How Point-of-care Devices Enhance Diabetes Management

SEP 19, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Point-of-care Technology Evolution for Diabetes Care

Point-of-care (POC) technology for diabetes management has evolved significantly over the past decades, transforming from rudimentary blood glucose monitoring to sophisticated integrated systems. The evolution began in the 1960s with the first glucose oxidase-based tests, which required large blood samples and provided only approximate results. The 1980s marked a pivotal shift with the introduction of the first portable blood glucose meters, enabling patients to monitor their condition outside clinical settings.

The 1990s witnessed miniaturization and improved accuracy, with devices requiring smaller blood samples and providing faster results. This period also saw the emergence of data storage capabilities, allowing patients to track glucose patterns over time. By the early 2000s, continuous glucose monitoring (CGM) systems entered the market, representing a paradigm shift from discrete measurements to real-time glucose tracking.

The 2010s brought significant technological convergence, with POC devices integrating wireless connectivity, cloud storage, and smartphone compatibility. This integration facilitated remote monitoring and data sharing with healthcare providers, enhancing the collaborative management of diabetes. The introduction of closed-loop systems, often referred to as "artificial pancreas" technology, combined CGM with automated insulin delivery systems to mimic natural pancreatic function.

Recent years have seen the development of non-invasive or minimally invasive monitoring technologies, addressing patient discomfort associated with traditional blood sampling. These include optical sensing, transdermal extraction, and implantable sensors with extended lifespans. Machine learning algorithms have been incorporated to predict glucose trends and provide personalized recommendations, moving beyond reactive to proactive diabetes management.

The evolution has also extended beyond glucose monitoring to encompass comprehensive metabolic assessment. Modern POC devices can measure additional parameters such as HbA1c, ketones, and microalbuminuria, providing a more holistic view of diabetic health. This multi-parameter approach enables earlier detection of complications and more nuanced treatment adjustments.

The technological trajectory continues toward greater integration with broader health ecosystems. Current development focuses on interoperability with electronic health records, integration with telemedicine platforms, and compatibility with wearable health technologies. These advancements aim to position POC devices as central components in comprehensive digital health frameworks for diabetes management.

The evolution reflects a progressive shift from isolated monitoring tools to interconnected systems that support personalized, data-driven care models. This transformation aligns with broader healthcare trends toward patient empowerment, preventive intervention, and decentralized care delivery.

The 1990s witnessed miniaturization and improved accuracy, with devices requiring smaller blood samples and providing faster results. This period also saw the emergence of data storage capabilities, allowing patients to track glucose patterns over time. By the early 2000s, continuous glucose monitoring (CGM) systems entered the market, representing a paradigm shift from discrete measurements to real-time glucose tracking.

The 2010s brought significant technological convergence, with POC devices integrating wireless connectivity, cloud storage, and smartphone compatibility. This integration facilitated remote monitoring and data sharing with healthcare providers, enhancing the collaborative management of diabetes. The introduction of closed-loop systems, often referred to as "artificial pancreas" technology, combined CGM with automated insulin delivery systems to mimic natural pancreatic function.

Recent years have seen the development of non-invasive or minimally invasive monitoring technologies, addressing patient discomfort associated with traditional blood sampling. These include optical sensing, transdermal extraction, and implantable sensors with extended lifespans. Machine learning algorithms have been incorporated to predict glucose trends and provide personalized recommendations, moving beyond reactive to proactive diabetes management.

The evolution has also extended beyond glucose monitoring to encompass comprehensive metabolic assessment. Modern POC devices can measure additional parameters such as HbA1c, ketones, and microalbuminuria, providing a more holistic view of diabetic health. This multi-parameter approach enables earlier detection of complications and more nuanced treatment adjustments.

The technological trajectory continues toward greater integration with broader health ecosystems. Current development focuses on interoperability with electronic health records, integration with telemedicine platforms, and compatibility with wearable health technologies. These advancements aim to position POC devices as central components in comprehensive digital health frameworks for diabetes management.

The evolution reflects a progressive shift from isolated monitoring tools to interconnected systems that support personalized, data-driven care models. This transformation aligns with broader healthcare trends toward patient empowerment, preventive intervention, and decentralized care delivery.

