Global Resource Landscape And Supply Risk For Direct Lithium Extraction

AUG 27, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

DLE Technology Background and Objectives

Direct Lithium Extraction (DLE) technology has emerged as a revolutionary approach to lithium production, representing a significant departure from traditional extraction methods. The evolution of lithium extraction techniques began with conventional mining of hard rock deposits and evaporative concentration from salt brines, which dominated the industry for decades. However, these traditional methods face substantial limitations in efficiency, environmental impact, and production timelines.

DLE technologies began gaining attention in the early 2000s, with significant acceleration in research and development occurring over the past decade. This acceleration coincides with the exponential growth in demand for lithium-ion batteries, primarily driven by electric vehicle manufacturing and renewable energy storage systems. The global lithium market has experienced unprecedented growth, with demand projected to increase by 400-500% by 2030.

The primary objective of DLE technology development is to establish more sustainable, efficient, and economically viable methods for extracting lithium from various sources, particularly brines. These technologies aim to reduce water consumption by 50-90% compared to evaporation ponds, decrease land use requirements by up to 70%, and significantly shorten production timelines from years to days or weeks.

Current DLE approaches encompass several distinct technological pathways, including adsorption-based systems, ion exchange membranes, solvent extraction processes, and electrochemical methods. Each pathway presents unique advantages and challenges regarding selectivity, recovery rates, energy consumption, and scalability. The technical evolution trajectory suggests continued refinement of these core approaches, with increasing focus on hybrid systems that combine multiple extraction principles.

The global landscape of lithium resources suitable for DLE application is diverse, with significant brine resources identified across the "Lithium Triangle" of South America (Argentina, Bolivia, Chile), North American deposits (particularly in Nevada and Arkansas), and emerging resources in China, Australia, and parts of Europe. The heterogeneous nature of these resources necessitates adaptable DLE technologies capable of processing varying brine chemistries and lithium concentrations.

Research objectives in the DLE field are increasingly focused on developing selective sorbents with higher capacity and durability, reducing energy requirements for regeneration processes, minimizing chemical consumption, and creating closed-loop systems that maximize water recycling. Additionally, there is growing emphasis on developing modular, scalable systems that can be deployed across diverse geographical and geological contexts.

DLE technologies began gaining attention in the early 2000s, with significant acceleration in research and development occurring over the past decade. This acceleration coincides with the exponential growth in demand for lithium-ion batteries, primarily driven by electric vehicle manufacturing and renewable energy storage systems. The global lithium market has experienced unprecedented growth, with demand projected to increase by 400-500% by 2030.

The primary objective of DLE technology development is to establish more sustainable, efficient, and economically viable methods for extracting lithium from various sources, particularly brines. These technologies aim to reduce water consumption by 50-90% compared to evaporation ponds, decrease land use requirements by up to 70%, and significantly shorten production timelines from years to days or weeks.

Current DLE approaches encompass several distinct technological pathways, including adsorption-based systems, ion exchange membranes, solvent extraction processes, and electrochemical methods. Each pathway presents unique advantages and challenges regarding selectivity, recovery rates, energy consumption, and scalability. The technical evolution trajectory suggests continued refinement of these core approaches, with increasing focus on hybrid systems that combine multiple extraction principles.

The global landscape of lithium resources suitable for DLE application is diverse, with significant brine resources identified across the "Lithium Triangle" of South America (Argentina, Bolivia, Chile), North American deposits (particularly in Nevada and Arkansas), and emerging resources in China, Australia, and parts of Europe. The heterogeneous nature of these resources necessitates adaptable DLE technologies capable of processing varying brine chemistries and lithium concentrations.

Research objectives in the DLE field are increasingly focused on developing selective sorbents with higher capacity and durability, reducing energy requirements for regeneration processes, minimizing chemical consumption, and creating closed-loop systems that maximize water recycling. Additionally, there is growing emphasis on developing modular, scalable systems that can be deployed across diverse geographical and geological contexts.

