How Model Predictive Control Improves Dynamic Pricing In Energy Markets

SEP 9, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

MPC in Energy Pricing: Background and Objectives

Model Predictive Control (MPC) has emerged as a sophisticated control methodology with roots dating back to the 1970s in process industries. Its evolution has been marked by significant advancements in computational capabilities, mathematical optimization techniques, and control theory. In the context of energy markets, MPC represents a paradigm shift from traditional static pricing models to dynamic, forward-looking approaches that can adapt to rapidly changing market conditions.

The energy sector has undergone dramatic transformation over the past two decades, driven by deregulation, the integration of renewable energy sources, and increasing volatility in supply and demand patterns. Traditional pricing mechanisms have proven inadequate in addressing these new challenges, creating an urgent need for more responsive and predictive pricing strategies.

MPC offers a promising solution by incorporating forecasting elements, constraint handling capabilities, and optimization techniques within a unified framework. The core principle involves predicting future system states over a finite horizon, optimizing control actions based on these predictions, and implementing only the first step of the calculated sequence before recalculating at the next time interval.

In energy markets specifically, MPC enables dynamic pricing that can anticipate supply fluctuations from intermittent renewable sources, respond to demand variations, and account for transmission constraints—all while optimizing for multiple objectives such as profit maximization, grid stability, and environmental impact reduction.

The technical evolution trajectory shows a clear progression from simple rule-based pricing to increasingly sophisticated algorithmic approaches. Early implementations focused primarily on day-ahead markets, while current research extends to real-time markets with sub-hourly or even minute-by-minute price adjustments.

The primary objective of implementing MPC in energy pricing is to develop robust, adaptive pricing mechanisms that can balance multiple competing factors: maximizing economic efficiency, ensuring system reliability, promoting renewable integration, and maintaining price stability for consumers. Secondary objectives include reducing price volatility, minimizing forecast errors, and creating appropriate price signals to incentivize beneficial consumer behavior.

Looking forward, the continued advancement of MPC in energy pricing aims to address several key challenges: computational efficiency for real-time implementation, handling of increasing uncertainty from renewable sources, incorporation of distributed energy resources, and development of multi-market coordination mechanisms that can optimize across different timeframes and geographical regions.

The energy sector has undergone dramatic transformation over the past two decades, driven by deregulation, the integration of renewable energy sources, and increasing volatility in supply and demand patterns. Traditional pricing mechanisms have proven inadequate in addressing these new challenges, creating an urgent need for more responsive and predictive pricing strategies.

MPC offers a promising solution by incorporating forecasting elements, constraint handling capabilities, and optimization techniques within a unified framework. The core principle involves predicting future system states over a finite horizon, optimizing control actions based on these predictions, and implementing only the first step of the calculated sequence before recalculating at the next time interval.

In energy markets specifically, MPC enables dynamic pricing that can anticipate supply fluctuations from intermittent renewable sources, respond to demand variations, and account for transmission constraints—all while optimizing for multiple objectives such as profit maximization, grid stability, and environmental impact reduction.

The technical evolution trajectory shows a clear progression from simple rule-based pricing to increasingly sophisticated algorithmic approaches. Early implementations focused primarily on day-ahead markets, while current research extends to real-time markets with sub-hourly or even minute-by-minute price adjustments.

The primary objective of implementing MPC in energy pricing is to develop robust, adaptive pricing mechanisms that can balance multiple competing factors: maximizing economic efficiency, ensuring system reliability, promoting renewable integration, and maintaining price stability for consumers. Secondary objectives include reducing price volatility, minimizing forecast errors, and creating appropriate price signals to incentivize beneficial consumer behavior.

Looking forward, the continued advancement of MPC in energy pricing aims to address several key challenges: computational efficiency for real-time implementation, handling of increasing uncertainty from renewable sources, incorporation of distributed energy resources, and development of multi-market coordination mechanisms that can optimize across different timeframes and geographical regions.