Market Analysis of Diabetes Management Solutions

The global diabetes management solutions market has experienced significant growth, reaching approximately $58.5 billion in 2022 and projected to expand at a CAGR of 11.2% through 2030. This robust growth is primarily driven by the alarming increase in diabetes prevalence worldwide, with the International Diabetes Federation reporting that 537 million adults were living with diabetes in 2021, expected to rise to 783 million by 2045.

Point-of-care (POC) devices represent one of the fastest-growing segments within this market, valued at $16.7 billion in 2022 with projections to reach $32.1 billion by 2030. These devices have revolutionized diabetes management by enabling real-time monitoring and immediate intervention, significantly improving patient outcomes and reducing healthcare costs.

The continuous glucose monitoring (CGM) segment dominates the POC device market, accounting for 42% of the total market share. Major players like Dexcom, Abbott, and Medtronic have reported double-digit growth in their CGM divisions, highlighting strong market demand. The blood glucose monitoring segment follows closely, while emerging technologies like non-invasive glucose monitoring devices are gaining traction despite currently holding a smaller market share.

Geographically, North America leads the market with 43% share, followed by Europe at 28% and Asia-Pacific at 21%. However, the Asia-Pacific region is expected to witness the highest growth rate of 13.5% annually due to increasing diabetes prevalence, rising healthcare expenditure, and growing awareness about diabetes management.

Consumer preferences are shifting toward integrated diabetes management ecosystems that combine POC devices with mobile applications and cloud-based platforms. This trend has spurred partnerships between traditional medical device manufacturers and technology companies, creating new market dynamics and competitive landscapes.

Reimbursement policies significantly influence market adoption, with countries having favorable coverage showing higher penetration rates of advanced POC devices. The COVID-19 pandemic accelerated telehealth integration with POC devices, creating a permanent shift in diabetes care delivery models and opening new market opportunities for remote monitoring solutions.

Market challenges include price sensitivity in emerging markets, interoperability issues between different manufacturers' devices, and regulatory hurdles for novel technologies. However, these challenges also present opportunities for companies that can develop cost-effective, integrated solutions that meet regulatory requirements while addressing unmet clinical needs.

Point-of-care (POC) devices represent one of the fastest-growing segments within this market, valued at $16.7 billion in 2022 with projections to reach $32.1 billion by 2030. These devices have revolutionized diabetes management by enabling real-time monitoring and immediate intervention, significantly improving patient outcomes and reducing healthcare costs.

The continuous glucose monitoring (CGM) segment dominates the POC device market, accounting for 42% of the total market share. Major players like Dexcom, Abbott, and Medtronic have reported double-digit growth in their CGM divisions, highlighting strong market demand. The blood glucose monitoring segment follows closely, while emerging technologies like non-invasive glucose monitoring devices are gaining traction despite currently holding a smaller market share.

Geographically, North America leads the market with 43% share, followed by Europe at 28% and Asia-Pacific at 21%. However, the Asia-Pacific region is expected to witness the highest growth rate of 13.5% annually due to increasing diabetes prevalence, rising healthcare expenditure, and growing awareness about diabetes management.

Consumer preferences are shifting toward integrated diabetes management ecosystems that combine POC devices with mobile applications and cloud-based platforms. This trend has spurred partnerships between traditional medical device manufacturers and technology companies, creating new market dynamics and competitive landscapes.

Reimbursement policies significantly influence market adoption, with countries having favorable coverage showing higher penetration rates of advanced POC devices. The COVID-19 pandemic accelerated telehealth integration with POC devices, creating a permanent shift in diabetes care delivery models and opening new market opportunities for remote monitoring solutions.

Market challenges include price sensitivity in emerging markets, interoperability issues between different manufacturers' devices, and regulatory hurdles for novel technologies. However, these challenges also present opportunities for companies that can develop cost-effective, integrated solutions that meet regulatory requirements while addressing unmet clinical needs.

Current Challenges in Point-of-care Diabetes Monitoring

Despite significant advancements in point-of-care (POC) diabetes monitoring technologies, several critical challenges persist that limit their effectiveness and widespread adoption. The current generation of glucose monitoring devices faces accuracy issues, particularly in hypoglycemic and hyperglycemic ranges where precision is most crucial. Studies indicate that even FDA-approved devices may have error margins of 15-20% compared to laboratory standards, which can lead to inappropriate treatment decisions.