Market Demand Analysis for Lithium Resources

The global lithium market is experiencing unprecedented growth driven primarily by the rapid expansion of electric vehicle (EV) production and energy storage systems. Current market projections indicate that lithium demand will increase from approximately 500,000 metric tons of lithium carbonate equivalent (LCE) in 2021 to over 3 million metric tons by 2030, representing a compound annual growth rate (CAGR) of 25-30%. This exponential growth trajectory has transformed lithium from a specialty chemical to a critical strategic resource for the global energy transition.

The EV sector remains the dominant demand driver, accounting for nearly 80% of lithium consumption. Major automotive manufacturers have committed over $300 billion in EV investments through 2030, with production targets requiring substantial lithium supply increases. Tesla alone aims to produce 20 million vehicles annually by 2030, which would require approximately 800,000 tons of LCE per year.

Energy storage systems represent the second-largest growth segment, with utility-scale installations increasing by 160% in 2021 compared to the previous year. This sector is projected to consume approximately 500,000 tons of LCE annually by 2030 as grid modernization and renewable energy integration accelerate globally.

Regional demand patterns show significant concentration in Asia, particularly China, which currently accounts for 39% of global lithium consumption. However, demand growth is accelerating in Europe and North America as domestic battery manufacturing capacity expands in response to supply chain security concerns and government incentives like the U.S. Inflation Reduction Act.

Price volatility has been a defining characteristic of the lithium market, with spot prices surging from $10,000/ton in early 2021 to over $70,000/ton in late 2022 before moderating. This volatility has intensified interest in Direct Lithium Extraction (DLE) technologies as potential solutions to supply constraints.

Supply-demand gap analysis indicates a potential shortfall of 600,000 to 800,000 tons of LCE by 2030 if new production capacity is not developed rapidly. Traditional lithium sources from brine evaporation and hard rock mining face significant expansion constraints due to lengthy development timelines, environmental concerns, and geopolitical factors.

This supply risk has elevated the strategic importance of DLE technologies, which promise faster development cycles, reduced environmental footprint, and the ability to access previously uneconomical lithium resources. Market research indicates that successful DLE implementation could potentially unlock over 5 million tons of additional lithium resources that are currently considered unviable through conventional extraction methods.

The EV sector remains the dominant demand driver, accounting for nearly 80% of lithium consumption. Major automotive manufacturers have committed over $300 billion in EV investments through 2030, with production targets requiring substantial lithium supply increases. Tesla alone aims to produce 20 million vehicles annually by 2030, which would require approximately 800,000 tons of LCE per year.

Energy storage systems represent the second-largest growth segment, with utility-scale installations increasing by 160% in 2021 compared to the previous year. This sector is projected to consume approximately 500,000 tons of LCE annually by 2030 as grid modernization and renewable energy integration accelerate globally.

Regional demand patterns show significant concentration in Asia, particularly China, which currently accounts for 39% of global lithium consumption. However, demand growth is accelerating in Europe and North America as domestic battery manufacturing capacity expands in response to supply chain security concerns and government incentives like the U.S. Inflation Reduction Act.

Price volatility has been a defining characteristic of the lithium market, with spot prices surging from $10,000/ton in early 2021 to over $70,000/ton in late 2022 before moderating. This volatility has intensified interest in Direct Lithium Extraction (DLE) technologies as potential solutions to supply constraints.

Supply-demand gap analysis indicates a potential shortfall of 600,000 to 800,000 tons of LCE by 2030 if new production capacity is not developed rapidly. Traditional lithium sources from brine evaporation and hard rock mining face significant expansion constraints due to lengthy development timelines, environmental concerns, and geopolitical factors.

This supply risk has elevated the strategic importance of DLE technologies, which promise faster development cycles, reduced environmental footprint, and the ability to access previously uneconomical lithium resources. Market research indicates that successful DLE implementation could potentially unlock over 5 million tons of additional lithium resources that are currently considered unviable through conventional extraction methods.