Energy Market Demand Analysis for Dynamic Pricing

Energy markets are experiencing a paradigm shift driven by increasing renewable energy integration, decentralization, and digitalization. The demand for electricity fluctuates significantly throughout the day, creating challenges for traditional pricing models that fail to reflect real-time supply and demand dynamics. Analysis of market data reveals that peak demand periods typically occur in the morning (7-9 AM) and evening (5-8 PM), with substantial seasonal variations across different regions. These fluctuations create opportunities for dynamic pricing strategies that can better align consumption with generation availability.

Consumer behavior studies indicate that price elasticity in energy markets varies significantly across different customer segments. Residential consumers show elasticity coefficients between -0.2 and -0.6, while commercial and industrial users demonstrate higher responsiveness with coefficients ranging from -0.7 to -1.2. This variability presents both challenges and opportunities for implementing effective dynamic pricing mechanisms that can influence consumption patterns.

The global energy market is increasingly characterized by volatility due to renewable energy intermittency. Solar and wind generation can fluctuate by 30-70% within hours, creating supply-side uncertainty that traditional pricing models cannot adequately address. Market research indicates that dynamic pricing solutions can reduce peak demand by 10-20% and overall energy costs by 5-15% when properly implemented with predictive controls.

Regulatory frameworks are evolving to accommodate these market realities, with many jurisdictions moving from fixed tariffs toward time-of-use pricing and real-time pricing models. The European Union's Clean Energy Package and similar initiatives in North America and Asia-Pacific regions are creating favorable conditions for advanced pricing mechanisms that leverage predictive analytics and control theory.

Demand response programs, enabled by dynamic pricing, represent a growing market segment projected to reach substantial value by 2028. These programs allow consumers to participate actively in energy markets by adjusting their consumption patterns in response to price signals. The integration of smart meters, home energy management systems, and industrial automation has created the technical infrastructure necessary for implementing sophisticated dynamic pricing strategies based on model predictive control.

Market analysis reveals that early adopters of dynamic pricing technologies have gained competitive advantages through reduced energy costs, improved grid reliability, and enhanced customer engagement. However, adoption barriers remain, including technology implementation costs, consumer education requirements, and regulatory hurdles that vary significantly across different markets.

Consumer behavior studies indicate that price elasticity in energy markets varies significantly across different customer segments. Residential consumers show elasticity coefficients between -0.2 and -0.6, while commercial and industrial users demonstrate higher responsiveness with coefficients ranging from -0.7 to -1.2. This variability presents both challenges and opportunities for implementing effective dynamic pricing mechanisms that can influence consumption patterns.

The global energy market is increasingly characterized by volatility due to renewable energy intermittency. Solar and wind generation can fluctuate by 30-70% within hours, creating supply-side uncertainty that traditional pricing models cannot adequately address. Market research indicates that dynamic pricing solutions can reduce peak demand by 10-20% and overall energy costs by 5-15% when properly implemented with predictive controls.

Regulatory frameworks are evolving to accommodate these market realities, with many jurisdictions moving from fixed tariffs toward time-of-use pricing and real-time pricing models. The European Union's Clean Energy Package and similar initiatives in North America and Asia-Pacific regions are creating favorable conditions for advanced pricing mechanisms that leverage predictive analytics and control theory.

Demand response programs, enabled by dynamic pricing, represent a growing market segment projected to reach substantial value by 2028. These programs allow consumers to participate actively in energy markets by adjusting their consumption patterns in response to price signals. The integration of smart meters, home energy management systems, and industrial automation has created the technical infrastructure necessary for implementing sophisticated dynamic pricing strategies based on model predictive control.

Market analysis reveals that early adopters of dynamic pricing technologies have gained competitive advantages through reduced energy costs, improved grid reliability, and enhanced customer engagement. However, adoption barriers remain, including technology implementation costs, consumer education requirements, and regulatory hurdles that vary significantly across different markets.

Current State and Challenges of MPC in Energy Markets

Model Predictive Control (MPC) has gained significant traction in energy market applications, yet its implementation faces various technical and market-related challenges. Currently, MPC is being deployed across several energy market segments, including wholesale electricity markets, distributed energy resources management, and grid-scale battery storage optimization. The technology has demonstrated promising results in pilot projects, with reported improvements in pricing efficiency ranging from 5-15% compared to traditional methods.