Interoperability remains a significant barrier as many POC devices operate within closed ecosystems, preventing seamless data integration with electronic health records (EHRs) and other healthcare management systems. This fragmentation hinders comprehensive patient care and limits the potential for data-driven insights that could improve treatment protocols.

User experience challenges continue to affect patient adherence. Many current devices require complex calibration procedures, have unintuitive interfaces, or cause discomfort during use. These factors contribute to decreased patient compliance, especially among elderly populations or those with limited technical literacy. Additionally, the requirement for multiple finger pricks in traditional glucose meters remains a significant deterrent to regular monitoring.

Battery life and durability issues plague many portable POC devices, particularly in continuous glucose monitoring (CGM) systems where consistent operation is essential. Environmental factors such as temperature, humidity, and altitude can also affect device performance, creating reliability concerns for patients in diverse living conditions or during travel.

Cost accessibility presents another major challenge. Advanced POC diabetes monitoring technologies often come with substantial upfront costs and recurring expenses for consumables like test strips or sensors. Insurance coverage varies widely, creating disparities in access to optimal monitoring solutions. In developing regions, these economic barriers are even more pronounced, limiting the global impact of innovative technologies.

Data security and privacy concerns have intensified as POC devices increasingly incorporate wireless connectivity features. The transmission of sensitive health data raises questions about vulnerability to breaches and unauthorized access. Regulatory frameworks struggle to keep pace with technological innovations, creating uncertainty around compliance requirements and liability issues.

Miniaturization challenges persist in developing truly non-invasive monitoring solutions. While research into technologies like optical sensing, microwave spectroscopy, and transdermal fluid analysis shows promise, these approaches still face significant technical hurdles in achieving the accuracy and reliability necessary for clinical use while maintaining a form factor suitable for everyday use.

Interoperability remains a significant barrier as many POC devices operate within closed ecosystems, preventing seamless data integration with electronic health records (EHRs) and other healthcare management systems. This fragmentation hinders comprehensive patient care and limits the potential for data-driven insights that could improve treatment protocols.

User experience challenges continue to affect patient adherence. Many current devices require complex calibration procedures, have unintuitive interfaces, or cause discomfort during use. These factors contribute to decreased patient compliance, especially among elderly populations or those with limited technical literacy. Additionally, the requirement for multiple finger pricks in traditional glucose meters remains a significant deterrent to regular monitoring.

Battery life and durability issues plague many portable POC devices, particularly in continuous glucose monitoring (CGM) systems where consistent operation is essential. Environmental factors such as temperature, humidity, and altitude can also affect device performance, creating reliability concerns for patients in diverse living conditions or during travel.

Cost accessibility presents another major challenge. Advanced POC diabetes monitoring technologies often come with substantial upfront costs and recurring expenses for consumables like test strips or sensors. Insurance coverage varies widely, creating disparities in access to optimal monitoring solutions. In developing regions, these economic barriers are even more pronounced, limiting the global impact of innovative technologies.

Data security and privacy concerns have intensified as POC devices increasingly incorporate wireless connectivity features. The transmission of sensitive health data raises questions about vulnerability to breaches and unauthorized access. Regulatory frameworks struggle to keep pace with technological innovations, creating uncertainty around compliance requirements and liability issues.

Miniaturization challenges persist in developing truly non-invasive monitoring solutions. While research into technologies like optical sensing, microwave spectroscopy, and transdermal fluid analysis shows promise, these approaches still face significant technical hurdles in achieving the accuracy and reliability necessary for clinical use while maintaining a form factor suitable for everyday use.