Global DLE Technology Status and Challenges

Direct Lithium Extraction (DLE) technologies have emerged as promising alternatives to traditional lithium extraction methods, yet their global implementation faces significant challenges. Currently, DLE technologies are at varying stages of development worldwide, with only a limited number of commercial-scale operations primarily concentrated in North America and parts of South America. Most DLE projects remain in pilot or demonstration phases, indicating a technology that is still maturing despite its potential.

The technical landscape of DLE is characterized by three predominant approaches: adsorption-based technologies using selective materials to capture lithium ions; ion exchange methods that replace lithium with other ions; and solvent extraction techniques that separate lithium from brine solutions. Each approach demonstrates different levels of efficiency, cost-effectiveness, and environmental impact across various brine chemistries, highlighting the absence of a universal solution.

A critical challenge facing global DLE adoption is the significant variability in brine compositions across different geographical regions. Lithium concentrations, impurity profiles, and physical properties differ substantially between South American salars, North American geothermal brines, and Chinese salt lakes, necessitating customized technological solutions for each resource type. This heterogeneity complicates standardization efforts and increases development costs.

Water consumption represents another substantial hurdle, particularly in arid regions where many lithium resources are located. While DLE promises reduced water usage compared to evaporation ponds, the technology still requires considerable water inputs for processing and regeneration cycles. This creates potential conflicts with local communities and ecosystems, especially in water-stressed regions of South America and Australia.

Energy requirements pose additional constraints on DLE implementation. Many processes demand significant electricity for pumping, heating, and regeneration steps. In regions with underdeveloped energy infrastructure or high energy costs, this dependency can undermine the economic viability of DLE operations, limiting deployment to areas with reliable and affordable energy access.

The global distribution of DLE expertise and intellectual property presents further complications. North American and European companies hold the majority of patents and technical knowledge, creating potential barriers for implementation in developing regions with significant lithium resources. This imbalance may exacerbate supply chain vulnerabilities and geopolitical tensions surrounding critical mineral access.

Regulatory frameworks governing DLE vary substantially across jurisdictions, with inconsistent environmental standards, permitting processes, and community engagement requirements. This regulatory heterogeneity creates uncertainty for investors and technology developers, potentially slowing global adoption rates despite the growing demand for lithium resources.

The technical landscape of DLE is characterized by three predominant approaches: adsorption-based technologies using selective materials to capture lithium ions; ion exchange methods that replace lithium with other ions; and solvent extraction techniques that separate lithium from brine solutions. Each approach demonstrates different levels of efficiency, cost-effectiveness, and environmental impact across various brine chemistries, highlighting the absence of a universal solution.

A critical challenge facing global DLE adoption is the significant variability in brine compositions across different geographical regions. Lithium concentrations, impurity profiles, and physical properties differ substantially between South American salars, North American geothermal brines, and Chinese salt lakes, necessitating customized technological solutions for each resource type. This heterogeneity complicates standardization efforts and increases development costs.

Water consumption represents another substantial hurdle, particularly in arid regions where many lithium resources are located. While DLE promises reduced water usage compared to evaporation ponds, the technology still requires considerable water inputs for processing and regeneration cycles. This creates potential conflicts with local communities and ecosystems, especially in water-stressed regions of South America and Australia.

Energy requirements pose additional constraints on DLE implementation. Many processes demand significant electricity for pumping, heating, and regeneration steps. In regions with underdeveloped energy infrastructure or high energy costs, this dependency can undermine the economic viability of DLE operations, limiting deployment to areas with reliable and affordable energy access.

The global distribution of DLE expertise and intellectual property presents further complications. North American and European companies hold the majority of patents and technical knowledge, creating potential barriers for implementation in developing regions with significant lithium resources. This imbalance may exacerbate supply chain vulnerabilities and geopolitical tensions surrounding critical mineral access.