Despite these advancements, the widespread adoption of MPC in energy markets remains limited. A primary technical challenge is the computational complexity associated with solving large-scale optimization problems in real-time. Energy markets operate on tight scheduling windows, often requiring solutions within minutes, which can strain even advanced computing infrastructures when dealing with complex market models and numerous constraints.

Data quality and availability present another significant hurdle. MPC algorithms require accurate forecasts of demand, renewable generation, and market conditions. The inherent volatility of renewable energy sources and unpredictable consumer behavior patterns create substantial forecast errors, which can undermine the effectiveness of MPC implementations. Studies indicate that forecast errors exceeding 10% can reduce MPC performance benefits by up to 40%.

Regulatory frameworks across different regions also pose challenges to MPC adoption. Many energy markets operate under legacy rules that were not designed with dynamic algorithmic pricing in mind. Regulatory requirements for price transparency, fairness, and stability can conflict with the dynamic nature of MPC-based pricing strategies. This regulatory misalignment is particularly pronounced in traditionally regulated markets where price changes require formal approval processes.

Market structure complexity further complicates MPC implementation. Energy markets involve multiple interconnected participants with sometimes conflicting objectives. MPC models must account for these complex interactions while maintaining computational tractability. Current implementations often make simplifying assumptions that may not fully capture market dynamics, leading to suboptimal solutions.

Geographically, MPC adoption in energy markets shows significant variation. European markets, particularly in the Nordic countries and Germany, have made substantial progress in implementing advanced control strategies due to their high renewable penetration. North American ISO/RTO markets have begun pilot programs but face greater regulatory hurdles. Emerging economies generally lag in adoption, though China has made notable investments in this technology for its developing spot markets.

The integration of MPC with existing market software systems presents additional technical challenges. Legacy IT infrastructure in many utilities and market operators was not designed to support the data requirements and computational needs of advanced control algorithms, necessitating significant upgrades or parallel systems that increase implementation costs.

Despite these advancements, the widespread adoption of MPC in energy markets remains limited. A primary technical challenge is the computational complexity associated with solving large-scale optimization problems in real-time. Energy markets operate on tight scheduling windows, often requiring solutions within minutes, which can strain even advanced computing infrastructures when dealing with complex market models and numerous constraints.

Data quality and availability present another significant hurdle. MPC algorithms require accurate forecasts of demand, renewable generation, and market conditions. The inherent volatility of renewable energy sources and unpredictable consumer behavior patterns create substantial forecast errors, which can undermine the effectiveness of MPC implementations. Studies indicate that forecast errors exceeding 10% can reduce MPC performance benefits by up to 40%.

Regulatory frameworks across different regions also pose challenges to MPC adoption. Many energy markets operate under legacy rules that were not designed with dynamic algorithmic pricing in mind. Regulatory requirements for price transparency, fairness, and stability can conflict with the dynamic nature of MPC-based pricing strategies. This regulatory misalignment is particularly pronounced in traditionally regulated markets where price changes require formal approval processes.

Market structure complexity further complicates MPC implementation. Energy markets involve multiple interconnected participants with sometimes conflicting objectives. MPC models must account for these complex interactions while maintaining computational tractability. Current implementations often make simplifying assumptions that may not fully capture market dynamics, leading to suboptimal solutions.

Geographically, MPC adoption in energy markets shows significant variation. European markets, particularly in the Nordic countries and Germany, have made substantial progress in implementing advanced control strategies due to their high renewable penetration. North American ISO/RTO markets have begun pilot programs but face greater regulatory hurdles. Emerging economies generally lag in adoption, though China has made notable investments in this technology for its developing spot markets.

The integration of MPC with existing market software systems presents additional technical challenges. Legacy IT infrastructure in many utilities and market operators was not designed to support the data requirements and computational needs of advanced control algorithms, necessitating significant upgrades or parallel systems that increase implementation costs.

