecycle management. The comprehensive tracking and documentation of fabrication records remains inconsistent across the sector. Many facilities lack standardized protocols for recording critical parameters during manufacturing processes, including heat treatment temperatures, cooling rates, and welding procedures. This documentation gap creates significant difficulties when conducting fitness-for-service assessments later in the asset's lifecycle.

Repair documentation presents another major challenge. When DSS components undergo repairs, particularly in field conditions, the documentation of repair procedures, materials used, and post-repair testing often falls short of industry standards. This deficiency becomes particularly problematic when multiple repairs occur over time, creating a complex repair history that becomes increasingly difficult to evaluate for cumulative effects on material properties.

The integration of historical data with current inspection results represents a significant technical hurdle. Legacy systems often store critical lifecycle information in formats incompatible with modern asset management platforms. This fragmentation of data across multiple systems and formats impedes the development of comprehensive lifecycle models necessary for accurate remaining life predictions.

Fitness-for-service (FFS) assessments for DSS components face unique challenges due to the material's complex microstructure. Current industry standards and codes provide limited guidance specific to duplex grades, particularly regarding the long-term effects of phase transformations and embrittlement mechanisms. Engineers often must extrapolate from carbon steel or austenitic stainless steel methodologies, which may not adequately address the unique degradation mechanisms of DSS.

Non-destructive evaluation (NDE) techniques for in-situ assessment of DSS microstructural changes remain limited in capability and application. While laboratory techniques can accurately characterize phase balance and detect detrimental phases, field-applicable NDE methods often lack the sensitivity required for early detection of microstructural degradation that could compromise mechanical properties.

The industry also struggles with knowledge transfer and expertise retention. As experienced engineers retire, critical knowledge about specific DSS applications, historical performance, and lessons learned from previous failures is being lost. This expertise gap is particularly evident in organizations that operate aging DSS equipment but have reduced their technical workforce through downsizing initiatives.

Regulatory compliance adds another layer of complexity, with varying requirements across different regions and industries regarding documentation, inspection intervals, and assessment methodologies for DSS components. This regulatory inconsistency creates challenges for organizations operating globally or across multiple industrial sectors.

Repair documentation presents another major challenge. When DSS components undergo repairs, particularly in field conditions, the documentation of repair procedures, materials used, and post-repair testing often falls short of industry standards. This deficiency becomes particularly problematic when multiple repairs occur over time, creating a complex repair history that becomes increasingly difficult to evaluate for cumulative effects on material properties.

The integration of historical data with current inspection results represents a significant technical hurdle. Legacy systems often store critical lifecycle information in formats incompatible with modern asset management platforms. This fragmentation of data across multiple systems and formats impedes the development of comprehensive lifecycle models necessary for accurate remaining life predictions.

Fitness-for-service (FFS) assessments for DSS components face unique challenges due to the material's complex microstructure. Current industry standards and codes provide limited guidance specific to duplex grades, particularly regarding the long-term effects of phase transformations and embrittlement mechanisms. Engineers often must extrapolate from carbon steel or austenitic stainless steel methodologies, which may not adequately address the unique degradation mechanisms of DSS.

Non-destructive evaluation (NDE) techniques for in-situ assessment of DSS microstructural changes remain limited in capability and application. While laboratory techniques can accurately characterize phase balance and detect detrimental phases, field-applicable NDE methods often lack the sensitivity required for early detection of microstructural degradation that could compromise mechanical properties.

The industry also struggles with knowledge transfer and expertise retention. As experienced engineers retire, critical knowledge about specific DSS applications, historical performance, and lessons learned from previous failures is being lost. This expertise gap is particularly evident in organizations that operate aging DSS equipment but have reduced their technical workforce through downsizing initiatives.

Regulatory compliance adds another layer of complexity, with varying requirements across different regions and industries regarding documentation, inspection intervals, and assessment methodologies for DSS components. This regulatory inconsistency creates challenges for organizations operating globally or across multiple industrial sectors.