Regulatory frameworks governing DLE vary substantially across jurisdictions, with inconsistent environmental standards, permitting processes, and community engagement requirements. This regulatory heterogeneity creates uncertainty for investors and technology developers, potentially slowing global adoption rates despite the growing demand for lithium resources.

Current DLE Technical Solutions Assessment

01 DLE technology advancements and extraction methods

Direct Lithium Extraction technologies have evolved to improve efficiency and reduce environmental impact compared to traditional methods. These innovations include selective adsorption materials, ion exchange resins, and membrane-based separation techniques that can extract lithium from brines, geothermal waters, and other sources with higher recovery rates and lower water consumption. These methods allow for extraction from resources previously considered uneconomical, expanding the potential lithium supply landscape.- DLE technologies and extraction methods: Direct Lithium Extraction (DLE) technologies involve innovative methods to extract lithium from brine resources more efficiently than traditional evaporation ponds. These technologies include ion exchange, adsorption, membrane filtration, and electrochemical processes that can selectively extract lithium ions from brines. DLE methods generally offer advantages such as faster extraction times, reduced environmental footprint, and higher recovery rates compared to conventional methods, making them increasingly important for meeting growing lithium demand.

- Resource assessment and geographical distribution: The global lithium resource landscape is characterized by uneven geographical distribution, with significant deposits concentrated in the 'Lithium Triangle' of South America, Australia, and increasingly in North America. Resource assessment technologies help identify and quantify lithium deposits in various geological formations including brines, hard rock (spodumene), and clay deposits. Understanding the distribution and quality of these resources is crucial for strategic planning and investment in lithium extraction projects to mitigate supply risks.

- Supply chain risks and mitigation strategies: The lithium supply chain faces various risks including geopolitical tensions, resource nationalism, environmental regulations, and market concentration. These factors can lead to supply disruptions and price volatility. Mitigation strategies include diversification of supply sources, development of alternative extraction technologies, recycling initiatives, and strategic partnerships between producers and consumers. Advanced risk assessment tools and predictive analytics are being developed to help stakeholders navigate these challenges and ensure stable lithium supply for battery production and other applications.

- Environmental impact and sustainability considerations: Environmental concerns related to lithium extraction include water usage, habitat disruption, and chemical pollution. DLE technologies aim to address these issues by reducing water consumption, minimizing land disturbance, and decreasing chemical usage compared to traditional methods. Sustainability frameworks for lithium extraction incorporate life cycle assessment, water management strategies, and community engagement practices. These approaches help balance the growing demand for lithium with environmental protection goals and can reduce long-term supply risks associated with environmental regulations or community opposition.

- Economic viability and commercialization challenges: The economic viability of DLE projects depends on factors such as operational costs, energy requirements, lithium recovery rates, and market prices. Commercialization challenges include scaling up laboratory-proven technologies to industrial levels, securing investment capital, and competing with established extraction methods. Economic assessments of DLE projects must consider both direct costs and externalities such as environmental benefits. Overcoming these challenges is essential for expanding the lithium supply base and reducing dependency on geographically concentrated conventional resources.

02 Geographical distribution of lithium resources and supply chain risks

The global lithium resource landscape is characterized by geographical concentration in specific regions, creating supply chain vulnerabilities. The majority of lithium reserves are located in the 'Lithium Triangle' of South America, Australia, and China, leading to geopolitical risks and market concentration concerns. This uneven distribution affects supply security, pricing stability, and creates potential bottlenecks in the lithium supply chain, particularly as demand increases for electric vehicle batteries and energy storage systems.Expand Specific Solutions03 Environmental and sustainability considerations in DLE