Current MPC Implementation Strategies for Energy Pricing

01 Model Predictive Control for Retail Pricing Optimization

Model Predictive Control (MPC) techniques are applied to retail pricing strategies to optimize revenue and inventory management. These systems use historical sales data, market conditions, and consumer behavior patterns to predict optimal pricing points. The MPC framework allows retailers to dynamically adjust prices based on real-time demand forecasts, competitor pricing, and inventory levels, resulting in maximized profits and reduced excess inventory.- Model Predictive Control for Retail Pricing Optimization: Model Predictive Control (MPC) techniques are applied to retail pricing strategies to optimize revenue and inventory management. These systems use historical sales data, market conditions, and consumer behavior patterns to forecast demand and dynamically adjust prices. The MPC algorithms continuously update pricing models based on real-time feedback, allowing retailers to maximize profits while maintaining competitive positioning in the market.

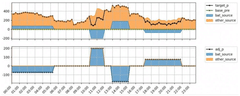

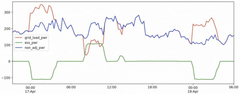

- Energy Market Dynamic Pricing Systems: Advanced predictive control systems for energy market pricing that balance supply and demand in real-time. These systems incorporate weather forecasts, grid conditions, renewable energy availability, and consumption patterns to optimize electricity pricing. The MPC frameworks enable utilities and energy providers to implement time-of-use pricing, demand response programs, and peak-shaving strategies while ensuring grid stability and maximizing operational efficiency.

- Transportation and Ride-sharing Dynamic Pricing: Predictive control algorithms for transportation services that implement surge pricing and dynamic fare adjustments. These systems analyze traffic patterns, rider demand, driver availability, and special events to optimize pricing in real-time. The MPC models balance the need to attract sufficient service providers while maintaining customer satisfaction, ultimately maximizing platform revenue and efficiency across varying market conditions.

- Manufacturing and Supply Chain Price Optimization: Model predictive control frameworks for manufacturing and supply chain pricing that respond to raw material costs, production capacity, and market demand fluctuations. These systems optimize pricing across complex distribution networks while accounting for inventory constraints, production schedules, and logistics costs. The dynamic pricing models help manufacturers maintain profit margins while adapting to supply chain disruptions and changing market conditions.

- AI-Enhanced Predictive Pricing Platforms: Advanced artificial intelligence and machine learning techniques integrated with model predictive control for next-generation dynamic pricing. These platforms incorporate neural networks, reinforcement learning, and natural language processing to analyze vast datasets including competitor pricing, social media sentiment, and macroeconomic indicators. The AI-enhanced systems can detect subtle market signals and consumer behavior patterns to implement more sophisticated and responsive pricing strategies across multiple channels.

02 Dynamic Pricing in Energy Markets Using MPC

Model Predictive Control frameworks are implemented in energy markets to establish dynamic pricing mechanisms that respond to fluctuating supply and demand conditions. These systems forecast energy consumption patterns, grid load, and generation capacity to determine optimal pricing strategies. By incorporating weather predictions, time-of-use patterns, and renewable energy availability, these MPC systems can incentivize consumption during periods of excess supply and discourage usage during peak demand, leading to more efficient grid management.Expand Specific Solutions03 Integrated MPC Systems for Supply Chain and Pricing Optimization

Advanced control systems integrate Model Predictive Control with supply chain management to create comprehensive dynamic pricing solutions. These systems simultaneously optimize production schedules, inventory levels, distribution logistics, and market pricing. By considering the entire value chain in the predictive model, businesses can implement pricing strategies that account for production costs, transportation constraints, and market demand fluctuations, resulting in improved overall operational efficiency and profitability.Expand Specific Solutions04 Machine Learning Enhanced MPC for Personalized Dynamic Pricing

Machine learning algorithms are incorporated into Model Predictive Control frameworks to enable personalized dynamic pricing strategies. These systems analyze individual customer data, purchase history, browsing behavior, and demographic information to predict willingness-to-pay and price sensitivity. The MPC component then optimizes personalized pricing offers in real-time, balancing customer acquisition costs, lifetime value predictions, and inventory constraints to maximize long-term profitability while maintaining customer satisfaction.Expand Specific Solutions05 Robust MPC Frameworks for Uncertain Market Conditions