Leading Manufacturers and Industry Stakeholders

The duplex stainless steel lifecycle management market is currently in a growth phase, driven by increasing demand for corrosion-resistant materials in critical applications. The global market size is estimated at approximately $5-7 billion, with projected annual growth of 5-8% through 2028. From a technological maturity perspective, industry leaders like NIPPON STEEL, Outokumpu Oyj, and Sandvik Intellectual Property AB have established advanced fabrication record systems and fitness-for-service assessment protocols. Companies including POSCO Holdings, JFE Steel, and Alleima Tube AB are investing in innovative repair methodologies and lifecycle extension technologies. The competitive landscape is characterized by strategic partnerships between steel manufacturers and research institutions, with emerging players from China such as Baosteel Desheng and Zhejiang Jiuli Hi-Tech Metals gaining market share through cost-effective solutions and localized service networks.

NIPPON STEEL CORP.

Technical Solution: Nippon Steel has developed a comprehensive lifecycle management system for duplex stainless steel components called "NSSC-FIT" (Fabrication Integration Technology). This system integrates material selection, fabrication documentation, and in-service monitoring. Their approach begins with precise control of nitrogen content (0.14-0.20%) and molybdenum (3-4%) in their duplex grades to optimize phase balance stability during fabrication and repairs. Nippon's fabrication records utilize a centralized digital platform that documents critical parameters including heat treatment temperatures, cooling rates, and interpass temperatures during welding. For repair operations, they've developed specialized heat input controls and post-weld heat treatment protocols that minimize detrimental phase formation. Their fitness-for-service methodology incorporates both conventional mechanical testing and advanced electrochemical techniques to assess localized corrosion susceptibility after repairs. Nippon Steel has also pioneered the use of portable X-ray diffraction for field assessment of phase balance in repaired areas, allowing real-time verification of microstructural integrity[3]. Their system includes predictive models that estimate remaining service life based on operating conditions and material degradation rates.

Strengths: Exceptional control of material chemistry and processing parameters that enhance long-term stability; innovative field-deployable testing methods that enable rapid assessment of repair quality. Weaknesses: Their comprehensive documentation system requires significant administrative overhead; their specialized repair procedures often require longer equipment downtime compared to conventional approaches.

Sandvik Intellectual Property AB

Technical Solution: Sandvik has pioneered an integrated lifecycle management approach for duplex stainless steel components focused on material optimization and documentation. Their SAF™ (Sandvik Austenitic-Ferritic) duplex grades feature tailored chemical compositions that enhance weldability and post-repair microstructural recovery. Sandvik's fabrication record system incorporates blockchain technology to create immutable documentation of material certificates, processing parameters, and quality control data throughout manufacturing. For critical applications, they employ in-situ monitoring during fabrication using acoustic emission sensors to detect and document microstructural changes in real-time. Their repair methodology centers on controlled heat input techniques and proprietary filler materials designed to maintain optimal ferrite-austenite balance (45-55%) after repairs. Sandvik's fitness-for-service assessment protocol combines conventional NDT with advanced ferritescope mapping and specialized corrosion testing to evaluate both mechanical integrity and corrosion resistance post-repair[2]. They've also developed simulation tools that predict microstructural evolution during service life based on operating conditions.

Strengths: Exceptional material science expertise with proprietary duplex grades optimized for specific applications; comprehensive documentation systems that enhance traceability and regulatory compliance. Weaknesses: Their specialized repair materials and procedures often require Sandvik-certified technicians, limiting repair flexibility; their advanced assessment tools require significant expertise to properly interpret results.

Key Repair Technologies and Documentation Protocols

Duplex stainless steels

PatentInactiveEP1446509A1

Innovation

- Developing duplex stainless steels with reduced nickel and molybdenum content, while maintaining corrosion resistance and weldability, to create a more cost-effective option for applications where AL 2205 is not necessary.

Duplex stainless steel

PatentInactiveEP1867748A1

Innovation

- A duplex stainless steel with a specific composition and microstructure of austenite and ferrite, optimized for mechanical properties and corrosion resistance without costly additives, and a simplified manufacturing process involving hot rolling and heat treatment.

Regulatory Framework for Duplex Steel Applications

The regulatory landscape governing duplex stainless steel applications has evolved significantly over decades to ensure safety, reliability, and performance across various industries. International standards organizations such as ASTM International, ASME, NACE International, and ISO have established comprehensive frameworks that dictate the requirements for duplex steel throughout its lifecycle.

