Examining Isocyanate Global Supply Chain Challenges

JUL 10, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Isocyanate Industry Overview and Objectives

Isocyanates play a crucial role in the global chemical industry, serving as key building blocks for a wide range of products, including polyurethanes, coatings, adhesives, and elastomers. The isocyanate market has experienced steady growth over the past decades, driven by increasing demand from various end-use industries such as construction, automotive, and furniture manufacturing.

The global isocyanate industry is characterized by its complex supply chain, involving multiple stages from raw material extraction to end-product manufacturing. Major players in this sector include chemical giants like BASF, Covestro, Huntsman Corporation, and Wanhua Chemical Group. These companies operate on a global scale, with production facilities strategically located across different regions to serve diverse markets.

In recent years, the isocyanate industry has faced several challenges, particularly in terms of supply chain management. The COVID-19 pandemic has exposed vulnerabilities in the global supply network, leading to disruptions in production and distribution. Additionally, geopolitical tensions and trade disputes have further complicated the international flow of isocyanates and their precursors.

Environmental concerns and regulatory pressures have also become increasingly significant factors shaping the industry's landscape. Stricter regulations on emissions and the use of certain chemicals have prompted manufacturers to invest in cleaner production technologies and explore more sustainable alternatives.

The primary objective of examining the global supply chain challenges in the isocyanate industry is to identify bottlenecks, assess risks, and develop strategies to enhance resilience and efficiency. This involves analyzing various aspects of the supply chain, including raw material sourcing, production capacity, transportation logistics, and inventory management.

Another key goal is to understand the impact of external factors such as geopolitical events, natural disasters, and market fluctuations on the isocyanate supply chain. By gaining insights into these dynamics, industry stakeholders can better prepare for potential disruptions and implement proactive measures to mitigate risks.

Furthermore, the industry aims to explore opportunities for innovation and sustainability within the supply chain. This includes investigating alternative raw materials, optimizing production processes, and developing more environmentally friendly isocyanate-based products. Such efforts are crucial for ensuring the long-term viability and competitiveness of the isocyanate industry in an increasingly sustainability-conscious global market.

The global isocyanate industry is characterized by its complex supply chain, involving multiple stages from raw material extraction to end-product manufacturing. Major players in this sector include chemical giants like BASF, Covestro, Huntsman Corporation, and Wanhua Chemical Group. These companies operate on a global scale, with production facilities strategically located across different regions to serve diverse markets.

In recent years, the isocyanate industry has faced several challenges, particularly in terms of supply chain management. The COVID-19 pandemic has exposed vulnerabilities in the global supply network, leading to disruptions in production and distribution. Additionally, geopolitical tensions and trade disputes have further complicated the international flow of isocyanates and their precursors.

Environmental concerns and regulatory pressures have also become increasingly significant factors shaping the industry's landscape. Stricter regulations on emissions and the use of certain chemicals have prompted manufacturers to invest in cleaner production technologies and explore more sustainable alternatives.

The primary objective of examining the global supply chain challenges in the isocyanate industry is to identify bottlenecks, assess risks, and develop strategies to enhance resilience and efficiency. This involves analyzing various aspects of the supply chain, including raw material sourcing, production capacity, transportation logistics, and inventory management.

Another key goal is to understand the impact of external factors such as geopolitical events, natural disasters, and market fluctuations on the isocyanate supply chain. By gaining insights into these dynamics, industry stakeholders can better prepare for potential disruptions and implement proactive measures to mitigate risks.

Furthermore, the industry aims to explore opportunities for innovation and sustainability within the supply chain. This includes investigating alternative raw materials, optimizing production processes, and developing more environmentally friendly isocyanate-based products. Such efforts are crucial for ensuring the long-term viability and competitiveness of the isocyanate industry in an increasingly sustainability-conscious global market.

Global Demand Analysis for Isocyanates

The global demand for isocyanates has been steadily increasing over the past decade, driven primarily by the growth in construction, automotive, and furniture industries. Isocyanates, particularly methylene diphenyl diisocyanate (MDI) and toluene diisocyanate (TDI), are crucial components in the production of polyurethanes, which find extensive applications in insulation materials, coatings, adhesives, and flexible foams.