Robust Model Predictive Control methodologies are developed to handle uncertainties in dynamic pricing applications. These systems incorporate risk assessment models, scenario analysis, and stochastic optimization techniques to create pricing strategies that remain effective despite unpredictable market fluctuations. By explicitly modeling uncertainty in demand, competitor responses, and external economic factors, these robust MPC frameworks provide stable pricing solutions that balance profit maximization with risk mitigation across various potential market scenarios.Expand Specific Solutions

Key Players in Energy Market Optimization Solutions

The dynamic pricing landscape in energy markets is evolving rapidly, with Model Predictive Control (MPC) emerging as a transformative technology. Currently in the growth phase, this market is expanding as utilities seek optimization solutions for increasingly complex grid operations. Leading academic institutions like Tsinghua University, North China Electric Power University, and Zhejiang University are driving theoretical advancements, while major industry players including State Grid Corporation of China, Huaneng Group, and various provincial power companies are implementing practical applications. International technology firms such as IBM and TCS are also entering this space, providing advanced analytics capabilities. The technology is approaching maturity in developed markets but remains in early adoption phases for many emerging economies, with integration challenges between theoretical models and real-world grid operations still being addressed.

Tsinghua University

Technical Solution: Tsinghua University's research team has developed a cutting-edge MPC framework for dynamic pricing in energy markets that focuses on social welfare optimization while maintaining system stability. Their approach integrates distributed MPC algorithms with game theory to model the strategic interactions between market participants. The system employs a multi-layer architecture that separates the slow-changing market structure parameters from fast-changing operational variables, enabling efficient computation while maintaining optimality. Tsinghua's implementation includes innovative congestion management techniques that incorporate transmission constraints directly into the pricing mechanism. Their research has pioneered the use of reinforcement learning to adapt MPC parameters in response to changing market conditions and participant behaviors. A distinctive feature is the incorporation of fairness constraints that ensure equitable distribution of benefits across different consumer segments. The framework has been validated through extensive simulations using real-world data from China's evolving electricity markets, demonstrating significant improvements in both economic efficiency and renewable integration compared to conventional pricing mechanisms.

Strengths: Strong theoretical foundation combining control theory, economics, and machine learning; innovative approaches to fairness and equity considerations; extensive validation through academic research. Weaknesses: Limited commercial-scale deployment compared to industry players; may require adaptation for practical implementation in different market structures.

State Grid Corp. of China

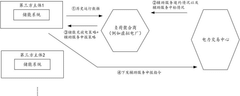

Technical Solution: State Grid Corporation of China has developed an advanced Model Predictive Control (MPC) system for dynamic pricing in energy markets that integrates multi-time scale prediction models with real-time grid constraints. Their approach utilizes a hierarchical MPC framework that operates at both day-ahead and real-time markets, incorporating renewable energy forecasting, demand response potential, and transmission constraints. The system employs a rolling horizon optimization technique that continuously updates price signals based on the latest market conditions and grid status. State Grid's implementation includes distributed algorithms that allow for scalable computation across vast geographic areas while maintaining system stability. Their MPC models account for uncertainty through robust optimization techniques, enabling the system to handle the volatility introduced by increasing renewable penetration. The platform has been deployed across multiple provincial grids in China, demonstrating significant improvements in grid efficiency and renewable integration.

Strengths: Extensive implementation experience across China's massive grid network; robust algorithms capable of handling large-scale systems; proven integration with existing market mechanisms. Weaknesses: High computational requirements for real-time implementation; potential challenges in adapting to fully liberalized markets; requires substantial data infrastructure.

Core MPC Algorithms for Real-time Energy Price Optimization

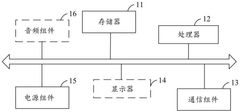

Optimized operation method of energy storage system, power management system and related equipment

PatentActiveCN118842036A

Innovation

- The model predictive control (MPC) optimization framework is used to dynamically update the charging and discharging strategy of the energy storage system. By controlling the energy storage power target value and the auxiliary service declaration status, the operation of the energy storage system is optimized to improve energy utilization.

Model-based predictive regulation of a building energy system

PatentInactiveEP1987402A1

Innovation

- A model-based predictive control method that uses a control and regulation device with a thermal and energetic behavior model to optimize the operation of building energy systems, allowing for selection of optimization criteria such as operating costs, energy consumption, or emissions, and enabling dimensioning of energy systems by determining performance limits and storage capacities.