Direct Lithium Extraction methods present both environmental challenges and sustainability advantages compared to traditional extraction. While DLE typically requires less land and water than evaporation ponds, it may have higher energy requirements and potential for chemical waste. Innovations focus on reducing the environmental footprint through closed-loop systems, renewable energy integration, and minimizing chemical usage. Sustainable DLE practices are becoming increasingly important for meeting ESG criteria and securing project financing and regulatory approvals.Expand Specific Solutions04 Economic viability and commercialization challenges

The economic feasibility of Direct Lithium Extraction projects faces several challenges including high capital expenditure requirements, operational costs, and technology scalability issues. While DLE offers potential for higher lithium recovery rates and faster production timelines than traditional methods, the commercialization pathway remains complex. Factors affecting economic viability include lithium concentration in the source material, energy costs, chemical reagent expenses, and waste management requirements. Market volatility and uncertain regulatory environments further complicate investment decisions in DLE projects.Expand Specific Solutions05 Supply risk mitigation strategies and resource security

To address lithium supply risks, various strategies are being developed including diversification of supply sources, strategic partnerships, recycling initiatives, and technological innovations. Companies and governments are investing in alternative lithium resources, creating stockpiles, developing domestic production capabilities, and establishing long-term supply agreements. Advanced resource assessment methodologies help identify new lithium deposits and evaluate extraction potential. Additionally, circular economy approaches focusing on lithium recycling from spent batteries are emerging as important components of supply risk mitigation.Expand Specific Solutions

Key Industry Players in Direct Lithium Extraction

The Direct Lithium Extraction (DLE) market is in its early growth phase, characterized by rapid technological innovation and increasing commercial deployment. The global market is projected to expand significantly due to rising lithium demand for electric vehicle batteries, with estimates suggesting a CAGR of 25-30% through 2030. Technologically, companies are at varying maturity levels: established players like Schlumberger and Energy Exploration Technologies have field-proven solutions, while innovative startups like Lilac Solutions, Watercycle Technologies, and Novalith Technologies are advancing novel extraction methods with lower environmental footprints. Academic institutions including The University of Manchester and King Abdullah University of Science & Technology are contributing fundamental research. The competitive landscape is diversifying with oil and gas companies (Baker Hughes) leveraging their subsurface expertise alongside specialized technology providers, creating a dynamic ecosystem poised for consolidation as the technology matures.

Schlumberger Technologies, Inc.

Technical Solution: Schlumberger has developed NeoLith Energy, an advanced direct lithium extraction (DLE) technology platform that applies a differentiated approach to selective extraction of lithium from brine resources. Their solution utilizes a novel sorbent-based approach that selectively captures lithium ions while rejecting other elements commonly found in brines. The process operates at ambient temperature and pressure, significantly reducing water and chemical consumption compared to traditional evaporation ponds. Schlumberger's DLE technology can process diverse brine compositions and achieves lithium recovery rates of over 90% in hours rather than months. Their integrated system includes pre-treatment, extraction, and post-processing modules that can be customized based on specific brine chemistry and project requirements. The company has established pilot plants in various locations to demonstrate commercial viability and scalability of their technology.

Strengths: High lithium recovery rates (>90%), reduced environmental footprint with minimal water usage, faster extraction timeframe (hours vs. months), and adaptability to various brine compositions. Weaknesses: Requires significant capital investment for commercial deployment, potential challenges in scaling to industrial production levels, and dependency on specific sorbent materials that may have limited supply chains.

Novalith Technologies Pty Ltd.

Technical Solution: Novalith Technologies has pioneered the LiCAL™ technology, a revolutionary carbon-dioxide-based direct lithium extraction process that transforms how lithium chemicals are produced from primary resources. Their approach uses carbon dioxide as a reagent for lithium extraction, creating a unique closed-loop system that simultaneously captures CO2 while producing battery-grade lithium chemicals. The process operates at ambient temperature and pressure conditions, utilizing proprietary sorbents that selectively bind with lithium ions in solution. Unlike conventional methods, Novalith's technology eliminates the need for extensive evaporation ponds and harsh reagents, reducing the production footprint by up to 90%. The system achieves lithium recovery rates exceeding 85% while producing minimal waste streams. Their integrated process converts extracted lithium directly to battery-grade lithium carbonate or hydroxide, eliminating multiple conversion steps typically required in traditional processing.