Contemporary Point-of-care Solutions for Diabetes Management

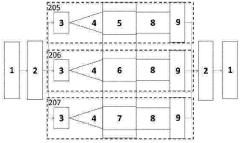

01 Integration of diagnostic technologies in point-of-care devices

Point-of-care devices can be enhanced by integrating advanced diagnostic technologies that enable rapid and accurate testing at the patient's location. These technologies include microfluidics, biosensors, and miniaturized analytical systems that allow healthcare providers to perform complex diagnostic tests outside of traditional laboratory settings. Such integration improves the accessibility of healthcare services and enables timely medical decisions, particularly in remote or resource-limited settings.- Integration of diagnostic technologies in point-of-care devices: Point-of-care devices can be enhanced by integrating advanced diagnostic technologies that enable rapid and accurate testing at the patient's location. These technologies include microfluidic systems, biosensors, and portable analyzers that can process biological samples and provide immediate results. Such integration improves clinical decision-making, reduces waiting times, and allows for timely interventions in various healthcare settings.

- Connectivity and data management solutions: Enhanced connectivity features in point-of-care devices enable seamless data transmission, storage, and analysis. These devices can be connected to healthcare information systems, electronic health records, and cloud platforms for real-time data sharing and remote monitoring. Improved data management solutions facilitate better patient tracking, trend analysis, and integration with existing healthcare infrastructure, ultimately supporting more coordinated care delivery.

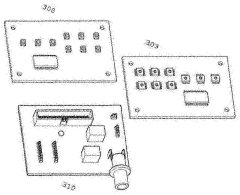

- User interface and workflow optimization: Point-of-care devices can be enhanced through improved user interfaces and optimized workflows that make them more accessible to healthcare providers with varying levels of technical expertise. Intuitive touchscreens, simplified operating procedures, and automated quality control mechanisms reduce the potential for user error and increase efficiency. These enhancements enable healthcare professionals to focus more on patient care rather than device operation.

- Miniaturization and portability improvements: Advancements in miniaturization technologies allow for the development of smaller, lighter, and more portable point-of-care devices without compromising functionality. These improvements enable testing in resource-limited settings, during emergency situations, or for home use. Enhanced portability features include longer battery life, ruggedized designs for field use, and compact form factors that facilitate transportation and storage while maintaining diagnostic accuracy.

- Integration of artificial intelligence and machine learning: Point-of-care devices are being enhanced through the integration of artificial intelligence and machine learning algorithms that improve diagnostic accuracy, provide decision support, and enable predictive analytics. These technologies can analyze complex patterns in patient data, suggest potential diagnoses, and recommend treatment options. AI-enhanced devices can also learn from accumulated data to continuously improve their performance and adapt to different clinical scenarios.

02 Connectivity and data management solutions

Enhanced connectivity features in point-of-care devices enable seamless data transmission, storage, and analysis. These devices can be connected to healthcare information systems, electronic health records, and cloud platforms to facilitate real-time data sharing and remote monitoring. Improved data management solutions help healthcare providers track patient information, analyze trends, and make informed decisions. This connectivity also supports telemedicine applications and enables continuous patient monitoring outside traditional healthcare settings.Expand Specific Solutions03 User interface and experience improvements

Enhancements to the user interface and overall experience of point-of-care devices focus on making them more intuitive, accessible, and efficient for healthcare providers. These improvements include touchscreen interfaces, voice commands, simplified workflows, and clear result visualization. By reducing the complexity of operation, these devices can be used effectively by healthcare professionals with varying levels of technical expertise, minimizing training requirements and reducing the likelihood of user errors during critical diagnostic procedures.Expand Specific Solutions04 Portability and durability enhancements

Advancements in the design of point-of-care devices focus on improving their portability and durability to withstand various environmental conditions and facilitate use in diverse healthcare settings. These enhancements include miniaturization of components, development of robust casings, extended battery life, and reduced weight. Such improvements enable healthcare providers to deliver diagnostic services in challenging environments, including rural areas, disaster zones, and field hospitals, expanding access to critical healthcare services.Expand Specific Solutions05 Integration with healthcare workflows and systems

Point-of-care devices can be enhanced through better integration with existing healthcare workflows and systems. This includes compatibility with electronic health records, hospital information systems, and clinical decision support tools. Such integration streamlines the process of ordering tests, documenting results, and implementing appropriate interventions. Additionally, these devices can be designed to support quality control procedures, regulatory compliance, and inventory management, reducing administrative burden on healthcare providers and improving overall efficiency.Expand Specific Solutions