Regulatory Framework for Algorithmic Energy Pricing

The regulatory landscape governing algorithmic pricing in energy markets is complex and evolving rapidly as technologies like Model Predictive Control (MPC) gain prominence. At the federal level, the Federal Energy Regulatory Commission (FERC) has established Order 745, which mandates that demand response resources must be compensated at market rates, creating a foundation for dynamic pricing mechanisms. This regulatory framework has been further enhanced by Order 841, which removes barriers for energy storage participation in wholesale markets, indirectly supporting MPC-based pricing strategies.

State-level Public Utility Commissions (PUCs) play a crucial role in implementing these federal directives while adapting them to local market conditions. Currently, approximately 60% of states have adopted some form of regulatory framework that permits algorithmic pricing in energy markets, though with varying degrees of oversight and consumer protection measures. These frameworks typically address transparency requirements, algorithmic fairness, and price volatility limitations.

The European Union's approach offers valuable comparative insights, particularly through its Clean Energy Package, which explicitly addresses algorithmic trading in energy markets. The EU framework mandates that pricing algorithms must be registered with regulatory authorities and undergo periodic audits to ensure compliance with anti-manipulation provisions. This contrasts with the more fragmented approach in the United States, where regulatory requirements can vary significantly across regional transmission organizations.

Data privacy considerations represent another critical dimension of the regulatory framework. As MPC systems rely on extensive consumer usage data to optimize pricing models, regulations like GDPR in Europe and the California Consumer Privacy Act in the US impose strict requirements on data collection, storage, and utilization practices. Energy companies implementing MPC-based pricing must navigate these requirements while maintaining algorithmic effectiveness.

Regulatory bodies are increasingly focusing on the potential for algorithmic collusion and market manipulation. The Justice Department and FTC have recently issued joint guidelines specifically addressing algorithmic pricing in essential service markets, including energy. These guidelines establish "safe harbor" provisions for certain types of predictive pricing models while identifying high-risk practices that could trigger antitrust scrutiny.

Looking forward, regulatory frameworks are likely to evolve toward "regulatory sandboxes" that allow controlled testing of innovative MPC pricing models before full-scale implementation. Several states, including New York and California, have already initiated such programs, providing valuable precedents for future regulatory approaches that balance innovation with consumer protection.

State-level Public Utility Commissions (PUCs) play a crucial role in implementing these federal directives while adapting them to local market conditions. Currently, approximately 60% of states have adopted some form of regulatory framework that permits algorithmic pricing in energy markets, though with varying degrees of oversight and consumer protection measures. These frameworks typically address transparency requirements, algorithmic fairness, and price volatility limitations.

The European Union's approach offers valuable comparative insights, particularly through its Clean Energy Package, which explicitly addresses algorithmic trading in energy markets. The EU framework mandates that pricing algorithms must be registered with regulatory authorities and undergo periodic audits to ensure compliance with anti-manipulation provisions. This contrasts with the more fragmented approach in the United States, where regulatory requirements can vary significantly across regional transmission organizations.

Data privacy considerations represent another critical dimension of the regulatory framework. As MPC systems rely on extensive consumer usage data to optimize pricing models, regulations like GDPR in Europe and the California Consumer Privacy Act in the US impose strict requirements on data collection, storage, and utilization practices. Energy companies implementing MPC-based pricing must navigate these requirements while maintaining algorithmic effectiveness.

Regulatory bodies are increasingly focusing on the potential for algorithmic collusion and market manipulation. The Justice Department and FTC have recently issued joint guidelines specifically addressing algorithmic pricing in essential service markets, including energy. These guidelines establish "safe harbor" provisions for certain types of predictive pricing models while identifying high-risk practices that could trigger antitrust scrutiny.

Looking forward, regulatory frameworks are likely to evolve toward "regulatory sandboxes" that allow controlled testing of innovative MPC pricing models before full-scale implementation. Several states, including New York and California, have already initiated such programs, providing valuable precedents for future regulatory approaches that balance innovation with consumer protection.