Strengths: Carbon-negative process that captures CO2, significantly reduced water consumption, elimination of evaporation ponds, and direct production of battery-grade materials. Weaknesses: Technology still scaling to commercial deployment, potential challenges with sorbent regeneration at industrial scale, and possible limitations in processing certain complex brine compositions.

Critical Patents and Innovations in DLE Technology

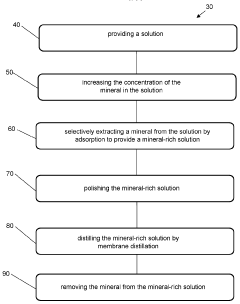

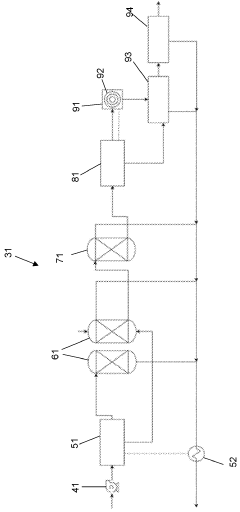

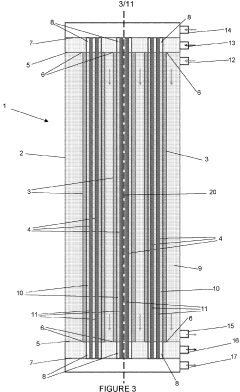

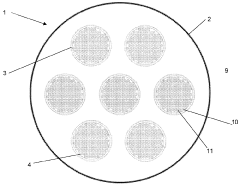

Method and apparatus for mineral extraction

PatentWO2023152511A1

Innovation

- A method and apparatus utilizing membrane distillation and adsorption to selectively extract lithium from brine by increasing lithium concentration through membrane distillation, followed by crystallization and desorption using a material with selective affinity for lithium, allowing for improved lithium recovery and reduced environmental impact.

A lithium extraction process through decoupled electrochemical processes

PatentWO2023228084A2

Innovation

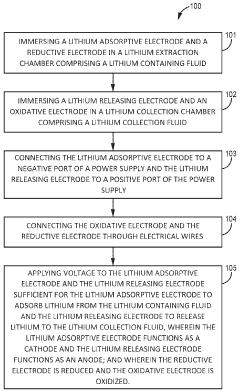

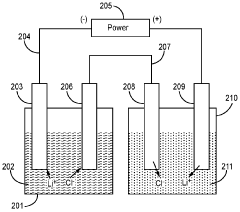

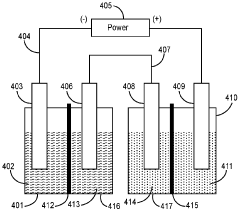

- A decoupled electrochemical process using lithium adsorptive and releasing electrodes, interconnected through oxidative and reductive electrodes, which selectively adsorb and release lithium without membranes, facilitating extraction from low-grade lithium resources by applying voltage to achieve high selectivity and efficiency.

Geopolitical Factors Affecting Lithium Supply Chain

The geopolitical landscape surrounding lithium resources has become increasingly complex as demand for this critical battery material continues to surge. The "Lithium Triangle" comprising Argentina, Bolivia, and Chile holds approximately 58% of the world's known lithium resources, creating significant geopolitical leverage for these South American nations. China has strategically positioned itself as a dominant force in the global lithium supply chain by securing mining rights and processing facilities across multiple continents, particularly in Australia and South America.

The United States has recognized this strategic vulnerability and has classified lithium as a critical mineral, implementing policies to reduce dependency on foreign sources. This includes funding domestic extraction projects and forming strategic partnerships with allied nations. However, the U.S. currently remains heavily dependent on imports, with limited domestic production capacity.