In the construction sector, the rising need for energy-efficient buildings has led to a surge in demand for polyurethane-based insulation materials. This trend is particularly pronounced in developing economies where rapid urbanization and infrastructure development are ongoing. The automotive industry's shift towards lightweight materials to improve fuel efficiency has also contributed significantly to the increased demand for isocyanates, as polyurethanes are used in various car components.

The Asia-Pacific region has emerged as the largest consumer of isocyanates, accounting for a substantial portion of global demand. China, in particular, has been a major driver of growth, with its booming construction and manufacturing sectors. Other key markets include North America and Europe, where stringent energy efficiency regulations continue to boost the use of polyurethane-based products.

The furniture and bedding industry has also played a crucial role in sustaining the demand for isocyanates. The growing middle class in emerging economies has led to increased consumption of furniture and mattresses, many of which utilize polyurethane foams. This trend is expected to continue, further supporting the isocyanate market growth.

However, the isocyanate market is not without challenges. Environmental concerns and health risks associated with isocyanate exposure have led to stricter regulations in many countries. This has prompted research into bio-based alternatives and more environmentally friendly production processes. Despite these challenges, the overall demand for isocyanates is projected to grow, albeit at a more moderate pace compared to previous years.

The COVID-19 pandemic temporarily disrupted the isocyanate supply chain and demand patterns. While initial lockdowns led to a sharp decline in demand, the subsequent economic recovery and pent-up demand in various end-use industries have helped stabilize the market. As global economies continue to recover, the demand for isocyanates is expected to rebound, driven by ongoing urbanization, infrastructure development, and the automotive industry's recovery.

In the construction sector, the rising need for energy-efficient buildings has led to a surge in demand for polyurethane-based insulation materials. This trend is particularly pronounced in developing economies where rapid urbanization and infrastructure development are ongoing. The automotive industry's shift towards lightweight materials to improve fuel efficiency has also contributed significantly to the increased demand for isocyanates, as polyurethanes are used in various car components.

The Asia-Pacific region has emerged as the largest consumer of isocyanates, accounting for a substantial portion of global demand. China, in particular, has been a major driver of growth, with its booming construction and manufacturing sectors. Other key markets include North America and Europe, where stringent energy efficiency regulations continue to boost the use of polyurethane-based products.

The furniture and bedding industry has also played a crucial role in sustaining the demand for isocyanates. The growing middle class in emerging economies has led to increased consumption of furniture and mattresses, many of which utilize polyurethane foams. This trend is expected to continue, further supporting the isocyanate market growth.

However, the isocyanate market is not without challenges. Environmental concerns and health risks associated with isocyanate exposure have led to stricter regulations in many countries. This has prompted research into bio-based alternatives and more environmentally friendly production processes. Despite these challenges, the overall demand for isocyanates is projected to grow, albeit at a more moderate pace compared to previous years.

The COVID-19 pandemic temporarily disrupted the isocyanate supply chain and demand patterns. While initial lockdowns led to a sharp decline in demand, the subsequent economic recovery and pent-up demand in various end-use industries have helped stabilize the market. As global economies continue to recover, the demand for isocyanates is expected to rebound, driven by ongoing urbanization, infrastructure development, and the automotive industry's recovery.

Supply Chain Bottlenecks and Challenges

The global isocyanate supply chain faces numerous bottlenecks and challenges that significantly impact its efficiency and reliability. One of the primary issues is the concentration of production in a few key regions, particularly China, which accounts for a substantial portion of global isocyanate manufacturing. This geographical concentration creates vulnerabilities in the supply chain, as disruptions in these areas can have far-reaching consequences for global availability.

Raw material shortages pose another significant challenge. Isocyanates require specific chemical precursors, such as aniline and phosgene, which can be subject to their own supply constraints. Fluctuations in the availability or pricing of these raw materials can create ripple effects throughout the isocyanate supply chain, leading to production delays and cost increases.