ASTM A923 serves as a cornerstone standard for detecting detrimental intermetallic phases in duplex stainless steels, providing critical testing methodologies to ensure material integrity during fabrication. Complementing this, ASME Boiler and Pressure Vessel Code Section VIII and Section IX establish stringent guidelines for pressure vessel applications, with specific provisions for duplex grades addressing their unique metallurgical characteristics.

For marine and offshore applications, NORSOK M-630 and M-601 standards provide detailed requirements for material selection, fabrication, and welding of duplex stainless steels in corrosive environments. These standards emphasize the importance of proper heat treatment and cooling rates to maintain the optimal austenite-ferrite balance critical to duplex steel performance.

The oil and gas sector relies heavily on NACE MR0175/ISO 15156, which governs materials selection for sour service environments where hydrogen sulfide presents significant corrosion challenges. These standards include specific provisions for duplex grades, detailing acceptable composition ranges and heat treatment parameters to ensure resistance to sulfide stress cracking.

Fitness-for-service assessments follow API 579-1/ASME FFS-1 guidelines, providing methodologies for evaluating the structural integrity of components that may have experienced degradation during service. For duplex steels specifically, these assessments must account for potential phase imbalances and intermetallic precipitations that could compromise mechanical properties.

Documentation requirements across these regulatory frameworks mandate comprehensive fabrication records, including material certification, welding procedure specifications, heat treatment records, and non-destructive examination results. Repair procedures must be qualified according to applicable codes, with special attention to heat input control and cooling rates to preserve the microstructural balance of duplex steels.

Recent regulatory trends show increasing emphasis on lifecycle management, with emerging standards focusing on predictive maintenance strategies and digital documentation systems to enhance traceability throughout the service life of duplex steel components. These developments reflect the growing recognition of duplex stainless steels as critical materials in high-performance applications where both safety and economic considerations drive regulatory evolution.

ASTM A923 serves as a cornerstone standard for detecting detrimental intermetallic phases in duplex stainless steels, providing critical testing methodologies to ensure material integrity during fabrication. Complementing this, ASME Boiler and Pressure Vessel Code Section VIII and Section IX establish stringent guidelines for pressure vessel applications, with specific provisions for duplex grades addressing their unique metallurgical characteristics.

For marine and offshore applications, NORSOK M-630 and M-601 standards provide detailed requirements for material selection, fabrication, and welding of duplex stainless steels in corrosive environments. These standards emphasize the importance of proper heat treatment and cooling rates to maintain the optimal austenite-ferrite balance critical to duplex steel performance.

The oil and gas sector relies heavily on NACE MR0175/ISO 15156, which governs materials selection for sour service environments where hydrogen sulfide presents significant corrosion challenges. These standards include specific provisions for duplex grades, detailing acceptable composition ranges and heat treatment parameters to ensure resistance to sulfide stress cracking.

Fitness-for-service assessments follow API 579-1/ASME FFS-1 guidelines, providing methodologies for evaluating the structural integrity of components that may have experienced degradation during service. For duplex steels specifically, these assessments must account for potential phase imbalances and intermetallic precipitations that could compromise mechanical properties.

Documentation requirements across these regulatory frameworks mandate comprehensive fabrication records, including material certification, welding procedure specifications, heat treatment records, and non-destructive examination results. Repair procedures must be qualified according to applicable codes, with special attention to heat input control and cooling rates to preserve the microstructural balance of duplex steels.

Recent regulatory trends show increasing emphasis on lifecycle management, with emerging standards focusing on predictive maintenance strategies and digital documentation systems to enhance traceability throughout the service life of duplex steel components. These developments reflect the growing recognition of duplex stainless steels as critical materials in high-performance applications where both safety and economic considerations drive regulatory evolution.

Corrosion Resistance and Lifecycle Extension Methods

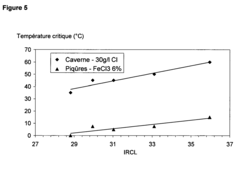

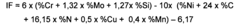

Duplex stainless steels (DSS) exhibit exceptional corrosion resistance due to their balanced microstructure of austenite and ferrite phases. This unique composition provides superior resistance to stress corrosion cracking, pitting, and crevice corrosion compared to conventional austenitic grades. The corrosion resistance is primarily attributed to the high chromium content (typically 22-25%) and the addition of molybdenum (3-4%) and nitrogen, which enhance the formation of a stable passive film.