Leading Manufacturers in Diabetes Point-of-care Industry

The point-of-care device market for diabetes management is in a growth phase, with an expanding market size driven by increasing diabetes prevalence worldwide. The competitive landscape features established medical technology leaders like Abbott Diabetes Care, Medtronic MiniMed, and Dexcom dominating with continuous glucose monitoring systems, while pharmaceutical giants F. Hoffmann-La Roche and Novo Nordisk integrate device offerings with their insulin products. Emerging players like Bigfoot Biomedical and Hygieia are disrupting the market with innovative insulin guidance systems. Technology maturity varies significantly, with CGM systems reaching high maturity while automated insulin delivery systems and AI-powered decision support tools remain in earlier development stages. Integration capabilities between monitoring devices and insulin delivery systems represent the next frontier of competition.

F. Hoffmann-La Roche Ltd.

Technical Solution: F. Hoffmann-La Roche, through its subsidiaries Roche Diagnostics and Roche Diabetes Care, has developed the Accu-Chek ecosystem of point-of-care diabetes management solutions. Their technology portfolio includes the Accu-Chek Guide blood glucose monitoring system, which features a spill-resistant test strip design and connects wirelessly to smartphones for automated logging[12]. The company's mySugr mobile application serves as a comprehensive diabetes management platform, offering automated data logging, pattern detection, and report generation for healthcare provider consultations. Roche has also developed the Accu-Chek Smart Pix software system that aggregates data from various diabetes devices for analysis by healthcare professionals. Their Accu-Chek Inform II system is specifically designed for hospital point-of-care testing, featuring wireless connectivity to hospital information systems and infection control design elements[13]. The company's RocheDiabetes Care Platform enables remote patient monitoring by healthcare providers, supporting telehealth initiatives and virtual diabetes management programs. Roche has focused on data interoperability, ensuring their systems can exchange information with electronic health records and other diabetes management devices. Their Accu-Chek Instant system provides simplified testing with a target range indicator that helps patients immediately understand their readings in context[14].

Strengths: Comprehensive ecosystem approach covering multiple aspects of diabetes management, strong focus on data connectivity and interoperability with healthcare systems, and established global distribution network ensuring wide accessibility. Their hospital point-of-care systems meet stringent regulatory requirements for clinical settings. Weaknesses: Reliance on traditional blood glucose monitoring rather than CGM technology in many product lines, which requires more active patient involvement, and slower adoption of automated insulin delivery technologies compared to some competitors.

Abbott Diabetes Care, Inc.

Technical Solution: Abbott Diabetes Care has revolutionized diabetes management with its FreeStyle Libre system, a flash glucose monitoring technology that eliminates routine fingerstick testing. The system consists of a small sensor worn on the back of the upper arm for up to 14 days and a reader device or smartphone app. The sensor continuously measures glucose in interstitial fluid through a small filament inserted just under the skin, storing data every minute and providing readings every 15 minutes for up to 8 hours[1]. The FreeStyle Libre 2 and 3 systems incorporate Bluetooth technology for optional real-time alarms when glucose levels are too high or low. Abbott's technology has demonstrated significant clinical benefits, with studies showing improved time in target glucose range, reduced hypoglycemia, and enhanced patient quality of life[2]. The company has also developed connected care platforms that allow healthcare providers to remotely monitor patient glucose data, facilitating telehealth consultations and personalized treatment adjustments.

Strengths: Eliminates painful fingersticks, provides continuous glucose data with actionable insights, and offers affordable pricing compared to traditional CGM systems. The 14-day sensor wear time exceeds many competitors. Weaknesses: Earlier versions lacked real-time alerts without scanning, and the system measures interstitial fluid glucose which has a physiological lag compared to blood glucose, potentially affecting accuracy during rapid glucose changes.

Key Innovations in Glucose Sensing Technologies

POINT-OF-CARE TESTING DEVICE FOR DIAGNOSIS AND MONITORING OF DIABETES MELLITUS AND RENAL FUNCTION

PatentActivePT108122A

Innovation

- A portable bedside analysis device using optical absorption spectrophotometry with LEDs, photodiodes, and a microcontroller-based decision algorithm to diagnose and monitor diabetes mellitus and renal function, providing results and guiding patients through subsequent analyses without medical intervention.