Trade tensions between major economies have directly impacted lithium markets, with tariffs and export restrictions creating supply uncertainties. The COVID-19 pandemic further exposed vulnerabilities in global supply chains, prompting many nations to reconsider their resource security strategies. This has accelerated the trend toward resource nationalism, with lithium-rich countries increasingly viewing their reserves as strategic assets rather than mere commodities.

Environmental and social governance concerns have added another layer of complexity to lithium geopolitics. Indigenous communities in lithium-rich regions have raised concerns about water usage and environmental degradation, leading to project delays and cancellations. These social license issues can quickly transform into political challenges that disrupt supply chains.

Regional political instability in key lithium-producing areas presents ongoing risks. For example, political shifts in Chile and Bolivia have led to policy uncertainties regarding foreign investment in lithium extraction. Meanwhile, Australia has emerged as a politically stable alternative source, though with different geological characteristics that affect extraction methods.

The race to secure lithium resources has also sparked new international alliances and partnerships. The European Union has launched initiatives to secure sustainable lithium supplies for its automotive industry, while Japan and South Korea have pursued strategic investments in lithium projects worldwide to support their electronics and automotive sectors.

For companies developing Direct Lithium Extraction (DLE) technologies, these geopolitical factors create both challenges and opportunities. DLE methods could potentially unlock resources in politically stable regions that were previously uneconomical, potentially reshaping the geopolitical landscape of lithium supply. However, the deployment of these technologies remains subject to the complex interplay of national interests, trade policies, and regional politics that characterize the current lithium market.

The United States has recognized this strategic vulnerability and has classified lithium as a critical mineral, implementing policies to reduce dependency on foreign sources. This includes funding domestic extraction projects and forming strategic partnerships with allied nations. However, the U.S. currently remains heavily dependent on imports, with limited domestic production capacity.

Trade tensions between major economies have directly impacted lithium markets, with tariffs and export restrictions creating supply uncertainties. The COVID-19 pandemic further exposed vulnerabilities in global supply chains, prompting many nations to reconsider their resource security strategies. This has accelerated the trend toward resource nationalism, with lithium-rich countries increasingly viewing their reserves as strategic assets rather than mere commodities.

Environmental and social governance concerns have added another layer of complexity to lithium geopolitics. Indigenous communities in lithium-rich regions have raised concerns about water usage and environmental degradation, leading to project delays and cancellations. These social license issues can quickly transform into political challenges that disrupt supply chains.

Regional political instability in key lithium-producing areas presents ongoing risks. For example, political shifts in Chile and Bolivia have led to policy uncertainties regarding foreign investment in lithium extraction. Meanwhile, Australia has emerged as a politically stable alternative source, though with different geological characteristics that affect extraction methods.

The race to secure lithium resources has also sparked new international alliances and partnerships. The European Union has launched initiatives to secure sustainable lithium supplies for its automotive industry, while Japan and South Korea have pursued strategic investments in lithium projects worldwide to support their electronics and automotive sectors.

For companies developing Direct Lithium Extraction (DLE) technologies, these geopolitical factors create both challenges and opportunities. DLE methods could potentially unlock resources in politically stable regions that were previously uneconomical, potentially reshaping the geopolitical landscape of lithium supply. However, the deployment of these technologies remains subject to the complex interplay of national interests, trade policies, and regional politics that characterize the current lithium market.

Environmental Impact and Sustainability of DLE Technologies

Direct Lithium Extraction (DLE) technologies present both environmental challenges and sustainability opportunities compared to traditional lithium extraction methods. While conventional evaporation ponds and hard-rock mining cause significant land disturbance, water consumption, and chemical pollution, DLE technologies offer potential pathways to more sustainable lithium production essential for the clean energy transition.