Environmental Impact of MPC-based Energy Pricing Systems

The implementation of Model Predictive Control (MPC) in energy market dynamic pricing systems yields significant environmental benefits that extend beyond economic efficiency. By optimizing energy distribution and consumption patterns, MPC-based pricing mechanisms contribute substantially to reducing greenhouse gas emissions and promoting sustainable energy practices.

MPC algorithms enable more precise integration of renewable energy sources into the grid by accurately forecasting generation capabilities and adjusting prices accordingly. This optimization leads to increased utilization of clean energy when available, reducing reliance on fossil fuel-based generation during peak demand periods. Studies indicate that advanced MPC pricing systems can increase renewable energy utilization by 15-20% compared to traditional fixed pricing models.

Carbon emission reductions represent another critical environmental benefit of MPC-based dynamic pricing. By incentivizing consumption during periods of abundant renewable generation through lower prices, these systems effectively shift demand away from carbon-intensive generation periods. Research from the International Energy Agency suggests that widespread implementation of advanced dynamic pricing could reduce carbon emissions in the electricity sector by 5-7% annually in developed markets.

The environmental impact extends to resource conservation through improved grid efficiency. MPC systems minimize transmission losses by optimizing load distribution and reducing the need for spinning reserves. This optimization decreases the overall energy generation requirements, conserving natural resources and reducing the environmental footprint of power generation infrastructure.

Water conservation represents an often-overlooked environmental benefit. Thermal power plants, which frequently ramp up during peak demand, require significant water resources for cooling. By flattening demand curves through dynamic pricing, MPC systems reduce the operational hours of these facilities, consequently decreasing water consumption in electricity generation by an estimated 3-4% in water-stressed regions.

Long-term environmental impacts include deferred or avoided infrastructure expansion. By managing demand more effectively, MPC-based pricing reduces the need for additional generation capacity, particularly peaker plants that often have higher emission profiles. The World Economic Forum estimates that effective demand management through advanced pricing mechanisms could reduce global power infrastructure requirements by up to 8% by 2030, representing significant avoided environmental impacts from construction and operation.

These environmental benefits create a positive feedback loop: as MPC systems facilitate greater renewable integration, the emissions profile of the grid improves, further enhancing the environmental advantages of electrification in other sectors like transportation and heating.

MPC algorithms enable more precise integration of renewable energy sources into the grid by accurately forecasting generation capabilities and adjusting prices accordingly. This optimization leads to increased utilization of clean energy when available, reducing reliance on fossil fuel-based generation during peak demand periods. Studies indicate that advanced MPC pricing systems can increase renewable energy utilization by 15-20% compared to traditional fixed pricing models.

Carbon emission reductions represent another critical environmental benefit of MPC-based dynamic pricing. By incentivizing consumption during periods of abundant renewable generation through lower prices, these systems effectively shift demand away from carbon-intensive generation periods. Research from the International Energy Agency suggests that widespread implementation of advanced dynamic pricing could reduce carbon emissions in the electricity sector by 5-7% annually in developed markets.

The environmental impact extends to resource conservation through improved grid efficiency. MPC systems minimize transmission losses by optimizing load distribution and reducing the need for spinning reserves. This optimization decreases the overall energy generation requirements, conserving natural resources and reducing the environmental footprint of power generation infrastructure.

Water conservation represents an often-overlooked environmental benefit. Thermal power plants, which frequently ramp up during peak demand, require significant water resources for cooling. By flattening demand curves through dynamic pricing, MPC systems reduce the operational hours of these facilities, consequently decreasing water consumption in electricity generation by an estimated 3-4% in water-stressed regions.

Long-term environmental impacts include deferred or avoided infrastructure expansion. By managing demand more effectively, MPC-based pricing reduces the need for additional generation capacity, particularly peaker plants that often have higher emission profiles. The World Economic Forum estimates that effective demand management through advanced pricing mechanisms could reduce global power infrastructure requirements by up to 8% by 2030, representing significant avoided environmental impacts from construction and operation.

These environmental benefits create a positive feedback loop: as MPC systems facilitate greater renewable integration, the emissions profile of the grid improves, further enhancing the environmental advantages of electrification in other sectors like transportation and heating.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!