Transportation and logistics present ongoing difficulties, especially given the hazardous nature of isocyanates. Strict regulations govern the handling, storage, and transportation of these chemicals, necessitating specialized equipment and trained personnel. This complexity adds to transportation costs and can lead to delays, particularly when crossing international borders or navigating different regulatory environments.

The isocyanate industry is also grappling with capacity constraints. As demand for polyurethane products continues to grow across various sectors, including construction, automotive, and furniture, manufacturers are struggling to keep pace. Expanding production capacity requires significant capital investment and time, creating a lag between demand increases and supply responses.

Environmental and safety regulations present another layer of complexity. Isocyanates are known for their potential health and environmental hazards, leading to increasingly stringent regulations worldwide. Compliance with these evolving standards often requires substantial investments in equipment upgrades, process modifications, and safety measures, which can strain resources and impact production capabilities.

Market volatility and demand fluctuations further complicate supply chain management. The isocyanate market is closely tied to economic cycles and specific industry trends, such as construction activity and automotive production. Rapid shifts in demand can lead to overproduction or shortages, making it challenging for suppliers to maintain optimal inventory levels and production schedules.

Lastly, the global nature of the isocyanate supply chain exposes it to geopolitical risks and trade tensions. Tariffs, trade disputes, and changing international relations can disrupt established supply routes and partnerships, forcing companies to seek alternative sources or adjust their global strategies. This uncertainty adds complexity to long-term planning and investment decisions within the industry.

Raw material shortages pose another significant challenge. Isocyanates require specific chemical precursors, such as aniline and phosgene, which can be subject to their own supply constraints. Fluctuations in the availability or pricing of these raw materials can create ripple effects throughout the isocyanate supply chain, leading to production delays and cost increases.

Transportation and logistics present ongoing difficulties, especially given the hazardous nature of isocyanates. Strict regulations govern the handling, storage, and transportation of these chemicals, necessitating specialized equipment and trained personnel. This complexity adds to transportation costs and can lead to delays, particularly when crossing international borders or navigating different regulatory environments.

The isocyanate industry is also grappling with capacity constraints. As demand for polyurethane products continues to grow across various sectors, including construction, automotive, and furniture, manufacturers are struggling to keep pace. Expanding production capacity requires significant capital investment and time, creating a lag between demand increases and supply responses.

Environmental and safety regulations present another layer of complexity. Isocyanates are known for their potential health and environmental hazards, leading to increasingly stringent regulations worldwide. Compliance with these evolving standards often requires substantial investments in equipment upgrades, process modifications, and safety measures, which can strain resources and impact production capabilities.

Market volatility and demand fluctuations further complicate supply chain management. The isocyanate market is closely tied to economic cycles and specific industry trends, such as construction activity and automotive production. Rapid shifts in demand can lead to overproduction or shortages, making it challenging for suppliers to maintain optimal inventory levels and production schedules.

Lastly, the global nature of the isocyanate supply chain exposes it to geopolitical risks and trade tensions. Tariffs, trade disputes, and changing international relations can disrupt established supply routes and partnerships, forcing companies to seek alternative sources or adjust their global strategies. This uncertainty adds complexity to long-term planning and investment decisions within the industry.