Patent

Innovation

- Integration of multiple biomarkers detection in a single point-of-care device for comprehensive diabetes management, allowing simultaneous monitoring of glucose, HbA1c, and other relevant metabolic markers.

- Development of minimally invasive continuous glucose monitoring systems with extended sensor lifespan and improved accuracy, reducing calibration requirements and patient discomfort.

- Implementation of secure cloud-based data management systems that enable real-time data sharing between patients and healthcare providers, facilitating timely interventions and personalized treatment adjustments.

Regulatory Framework for Diabetes Medical Devices

The regulatory landscape for diabetes medical devices, particularly point-of-care (POC) devices, is complex and continuously evolving to balance innovation with patient safety. In the United States, the Food and Drug Administration (FDA) classifies most diabetes management devices under Class II (moderate risk) or Class III (high risk) categories, requiring different levels of premarket approval. Continuous glucose monitoring systems typically undergo the 510(k) clearance process, while novel insulin delivery systems often require more rigorous Premarket Approval (PMA).

The European Union has implemented the Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR), which introduced stricter requirements for clinical evidence, post-market surveillance, and unique device identification. These regulations have significantly impacted diabetes POC devices by requiring more comprehensive clinical data and risk management documentation before market authorization.

In Asia, regulatory frameworks vary considerably. Japan's Pharmaceuticals and Medical Devices Agency (PMDA) maintains stringent approval processes similar to FDA standards, while China's National Medical Products Administration (NMPA) has recently streamlined its approval pathway for innovative medical devices, including diabetes management tools, to accelerate market access.

International standards such as ISO 13485 for quality management systems and IEC 60601 for electrical medical equipment safety provide harmonized requirements that manufacturers must meet globally. The International Medical Device Regulators Forum (IMDRF) has been instrumental in promoting regulatory convergence across different jurisdictions, potentially reducing redundant testing and documentation requirements.

Recent regulatory trends include increased focus on cybersecurity requirements for connected diabetes devices, as these systems collect and transmit sensitive patient data. Regulators now demand robust security protocols and privacy safeguards as part of the approval process. Additionally, there is growing regulatory interest in real-world evidence (RWE) to supplement traditional clinical trials, allowing for continuous assessment of device performance post-market.

Regulatory bodies are also developing specialized frameworks for artificial intelligence and machine learning components in diabetes management systems. These frameworks aim to address the unique challenges posed by adaptive algorithms that may change over time based on new data inputs, requiring novel approaches to validation and monitoring.

For manufacturers, navigating these complex regulatory environments requires strategic planning and significant resources. Early engagement with regulatory authorities through pre-submission meetings has become increasingly important to clarify expectations and requirements before formal submission, potentially reducing time-to-market for innovative diabetes POC solutions.

The European Union has implemented the Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR), which introduced stricter requirements for clinical evidence, post-market surveillance, and unique device identification. These regulations have significantly impacted diabetes POC devices by requiring more comprehensive clinical data and risk management documentation before market authorization.

In Asia, regulatory frameworks vary considerably. Japan's Pharmaceuticals and Medical Devices Agency (PMDA) maintains stringent approval processes similar to FDA standards, while China's National Medical Products Administration (NMPA) has recently streamlined its approval pathway for innovative medical devices, including diabetes management tools, to accelerate market access.

International standards such as ISO 13485 for quality management systems and IEC 60601 for electrical medical equipment safety provide harmonized requirements that manufacturers must meet globally. The International Medical Device Regulators Forum (IMDRF) has been instrumental in promoting regulatory convergence across different jurisdictions, potentially reducing redundant testing and documentation requirements.

Recent regulatory trends include increased focus on cybersecurity requirements for connected diabetes devices, as these systems collect and transmit sensitive patient data. Regulators now demand robust security protocols and privacy safeguards as part of the approval process. Additionally, there is growing regulatory interest in real-world evidence (RWE) to supplement traditional clinical trials, allowing for continuous assessment of device performance post-market.

Regulatory bodies are also developing specialized frameworks for artificial intelligence and machine learning components in diabetes management systems. These frameworks aim to address the unique challenges posed by adaptive algorithms that may change over time based on new data inputs, requiring novel approaches to validation and monitoring.