In marine and offshore applications, DSS demonstrates remarkable resistance to chloride-induced corrosion, making it ideal for seawater handling systems. However, prolonged exposure to temperatures between 300-550°C can lead to the formation of detrimental intermetallic phases, compromising corrosion resistance and mechanical properties.

Lifecycle extension methods for DSS components begin with proper material selection and fabrication practices. Controlling heat input during welding prevents excessive ferrite formation and maintains the optimal phase balance. Post-weld heat treatment at appropriate temperatures (1050-1100°C) followed by rapid cooling helps restore the desired microstructure and corrosion properties after fabrication.

Regular condition monitoring using non-destructive testing techniques such as ultrasonic testing, eddy current analysis, and ferrite content measurements enables early detection of degradation. These methods provide valuable data for remaining life assessment and help prevent unexpected failures.

Surface treatment technologies significantly extend DSS lifecycle. Electropolishing removes surface contaminants and enhances the passive layer formation. Laser surface modification improves localized corrosion resistance by refining the microstructure at the surface. Additionally, controlled shot peening introduces compressive residual stresses that inhibit crack initiation and propagation.

Chemical inhibitors and protective coatings serve as effective barriers against corrosive environments. Modern ceramic-polymer hybrid coatings provide excellent adhesion and durability while maintaining the inherent properties of the base material. For critical applications, cathodic protection systems offer supplementary defense against galvanic corrosion.

Advanced repair techniques have revolutionized DSS lifecycle management. Localized weld repairs using matching filler materials restore structural integrity without compromising corrosion resistance. For severely degraded components, overlay welding with super duplex grades provides enhanced performance in the repaired areas. These techniques, when properly executed with appropriate heat control and post-weld treatments, can extend service life significantly.

Fitness-for-service assessments incorporating fracture mechanics principles and corrosion rate models enable data-driven decisions regarding continued operation, repair, or replacement. These assessments consider environmental factors, loading conditions, and material degradation mechanisms to establish safe operating parameters and inspection intervals.

In marine and offshore applications, DSS demonstrates remarkable resistance to chloride-induced corrosion, making it ideal for seawater handling systems. However, prolonged exposure to temperatures between 300-550°C can lead to the formation of detrimental intermetallic phases, compromising corrosion resistance and mechanical properties.

Lifecycle extension methods for DSS components begin with proper material selection and fabrication practices. Controlling heat input during welding prevents excessive ferrite formation and maintains the optimal phase balance. Post-weld heat treatment at appropriate temperatures (1050-1100°C) followed by rapid cooling helps restore the desired microstructure and corrosion properties after fabrication.

Regular condition monitoring using non-destructive testing techniques such as ultrasonic testing, eddy current analysis, and ferrite content measurements enables early detection of degradation. These methods provide valuable data for remaining life assessment and help prevent unexpected failures.

Surface treatment technologies significantly extend DSS lifecycle. Electropolishing removes surface contaminants and enhances the passive layer formation. Laser surface modification improves localized corrosion resistance by refining the microstructure at the surface. Additionally, controlled shot peening introduces compressive residual stresses that inhibit crack initiation and propagation.

Chemical inhibitors and protective coatings serve as effective barriers against corrosive environments. Modern ceramic-polymer hybrid coatings provide excellent adhesion and durability while maintaining the inherent properties of the base material. For critical applications, cathodic protection systems offer supplementary defense against galvanic corrosion.

Advanced repair techniques have revolutionized DSS lifecycle management. Localized weld repairs using matching filler materials restore structural integrity without compromising corrosion resistance. For severely degraded components, overlay welding with super duplex grades provides enhanced performance in the repaired areas. These techniques, when properly executed with appropriate heat control and post-weld treatments, can extend service life significantly.

Fitness-for-service assessments incorporating fracture mechanics principles and corrosion rate models enable data-driven decisions regarding continued operation, repair, or replacement. These assessments consider environmental factors, loading conditions, and material degradation mechanisms to establish safe operating parameters and inspection intervals.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!