Current Supply Chain Management Strategies

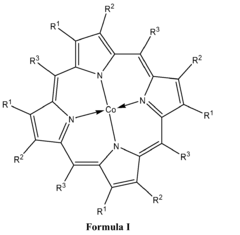

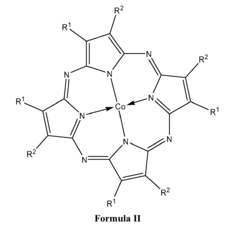

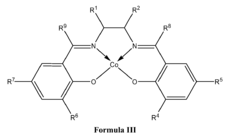

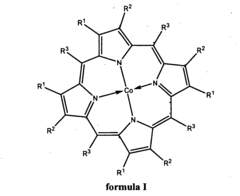

01 Synthesis and properties of isocyanates

Isocyanates are a class of highly reactive compounds characterized by the -NCO functional group. They are widely used in the production of polyurethanes and other polymeric materials. The synthesis of isocyanates often involves the reaction of amines with phosgene or other carbonyl-containing compounds. Their reactivity makes them valuable in various industrial applications, but also requires careful handling due to potential health hazards.- Synthesis and applications of isocyanates: Isocyanates are versatile compounds used in various industrial applications. They are key ingredients in the production of polyurethanes, coatings, adhesives, and elastomers. The synthesis of isocyanates often involves the reaction of amines with phosgene or alternative routes to avoid the use of toxic phosgene.

- Isocyanate-based polymers and composites: Isocyanates are crucial in the development of high-performance polymers and composites. They react with polyols to form polyurethanes, which can be tailored for specific properties such as flexibility, durability, and chemical resistance. These materials find applications in automotive, construction, and aerospace industries.

- Environmental and safety considerations in isocyanate handling: Due to their reactivity and potential health hazards, isocyanates require careful handling and storage. Innovations focus on developing safer alternatives, improving workplace safety measures, and reducing environmental impact. This includes the use of blocked isocyanates, water-based systems, and low-VOC formulations.

- Isocyanate-free technologies: Research is ongoing to develop isocyanate-free alternatives for traditional polyurethane applications. These include bio-based materials, hybrid systems, and novel chemistries that aim to provide similar performance characteristics without the associated health and environmental concerns of isocyanates.

- Specialized isocyanate applications: Isocyanates find use in specialized applications beyond traditional polymer synthesis. These include their use in surface treatments, as crosslinking agents in coatings, in the production of pesticides, and in the development of advanced materials for electronic and medical devices.

02 Applications of isocyanates in polymer chemistry

Isocyanates play a crucial role in polymer chemistry, particularly in the production of polyurethanes. They react with polyols to form urethane linkages, which are the basis for a wide range of materials including foams, elastomers, and coatings. The versatility of isocyanates allows for the creation of polymers with tailored properties, such as flexibility, durability, and chemical resistance.Expand Specific Solutions03 Isocyanate-based adhesives and sealants

Isocyanates are key components in the formulation of high-performance adhesives and sealants. These products utilize the reactivity of isocyanates to create strong, durable bonds between various substrates. Isocyanate-based adhesives and sealants find applications in construction, automotive, and aerospace industries, offering excellent adhesion, weather resistance, and structural integrity.Expand Specific Solutions04 Environmental and safety considerations for isocyanates

The use of isocyanates requires careful consideration of environmental and safety factors. These compounds can pose health risks, particularly respiratory issues, if not handled properly. Efforts are being made to develop safer alternatives or improved handling methods. This includes the use of personal protective equipment, proper ventilation systems, and the development of low-emission or blocked isocyanate formulations to reduce exposure risks.Expand Specific Solutions05 Novel isocyanate derivatives and modifications

Research is ongoing to develop novel isocyanate derivatives and modifications to enhance their properties or reduce their reactivity. This includes the creation of blocked isocyanates, which remain stable at room temperature and only become reactive under specific conditions. Other modifications aim to improve compatibility with different systems, reduce volatility, or enhance specific performance characteristics for specialized applications.Expand Specific Solutions

Key Isocyanate Producers and Suppliers

The global isocyanate supply chain faces significant challenges in a mature yet evolving market. The industry is in a consolidation phase, with major players like Wanhua Chemical, BASF, Covestro, and Dow dominating production. Market size is substantial, driven by growing demand in construction, automotive, and electronics sectors. Technological maturity varies, with established processes for common isocyanates, but ongoing innovation in specialty grades and eco-friendly alternatives. Companies like Mitsui Chemicals and Asahi Kasei are investing in R&D to address environmental concerns and improve production efficiency. The competitive landscape is characterized by strategic partnerships, capacity expansions, and a focus on sustainability to meet stringent regulations and changing customer preferences.