Water usage represents a critical environmental consideration for DLE implementation. Many DLE processes require substantial water inputs, particularly concerning in arid regions where lithium resources are abundant. However, advanced DLE technologies are demonstrating improved water efficiency through closed-loop systems that recycle process water, potentially reducing consumption by 30-70% compared to evaporation methods. This advancement is particularly significant in water-stressed regions like Chile's Atacama Desert and Argentina's lithium triangle.

Chemical usage and waste management constitute another environmental dimension of DLE technologies. While some DLE methods utilize selective adsorbents that minimize chemical inputs, others employ significant quantities of solvents and reagents that require careful handling and disposal. Recent innovations in biodegradable sorbents and environmentally benign extraction chemicals show promise for reducing the environmental footprint of these processes.

Energy consumption patterns of DLE technologies vary considerably across different technological approaches. Most DLE methods require more energy per unit of lithium produced than traditional solar evaporation, but significantly less than hard-rock mining operations. The sustainability profile improves substantially when renewable energy sources power DLE facilities, creating potential for near-carbon-neutral lithium production pathways.

Land use impacts represent a notable advantage of DLE technologies. Conventional evaporation methods require extensive surface area—approximately 2,000 hectares per 20,000 tonnes of lithium carbonate equivalent production annually. In contrast, DLE facilities can operate with a physical footprint 50-100 times smaller, dramatically reducing ecosystem disruption and habitat fragmentation.

Biodiversity protection emerges as another potential benefit of DLE implementation. By minimizing surface disturbance and reducing water extraction from sensitive ecosystems, properly designed DLE operations can help preserve fragile desert and salt flat habitats that host unique and often endangered species. This aspect becomes increasingly important as lithium demand accelerates in biodiversity hotspots across South America and elsewhere.

The life-cycle environmental assessment of DLE technologies remains complex and context-dependent. While offering significant improvements in certain environmental dimensions, the overall sustainability of these technologies depends on site-specific implementation factors, including energy sources, water availability, and waste management practices.

Water usage represents a critical environmental consideration for DLE implementation. Many DLE processes require substantial water inputs, particularly concerning in arid regions where lithium resources are abundant. However, advanced DLE technologies are demonstrating improved water efficiency through closed-loop systems that recycle process water, potentially reducing consumption by 30-70% compared to evaporation methods. This advancement is particularly significant in water-stressed regions like Chile's Atacama Desert and Argentina's lithium triangle.

Chemical usage and waste management constitute another environmental dimension of DLE technologies. While some DLE methods utilize selective adsorbents that minimize chemical inputs, others employ significant quantities of solvents and reagents that require careful handling and disposal. Recent innovations in biodegradable sorbents and environmentally benign extraction chemicals show promise for reducing the environmental footprint of these processes.

Energy consumption patterns of DLE technologies vary considerably across different technological approaches. Most DLE methods require more energy per unit of lithium produced than traditional solar evaporation, but significantly less than hard-rock mining operations. The sustainability profile improves substantially when renewable energy sources power DLE facilities, creating potential for near-carbon-neutral lithium production pathways.

Land use impacts represent a notable advantage of DLE technologies. Conventional evaporation methods require extensive surface area—approximately 2,000 hectares per 20,000 tonnes of lithium carbonate equivalent production annually. In contrast, DLE facilities can operate with a physical footprint 50-100 times smaller, dramatically reducing ecosystem disruption and habitat fragmentation.

Biodiversity protection emerges as another potential benefit of DLE implementation. By minimizing surface disturbance and reducing water extraction from sensitive ecosystems, properly designed DLE operations can help preserve fragile desert and salt flat habitats that host unique and often endangered species. This aspect becomes increasingly important as lithium demand accelerates in biodiversity hotspots across South America and elsewhere.

The life-cycle environmental assessment of DLE technologies remains complex and context-dependent. While offering significant improvements in certain environmental dimensions, the overall sustainability of these technologies depends on site-specific implementation factors, including energy sources, water availability, and waste management practices.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!