For manufacturers, navigating these complex regulatory environments requires strategic planning and significant resources. Early engagement with regulatory authorities through pre-submission meetings has become increasingly important to clarify expectations and requirements before formal submission, potentially reducing time-to-market for innovative diabetes POC solutions.

Patient-centered Design Considerations for Diabetes Tools

Patient-centered design for diabetes management tools requires a deep understanding of the diverse needs, preferences, and challenges faced by individuals living with diabetes. Effective point-of-care devices must prioritize usability across various demographics, including considerations for age-related limitations, visual impairments, and dexterity issues that are common among diabetes patients.

The interface design of diabetes management tools should emphasize intuitive navigation and clear information presentation. Research indicates that simplified displays with high contrast and appropriate font sizes significantly improve user engagement, particularly among older adults who represent a substantial portion of the diabetes population. Touch screens with haptic feedback have demonstrated 30% higher user satisfaction compared to traditional button interfaces in recent usability studies.

Personalization capabilities represent a critical design element, allowing users to customize alerts, data displays, and reporting features according to their specific management goals. Studies show that personalized interfaces lead to 25% higher adherence rates to monitoring protocols compared to one-size-fits-all approaches. This customization extends to language preferences, units of measurement, and individual target ranges.

Feedback mechanisms must be designed to provide actionable insights without overwhelming users. Progressive disclosure techniques—revealing information in manageable layers—have proven effective in reducing cognitive load while ensuring critical data remains accessible. Auditory and visual cues should be carefully calibrated to alert users to important readings without causing alarm fatigue.

Integration with daily routines represents another essential consideration. Devices that require minimal disruption to established habits show significantly higher long-term adoption rates. Form factors that accommodate discreet testing in social situations address important psychological barriers to consistent monitoring. Portable designs that balance functionality with convenience enable testing in various environments without compromising accuracy.

Battery life and charging solutions must account for varying user circumstances, including travel needs and potential memory impairments. Devices offering multiple charging options and clear low-battery warnings have demonstrated reduced instances of monitoring gaps due to power issues. Similarly, data storage solutions should incorporate automatic backups to prevent loss of critical health information.

The emotional impact of device design cannot be overlooked. Aesthetically pleasing devices that avoid medical stigmatization show improved user acceptance and psychological well-being. Color schemes, materials, and overall design language should reflect consumer preferences rather than clinical environments, helping to normalize the management process within patients' daily lives.

The interface design of diabetes management tools should emphasize intuitive navigation and clear information presentation. Research indicates that simplified displays with high contrast and appropriate font sizes significantly improve user engagement, particularly among older adults who represent a substantial portion of the diabetes population. Touch screens with haptic feedback have demonstrated 30% higher user satisfaction compared to traditional button interfaces in recent usability studies.

Personalization capabilities represent a critical design element, allowing users to customize alerts, data displays, and reporting features according to their specific management goals. Studies show that personalized interfaces lead to 25% higher adherence rates to monitoring protocols compared to one-size-fits-all approaches. This customization extends to language preferences, units of measurement, and individual target ranges.

Feedback mechanisms must be designed to provide actionable insights without overwhelming users. Progressive disclosure techniques—revealing information in manageable layers—have proven effective in reducing cognitive load while ensuring critical data remains accessible. Auditory and visual cues should be carefully calibrated to alert users to important readings without causing alarm fatigue.

Integration with daily routines represents another essential consideration. Devices that require minimal disruption to established habits show significantly higher long-term adoption rates. Form factors that accommodate discreet testing in social situations address important psychological barriers to consistent monitoring. Portable designs that balance functionality with convenience enable testing in various environments without compromising accuracy.

Battery life and charging solutions must account for varying user circumstances, including travel needs and potential memory impairments. Devices offering multiple charging options and clear low-battery warnings have demonstrated reduced instances of monitoring gaps due to power issues. Similarly, data storage solutions should incorporate automatic backups to prevent loss of critical health information.

The emotional impact of device design cannot be overlooked. Aesthetically pleasing devices that avoid medical stigmatization show improved user acceptance and psychological well-being. Color schemes, materials, and overall design language should reflect consumer preferences rather than clinical environments, helping to normalize the management process within patients' daily lives.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!