Wanhua Chemical Group Co., Ltd.

Technical Solution: Wanhua Chemical Group has developed advanced isocyanate production technologies to address global supply chain challenges. They have implemented a vertically integrated supply chain model, controlling key raw materials like aniline and nitrobenzene[1]. Their proprietary gas-phase technology for MDI production increases efficiency by up to 20% compared to traditional liquid-phase processes[2]. Wanhua has also invested in strategic global production sites, including facilities in China, Hungary, and the US, to mitigate geopolitical risks and reduce transportation costs[3]. Additionally, they have developed eco-friendly alternatives like non-phosgene routes for isocyanate production, reducing environmental impact and dependency on hazardous raw materials[4].

Strengths: Vertical integration, proprietary technology, global production network. Weaknesses: High capital investment required, potential overcapacity in certain regions.

BASF Corp.

Technical Solution: BASF has implemented a comprehensive strategy to address isocyanate supply chain challenges. They have developed a flexible production network with sites in Europe, North America, and Asia, allowing for rapid response to regional demand fluctuations[1]. BASF's Verbund concept integrates production processes, reducing raw material waste and improving energy efficiency by up to 15%[2]. They have also invested in digital supply chain solutions, including predictive analytics and blockchain technology, to enhance transparency and reduce disruptions[3]. BASF's eco-efficient isocyanate production methods, such as their gas-phase technology for TDI production, have reduced carbon footprint by approximately 30% compared to conventional methods[4]. Furthermore, they have developed bio-based alternatives to traditional isocyanates, reducing reliance on fossil resources[5].

Strengths: Global production network, integrated production processes, digital supply chain solutions. Weaknesses: High exposure to raw material price volatility, regulatory challenges in different regions.

Innovative Supply Chain Technologies

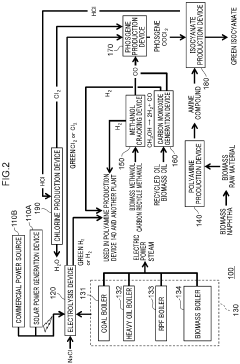

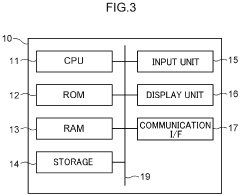

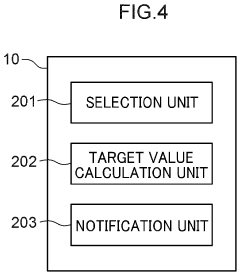

Isocyanate production system, isocyanate composition, polymerizable composition, resin, and molded article

PatentPendingEP4371974A1

Innovation

- An isocyanate production system that utilizes biomass-based energy sources, recycled materials, and carbon monoxide and hydrogen generated from renewable sources to produce phosgene and polyamine compounds, with a control device optimizing energy and material usage to minimize environmental load and carbon dioxide emissions.

One-pot catalytic process for the synthesis of isocyanates

PatentActiveEP1870398B1

Innovation

- A one-pot catalytic process using a mixture of an amine, alcohol, carbon monoxide, an oxygen-containing gas, and a metal complex catalyst in a specific solvent, allowing for the direct synthesis of isocyanates without intermediate carbamate isolation and minimizing hazardous gas interactions by dissolving reactants in halocarbons or oxygenated fluorinated hydrocarbons.

Regulatory Impact on Isocyanate Supply

The regulatory landscape surrounding isocyanates has a significant impact on the global supply chain, influencing production, distribution, and usage patterns. Environmental and health concerns have led to increasingly stringent regulations worldwide, particularly in developed economies.

In the European Union, the REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation has placed additional requirements on isocyanate manufacturers and importers. This includes mandatory safety assessments, registration of substances, and potential restrictions on certain applications. The EU has also implemented specific workplace exposure limits for isocyanates, necessitating enhanced safety measures in industrial settings.

The United States Environmental Protection Agency (EPA) has implemented regulations under the Toxic Substances Control Act (TSCA) that affect isocyanate production and use. These include reporting requirements, risk evaluations, and potential restrictions on certain isocyanate compounds. Additionally, the Occupational Safety and Health Administration (OSHA) has established permissible exposure limits and mandated safety protocols for workers handling isocyanates.

In Asia, countries like China and Japan have been strengthening their chemical regulations, including those pertaining to isocyanates. China's Measures for Environmental Management of New Chemical Substances and Japan's Chemical Substances Control Law have introduced new requirements for registration, evaluation, and risk assessment of isocyanate-containing products.

These regulatory changes have led to increased compliance costs for manufacturers and suppliers, potentially affecting the availability and pricing of isocyanates in the global market. Some companies have been forced to reformulate products or seek alternative materials to meet regulatory standards, disrupting established supply chains.

The transportation of isocyanates is also subject to strict regulations due to their hazardous nature. International agreements such as the European Agreement concerning the International Carriage of Dangerous Goods by Road (ADR) and the International Maritime Dangerous Goods (IMDG) Code impose specific requirements on packaging, labeling, and handling during transport. These regulations can increase logistics costs and complexity in the isocyanate supply chain.

Furthermore, the growing focus on sustainability and circular economy principles is driving regulatory initiatives aimed at promoting the recycling and responsible disposal of isocyanate-containing products. This trend is likely to shape future regulations and impact the entire lifecycle of isocyanate products, from production to end-of-life management.

As regulations continue to evolve, isocyanate suppliers and users must remain vigilant and adaptable. Proactive engagement with regulatory bodies, investment in research and development for safer alternatives, and collaboration across the supply chain will be crucial in navigating the complex regulatory landscape and ensuring a stable supply of isocyanates in the global market.

In the European Union, the REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation has placed additional requirements on isocyanate manufacturers and importers. This includes mandatory safety assessments, registration of substances, and potential restrictions on certain applications. The EU has also implemented specific workplace exposure limits for isocyanates, necessitating enhanced safety measures in industrial settings.

The United States Environmental Protection Agency (EPA) has implemented regulations under the Toxic Substances Control Act (TSCA) that affect isocyanate production and use. These include reporting requirements, risk evaluations, and potential restrictions on certain isocyanate compounds. Additionally, the Occupational Safety and Health Administration (OSHA) has established permissible exposure limits and mandated safety protocols for workers handling isocyanates.

In Asia, countries like China and Japan have been strengthening their chemical regulations, including those pertaining to isocyanates. China's Measures for Environmental Management of New Chemical Substances and Japan's Chemical Substances Control Law have introduced new requirements for registration, evaluation, and risk assessment of isocyanate-containing products.

These regulatory changes have led to increased compliance costs for manufacturers and suppliers, potentially affecting the availability and pricing of isocyanates in the global market. Some companies have been forced to reformulate products or seek alternative materials to meet regulatory standards, disrupting established supply chains.

The transportation of isocyanates is also subject to strict regulations due to their hazardous nature. International agreements such as the European Agreement concerning the International Carriage of Dangerous Goods by Road (ADR) and the International Maritime Dangerous Goods (IMDG) Code impose specific requirements on packaging, labeling, and handling during transport. These regulations can increase logistics costs and complexity in the isocyanate supply chain.

Furthermore, the growing focus on sustainability and circular economy principles is driving regulatory initiatives aimed at promoting the recycling and responsible disposal of isocyanate-containing products. This trend is likely to shape future regulations and impact the entire lifecycle of isocyanate products, from production to end-of-life management.

As regulations continue to evolve, isocyanate suppliers and users must remain vigilant and adaptable. Proactive engagement with regulatory bodies, investment in research and development for safer alternatives, and collaboration across the supply chain will be crucial in navigating the complex regulatory landscape and ensuring a stable supply of isocyanates in the global market.

Sustainability in Isocyanate Supply Chains

Sustainability in isocyanate supply chains has become a critical focus for the industry, driven by increasing environmental concerns and regulatory pressures. The global isocyanate market, a key component in polyurethane production, faces significant challenges in aligning its supply chain with sustainable practices. These challenges stem from the energy-intensive nature of isocyanate production, the use of fossil fuel-based raw materials, and the potential environmental and health risks associated with handling and transportation.

One of the primary sustainability issues in the isocyanate supply chain is the carbon footprint of production processes. Isocyanate manufacturing requires substantial energy inputs, often derived from fossil fuels, contributing to greenhouse gas emissions. Industry leaders are exploring ways to reduce this impact through energy efficiency improvements and the integration of renewable energy sources in production facilities. Some companies have implemented combined heat and power systems and waste heat recovery technologies to optimize energy use.

Raw material sourcing presents another sustainability challenge. Isocyanates are typically derived from petroleum-based feedstocks, which are non-renewable and contribute to resource depletion. Research is underway to develop bio-based alternatives, such as isocyanates derived from plant oils or other renewable sources. While these alternatives show promise, scaling up production to meet global demand remains a significant hurdle.

Transportation and logistics within the isocyanate supply chain also pose sustainability concerns. The hazardous nature of isocyanates requires specialized handling and transportation methods, often leading to increased fuel consumption and emissions. Companies are investing in more efficient logistics networks, including optimized route planning and the use of lower-emission vehicles, to mitigate these impacts.

Waste reduction and circular economy principles are gaining traction in the isocyanate industry. Manufacturers are implementing closed-loop systems to recover and recycle solvents and by-products, reducing waste and improving resource efficiency. Additionally, end-of-life considerations for polyurethane products made with isocyanates are driving innovations in recycling and upcycling technologies.

Water management is another critical aspect of sustainability in isocyanate supply chains. Production processes can be water-intensive and may generate wastewater containing hazardous substances. Advanced water treatment technologies and water recycling systems are being adopted to minimize water consumption and reduce the environmental impact of effluents.

As the industry moves towards greater sustainability, collaboration across the supply chain is essential. Manufacturers, suppliers, and end-users are working together to develop more sustainable products and processes. This includes joint research initiatives, sharing of best practices, and the establishment of industry-wide sustainability standards and certifications.

One of the primary sustainability issues in the isocyanate supply chain is the carbon footprint of production processes. Isocyanate manufacturing requires substantial energy inputs, often derived from fossil fuels, contributing to greenhouse gas emissions. Industry leaders are exploring ways to reduce this impact through energy efficiency improvements and the integration of renewable energy sources in production facilities. Some companies have implemented combined heat and power systems and waste heat recovery technologies to optimize energy use.

Raw material sourcing presents another sustainability challenge. Isocyanates are typically derived from petroleum-based feedstocks, which are non-renewable and contribute to resource depletion. Research is underway to develop bio-based alternatives, such as isocyanates derived from plant oils or other renewable sources. While these alternatives show promise, scaling up production to meet global demand remains a significant hurdle.

Transportation and logistics within the isocyanate supply chain also pose sustainability concerns. The hazardous nature of isocyanates requires specialized handling and transportation methods, often leading to increased fuel consumption and emissions. Companies are investing in more efficient logistics networks, including optimized route planning and the use of lower-emission vehicles, to mitigate these impacts.

Waste reduction and circular economy principles are gaining traction in the isocyanate industry. Manufacturers are implementing closed-loop systems to recover and recycle solvents and by-products, reducing waste and improving resource efficiency. Additionally, end-of-life considerations for polyurethane products made with isocyanates are driving innovations in recycling and upcycling technologies.

Water management is another critical aspect of sustainability in isocyanate supply chains. Production processes can be water-intensive and may generate wastewater containing hazardous substances. Advanced water treatment technologies and water recycling systems are being adopted to minimize water consumption and reduce the environmental impact of effluents.

As the industry moves towards greater sustainability, collaboration across the supply chain is essential. Manufacturers, suppliers, and end-users are working together to develop more sustainable products and processes. This includes joint research initiatives, sharing of best practices, and the establishment of industry-wide sustainability standards and certifications.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!